TIDMIIG

RNS Number : 4731R

Intuitive Investments Group plc

27 October 2023

27 October 2023

This announcement contains inside information for the purposes

of UK Market Abuse Regulation

Intuitive Investments Group plc

("IIG" or the "Company")

Investment in China-based technology company, Hui10 Inc, in

exchange for new shares

Intuitive Investments Group plc (SFM: IIG), the closed-end

investment company, is pleased to announce that it has agreed, at a

valuation of $365 million*, to invest in the entire issued share

capital of Hui10 Inc. ("Hui10") in exchange for the issue of

1,911,529,540 new Ordinary Shares in the Company ("Consideration

Shares") to vendor shareholders of Hui10 (the "Vendor

Shareholders").

This investment is in accordance with the Company's investment

objective and policy and follows the appointment of Sir Nigel Rudd

as Chairman and the Company's move to the Specialist Fund Segment

of the London Stock Exchange's Main Market on 8 August 2023.

Hui10 is a technology company with interests in two operating

businesses involved in transforming the lottery in China. It holds

a 33% share in Beijing Huishi Dehua Information Technology Co., Ltd

("Huishi Dehua") which enables, through its digital based payment

platform, the market expansion of the Chinese lottery. It also owns

60% of Beijing Huishi Chunyuan Technical Development Co., Ltd

("Lucky World") whose omni channel technology platform provides

China's lottery shops access to a wider fast-moving consumer goods

("FMCG") product offering.

Huishi Dehua

Huishi Dehua 's patented technology digitises the method of

playing the lottery via a smartphone, linked to China UnionPay

smart point-of-sale terminals ("POS"). This exclusive payment

platform will allow the country's 1.1 billion adult population

access to play the lottery which currently only reaches an

estimated 100 million users. This platform operates and facilitates

an omni-channel offer including:

-- PELT (Points Exchange Lottery Tickets): a proprietary

digital assets exchange platform, providing third party

loyalty program operators the facility to enable their

members to redeem their points for lottery play.

-- Scratch cards: providing retailers with POS terminal and

APP based tools for the distribution, sales, small prize

settlement and management of scratch cards.

-- Jackpot lottery: providing any merchant with a UnionPay

POS terminal, approved by the lottery issuer, the ability

to process lottery play.

The ability of Huishi Dehua to deliver this transformation is

underpinned by the position it has developed over the past seven

years, including developing copyrighted intellectual property,

integrating its payments platform and establishing a framework of

exclusive agreements across the lottery network, which together,

are expected to enable the business to rapidly expand the lottery

across China.

Lucky World

Lucky World was created to support upwards of 175,000 existing

lottery-only shops grow as lottery distribution expands through

Huishi Dehua. Operating as a 'Lucky World' branded, omni-channel

retail banner for the existing retail lottery network with national

coverage it sells online and instore FMCG to existing regular

lottery customers. Through the platform customers can order goods

online, selecting either for delivery to their local lottery shop

or home. Furthermore, customers purchasing goods receive loyalty

points 'Lucky Beans', which are redeemed in-shop only for free

lottery play, encouraging footfall. Lucky World provides low-cost

efficient payment services to the lottery shopkeeper via UnionPay,

including WeChat Pay and AliPay, for all Lucky World products

offering significant savings on costs, transaction speed, improving

efficiency and valuable data collection.

Value opportunity

Each of the businesses is forecasting significant growth over

the next five years.

Huishi Dehua is aiming to increase the number of lottery enabled

terminals to approximately three million shops and retail outlets

across China, targeting to attract in excess of 400 million

registered lottery users, with over 300 million active players,

representing approximately 30% of the addressable market in China.

As a payment platform the business receives a small share from the

sale of each ticket, therefore this increase in participation

represents a significant opportunity for value growth. This

increased consumer participation would bring the Chinese lottery up

to the lower end of that achieved in more established lottery

markets including North America, Europe and the UK.

Lucky World is focused on connecting the majority of the

existing dedicated lottery only shops to the Lucky World format,

each sale generates a margin for the shop owner as well as Lucky

World, therefore the rollout programme represents a significant

opportunity for shareholder value generation.

As part of the Investment Giles Willits will be joining the

Board of IIG with specific oversight of Hui10. Giles has over 30

years' experience working in senior finance positions, including

over 20 years in executive board positions including Entertainment

One Ltd. a FTSE250 company. Giles invested in Hui10 in 2018.

Sir Nigel Rudd, non-Executive Chairman, said:

" I have had a career of realising shareholder value and believe

the investment into Hui10 represents a transformational opportunity

for the Company. I strongly believe Hui10 has the capability to

return shareholders many times their investment at flotation and

from the current share price. "

The Board of the Company is responsible for making this

notification.

* Valuation based on the audited NAV per Ordinary Share of the

Company as at 31 December 2022 and adjusted for the fundraising as

announced on 11 July 2023

Intuitive Investments Group plc www.iigplc.com

Sir Nigel Rudd, Non-Executive Via FTI Consulting

Chairman

Robert Naylor, CEO

SP Angel Corporate Finance LLP

- Financial Adviser +44 (0) 20 3470 0470

Jeff Keating / David Hignell /

Kasia Brzozowska

FTI Consulting

Jamie Ricketts / Valerija Cymbal IIG@fticonsulting.com

/ Jemima Gurney

Application for admission and total voting rights

Application has been made for the Consideration Shares, which

will rank equally with the existing ordinary shares of 1 pence each

in the Company ("Ordinary Shares") of the Company, to be admitted

to trading on Specialist Fund Segment of the Main Market, becoming

effective in accordance with the admission and disclosure standards

of the London Stock Exchange. It is expected that admission will

become effective and dealings in Consideration Shares will commence

at 8:00 a.m. on or around 31 October 2023 ("Admission").

Following Admission, the Company's issued share capital will

consist of 1,998,389,184 Ordinary Shares. Since the Company

currently holds no shares in treasury, the total number of voting

rights in the Company will be 1,998,389,184. Shareholders may use

this figure as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change to their interest in, the Company under the FCA's

Disclosure Guidance and Transparency Rules.

About Intuitive Investments Group plc

IIG is an investment company seeking to provide investors with

exposure to a portfolio concentrating on fast growing and/or high

potential Life Sciences and Technology businesses operating

predominantly in the UK, continental Europe, the US and APAC,

utilising the Board's experience to seek to generate capital growth

over the long term for shareholders.

THIS ANNOUNCEMENT IS RESTRICTED AND IS NOT FOR RELEASE,

PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR

INDIRECTLY, IN, INTO OR FROM THE UNITED STATES, AUSTRALIA, NEW

ZEALAND, CANADA, THE REPUBLIC OF SOUTH AFRICA OR JAPAN OR ANY OTHER

JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION

WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION, RECOMMATION,

OFFER OR ADVICE TO ANY PERSON TO PURCHASE AND/OR SUBSCRIBE FOR,

OTHERWISE ACQUIRE OR DISPOSE OF ANY SECURITIES IN INTUITIVE

INVESTMENTS GROUP PLC OR ANY OTHER ENTITY IN ANY JURISDICTION.

NEITHER THIS ANNOUNCEMENT NOR THE FACT OF ITS DISTRIBUTION, SHALL

FORM THE BASIS OF, OR BE RELIED ON IN CONNECTION WITH ANY

INVESTMENT DECISION IN RESPECT OF INTUITIVE INVESTMENTS GROUP

PLC.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (596/2014/EU) AS THE

SAME HAS BEEN RETAINED IN UK LAW AS AMED BY THE MARKET ABUSE

(AMMENT) (EU EXIT) REGULATIONS (SI 2019/310) ("UK MAR").

IN ADDITION, MARKET SOUNDINGS (AS DEFINED IN UK MAR) WERE TAKEN

IN RESPECT OF CERTAIN OF THE MATTERS CONTAINED WITHIN THIS

ANNOUNCEMENT, WITH THE RESULT THAT CERTAIN PERSONS BECAME AWARE OF

INSIDE INFORMATION (AS DEFINED UNDER UK MAR). UPON THE PUBLICATION

OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THOSE

PERSONS THAT RECEIVED INSIDE INFORMATION IN A MARKET SOUNDING ARE

NO LONGER IN POSSESSION OF SUCH INSIDE INFORMATION, WHICH IS NOW

CONSIDERED TO BE IN THE PUBLIC DOMAIN.

The Specialist Fund Segment is intended for institutional,

professional, professionally advised and knowledgeable investors

who understand, or who have been advised of, the potential risk

from investing in companies admitted to the Specialist Fund

Segment. The Specialist Fund Segment is only suitable for

investors: (i) who understand the potential risk of capital loss

and that there may be limited liquidity in the underlying

investments of the Company; (ii) for whom an investment in

securities admitted to trading on the Specialist Fund Segment is

part of a diversified investment programme; and (iii) who fully

understand and are willing to assume the risks involved in such an

investment portfolio.

Background

Hui10 Overview

Hui10 is a China based technology company with interests in:

-- Beijing Huishi Dehua Information Technology Co., Ltd ("Huishi

Dehua") in which Hui10 owns 33%, which is a technology

business that is transforming the Chinese lottery; and

-- Beijing Huishi Chunyuan Technical Development Co., Ltd

("Lucky World") in which Hui10 owns 60% of the business:

a company rolling out an omnichannel technology platform

that will transform approximately 175,000 dedicated lottery

only shops in China expanding their offering to include

fast-moving consumer goods("FMCG") .

Huishi Dehua is enabling the transformation and market expansion

of terrestrial lottery play across China. Its patented technology

digitises the method of playing lottery via a smartphone, linked to

China UnionPay smart point-of-sale terminals ("POS"). This

exclusive payment platform will allow the country's 1.1 billion

adult population access to play the lottery in China which

currently only reaches an estimated 100 million users. China

UnionPay is a Chinese state-owned financial services corporation

which provides bank card services and is the world's largest card

payment processing organisation.

Huishi Dehua's technology platform operates and facilitates the

following omnichannel activities :

-- PELT (Points Exchange Lottery Tickets), a proprietary

digital assets exchange platform, providing third party

loyalty program operators the facility to enable their

members to redeem their points for lottery play. PELT

customers are businesses operating their own loyalty programmes

including retail banks, travel agents, airlines, supermarket

chains and telecoms companies.

-- Scratch cards, providing retailers with POS terminal and

APP based tools for the distribution, sales, small prize

settlement and management of scratch cards.

-- Jackpot lottery which provides any merchant with a UnionPay

POS terminal, approved by the lottery issuer, the ability

to process lottery play.

The ability of Huishi Dehua to deliver this transformation is

underpinned by the position it has developed over the past seven

years, including developing copyrighted intellectual property,

integrating payments platform and establishing a framework of

exclusive agreements across the lottery network, which together are

expected to enable the business to rapidly expand the lottery

across China.

Lucky World was created to help upwards of 175,000 existing

lottery-only shops grow as lottery distribution expands through

Huishi Dehua. Lucky World will transform the existing retail

lottery network into a 'Lucky World' branded and omnichannel retail

banner with national coverage selling online and instore FMCG to

the approximately 100 million existing regular lottery customers,

whilst also targeting a wider customer base within the adult

population via Douyin (TikTok) and Weixin (WeChat). Hui10 expect to

roll out nationwide in 2024.

Lucky World's principal activities include t he Lucky World

platform that enables the shopkeeper to sell FMCG to their

customers. Lucky World also has supply chain logistics arrangements

provided by JingDong (JD.com) under a white label contract. JD.com

provides over 20,000 FMCG to the platform. Through the platform

customers can order goods online, selecting either for delivery to

their local lottery shop or home. Furthermore, customers purchasing

goods receive loyalty points 'Lucky Beans', which are redeemed

in-shop only for free lottery play, encouraging footfall. Lucky

World provides low-cost efficient payment services to the lottery

shopkeeper via UnionPay, including WeChat Pay and AliPay, for all

Lucky World products offering significant savings on costs,

transaction speed, improving efficiency and valuable data

collection.

Opportunity

Each of the businesses is forecasting significant growth over

the next five years. Huishi Dehua is aiming to increase the number

of lottery enabled terminals to approximately three million in

shops and retail outlets across China, targeting to attract over

400 million registered lottery users, with 300 million active

players, representing over 30% of the addressable market in China.

As a payment platform the business gets a small share from the sale

of each ticket and as such this volume of participation represents

a significant opportunity for value growth. If achieved these

targets would bring the China lottery participation levels to the

lower end of the range of levels that are achieved in most

established lottery markets including North America, Europe and the

UK. Lucky World is focused on converting the majority of these to

the Lucky World format while expanding the range of FMCG stock

keeping units ("SKUs") they can offer to the established customer

base. Each sale generates a margin for the shop owner and Lucky

World. As such this rollout programme represents a significant

opportunity for shareholder value generation.

Current Trading

As at the end of September 2023 Hui10 had the following

activities.

Huishi Dehua operates in 273 non-lottery shops selling UnionPay

scratch cards. In addition, PELT has over 57,000 registered users

redeeming lottery tickets for loyalty points through a trial with

UnionPay. The business is also working on near term initiatives to

extend the number of shops operating lottery terminals and deliver

a rapid expansion of the PELT offering.

There are currently 53 shops operating Lucky World, as the

business undertakes promotional activity with both Lucky World

branded merchandise and FMCG goods supplied by third parties. To

date, the promotions have been well received generating positive

customer and lottery shop owner feedback. It is planned to continue

to roll out stores and expand the SKU offering while further

developing strategic relationships with specific suppliers of FMCG

goods.

Hui10 Board

Frank Li, co-founder and co-CEO

Frank is co-founder of Hui10, which he established in 2014

together with Daniel Levine. Prior to this he was general manager

of Innovative World Technologies team which he transformed into a

SaaS company, working with China Welfare Lottery Issuance and

Management Centre. Frank's background is working in technology

based businesses including Oracle and Starcom Co., Ltd. Frank

graduated from the School of Electronic Engineering, Beijing Union

University, majoring in radio engineering.

Daniel Levine, co-founder and co-CEO

Daniel is co-founder of Hui10. Prior to this he worked with the

Innovative World Technologies team focused in the

telecommunications sector, and which developed solutions for China

Welfare Lottery. In 2006 Daniel founded Assist in China Ltd, with

the purpose of supporting individuals and companies operating

business with, or in China, guiding them through complex and

unfamiliar environment. During this period, Daniel supported Frank

in completing the successful IPO for Innovative World Technologies

on China's 3(rd) board, the NEEQ Stock Exchange.

Harry Willits, non-executive director and General Counsel

Harry is general counsel of Allwyn Entertainment Limited the

incoming operator of the fourth National Lottery. Previously he has

held positions as general counsel at William Hill and Gala Coral

Group (now part of Entain plc). Harry has been an investor in Hui10

since 2017 and a Director since March 2017.

Stephen Freear, independent non-executive director of Hui10

Stephen has 30 years' experience as a banker, starting at

Barclays in 1985 in commercial banking before moving into

investment banking in 1989. He is a specialist in Asian equities,

derivative and convertible bonds. Stephen has spent the majority of

his career working at Normura International and MUFG, Hong Kong

office. At MUFG, he was managing director, head of equities and

derivatives and member of management committee of MUFG London. From

2018 to 2022 Stephen was a consultant to Premier League football

club Crystal Palace.

Li Feng, independent non-executive director of Hui10

From 2018 Li Feng has been Secretary-general of Bejing Yigong

Public Welfare Foundation and general manager of Future Famous

(Beijing) Education Technology Co., Ltd. Prior to this he was

general manager of the medical health and cultural tourism

department of PingAn Bank. Previously Li Feng was a director of

product research and development, department of retail banking,

head office of PingAn Bank Prioer to this Li Feng was president of

Zizhu, sub-branch of Beijing branch, China Minsheng Bank.

In addition, as part of the investment Giles Willits will be

joining the Board of IIG with specific oversight of Hui10. Giles

has over 30 years' experience working in senior finance positions,

including over 20 years in executive board positions including

Group CFO at IG Design Group plc an AIM50 company, and

Entertainment One Ltd. a FTSE250 company. Giles was previously

Director of Group Finance at J Sainsbury's plc, FTSE100 and is a

qualified Chartered Accountant. Specific to Hui10, Giles invested

in Hui10 in 2018 and since then has been advising the business.

Directors' shareholdings in the Company

The table below summarises the Ordinary Shares held by the

Directors of Hui10 Board further to Admission.

Name Number of Percentage of Share

Ordinary Shares Capital further

to Admission

Frank Li 360,156,839 18.0%

----------------- --------------------

Daniel Levine 111,110,528 5.6%

----------------- --------------------

Harry Willits 21,696,836 1.1%

----------------- --------------------

Stephen Freear 7,087,434 0.4%

----------------- --------------------

Li Feng 11,860,178 0.6%

----------------- --------------------

In addition to the Hui10 Board the business currently has 42

employees located across seven offices (Beijing, Handan, Taiyuan,

Jinan, Jiu Jiang, Shi Jiazhuang and ShenZhen) in China. The main

functions of the team cover operations, marketing and finance. The

Hui10 senior management team is highly experienced with a proven

track record and unique expertise in platform infrastructure,

lottery operations and the Chinese regulatory environment. As part

of the expected expansion of the business over the next three years

the team is forecast to grow to over 350 in China.

Hui10 Background Information

Hui10, is a company incorporated in the Cayman Islands on 28

January 2015. Its LEI company number is 296186 and its registered

office is Sertus Incorporations (Cayman) Limited, Sertus Chambers,

Governors Square, Suite #5-204, 23 Lime Tree Bay Avenue, P.O. Box

2547, Grand Cayman, Kyl-1104, Cayman Islands. The Company's Head

Office is based in China at 18, Zhongguancun Internet Creative

Cultural Ind. Park Fuwai Liangjiadian 1, Haidian District, Beijing

100142, PRC. Further information can be seen at www.hui10inc.com

.

Financial information

The summary financial information for Hui10 for the two years

ended 31(st) December 2022 is below.

2022 2021

RMB '000 RMB '000

Revenue 1,826 1,723

---------- ----------

Loss before tax (Continuing Operations) (34,967) (19,537)

---------- ----------

In the year to 30 September 2023 the business has generated

revenues of RMB 358,744.

Hui10 share growth incentive scheme

The success of the investment will depend on the performance of

key employees and advisers in executing and supporting the growth

strategy. Hui10 will establish equity-based incentive arrangements

which will be an important means of motivating key employees,

consultants and advisers, and which will align with the interests

of shareholders. Hui10 will create a scheme in which participants

are only rewarded if a predetermined level of shareholder value is

created over a three to five year period or upon a change of

control of the Hui10 (whichever occurs first). The reward will be

calculated on a formula basis by reference to the growth in market

capitalisation of Hui10 over and above the value of US$365,000,000.

It will allow for adjustments for the issue of any new Ordinary

Shares and taking into account dividends and capital returns

("Shareholder Value"). As Hui10 is not a listed company the

calculation of Shareholder Value will be based on the lower of a

15x multiple of Adjusted EBITDA and the market capitalisation of

IIG (or in the event of a change of control of Hui10, the valuation

of Hui10).

The reward will be realised by the exercise by the beneficiaries

of a put option in respect of a new class of Hui10 shares and

satisfied either in cash or by the issue of new Ordinary Shares, at

the election of the Company. Under these arrangements in place,

participants are entitled up to in total 15% ("Incentive Pool") of

the Shareholder Value created, subject to such Shareholder Value

having increased by at least 25% per annum compounded over a period

of between three and five years from the Investment date or

following a change of control of the Company. To implement the

Incentive Scheme, Hui10 has approved the creation of a new share

class. The new share class does not have voting or dividend

rights.

The beneficiaries in the Incentive Scheme will include the

following;

Percentage of Share

Incentive Pool

Daniel Levine (including Frank Li) 6.3%

--------------------

Harry Willits 2.4%

--------------------

Giles Willits 2.4%

--------------------

Stephen Freear 0.3%

--------------------

The remaining 3.6% of the Incentive Pool has/will be allocated

amongst senior employees and certain advisers to Hui10 Inc.

Major shareholders

The Company is aware of the following persons who, directly or

indirectly will have an interest in 3% or more of the voting rights

of the Company's issued Ordinary Share capital further to

Admission:

Name Number of Percentage of Share

Ordinary Shares Capital

Frank Li Tong 360,156,839 18.0%

----------------- --------------------

Coral Group Trading Limited 216,448,245 10.8%

----------------- --------------------

Hingap Limited 189,762,845 9.5%

----------------- --------------------

Peter Kershaw 165,457,343 8.3%

----------------- --------------------

Knarfil International Limited 143,041,916 7.2%

----------------- --------------------

Zhixing Glabal Investments Limited 118,601,778 5.9%

----------------- --------------------

Daniel Levine 111,110,528 5.6%

----------------- --------------------

Wealth Chance Investment Group 87,265,857 4.4%

----------------- --------------------

Affinity Trustees Limited/Philippe

Jabre 68,548,642 3.4%

----------------- --------------------

Summary of the sale and purchase agreement

All of the Vendor Shareholders of Hui10 have entered into a

share sale and purchase agreement with IIG agreeing to sell the

whole of the share capital of Hui10 in exchange for the issue of

shares in IIG. Following completion of the sale and issue of the

Consideration Shares, the Vendor Shareholders of Hui10 will hold

95.7% of the issued share capital of IIG.

Each of the Vendor Shareholders have provided warranties

relating to their ownership of Hui10 shares and authority to sell

the shares to IIG. Commercial and tax warranties have been granted

by the Company and each of Daniel Levine and Frank Li (the

"Executives"). IIG is also able to rely on the information in a

Legal Due Diligence Report addressed to IIG and prepared by Han Kun

Law, the legal advisors to Hui10. Certain Vendor Shareholders

including Frank Li, Daniel Levine, Harry Willits and Coral Group

Trading Limited have entered into 12-month lock-in and 12-month

orderly market agreements.

Investment Terms Agreement

Hui10, IIG and the Executives have also entered into and

Investment Terms Agreement ("Investment Terms Agreement")

supporting IIG's investment into Hui10. Hui10 has undertaken to

provide certain financial and other information to IIG and require

IIG consent before taking certain actions and decisions. The

Company has the right to appoint two observes to attend board

meetings of Hui10 and receive information relating to other

companies and investment in the Hui10 group. Giles Willits has been

appointed an observer for the Company. Hui10 has the right to

appoint one observer to attend IIG Board Meetings. The Executives

have entered into restrictive covenants in the Investment Terms

Agreement undertaking not to compete with the Company for a period

in the event they cease to be employees of Hui10.

Related party transactions

The Company is not required to comply with the provisions of

Chapter 11 of the Listing Rules regarding related party

transactions. The Company has, however, adopted a related party

policy which shall apply to any transaction which it may enter into

with any Director or any of their affiliates, which would

constitute a "related party transaction" as defined in, and to

which would apply, Chapter 11 of the Listing Rules. In accordance

with its related party policy, the Company shall not enter into any

such related party transaction without first obtaining the approval

of a majority of the Directors who are independent of the relevant

related party.

The Chairman holds 1,500,000 ordinary shares in Hui10 which will

become 17,790,271 Ordinary Shares in the Company on Admission.

Furthermore, the Chairman is interested in a warrant issued by

Hui10 as more fully described below. The independent Directors,

which is the entire Board, except for the Chairman, unanimously

approved the Investment.

Giles Willits, who will join the board of the Company holds

163,572 ordinary shares in Hui10 which will become 1,939,997

Ordinary Shares in the Company on Admission. He is also a

participant in the Hui10 Share Incentive Growth Scheme described

above.

Warrants in the Company and Hui10

Conditional on Admission, the Company has executed a warrant

instrument and issued 39,967,785 warrants to Mannerston Investments

Limited, a company in which David Evans has a significant interest.

Each Warrant entitles the warrant holder to subscribe for one

Ordinary Share at an exercise price of 15.6632 pence during the

period commencing on 31 October 2023 and ending on the tenth

anniversary and are conditional on the share price reaching 31.3264

pence. Once this condition has been satisfied, the Warrant is

regarded as vested and may be exercised at any time thereafter,

even if the IIG share price subsequently falls below 31.3264 pence

per share. Full exercise of the subscription rights under the

Warrants will result in the issue of 39,967,785 new Ordinary

Shares.

Conditional on Admission, Hui10 executed a warrant instrument

and issued 1,658,956 warrants to the Chairman and an aggregate of

1,658,956 additional warrants to certain connected parties. Each

warrant entitles the warrant holder to subscribe for one Class B

share in Hui10 at an exercise price of GBP1.8868. Exercise of the

Warrants is subject to satisfaction of a vesting condition being

the closing price of the shares in IIG being equal to or more than

31.3264 pence per share. Once this condition has been satisfied,

the Warrant is regarded as vested and may be exercised at any time

thereafter, even if the IIG share price subsequently falls below

31.3264 pence per share. In the event that Hui10 declares any

dividend on the Ordinary Shares, it is obliged to accrue a pro rata

amount in respect of a notional dividend on the B Shares. Such

accrued notional dividend may be used by the Warrantholder towards

payment of the subscription price on the exercise of the

Warrants.

Each of the Warrantholders are intending to enter into, a put

and call option agreement with IIG, entitling the Warrantholders to

require IIG to acquire the Class B Shares issued in Hui10 on

exercise of the Warrants in exchange for the issue of an aggregate

of 39,967,785 new Ordinary Shares for all of the Class B Shares in

issue in Hui10. IIG has the right to choose whether to issue shares

or to pay cash on the exercise of the put or call option. The

Warrantholders have a period of 30 days to exercise their put

option. If the put option is not exercised by a Warrantholder

within 30 days, IIG may exercise its call option to acquire the

Class B shares in exchange for the issue of IIG shares or payment

in cash, at its discretion.

Accounting treatment of the Investment

The Board of Directors, in consultation with its advisers, has

assessed IIG as meeting the definition of an investment entity as

per IFRS 10 Consolidated Financial Statements requirements.

Therefore, Hui10 will be held at fair value on IIG's balance sheet

and any revaluation will be shown through its profit or loss in

accordance with IFRS 9 Financial Instruments. Hui10 will not be

consolidated as a subsidiary of IIG.

Proposed consolidation of the Ordinary Shares

It is the intention of the Company to consolidate the Ordinary

Shares by issuing one new ordinary share for every ten existing

Ordinary Shares at the Company's next Annual General Meeting

expected to be held in January 2024.

Investment Policy

The Company's investment policy is focussed on fast growing and

high potential life sciences, healthcare and technology businesses

operating predominantly in the UK, continental Europe, the US and

APAC. The Company's share issuance authorities allows for up to 3.7

billion new Ordinary Shares to be issued in consideration for

assets, as set out in the Company's prospectus and circular to

shareholders dated 11 July 2023.

END

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFEIEEMEDSEES

(END) Dow Jones Newswires

October 27, 2023 02:00 ET (06:00 GMT)

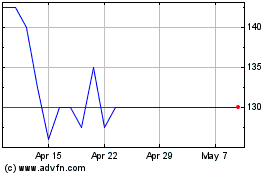

Intuitive Investments (LSE:IIG)

Historical Stock Chart

From Apr 2024 to May 2024

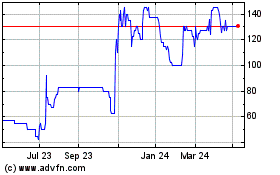

Intuitive Investments (LSE:IIG)

Historical Stock Chart

From May 2023 to May 2024