TIDMBAKK

RNS Number : 7180T

Bakkavor Group PLC

29 March 2021

29 March 2021

Bakkavor Group plc

("Bakkavor", "the Group" or "the Company")

2020 Annual Financial Report

Bakkavor announces that it has today published its 2020 Annual

Financial Report ("Annual Financial Report") on the Company's

website at www.bakkavor.com

The Annual Financial Report will be posted to shareholders on 29

March 2021, or otherwise made available to shareholders, as

required under DTR 6.3.5R(3).

As required under Listing Rule 9.6.1, a copy of the Annual

Financial Report will be submitted to the Financial Conduct

Authority's National Storage Mechanism (NSM) and will shortly

become available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

The Company's 2020 Final Results announcement in respect of the

52-week period ended 26 December 2020, including audited financial

statements prepared in accordance with the applicable accounting

standards, was released on 16

March 2021 (RNS Number 3302S), and can be viewed at www.bakkavor.com

The appendix to this announcement contains additional

information which has been extracted from the Annual Financial

Report for the purposes of compliance with the Financial Conduct

Authority's Disclosure Guidance & Transparency Rules and should

be read together with the 2020 Final Results announcement.

Together, these constitute the information required by DTR 6.3.5

to be communicated to the media in unedited full text through a

Regulatory Information Service. This information is not a

substitute for reading the full Annual Financial Report.

LEI number: 213800COL7AD54YU9949

ENQUIRIES

Institutional investors and analysts:

Ben Waldron, Chief Financial Officer

Sally Barrett-Jolley, Head of Corporate Affairs +44 (0) 20 7908

6143

Media:

Will Palfreyman, Tulchan Communications +44 (0) 20 7353 4200

Appendix: additional information required by DTR 6.3.5

Page and note references in this Appendix refer to page numbers

and notes in the Annual Financial Report.

Directors' Responsibilities and Statements

The following responsibility statement is extracted from the

Statement of Directors' Responsibilities on page 143 of the Annual

Financial Report and is repeated here solely for the purpose of

complying with DTR 6.3.5.

The statement relates to the full Annual Financial Report and

not the extracted information presented in this announcement or the

2020 Final Results announcement:

The Directors are responsible for preparing the Annual Report

and the Financial Statements in accordance with applicable law and

regulation.

Company law requires the Directors to prepare Financial

Statements for each financial year. Under that law the Directors

have prepared the Group Financial Statements in accordance with

International Accounting Standards in conformity with the

requirements of the Companies Act 2006. Additionally, the Financial

Conduct Authority's Disclosure Guidance and Transparency Rules

require the Directors to prepare the Group financial statements in

accordance with international financial reporting standards adopted

pursuant to Regulation (EC) No 1606/2002 as it applies in the

European Union. The Directors have prepared the Company financial

statements in accordance with United Kingdom Generally Accepted

Accounting Practice (United Kingdom Accounting Standards,

comprising FRS 101 "Reduced Disclosure Framework", and applicable

law).

Under Company law, Directors must not approve the Financial

Statements unless they are satisfied that they give a true and fair

view of the state of affairs of the Group and Company and of the

profit or loss of the Group for that period. In preparing the

Financial Statements, the Directors are required to:

-- Select suitable accounting policies and then apply them consistently;

-- State whether, for the Group, international accounting

standards in conformity with the requirements of the Companies Act

2006 and international financial reporting standards adopted

pursuant to Regulation (EC) No 1606/2002 as it applies in the

European Union have been followed, and United Kingdom Accounting

Standards, comprising FRS 101, have been followed for the Company

Financial Statements, subject to any material departures disclosed

and explained in the Financial Statements;

-- Make judgements and accounting estimates that are reasonable and prudent; and

-- Prepare the Financial Statements on the going concern basis,

unless it is inappropriate to presume that the Group and Company

will continue in business.

The Directors are also responsible for safeguarding the assets

of the Group and Company and hence for taking reasonable steps for

the prevention and detection of fraud and other irregularities.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Group's and

Company's transactions and disclose with reasonable accuracy at any

time the financial position of the Group and Company and enable

them to ensure that the financial statements and the Directors'

Remuneration Report comply with the Companies Act 2006.

The Directors are responsible for the maintenance and integrity

of the Company's website. Legislation in the United Kingdom

governing the preparation and dissemination of Financial Statements

may differ from legislation in other jurisdictions.

Directors' confirmations

The Directors consider that the Annual Report & Accounts,

taken as a whole, is fair, balanced and understandable and provides

the information necessary for shareholders to assess the Group's

and Company's position and performance, business model and

strategy.

Each of the Directors, whose names and functions are listed in

the Group Board section, confirm that, to the best of their

knowledge:

-- The Group Financial Statements, which have been prepared in

accordance with International Accounting Standards in conformity

with the requirements of the Companies Act 2006 and additionally,

in accordance with International Financial Reporting Standards

adopted pursuant to Regulation (EC) No 1606/2002 as it applies in

the European Union, give a true and fair view of the assets,

liabilities, financial position and profit of the Group;

-- The Company Financial Statements, which have been prepared in

accordance with United Kingdom Accounting Standards, comprising FRS

101, give a true and fair view of the assets, liabilities,

financial position and profit of the Company; and

-- The Strategic Report includes a fair review of the

development and performance of the business, and the position of

the Group and Company, together with a description of the principal

risks and uncertainties that it faces.

Approved on behalf of the Board by:

A Gudmundsson B Waldron

Chief Executive Officer Chief Financial Officer

15 March 2021

Principal Risks and Uncertainties

The risks and uncertainties set out below are extracted from

pages 74 to 83 of the Annual Financial Report and are repeated here

solely for the purpose of complying with DTR 6.3.5.

COVID-19 - Risk Summary

COVID-19 emerged as a major risk to companies in China in

January and since then has spread to impact companies all around

the world. During the year, as the situation has continued to

evolve, the Group has put in place a number of actions to mitigate

the potential impacts to the business in the three regions in which

we operate and across our supply chain. Details of these mitigating

actions were explained in the 2019 Annual Financial Report,

published in May 2020, and are explained in further detail here to

reflect additional actions taken during the remainder of the

year.

Unlike many other industries which have been severely impacted

by COVID-19, such as travel and hospitality, the food manufacturing

industry and provision of food remain fundamental to consumers.

Fresh food and the convenience of FPF supports the health and

wellbeing of consumers and maintaining the continuity and

availability of our products is a key priority for both our

industry and government. For this reason, our Group was defined as

providing a 'key' or 'essential' service and received protection

and, in some cases, exemption from many of the restrictions placed

on individuals and companies in these difficult times.

Given that we manufacture and distribute most of our products

every day, the Group is used to accommodating volatile and

sometimes unpredictable ordering patterns. With a short shelf-life

on most of our raw materials and finished goods, we can only hold

limited stocks at any time. We therefore have sophisticated supply

chains, with robust planning and scheduling procedures and a range

of contingency plans are in place in line with our normal operating

plans. This gives us a relatively high degree of flexibility and

agility in our operations and has served us well in adapting to the

challenges presented by the pandemic throughout the year.

This section addresses the key risks to each of the Group's

three markets: the UK, US and China. We have assessed these risks

under three general headings: People management, Supply chain and

logistics and Consumer demand. We also list the specific mitigating

actions and consider the potential impact of the ongoing COVID-19

pandemic on both our financial performance and the Group's

liquidity position and our ability to meet our financial

obligations as they fall due.

United Kingdom

In the UK, we have a mature business employing almost 16,500

people across 23 sites, providing short shelf-life chilled

convenience products to a range of major supermarket retailers. The

business operates in four key categories: meals, salads, desserts

and pizza & bread.

1. People management

The presence of COVID-19 in the local communities in which we

operate has the potential to impact the health and safety of our

colleagues and can lead to a shortage of core staff in our

factories. Our business is a mix of both highly automated and

labour-intensive production, and most sites operate 24/7 and 364

days a year. Should a large number of employees be off work, it is

possible that we might have to reduce our output to match labour

availability. During the first lockdown in 2020, some of our sites

experienced high levels of staff absence due to illness,

self-isolation and shielding. Weak consumer demand during this

period offset much of the impact of staff shortages.

Mitigating action

As a business, we are fully committed to ensuring we safeguard

the health, safety and wellbeing of all our colleagues in carrying

out their work. As a large FPF manufacturer, our established

controls for managing both people and food safety within our

operations are industry-leading. While our regular handwashing

procedures and high levels of good manufacturing practice ("GMP")

and hygiene ensure a safe working environment, we have also

implemented a number of additional controls and enhanced safety

measures following the virus outbreak. This has included restricted

visitor access, suspending all travel unless deemed business

critical, a more rigorous return to work procedure, more frequent

cleaning regimes at touchpoints, additional handwashing protocols,

adhering to Public Health England ("PHE") guidelines for social

distancing in our offices, rest changing and ancillary areas,

thermal imaging for temperature checks, safety screens for factory

workers on the line, mandatory visors, mandatory masks for

office-based staff, as well as following specific PHE guidance for

distancing in food manufacturing businesses. We are taking measures

to ensure that these operating procedures are fully understood,

including the launch of the Bakkavor Coronavirus Management System

("BCMS") portal on our intranet that provides managers and

colleagues with a 'one-stop shop' of all the latest information,

and are rigorously complied with so that we maintain the highest

standards. We continue to audit ourselves against both our standard

controls and our enhanced COVID-19 protocols on both an announced

and unannounced basis.

We have also actioned and continue to take advice from many

sources, including HM Government, Public Health England and the

NHS. In addition to this, we maintain regular dialogue with all

employees by asking them to engage in surveys for feedback on our

health & safety protocols. We therefore believe that the

current practices and the additional new measures recently

introduced should lower the risk of outbreaks at our sites. Where

we have experienced an outbreak, for example at our Newark and

Tilmanstone sites, we have worked very closely with PHE and the

relevant local authorities to put in place a full testing programme

to prioritise the health and safety of our colleagues on site.

The financial and emotional wellbeing of our colleagues during

the pandemic is just as important as physical wellbeing. To support

this, in April we launched a UK-wide Bakkavor Wellbeing Toolkit to

offer colleagues emotional, physical and financial support. The

Toolkit includes a variety of well-established resources, links and

support mechanisms such as our Employee Assistance Programme,

Grocery Aid helpline and Neyber - a financial wellbeing hub

provided as a benefit for colleagues. We cascaded the Toolkit in

physical as well as virtual form by promoting the resources during

Mental Health Awareness Week and on pull-up banners and extra

printed materials for colleagues at site level.

Labour shortage has become a problem at a small number of sites,

within certain times of the year, which we have mitigated by

agreeing to reduce ranges with our customers and/or transferring

production to other sites with spare capacity. Overall, this has

not had a material impact on UK sales. Our business is classified

as critical to the COVID-19 response. This means that all Bakkavor

employees are classified as key workers and are therefore entitled

to support with childcare and continued education.

Taken together, these factors mean we consider that our employee

attendance will continue at an appropriate level such that we can

maintain production.

2. Supply chain and logistics

A second risk to our business could be an interruption to our

raw material supply chain. Due to the short shelf-life of a number

of raw materials that we hold in stock, we are used to operating a

sophisticated supply chain that ensures we can procure, manufacture

and distribute product every day. Our raw materials are sourced

from across the world, with approximately 37% from the EU and 16%

from other parts of the world. With low stocks held at site, any

disruption in the supply of our raw materials could mean we are

unable to meet orders for particular products. Furthermore, in the

event of broader economic stress in the regions in which our

suppliers operate, we could find availability and cost of our key

raw materials under pressure.

Mitigating action

As a business, we are highly experienced in problem-solving

issues regarding supply chain and logistics. Our procurement

function is largely centralised at our Head Office in Spalding,

Lincolnshire, with commodity focused specialists. This expertise

gives us a deep knowledge of the supply chain, including

well-established relationships with individual farmers, growers and

suppliers. In addition, we have 'on the ground' presence with

colleagues based in China, Spain, Italy and South America, which is

a key strength in understanding what is happening within the supply

base and within the local area. This includes a dedicated team

based in Spain who co-ordinate the buying of fresh produce globally

and the transportation of raw materials from southern Europe to the

UK, and a team in China who co-ordinate the purchase and shipping

of raw materials from Chinese suppliers back to the UK. We make

limited use of forwarding agents, preferring to rely on our own

professionals to ensure the smooth running of what is in effect a

just-in-time operating model. This ensures that in the case of

difficulties with product availability or transport we are best

placed to seek alternative sources or routes.

We also make full use of UK raw materials wherever possible,

with approximately 47% of raw materials purchased from the UK, and

have a flexible model which allows us to switch suppliers to match

seasonal availability, particularly in the spring and summer when

UK crops are more readily available. Robust dual-sourcing

procedures ensure that we are never completely reliant on one

particular supplier and potentially left with no alternatives. With

the changing product requirements of our customers, we already have

a robust and well established process in place to approve new raw

materials and suppliers, and, should we need to accelerate this, we

can work effectively with our customers to ensure the appropriate

approvals are obtained.

Our commercial teams have worked with our customers to create

practical solutions, changing the specification of products and

shifting production to sites that can meet changing demand. This

includes the introduction of pizza manufacturing into Spalding Deli

within five days to meet growing orders during the first UK-wide

lockdown.

Following the virus outbreak, we have taken a number of

mitigating actions throughout 2020. This has included increasing

stock holding across the supply chain, review of alternative and

additional suppliers for critical raw materials, implementation of

alternative supply options and daily Procurement Leadership Team

reviews during the early stages of the pandemic. We have also

maintained very close day-to-day contact with our suppliers and

been able to respond with appropriate support for those under

financial pressures.

During 2020 we have experienced few material supply chain

interruptions because of these mitigating actions. Due to the

success in managing supply chain complexity throughout the year, we

are confident in our ability to ensure continuity of supply in 2021

and this view is further reinforced by the signing of the free

trade agreement between the EU and UK.

3. Consumer demand

Finally, demand for our products has been affected by consumers

changing their buying preferences. There is uncertainty for us

around how long this will impact our business volumes.

Mitigating action

Demand throughout the year remained volatile, particularly

during periods of lockdown or heightened restrictions, as consumers

cut back on the number of store visits they made, reverting to

'one-big shop' and consequently switched away from short shelf-life

products. In order to mitigate this, in H1, we began to make use of

the Government's Job Retention Scheme to 'furlough' workers, cut

costs through a reduction of agency staff, made changes to shift

patterns, delayed new product launches, temporarily closed a

factory in Bo'ness to realign our capacity with a rapid drop in

demand of food-to-go products, and identified new and more

efficient ways of working with our customers, which has led to the

restructuring of several office-based functions.

In H2 we experienced an encouraging recovery in sales as the

first COVID-19 lockdown was lifted, however, volumes were adversely

affected in the final quarter by further restrictions. Most

furloughed staff returned to work with only vulnerable staff

remaining on furlough. Whilst our Bo'ness factory reopened in H2,

two other sites were closed to 'right size' our production

facilities to match ongoing demand. Investment in our sites

continued throughout 2020, though at lower levels than originally

planned. Our teams have concentrated on driving growth back into

category as we enjoyed a stronger Christmas period and have

confidence in our ability to handle extra volume increases during

2021.

US

In the US, our business employs over 800 people and operates

from five sites, producing chilled convenience food for US grocery

retailers.

1. People management

The risks to our US business of the impact of a shortage of core

staff and / or management are the same as the UK business, and

described above.

Mitigating action

The mitigating actions outlined for the UK business can equally

apply to the US, with the following additional points of note.

We have also actioned and continue to take advice from many

sources including state, federal and county bodies, the US Food and

Drug Administration, the US Department of Agriculture and public

health organisations.

The food manufacturing sector is classified as a critical

infrastructure industry, which means our business is required to

continue to operate as usual and our staff are exempt from any

'Stay at Home' orders that were in place in the states in which we

operate.

In the event of an acute shortage of labour, our ability to

transfer employees between sites is limited due to the geographical

spread of our sites and current guidance against domestic travel.

However, following the temporary closure of our Breadeli site, we

moved colleagues over to our nearby meals production facility in

Charlotte, North Carolina. The site has since reopened. There are

also actions we could take to reduce the complexity in our product

ranges, thereby reducing the reliance on labour.

We are also considering a move to mandatory vaccination in 2021

once supplies become available.

2. Supply chain and logistics

A second risk to our business could be an interruption to our

raw material supply chain. Due to the short shelf-life of a number

of raw materials that we hold in stock, we are used to operating a

sophisticated supply chain that ensures we can manufacture and

distribute product every day. Our raw materials are primarily

sourced locally in the US, with a small number of products sourced

from other parts of the world including Mexico, Chile, Argentina

and China. With low stocks held at site, any disruption in the

supply of our raw materials could mean we were unable to meet

orders for particular products.

Mitigating action

The mitigating actions outlined for the UK business can equally

apply to the US, with the following additional points of note.

Our procurement function in the US primarily operates from

individual sites, although overall management rests centrally. We

source most of our raw materials locally, minimising the risk of

disruption through restrictions imposed as a consequence of the

outbreak, especially as the food manufacturing sector is classified

as a critical infrastructure industry and therefore ensuring it is

fully operational is a key priority for authorities.

We have experienced occasional disruption from supplier

factories being affected by COVID-19, notably from one of our

chicken suppliers who was forced to temporarily close one of their

factories due to high levels of staff absence. With that said, this

did not lead to any material interruption to our service levels as

we were able to secure alternative supplies from another

source.

3. Consumer demand

As outlined in the UK section, there was a risk that consumer

demand for our products could fall over the long term if consumers

were to change their buying preferences and / or our customers were

to limit or change the range of products that they offered. In the

first half it was true that volumes were adversely affected, but in

H2 volumes have picked up and FPF is increasing strongly with fresh

prepared meals in particular growing in penetration.

Mitigating action

The mitigating actions outlined for our UK business apply to the

US, with the following additional points of note.

Consistent with our UK business, in the US we adjust volumes to

match demand on a daily basis. We operate from five sites in the US

and our products are supplied to both local and national grocery

retailers. While each site is generally dedicated to a particular

key food category, all are multiproduct, most are multi-customer

and are geared to production of the full range of their products

every day. This means they are operationally flexible and used to

accommodating changing priorities.

In some instances, we can also supply the same product from two

different sites should it become necessary, because of supplying

both East and West Coast retail stores, as well as particularly

high short-term promotional volumes for example. This applies to

all key food categories, except for bread, which is only produced

at our Breadeli site in Charlotte, North Carolina.

China

In China, our business employs approximately 2,100 people and

operates from nine sites, including one in Hong Kong, and one

farm. It supplies fresh prepared foods and vegetables, mainly to

western foodservice customers.

1. People management

The risks to our business in China of the impact of a shortage

of core staff and / or management are the same as the UK

business.

Mitigating action

The mitigating actions outlined for the UK business apply to

China, with the following additional points of note.

We have also actioned and continue to take advice from all

relevant Chinese Government authorities, including the Food Safety

Administration, Department of Labour and the Tax bureau. In

addition to this, we maintain regular dialogue with all employees,

many of whom live on-site in company dormitories making it easier

for us to ensure that they are maintaining the highest hygiene

standards.

Due to our customer base, we are not considered 'critical' to

the COVID-19 response but are permitted to continue production.

Compared to the UK, the incidence of COVID-19 has been much

lower in China generally with no recorded cases in our factories on

mainland China. Early in the year our Wuhan factory was closed for

several weeks, but all other factories remained open and were used

by the local government as examples of how companies should respond

to the pandemic. During H2 operations have been more or less back

to normal as temperature checks and face coverings were in use

pre-COVID-19.

Hong Kong continues to experience more disruption with repeated

lockdown periods and continuing COVID-19 cases in the general

public that are leading to local lockdowns, which can in turn

affect staff availability.

2. Supply chain and logistics

A second risk to our business could be an interruption to our

raw material supply chain. As we hold limited stocks of short

shelf-life products, we are used to operating a sophisticated

supply chain that ensures we can manufacture and distribute product

every day. Our raw materials are almost exclusively sourced

locally, with very little imported from outside China. With low

stocks held at site, any disruption in the supply of our raw

materials could mean we were unable to meet orders for particular

products.

Mitigating action

The mitigating actions outlined for the UK business apply to

China, with the following additional points of note.

As a business, we are extremely experienced in problem-solving

issues regarding supply chain and logistics. Our procurement

function in China is largely operated out of individual sites,

although overall management rests centrally. We source most of our

products locally, minimising the risk of disruption through

restrictions imposed as a consequence of the outbreak, especially

since maintaining a fully operational food industry is a key

priority for authorities.

We have not experienced any material supply shortages, in part

due to lower demand levels at the peak of the crisis.

3. Consumer demand

As outlined in the UK section, there is a risk that demand for

our products could continue to fall if consumers were to change

their buying preferences over the long term or our customers were

to limit or change the range of products that they offered. Our

customer base in China is primarily with western foodservice

players and therefore they may be unable to keep stores open due to

any further local and / or central government restrictions put in

place.

Mitigating action

As a large food manufacturing business, we adjust volumes to

match demand daily. We operate through nine sites in China and

across a number of categories. All our sites are multi-product,

multi-customer and are geared to production of the full range of

their products every day. This means they are all extremely

flexible and used to changing priorities. In February, when it

became necessary to temporarily close a number of our factories, we

maintained customer service levels by transferring production

across our remaining locations, including our new site at Haimen.

Given the challenging nature of the operating environment, we also

took a number of necessary actions to control costs. As in other

parts of the Group, these included temporary salary cuts and

recruitment freezes and in Hong Kong we have streamlined our

operating structure.

We also continued to offer our customers innovative products by

developing in-home meal solutions that meet the needs of

foodservice providers as they adjust to the fact that consumers are

spending more time at home.

Demand was badly affected in the first half of the year but by

the last quarter customer demand on mainland China was only

slightly below pre-COVID-19 levels. This being said, it continues

to be occasionally disrupted at individual factories by local

lockdowns. In Hong Kong, demand continues to be depressed by the

ongoing COVID-19 cases and lockdowns.

Brexit - Risk Summary

Overall risk

At the end of the transition period, the introduction of EU and

UK border controls will increase administrative costs and may lead

to food inflation and disruption at ports of entry. In addition to

this, new immigration controls could affect labour

availability.

Mitigating action

The Brexit Working Group, a multidiscipline team, established in

2018, on behalf of the Group Board have kept Brexit mitigations

under review, including organisational changes, systems

development, customer plans, stock levels and staff retention.

1. Disruption at ports of entry

The new administrative procedures required at the ports of entry

into the UK, notwithstanding the transitional arrangements that the

UK Government have introduced, are likely to result in delays that

could lead to a shortage of supplies and disruption to the

manufacturing and delivery process.

Mitigating action

Where possible, Bakkavor increased stocks of longer-life raw

materials and packaging in advance of the year-end and will hold

these levels during the first quarter of 2021.

In conjunction with Bakkavor's customers, the Group has sought

to reduce dependence on EU imports where equivalent raw material is

available from UK sources. Notable examples are the increase in the

proportion of both raw chicken and liquid egg that are now sourced

from within the UK.

Bakkavor has secured permission to use Customs Simplified

Freight Procedures ("CFSP") from the beginning of 2021 to simplify

and speed up border arrangements.

2. Shortage of customs clearance services

The customs clearance industry will have to expand massively to

cope with the new customs declarations at the UK ports of entry and

there is a risk that there will not be enough qualified staff.

Mitigating action

The Bakkavor Inbound Logistics team ("BIL"), based in Southern

Spain and Lincolnshire, have been responsible for the importing of

salad items from Southern Europe for many years. As part of the

Group's Brexit preparations at the beginning of 2020, they

successfully took on responsibility for the importation and customs

clearance of all imports from outside of the EU. BIL trained some

of its existing staff as clearance agents, recruited and trained

additional customs clerks, and implemented software which connects

the ERP system with the customs computer systems. At the end of the

transition period they took responsibility for imports from the EU

and the rest of world and have recruited and trained additional

staff as clearance agents. With this experience, Bakkavor is in a

strong position to take on the clearance of EU imports.

3. Accurate customs declarations and security controls for

imports

With many UK factories there was a risk that importing from the

EU would not be carried out consistently.

Mitigating action

In early 2019 Bakkavor was accredited with AEO status in the UK,

for both security and customs clearance. This accreditation

established a relationship with the customs authorities and should

facilitate border crossings in the future.

Ordering from EU suppliers has been centralised by expanding the

BIL team responsibilities to give them ownership over order

placement with EU suppliers on behalf of all of our Bakkavor UK

factories. In order to ensure this process happens, the IS team has

developed a portal to allow EU suppliers to provide the information

required for UK clearance.

BIL is also responsible for controlling transport into the UK.

They have added a clear service level agreement with all major

hauliers to confirm them as trusted traders, which will allow them

to deliver direct to Bakkavor sites in the UK. BIL has arranged for

hauliers without the Trusted Trader Status to report to a

third-party site in Kent in order to carry out the security checks

required.

To facilitate exports from small suppliers in Southern Spain,

BIL has established a LAME facility in Northern Spain which has

been approved by the Spanish customs authorities as a consolidation

facility for the export of produce from the region. In addition to

this, Bakkavor's Spanish office has gained European AEO status.

4. New border controls for exports to Ireland

Beginning in 2021, exports to the Republic of Ireland and

Northern Ireland will be subject to new border control

arrangements.

Mitigating action

Bakkavor has been liaising with customers to prepare for the new

border procedures required when exporting to the Republic of

Ireland and Northern Ireland, including possible duty payments.

All of Bakkavor's packaging has already been modified to include

both Irish and UK addresses. Bakkavor has registered for the UK

Government Trader Support Scheme, which provides guidance on the

implementation of the Northern Ireland Protocol.

Export Health Certs ("EHC") are required for exports to the EU

containing products of animal origin ("POAO") to confirm that the

product meets the health requirements of the EU. Bakkavor supplies

many composite products to the stores of its retail customers in

Ireland. From the beginning of 2021, because a number of these

products include POAO, they will require export health

certification. For composite products of the sort that Bakkavor

exports, the UK Government has introduced a groupage system which

Bakkavor is adopting.

We have appointed vets to attest production at each of our UK

sites every 30 days and have appointed vets to authorise EHCs at

point of departure from Bakkavor's premises. All Bakkavor UK sites

have collected the information they need to provide evidence of the

safety of their products and the Group IS team has developed

software to make this information available to our vets and/or our

customers.

5. Brexit impact on currency movements

Following the transition period it is also possible that

Sterling will fall in value, increasing the cost of imports. The

additional costs of raw materials will need to be passed on to

consumers via higher prices in stores and may reduce consumer

demand.

Mitigating action

Bakkavor will be forced to pass on raw material inflation and

clearance costs to its customers.

In the event of Sterling weakness Bakkavor will seek to increase

the proportion of its raw materials purchased from UK sources.

It is Bakkavor Group Policy to mitigate exposure to movements in

the Sterling-Euro exchange rate by purchasing forward currency

contracts, in order to reduce the risk of currency fluctuation. The

proportion covered in 2021 has been increased beyond the normal

policy levels in light of potential Brexit disruption.

6. Immigration law changes

The new immigration law, post-Brexit, will restrict our ability

to recruit EU staff as the majority of our workforce are paid below

the new minimum levels for work visas.

Mitigating action

To mitigate this, the Group has regularly encouraged existing EU

staff to obtain settled or pre-settled status. This includes

holding workshops and providing internet access to help assist with

these applications. During 2020 our staff turnover level fell

during the COVID-19 lockdown period as EU staff remained in the UK.

We're expecting it to increase once lockdown measures are fully

released and will likely be further exacerbated after January 2021

when the new immigration law is introduced. There is a need to

concentrate recruitment in the UK, which includes looking at

different shift patterns such as more family-friendly shift

patterns to encourage local recruitment. Bakkavor is also seeking

to further reduce its reliance on agency labour, which has a high

proportion of EU nationals.

Link to Our Strategic Priorities

1: LEVERAGING NUMBER ONE POSITION IN THE UK

2: ACCELERATING GROWTH IN HIGH-POTENTIAL INTERNATIONAL

MARKETS

3: IMPROVING OPERATIONAL EFFICIENCY

Food safety and integrity

Description Mitigating controls Risk Trend

Millions of people eat our Stringent food safety 2020

products every day. We have policies in place throughout NO CHANGE

a duty to make food that is the organisation and The risk

safe and that is clearly and use of Hazard Analysis has stayed

correctly labelled. Critical Control Point the same.

principles to identify

Consumer safety and confidence and control food safety

are vital to our business; risks. Employees trained

any issue that breaches that against documented procedures.

trust could result in loss

or reduction of customer business Supply chain food safety

and also impact our credibility and integrity is understood

and reputation. and managed through robust

risk assessment and management

Link to strategy process.

Food safety audits conducted

1, 2, 3 for new suppliers with

regular audits of existing

suppliers.

Regular reporting of

food safety performance

to the Board and immediate

reporting of significant

issues.

---------------------------------- --------------

Raw material and input cost inflation

--------------

Description Mitigating controls Risk Trend

The Group's cost base and Central procurement team 2020

margin are vulnerable to fluctuations focused on achieving NO CHANGE

in the price and availability a balance between price, The risk

of raw materials, packaging quality, availability has remained

materials and freight. and service levels. the same

with COVID-19

Ability to pass on any increases Forward purchasing agreed and Brexit

in these costs to customers and price variations having the

within a reasonable timeframe passed on where possible. potential

is a challenge and failure Agreements in place with to disrupt

to do so could impact the some customers on recovery supply chains

Group's profitability and of raw material cost leading to

hence its ability to continue impacts. higher costs

to invest in the business. and/or

Continued focus on cost shortages.

Link to strategy reduction and productivity

enhancements.

1, 3

---------------------------------- --------------

Reliance on a small number of key customers

--------------

Description Mitigating controls Risk Trend

We work with four of the largest Close partnership model 2020

food retailers in the UK and in place with customers. NO CHANGE

a significant proportion of In the UK, customer-specific Customer

our revenue is from these champions and teams manage concentration

customers. In the US we work strategic customer relationships. has remained

with a small number of large unchanged.

retailers and in China a small Relationships with all

number of large food service grocery retailers beyond

customers. the four largest gives

breadth of cover. Strong

Any major customer loss would reputation for food safety

have a significant negative and quality.

impact on our business.

Reputation amongst customers

Link to strategy for strong insights and

innovation capabilities.

1, 3

Significant investment

in manufacturing facilities

and highly complex 'just

in time' manufacturing

process.

---------------------------------- --------------

Labour Availability and Costs

Description Mitigating controls Risk Trend

Manpower scarcity and higher Specific campaigns and 2020

labour costs could affect focus groups in place UP

the Group's business and future targeting recruitment The potential

profitability. of future employees and medium-term

building attractiveness impact from

The Group competes with other of careers in the food reduced immigration

manufacturers for good and industry. and the retention

reliable employees. The supply of existing

of such employees is limited Initiatives in place EU colleagues

and competition to hire and to enhance and upgrade following

retain them may result in factory site facilities Brexit has

higher labour costs. to help attract and retain increased

employees. the risk

Additionally, in the UK, Brexit of labour

presents a risk as historically Central staff dedicated availability

the Group has employed a material to recruitment and management in the UK.

number of people who are citizens of staff costs.

of EU countries.

Initiatives in place

Link to strategy to support employees

with Brexit-related concerns.

1, 2, 3

--------------------------------- --------------------

IT systems and cyber risk

--------------------

Description Mitigating controls Risk Trend

Unauthorised access of the Group Information Systems 2020

Company's Information Technology ("IS") manage access UP

("IT") systems could lead to business data in the The risk

to breaches of data protection UK through strong password has increased

and release of market sensitive protection, role-based as cyber

information. access to business systems threats have

and policies to ensure become more

Any breakdown or failure in appropriate use. The common during

the Group's IT infrastructure risk associated with the COVID-19

or the Group's communication high levels of home working pandemic.

networks, including malicious have been addressed with

cyber-attacks by third parties, enhanced processes and

could delay or otherwise impact the introduction of two

the Group's day-to-day business. factor authentication.

Link to strategy Group IS has strict policies

and actively ensures

1, 2 that the IS infrastructure

and equipment in the

UK in particular, are

sufficiently protected

against malicious cyber-attacks.

We work closely with

our cyber security partner

and continue to enhance

our controls. In addition,

we have cyber insurance

and therefore some of

the risk of a cyber-attack

is passed onto our insurers.

Local teams in the US

and China are developing

our IS infrastructure

capabilities.

--------------------------------- --------------------

Health and safety

--------------------

Description Mitigating controls Risk Trend

We understand our duty of H&S and environmental 2020

care to secure and protect impacts are managed locally UP

the health and safety ("H&S") by our teams and by the The level

of our employees and to reduce Group's in-house experts of risk has

the environmental impact of who embed and monitor remained

our operations. practices. unchanged

in terms

Failure to maintain the H&S Stringent processes are of accidents

of employees could have a implemented for identifying at work,

significant reputational impact and managing H&S and however COVID-19

and also have serious legal environmental risks. has provided

consequences. an additional

Regular reporting of risk to the

Link to strategy H&S Key Performance Indicators health of

to the Group Board and our colleagues.

1, 2 immediate reporting of

significant issues.

An established culture

of employee engagement

around accident prevention

across the Group.

--------------------------------- --------------------

Recruitment and retention of key employees

--------------------

Description Mitigating controls Risk Trend

We have a highly experienced Company values used to 2020

management team who are passionate recruit, appraise, reward NO CHANGE

about our business and who and develop employees. The level

are integral to our continued of risk has

growth and success as a market Ongoing succession planning, remained

leader. The loss of any of commitment to training unchanged.

these personnel, or the Group's and bonus schemes in

inability to recruit new personnel, place to retain key personnel

would have an adverse impact and manage staff turnover.

on the Group.

Graduate recruitment

We risk being unable to achieve and apprenticeship schemes

our strategic growth objectives have been expanded.

without the recruitment, development

and retention of talented Training and career development

and committed people who understand opportunities have been

and respect our values. enhanced.

Link to strategy

1, 2, 3

--------------------------------- --------------------

Strategic Growth and Change programmes

Description Mitigating controls Risk Trend

Much of our future growth All capital investment 2020

will be delivered from new and organisational change DOWN

factory builds and acquisitions. projects are subject The risk

This adds a level of execution to detailed review by has decreased

risk to continuing operations. the Board and Senior in the short

Link to strategy Management considering term as we

1, 2, 3 the risks and opportunities have reduced

of each proposal. capital expenditure

on new factory

Detailed planning and builds, while

sharing of best practice new ventures

within the Group minimises have become

risk. more mature.

----------------------------------- ------------------------------- ----------------------

Treasury and Pensions

----------------------

Description Mitigating controls Risk Trend

To achieve our growth objectives, Financial results, projections 2020

we require a strong financial and covenant performance NO CHANGE

platform. reviewed regularly. The Group

has proved

The Group has significant Open and regular dialogue resilient

facilities governed by financing with our lenders and over the

agreements under which we an active investor engagement last 12 months

are subject to various financial programme. and has good

covenants and undertakings. levels of

Treasury function operates headroom

Breaching any covenant would within framework of strict on its facilities.

impair our ability to maintain Group Board-approved

existing financing and secure policies and procedures.

future financing, thereby

destabilising the business. Active policy of hedging

known non-Sterling denominated

The Group has a closed defined expenditure both for

benefit pension plan which specific projects and

is exposed to interest and on a rolling basis for

inflation rates, values of material purchases.

assets and increased life

expectancy. The pension scheme has

hedges in place for a

Link to strategy large portion, but not

all, of its risks.

3

------------------------------- ----------------------

Brexit disruption

----------------------

Description Mitigating controls Risk Trend

Read more about our Brexit Learn more about our 2020

risk summary above and on mitigating actions above DOWN

pages 78-79. and on pages 78-79 of Disruption

the Brexit risk summary. at ports

Link to strategy of entry

is possible

1 in the first

quarter of

2021 whilst

new Administrative

procedures

bed in. However,

overall,

the risks

have been

reduced significantly

following

the signing

of the free

trade deal.

------------------------------- ----------------------

Disruption to Group operations

----------------------

Description Mitigating controls Risk Trend

Catastrophic damage to one Building and property 2020

of our factories by fire, management protocols DOWN

flood or mechanical breakdown are employed and audited COVID-19

as well as disruption due in conjunction with our mitigations

to information systems failure property insurers. are now well

or pandemics. established

Business continuity plans and resulting

Link to strategy are in place for each disruption

factory site and for has reduced

1, 2 many products alternative over time.

Bakkavor factories could

supply in the event of

a major issue.

------------------------------- ----------------------

Sustainability

Description Mitigating controls Risk Trend

To continue with our growth Under our Corporate 2020

agenda we must ensure that the Responsibility strategy, UP

business is developing in a Trusted Partner, we COVID-19

sustainable way. are scaling up our and Brexit

focus and performance have both

Link to strategy monitoring in relation introduced

to a number of key an increased

1, 2, 3 areas including carbon, level of

waste, packaging and uncertainty.

responsible sourcing.

-------------------------------------- ----------------------------- -----------------

Consumer behaviour and demand

-----------------

Description Mitigating controls Risk Trend

Changes in consumer demand due We work closely with 2020

to a serious change in the economy our customers to adapt UP

or other consumption factors to changing consumer COVID-19

could impact our plans. trends such as dietary restrictions

changes, sustainability have temporarily

Link to strategy concerns and the impact reduced demand

of COVID-19 on shopping for fresh

1 habits. prepared

foods.

----------------------------- -----------------

Competitors

-----------------

Description Mitigating controls Risk Trend

The Group operates in a highly Developing and maintaining 2020

competitive market. strong working relationships NO CHANGE

with our customers The level

Link to strategy underpinned by high of risk has

service levels and remained

1, 2 constant product development unchanged.

and innovation.

----------------------------- -----------------

Legal and Regulatory

-----------------

Description Mitigating controls Risk Trend

Bakkavor is subject to a wide Our legal, financial, 2020

range of legislation, regulations tax, and environmental NO CHANGE

and codes of practice covering teams monitor relevant The level

many aspects of our business laws and regulations of risk has

including food safety, health to ensure compliance. remained

& safety, data privacy, competition, unchanged.

ethical business, tax and financial Our outsourced internal

reporting. Failure to comply audit team provides

could impact our reputation assurance on key risks.

and lead to financial penalties.

In 2020 we introduced

Link to strategy e-learning training

for key global policies,

1, 2 including anti-bribery

& corruption and cyber

security.

----------------------------- -----------------

COVID-19 Pandemic

Description Mitigating controls Risk Trend

Read more about our COVID-19 Learn more about our 2020

risk summary above and on pages mitigating actions NEW

74-77. above and on pages UP

74-77 of the COVID-19 The impact

risk summary. of COVID-19,

Link to strategy raising costs

and affecting

1, 2, 3 consumer

demand, is

expected

to continue

but for an

unknown amount

of time.

----------------------------- -----------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSUBSNRAVUOUAR

(END) Dow Jones Newswires

March 29, 2021 02:00 ET (06:00 GMT)

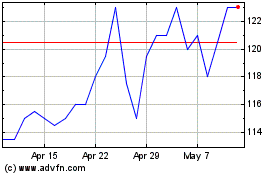

Bakkavor (LSE:BAKK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bakkavor (LSE:BAKK)

Historical Stock Chart

From Apr 2023 to Apr 2024