TIDMKBT

RNS Number : 8816T

K3 Business Technology Group PLC

30 March 2021

AIM: KBT

30 March 2021

K3 Business Technology Group plc

("K3", "the Company" or "Group")

Shareholder Loan Conversion,

Notification of PDMR Dealings

and

Total Voting Rights

Further to the announcement earlier today of the Company's

results for the year to 30 November 2020, the Company reports that

it has reached agreement with two of its major shareholders,

Kestrel Partners LLP (through its discretionary clients)

("Kestrel") (represented by Non-executive Director Oliver Scott)

and Johan Claesson (also Non--executive Director) via his

associated company, CA Fastigheter AB (together "the Lenders") to

convert the full principal amount of the GBP3.0m shareholder loans

("Shareholder Loans") into ordinary shares of 25p each in the

Company ("Ordinary Shares") (the "Loan Conversion") at a conversion

price of GBP1.68 per Ordinary Share (being the prevailing bid-price

on 26 March 2021).

Taking in to account this Loan Conversion and the receipt of the

Starcom disposal proceeds, the Group's consolidated pro forma net

cash position as at 28 February 2021 was GBP5.8m.

The Shareholder Loans were made on an unsecured basis on 1 April

2020 to strengthen the Group's liquidity position during the

initial period of the Coronavirus pandemic (at which point the

closing price of K3 Ordinary Shares was 80p per Ordinary Share) and

repayment was due in full on 30 June 2021 together with accrued

interest.

As part of the process of extending the Group's bank facilities,

the independent directors of K3 (being all directors excluding

Johan Claesson and Oliver Scott) ("Independent Directors") have

agreed with the Lenders to fully convert the Shareholder Loans into

Ordinary Shares. Taking into account the Company's future plans,

the Independent Directors believe that the Loan Conversion is an

advantageous way of further strengthening the Group's balance

sheet.

The main terms of the conversion of the Shareholder Loans are as

follows:

- conversion is at a price of GBP1.68 per Ordinary Share (being

the prevailing bid-price on 26 March 2021);

- upon conversion of the Shareholder Loans CA Fastigheter AB and

discretionary clients of Kestrel will receive 892,857 Ordinary

Shares each (1,785,714 Ordinary Shares in aggregate) (together the

"Conversion Shares");

- payment of accrued interest and conversion costs amounting to

an aggregate amount of GBP552,064 will be paid by the Company to

the Lenders in cash on or around the date of conversion; and

- the warrants over 1.2m Ordinary Shares granted to the Lenders

at the date of the Shareholder Loans have not been exercised and

will remain in place.

The Loan Conversion will increase the Company's issued share

capital by 1,785,714 new Ordinary Shares, representing 4.16% of the

Company's current issued share capital. The Conversion Shares will

be allotted pursuant to existing general authorities granted to the

Directors at last year's AGM. Application will be made to the

London Stock Exchange for the Conversion Shares to be admitted to

trading on AIM which is expected to occur on 7 April 2021.

The revised shareholdings of Kestrel and Mr Claesson following

the issue of the Conversion Shares will be:

Kestrel

Shareholder Ordinary Shares Percentage of issued

share capital

Kestrel Opportunities (a client

of Kestrel) 8,490,479 18.98%

Kestrel other clients 2,823,569 6.31%

Total 11,314,048 25.29%

Mr Scott is a partner of and holds a beneficial interest in

Kestrel. Mr Scott is also a shareholder in one of Kestrel's clients

("Kestrel Opportunities").

Mr Claesson

Shareholder Ordinary Shares Percentage of issued

share capital

PJ Claesson 5,072,926 11.34%

Johan och Marianne Claesson

AB 1,947,461 4.35%

Fastighets AB Bremia 567,500 1.27%

CA Fastigheter AB 3,133,893 7.01%

Total 10,721,780 23.97%

Further disclosures regarding the above PDMR dealings are set

out at the foot of this announcement.

Related party transactions

The agreements reached by K3 with each of Kestrel (and its

underlying clients) and Mr Claesson in order to give effect to the

Loan Conversion and the payment of the associated interest and

conversion costs constitute related party transactions under the

AIM Rules, by virtue of Kestrel and Mr Claesson each being

substantial shareholders in the Company (as defined in the AIM

Rules) and Mr Claesson and Mr Scott each being a Non-executive

Director of the Company.

Having consulted with finnCap (as the Company's nominated

adviser), the Independent Directors consider that the terms of the

related party transaction are fair and reasonable insofar as the

Company's Shareholders are concerned.

Total Voting Rights

Following the Loan Conversion, the issued share capital of the

Company is 44,732,379 Ordinary Shares. There are no shares held in

treasury and thus the total number of voting rights in the Company

is 44,732,379, which may be used by shareholders as the denominator

for the calculations by which they will determine if they are

required to notify their interest in, or a change to their interest

in, the Company under the FCA's Disclosure Guidance and

Transparency Rules.

Enquiries:

K3 Business Technology Marco Vergani, CEO T: 0161 876 4498

Group plc Rob Price, CFO

finnCap Limited (NOMAD Julian Blunt/James Thompson T: 020 7220 0500

& Broker) (Corporate Finance)

Richard Chambers, Sunila

De Silva (Corporate

Broking)

KTZ Communications Katie Tzouliadis/Dan T: 020 3178 6378

Mahoney

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS DEFINED IN

ARTICLE 7 OF THE MARKET ABUSE REGULATION EU NO. 596/2014, AS

RETAINED AND APPLICABLE IN THE UK PURSUANT TO S3 OF THE EUROPEAN

UNION (WITHDRAWAL) ACT 2018 ("MAR").

1. Details of Persons Discharging Managerial Responsibilities "PDMR" / person closely associated

with them ('PCA')

a) Name Oliver Scott

2. Reason for notification

b) Position / status Non-executive director

c) Initial notification / amendment Initial Notification

3. Details of the issuer, emission allowance market participant, auction platform, auctioneer

or auction monitor

b) Name K3 Business Technology Group plc

c) LEI 213800QOJ9OF2AV81748

4. Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii)

each type of transaction; (iii) each date; and (iv) each place where transactions have been

conducted

a) Description of the financial instrument ordinary shares of 25p each

Identification code

GB00B00P6061

b) Nature of the transaction Subscription for new ordinary shares of 25p each by clients of Kestrel

Partners LLP (in which

Mr Scott is a partner) by way of loan conversion

c) Price(s) and volume(s) Volume: 892,857

Price: GBP1.68 per Ordinary Share (by way of loan conversion)

d) Aggregated information n/a

Aggregated volume Price

e) Date of the transaction 30 March 2021

f) Place of the transaction Outside a trading venue

Details of Persons Discharging Managerial Responsibilities "PDMR" / person closely associated

with them ('PCA')

Name Per Johan Claesson

Reason for notification

Position / status Non-executive director

Initial notification / amendment Initial Notification

Details of the issuer, emission allowance market participant, auction platform, auctioneer

or auction monitor

Name K3 Business Technology Group plc

LEI 213800QOJ9OF2AV81748

Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii)

each type of transaction; (iii) each date; and (iv) each place where transactions have been

conducted

Description of the financial instrument ordinary shares of 25p each

Identification code

GB00B00P6061

Nature of the transaction Subscription for new ordinary shares of 25p each by CA Fastigheter AB (a

company controlled

by Mr Claesson) by way of loan conversion

Price(s) and volume(s) Volume: 892,857

Price: GBP1.68 per Ordinary Share (by way of loan conversion)

Aggregated information n/a

Aggregated volume Price

Date of the transaction 30 March 2021

Place of the transaction Outside a trading venue

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCDBGDXRBDDGBC

(END) Dow Jones Newswires

March 30, 2021 02:30 ET (06:30 GMT)

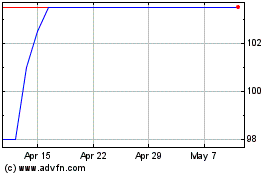

K3 Business Technology (LSE:KBT)

Historical Stock Chart

From Mar 2024 to Apr 2024

K3 Business Technology (LSE:KBT)

Historical Stock Chart

From Apr 2023 to Apr 2024