Baker Steel Resources Trust Ltd Net Asset Value(s) (9238Q)

March 03 2021 - 1:00AM

UK Regulatory

TIDMBSRT

RNS Number : 9238Q

Baker Steel Resources Trust Ltd

03 March 2021

BAKER STEEL RESOURCES TRUST LIMITED

(Incorporated in Guernsey with registered number 51576 under the

provisions of The Companies (Guernsey) Law, 2008 as amended)

3 March 2021

26 February 2021 Unaudited NAV Statement

Net Asset Value

Baker Steel Resources Trust Limited (the "Company") announces

its unaudited net asset value per share at 26 February 2021:

Net asset value per Ordinary Share: 95.2 pence

The NAV per share has increased by 0.4% against the NAV at 31

January 2021, with the increase in the carrying value of Anglo

Saxony Mining Limited offset by falls in the listed precious metal

shares held in the portfolio and by increases in the Sterling

exchange rates against the currencies in which the Company's

investments are held.

The Company had a total of 106,462,502 Ordinary Shares in issue

with a further 700,000 shares held in treasury as at 26 February

2021 .

Investment Update

The Company's top 12 investments were as follows as a percentage

of NAV:

26 February 31 December 2020

2021

Bilboes Gold Limited 16.7% 16.9%

Futura Resources Ltd 16.2% 16.5%

Cemos Group plc 14.2% 14.6%

Tungsten West Limited 13.1% 12.6%

Polar Acquisition Ltd 11.0% 11.2%

Anglo Saxony Mining Limited 5.2% 4.0%

Mines & Metals Trading

Peru PLC 4.6% 4.5%

Nussir ASA 3.4% 3.5%

Azarga Metals Corp 2.8% 2.8%

Sarmin Minerals Exploration 2.7% 2.7%

Metals Exploration plc 2.0% 1.9%

Black Pearl Limited Partnership 1.3% 1.2%

Listed Precious Metal Shares 3.2% 3.9%

Other Investments 2.8% 2.8%

Net Cash, Equivalents and

Accruals 0.8% 0.8%

Anglo Saxony Mining Limited ("ASM")

On 26 February 2021, Panthera Resources Plc announced that it

had sold its entire interest in ASM representing approximately 14%

of the company to a new investor at a 50% premium to the Company's

carrying value at 31 January 2021. The Company has therefore

increased the carrying value of the ASM equity and convertible

loans that it holds. At the uplifted the whole of ASM is valued at

approximately EUR14 million on a fully diluted basis. The Company

would own approximately 25% of ASM should it exercise its right to

convert its convertibles.

This sale paves the way for ASM to raise new equity to fund the

definitive feasibility study on its Telehauser tin project in

Saxony, Germany. During 2020, ASM completed a pre-feasibility study

(PFS) on Telehauser into a mine producing approximately 3,000

tonnes of tin per annum in concentrate over a 12-year mine life

with an after tax NPV(5%) of EUR11M and an IRR of 6.7% using a

US$20,500/tonne tin price. Tin has long been identified as one of

the principal beneficiaries of the global move towards

electrification due to its use as solder for electrical

connections, and a tin mine in the heart of Europe is likely to be

of strategic importance. The price of tin has risen approximately

70% over the past year to US$27,500/tonne at the end of February

2021. Applying this tin price to the pre-feasibility study economic

model would give an after tax NPV(5%) of EUR90M and an IRR of

18.9%.

The PFS recommended additional drilling to improve confidence in

and the potential size of the mineral resources at Telehauser and

the likely significant reduction in mining dilution once more

accurate information is available on the geometry of the orebodies

as well additional metallurgical testwork in order improve

recoveries of by-product metals in particular Indium, as meaningful

sources of upside potential for the final DFS outcome.

Mines & Metals Trading (Peru) PLC ("MMTP")

On 11 February 2021 MMTP announced a business combination with

TSX-V listed mineral exploration company Oro X Mining Corp.

Pursuant to the 50:50 merger Oro X will acquire 100% of the shares

of MMTP with the resultant merged company called Silver X. Oro X's

flagship asset is the Coriorcco gold exploration project in

Ayacucho, Peru. The combination of Oro X's and MMTP's teams, assets

and operational experience creates a growth-focused platform primed

to consolidate the fragmented Peruvian silver landscape.

As a condition of the business combination transaction, Echelon

Wealth Partners Inc. and Red Cloud Securities Inc. have been

engaged to raise a minimum of C$14 million. Trading in Oro X has

been halted pending pricing of the share placing and completion of

the transaction. The proceeds are planned to be used for mine

development and exploration activities at MMTP's Recuperada Mine in

Peru, and for general working capital. The offering is expected to

close around 31 March 2021.

Further details of the Company and its investments are available

on the Company's website www.bakersteelresourcestrust.com

Enquiries:

Baker Steel Resources Trust Limited +44 20 7389 8237

Francis Johnstone

Trevor Steel

Numis Securities Limited +44 20 7260 1000

David Benda (corporate)

James Glass (sales)

The Net Asset Value ("NAV") figure stated is based on unaudited

estimated valuations of the underlying investments and not

necessarily based on observable inputs. Such estimates are not

subject to any independent verification or other due diligence and

may not comply with generally accepted accounting practices or

other generally accepted valuation principles. In addition, some

estimated valuations are based on the latest available information

which may relate to some time before the date set out above.

Accordingly, no reliance should be placed on such estimated

valuations and they should only be taken as an indicative guide.

Other risk factors which may be relevant to the NAV figure are set

out in the Company's Prospectus dated 26 January 2015.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVKZGGFVZNGMZM

(END) Dow Jones Newswires

March 03, 2021 02:00 ET (07:00 GMT)

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

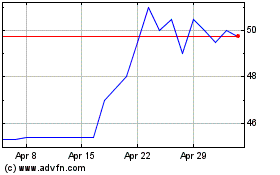

Baker Steel Resources (LSE:BSRT)

Historical Stock Chart

From Apr 2023 to Apr 2024