TIDMBMTO

RNS Number : 7711W

Braime Group PLC

27 April 2021

BRAIME GROUP PLC

(formerly T.F. & J.H. BRAIME (HOLDINGS) P.L.C.)

("Braime" or the "Company" and with its subsidiaries the

"Group")

ANNUAL RESULTS FOR THE YEARED 31ST DECEMBER 2020

At a meeting of the directors held today, the accounts for the

year ended 31st December 2020 were submitted and approved by the

directors. The accounts statement is as follows:

Chairman's statement

Overview of the year

Group sales revenue in 2020 reduced marginally by 2% from

GBP33.4m to GBP32.8m but the profit before tax fell by over 30%

from GBP1.75m in the previous year to GBP1.2m in 2020. The

disproportionate reduction in the profit before tax was due in part

to the strengthening in the value of Sterling against the

currencies in our principal markets but also due to the much higher

costs of maintaining production and sales during the Covid

pandemic.

In normal circumstances, the result in 2020 would be very

disappointing but in the quite exceptional circumstances which

affected the Group globally throughout 2020, the result achieved

was significantly better than we had dared hope for during much of

the year. Throughout the crisis, we achieved our twin aims of

maintaining the full employment of our valued staff, while

consistently continuing to supply our vital customer base.

We were only able to achieve this due to two factors; firstly

the work and enterprise of our management teams across all parts of

our Group, who successfully adapted our working practices and put

in place measures which minimised the risk to our employees of

continuing to work in very difficult circumstances; secondly, the

courage and the flexibility of our employees themselves in

continuing to work throughout the year and their willingness to

work the extra hours asked of them in order to compensate for the

hours lost by unavoidable absences or quarantine. As always, and

even more so in 2020, we depend on the efforts and the huge

contribution made by all our employees.

Having survived as a business through the past very challenging

12 months, we are starting this new year with a lot of renewed

positivity. The Group remains in a solid position financially; this

enables us to continue to invest in the future and in our ongoing

plans to secure more business through continually improving our

operations and our products.

Capital investments

During the pandemic, we worked hard to preserve our working

capital resources and in 2020 we generated GBP2.7m from our

operations, compared to GBP1.7m in the previous year.

Nevertheless, we invested during the year a total of GBP2.1m, of

which GBP1.5m was spent on building our new EUR2.2m sales and

distribution facility in France which we announced last year. We

had planned to occupy the new facility by February 2021 but

construction was delayed by the Covid restrictions and we now plan

to re-locate during May this year.

We also continued the major investment, started in 2019, in

another robotic production cell and took advantage of an

opportunity to purchase at auction, and refurbish internally, a

very large wide coil fed 400 tonne mechanical press. Installation

and commissioning of the latter investment enabled us to take on

specific new work in December.

Meanwhile we continue to invest time and energy in the

development of new products, including some which will be launched

later this year. We fund these development activities out of our

profits.

Dividend

In October 2020, the Company paid a first Interim dividend of

4.0p. Given what we believe was a very positive result in

exceptional circumstance, and the strength of our overall financial

position, the board proposes to pay a second interim dividend of

7.8p, making a total of 11.8p for the year, compared to 11.6p in

2019.

The second dividend of 7.8p will be paid on the 25(th) of May

2021 to the holders of the Ordinary and 'A' Ordinary shares on the

share register on 6(th) May 2021.

Free Trade Agreement with the EU

We were pleased that, at the very last minute, economic "common

sense" prevailed and a mutually beneficial Free Trade Agreement was

signed between the UK and the EU.

Although around three-quarters of our group sales are made

outside the EU, the European economic area remains a very important

market for us. As a result of the trade agreement, even when our

exports to the EU include raw materials sourced globally, our

valued European customers can continue to purchase of our products

duty free. Equally important, the Free Trade Agreement enables us

to continue to purchase and re-export supplies sourced from

existing partners in the EU.

We are fortunate that as a company we are well used to the

preparation of the standard documentation required to export

globally. Apart from one or two "hiccups "in the first weeks of

January, while we adapted our documentation to meet the new EU

requirements, our exports and imports to and from the EU have

continued seamlessly. The final resolution of this long-standing

issue will also now allow us to reduce the high levels of stocks

built up in our businesses, both in the UK and France, in order to

mitigate the situation in a worst-case scenario.

Important information regarding the AGM

The Company is closely monitoring public health guidance and

legislation issued by the UK government in relation to the Covid

pandemic. At the time of writing, the government continues to place

restrictions on mass gatherings and social contact. However, it is

expected shareholder attendance will be possible under the

government's published roadmap and we are therefore proposing to go

ahead with an open meeting. Shareholders intending to attend the

AGM are asked to register their intention as soon as possible by

emailing investor@braime.co.uk .

The health and safety of our colleagues and shareholders is very

important to us. Given the constantly evolving nature of the

situation, should circumstances change such that we consider it is

no longer possible for shareholders to attend the meeting or

limiting the numbers in attendance is required, we will notify

shareholders through the Company's website www.braimegroup.com and,

where appropriate, by a Regulatory News Service announcement.

For the same reason of uncertainty, we strongly encourage all

shareholders to exercise their votes by submitting their proxy by

post in advance of the meeting and shareholders are strongly

encouraged to appoint the Chairman of the meeting as their proxy.

Details of how to do this are set out in the notes accompanying

notes to the Notice. This will ensure that your votes are cast in

accordance with your wishes.

Irrespective of the guidelines in place at the time of the 2021

AGM, we understand that some shareholders may not wish to travel

but may still wish to ask questions of the board. Any questions

should be emailed to investor@braime.co.uk in advance and we will

endeavour to add a synopsis of all questions and answers to our

website shortly after the meeting.

Current trading, outlook, and risks

We have continued to support our customers worldwide throughout

the pandemic, and have proved the resilience of our business.

Hopefully we are now finally emerging in a relatively strong

position, and do so with renewed enthusiasm.

In spite of the major difficulties and challenges faced in 2020,

we have learnt valuable lessons on how to adapt our processes to

continue communication with our customers without direct contact.

However, the substantial improvements we have made this year to

maintain "virtual" contact with our customers will never replace

the importance of visiting and meeting our customers face to face

and we will re-commence direct customer contact and our

participation in trade exhibitions at the earliest opportunity. Our

business has been built on the lessons learnt and the ideas created

by close and regular contact with our customers and all our product

development is rooted in this process.

Meanwhile, we have still been able to continue to invest time

and resources to improve our operations and develop new products,

and this remains our long-term strategy. Although the intake of new

orders remains patchy, overall, we can see a gradual increase in

confidence and in the number of new projects generated by our

customers worldwide.

Currently a major area of concern across the Group is the sudden

steep increase in the cost of raw materials and the related issue

of longer delivery times of both inbound raw materials and outbound

deliveries to customer; both have been caused by the Covid pandemic

which has led to a major imbalance in container traffic and

deep-sea shipping. Adjusting to constantly fluctuating material

costs, while continuing to remain competitive and retain our

customers without seriously eroding our margins, is a going again

to be a challenging and time-consuming process.

Our product mix is well balanced and one of our strengths and is

made up by the combination of the manufacture of components for

commercial vehicles and the manufacture and distribution of

components used in the material handling and processing of granular

commodities, particularly food related. As a Group our worldwide

sales are weighted towards regions which offer the potential for

significant long-term growth.

Over 80% of Group sales are made in overseas markets and a

significant proportion of our products are still manufactured and

exported from the UK but sold in local currencies. In recent years,

the Group has benefited from a gradual decline in the value of

Sterling and this has increased our ability to compete. In

contrast, we remain exposed to any sudden strengthening of the

Pound. This point has been made before but it remains very

pertinent.

Nicholas Braime, Chairman

27th April 2021

For further information please contact:

Braime Group PLC

Nicholas Braime/Cielo Cartwright

0113 245 7491

W. H. Ireland Limited

Katy Mitchell

0113 394 6628

The directors present their strategic report of the Company and

the Group for the year ended 31st December 2020.

Principal activities

The principal activities of the Group during the year under

review was the manufacture of deep drawn metal presswork and the

distribution of material handling components and monitoring

equipment. Manufacturing activity is delivered through the Group's

subsidiary Braime Pressings Limited and the distribution activity

through the Group's 4B division.

Braime Pressings specialises in metal presswork, including deep

drawing, multi-stage progression and transfer presswork. Founded in

1888, the business has over 130 years of manufacturing experience.

The metal presswork segment operates across several industries

including the automotive sector and supplies external as well as

group customers.

The subsidiaries within the 4B division are industry leaders in

developing high quality, innovative and dependable material

handling components for the agricultural and industrial sectors.

They provide a range of complementary products including elevator

buckets, elevator and conveyor belting, elevator bolts and belt

fasteners, forged chain, level monitors and sensors and controllers

for monitoring safety and providing preventative maintenance

systems which facilitate handling and minimise the risk of

explosion in hazardous areas. The 4B division has operations in the

Americas, Europe, Asia, Australia and Africa and in 2020 traded in

ninety-seven countries. The US subsidiary also has an

injection-molding plant. All injection-molded products are made

wholly for internal consumption and this is classed as 4B division

activity rather than included in the manufacturing segment.

Performance highlights

For the year ended 31st December 2020, the Group generated

revenue of GBP32.8m, down GBP0.6m from prior year. Profit from

operations was GBP1.4m, down GBP0.8m from prior year. EBITDA was

GBP2.7m. At 31st December 2020, the Group had net assets of

GBP15.0m. The full year results are better than expectations at the

half-year, when there was even greater uncertainty facing the

global business as a result of the Covid-19 pandemic and ensuing

lockdown. The Group benefitted from the forgiveness of GBP0.4m of

the government loan which we reported in the half year had been

received by our US subsidiary. The loan was forgiven after the

business demonstrated that it had maintained its employee numbers

despite a reduction in sales from the pandemic.

Cash flow

Inventories increased by GBP0.3m as the business judiciously

prepared for the United Kingdom's departure from the EU by building

up a buffer of certain inventory lines, and trade and other

receivables increased by GBP0.4m reflecting increased customer

activity close to the year end for the same reason. These were more

than offset by an increase in our trade and other payables of

GBP0.9m. In total the business generated funds from operations of

GBP2.7m (2019 - GBP1.7m). The group continued its programme of

investment during the year, spending GBP2.1m on capital items;

GBP1.5m of this was on the construction of the new warehouse in

France which was announced by the Group in our 2019 annual report.

After the payment of other financial costs and the dividend, the

cash balance (net of overdraft) was GBP1.2m, an increase of GBP0.5m

from the prior year.

Bank facilities

The Group's operating banking facilities are renewed annually.

As announced early last year, the EUR2.2m French warehouse

construction is being funded largely through the procurement of a

syndicated loan of EUR1.7m from BNP and Credit du Nord and the

remaining from Group cashflows. Our facility with HSBC provides

ample headroom for the Group to make the necessary investments in

the year. The business continues to enjoy good relations with its

bankers who are cognizant of the general economic uncertainties

facing the business as the global economy continues to suffer from

the effects of the pandemic.

Taxation

The tax charge for the year was GBP0.3m, with an effective rate

of tax of 28.5% (2019 - 23%). The effective rate is higher than the

standard UK tax rate of 19% (2019 - 19%), this results from the

blending effect of the different rates of tax applied by each of

the countries in which the Group operates, in particular, our US

operations' tax charge affects the blended rate. In any financial

year the effective rate will depend on the mix of countries in

which profits are made, however the Group continues to review its

tax profile to minimise the impact.

Capital expenditure

In 2020, the Group invested GBP2.1m (2019 - GBP1.7m) in

property, plant and equipment. In addition to GBP1.5m of the French

warehouse construction, the Group also invested in a 400 ton press,

an automated tap plate assembly, more robotics and expanded its

bucket tooling portfolio.

Balance sheet

Net assets of the Group have increased to GBP15.0m (2019 -

GBP14.3m). A foreign exchange loss of GBP0.1m (2019 - GBP0.3m) was

recorded on the re-translation of the net assets of the overseas

operations, which has decreased retained earnings in the year.

Principal exchange rates

The Group reports its results in sterling, its presentational

currency. The Group operates in six other currencies and the

principal exchange rates in use during the year and the comparative

figures for the year ending 31st December 2019 are shown in the

table below. Following the exit of the UK from the EU, sterling

strengthened against many of the currencies in which we operate and

consequently as mentioned above the Group's reserves decreased by

GBP0.1m from losses in foreign currency translations.

Average rate Average rate Closing rate Closing rate

Currency Symbol Full year Full year 31st Dec 31st Dec

2020 2019 2020 2019

Australian Dollar AUD 1.867 1.840 1.763 1,883

Chinese Renminbi

(Yuan) CNY 8.880 8.810 8.890 9.150

Euro EUR 1.126 1.144 1.112 1.177

South African Rand ZAR 21.309 18.453 20.030 18.548

Thai Baht THB 40.404 39.578 40.838 39.346

United States Dollar USD 1.290 1.281 1.365 1.321

Our business model

The two segments of the Group are very different operations and

serve different markets, however together they provide

diversification, strength and balance to the Group and their

activities.

The focus of the manufacturing business is to produce quality,

technically demanding components. The use of automated equipment

allows us to produce in high volumes whilst maintaining flexibility

to respond to customer demands.

The material handling components business operates from a number

of locations around the globe allowing us to be close to our core

markets. The focus of the business is to provide innovative

solutions drawing on our expertise in material handling and access

to a broad product range.

Performance of Braime Pressings Limited, manufacturer of deep

drawn metal presswork

Braime Pressings Limited sales of GBP6.8m were in line with

prior year. Intercompany sales and external sales were GBP3.0m and

GBP3.8m as compared to GBP3.4m and GBP3.4m respectively in 2019.

Loss for the period was GBP0.2m (2019 - loss GBP0.3m). The

manufacturing arm continues to face pricing pressures in a highly

competitive environment. At the start of 2020 the business further

invested in sales development however activities were restricted by

the government-imposed lockdowns which prevented visits to customer

premises. The board believes the business continues to add

strategic value through its supply to the 4B division and

complementary engineering expertise.

Performance of the 4B division, world-wide distributor of

components and monitoring systems for the material handling

industry

Revenues fell from GBP36.2m to GBP34.2m, with external sales

down GBP1.0m. The 4B group sales were affected by the covid

pandemic with the geographical regions of the Americas and Africa

being particularly affected with sales decreasing by GBP1.0m and

GBP0.4m respectively. The European market by contrast increased by

GBP0.8m compared to 2019. Profit for the period fell by GBP0.3m to

GBP1.4m as a result of reduced sales.

We continue to invest in product development and during the year

we launched our internet ethernet node remote monitoring interface

(IE-NODE); this provides a visual view of all devices on the

network, allowing for easy identifying of each unit of the network

and for settings to be readily changed as needed. In 2020 we

launched our unique and patented round bottom version of the

popular Bolt-N-Go, which makes it much easier to install, replace

and maintain chain compared to conventional welded steel chain.

The Covid-19 pandemic continues to cast uncertainty over the

global economy. The new ways of working too, following Brexit will

take some time to iron out and there will be some disruption to

supply chains which may continue well into the year. The board is

pleased with business performance in 2020 given the challenging

environment. The Group's underlying business model is on a solid

base and its wide geographical presence in the agricultural

equipment sector, which is essential for the maintenance of food

supply, provides it with some buffer in the continuing unsettled

economic climate. With the continuing support of its bankers, the

loyalty of its dedicated employees and its longstanding customers

and partners, the Group remains positive it will weather these

adversities.

Key performance indicators

The Group uses the following key performance indicators to

assess the performance of the Group as a whole and of the

individual businesses:

Key performance indicator Note 2020 2019

Turnover growth 1 (1.9%) (6.4%)

Gross margin 2 46.7% 49.1%

Operating profit 3 1.38m GBP2.21m

Stock days 4 182 days 176 days

Debtor days 5 56 days 57 days

Notes to KPI's

1. Turnover growth

The Group aims to increase shareholder value by measuring the

year on year growth in Group revenue. Whilst 2020 is down on the

prior year, the board consider the results to be very positive

given the global pandemic.

2. Gross margin

Gross profit (revenue plus change in inventories less raw

materials used) as a percentage of revenue is monitored to maximise

profits available for reinvestment and distribution to

shareholders. The reduction in margin reflects pressures on the

supply chain.

3. Operating profit

Sustainable growth in operating profit is a strategic priority

to enable ongoing investment and increase shareholder value.

Reduced turnover has impacted operating profit which has also been

affected by sterling strengthening.

4. Stock days

The average value of inventories divided by raw materials and

consumables used and changes in inventories of finished goods and

work in progress expressed as a number of days is monitored to

ensure the right level of stocks are held in order to meet customer

demands whilst not carrying excessive amounts which impacts upon

working capital requirements. Stockholding has increased due to

inventory build-up in December 2020 to mitigate the impact of any

disruption caused by the United Kingdom finally leaving the EU.

5. Debtor days

The average value of trade receivables divided by revenue

expressed as a number of days. This is an important indicator of

working capital requirements. Debtor days have improved from the

position at the half year and management are focusing on reducing

this to improve cashflows.

Other metrics monitored weekly or monthly include quality

measures (such as customer complaints), raw materials buying

prices, capital expenditure, line utilisation, reportable accidents

and near-misses.

Principal risks and uncertainties

Coronavirus Covid-19

At the time of writing, the global number of cases of Covid-19

infections remains high. Cases in the Far East and Australia have

declined and the US and UK governments' rapid roll out of the

Covid-19 vaccine programme and the published roadmap in the UK for

easing the current lockdown restrictions provide grounds for

optimism that some normality may resume by the summer. At the same

time, however, the rest of Europe is experiencing a rise in

infection cases and there is a threat that new variants, resistant

to the current vaccines, could emerge. Covid-19 therefore remains a

business threat and presents itself in various forms, including but

not limited to the threat of continuity of supplies, the health of

our employees, the ability of customers to meet payments, currency

fluctuations and business interruption resulting from government

interventions and hastily introduced travel restrictions.

The Group has demonstrated its ability to maintain activity

during these unprecedented times but clearly the global pandemic

has impacted sales. The Group supplies essential components parts

into the agricultural materials handling sector and during 2020

governments took necessary steps to protect the food supply chain

and our operations were classified as operations that had to remain

open. Nevertheless, threats emerge from key personnel becoming

infected with the virus, suppliers being unable to fulfil orders,

be it raw materials or inventory supplies or logistics partners

unable to conduct deliveries. The Group has put in place

significant health and safety measures to maintain operations,

including the retraining of personnel in key processes, social

distancing and reviewing alternative suppliers. The Group's key

objective is to ensure the safety and well-being of our employees,

while continuing to trade as normally as possible.

General risks

The market remains challenging for our manufacturing division,

due to pricing pressures throughout the supply chain. The

maintenance of the TS16949 quality standard is important to the

Group and allows it to access growing markets within the automotive

and other sectors. A process of continual improvement in systems

and processes reduces this risk as well as providing increased

flexibility to allow the business to respond to customer

requirements.

Our 4B division maintains its competitive edge in a price

sensitive market through the provision of engineering expertise and

by working closely with our suppliers to design and supply

innovative components of the highest standard. In addition, ranges

of complementary products are sold into different industries. The

monitoring systems are developed and improved on a regular

basis.

The directors receive monthly reports on key customer and

operational metrics from subsidiary management and review these.

The potential impact of business risks and actions necessary to

mitigate the risks, are also discussed and considered at the

monthly board meetings. The directors have put in place formal

business continuity and disaster recovery plans with respect to its

UK and US operations. The more significant risks and uncertainties

faced by the Group are set out below:-

-- Raw material price fluctuation :- The Group is exposed to

fluctuations in steel and other raw material prices and to mitigate

this volatility, the Group fixes its prices with suppliers where

possible.

-- Reputational risk :- As the Group operates in relatively

small markets any damage to, or loss of reputation could be a major

concern. Rigorous management attention and quality control

procedures are in place to maximise right first time and on time

delivery. Responsibility is taken for ensuring swift remedial

action on any issues and complaints.

-- Damage to warehouse or factory:- Any significant damage to a

factory or warehouse will cause short-term disruption. To mitigate

these risks, the Group has arrangements with key suppliers to step

up supply in the event of a disruption.

-- Brexit impact:- The UK finally left the EU at the end of

2020. A trade agreement has been struck with the EU and whilst this

has alleviated much of the immediate uncertainties surrounding a

no-deal scenario, the finer details of the agreement remain to be

negotiated and some aspects of the trade deal are on transitional

arrangements only. The Group, along with other businesses, faces

economic and political uncertainty in the future resulting from

changes to these details as yet unknown. However, the directors

consider that its operations in Europe provide the group with

further trading options and the fact that three-quarters of the

Group's revenues are derived from markets outside the EU provides

the Group with some resilience to any impact.

-- Economic fluctuations :- The Group derives a significant

proportion of its profits from outside the UK and is therefore

sensitive to fluctuations in the economic conditions of overseas

operations including foreign currency fluctuations. As the Covid-19

pandemic has demonstrated, economies are greatly intertwined and

reverberations feed through the supply chain.

Financial instruments

The operations expose the Group to a variety of financial risks

including the effect of changes in interest rates on debt, foreign

exchange rates, credit risk and liquidity risk.

The Group's exposure in the areas identified above are discussed

in note 17 of the financial statements.

The Group's principal financial instruments comprise sterling

and foreign cash and bank deposits, bank loans and overdrafts,

other loans and obligations under finance leases together with

trade debtors and trade creditors that arise directly from

operations. The main risks arising from the Group's financial

instruments can be analysed as follows:

Price risk

The Group has no significant exposure to securities price risk,

as it holds no listed equity instruments.

Foreign currency risk

The Group has a centralised treasury function which manages the

Group's banking facilities and all lines of funding. Forward

contracts are on occasions used to hedge against foreign exchange

differences arising on cash flows in currencies that differ from

the operational entity's reporting currency.

Credit risk

The Group's principal financial assets are bank balances, cash

and trade receivables, which represent the Group's maximum exposure

to credit risk in relation to financial assets.

The Group's credit risk is primarily attributable to its trade

receivables. Credit risk is mitigated by a stringent management of

customer credit limits by monitoring the aggregate amount and

duration of exposure to any one customer depending upon their

credit rating. The Group also has credit insurance in place. The

amounts presented in the balance sheet are net of allowance for

doubtful debts, estimated by the Group's management based on prior

experience and their assessment of the current economic

environment.

The credit risk on liquid funds is limited because the

counterparties are banks with high credit-ratings assigned by

international credit-rating agencies. The Group has no significant

concentration of credit risk, with exposure spread over a large

number of counterparties and customers.

Liquidity risk

The Group's policy has been to ensure continuity of funding

through acquiring an element of the Group's fixed assets under

medium term loans and finance leases and arranging funding for

operations via bank overdrafts to aid short term flexibility.

Cash flow interest rate risk

Interest rate bearing assets comprise cash and bank deposits,

all of which earn interest at a fixed rate. The interest rate on

the bank overdraft is at market rate and the Group's policy is to

keep the overdraft within defined limits such that the risk that

could arise from a significant change in interest rates would not

have a material impact on cash flows. The Group's policy is to

maintain other borrowings at fixed rates to fix the amount of

future interest cash flows.

The directors monitor the level of borrowings and interest costs

to limit any adverse effects on the financial performance of the

Group.

Health and safety

We maintain healthy and safe working conditions on our sites and

measure our ability to keep employees and visitors safe. We

continuously aim to improve our working environments to ensure we

are able to provide safe occupational health and safety standards

to our employees and visitors. The directors receive monthly

H&S reports and we carry out regular risk management audits to

identify areas for improvement and to minimise safety risks. Our

H&S manager has been involved in formulating plans and

procedures in the event of an outbreak of the Covid-19 virus in our

premises. As part of our precautionary measures we have introduced

social distancing and hand sanitisers in our factory and those able

to work from home are enabled to do so. As a global business, the

Group is able to tap into the experience of its various

international locations to share best practice and learning

points.

Research and development

The Group continues to invest in research and development and

regularly liaises with university engineering groups with a view to

improving features of its products. This has resulted in

innovations in the products which will benefit the Group in the

medium to long term.

Duties to promote the success of the Company

Section 172 of the Companies Act 2006 requires the directors to

act in a way that they consider, in good faith, would be most

likely to promote the success of the Company for the benefit of its

members as a whole, and in doing so have regard (amongst other

matters) to:

- the most likely consequences of any decision in the long term;

- the interest of the Company's employees;

- the need to foster the Company's business relationships with suppliers, customers and others;

- the impact of the Company's operations on the community and the environment;

- the desirability of the Company maintaining a reputation for

high standards of business conduct; and

- the need to act fairly between the members of the Company.

The Board confirms that, during the year, it has had regard to

the matters set out above. Further details as to how the directors

have fulfilled their duties are set out below and in the Governance

Report which in particular, expands on directors' duties and

stakeholder liaison.

Business ethics and human rights

The Board is respectful of the Company's long history, and

considers the long-lasting impact of its decisions. We are

committed to conducting our business ethically and responsibly, and

treating employees, customers, suppliers and shareholders in a

fair, open and honest manner. As a business, we receive audits by

both our independent auditors and by our customers and we look to

source from suppliers who share our values. We encourage our

employees to provide feedback on any issues they are concerned

about and have a whistle-blowing policy that gives our employees

the chance to report anything they believe is not meeting our

required standards.

The Group is similarly committed to conducting our business in a

way that is consistent with universal values on human rights and

complying with the Human Rights Act 1998. The Group gives

appropriate consideration to human rights issues in our approach to

supply chain management, overseas employment policies and

practices. Where appropriate, we support community partnering.

Employees

The quality and commitment of our people has played a major role

in our business success. This has been demonstrated in many ways,

including improvements in customer satisfaction, the development of

our product lines and the flexibility they have shown in adapting

to changing business requirements. Employee performance is aligned

to the achievement of goals set within each subsidiary and is

rewarded accordingly. Employees are encouraged to use their skills

to best effect and are offered training either externally or

internally to achieve this. As a global business, the Group fully

recognises and seeks to harness the benefits of diversity within

its work force. The Group is grateful to its employees for

continuing to come to work in what has been a worrying time for

themselves and their families

Environment

The Group's policy with regard to the environment is to

understand and effectively manage the actual and potential

environmental impact of our activities. Operations are conducted

such that we comply with all legal requirements relating to the

environment in all areas where we carry out our business. The Group

continuously looks for ways to harness energy reduction

(electricity and gas) and water. The Company has installed a 190KW

solar system on its UK premises and is currently seeking permission

from the national grid to extend our installation of solar panels.

The Group is conducting an energy audit of its principal plant and

property with the help of energy consultants to understand ways of

reducing our energy consumption and operating in an environmentally

sustainable manner. During the period of this report the Group has

not incurred any fines or penalties or been investigated for any

breach of environmental regulations.

Social and community matters

We recognise our responsibility to work in partnership with the

communities in which we operate and we encourage active employee

support for their community in particular, in aid of technical

awareness and training. We regularly participate in a number of

education events encouraging interest in engineering in young

people. It is our policy not to provide political donations.

Consolidated income statement for the year ended 31st December

2020 (audited)

2020 2019

GBP'000 GBP'000

Revenue 32,803 33,433

Changes in inventories of finished goods and work

in progress (63) 959

Raw materials and consumables used (17,428) (17,986)

Employee benefits costs (8,408) (8,530)

Depreciation and amortisation expense (1,280) (1,236)

Other expenses (4,277) (4,737)

Other operating income 30 318

--------------------------------------------------- ----------- -----------

Profit from operations 1,377 2,221

Finance expense (191) (477)

Finance income 9 2

--------------------------------------------------- ----------- -----------

Profit before tax 1,195 1,746

Tax expense (341) (397)

--------------------------------------------------- ----------- -----------

Profit for the year 854 1,349

--------------------------------------------------- ----------- -----------

Profit attributable to:

Owners of the parent 823 1,360

Non-controlling interests 31 (11)

--------------------------------------------------- ----------- -----------

854 1,349

--------------------------------------------------- ----------- -----------

Basic and diluted earnings per share 59.31p 93.68p

--------------------------------------------------- ----------- -----------

Consolidated statement of comprehensive income for the year

ended 31st December 2020 (audited)

2020 2019

GBP'000 GBP'000

Profit for the year 854 1,349

Items that will not be reclassified subsequently

to profit or loss

Net pension remeasurement gain on post employment

benefits 66 178

Items that may be reclassified subsequently to

profit or loss

Foreign exchange losses on re-translation of overseas

operations (133) (323)

------------------------------------------------------- -------- --------

Other comprehensive income for the year (67) (145)

Total comprehensive income for the year 787 1,204

------------------------------------------------------- -------- --------

Total comprehensive income attributable to:

Owners of the parent 744 1,231

Non-controlling interests 43 (27)

------------------------------------------------------- -------- --------

787 1,204

------------------------------------------------------- -------- --------

Consolidated balance sheet at 31st December 2020 (audited)

2020 2019

GBP'000 GBP'000

Assets

Non-current assets

Property, plant and equipment 7,830 6,824

Intangible assets 37 48

Rights of use assets 487 278

Total non-current assets 8,354 7,150

Current assets

Inventories 8,864 8,573

Trade and other receivables 5,855 5,697

Cash and cash equivalents 1,533 1,679

-------------------------------------------------- -------- --------

Total current assets 16,252 15,949

-------------------------------------------------- -------- --------

Total assets 24,606 23,099

-------------------------------------------------- -------- --------

Liabilities

Current liabilities

Bank overdraft 335 1,016

Trade and other payables 4,744 3,808

Other financial liabilities 2,133 2,163

Corporation tax liability 78 19

-------------------------------------------------- -------- --------

Total current liabilities 7,290 7,006

Non-current liabilities

Financial liabilities 2,075 1,384

Deferred income tax liability 278 360

-------------------------------------------------- -------- --------

Total non-current liabilities 2,353 1,744

-------------------------------------------------- -------- --------

Total liabilities 9,643 8,750

-------------------------------------------------- -------- --------

Total net assets 14,963 14,349

-------------------------------------------------- -------- --------

Share capital 360 360

Capital reserve 257 257

Foreign exchange reserve (151) (6)

Retained earnings 14,800 14,084

-------------------------------------------------- -------- --------

Total equity attributable to the shareholders of

the parent 15,266 14,695

Non-controlling interests (303) (346)

-------------------------------------------------- -------- --------

Total equity 14,963 14,349

-------------------------------------------------- -------- --------

Consolidated cash flow statement for the year ended 31st

December 2020 (audited)

2020 2019

GBP'000 GBP'000

Operating activities

Net profit 854 1,349

Adjustments for:

Depreciation and amortisation 1,280 1,236

Foreign exchange losses (170) (255)

Finance income (9) (2)

Finance expense 191 477

Loss/(gain) on sale of land and buildings, plant,

machinery and motor vehicles 1 (12)

Adjustment in respect of defined benefits scheme 71 93

Income tax expense 341 397

Income taxes paid (168) (451)

---------------------------------------------------- -------- --------

1,537 1,483

---------------------------------------------------- -------- --------

Operating profit before changes in working capital

and provisions 2,391 2,832

(Increase)/decrease in trade and other receivables (356) 1,044

Increase in inventories (291) (701)

Increase/(decrease) in trade and other payables 942 (1,499)

295 (1,156)

---------------------------------------------------- -------- --------

Cash generated from operations 2,686 1,676

Investing activities

Purchases of property, plant, machinery and motor

vehicles and intangible assets (2,057) (1,660)

Sale of land and buildings, plant, machinery and

motor vehicles 13 27

Interest received 4 2

---------------------------------------------------- -------- --------

(2,040) (1,631)

Financing activities

Proceeds from long term borrowings 1,117 728

Repayment of borrowings (419) (459)

Repayment of hire purchase creditors (217) (281)

Repayment of lease liabilities (228) (210)

Bank interest paid (124) (426)

Lease interest paid (38) (33)

Hire purchase interest paid (29) (15)

Dividends paid (173) (167)

---------------------------------------------------- -------- --------

(111) (863)

---------------------------------------------------- -------- --------

Increase/(decrease) in cash and cash equivalents 535 (818)

Cash and cash equivalents, beginning of period 663 1,481

---------------------------------------------------- -------- --------

Cash and cash equivalents, end of period 1,198 663

---------------------------------------------------- -------- --------

Consolidated statement of changes in equity for the year ended

31st December 2020 (audited)

Foreign Non-

Share Capital Exchange Retained Controlling Total

Capital Reserve Reserve Earnings Total Interests Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1st January

2019 360 257 301 12,713 13,631 (319) 13,312

Comprehensive income

Profit - - - 1,360 1,360 (11) 1,349

Other comprehensive

income

Net pension remeasurement

gain recognised directly

in equity - - - 178 178 - 178

Foreign exchange losses

on re-translation of

overseas subsidiaries

consolidated operations - - (307) - (307) (16) (323)

--------------------------- ---------- ---------- ---------- ----------- -------- ------------- ---------

Total other comprehensive

income - - (307) 178 (129) (16) (145)

Total comprehensive

income - - (307) 1,538 1,231 (27) 1,204

--------------------------- ---------- ---------- ---------- ----------- -------- ------------- ---------

Transactions with owners

Dividends - - - (167) (167) - (167)

--------------------------- ---------- ---------- ---------- ----------- -------- ------------- ---------

Total transactions with

owners - - - (167) (167) - (167)

--------------------------- ---------- ---------- ---------- ----------- -------- ------------- ---------

Balance at 1st January

2020 360 257 (6) 14,084 14,695 (346) 14,349

Comprehensive income

Profit - - - 823 823 31 854

Other comprehensive

income

Net pension remeasurement

gain recognised directly

in equity - - - 66 66 - 66

Foreign exchange losses

on re-translation of

overseas subsidiaries

consolidated operations - - (145) - (145) 12 (133)

--------------------------- ---- ---- -------- ------- -------- ------ --------

Total other comprehensive

income - - (145) 66 (79) 12 (67)

Total comprehensive

income - - (145) 889 744 43 787

--------------------------- ---- ---- -------- ------- -------- ------ --------

Transactions with owners

Dividends - - - (173) (173) - (173)

Total transactions with

owners - - - (173) (173) - (173)

--------------------------- ---- ---- -------- ------- -------- ------ --------

Balance at 31st December

2020 360 257 (151) 14,800 15,266 (303) 14,963

--------------------------- ---- ---- -------- ------- -------- ------ --------

1. EARNINGS PER SHARE AND DIVIDENDS

Both the basic and diluted earnings per share have been

calculated using the net results attributable to shareholders of

Braime Group PLC as the numerator.

The weighted average number of outstanding shares used for basic

earnings per share amounted to 1,440,000 shares (2019 - 1,440,000).

There are no potentially dilutive shares in issue.

Dividends paid 2020 2019

GBP'000 GBP'000

Equity shares

Ordinary shares

Interim of 8.00p (2019 - 8.00p) per share paid

on 5th June 2020 38 38

Interim of 4.00p (2019 - 3.60p) per share paid

on 16th October 2020 19 17

------------------------------------------------ -------- --------

57 55

------------------------------------------------ -------- --------

'A' Ordinary shares

Interim of 8.00p (2019 - 8.00p) per share paid

on 5th June 2020 77 77

Interim of 4.00p (2019 - 3.60p) per share paid

on 16th October 2020 39 35

------------------------------------------------ -------- --------

116 112

------------------------------------------------ -------- --------

Total dividends paid 173 167

------------------------------------------------ -------- --------

An interim dividend of 7.80p per Ordinary and 'A' Ordinary share

will be paid on 25th May 2021.

2. SEGMENTAL INFORMATION

Central Manufacturing Distribution Total

2020 2020 2020 2020

GBP'000 GBP'000 GBP'000 GBP'000

Revenue

External - 3,762 29,041 32,803

Inter Company 1,772 3,068 5,159 9,999

--------------------------------- -------- -------------- ------------- --------

Total 1,772 6,830 34,200 42,802

--------------------------------- -------- -------------- ------------- --------

Profit

EBITDA 309 (163) 2,511 2,657

Finance costs (105) (31) (55) (191)

Finance income - 7 2 9

Depreciation and amortisation (592) (28) (660) (1,280)

Tax expense 32 - (373) (341)

(Loss)/profit for the period (356) (215) 1,425 854

--------------------------------- -------- -------------- ------------- --------

Assets

Total assets 5,178 4,200 15,228 24,606

Additions to non current assets 415 54 2,020 2,489

Liabilities

Total liabilities 801 2,025 6,817 9,643

Central Manufacturing Distribution Total

2019 2019 2019 2019

GBP'000 GBP'000 GBP'000 GBP'000

Revenue

External - 3,416 30,017 33,433

Inter Company 2,104 3,440 6,224 11,768

--------------------------------- -------- -------------- ------------- --------

Total 2,104 6,856 36,241 45,201

--------------------------------- -------- -------------- ------------- --------

Profit

EBITDA 851 (244) 2,850 3,457

Finance costs (305) (27) (145) (477)

Finance income - - 2 2

Depreciation (607) (18) (611) (1,236)

Tax expense (114) 39 (322) (397)

(Loss)/profit for the period (175) (250) 1,774 1,349

--------------------------------- -------- -------------- ------------- --------

Assets

Total assets 5,529 3,657 13,913 23,099

Additions to non current assets 1,138 76 607 1,821

Liabilities

Total liabilities 852 1,768 6,130 8,750

3. BASIS OF PREPARATION

The consolidated financial statements have been prepared in

accordance with International Financial Reporting Standards as

adopted by the European Union (IFRSs as adopted by the EU), IFRIC

interpretations and the Companies Act 2006 applicable to companies

reporting under IFRS. The consolidated financial statements have

been prepared under the historical cost convention. The accounting

policies adopted are consistent with those of the annual financial

statements for the year ended 31st December 2020 as described in

those financial statements.

4. ANNUAL GENERAL MEETING

.

The Company is closely monitoring public health guidance and

legislation issued by the UK government in relation to the Covid

pandemic. At the time of writing, the government continues to place

restrictions on mass gatherings and social contact. However, it is

expected shareholder attendance will be possible under the

government's published roadmap and we are therefore proposing to go

ahead with an open meeting. Shareholders intending to attend the

AGM are asked to register their intention as soon as possible by

emailing investor@braime.co.uk .

The health and safety of our colleagues and shareholders is very

important to us. Given the constantly evolving nature of the

situation, should circumstances change such that we consider it is

no longer possible for shareholders to attend the meeting or

limiting the numbers in attendance is required, we will notify

shareholders through the Company's website www.braimegroup.com and,

where appropriate, by a Regulatory News Service announcement.

For the same reason of uncertainty, we strongly encourage all

shareholders to exercise their votes by submitting their proxy by

post in advance of the meeting and shareholders are strongly

encouraged to appoint the Chairman of the meeting as their proxy.

Details of how to do this are set out in the notes accompanying

notes to the Notice. This will ensure that your votes are cast in

accordance with your wishes.

Irrespective of the guidelines in place at the time of the 2021

AGM, we understand that some shareholders may not wish to travel

but may still wish to ask questions of the board. Any questions

should be emailed to investor@braime.co.uk in advance and we will

endeavour to add a synopsis of all questions and answers to our

website shortly after the meeting.

The Annual General Meeting of the members of the company will be

held at the registered office of the company at Hunslet Road,

Leeds, LS10 1JZ on Wednesday 23rd June 2021 at 11.45am. The annual

report and financial statements will be sent to shareholders by

25th May 2021 and will also be available on the company's website (

www.braimegroup.com ) from that date.

5. THE ANNOUNCEMENT

The financial information set out in this announcement does not

constitute statutory accounts as defined by section 434 of the

Company Act 2006. The financial information for the year ended 31st

December 2020 has been extracted from the Group's financial

statements upon which the auditor's opinion is unqualified, does

not include reference to any matters to which they wish to draw

attention by way of emphasis without qualifying their report, and

does not include any statement under section 498 of the Companies

Act 2006. Statutory accounts for the year ended 31st December 2019

have been delivered to the Registrar of Companies, and those for

2020 will be delivered in due course.

6. EVENTS AFTER THE REPORTING PERIOD

There were no events after the balance sheet date that would

require disclosure in accordance with IAS10, "Events after the

reporting period".

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR BUGDSIDDDGBR

(END) Dow Jones Newswires

April 27, 2021 11:29 ET (15:29 GMT)

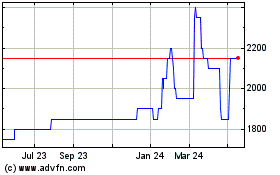

Braime (LSE:BMTO)

Historical Stock Chart

From Nov 2024 to Dec 2024

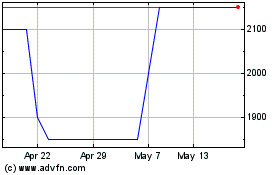

Braime (LSE:BMTO)

Historical Stock Chart

From Dec 2023 to Dec 2024