TIDMHSS

RNS Number : 1732D

HSS Hire Group PLC

26 October 2020

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF EU REGULATION 596/2014.

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR PUBLICATION, RELEASE OR DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN, INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, JAPAN, SWITZERLAND, NEW ZEALAND,

THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER JURISDICTION WHERE TO DO

SO WOULD BREACH ANY APPLICABLE LAW OR REGULATION. PLEASE SEE THE

IMPORTANT NOTICE AT THE OF THIS ANNOUNCEMENT.

THIS ANNOUNCEMENT IS AN ADVERTISEMENT AND DOES NOT CONSTITUTE A

PROSPECTUS OR PROSPECTUS EQUIVALENT DOCUMENT. NEITHER THIS

ANNOUNCEMENT NOR ANYTHING CONTAINED HEREIN SHALL FORM THE BASIS OF,

OR BE RELIED UPON IN CONNECTION WITH, ANY OFFER OR COMMITMENT

WHATSOEVER IN ANY JURISDICTION. ANY DECISION TO PURCHASE, SUBSCRIBE

FOR, OTHERWISE ACQUIRE, SELL OR OTHERWISE DISPOSE OF ANY SECURITIES

REFERRED TO IN THIS ANNOUNCEMENT MUST BE MADE SOLELY ON THE BASIS

OF THE INFORMATION THAT IS CONTAINED IN AND INCORPORATED BY

REFERENCE INTO THE COMBINED PROSPECTUS AND CIRCULAR TO BE PUBLISHED

BY THE COMPANY IN DUE COURSE.

HSS Hire Group plc

("HSS Hire" or the "Company",

together with its consolidated subsidiaries, the "Group")

Proposed Capital Raise of up to GBP54 million

HSS Hire today announces that it proposes to raise gross

proceeds of up to c.GBP54.0 million by way of a Firm Placing and

Open Offer (the "Capital Raise") in the coming weeks and has

secured commitments from three of its major shareholders to

subscribe c.GBP43.5 million for Company shares as part of the

Capital Raise.

As set out in the Company's 2020 interim results on 8 October

2020, the Board has been encouraged by the resilience that HSS Hire

has shown during this period of unprecedented disruption brought

about by the COVID-19 pandemic. Revenues have now returned to above

90% of 2019 levels and the Group has also seen a notable

acceleration of its digital strategy with a significant increase in

online penetration.

However, the COVID-19 pandemic and the significant disruption

that it has caused has inevitably had a significant impact on the

Group's revenue in 2020. In response, the Group implemented a

number of measures to reduce costs and preserve liquidity which has

enabled HSS Hire to meet the debt covenants under its borrowing

facilities to date. However, given that the challenging economic

environment may last for a prolonged period, it is possible that

without the Capital Raise these covenants may be breached when

tested at the end of 2020. Having fully reviewed the options

available to the Group, the Board has concluded it is prudent to

raise capital before the year end.

The Directors believe that the Capital Raise will ensure a

strong cash position and reduce net leverage, enabling the Group to

continue to its strong progress and successfully execute its

strategy.

Transaction Summary

-- Intention to raise gross proceeds of up to c.GBP54.0 million

by way of a Firm Placing and Open Offer at a price of 10p per

share

o Three of the Company's major shareholders, representing

approximately 78% of its issued share capital, have provided

commitments to invest c.GBP43.5 million in the Capital Raise

o Firm Placing of c.GBP18.6 million with Toscafund Asset

Management LLP ("Toscafund") and Ravenscroft (CI) Limited

("Ravenscroft")

o Open Offer of up to c.GBP35.5 million

-- Exponent Private Equity LLP ("Exponent") has committed to

subscribe for GBP15 million of shares under the Open Offer

-- Toscafund has committed to subscribe for their pro-rata

entitlement under the Open Offer

-- Ravenscroft has committed to subscribe for their pro-rata

entitlement under the Open Offer

-- The commitments to subscribe for shares in the Open Offer are

subject to certain conditions, as described below

-- The Open Offer will not be underwritten, save as described

above

-- The Company intends to use the net proceeds from the Capital Raise to:

o Continue investment in the technology platform to strengthen

the Group's commercial proposition

o Continue investment in the hire fleet to support the Group's

tool hire business

o Repay GBP15 million of debt that falls due in January 2021 to

enable the Group to continue to de-lever

-- Given the current free float and size of HSS Hire, the Board

is exploring alternative listing venues for the Company, while

ensuring an active market in its ordinary shares

-- A combined prospectus and circular (the "Prospectus") setting

out full details of the Capital Raise is expected to be published

during the coming weeks

-- The Capital Raise is conditional on certain resolutions being

passed by the Shareholders. A Notice of the General Meeting of the

Company for the Shareholders to consider and approve the

resolutions in connection with the Capital Raise will be included

in the Prospectus. Each of Exponent, Toscafund and Ravenscroft has

agreed to vote in favour of such resolutions.

Alan Peterson OBE, Chairman, commented today:

"This transaction is a major vote of confidence from three

shareholders representing over 75% of the Company's shares. It is

testament to the significant strategic and operational progress HSS

Hire has made since the start of 2018 as well as its resilience in

challenging economic conditions. This capital injection will enable

the Group to further reduce its leverage - one of our foremost

objectives - and gives us a strong platform from which to continue

to implement change and drive growth. I am delighted that the Open

Offer gives all current owners of the business the opportunity to

participate on the same terms, and on behalf of the Board, I would

like to thank all our shareholders as well as HPS and our other

lenders for their continued positive support."

Background to the Capital Raise

The current executive Directors joined HSS Hire between August

2016 and June 2017, and in August 2017 launched a detailed

strategic review, the conclusion of which was announced in December

2017. The Group engaged an independent third party to work with

management to undertake an extensive strategic review of the

business. The review was wide ranging in scope and involved

analysis of 20 million contract lines, more than 35,000 customers,

1,600 products and more than 240 locations. The Group focused on a

number of areas including profitability, the cost of its

operations, processes it has in place and the market

opportunity.

Following this strategic review, the Group set out its new

strategy in December 2017. This set out three key strategic

priorities: de-lever the Group, repair the tool hire business and

strengthen the Group's commercial proposition. These priorities

remain unchanged following the COVID-19 pandemic, albeit with a

nuance from repair the tool hire business, to transform the tool

hire business, following a successful transformation programme in

2018.

HSS Hire has made considerable progress against these three core

elements of its strategy. Since the 2017 strategic review, the

Group has reduced its total leverage from 4.8x as at the end of

FY17 to 2.8x as at the end of FY19 through improved Adjusted

EBITDA, a continued focus on working capital management and the use

of proceeds from the sale of UK Platforms Limited.

The Group returned its tool hire business to profitability in

FY18 and in FY19 grew revenue ahead of the market, recording

revenue growth of 3.9% and EBITA of GBP26.5 million. Furthermore,

it significantly improved EBITA margins (growing from 0.5% in FY17

to 8.1% in FY19), delivered a marked improvement in return on

capital employed (growing from 1.0% in FY17 to 20.8% in FY19) and

achieved a second record year of adjusted EBITDA on a comparable

basis.

Lastly, the Group has significantly strengthened its commercial

proposition and prioritised the investment in technology to

transform the Group's digital offering and OneCall rehire

proposition into a more scalable technology-led business with

seamless customer experience. One of several successful digital

initiatives was the launch of the new OneCall rehire platform,

'Brenda'. Brenda is a new, modern automated platform which has the

ability to source hire equipment from the Group's extensive network

of suppliers but significantly shortens the customer journey and

provides superior visibility of the rehire process for customers,

suppliers and colleagues alike. Combined with the launch of HSS

Hire's customer and driver apps this investment is now enabling the

Group to transform its operating model and remove significant fixed

costs associated with its branch network whilst maintaining a

national presence.

As part of the Group's new strategy, in June 2018 it put in

place a Senior Financing Facility and a new Revolving Credit

Facility. These facilities replaced the Group's existing revolving

credit facility and listed bonds, each of which were due to mature

in 2019. The Senior Financing Facility and the Revolving Credit

Facility provided the liquidity and flexibility to continue the

delivery of the Group's strategic priorities.

Reasons for the Capital Raise

The HSS Hire management team has made considerable progress in

de-levering the Group. As at 27 June 2020, the Group's net debt

(excluding the IFRS16 impact of GBP80.1 million of additional lease

liabilities) stood at GBP156.7 million, a reduction of GBP22.8

million from 28 December 2019. This included a Senior Financing

Facility fully drawn down at GBP182m, and GBP17.2 million of

drawings from the Group's Revolving Credit Facility. Both the

Senior Financing Facility and Revolving Credit Facility are subject

to a net debt leverage financial covenant test every quarter.

The COVID-19 pandemic has significantly impacted the Group's

revenue in 2020. As a result, the Group implemented the following

measures to manage costs and preserve liquidity:

-- The Group has reduced capital expenditure and continues to

adopt a disciplined approach to investment driven by demand and

returns.

-- The Group has engaged in overhead reduction and utilised the

UK Government's Job Retention Scheme placing, at the highest point,

62% of the Group's workforce on furlough in March 2020. Since then

it has engaged in a significant restructuring and moved to a

digital approach, including the following steps:

o The Group plans to permanently shut 134 branches; and

o The Group has made 12% of its approximately 2,400 employees

redundant as of October 2020.

-- The Group has also negotiated rental holidays with landlords,

utilised rates relief, deferred certain HMRC payments and reduced

the salaries of certain members of management.

-- The Group has also utilised a number of additional measures

made available by the UK Government to help conserve cash.

The Group's strategy and the actions taken by management to

improve liquidity have enabled the Group to meet its debt covenants

under its borrowing facilities to date. However, the current

disruption caused by COVID-19 and consequential economic backdrop

may last for a prolonged period. Without the Capital Raise, it is

possible that the covenants may be breached when tested at the end

of 2020. Consequently, if the Capital Raise does not successfully

complete, the Group's lenders may be in a position to declare a

default of the Group's debt, which could cause Shareholders to lose

all or a substantial part of their investment in the Company.

The Directors believe that the Capital Raise will ensure a

strong cash position and reduce net leverage, enabling the Group to

continue with its strong progress and successfully execute its

strategy. In particular, the Directors believe that HSS Hire is

well placed to capitalise on its investment in technology. Since

March 2020, the Group has seen a 33% increase in online users and a

significant shift in orders being placed through digital channels,

from less than 10% to over 30% penetration. During the COVID-19

pandemic, the Group has operated with just 20% of its branch

network open and yet has returned the business to over 90% of prior

year revenues as at 30 September 2020. This has been enabled by the

Group's technology (e.g. click-and-collect, digital channels), the

strength of the Group's distribution network (40 Customer

Distribution Centres) and successful trials of alternative sales

models (such as virtual sales colleagues and concessions within

builders merchant partners). The Board believes that these changes

have the capacity to allow the Group to generate a similar level of

revenues as in previous years while operating with a significant

lower cost base, driving both profitability and returns on

capital.

Alongside the benefits from its investment in technology, the

Directors believe that the COVID-19 pandemic could accelerate an

ongoing trend among customers to outsource their equipment needs

and equipment management as many companies look to rationalise

their head-office functions and focus on core activities.

Furthermore, the Directors believe that within this outsourcing

trend there is an increasing demand to rationalise the number of

suppliers of rental equipment, which the Directors expect to

inevitably benefit the larger players such as the Group. The

Directors believe that the Group is particularly well positioned to

take advantage of this, given the strength of its Services division

offering, the "one-stop-shop" proposition of OneCall and the

opportunities created by the Brenda technology platform to add

bolt-on product verticals to this online marketplace. The Directors

believe the Capital Raise will provide a sustainable capital

structure alongside strong liquidity to allow HSS Hire to

capitalise on the evolving industry dynamics and continue to grow

the business. As part of the Capital Raise the Board is also

reviewing the current management incentive plans.

Irrevocable voting undertakings

Exponent, which holds in aggregate 85,681,708 of the Company's

shares which represents 50.3% of the Company's issued share

capital, Toscafund, which holds in aggregate 45,812,070 of the

Company's shares which represents 26.9% of the issued share capital

and Ravenscroft, which holds in aggregate 1,990,000 of the

Company's shares which represents 1.2% of the issued share capital,

in each case as at 22 October 2020 (being the last practicable date

prior to the publication of this announcement), has each provided

irrevocable undertakings including in respect of exercising all of

the voting rights attaching to the shares in the Company to which

they are the legal or beneficial owner (or over which they act on

behalf of clients who are the beneficial owner) to vote in favour

of each of the resolutions to approve the Capital Raise and other

matters which will be proposed at the General Meeting and at any

adjournment thereof.

Conditionality

The commitment of one of the major shareholders to participate

in the Capital Raise is conditional on the outcome of the Group's

property restructuring. The Group has certain leasehold properties

within its portfolio which it no longer utilises (being 'dark

stores' and certain other operational and office locations). As

announced on 8 October 2020, the Group has taken the decision to

close permanently a significant proportion of its branch network,

as a result of which the Group's dark store liabilities may

increase. The Group is working with property restructuring advisors

as regards these site closures. The major shareholder's

participation in the Capital Raise is conditional on the Group

achieving a reduction of at least 75% in its dark store

liabilities.

The aggregate commitment of c.GBP43.5 million from the major

shareholders to participate in the Capital Raise is conditional on

the participation of each of the other major shareholders.

Board observer

Following completion of the Capital Raise, Ravensworth

International Limited (on whose behalf Ravenscroft is participating

in the Capital Raise) will have the right to appoint an observer to

the Board, who will be able to attend Board meetings but not vote.

This right will continue for so long as Ravensworth International

Limited owns or controls 20% or more of the issued share capital of

the Company.

Related party transaction

As Toscafund holds 26.9% of the Company's issued share capital

(as at 22 October 2020 (being the last practicable date prior to

the publication of this announcement)), it is a related party for

the purposes of the Listing Rules. The Firm Placing to Toscafund

will constitute a related party transaction and will need to be

approved at the General Meeting by the independent Shareholders

(being Shareholders other than Toscafund or any of its associates).

Further details will be included in the Prospectus which is

expected to be published during the coming weeks.

HPS warrant instruments

Under the terms of the warrant instrument issued to various

affiliates of HPS Investment Partners ("HPS") on 20 June 2018 (the

"Warrant Instrument"), HPS has the right to subscribe for a number

of shares in the Company representing 5% of the shares that will be

issued under the Capital Raise, on the same terms as shares are

issued under the Capital Raise.

Proposed transfer of listing

The Board believes that an alternative listing venue may be more

suitable than the Company's existing listing on the premium segment

of the Official List of the FCA.

HSS Hire's current free float stands at 13.8% and has been

broadly unchanged for several years. Following the Capital Raise,

the Company's free float is likely to be reduced further. As

previously disclosed, the Company has been in dialogue with the FCA

for some time and agreed a modification of Listing Rule 9.2.15R,

which would otherwise require a free float of at least 25%. The

current modification expires on 20 August 2021. Whilst a company's

appropriateness for an alternative listing venue is, in part,

dependent on it having sufficient free float in order that there is

a properly functioning market in the shares, the Board notes that

certain other listing venues have a lower minimum requirement for a

number of shares to be held in public hands.

The Board believes an alternative venue may provide lower annual

costs and simpler administration and regulatory requirements more

appropriate to a company of HSS Hire's size and also more

flexibility in relation to corporate transactions should such

opportunities or initiatives arise or become relevant to the Group

in the future. The Board is exploring alternative options and will

update Shareholders in due course.

For further information, please contact:

HSS Hire Group plc Tel: 020 3757 9248

Steve Ashmore, Chief Executive Officer Please email: Investors@HSS.com

Paul Quested, Chief Financial Officer

Greig Thomas, Head of Group Finance

Numis Securities Tel: 020 7260 1000

Stuart Skinner

George Price

George Shiel

Teneo Tel: 07785 528363 / 07557 491860

Matt Thomlinson

Tom Davies

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation ("MAR") EU no.596/2014. Upon the

publication of this announcement via Regulatory Information Service

("RIS"), this inside information is now considered to be in the

public domain.

The person responsible for releasing this announcement is Daniel

Joll, Company Secretary.

HSS Hire Group plc LEI: 2138004DGL1J6VQO6S92

Important notices

This announcement has been issued by and is the sole

responsibility of the Company. The information contained in this

announcement is for background purposes only and does not purport

to be full or complete. The information in this announcement is

subject to change.

This announcement is not a prospectus but an advertisement.

Neither this announcement nor anything contained in it shall form

the basis of, or be relied upon in conjunction with, any offer or

commitment whatsoever in any jurisdiction. Investors should not

acquire any shares referred to in this announcement except on the

basis of the information contained in the Prospectus to be

published by the Company in connection with the Capital Raise.

Copies of the Prospectus when published will be available on the

Company's website at www.HSShiregroup.com. Neither the content of

the Company's website nor any website accessible by hyperlinks on

the Company's website is incorporated in, or forms part of, this

announcement. The Prospectus will provide further details of the

new shares being offered pursuant to the Capital Raise.

This announcement does not contain or constitute an offer for

sale or the solicitation of an offer to purchase securities in the

United States. The new shares have not been and will not be

registered under the US Securities Act of 1933 (the "Securities

Act") or under any securities laws of any state or other

jurisdiction of the United States and may not be offered, sold,

taken up, exercised, resold, renounced, transferred or delivered,

directly or indirectly, within the United States except pursuant to

an applicable exemption from or in a transaction not subject to the

registration requirements of the Securities Act and in compliance

with any applicable securities laws of any state or other

jurisdiction of the United States. There will be no public offer of

the new shares in the United States.

This announcement contains "forward-looking statements", which

include statements other than statements of historical facts,

including, without limitation, those regarding the Company's

intentions, beliefs or current expectations concerning, among other

things, its future financial condition and performance and results

of operations; its strategy, plans, objectives, prospects, growth,

goals and targets; future developments in the industry and markets

in which the Company participates or is seeking to participate; and

anticipated regulatory changes in the industry and markets in which

the Company operates. In some cases, these forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believe", "continue", "could",

"expect", "intend", "may", "plan", "should" or "will" or, in each

case, their negative, or other variations or comparable

terminology. By their nature, forward-looking statements are

subject to known and unknown risks, uncertainties and other factors

because they relate to events and depend on circumstances that may

or may not occur in the future. Such forward-looking statements are

based on numerous assumptions, some of which are outside of the

Company's influence and/or control, regarding the Company's present

and future business strategies and the environment in which the

Company will operate in the future. Shareholders and potential

investors are cautioned that forward-looking statements are not

guarantees of future performance and that the Company's actual

financial condition, results of operations, cash flows and

distributions to Shareholders and the development of its financing

strategies, and the development of the industry in which it

operates, may differ materially from the impression created by the

forward-looking statements contained in this announcement. In

addition, even if the Company's financial condition, results of

operations, cash flows and distributions to Shareholders and the

development of their financing strategies, and the development of

the industry in which they operate, are consistent with the

forward-looking statements contained in this announcement, those

results or developments may not be indicative of results or

developments in subsequent periods. No statement in this

announcement is intended to be a profit forecast.

Numis Securities Limited ("Numis") is authorised and regulated

in the United Kingdom by the FCA. Numis is acting exclusively for

the Company and no one else in connection with the Capital Raising

and the matters referred to herein and will not regard any other

person (whether or not a recipient of this announcement) as a

client in relation to the Capital Raising and will not be

responsible to anyone other than the Company for providing the

protections afforded to their clients or for providing advice in

relation to the Capital Raising and the matters referred to

herein.

Neither Numis, nor any of its affiliates (or their directors,

officers, employees or advisers), accepts any responsibility or

liability whatsoever for or makes any representation or warranty,

express or implied, as to this announcement, including the truth,

accuracy, fairness, sufficiency or completeness of the information

or the opinions or beliefs contained in this announcement (or any

part hereof). None of the information in this announcement has been

independently verified or approved by Numis, or any of its

affiliates. Numis and each of its affiliates (and their directors,

officers, employees or advisers) accordingly disclaim all and any

liability, whether arising in tort, contract or in respect of any

statements or other information contained in this announcement and

no representation or warranty, express or implied, is made by

either Numis or any of its affiliates (or any of their respective

directors, officers, employees or advisers) as to the accuracy,

completeness or sufficiency of the information contained in this

announcement. Save in the case of fraud, no responsibility or

liability is accepted by Numis or any of its affiliates (or any of

their directors, officers, employees or advisers) for any errors,

omissions or inaccuracies in such information or opinions or for

any loss, cost or damage suffered or incurred howsoever arising,

directly or indirectly, from any use of this announcement or its

contents or otherwise in connection with this announcement. No

person has been authorised to give any information or to make any

representations other than those contained in this announcement

and, if given or made, such announcements must not be relied on as

having been authorised by the Company, Numis or any of its

affiliates. Subject to the listing rules made by the Financial

Conduct Authority ("FCA") pursuant to Part 6 of the Financial

Services and Markets Act 2000, as amended ("FSMA"), the Prospectus

Regulation (EU) 2017/1129 rules made by the FCA under Part 6 of the

FSMA, the disclosure guidance and transparency rules made by the

FCA under Part 6 of the FSMA and MAR, the issue of this

announcement and any subsequent announcement shall not, in any

circumstances, create any implication that there has been no change

in the affairs of the Group since the date of this announcement or

that the information contained in it is correct as at any

subsequent date.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEUNUNRRWURURA

(END) Dow Jones Newswires

October 26, 2020 03:00 ET (07:00 GMT)

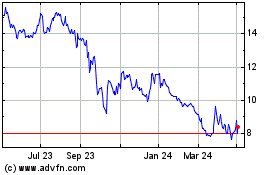

Hss Hire (LSE:HSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

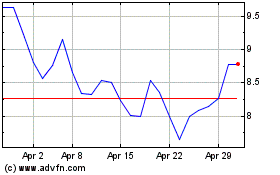

Hss Hire (LSE:HSS)

Historical Stock Chart

From Apr 2023 to Apr 2024