AIM Schedule One - Jadestone Energy PLC (3268T)

March 24 2021 - 6:00AM

UK Regulatory

TIDMJSE

RNS Number : 3268T

AIM

24 March 2021

ANNOUNCEMENT TO BE MADE BY THE AIM APPLICANT PRIOR TO ADMISSION

IN ACCORDANCE WITH RULE 2 OF THE AIM RULES FOR COMPANIES ("AIM

RULES")

COMPANY NAME:

Current: Jadestone Energy Inc (registration number: BC0350583)

Proposed: Jadestone Energy Plc (company number: 13152520)

("Jadestone" or the "Company)

COMPANY REGISTERED OFFICE ADDRESS AND IF DIFFERENT, COMPANY

TRADING ADDRESS (INCLUDING POSTCODES):

Current:

Jadestone Energy Inc.

3 Anson Road

#13-01 Springleaf Tower

Singapore, 079909

Proposed:

Jadestone Energy Plc

Suite 1, 3rd Floor 11-12

St. James's Square

London, SW1Y 4LB

COUNTRY OF INCORPORATION:

Current: Canada

Proposed: England and Wales

COMPANY WEBSITE ADDRESS CONTAINING ALL INFORMATION REQUIRED

BY AIM RULE 26:

www.jadestone-energy.com/aim/

COMPANY BUSINESS (INCLUDING MAIN COUNTRY OF OPERATION) OR,

IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING

POLICY. IF THE ADMISSION IS SOUGHT AS A RESULT OF A REVERSE

TAKE-OVER UNDER RULE 14, THIS SHOULD BE STATED:

Jadestone is an independent oil and gas company focused in

the Asia Pacific region, with a focus on production and near-term

development assets. It has a balanced, low risk, full cycle

portfolio of development, production and exploration assets

in Australia, Vietnam and other parts of Southeast Asia (including

Indonesia and the Philippines). Jadestone Energy Inc ("Inc")

had its common shares (the "Common Shares") admitted to trading

on AIM on 8 August 2018.

The Company has a 100% operated working interest in the Stag

oilfield and the Montara project, both shallow-water offshore

Australia. Both the Stag and Montara assets include producing

oil fields, with further development and exploration potential.

The Company also has a 100% operated working interest in two

gas development blocks in Southwest Vietnam, and an operated

90% interest in the Lemang PSC, onshore Sumatra, Indonesia,

which includes the Akatara gas field.

In addition, the Company has executed a sale and purchase agreement

to acquire an operated 69% interest in the Maari Project, shallow

water offshore New Zealand, and anticipates completing the

transaction in H1 2021, upon receipt of customary approvals.

Jadestone Energy is headquartered in Singapore, has its principal

technical team in Kuala Lumpur and country operational offices

in Perth, Jakarta, Ho Chi Minh City, and New Plymouth.

Inc is proposing to complete a reorganisation of its corporate

structure through a Canadian plan of arrangement under section

288 of the Business Corporations Act (British Columbia) (the

"Arrangement") to introduce Jadestone Energy Plc ("PLC") as

the new ultimate parent company of the Jadestone group and

pursuant to the Arrangement, the current shareholders of Inc

will have their Common Shares exchanged for ordinary shares

in PLC and the Common Shares will cease to be admitted to trading

on AIM (the "De-listing"). It is proposed that following the

De-listing, the Ordinary Shares (defined herein) will be admitted

to trading on AIM ("Admission").

DETAILS OF SECURITIES TO BE ADMITTED INCLUDING ANY RESTRICTIONS

AS TO TRANSFER OF THE SECURITIES (i.e. where known, number

and type of shares, nominal value and issue price to which

it seeks admission and the number and type to be held as treasury

shares):

462,149,477 ordinary shares of 50p each in the capital of Jadestone

(the "Ordinary Shares").

There are no shares held in treasury.

There are no restrictions on the transfer of securities to

be admitted.

CAPITAL TO BE RAISED ON ADMISSION (AND/OR SECONDARY OFFERING)

AND ANTICIPATED MARKET CAPITALISATION ON ADMISSION:

No capital being raised on admission.

Current market capitalisation: GBP314 million

PERCENTAGE OF AIM SECURITIES NOT IN PUBLIC HANDS AT ADMISSION:

33.4%

DETAILS OF ANY OTHER EXCHANGE OR TRADING PLATFORM TO WHICH

THE AIM SECURITIES (OR OTHER SECURITIES OF THE COMPANY) ARE

OR WILL BE ADMITTED OR TRADED:

None.

Following the Arrangement becoming effective, Inc will apply

to delist the Common Shares from trading on AIM and PLC will

seek admission of the Ordinary Shares to trading on AIM.

FULL NAMES AND FUNCTIONS OF DIRECTORS AND PROPOSED DIRECTORS

(underlining the first name by which each is known or including

any other name by which each is known):

Alexander Paul Blakeley - Executive Director, President and

Chief Executive Officer

Daniel ("Dan") Patrick Young - Executive Director and Chief

Financial Officer

Dennis Joseph McShane - Proposed Independent Non-Executive

Director, Chairman =

Robert ("Bob") Alexander Lambert - Proposed Independent Non-Executive

Director, Deputy Chairman

Iain Archibald McLaren - Proposed Independent Non-Executive

Director

Lisa Anne Stewart - Proposed Independent Non-Executive Director

Cedric Christian Joseph Fontenit - Proposed Independent Non-Executive

Director

David Loren Neuhauser - Proposed Non-Executive Director

FULL NAMES AND HOLDINGS OF SIGNIFICANT SHAREHOLDERS EXPRESSED

AS A PERCENTAGE OF THE ISSUED SHARE CAPITAL, BEFORE AND AFTER

ADMISSION (underlining the first name by which each is known

or including any other name by which each is known):

% ISC

Tyrus Capital S.A.M 25.58%

-------

Livermore Partners LLC 6.99%

-------

Odey Asset Management 6.22%

-------

Baillie Gifford & Co 5.90%

-------

Premier Miton Investors 5.12%

-------

Polar Capital 4.17%

-------

BlackRock 3.82%

-------

Progressive Capital Partners 3.43%

-------

Sandgrove Capital Management 3.29%

-------

Invesco 3.22%

-------

NAMES OF ALL PERSONS TO BE DISCLOSED IN ACCORDANCE WITH SCHEDULE

2, PARAGRAPH (H) OF THE AIM RULES:

Name

Allion

Allison Stenning

Clayton Utz

Consult45 Limited

Gibson, Dunn & Crutcher LLP

Jam Financial Consulting Limited

Langford Consultancy

Maree Melody

Maxdan Pty Ltd

Oakes Consultancy

Pitcher Partners Accountants & Advisors WA Pty Ltd

PricewaterHouse Coopers AU

PricewaterHouse Coopers NZ

Two Consult Pty Ltd

Vazey Accounting Services

Vistic Limited

Watson Farley and Williams

Wilson Consultancy Services

ZR Lawfirm

(i) ANTICIPATED ACCOUNTING REFERENCE DATE

(ii) DATE TO WHICH THE MAIN FINANCIAL INFORMATION IN THE ADMISSION

DOCUMENT HAS BEEN PREPARED (this may be represented by unaudited

interim financial information)

(iii) DATES BY WHICH IT MUST PUBLISH ITS FIRST THREE REPORTS

PURSUANT TO AIM RULES 18 AND 19:

(i) 31 December

(ii) 30 June 2020

(iii) By 30 June 2021, Annual Results for year ended 31 December

2021; by 30 September 2021, Half Yearly Results for six months

ended 30 June 2021; by 30 June 2022, Annual Results for year

ended 31 December 2021.

EXPECTED ADMISSION DATE:

Admission expected on 26 April 2021

NAME AND ADDRESS OF NOMINATED ADVISER:

Stifel Nicolaus Europe Limited

150 Cheapside

London

EC2V 6ET

NAME AND ADDRESS OF BROKER:

Stifel Nicolaus Europe Limited

150 Cheapside

London

EC2V 6ET

OTHER THAN IN THE CASE OF A QUOTED APPLICANT, DETAILS OF WHERE

(POSTAL OR INTERNET ADDRESS) THE ADMISSION DOCUMENT WILL BE

AVAILABLE FROM, WITH A STATEMENT THAT THIS WILL CONTAIN FULL

DETAILS

ABOUT THE APPLICANT AND THE ADMISSION OF ITS SECURITIES:

Not applicable.

THE CORPORATE GOVERNANCE CODE THE APPLICANT HAS DECIDED TO

APPLY

Quoted Companies Alliance ("QCA") Corporate Governance guidelines.

DATE OF NOTIFICATION:

24 March 2021

NEW/ UPDATE:

NEW

QUOTED APPLICANTS MUST ALSO COMPLETE THE FOLLOWING:

THE NAME OF THE AIM DESIGNATED MARKET UPON WHICH THE APPLICANT'S

SECURITIES HAVE BEEN TRADED:

AIM

THE DATE FROM WHICH THE APPLICANT'S SECURITIES HAVE BEEN SO

TRADED:

The Common Shares were admitted to trading on AIM on 8 August

2018.

CONFIRMATION THAT, FOLLOWING DUE AND CAREFUL ENQUIRY, THE APPLICANT

HAS ADHERED TO ANY LEGAL AND REGULATORY REQUIREMENTS INVOLVED

IN HAVING ITS SECURITIES TRADED UPON SUCH A MARKET OR DETAILS

OF WHERE THERE HAS BEEN ANY BREACH:

The Directors and the Proposed Directors confirm that, after

due and careful enquiry, Jadestone has adhered to all legal

and regulatory requirements involved in having its securities

traded on AIM.

AN ADDRESS OR WEB-SITE ADDRESS WHERE ANY DOCUMENTS OR ANNOUNCEMENTS

WHICH THE APPLICANT HAS MADE PUBLIC OVER THE LAST TWO YEARS

(IN CONSEQUENCE OF HAVING ITS SECURITIES SO TRADED) ARE AVAILABLE:

www.jadestone-energy.com/rns/

DETAILS OF THE APPLICANT'S STRATEGY FOLLOWING ADMISSION INCLUDING,

IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING

STRATEGY:

The Jadestone Group has built a business delivering free cash

flow streams. Surplus free cash flow is first prioritised for

redeployment into investments within the business, and also

in inorganic activity, provided they meet internal investment

criteria. Thereafter, and wherever possible, the board will

look to provide shareholder distributions, in the form of dividends,

having commenced this in September 2020.

Following Admission, the Jadestone Group will continue to build

a balanced and resilient portfolio of production assets, and

development assets, by applying the following four focused

key principles:

a) to acquire assets with production and/or discovered resources

in the Asia-Pacific region;

b) to realise additional value from existing producing assets

through superior operating capabilities, cost control and incremental

brown field development;

c) to move its existing discoveries to production into the

Asia-Pacific region's energy-short markets; and

d) to add additional reserves and production volumes through

undertaking low risk in-field and near-field exploration.

The Asia-Pacific region consists of numerous mature hydrocarbon

basins with upstream assets operated, in many cases, by national

oil companies, oil majors and large cap independents. The Jadestone

Group frequently reviews and evaluates such assets and is currently

evaluating a number of opportunities although none is sufficiently

progressed so as to require disclosure. Whilst the Jadestone

Group's acquisition screening is stringent, the group is confident

that it will continue to find more opportunities which fit

its strategy to re-invest and generate incremental value well

beyond the seller's view.

A DESCRIPTION OF ANY SIGNIFICANT CHANGE IN FINANCIAL OR TRADING

POSITION OF THE APPLICANT, WHICH HAS OCCURRED SINCE THE END

OF THE LAST FINANCIAL PERIOD FOR WHICH AUDITED STATEMENTS HAVE

BEEN PUBLISHED:

All significant changes in the financial or trading position

of Jadestone since 30 June 2020, being the end of the last

financial period for which unaudited financial statements were

published have been the subject of public announcements and

are in the Public Record.

Public Record means all information filed with the Canadian

Securities regulatory authority on www.sedar.com, filed with

the system for electronic disclosure by insiders (SEDI) (available

at www.sedi.ca), all information disclosed to a Regulatory

Information Service with the London Stock Exchange on www.londonstockexchange.com,

all information available on the Company's website at www.jadestone-energy.com

and all information contained in the circular to the shareholders

of Jadestone dated 22 March 2021.

A STATEMENT THAT THE DIRECTORS OF THE APPLICANT HAVE NO REASON

TO BELIEVE THAT THE WORKING CAPITAL AVAILABLE TO IT OR ITS

GROUP WILL BE INSUFFICIENT FOR AT LEAST TWELVE MONTHS FROM

THE DATE OF ITS ADMISSION:

The Directors and the proposed directors have no reason to

believe that the working capital available to Jadestone will

be insufficient for its present requirements and for at least

12 months from the date of Admission.

DETAILS OF ANY LOCK-IN ARRANGEMENTS PURSUANT TO RULE 7 OF THE

AIM RULES:

Not applicable.

A BRIEF DESCRIPTION OF THE ARRANGEMENTS FOR SETTLING THE APPLICANT'S

SECURITIES:

The Ordinary Shares admitted to AIM will be eligible for settlement

in CREST.

A WEBSITE ADDRESS DETAILING THE RIGHTS ATTACHING TO THE APPLICANT'S

SECURITIES:

www.jadestone-energy.com/aim/

INFORMATION EQUIVALENT TO THAT REQUIRED FOR AN ADMISSION DOCUMENT

WHICH IS NOT CURRENTLY PUBLIC:

Please refer to the Appendix to the Schedule One announcement

on the Company's website ( www.jadestone-energy.com/aim/ )

for the following details:

* Strategy following Admission;

* Corporate Governance (post admission);

* Application of the City Code on Takeovers and

Mergers; and

* Material contracts.

Significant additional information in relation to the Admission

is included in the Circular to the shareholders of Jadestone

dated 22 March 2021, which is available on the Company's website

( www.jadestone-energy.com/ ) and on SEDAR at www.sedar.com

.

A WEBSITE ADDRESS OF A PAGE CONTAINING THE APPLICANT'S LATEST

ANNUAL REPORT AND ACCOUNTS WHICH MUST HAVE A FINANCIAL YEAR

END NOT MORE THEN NINE MONTHS PRIOR TO ADMISSION AND INTERIM

RESULTS WHERE APPLICABLE. THE ACCOUNTS MUST BE PREPARED IN

ACCORDANCE WITH ACCOUNTING STANDARDS PERMISSIBLE UNDER AIM

RULE 19:

https://www.jadestone-energy.com/investor-relations/financial-results/

THE NUMBER OF EACH CLASS OF SECURITIES HELD IN TREASURY:

None.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PAAPPUCUWUPGGUC

(END) Dow Jones Newswires

March 24, 2021 07:00 ET (11:00 GMT)

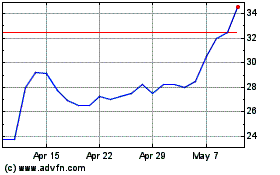

Jadestone Energy (LSE:JSE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Jadestone Energy (LSE:JSE)

Historical Stock Chart

From Apr 2023 to Apr 2024