TIDMCAPC

RNS Number : 5672R

Capital & Counties Properties Plc

09 March 2021

09 MARCH 2021

CAPITAL & COUNTIES PROPERTIES PLC ("CAPCO")

AUDITED PRELIMINARY RESULTS FOR THE YEARED 31 DECEMBER 2020

Prime central London REIT centred around Covent Garden,

well-positioned to benefit from recovery over time

Henry Staunton, Chairman of Capco, commented:

"2020 was an extraordinary year with significant market

uncertainty. Capco's support to its people, customers and broader

Covent Garden community ensures the business is well-positioned to

benefit from a recovery and prosper over time. We remain focused on

responsible stewardship, disciplined capital management and are

committed to delivering long-term value for shareholders from our

unique portfolio of West End focused investments."

Ian Hawksworth, Chief Executive of Capco, commented:

"Capco's financial strength has allowed us to support our

customers and business partners whilst taking advantage of market

opportunities during an unprecedented year which significantly

impacted rents and property valuations. As a long-term investor we

are optimistic about the enduring appeal of Covent Garden and

London's West End and are confident that Capco is well-positioned

to benefit from London's economic recovery."

Key financials

- Equity attributable to owners of the Parent of GBP1.8 billion (2019: GBP2.5 billion)

- EPRA NTA 212 pence per share, a decrease of 28 per cent (2019: 293 pence per share)

- Total property value GBP1.9 billion, a decrease of 26 per cent

(like-for-like) (2019: GBP2.8 billion)

- Group net debt to gross assets ratio of 28 per cent (2019: 15 per cent)

- Underlying earnings per share -0.7 pence (2019: 1.0 pence per share)

Covent Garden, a landmark estate positioned for future value

creation

- Covent Garden total property value of GBP1.8 billion, a

decrease of 27 per cent (like-for-like) since 31 December 2019

- ERV decreased by 22 per cent (like-for-like) to GBP81 million

(2019: GBP108 million) and equivalent yield of 3.91 per cent (2019:

3.65 per cent)

- Reported net rental income down 74 per cent to GBP16 million

against December 2019 and underlying net rental income down 30 per

cent (like-for-like) to GBP44 million

- EPRA vacancy is 3.5 per cent (2019: 3.2 per cent)

- Capco continues to provide support to retail and hospitality

customers on a short-term basis, with rental agreements being

adjusted case-by-case to include deferrals and turnover-linked

arrangements

- Encouraging indicators upon reopening following easing of

measures in the second half of 2020

- 65 new leases and renewals, representing GBP6.2 million of

contracted income were agreed during the year

- Continuing to attract high quality brands including Tiffany

& Co., Vashi, The Gentlemen Baristas and Arc'teryx

- Public realm improvements including pedestrianisation and 500

al fresco dining covers, enhancing trading prospects

- Completed the sale of the Wellington block for GBP76.5

million, in line with June 2020 valuation

Committed to sustainability and innovating to meet customer

needs

- New commitment to achieve Net Zero Carbon by 2030

- A new Environment, Sustainability and Community ("ESC") Board

Committee has been established

- Net Zero Carbon Pathway to be published in 2021

- Additional pedestrianisation of streets around the Piazza further improving air quality

- Assistance provided to COVID-19 funds supporting homelessness,

food banks and the elderly as well as hospitality and retail

foundations.

Acquisition of significant stake in Shaftesbury PLC

- Unique opportunity to acquire a significant stake in a company

with an exceptional mixed-use portfolio of c.600 buildings across

the West End

- GBP501 million invested, resulting in a shareholding of 25.2 per cent

- Represents a compelling investment and entry point at an

implied value of approximately GBP1,200 per square foot

- Consistent with Capco's strategy to invest in complementary

opportunities on or near Covent Garden

Maintaining a strong balance sheet with significant financial

flexibility

- Covent Garden net debt GBP352 million (2019: GBP555 million)

and loan to value ratio of 19 per cent (30 June 2020: 36 per cent)

(2019: 21 per cent)

- Significant headroom against the LTV covenant position, and

interest cover covenant waivers agreed for 2021

- Group net debt of GBP710 million (2019: GBP442 million) and

net debt to gross assets of 28 per cent

- Access to Group liquidity comprising undrawn facilities and

cash of GBP1 billion (2019: GBP895 million), and capital

commitments of GBP2 million (2019: GBP14 million)

- Weighted average maturity on drawn debt of over 5 years (2019:

7.3 years) and average cost of debt of 2.6 per cent (2019: 3.0 per

cent)

- The Directors have decided not to propose a dividend for 2020 (2019: 1.5 pence per share)

Other investments

- GBP195 million of deferred consideration from the Earls Court

sale was received with the final payment of GBP15 million due later

this year

- Completion of Lillie Square Phase 2 with 94 units handed over

this year, representing GBP116 million of net proceeds (GBP58

million Capco share)

KEY FINANCIALS

2020 2019

=================================================== ========== ==========

Equity attributable to owners of the Parent GBP1,760m GBP2,478m

Equity attributable to owners of the Parent per

share 206.8p 290.0p

-27.2% Total return in 2020 (2019: -9.6 %)

EPRA net tangible assets GBP1,806m GBP2,506m

EPRA net tangible assets per share 212.1p 292.9p

Dividend per share - 1.5p

-24.4% Total property return in 2020 (2019: -5.4%)

Property market value(1) GBP1,942m GBP2,774m

Net rental income from continuing operations

(2) GBP15.8m GBP61.2m

Loss for the year attributable to owners of the

Parent -GBP702.7m -GBP253.6m

--------------------------------------------------- ---------- ----------

Headline loss per share -1.3p -2.2p

--------------------------------------------------- ---------- ----------

Basic loss per share(3) -82.5p -29.7p

--------------------------------------------------- ---------- ----------

Underlying (loss)/earnings per share(4) -0.7p 1.0p

=================================================== ========== ==========

1. On a Group share basis. Refer to Property Data on page 73 for

the Group's percentage ownership of property.

2. On a Group share basis. Refer to note 2 "Segmental Reporting"

on page 43.

3. From continuing and discontinued operations. Refer to note 12

"Earnings per share and Net Assets Per Share" on page 53.

4. From continuing and discontinued operations. Refer to note 3

'Underlying Earnings' on page 46.

ENQUIRIES

Capital & Counties Properties PLC:

Ian Hawksworth Chief Executive +44 (0)20 3214 9188

Situl Jobanputra Chief Financial Officer +44 (0)20 3214 9183

Head of Commercial Finance

Sarah Corbett and Investor Relations +44 (0)20 3214 9165

Media enquiries:

UK: Hudson Sandler Michael Sandler +44 (0)20 7796 4133

SA: Instinctif Frederic Cornet +27 (0)11 447 3030

A presentation will take place today at 08.30am through a

webcast on the Group's website www.capitalandcounties.com followed

by analyst Q&A.

A copy of this announcement is available for download from our

website at www.capitalandcounties.com and hard copies can be

requested via the website or by contacting the Company

(feedback@capitalandcounties.com or telephone +44 (0)20 3214

9170).

CHAIRMAN'S STATEMENT

Overview

2020 was an extraordinary year, with significant market

uncertainty and challenging trading conditions for Capco and many

of its customers due to the pandemic. As a responsible long-term

investor in central London real estate, Capco has prioritised the

health and safety of its people, customers and visitors. I am proud

of our response to the pandemic, which would not have been possible

without the hard work of our employees and service providers, and I

thank them for their commitment.

Capco's strong financial position enabled the Group to take

decisive action to support our customers as well as take advantage

of market opportunities, including the acquisition of a 25.2 per

cent interest in Shaftesbury PLC ("Shaftesbury"). Capco has further

strengthened its financial flexibility through disposals and

financing initiatives. There is continued market uncertainty in

2021, however we are confident in the long-term prospects for the

West End, in particular Covent Garden. Through our long-term

vision, entrepreneurial culture and implementation of strategy, we

have positioned the business competitively to benefit from a

recover y.

COVID-19 response

Capco took decisive action to ensure the safety and security of

Covent Garden, whilst also providing support on a case-by-case

basis to customers experiencing cash flow challenges as a result of

COVID-19. Extensive security and cleaning measures were implemented

across the Covent Garden estate. In collaboration with

stakeholders, Capco has made enhancements to public realm,

including the pedestrianisation of additional streets during 2020

and the provision of al fresco dining to create a welcoming open

air environment. We were encouraged by the response to these

initiatives, which saw footfall and sales rebuilding well, prior to

the implementation of further restrictions in December 2020.

Capco worked closely with local communities to provide

assistance to charity partners in the West End, including providing

financial aid to COVID-19 funds supporting homelessness, food banks

and the elderly as well as hospitality, retail and cultural

foundations. Capco's support to its customers and broader Covent

Garden community will position the business to benefit from a

recovery and prosper over time.

It has been an unprecedented year for all our colleagues. The

work required during 2020 to support our customers and position the

business competitively to benefit from recovery has required

significant effort from employees across the business, and the

Board would like to thank each of them for their contribution and

commitment. Capco did not furlough any of its employees, nor did it

take up any other direct government support measures.

Sustainability

Our purpose is to invest in and create world-class places,

focusing on central London. Using our vision, long-term approach

and responsible stewardship, we deliver economic and social value

and generate benefits for our stakeholders. Capco has renewed its

approach to environment, sustainability and community initiatives

supported by a Board Committee as well as a new "ESC" strategy with

a commitment to achieve Net Zero Carbon by 2030. We will publish a

detailed pathway to Net Zero Carbon during 2021, but given the

urgency of tackling climate change, we make the 2030 commitment

now. Our activities are underpinned by a commitment to the highest

standards of health and safety and ethical practices, focusing our

activities on areas including improving air quality, delivering

best in class heritage environmental performance and responsible

and sustainable development practices in renewing our existing

buildings.

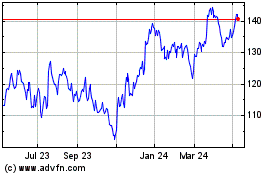

Financial performance and position

The COVID-19 pandemic has had a material impact on the financial

performance of the Group in 2020. Capco's total shareholder return

for the year, which comprises share price performance plus the

dividends paid during the year, is -44 per cent. Total return for

the year, which represents the change in net assets plus the

dividends paid during the year, is -27 per cent. The total value of

Capco's property portfolio has declined by 26 per cent on a

like-for-like basis to GBP1.9 billion.

Challenging occupier and investment market conditions resulting

from the pandemic have had a negative impact on property valuations

and rental values. Covent Garden recorded a 27 per cent

like-for-like decline in property valuation and a 30 per cent

like-for-like decline in underlying net rental income. In view of

disruption to customer cash flows, Capco has provided support to

its customers where appropriate. This aligns with our objective to

maintain the vibrant consumer offer at Covent Garden and support

the long-term value of the estate.

Capco takes a prudent approach to financial management and the

Board implemented a number of actions early in the year in response

to the COVID-19 pandemic, including cancellation of the GBP100

million share buyback programme and suspension of the dividend.

During the year Capco raised over GBP700 million through disposals,

including the Wellington block, and financing activities,

maintaining its disciplined approach to capital management.

Capco's capital management decisions have enhanced its financial

flexibility, providing a more appropriate funding balance across

the Group while providing access to substantial levels of

liquidity. The Group has modest capital commitments and a net debt

to gross assets ratio of 28 per cent. There is substantial headroom

against the Covent Garden loan to value covenant with a loan to

value ratio of 19 per cent . Waivers have been agreed with the

Covent Garden lending banks and noteholders in relation to the

interest cover covenant for June and December 2021.

Whilst there has been some upward pressure on certain costs as a

result of the pandemic, a number of efficiencies have been

implemented, including consolidating the business in one office at

Covent Garden.

Given current market conditions and the significant

uncertainties, the Board has taken the decision to not declare a

dividend for 2020. The Company will recommence dividend payments as

soon as it is appropriate.

Investment in Shaftesbury PLC

Capco has continued to implement its strategy of investing in

complementary opportunities on or near the Covent Garden estate. In

May 2020, Capco agreed to acquire a significant shareholding in

Shaftesbury across two tranches for total consideration of GBP436

million. On 22 October 2020, Capco participated in a capital

raising by Shaftesbury and invested a further GBP65 million

resulting in a 25.2 per cent interest in Shaftesbury. This

shareholding represents a compelling investment which the Board

believes will generate long-term value for Capco shareholders.

Other investments

Other investments include a joint venture interest in the Lillie

Square development. The handover of Phase 2 apartments continued

during the year, with a total of 94 units representing GBP116

million of net cash proceeds (GBP58 million Capco share) completed

during the year. GBP195 million of deferred consideration from the

Earls Court sale was received with the final payment of GBP15

million due later this year.

The Board

The Board continues to keep its composition under review, to

ensure that we have the appropriate mix of skills and experience to

deliver Capco's strategy as a prime central London focused REIT.

Capco embraces diversity with 43 per cent gender and ethnic

diversity on our Board, an increase from 20 per cent in 2019,

recognising that diversity of experience and perspective can bring

benefits across the business.

In February 2020, we were delighted to appoint Michelle McGrath,

who had been a senior executive with the Company for six years,

most recently as Director of Covent Garden, to the Board as an

Executive Director. Michelle has played an important role in

leading the asset management and investment teams of the Covent

Garden portfolio. As I reported last year, Gerry Murphy and Andrew

Strang retired from the Board during 2020, and we thank each of

them for their service to the Company.

Following the establishment of the Board ESC Committee chaired

by Charlotte Boyle, Jonathan Lane will become Chairman of the

Remuneration Committee following the 2021 AGM, and Charlotte Boyle

will step down from that role on the same date, remaining a member

of the Remuneration Committee.

Six of the Company's Directors invested in shares during the

year, demonstrating the Board's continued confidence in the

long-term success of the Company.

Board oversight

Throughout 2020 the Board received regular updates from the

Executive Directors, which ensured the Non-executive Directors were

kept informed on a regular basis on developments relating to

Capco's response to the COVID-19 pandemic, its impact on the

business and management actions. Although the Board was unable to

meet face to face for much of the year, through technology we

maintained our regular programme of Board meetings and updates, and

found the virtual Board Room to be very effective. The Executive

Directors ensured that the Board received updates on the views of a

range of stakeholders including shareholders, local communities,

partners, lenders and government. In addition, Charlotte Boyle has

been invited to attend Capco's ESC Executive Committee meetings,

which ensures that the views of employees are clearly heard by the

Board.

Voting on AGM resolutions

At Capco's 2020 Annual General Meeting, the Company's new

Remuneration Policy was approved, however the Company received

significant shareholder votes against three resolutions. The

Remuneration Committee has engaged with shareholders to understand

the reasons for these votes, and has made a number of commitments

in respect of the implementation of the Directors' Remuneration

Policy to accommodate the feedback received from shareholders.

These commitments are explained within the 2020 Directors'

Remuneration Report.

At the General Meeting held on 10 August 2020, although the

resolution seeking approval for the second tranche of investment in

Shaftesbury PLC was passed, Capco received a significant

shareholder vote against the resolution. The Company has engaged

with shareholders to understand the reasons for these votes, and

also notes that selected corporate governance and shareholder

advisory bodies focused on short-term share price movements, rather

than the long-term strategic rationale for the investment.

Discussions with shareholders indicate a strong level of support

for the investment. The Board thanks the Company's shareholders for

their engagement on these matters.

Looking ahead

Capco's strong financial position and experienced management

have enabled us to take a proactive approach across the estate to

protect long-term value, take advantage of market opportunities and

position the business to return to growth and prosperity as the

market recovers. We thank our customers, our employees and business

partners for the determination and resilience they have shown

throughout this period.

There are many challenges ahead, however the Group is

well-positioned to navigate through this period of uncertainty. We

remain focused on responsible stewardship, and disciplined capital

management, and are committed to delivering long-term value for

shareholders from our unique portfolio of West End focused

investments.

Henry Staunton

Chairman

8 March 2021

Chief Executive's review

Overview

2020 was a very challenging year, COVID-19 has had a major

impact on the valuation of Covent Garden as well as causing

significant disruption to near-term income. However, our strong

financial position enabled us to take proactive decisions to

protect the long-term value of our Covent Garden estate, take

advantage of market opportunities and position the business to

return to growth and prosperity.

Throughout this period of COVID-19 uncertainty Capco has

prioritised the health and safety of our people, customers and

visitors. We have continued to innovate and collaborate with

stakeholders to position the estate for recovery as restrictions

are lifted and the West End gets back to business.

Our objective is to maintain a strong customer line-up ensuring

a world-class estate for the longer term through supporting our

customers on a case-by-case basis and generating new leasing

activity underlining the unique offer of Covent Garden for the

occupational market. Whilst conditions are challenging today, these

actions will support our business to benefit from a gradual

recovery.

Throughout 2020, we continued to engage with our audiences

through multi-channel marketing activities with an extensive

digital outreach programme and estate marketing initiatives, as

well as investment in high quality public realm. This included the

temporary pedestrianisation of additional streets and provision of

over 500 additional outdoor covers enhancing the overall customer

experience. We have been encouraged by the response to these

initiatives. Covent Garden was one of the most vibrant districts of

central London with footfall and sales building prior to the

current restrictions being imposed in December 2020.

Capco has developed its extensive ESC agenda, supported by a new

Board Committee, and has committed to achieve Net Zero Carbon by

2030. This commitment today recognises that a detailed plan for our

heritage estate will be published in 2021, but is made in the

knowledge that tackling the challenges of climate change requires

action now. Capco is focused on responsible stewardship promoting a

cleaner, greener estate through enhanced air quality, greening, and

energy and waste management initiatives.

Over the course of 2020, we reshaped the organisation providing

roles of responsibility and leadership to a number of employees

reflective of our dynamic and entrepreneurial culture. We also

completed the move to our new head office in Covent Garden which

has allowed us to bring efficiencies and reduce our cost base. I

would like to thank every employee for the commitment and

resilience demonstrated through this challenging year.

Capco is financially strong with access to substantial

liquidity, enabling the business to withstand the immediate impact

of COVID-19 whilst taking advantage of opportunities commensurate

with strategy, including the acquisition of an interest of 25.2 per

cent in Shaftesbury PLC.

Purpose, strategy and capital allocation

Our purpose is to invest in and create world-class places,

focusing on central London. Using our vision, long-term approach

and responsible stewardship, we deliver economic and social value

and generate benefits for our stakeholders.

Capco has assembled the Covent Garden portfolio over a period of

14 years. As a long-term steward of the Covent Garden estate, Capco

has utilised creative asset management and investment to establish

a world-class estate rich in heritage and culture in the heart of

London's West End. Covent Garden's scale and concentrated ownership

would be incredibly difficult to replicate making it a scarce and

valuable real estate investment.

The Group is well-positioned financially and with a strategic

focus on Covent Garden and the West End. Capco's investment

strategy is to invest in complementary opportunities on or near the

Covent Garden estate. Capco's ambitious and creative culture

encourages value creation opportunities whilst maintaining cost and

capital discipline.

Substantially all of the Company's property value is within the

Covent Garden business, with the portfolio currently independently

valued at GBP1.8 billion. In addition, the Company has an

investment in Shaftesbury PLC valued at GBP552 million at 31

December 2020. Shaftesbury PLC is a real estate investment trust

which invests exclusively in London's West End. Capco has a track

record of accretive investment and aggregation of ownership in the

West End and it is intended that opportunities to expand our

ownership in the area will be pursued in line with ambitions to

grow the business.

Each capital decision is assessed on its merits including

investment in owned assets, development and repositioning

opportunities, accretive acquisitions on or near the Covent Garden

estate, opportunistic investments in London, the disposal of

non-strategic assets and distributions to shareholders as

appropriate.

The Group raised over GBP700 million in 2020 through disposals

and financing activities, maintaining its disciplined approach to

capital management. Capco disposed of the Wellington block for

GBP76.5 million and received GBP195 million deferred consideration

from the sale of Earls Court, as well as GBP58 million (Capco

share) of net disposal proceeds received during the year in the

Lillie Square joint venture.

Financing activities included a GBP275 million exchangeable bond

and a GBP125 million secured loan which enhance Capco's strong

financial position and provide a more appropriate funding balance

across the investments of the Group. Group net debt to gross assets

is 28 per cent, whilst Covent Garden's loan to value ratio is 19

per cent and net debt is GBP352 million. The Board has set balance

sheet leverage parameters of up to 40 per cent as represented by

the net debt to gross assets ratio. Interest cover covenant waivers

in respect of 2021 have been agreed with the Covent Garden lenders

to address interruption to near-term income.

Following the sale of Earls Court, Capco has continued to reduce

administration costs and is now on track to achieve its underlying

run rate of GBP20 million in 2021.

Given current market conditions and the significant

uncertainties, the Board has taken the decision to not declare a

dividend for 2020. The Company will recommence dividend payments as

soon as it is appropriate. Our ambition is to generate attractive

returns for our shareholders over the long-term through investment

in central London real estate.

Valuation and performance

The total property valuation of the Group declined by 26 per

cent (like-for-like) in the year to 31 December 2020 to GBP1.9

billion. Against a challenging retail and F&B/hospitality

backdrop, Covent Garden declined by 27 per cent (like-for-like) to

GBP1.8 billion, principally driven by movements in ERV which

decreased by 22 per cent (like-for-like) and a widening in the

equivalent yield of 28 basis points to 3.91 per cent.

As a consequence of the unprecedented operating conditions,

underlying net rental income decreased by 30 per cent like-for-like

compared with December 2019. There was positive occupational demand

at the beginning of the year but this was significantly interrupted

from late February onwards. Nevertheless 65 new leases and renewals

representing GBP6.2 million of rental income completed in the year

including the introduction of 14 new brands. EPRA vacancy remains

stable at 3.5 per cent however across the West End there is greater

pressure on customers, which together with a difficult leasing

market, is anticipated to have a negative impact on occupancy

levels over 2021.

Capco's investment at Lillie Square decreased in value by 9 per

cent (like-for-like ) to GBP115 million at 31 December 2020.

The decline in the valuation of the property portfolio has

resulted in EPRA net tangible assets declining by 28 per cent over

the year to 212 pence per share.

Property valuations

Valuation

Market Market Change

Value 2020 Value 2019 Like-for-Like

GBPm GBPm 1

================================ =========== =========== ==============

Covent Garden 1,825 2,596 -27.3%

Other 2 117 178 -9.1%

Group share of total property 3 1,942 2,774 -26.4%

================================ =========== =========== ==============

1 Valuation change takes account of amortisation of tenant lease

incentives, capital expenditure, disposals, fixed head leases and

unrecognised trading surplus.

2 Includes Capco's interest in the Lillie Square joint venture

and Lillie Square Holdings Group.

3 A reconciliation of carrying value of investment, development

and trading property to the market value is shown in note 13

'Property Portfolio'.

CBRE has undertaken an independent valuation of the Covent

Garden estate. The total valuation of the estate is GBP1,825

million and represents the aggregated value of the individual

properties, with no reflection of any additional estate premium

which potential investors may ascribe to the concentrated and

comprehensive nature of ownership within the estate. The

predominantly freehold nature, concentrated ownership, scale of the

estate as well as the portfolio mix may lead prospective purchasers

to regard certain parts of the portfolio, for example by street, to

have a greater value than the aggregate of the individual property

values.

New leasing activity and estate animation

Capco remains confident in its customer mix, continuing to focus

on concepts with differentiated offerings, successful multi-channel

programmes, close customer relationships and brands that recognise

the value of high-profile locations with a complementary leisure

and dining offering.

Contemporary luxury jewellery brand Vashi signed a long-term

lease on James Street for a new London flagship store, which is set

to open in 2021. This new opening joins established luxury brands

Tiffany & Co., which agreed terms in December 2020 for a new

lease, and Bucherer, which has continued with expansion plans at

the Royal Opera House Arcade opening in 2021. Peloton continues the

fit out of its European flagship training studio and retail store

on Floral Street, joining Ganni and American Vintage which opened

stores earlier in the year.

Notwithstanding current disruption to business activity, four

new brands opened in December 2020 including streetwear store Kick

Game, Belgian chocolatiers Neuhaus, British heritage brand

Mackintosh, and vegan cookie concept Floozie Cookie. A number of

new dining concepts have been introduced to the estate, including

acclaimed restaurant Darjeeling Express, The Gentlemen Baristas and

al fresco bar NaNas. The latest additions further enhance Covent

Garden's attractiveness as a dining destination.

Capco continued to implement its clear estate marketing strategy

focusing on its digital capabilities, partnering with retail and

dining brands as well as cultural partners to introduce engaging

pop-ups and events to promote Covent Garden and the West End.

Activities included an open air cinema on Covent Garden's Piazza in

the summer and an immersive LEGO installation on the East Piazza

for the Christmas trading period. Capco's focused digital strategy

continues to drive consumer engagement, with an extensive

digital-first programme centred around 'Covent Garden at Home'

content, delivering aspects of the estate virtually to consumers

via an enhanced website.

Covent Garden positioned for growth

Capco has transformed the Covent Garden estate into a prime

district in the heart of London's West End. The portfolio comprises

526 units of shops and restaurants as well as offices, hotels,

museums and residential assets. Across the estate, 50 per cent of

the value is represented by retail, 21 per cent by F&B use, 15

per cent office, 10 per cent residential and 4 per cent

leisure.

London is one of the world's greatest cities with a long track

record of attracting talent, visitors and investment from around

the world. Covent Garden is a global destination with one of the

world's strongest retail and dining line-ups, in a heritage

setting, competitively positioned as a global brand. Its

differentiated offer has consistently delivered an attractive

environment for over 40 million visitors every year. The consumer

mix in 2019 represented approximately 40 per cent international, 40

per cent Londoners and 20 per cent domestic with the pedestrian

flow across the estate continuing to evolve.

COVID-19 restrictions and social distancing measures imposed by

government have had and continue to have, a material adverse effect

on normal patterns of footfall across the estate. Advice to avoid

unnecessary travel, together with reduced physical office

occupancy, closure of non-essential retail, hospitality and leisure

venues for extended periods and limitations on international

leisure and business travel have had a dramatic impact on footfall

and trade.

We are encouraged by the response to marketing initiatives and

appreciative of the determination, creativity and enthusiasm of our

customers. The enduring appeal of Covent Garden was seen by

recovery in footfall and trade following the easing of measures in

the second half of 2020.

High quality global locations are key to retailers and F&B

concepts when selecting sites around the world. Retailers continue

to adapt to changes in consumer shopping behaviour and evolve their

physical retail offers to place more emphasis on customer

experience, service and flagship retailing with better digital

engagement. Capco offers a unique customer experience, utilising

the historic Piazza through events and cultural installations to

drive global estate recognition. We will continue to innovate at

Covent Garden and to support our customers whilst evolving the mix.

Covent Garden's strong fundamentals and enduring appeal give us

confidence in the long-term prospects of the business.

Other investments

Our investment in Shaftesbury PLC is a unique opportunity to own

a significant stake in an exceptional mixed-use real estate

portfolio, adjacent to Capco's world-class Covent Garden estate.

Capco aims to maximise the strategic and economic value of its

investment which was made at an attractive entry price with an

implied value of approximately GBP1,200 per square foot and we

believe will generate long-term value for Capco shareholders. The

investment is consistent with Capco's strategy to invest in

complementary opportunities on or near the Covent Garden

estate.

GBP195 million of deferred consideration from the sale of Earls

Court was received in 2020, with the balance of GBP15 million

expected in November 2021. The Lillie Square joint venture

continues to progress. Handover of units sold in Phase 1 is

complete, with a small number of units available. 94 Phase 2 units

have been handed over representing net proceeds of GBP116 million

(GBP58 million Capco share). A further 92 units remain in Phase 2,

of which 60 have been pre-sold; should they all complete this will

generate approximately GBP70 million of further proceeds (GBP35

million Capco share).

Sustainability, Environment and Stakeholders

Capco has developed its extensive ESC agenda, supported by a new

Board Committee, and committed to achieve Net Zero Carbon by 2030.

We are focused on responsible stewardship, promoting a cleaner,

greener estate through enhanced air quality, greening and energy

and waste management initiatives. We seek to generate positive

outcomes for our stakeholders and the community, upholding high

standards of professional ethics and corporate governance whilst

encompassing a dynamic, inclusive and diverse corporate

culture.

The heritage of Covent Garden is incredibly important to the

West End; therefore Capco took decisive action to ensure the safety

and security of the estate when government lockdown measures were

announced. Being a good neighbour is important to us and we have

refocused our community programme to prioritise initiatives and

charity partners in Covent Garden. This includes the provision of

financial aid to COVID-19 funds supporting homelessness, food banks

and the elderly as well as hospitality and retail foundations.

In partnership with Westminster City Council, there were

additional pedestrianised streets in the Covent Garden area for an

extended period during 2020, as well as additional outdoor seating

areas for our restaurants, providing approximately 500 temporary

incremental outdoor covers across 20 al fresco dining

locations.

Our People

We reshaped the organisation this year through the

simplification of the Group, providing our talented and diverse

workforce opportunities for leadership and responsibility. Our

employees are key to our business which promotes a culture of

creative passion for Covent Garden to allow employees to reach

their potential whilst creating value for our stakeholders.

Technology has enabled the business to continue to operate

remotely. Effective communication and keeping everyone connected

have been vital to managing this challenging period. We supported

our employees through regular town halls, business updates and

seminars focusing on well-being initiatives including nutrition,

exercise and mental health awareness.

Outlook

We are optimistic that the enduring appeal of Covent Garden will

drive a recovery of footfall and trade over the course of this year

and next. Operating conditions will remain difficult for our

customers which is anticipated to lead to enhanced levels of

vacancy and further adjustments in valuation and rental levels.

However our immediate priority is focused on making sure our

customers reopen successfully. Getting office workers back will

help the economy move towards more normal levels of activity. There

is a clear roadmap for our retailers and restaurateurs to build

trade. The upcoming easing of restrictions and the reopening of

hospitality, retail and leisure activities will lead to a gradual

return of domestic footfall.

We continue to seek efficiencies across the business and remain

disciplined in the allocation of our capital. We will continue to

focus on responsible stewardship, implementing our ESC strategy and

working to achieve our Net Zero Carbon target by 2030. Our actions

in 2020 ensure the business is very well-positioned to benefit from

the economic recovery. We are confident in the future of the West

End and the long-term value of our unique portfolio of

investments.

Ian Hawksworth

Chief Executive

8 March 2021

Strategic Report

COVENT GARDEN

A world-class destination

The Covent Garden estate represents a carefully assembled

portfolio in the heart of London's West End, comprising retail,

dining, leisure and cultural space complemented by high quality

offices and residential apartments. Through creative asset

management and disciplined investment, Covent Garden has been

established as an exceptional mixed-use portfolio of approximately

1.1 million square feet of lettable space, across 75 buildings and

526 units. Covent Garden provides a broad range of unit sizes,

ensuring it attracts a wide spectrum of retail and F&B

occupiers.

Capco has transformed Covent Garden into a global destination

having curated one of the strongest retail and dining line-ups in

the world in a heritage setting, positioning Covent Garden

competitively as a global brand. Occupiers across all uses are more

discerning than ever and in particular, retail and hospitality

value more than the location alone. Capco's approach focuses on the

creation of brand value, the understanding of consumer behaviour

and trends and crucially how these interplay with heritage, culture

and experience within a sustainable vision for the estate.

Supporting the reopening of retail and hospitality customers

Capco began the year with a strong leasing pipeline and growth

in sales and footfall, however activity levels were significantly

affected by the pandemic. By 23 March 2020 the majority of retail

and F&B (food and beverage) customers closed across the estate.

Throughout this period of COVID-19 uncertainty, Capco has

prioritised the health and safety of its people, customers and

visitors.

The heritage of Covent Garden is incredibly important. Capco

therefore took early action to ensure the safety of the estate with

additional security deployed to protect residential homes and

commercial premises. Working with our customers, Capco implemented

social distancing protocols across the estate, including marked

queuing systems, social distancing signage and enhanced cleaning

regimes, including hand sanitiser stations. Capco has been

encouraged by the resilience and creativity of our customers

through this challenging period.

As a long-term investor in the estate, Capco has provided

support on a case-by-case basis to customers experiencing cash flow

challenges as a result of COVID-19. Bespoke solutions have been

agreed which include rent deferrals, rent-free periods and other

arrangements reflecting the position of each customer. For certain

customers, rental agreements were linked to turnover for the second

half of the year in exchange for other provisions including lease

extensions and greater landlord flexibility. Against a backdrop of

significant market uncertainty and challenging trading conditions,

Capco continues to provide support to customers where appropriate.

Capco continues to maintain regular engagement with its customers,

offering assistance to provide confidence to our customers to

resume trading as restrictions are eased.

Understanding customers' businesses has always been part of

Capco's leasing approach and this year Capco has engaged in several

hundred direct discussions with its customers. Customers were

requested to provide detailed business information which was

analysed on a case-by-case basis and bespoke solutions agreed. The

objective is to maintain a strong customer line-up ensuring a

world-class estate for the longer term and whilst conditions are

challenging today, these actions will support the business to

benefit from a recovery over time.

After extended periods of closure, the vast majority of

retailers reopened during the summer and again in December,

adapting their operations to ensure effective social distancing

measures were in place and many have adopted revised trading hours

to reflect footfall patterns. The overwhelming response from

customers and the consumer drove the vibrancy of the estate which

continued to offer the Covent Garden experience with ongoing

activities through brand partnerships across the Piazza. The

enduring appeal of Covent Garden remains, with an encouraging

recovery in footfall and trade following the easing of measures in

the second half of 2020. The current government restrictions remain

in place and are expected to ease over the coming months.

Performance

The valuation of the estate decreased by 27 per cent

like-for-like to GBP1.8 billion over the year. Substantially all of

the valuation movement relates to the retail, leisure and F&B

portfolio which represents 75 per cent of total property value. The

main contributors were a 22 per cent (like-for-like) decline in ERV

to GBP80.8 million, expansion in the equivalent yield of 28 basis

points to 3.91 per cent and the valuer's assumption on loss of

near-term income (GBP27 million).

65 leasing transactions with a rental value of GBP6.2 million

(2019: GBP17.4 million) completed during the year, 29 per cent

below 31 December 2019 ERV (excluding seven short-term lettings).

Of the 65 leasing transactions, 43 took place in the second half of

the year.

Underlying net rental income was GBP44.1 million for the year,

down 30 per cent (like-for-like) compared to 2019. During this

challenging period a small number of tenants have entered into

administration, representing GBP4 million of passing rent.

The leasing market has been disrupted as a result of COVID-19

with some occupiers seeking more flexible arrangements rather than

committing to longer term leases until there is better visibility,

however Covent Garden continues to attract high quality brands and

operators. At 31 December 2020, EPRA vacancy was 3.5 per cent (31

December 2019: 3.2 per cent). Approximately 6.5 per cent of ERV is

in or is held for development or refurbishment (31 December 2019:

4.6 per cent (adjusted for the sale of the Wellington block)).

Whilst EPRA vacancy has been stable, the disrupted trading

environment combined with a difficult leasing market is anticipated

to have a negative impact on occupancy levels over 2021.

In view of recent and ongoing restrictions to trading activity,

support continues to be provided to our customers on a case-by-case

basis. Overall, 62 per cent of rent has been collected for 2020. As

an update to levels previously announced, 47 per cent of December

rents (in respect of Q1 2021) have been collected. Rent collection

levels for previous periods have continued to increase, with 2020

quarter collections at 53 per cent, 45 per cent and 53 per cent for

Q2 to Q4 2020. Capco's retail and hospitality customers have had

significantly reduced income following the national lockdown during

the Christmas trading period, which traditionally has been an

important source of revenue and provided liquidity through the

slower first quarter of the year. The gradual return to more normal

rent collection levels will be connected to the recovery in

footfall and sales.

Retail

Capco's emphasis on the consumer is essential to ensuring that

the estate is positioned as a leading destination for visitors.

Retail space represents 50 per cent of the portfolio by value.

Capco continues to focus on concepts relevant to the consumer and

highly productive categories such as jewellery, gifting,

accessories, fashion, cosmetics, fitness and well-being. The

increasing significance of online purchases by consumers and the

evolving omni-channel sales strategies pursued by retailers

underpin the importance for brands in choosing leading global

destinations.

Capco has always taken a creative approach to leasing, providing

high quality concepts the opportunity to trade on the estate, often

with turnover arrangements, which have transitioned into longer

term occupation. The new concepts introduced to the estate during

2020 include both long and shorter-term arrangements, providing the

opportunity for both Capco and the customer to benefit from a

recovery over time. Given the highly productive nature of the

categories and concepts on the Covent Garden estate these

arrangements are expected to deliver value when more normal trading

conditions return.

Although occupational demand has reduced, Covent Garden

continues to attract high quality brands and operators. Luxury

jewellery brand Vashi signed a long-term lease on James Street for

a new London flagship store which is set to open in 2021. This new

opening joins established luxury brands Tiffany & Co., which

agreed terms in December 2020 for a new lease, and Bucherer, which

has continued with expansion plans in a larger unit at the Royal

Opera House Arcade opening in 2021.

Luxury Belgian chocolatier Neuhaus opened a new store in the

iconic Market Building, selling handcrafted, artisanal chocolates.

Peloton continues the fit out of its European flagship training

studio and retail store on Floral Street joining Ganni and American

Vintage which opened stores earlier in the year.

Kick Game opened on James Street in December offering designer

styles in sneakers and streetwear, including limited edition

sneakers from brands such as Off-White, Yeezy, Supreme and the DIOR

collaboration. Traditional British coatmakers Mackintosh opened a

new store on James Street and apparel brand Arc'teryx agreed terms

in January 2021 to open a store on Long Acre.

Dining

Introducing high quality innovative food concepts has been

central to the dining strategy for Covent Garden. The estate offers

a diverse range of dining experiences, from casual to premium, and

is one of London's best dining destinations. The majority of

restaurants focus on quality and experience, often with an all-day

offer, with many brands choosing Covent Garden as their first

physical global or UK presence rather than standard chain

restaurants. Restaurateurs tend to invest significant capital

fitting out, therefore, leases tend to be longer than for retail

units. Dining space represents 21 per cent of the portfolio by

value.

A number of new dining concepts have been introduced to the

estate, including acclaimed restaurant Darjeeling Express which has

taken the space formerly occupied by Carluccios. Headed by

celebrated chef Asma Khan, the restaurant offers an all-day casual

deli menu alongside a newly launched tasting menu.

The dining offering on James Street continues to evolve with the

introduction of vegan cookie brand Floozie Cookie, from former

Claridge's Pastry Chef Kimberly Lin. The all-vegan restaurant,

which opened in December, serves Lin's signature "stuffed cookies"

alongside plant based hot chocolates and milks. Bubblewrap has also

opened joining the host of dining concepts across the estate

providing casual treats for the consumer.

Al fresco garden bar NaNas has signed a new long-term lease for

a bar and restaurant overlooking the Piazza and will provide an

all-day food and drinks menu inspired by French-Lebanese heritage.

The Gentlemen Baristas has signed a new flagship restaurant on

Henrietta Street. These were both summer pop-ups which have

converted into longer term opportunities.

The latest introductions further enhance Covent Garden's

attractiveness as a dining destination. The Big Mamma Group is

scheduled to open its new restaurant during the year on Henrietta

Street.

Office

Covent Garden is a prime office location underpinned by the

appeal of the overall estate and its excellent connectivity. There

is a significant working population in the district which provides

consumers for the hospitality and retail sectors.

Covent Garden has a contemporary office portfolio ranging from

warehouses to newly refurbished space, offering both multi-tenanted

and single occupancy workspace. The portfolio contains a variety of

spaces, from boutique offices to 10,000 square foot open plans and

attracts financial services, technology, creative industries and

SMEs. Joining the existing line-up, global co-working space

provider WeWork completed its fit out during 2020 and opened at 22

Long Acre. Office space represents 15 per cent of the portfolio by

value. Occupants are attracted to the estate environment, which

includes high quality retail and F&B options in the surrounding

area as well as offering a secure environment.

As a result of the pandemic, office utilisation has been low in

2020 in line with other locations in central London. COVID-19 has

accelerated existing trends of a growing demand for 'plug and play'

space on flexible lease terms in the London office market.

Furthermore, remote working may change the way offices are used

once the recovery begins, which may result in a change to space

requirements.

Residential

Covent Garden is established as a premium residential address.

Residential space represents 10 per cent of the portfolio by value

and comprises 213 units. Generally there is strong leasing demand

for residential accommodation across the estate with a high

incidence of leases that renew at the end of the term, however this

year there has been an increased level of vacancy across the

portfolio with many overseas residents in particular not renewing

tenancies.

Investment activity

Capco continues its disciplined approach to capital allocation.

In October 2020, Capco completed the sale of the Wellington block

to The Portfolio Club for GBP76.5 million (before costs) which was

in line with the property valuation as at 30 June 2020. The sale

price represented a capital value per square foot of approximately

GBP1,100 for an undeveloped site. The Portfolio Club, a joint

venture between APG and London Central Portfolio, is a new

lifestyle hospitality brand in prime central London locations. The

Wellington block is a freehold island site located on the south

east corner of Covent Garden comprising six separate properties and

has recently received planning consent to develop a 146-room hotel

with retail and restaurant space. The innovative owner operators

have plans to redevelop the Wellington block into a contemporary

hotel which will further contribute to Covent Garden's position as

a world-class destination. Vacant possession of the property has

been secured over the majority of the site and the ERV of the

properties as at 30 June 2020 was GBP4.2 million.

Capco has a strong balance sheet and access to significant

liquidity to take advantage of market opportunities. Capco's

extensive knowledge of the district, close network of contacts and

proven track record mean Capco is often the best positioned to

acquire properties, frequently off-market. There are a number of

properties on or around the estate being actively tracked for

acquisition and repositioning opportunities. There are also active

asset management and refurbishment initiatives across the estate. 3

Henrietta Street has been transformed into an F&B townhouse

with terms agreed with The Gentlemen Baristas. Refurbishment of

29-30 Maiden Lane is complete with Big Mamma's restaurant set to

open later this year.

Consumer engagement and positioning a world-class estate

Capco engages actively with its audiences through multi-channel

marketing activities such as events, brand partnerships and digital

outreach. Covent Garden has a significant social media presence and

is established as one of the most highly engaged retail

destinations globally through Instagram, Facebook and Twitter.

During 2020, Capco continued to engage directly with the

consumer throughout lockdown periods with a digital outreach

programme centred around 'Covent Garden at Home' content, bringing

elements of the estate home to consumers via an enhanced

website.

Capco continues to implement its consumer focused marketing

strategy and is collaborating closely with occupiers and

stakeholders to promote Covent Garden and the West End, encouraging

a gradual recovery of trade and footfall over time. A number of

initiatives were delivered to support the reopening of the estate

in the summer including floating a rainbow above the Market

Building, suspending 'Thank You NHS' flags on King Street and an

art installation by British graphic artist Anthony Burrill entitled

'Love Hope & Joy'.

With many of the area's restaurants open for take away, Covent

Garden hosted an al fresco, socially distanced dining area on the

Piazza providing the opportunity for visitors to dine outside in

the heart of the West End. As part of the ongoing cultural

programming for the estate, Capco partnered with the Royal Opera

House in September to offer a free open air cinema on the Piazza,

providing a unique experience for visitors to enjoy al fresco

culture.

A number of initiatives were delivered over the Christmas period

providing an inviting festive setting for the consumer, including

daily snowfall in front of the iconic 60 foot Christmas tree on the

Piazza. Covent Garden hosted an immersive LEGO installation on the

East Piazza as well as the estate's first ever Mulled Wine Festival

with 25 dining concepts participating.

Sustainability, environment and stakeholder engagement

Capco has renewed its commitment to environmental,

sustainability and community initiatives, launching a new ESC

strategy, supported by a Board Committee. Capco aims to minimise

the impact of our activities on the environment and has committed

to achieve Net Zero Carbon by 2030.

Capco works closely with stakeholders and collaborates on key

estate initiatives, including public realm, to further enhance the

customer experience and accessibility of the estate. It seeks to

minimise the impact of operations on the environment by employing

an active approach to air quality, congestion, environmental and

sustainability issues, and implementing initiatives that improve

the quality of the environment for all, such as pedestrianisation

and increasing greenery.

One of Covent Garden's key differentiators is its largely

pedestrianised nature. For a period during 2020, in partnership

with Westminster City Council, Capco made enhancements to the

public realm by introducing additional pedestrianised streets in

the Covent Garden area to allow for greater freedom of movement and

use of outdoor space. Newly pedestrianised streets included

Henrietta Street, Floral Street, Maiden Lane and Tavistock Street

alongside extended car-free hours for the Piazza and King Street.

Further to this, there were additional outdoor seating areas across

these streets for our restaurants, providing over 500 incremental

outdoor covers across over 20 al fresco dining spots.

Capco has been working closely with local communities and

continues to provide assistance to charity partners in the West

End. Capco is one of the founding sponsors of the Covent Garden

food bank. Financial aid has been provided to COVID-19 funds

supporting homelessness, food banks and the elderly, as well as

hospitality and retail foundations.

During November 2020, in partnership with charity Only A

Pavement Away which works alongside Crisis, Capco ran a charity

auction with prizes from shops and restaurants from across the

Covent Garden estate including a one-to-one cooking masterclass

with Darjeeling Express' Asma Khan, and exclusive dining

experiences at Red Farm, Din Tai Fung and The Gentlemen Baristas.

All proceeds were donated to the charity to help purchase and

distribute over 2,000 thermal refillable flasks for those most in

need during the festive season.

Future priorities

Capco will continue to take a proactive approach to creative

asset management and investment across the estate to protect

long-term value and take advantage of market opportunities. Capco's

immediate priority is focused on supporting our customers to reopen

successfully. There are challenges in the near-term with operating

conditions for our customers remaining difficult, which is

anticipated to lead to enhanced levels of vacancy. However Capco's

decisive actions taken in 2020 position the estate to benefit from

a recovery and to prosper over time.

Further to this, Capco will continue to invest in the estate and

expand its ownership through acquisitions. Capco is committed to

consumer engagement, aiming to continue enhancing the customer

environment and develop an extensive ESC agenda. Further to our Net

Zero Carbon 2030 commitment, a detailed pathway will be published

during the course of 2021. We will continue to focus on our

commitments to air quality, greening and waste management,

alongside charitable support and community engagement as a

responsible owner.

Other investments

Ownership of 25.2% Shaftesbury PLC shares

In May 2020, Capco agreed to acquire a significant shareholding

in Shaftesbury across two tranches for total consideration of

GBP436 million, at a price of 540 pence per Shaftesbury share. The

investment comprised the acquisition of 64.4 million shares for

GBP347.7 million in cash, representing 20.94 per cent of

Shaftesbury's shares, which completed on 3 June 2020 (the "First

Tranche") and the acquisition of a subsequent tranche of

approximately 16.3 million shares for GBP88.2 million in cash,

representing 5.31 per cent of Shaftesbury's shares (the "Second

Tranche").

Capco published a shareholder circular on 21 July 2020 in

respect of the acquisition of the Second Tranche, which, when

aggregated with the First Tranche, constituted a Class 1

transaction for the purposes of the Listing Rules and was therefore

conditional on approval by shareholders at the General Meeting.

Shareholder approval was granted on 10 August 2020.

In October 2020, Shaftesbury announced its intention to raise up

to GBP307 million of gross proceeds through a firm placing, placing

and open offer and an offer for subscription (the "Capital

Raising"). Capco committed to subscribe for GBP65 million of new

Shaftesbury shares at the placing price of 400 pence, resulting in

a shareholding in Shaftesbury following completion of the Capital

Raising of 25.2 per cent (96.97 million shares). Capco's weighted

average entry price (before associated costs) for its investment in

Shaftesbury is 517 pence per share at a cost of GBP501 million.

The Shaftesbury investment is a unique opportunity to acquire a

significant stake in an exceptional mixed-use real estate portfolio

of approximately 600 buildings, adjacent to Capco's world-class

Covent Garden estate. Shaftesbury PLC is a real estate investment

trust which invests exclusively in London's West End. It represents

a compelling investment and entry price with an implied value of

approximately GBP1,200 per square foot, which the Directors believe

will generate long-term value for Capco shareholders. The

investment is consistent with Capco's strategy to invest in

complementary opportunities on or near the Covent Garden

estate.

Earls Court deferred proceeds

GBP195 million of deferred consideration from the Earls Court

sale was received in 2020 with the balance of GBP15 million due in

November 2021. Proceeds have been used to reduce borrowings under

the Covent Garden revolving credit facility.

Lillie Square

Capco owns 50 per cent of the Lillie Square joint venture, a one

million square foot (GEA) residential development located in West

London. The development can deliver a total of over 600 private

homes plus 200 affordable homes across three phases.

The property valuation as at 31 December 2020 was GBP115 million

(Capco share), a 9 per cent decline (like-for-like) against the 31

December 2019 valuation of GBP177 million. In addition, Capco owns

GBP2 million of other related assets adjacent to the Lillie Square

estate. Net debt was GBP1.8 million (GBP0.9 million Capco share) at

31 December 2020.

Development of Lillie Square is well-progressed. Handover of 227

Phase 1 units is complete, with a small number of units available.

The completion of Phase 2 continues with 94 units handed over,

representing GBP116 million of net proceeds (GBP58 million Capco

share). Six contracts, representing approximately GBP8 million in

value, have been rescinded resulting in non-completion of pre-sold

units. 92 units remain in Phase 2, of which 60 have been pre-sold;

should they all complete this will generate approximately GBP70

million of further proceeds (GBP35 million Capco share). This

includes the previously announced bulk sale of 49 units and 31 car

parking spaces representing GBP66 million (GBP33 million Capco

share).

FINANCIAL REVIEW

The COVID-19 pandemic has had a material impact on the financial

results of the Group in the year, as demonstrated by the 27.3 per

cent like-for-like decline in the independent property valuation of

the Covent Garden portfolio and a 74.2 per cent reduction in the

Group's net rental income (30.3 per cent on an underlying basis),

primarily due to additional impairment charges in the year. Levels

of cash collection have reduced significantly with rent collection

for the year significantly lower than normal levels with 62 per

cent collected for the year. Collection for the first quarter of

2021 stands at 47 per cent compared with 98 per cent for the first

quarter of 2020.

Overall EPRA NTA (net tangible assets) per share decreased by

27.6 per cent during the year, from 292.9 pence at 31 December 2019

to 212.1 pence. Combined with the 1.0 pence per share dividend paid

to shareholders during the year, the total return for the year is

-27.2 per cent. Total shareholder return for the year, reflecting

the movement in the share price from 262 pence to 145 pence,

together with the value of dividends, was -44.3 per cent.

The underlying loss from continuing activities was GBP6.2

million compared with underlying earnings of GBP9.5 million for

2019, driven primarily by the reduction in net rental income.

Rental income

In view of disruption to business and consumer activity, bespoke

support has been provided to customers on a case-by-case basis,

which includes rent deferrals, rent-free periods and other

arrangements reflecting the position of each customer. For many

retail and food & beverage customers, rental agreements have

been linked to turnover for the second half of 2020 in exchange for

other provisions such as insertion of landlords flexibility, lease

extensions and enhanced sharing of data. The accounting treatment

for customer support, which results in divergence between net

rental income on a reported and cash flow basis, can be summarised

as follows:

-- In relation to rent deferrals, the rental income is

recognised as normal with the deferred rent receivable balance

remaining in trade receivables until settled. The balance is

assessed for impairment at each balance sheet reporting date.

-- Rent-free periods provided during a lease term are generally

considered to constitute a lease modification under IFRS 16 with

the rental income recalculated based on the revised consideration

over the remaining lease term, in line with current accounting

practice for tenant lease incentives. The balance will be assessed

for impairment at each reporting date. On entering into a lease

modification any initial direct costs associated with the lease,

including surrender premia previously paid to outgoing customers,

are derecognised and charged against income.

-- Turnover-linked rents are recorded in the period in which they are earned.

Gross rental income decreased by GBP2.6 million to GBP75.8

million, a 3.3 per cent reduction compared with 2019. Net rental

income has reduced by GBP45.4 million compared with 2019, driven

largely by:

-- GBP16.7 million of derecognition of initial direct costs

associated with entering into lease modifications;

-- GBP11.1 million impairment of tenant lease incentives;

-- GBP14.0 million of bad debt expense. This represents an

increase in bad debt expense of GBP12.4 million from 2019.

The lease modification costs and impairment of tenant lease

incentives of GBP27.8 million are excluded from underlying net

rental income as they are at levels not experienced in the past nor

expected to be incurred once tenant support measures required as a

result of COVID-19 conclude. On an underlying basis, net rental

income has reduced by GBP17.6 million to GBP43.6 million, driven

predominantly by the increase in bad debt expense.

Balance sheet

The property valuation of the Covent Garden estate has decreased

by 27.3 per cent (like-for-like) to GBP1,825 million as a result of

a 22.2 per cent decline in ERV to GBP80.8 million, expansion in the

equivalent yield of 28 basis points to 3.91 per cent and other

movements including the valuer's assumption on loss of near-term

income over the next six to 12 months of GBP27 million.

Despite the impact of COVID-19, the Group is well-positioned

with a clear focus to grow its property investment business centred

around the West End, supported by a strong financial position. With

net debt to gross assets of 28 per cent and access to substantial

cash and undrawn facilities, currently GBP1 billion, the Group has

the ability to withstand market volatility, capitalise on

investment opportunities and deliver long-term value creation.

The Company's strong financial position enabled it to complete

the acquisition of a significant stake in Shaftesbury PLC

("Shaftesbury") during the year. The initial acquisition was

completed over two tranches in June and August 2020 for GBP436

million. A further GBP65 million was invested through participation

in a capital raising by Shaftesbury which completed in November

2020. As a result of these transactions, the Company has a

shareholding of 25.2 per cent in Shaftesbury represented by

96,971,003 shares at a weighted in-price (before costs) of 517

pence per share.

During the year, GBP400 million of capital was raised through

the issuance of exchangeable bonds and a secured loan, both having

reference to the investment in Shaftesbury. The GBP275 million of

exchangeable bonds, exchangeable for shares of Shaftesbury or cash

at the Company's election, carry a cash coupon of two per cent per

annum and are redeemable at par in March 2026. The exchangeable

bonds benefit from a pledge over approximately 10.0 per cent of

shares in Shaftesbury. The GBP125 million secured loan has a

maturity of three years, is secured against shares in Shaftesbury

and is at an interest rate broadly in line with the Group's

weighted average cost of debt.

In March 2020, GBP90 million of deferred consideration was

received in relation to the sale of Earls Court and an additional

GBP105 million was received in November 2020. A final payment of

GBP15 million from the sale is due in November 2021.

Proceeds from the financing activities and disposals, including

the sale of the Wellington block for GBP76.5 million, were used to

reduce the amount of drawn borrowings under the Covent Garden

revolving credit facility.

Phase 2 of Lillie Square completed with 94 units handed over

during the year, generating net proceeds of GBP58 million (Capco

share). 92 units remain in Phase 2, of which 60 have been pre-sold;

should they all complete this will generate approximately GBP70

million of further proceeds (GBP35 million Capco share). This

includes the bulk sale of 49 units representing GBP66 million

(GBP33 million Capco share). Six contracts, representing

approximately GBP8 million in value, have been rescinded resulting

in non-completion of pre-sold units. The joint venture had net debt

of GBP1.8 million as at year end (Capco share: GBP0.9 million).

Basis of preparation

As required by IFRS 11 'Joint Arrangements', the Group presents

its joint ventures under the equity method in the consolidated

financial statements. The Group's interest in joint ventures is

disclosed as a single line item in both the consolidated balance

sheet and consolidated income statement rather than proportionally

consolidating the Group's share of assets, liabilities, income and

expenses on a line by line basis.

The Group uses Alternative Performance Measures ("APMs"),

financial measures which are not specified under IFRS, to monitor

the performance of the business. These include a number of the key

financials shown on page 2. Many of the APMs included are based on

the EPRA Best Practice Recommendations reporting framework, which

aims to improve the transparency, comparability and relevance of

published results of public real estate companies in Europe. With

effect from 1 January 2020, EPRA net asset value ("EPRA NAV") and

EPRA triple net asset value ("EPRA NNNAV") have been replaced by

three new net asset valuation metrics, being EPRA Net Reinstatement

Value ("EPRA NRV"), EPRA Net Tangible Assets ("EPRA NTA") and EPRA

Net Disposal Value ("EPRA NDV"). EPRA NTA is considered to be the

most relevant measure for the Group's operating activity and is the

primary measure of net asset value, replacing the metric EPRA NAV

previously reported. These measures have been adopted with the

comparator year shown in EPRA measures on page 69.

One of the key performance measures the Group uses is underlying

earnings. The Group considers the presentation of underlying

earnings to be useful supplementary information as it removes

unrealised and certain other items and therefore better represents

the recurring, underlying performance of the business. Items that

are excluded are net valuation gains or losses (including profits

or losses on disposals), fair value changes, impairment charges,

net refinancing charges, costs of termination of derivative

financial instruments and other non-recurring costs and income.

Given the scale of the rental support provided to tenants during

the course of the year, the non-cash lease modification expenses

and impairment of incentives totalling GBP27.8 million are highly

material and at levels not experienced in the past nor expected to

be incurred once tenant support measures required as a result of

COVID-19 conclude. Accordingly, they have been excluded from

underlying earnings. Underlying earnings is reported on a Group

share basis.

A summary of EPRA performance measures and key Group measures

included within these condensed financial statements is shown in

EPRA measures on page 69.

Internally the Board focuses on and reviews information and

reports prepared on a Group share basis, which includes the Group's

share of joint ventures, as this represents the economic value

attributable to the Company's shareholders. In order to align with

the way the Group is managed this financial review presents the

financial position, performance and cash flow analysis on a Group

share basis.

Discontinued operation

On 29 November 2019, the Group completed the sale of its

interests in Earls Court, excluding Lillie Square, to APG and

Delancey (on behalf of its client fund) for GBP425 million. As

Earls Court Properties represented a major line of business, its

results and cash flows have been reported in the comparator period

1 January 2019 to 29 November 2019 as having arisen from a

discontinued operation. Further information on the disposal of the

Earls Court Properties business is set out in note 10 'Discontinued

Operation'.

FINANCIAL PERFORMANCE

The Group presents underlying earnings and underlying earnings

per share on a Group share basis. The Group considers this

presentation to provide useful information as it removes unrealised

and certain other items and therefore better represents the