DFS Furniture PLC Trading Statement (1365G)

July 17 2023 - 1:00AM

UK Regulatory

TIDMDFS

RNS Number : 1365G

DFS Furniture PLC

17 July 2023

THIS STATEMENT CONTAINS INSIDE INFORMATION

DFS FURNITURE plc

PERIOD END TRADING UPDATE

FY23 profit within previously guided range

Group achieves record market share

DFS, ("DFS" and "the Group"), the market leading retailer of

living room and upholstered furniture in the United Kingdom,

announces the following update for the 52 week period to 25 June

2023 ("FY23").

FY23 Highlights:

-- Record market share of 38%, underpinned by the Group's

leading brands, scale and well invested integrated retail

proposition

-- Underlying profit before tax and brand amortisation for FY23

in line with previous guidance at slightly above GBP30m despite the

market being significantly worse than expected

-- Gross margin rate continuing to improve, supported by freight

costs returning to pre-pandemic levels and effective cost

control

-- Consumer demand continues to be impacted by the macroeconomic

environment; market volumes down by c.15%-20% across FY23

-- Expect to continue to outperform a declining market in FY24

and grow market share delivering low single digit GBPm profit

growth

FY23 trading performance delivered strong market share gains in

a weak market

The Group has a track record of growing market share in all

trading environments. This has continued through FY23, with market

share increasing to 38%. Gross sales increased by 15% compared to

the comparative* pre pandemic period (FY19), down 4% year on

year.

The well-publicised global macro-economic challenges impacted

overall market volumes, which were down c.15-20% year-on-year.

However, an improving gross margin rate and good cost control

supported an estimated underlying profit before tax and brand

amortisation of just over GBP30m.

Outlook for FY24

Trading at the start of the year has been consistent with the

Board's expectations. We currently expect market volumes to decline

by mid-single digits for the full year, however, the economic

outlook remains uncertain. To that end the business has been

prudent in its planning, is taking actions to maximise operating

cashflow through continuous margin improvement, delivering cost

savings and reducing capital expenditure. Despite the ongoing

pressure on market volumes, we expect underlying profit in FY24 to

be slightly above FY23 levels, supported by the Group's leading

brands, scale and well invested integrated retail proposition.

Longer term view

When the market recovers, given our increased market share, the

operating leverage within the business and our negative working

capital cycle, we are well positioned and remain confident in

delivering our long-term targets of GBP1.4bn of revenue, an 8%

profit before tax margin and 75% post tax free cash conversion

driving strong returns for our shareholders.

Comment from Tim Stacey, Group Chief Executive

"I would like to take this opportunity to thank every one of our

colleagues and partners for their commitment, hard work and

dedication as we trade through the increasingly challenging market

conditions.

We are in the strongest position we have ever been as a Group in

terms of market share, and when the market recovers, we will be

well placed to deliver our strategy and grow our earnings and cash

flows towards our longer term plan"

The Group will report its FY23 results on 21 September 2023.

*Pro forma unaudited 52 week period to 30 June 2019. Excludes

International and Sofa Workshop given the closure of these

operations.

DFS (enquiries via Teneo)

Tim Stacey (Group CEO)

John Fallon (Group CFO)

Phil Hutchinson (Investor Relations)

investor.relations@dfs.co.uk

Teneo

James Macey-White

Jessica Reid

Ayo Sangobowale

+44 (0)20 7353 4200

85fs.dfs@teneo.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFERDEISLIV

(END) Dow Jones Newswires

July 17, 2023 02:00 ET (06:00 GMT)

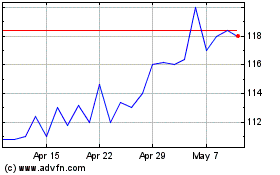

Dfs Furniture (LSE:DFS)

Historical Stock Chart

From Apr 2024 to May 2024

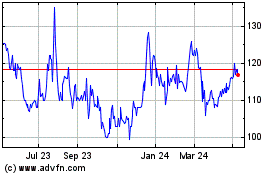

Dfs Furniture (LSE:DFS)

Historical Stock Chart

From May 2023 to May 2024