TIDMIUG

RNS Number : 5666J

Intelligent Ultrasound Group PLC

17 August 2023

Half Year Report

Intelligent Ultrasound Group plc (AIM: IUG), the 'classroom to

clinic' ultrasound company, specialising in artificial intelligence

(AI) software and simulation, announces its unaudited half year

results to 30 June 2023.

Financial highlights

-- Revenue for the period to 30 June 2023 has grown by 3% to GBP6.1m (H1 2022: GBP5.9m)

o H1 2022 revenue figures included GBP1.4m of one-off orders

from the NHS in the UK, so on an adjusted 'like-for-like' * basis,

revenue in H1 2023 increased by 35% (H1 2022 adjusted * :

GBP4.5m)

o The Group's clinical AI products continue to gain traction and

revenues more than doubled to GBP0.7m (H1 2022: GBP0.3m)

-- Operating loss increased by GBP0.2m to GBP1.5m (H1 2022: GBP1.3m) in the period

-- Cash at bank on 30 June 2023 was GBP3.3m (31 December 2022:

GBP7.2m), impacted by working capital seasonality in respect of

timing of revenues and receipts of inventory in H1

-- Cash utilisation in H2 is expected to be materially lower

-- The Group anticipates reaching profitability with its current cash

Operational highlights

-- ScanNav Anatomy Peripheral Nerve Block (PNB) AI software

upgrades released in UK and US market

-- BabyWorks 2.0 simulator product update released

-- ScanTrainer Endometriosis simulator module released

Stuart Gall, CEO of Intelligent Ultrasound commented:

"This has been another positive start to the year. We are

growing sales of our AI-related clinical products, as they move out

of the early phase of commercialisation and we continue to have an

excellent relationship with GE Healthcare, our OEM partner in

women's healthcare AI. Our simulation products are performing well

in the market and our new releases, including the endometriosis

training module for the ScanTrainer simulator, have been well

received.

We are building an exciting 'Classroom to Clinic' ultrasound

business and we continue to anticipate reaching profitability with

our current cash"

Enquiries:

Intelligent Ultrasound Group www.intelligentultrasound.com

plc

Stuart Gall, CEO Tel: +44 (0)29 2075 6534

Helen Jones, CFO

Cenkos Securities Tel: +44 (0)20 7397 8900

Giles Balleny / Max Gould (Corporate

Finance)

Dale Bellis / Julian Morse (Sales)

TB Cardew - PR Advisors Intelligentultrasound@tbcardew.com

Ed Orlebar Tel: +44 (0)7738 724630

Allison Connolly Tel: +44 (0)7587 453955

Emma Pascoe-Watson Tel: +44 (0)7774 620415

Hero Kurzeja Tel: +44 (0)7827 130430

About Intelligent Ultrasound Group

Intelligent Ultrasound (AIM: IUG) is one of the world's leading

'classroom to clinic' ultrasound companies, specialising in

real-time hi-fidelity virtual reality simulation for the ultrasound

training market ('classroom') and artificial intelligence-based

clinical image analysis software tools for the diagnostic medical

ultrasound market ('clinic'). Based in Cardiff in the UK and

Atlanta in the US, the Group has two revenue streams:

Simulation

Real-time hi-fidelity ultrasound education and training through

simulation. Our main products are the ScanTrainer obstetrics and

gynaecology training simulator, the HeartWorks echocardiography

training simulator, the BodyWorks Eve Point of Care and Emergency

Medicine training simulator with Covid-19 module and the new

BabyWorks Neonate and Paediatric training simulator. To date over

1,500 simulators have been sold to over 750 medical institutions

around the world.

Clinical AI software

Deep learning-based algorithms to make ultrasound machines

smarter and more accessible using our proprietary ScanNav

ultrasound image analysis technology. Current products on the

market utilising this technology are GE Healthcare's SonoLyst

software that is incorporated in their Voluson Expert 22 and SWIFT

ultrasound machines; ScanNav Anatomy PNB that simplifies

ultrasound-guided needling by providing the user with real-time

AI-based

anatomy highlighting for a range of medical procedures; and NeedleTrainer that teaches real-time ultrasound-guided needling and incorporates ScanNav Anatomy PNB.

www.intelligentultrasound.com

NOTE: ScanNav Anatomy PNB is CE approved and cleared for sale in

the US by the FDA, but is not available for sale in any other

territory requiring government approval for this type of

product.

* This is an a lternative performance measure defined on page

6.

INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2023

This has been another positive trading period for the Group. A

strong simulation sales performance in North America was combined

with promising progress in our clinical AI software revenues that

put us in a good position to continue the growth of the business in

2023 in this exciting sector of the market.

Simulation

Revenue

Although our simulation revenue declined by 5% to GBP5.3m (H1

2022: GBP5.6m), the H1 2022 simulation revenue included GBP1.4m of

one-off UK sales to an NHS training initiative, so when compared on

a 'like-for-like'* basis our, simulation revenue increased by

27%.

Sales from the Group's direct sales team in North America grew

154% to GBP2.7m (H1 2022: GBP1.1m), reflecting the increased

product range and investment in the expansion of the sales team

over the last 12 months.

The Group's reseller network also had a positive period of

trading and increased revenues by 104% to GBP1.1m (H1 2022:

GBP0.5m). This was a good recovery after a difficult couple of

years for our rest of the world revenues, but we believe there

remains a significant opportunity for further sales growth in a

number of the large European markets such as France and

Germany.

The Chinese simulation market has shown signs of recovery,

following two years of inactivity and we are working with our

reseller to build on this tentative revival and grow sales in this

potentially important market.

As expected, the strong H1 weighting to our simulation sales in

the UK market last year, resulted in a period on period decline of

61% to GBP1.6m (H1 2022: GBP4.0m). This was mainly due to the

majority of our 2022 UK sales, which also contained a large one-off

NHS training initiative worth GBP1.4m, being ordered in the first

half of the year, rather than following the more normal seasonal

spread. If the GBP1.4m one-off order is removed, on a

like-for-like* basis, the decline was 40%. The UK remains an

important market for us, both in terms of product testing and

revenue, and with a more normal seasonal spread being experienced

this year, we expect the UK's simulation sales to close the gap on

the 2022 like-for-like full year revenue figure of GBP3m.

Research and Development

In the period we focussed on releasing the:

-- BabyWorks 2.0 simulator product update, which included

improvements to the lung and brain imaging, as well as new cardiac

pathologies

-- Endometriosis training module for the ScanTrainer simulator

to help sonographers develop an increased understanding of

endometriosis using real ultrasound images

Clinical AI software

Revenue

Our clinical AI revenue, which is now moving out of the early

stage of commercialisation, grew 144% to GBP0.7m (H1 2022: GBP0.3m)

based on sales of three AI related products:

-- Our ScanNav Assist AI technology drives GE HealthCare's

SonoLyst X/IR software, the world's first fully integrated

ultrasound AI tool that automatically and in real-time recognises

the 21 views recommended for fetal sonography imaging and is an

optional extra on the Expert 22 and SWIFT ultrasound machines. We

continue to have an excellent relationship with GE Healthcare.

-- ScanNav Anatomy Peripheral Nerve Block ("PNB") , is our own

CE and FDA cleared, direct-to-market device, that simplifies

ultrasound-guided needling by providing the user with real-time

AI-based anatomy highlighting for a range of medical procedures.

Our aim is to support the large number of anaesthetists, who are

competent but less confident in the specialist knowledge of

ultrasound anatomy, to perform nerve blocks and as a result

increase the number of ultrasound-guided nerve blocks that they can

perform. As such we are focussed on releasing studies during the

year to support the adoption of the system and educate and grow the

market for ScanNav Anatomy PNB.

-- NeedleTrainer, our second direct-to-market device, teaches

real-time ultrasound-guided needling and incorporates ScanNav

Anatomy PNB to enable medical professionals to develop hand-eye

coordination, optimum positioning, and accuracy in

ultrasound-guided interventional procedures.

We continue to make positive progress in the commercialisation

of these products and revenue is expected to continue to grow in H2

and beyond.

Research and Development

In the period we focussed on releasing the:

-- NeedleTrainer software and calibration enhancements

-- ScanNav Anatomy Peripheral Nerve Block AI software upgrades for the UK and US market

In addition we continue to work on new developments in the areas

of women's health, emergency medicine and liver.

Operations

We continue to operate out of our head office in the centre of

Cardiff and warehouse in Caerphilly and successfully operate a

flexible hybrid work environment, whereby the majority of employees

combine office and at-home working that is appropriate to the

Company and employee.

Board changes

In June 2023, Ian Whittaker who has served as an Executive

Director and Chief Operating Officer (COO) since joining the Group

on the acquisition of Inventive Medical Ltd in August 2016,

announced he would not be seeking re-election to the Board of

Directors at the Annual General Meeting and that he would retire

from his position as COO on 31 December 2023.

The Board extends its thanks to Ian for his commitment and

invaluable contribution to growing the simulation revenue and

profitability significantly over the last seven years and wishes

him continued success in his business and personal endeavours.

Environmental, Social, and Governance (ESG)

In May we published our second ESG report in the annual report

and accounts and for the first time we have provided a full

calculation of our Scope 3 emissions. We are also delighted to be

working with the World Federation for Ultrasound in Medicine and

Biology ("WFUMB") in their mission to bring sustainable ultrasound

training programmes to the underserved areas of the world.

We continue to instigate new initiatives to promote better

employee and local engagement and believe we are having a positive

impact locally, nationally and globally.

The full report can be viewed here: 2022 ESG Report

Financial Review

-- Revenue of GBP6.1m (H1 2022: GBP5.9m)

-- Operating loss for the period of GBP1.5m (H1 2022: GBP1.3m)

-- Cash and cash equivalents at 30 June 2023 of GBP3.3m (31 December 2022: GBP7.4m)

-- Net cash outflow from operating activities of GBP2.7m (H1 2022: GBP0.7m)

H1 2023 was a positive trading period for the Group, seeing a

significantly improved performance from the North American and

Reseller sales regions as well as continued growth in Clinical AI

revenues. Gross profit for the period increased by GBP0.1m to

GBP3.9m with the average gross margin improving to 65% (H1 2022:

64%).

The Group's operating loss for the period increased by GBP0.2m

to GBP1.5m (H1 2022: loss of GBP1.3m), with administrative expenses

increasing by GBP0.3m to GBP5.4m (H1 2022: GBP5.1m), largely

attributable to increased marketing activity in the US and UK as

well as inflationary increases in salaries and other G&A costs,

partly offset by GBP0.3m lower expensed research and development

(R&D). Total research and development (R&D) expenditure in

H1 2023 was GBP1.5m (H1 2022: GBP1.7m) of which GBP0.8m (H1 2022:

GBP1.1m) has been expensed and GBP0.7m (H1 2022: 0.6m) has been

capitalised.

The tax credit for the period of GBP0.3m relating to the UK SME

R&D tax credit scheme was slightly lower than the previous

period as a result of the reduction in SME R&D tax relief rates

introduced as part of the R&D Tax Relief reforms which came

into effect from 1 April 2023. These Government changes are

expected to reduce the Group's annual R&D tax credit by around

40% in 2023 and 45% in 2024.

The loss after taxation for the period was GBP1.2m (H1 2022:

GBP1.0m).

The Group's net assets at 30 June 2023 reduced by GBP1.2m to

GBP11.0m (31 December 2022: GBP12.2m). Intangible assets increased

by GBP0.2m to GBP3.5m relating to capitalised development costs.

Property, plant and equipment increased by GBP0.1m with additions

of demonstration equipment.

The profile of sales invoicing was weighted towards the end of

the period resulting in significantly higher trade and other

receivables at the period end of GBP3.7m (31 December 2022:

GBP2.0m). Included within trade and other receivables is the

current tax asset of GBP1.0m, representing the R&D tax credit

from FY2022 not yet received plus the anticipated R&D tax

credit accrued for H1 2023Inventory was also GBP0.3m higher at 30

June 2023 impacted by timings of inventory receipts.

Trade and other payables at 30 June 2023 were GBP2.6m (31

December 2022: GBP2.7m), consisting mainly of trade payables of

GBP1.1m and accruals of GBP1.3m. Total lease liabilities increased

by GBP0.1m to GBP0.6m (31 December 2022: GBP0.5m) attributable to a

new lease for our US sales office.

The Group had cash and cash equivalents of GBP3.3m at 30 June

2023 (31 December 2022: GBP7.2m), a movement of GBP3.9m in the

period (H1 2022: GBP1.5m). Operating cash outflows in the period

increased by GBP2.0m to GBP2.7m (H1 2022: GBP0.7m) with the cash

position being significantly impacted by higher working capital

balances within trade receivables and inventory. Cash outflows from

investing activities totalled GBP0.9m, of which GBP0.7m related to

capitalised R&D costs (H1 2022: GBP0.6m) and GBP0.2m of

additions to property, plant and equipment (H1 2022: GBP0.4m).

The net cash outflow from financing activities was GBP0.1m (H1

2022: GBP0.1m), principally relating to lease payments. The net

cash outflow in the second half of the year is expected to

significantly reduce with lower inventory and trade receivables in

addition to the receipt of the FY2022 R&D tax credit of

GBP0.7m.

Outlook

This has been another positive start to the year.

We are growing sales of our AI-related clinical products, as

they move out of the early phase of commercialistion and we

continue to have an excellent relationship with GE Healthcare, our

OEM partner in women's healthcare AI. Our simulation products are

performing well in the market and we are building an exciting

'Classroom to Clinic' ultrasound business.

We continue to anticipate reaching profitability with our

current cash.

Stuart Gall

CEO

17 August 2023

*This is an alternative performance measure that adjusts H12022

revenue for one-off exceptional orders. 'Like-for-like' revenue is

reconciled to Revenue as follows:

H12022 Group Revenue (as reported) GBP5.9m

Adjusted for exceptional one-off orders GBP(1.4)m

Adjusted 'like-for-like' revenue GBP3.5m

CONSOLIDATED STATEMENT OF PROFIT AND LOSS AND OTHER

COMPREHENSIVE INCOME

Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

30 June 30 June 31 December

Note 2023 2022 2022

GBP'000 GBP'000 GBP'000

REVENUE 4 6,064 5,900 10,100

Cost of sales (2,129) (2,133) (3,766)

--------- --------- ------------

GROSS PROFIT 3,935 3,767 6,334

Other income 4 6 8

Administrative expenses (5,439) (5,121) (10,014)

--------- --------- ------------

OPERATING LOSS (1,500) (1,348) (3,672)

Finance income 16 - 1

Finance costs (12) (19) (31)

--------- --------- ------------

LOSS BEFORE INCOME TAX (1,496) (1,367) (3,702)

Taxation 5 256 333 718

--------- --------- ------------

LOSS ATTRIBUTABLE TO THE EQUITY

SHAREHOLDERS OF THE PARENT (1,240) (1,034) (2,984)

OTHER COMPREHENSIVE (EXPENSE)/INCOME

Items that will or may be reclassified

to profit or loss:

Exchange (loss)/gain arising on

translation of foreign operations (84) 175 238

OTHER COMPREHENSIVE (EXPENSE)/INCOME

FOR THE PERIOD (84) 175 238

--------- --------- ------------

TOTAL COMPREHENSIVE EXPENSE ATTRIBUTABLE

TO THE EQUITY SHAREHOLDERS OF THE

PARENT (1,324) (859) (2,746)

========= ========= ============

LOSS PER ORDINARY SHARE (PENCE)

ATTRIBUTABLE TO THE EQUITY SHAREHOLDERS

OF THE PARENT

Basic and diluted 6 (0.38) (0.38) (1.08)

========= ========= ============

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

Note Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

NON-CURRENT ASSETS

Intangible assets 7 3,541 2,776 3,272

Property, plant and equipment 1,316 1,277 1,174

Trade and other receivables 61 61 61

---------- ---------- -------------

4,918 4,114 4,507

---------- ---------- -------------

CURRENT ASSETS

Inventories 1,869 1,359 1,603

Trade and other receivables 3,725 2,193 2,025

Current tax asset 972 1,107 713

Cash and cash equivalents 3,335 3,544 7,166

---------- ---------- -------------

9,901 8,203 11,507

---------- ---------- -------------

TOTAL ASSETS 14,819 12,317 16,014

---------- ---------- -------------

CURRENT LIABILITIES

Trade and other payables 8 (2,561) (1,966) (2,732)

Deferred income (336) (284) (337)

Lease liabilities (193) (117) (188)

Provisions (22) (22) (22)

---------- ---------- -------------

(3,112) (2,389) (3,279)

---------- ---------- -------------

NON-CURRENT LIABILITIES

Deferred income (237) (349) (209)

Lease liabilities (391) (447) (298)

Other payables (65) (65) (65)

---------- ---------- -------------

(693) (861) (572)

---------- ---------- -------------

TOTAL LIABILITIES (3,805) (3,250) (3,851)

---------- ---------- -------------

NET ASSETS 11,014 9,067 12,163

========== ========== =============

EQUITY

Share capital 9 3,269 2,707 3,269

Share premium 30,207 25,959 30,207

Accumulated losses (31,191) (28,001) (29,951)

Share-based payment reserve 1,928 1,580 1,753

Merger reserve 6,538 6,538 6,538

Foreign exchange reserve 98 119 182

Other reserves 165 165 165

TOTAL EQUITY 11,014 9,067 12,163

========= ========= =========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share-based

payment Foreign

Share Share Accumulated reserve Merger exchange Other Total

capital premium losses reserve reserve reserves equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------- ---------- ------------- ------------ ---------- ---------- ---------- ---------

AT 1 JANUARY

2022 2,707 25,959 (26,967) 1,373 6,538 (56) 165 9,719

---------- ---------- ------------- ------------ ---------- ---------- ---------- ---------

COMPREHENSIVE

EXPENSE FOR THE

PERIOD

Loss for the

period - - (1,034) - - - - (1,034)

Other

comprehensive

income - - - - - 175 - 175

TRANSACTIONS

WITH OWNERS,

RECORDED

DIRECTLY IN

EQUITY

Share-based

payments - - - 207 - - - 207

---------- ---------- ------------- ------------ ---------- ---------- ---------- ---------

AT 30 JUNE 2022 2,707 25,959 (28,001) 1,580 6,538 119 165 9,067

---------- ---------- ------------- ------------ ---------- ---------- ---------- ---------

COMPREHENSIVE

INCOME/(EXPENSE)

FOR THE PERIOD

Loss for the

period - - (1,950) - - - - (1,950)

Other

comprehensive

income - - - - - 63 - 63

TRANSACTIONS

WITH OWNERS,

RECORDED

DIRECTLY IN

EQUITY

Issue of share

capital 562 4,248 - - - - - 4,810

Share-based

payments - - - 173 - - - 173

---------- ---------- ------------- ------------ ---------- ---------- ---------- ---------

AT 31 DECEMBER

2022 3,269 30,207 (29,951) 1,753 6,538 182 165 12,163

---------- ---------- ------------- ------------ ---------- ---------- ---------- ---------

COMPREHENSIVE

INCOME/(EXPENSE)

FOR THE PERIOD

Loss for the

period - - (1,240) - - - - (1,240)

Other

comprehensive

expense - - - - - (84) - (84)

TRANSACTIONS

WITH OWNERS,

RECORDED

DIRECTLY IN

EQUITY

Share-based

payments - - - 175 - - - 175

AT 30 JUNE 2023 3,269 30,207 (31,191) 1,928 6,538 98 165 11,014

========== ========== ============= ============ ========== ========== ========== =========

CONSOLIDATED STATEMENT OF CASH FLOWS

Unaudited Unaudited Audited

6 months 6 months 31 December

ended ended 2022

30 June 2023 30 June 2022

GBP'000 GBP'000 GBP'000

CASH FLOW FROM CONTINUING OPERATING ACTIVITIES

Loss before tax (1,496) (1,367) (3,702)

Add back:

Depreciation 306 287 604

Amortisation of intangible assets 466 363 780

Net finance (income)/costs (4) 19 30

Share-based payments expense 175 207 380

------------- ------------- ------------

Operating cash flows before movement

in working capital (553) (491) (1,908)

Movement in inventories (267) (160) (404)

Movement in trade and other receivables (1,763) 531 739

Movement in trade and other payables (123) (743) (70)

------------- ------------- ------------

Cash used in operations (2,706) (863) (1,643)

Income taxes (paid)/received (2) 181 959

------------- ------------- ------------

NET CASH USED IN OPERATING ACTIVITIES (2,708) (682) (684)

------------- ------------- ------------

CASH FLOWS FROM INVESTING ACTIVITIES

Purchase of property, plant and equipment (213) (157) (357)

Interest received 16 - 1

Internally generated and purchase of intangible

assets (737) (582) (1,467)

NET CASH USED IN INVESTING ACTIVITIES (934) (739) (1,823)

------------- ------------- ------------

CASH FLOWS FROM FINANCING ACTIVITIES

Issue of new shares - - 5,200

Share issue costs - - (390)

Principal elements of lease payments (139) (112) (231)

Finance costs paid (14) (19) (37)

NET CASH (USED IN)/GENERATED BY FINANCING

ACTIVITIES (153) (131) 4,548

------------- ------------- ------------

NET (DECREASE)/INCREASE IN CASH AND CASH

EQUIVALENTS (3,795) (1,552) 2,041

CASH AND CASH EQUIVALENTS AT BEGINNING

OF PERIOD 7,166 4,950 4,950

Exchange (losses)/gains on cash and cash

equivalents (36) 146 175

CASH AND CASH EQUIVALENTS AT OF PERIOD 3,335 3,544 7,166

============= ============= ============

NOTES TO THE CONSOLIDATED INTERIM REPORT

for the six months ended 30 June 2023

1. BASIS OF PREPARATION AND ACCOUNTING POLICIES

The financial information contained in this interim report has

not been audited by the Group's auditor and does not constitute

statutory accounts as defined in Section 434 of the Companies Act

2006. The Directors approved and authorised this interim report on

16 August 2023. The financial information for the preceding full

year is extracted from the statutory accounts for the financial

year ended 31 December 2022. Those accounts, upon which the auditor

issued an unqualified opinion and did not include a statement under

Section 498(2) or (3) of the Companies Act 2006, have been

delivered to the Registrar of Companies. The report drew attention

by way of emphasis to note 4 of the financial statements regarding

key estimation uncertainty in respect of the timing of forecasted

sales of Clinical AI products used in the recoverability assessment

of the Clinical AI intangible assets, investment value and

intercompany receivables.

This interim report has been prepared in accordance with UK AIM

Rules for Companies. The Group has not applied IAS 34 "Interim

Financial Reporting" (which is not mandatory for AIM listed

companies) in the preparation of this interim report. The interim

report has been prepared in a manner consistent with the accounting

policies set out in the statutory accounts for the financial year

ended 31 December 2022.

The Company is a limited liability company incorporated and

domiciled in England & Wales and whose shares are quoted on

AIM, a market operated by The London Stock Exchange. The Group

financial statements are presented in pounds Sterling.

Going concern

The Board has reviewed recently updated cash flow forecasts for

the period to the end of 2024 based on latest trading and estimates

and assumptions for future product development projects, sales

pipeline, revenues and costs and timing and quantum of investments

in the R&D programmes. The Directors have a reasonable

expectation that the Group has adequate cash resources and support

to continue in operational existence for the foreseeable future,

considered to be at least 12 months from the date of approval of

this Interim report.

2. BASIS OF CONSOLIDATION

The consolidated interim report incorporates the results of the

Company and its subsidiary undertakings.

3. NEW ACCOUNTING STANDARDS

Several amendments and interpretations apply for the first time

in 2023, but do not have an impact on the interim condensed

consolidated financial statements of the Group.

4. REVENUE ANALYSIS

The following table provides an analysis of the Group's revenue

by geography based upon location of the Group's customers.

Period ended 30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

United Kingdom 1,899 4,145 5,145

North America 2,795 1,179 2,943

Rest of World 1,370 576 2,012

-------- ----------------- -----------------

6,064 5,900 10,100

======== ================= =================

Clinical AI royalty income is included in the regions, but based

on the external customer's invoicing country rather than the

destination of the end customer.

5. TAXATION

Unaudited Unaudited Audited

6 months 6 months 12 months

ended 30 June ended 30 ended 31

2023 June 2022 December

2022

GBP'000 GBP'000 GBP'000

R&D tax credit 258 336 711

R&D tax credit relating to prior

periods - - 7

US corporation tax (2) (3) -

256 333 718

--------------- ----------- -----------

6. LOSS PER SHARE

Unaudited Unaudited

6 months 6 months Audited

ended 30 ended 30 year ended

June 2023 June 2022 31 December

2022

GBP'000 GBP'000 GBP'000

Loss for the year after taxation (1,240) (1,034) (2,984)

------------ ------------ -------------

Number of shares: No. No. No.

Basic and diluted weighted average

number of ordinary shares 326,869,921 270,653,485 275,274,014

------------ ------------ -------------

Basic and diluted loss pence per

share (0.38) (0.38) (1.08)

------------ ------------ -------------

In the periods ended 30 June 2023, 30 June 2022 and 31 December

2022 there were share options in issue which could potentially have

a dilutive impact, but as the Group is loss making in all periods,

they are anti-dilutive and therefore the weighted average number of

ordinary shares for the purpose of the basic and dilutive loss per

share is the same.

7. INTANGIBLE ASSETS

The net book value of intangible assets at 30 June 2023 includes

intellectual property and brands acquired with the purchase of

Intelligent Ultrasound Limited totalling GBP0.6m (31 December 2022:

GBP0.7m). The remaining net book value of intangible assets relate

to capitalised development costs of GBP2.9m.

8. CURRENT LIABILITIES - TRADE AND OTHER PAYABLES

Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Trade payables 1,053 874 1,3 59

Taxation and social security 255 137 397

Other payables 1 - 5

Accruals 1,252 955 971

2,561 1,966 2,7 32

========== ========== =============

9. SHARE CAPITAL

Allotted, issued and fully paid: No. GBP'000

Ordinary shares of 1p each

Balance at 1 January 2022 and 30 June 2022 270,653,485 2,707

Shares issued for cash 56,216,436 562

----------- -------

Balance at 31 December 2022 and 30 June

2023 326,869,921 3,269

----------- -------

10. INTERIM ANNOUNCEMENT

A copy of this report will be posted on the Company's website at

Intelligent Ultrasound .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DBGDIIBBDGXL

(END) Dow Jones Newswires

August 17, 2023 02:00 ET (06:00 GMT)

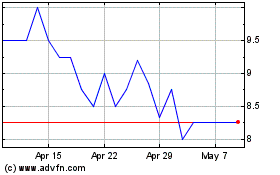

Intelligent Ultrasound (LSE:IUG)

Historical Stock Chart

From Apr 2024 to May 2024

Intelligent Ultrasound (LSE:IUG)

Historical Stock Chart

From May 2023 to May 2024