Lancashire Holdings Ltd Q3 Trading Statement

November 09 2023 - 1:00AM

UK Regulatory

TIDMLRE

LANCASHIRE HOLDINGS LIMITED

9 November 2023

Hamilton, Bermuda

Lancashire Holdings Limited ("Lancashire" or "the Group") today announces its

trading statement for the nine months ended 30 September 2023.

Trading statement highlights

· Gross premiums written increased by 23.2% year-on-year to $1.6 billion.

· IFRS 17 insurance revenue increased by 22.1% year-on-year to $1.1 billion.

· Group Renewal Price Index (RPI) of 117%.

· Total net investment return, including unrealised gains and losses, of 2.8%.

· Capital return of up to $169 million ($119 million in special dividend and

up to $50 million in buy-backs of Lancashire's Common Shares) following strong

operating performance year-to-date.

Alex Maloney, Group Chief Executive Officer, commented:

"During the first nine months of 2023, we have continued to successfully

implement our long-term strategy to manage the market cycle and deliver strong

profitable growth through a portfolio of diversified products.

Gross premiums written increased by 23.2% to $1.6 billion in the year to date,

with rates remaining extremely attractive across our product lines. We continue

to expect a positive environment into 2024, with further opportunities for

Lancashire.

Our investment returns have also continued to benefit from the higher interest

rate environment and the short duration of our portfolio, with a total net

investment return, including unrealised gains and losses, of 2.8% for the

period.

Capital management and balancing risk and return have for a long time been at

the heart of our strategy, and we continue to hold an extremely robust capital

position.

Our disciplined underwriting, and successful diversification strategy, mean that

we are in a position to pay out some of the capital generated to date, and still

have the flexibility to fund further growth and realise our ambitions for this

phase of the market cycle.

Following the strong operating performance in the year-to-date, I am pleased to

report that the Board has approved a capital return of up to $169 million,

including $119 million in special dividend and up to $50 million in buy-backs.

Our previously announced plans to expand our international footprint further

through Lancashire Insurance U.S. continue, and we are pleased with the progress

we are making towards an underwriting launch in early 2024.

I am always impressed by the talent, hard work and dedication of our people

across the Lancashire Group and I would like to thank them for their ongoing

commitment to the business.

I would also like to thank our clients, brokers and shareholders for their

continued support."

Business update

Gross premiums written and IFRS 17 insurance revenue

Nine months

ended

30 September 30 September Change Change RPI

2023 2022

$m $m $m % %

Reinsurance 19.2 % 123 %

837.7 702.9 134.8

Insurance 28.3 % 112 %

722.2 562.8 159.4

Gross 23.2 % 117 %

premiums 1,559.9 1,265.7 294.2

written

Reinsurance 24.9 %

521.7 417.6 104.1

Insurance 19.6 %

589.5 492.7 96.8

IFRS 17 22.1 %

insurance 1,111.2 910.3 200.9

revenue

Gross premiums written

Gross premiums written increased by $294.2 million or 23.2% in the first nine

months of 2023 compared to the same period in 2022. The Group's two segments,

and the key market factors impacting them, are discussed below.

Reinsurance segment

The build out of our casualty reinsurance lines continued to be the most

significant contributor to growth in the reinsurance segment. Our specialty

reinsurance class also continued to add new business in a positive rating

environment, with the property reinsurance class also benefiting from

significant rate increases. Overall the RPI was 123% for the segment.

Insurance segment

The growth in the insurance segment is primarily driven by property insurance,

with significant rate increases in the property direct and facultative class and

the continued build out of the property construction book of business. In

specialty insurance more premium was written in the political risk class, and

energy and marine continued to grow across our underwriting platforms taking

advantage of positive market conditions across most classes. Aviation insurance

benefited from exceptionally strong RPIs, albeit the major renewal period is in

the fourth quarter. Overall the RPI was 112% for the segment.

IFRS 17 insurance revenue

Insurance revenue is a new measure introduced by IFRS 17 and is comparable to

IFRS 4 gross premiums earned less inwards reinstatement premium and is net of

commission costs. Insurance revenue increased by $200.9 million or 22.1%, in the

first nine months of 2023 compared to the same period in 2022. The market

factors driving the increase in gross premiums written also drove the increase

in insurance revenue.

Loss environment

The first nine months of 2023 has seen natural catastrophe loss activity across

a number of events including U.S. wind and convective storms, the Hawaiian

wildfires, the Turkey earthquake, hurricane Idalia, and cyclones and flooding in

New Zealand. We also incurred some risk losses, particularly in our energy

classes. These losses were not individually material.

Investments

As at 30 September 2023 30 September 2022

Duration 1.6 years 1.7 years

Credit quality AA- AA-

Book yield 3.9% 2.3%

Market yield 5.8% 4.6%

Managed investments ($m) $2,661.4 $2,291.9

The Group's investment portfolio, including unrealised gains and losses,

returned 2.8% for the first nine months of 2023. The positive returns were

driven by $79.6 million of investment income as our portfolio benefited from

higher yields.

The Group's investment portfolio, including unrealised gains and losses,

returned negative 5.0% for the first nine months of 2022. The majority of the

losses were driven by significant increases in treasury rates.

Dividends

Lancashire's Board of Directors has declared a special dividend of $0.50 per

common share (approximately £0.41 per common share at the current exchange

rate), which will result in an aggregate payment of approximately $119 million.

The dividend will be paid in Pounds Sterling on 15 December 2023 (the "Dividend

Payment Date") to shareholders of record on 17 November 2023 (the "Record Date")

using the £ / $ spot market exchange rate at 12 noon London time on the Record

Date. Shareholders interested in participating in the dividend reinvestment plan

("DRIP"), or other services including international payment, are encouraged to

contact the Group's registrars, Link Asset Services, for more details.

Intention to purchase own shares

At Lancashire's Annual General Meeting held on 26 April 2023, Lancashire's

shareholders granted a general authority for Lancashire to make market purchases

of up to 24,401,000 of its own common shares of $0.50 each

("Common Shares"). Pursuant to and in accordance with that authority, Lancashire

intends to purchase its own Common Shares within certain parameters at an

aggregate price not exceeding $50 million. A further announcement in accordance

with Listing Rule 12.4 will be made in due course.

Analyst and Investor Conference Call

There will be an analyst and investor conference call on the trading statement

at 1:00pm UK time / 9:00am Bermuda time / 8:00am EST on Thursday 9 November

2023. The conference call will be hosted by Lancashire management and a

presentation will be made available on the Group's website prior to the call.

Please note that conference call participants are required to register in

advance to access either the audio conference call or webcast, the full

registration and access details are set out below.

Audio https://register.vevent.com/register/BIff9dde6ecbf3496ebfbe9f58cb884ec

access: 5 (https://protect-eu.mimecast.com/s/_

-oPCj2Bncy9GOvIWuZb5?domain=register.vevent.com)

Please register to obtain your personal audio conference pin and call

details.

Webcast https://onlinexperiences.com/Launch/QReg/ShowUUID=4FB61DDF-AA7E-4605

access: -B287-CAAD2798E2CE (https://protect

-eu.mimecast.com/s/FIgbCk5goiqNXwpTVkpFP?domain=onlinexperiences.com)

Please use this link to register and access the call via webcast.

A webcast replay facility will be available for 12 months and accessible at:

https://www.lancashiregroup.com/en/investors/results-reports-and

-presentations.html

Investor Day 2023

Lancashire will be holding an Investor Day on 14 November 2023 at 20 Fenchurch

Street, London. For further information please contact

jelena.bjelanovic@lancashiregroup.com.

Contact information

Lancashire

Holdings

Limited

Christopher +44 20 7264

Head

4145chris.head@lancashiregroup.com (chris.head%40lancashiregroup.com)

Jelena +44 20 7264 4066jelena.bjelanovic@lancashiregroup.com

Bjelanovic

FTI +44 20 37271046

Consulting

Edward Edward.Berry@FTIConsulting.com

Berry

Tom Tom.Blackwell@FTIConsulting.com

Blackwell

About Lancashire

Lancashire, through its UK and Bermuda-based operating subsidiaries, is a

provider of global specialty insurance and reinsurance products.

Lancashire common shares trade on the premium segment of the Main Market of the

London Stock Exchange under the ticker symbol LRE. Lancashire has its head

office and registered office at Power House, 7 Par-la-Ville Road, Hamilton HM

11, Bermuda.

The Bermuda Monetary Authority is the Group Supervisor of the Lancashire Group.

For more information, please visit Lancashire's website at

www.lancashiregroup.com.

This release contains information, which may be of a price sensitive nature that

Lancashire is making public in a manner consistent with the UK Market Abuse

Regulation and other regulatory obligations. The information was submitted for

publication, through the agency of the contact persons set out above, at 07:00

GMT on 9 November 2023.

NOTE REGARDING RPI METHODOLOGY:

THE RENEWAL PRICE INDEX ("RPI") IS AN INTERNAL METHODOLOGY THAT MANAGEMENT USES

TO TRACK TRENDS IN PREMIUM RATES OF A PORTFOLIO OF INSURANCE AND REINSURANCE

CONTRACTS. THE RPI IN THE RESPECTIVE SEGMENTS IS CALCULATED ON A PER CONTRACT

BASIS AND REFLECTS MANAGEMENT'S ASSESSMENT OF RELATIVE CHANGES IN PRICE, TERMS,

CONDITIONS AND LIMITS AND IS WEIGHTED BY PREMIUM VOLUME. THE RPI DOES NOT

INCLUDE NEW BUSINESS, TO OFFER A CONSISTENT BASIS FOR ANALYSIS. THE CALCULATION

INVOLVES A DEGREE OF JUDGEMENT IN RELATION TO COMPARABILITY OF CONTRACTS AND THE

ASSESSMENT NOTED ABOVE. TO ENHANCE THE RPI METHODOLOGY, MANAGEMENT MAY REVISE

THE METHODOLOGY AND ASSUMPTIONS UNDERLYING THE RPI, SO THE TRENDS IN PREMIUM

RATES REFLECTED IN THE RPI MAY NOT BE COMPARABLE OVER TIME. CONSIDERATION IS

ONLY GIVEN TO RENEWALS OF A COMPARABLE NATURE SO IT DOES NOT REFLECT EVERY

CONTRACT IN THE PORTFOLIO OF CONTRACTS. THE FUTURE PROFITABILITY OF THE

PORTFOLIO OF CONTRACTS WITHIN THE RPI IS DEPENDENT UPON MANY FACTORS BESIDES THE

TRENDS IN PREMIUM RATES.

NOTE REGARDING ALTERNATIVE PERFORMANCE MEASURES:

THE GROUP USES ALTERNATIVE PERFORMANCE MEASURES TO HELP EXPLAIN BUSINESS

PERFORMANCE AND FINANCIAL POSITION. THESE MEASURES HAVE BEEN CALCULATED

CONSISTENTLY WITH THOSE AS DISCLOSED IN THE GROUP'S ANNUAL REPORT AND ACCOUNTS

FOR THE YEAR ENDED 31 DECEMBER 2022 AND THE GROUP'S UNAUDITED CONDENSED INTERIM

CONSOLIDATED FINANCIAL

STATEMENTS FOR THE SIX MONTHS ENDING 30 JUNE 2023.

NOTE REGARDING FORWARD-LOOKING STATEMENTS:

CERTAIN STATEMENTS AND INDICATIVE PROJECTIONS (WHICH MAY INCLUDE MODELLED LOSS

SCENARIOS) MADE IN THIS RELEASE OR OTHERWISE THAT ARE NOT BASED ON CURRENT OR

HISTORICAL FACTS ARE FORWARD-LOOKING IN NATURE INCLUDING, WITHOUT LIMITATION,

STATEMENTS CONTAINING THE WORDS "BELIEVES", "AIMS", "ANTICIPATES", "PLANS",

"PROJECTS", "FORECASTS", "GUIDANCE", "INTENDS", "EXPECTS", "ESTIMATES",

"PREDICTS", "MAY", "CAN", "LIKELY", "WILL", "SEEKS", "SHOULD", OR, IN EACH CASE,

THEIR NEGATIVE OR COMPARABLE TERMINOLOGY. SUCH FORWARD LOOKING STATEMENTS

INVOLVE KNOWN AND UNKNOWN RISKS, UNCERTAINTIES AND OTHER IMPORTANT FACTORS THAT

COULD CAUSE THE ACTUAL RESULTS, PERFORMANCE OR ACHIEVEMENTS OF THE GROUP TO BE

MATERIALLY DIFFERENT FROM FUTURE RESULTS, PERFORMANCE OR ACHIEVEMENTS EXPRESSED

OR IMPLIED BY SUCH FORWARD-LOOKING STATEMENTS. FOR A DESCRIPTION OF SOME OF

THESE FACTORS, SEE THE GROUP'S ANNUAL REPORT AND ACCOUNTS FOR THE YEAR ENDED 31

DECEMBER 2022 AND THE GROUP'S UNAUDITED CONDENSED INTERIM CONSOLIDATED FINANCIAL

STATEMENTS FOR THE SIX MONTHS ENDING 30 JUNE 2023. IN ADDITION TO THOSE FACTORS

CONTAINED IN THE GROUP'S 2022 ANNUAL REPORT AND ACCOUNTS AND THE GROUP'S

UNAUDITED CONDENSED INTERIM CONSOLIDATED FINANCIAL STATEMENTS FOR THE SIX MONTHS

ENDING 30 JUNE 2023, ANY FORWARD-LOOKING STATEMENTS CONTAINED IN THIS RELEASE

MAY BE AFFECTED BY: THE IMPACT OF THE ONGOING CONFLICTS IN UKRAINE AND THE

MIDDLE EAST, INCLUDING ANY ESCALATION OR EXPANSION THEREOF, ON THE GROUP'S

BUSINESS, RESERVES OR CLIENTS, THE CONTINUED UNCERTAINTY OF THE SITUATION IN

RUSSIA, INCLUDING ISSUES RELATING TO POLICY COVERAGE AND THE IMPACT OF

GOVERNMENT SANCTIONS, THE IMPACT ON SECURITIES IN OUR INVESTMENT PORTFOLIO AND

ON GLOBAL FINANCIAL MARKETS GENERALLY, AS WELL AS ANY GOVERNMENTAL OR REGULATORY

CHANGES, ARISING THEREFROM; THE NUMBER AND TYPE OF INSURANCE AND REINSURANCE

CONTRACTS THAT THE GROUP WRITES OR MAY WRITE; THE GROUP'S ABILITY TO

SUCCESSFULLY IMPLEMENT ITS BUSINESS STRATEGY DURING `SOFT' AS WELL AS `HARD'

MARKETS; THE CONTINUATION OF INCREASED PREMIUM RATES THAT ARE AVAILABLE AT

POLICY INCEPTION FOR LINES WITHIN ITS TARGETED BUSINESS; INCREASED COMPETITION

ON THE BASIS OF PRICING, CAPACITY, COVERAGE TERMS OR RELATED FACTORS; AND

CYCLICAL DOWNTURNS OF THE INDUSTRY. ALL FORWARD-LOOKING STATEMENTS IN THIS

RELEASE OR OTHERWISE SPEAK ONLY AS AT THE DATE OF PUBLICATION. LANCASHIRE

EXPRESSLY DISCLAIMS ANY OBLIGATION OR UNDERTAKING (SAVE AS REQUIRED TO COMPLY

WITH ANY LEGAL OR REGULATORY OBLIGATIONS INCLUDING THE RULES OF THE LONDON STOCK

EXCHANGE) TO DISSEMINATE ANY UPDATES OR REVISIONS TO ANY FORWARD-LOOKING

STATEMENT TO REFLECT ANY CHANGES IN THE GROUP'S EXPECTATIONS OR CIRCUMSTANCES ON

WHICH ANY SUCH STATEMENT IS BASED. ALL SUBSEQUENT WRITTEN AND ORAL FORWARD

LOOKING STATEMENTS ATTRIBUTABLE TO THE GROUP OR INDIVIDUALS ACTING ON BEHALF OF

THE GROUP ARE EXPRESSLY QUALIFIED IN THEIR ENTIRETY BY THIS NOTE. PROSPECTIVE

INVESTORS SHOULD SPECIFICALLY CONSIDER THE FACTORS IDENTIFIED IN THIS RELEASE

AND THE REPORT AND ACCOUNTS AND THE UNAUDITED CONDENSED INTERIM CONSOLIDATED

FINANCIAL STATEMENTS NOTED ABOVE WHICH COULD CAUSE ACTUAL RESULTS TO DIFFER

BEFORE MAKING AN INVESTMENT DECISION.

This information was brought to you by Cision http://news.cision.com

https://news.cision.com/lancashire-holdings-ltd/r/q3-trading-statement,c3872104

END

(END) Dow Jones Newswires

November 09, 2023 02:00 ET (07:00 GMT)

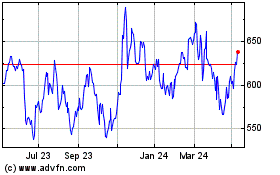

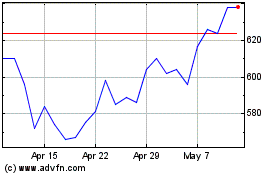

Lancashire (LSE:LRE)

Historical Stock Chart

From Apr 2024 to May 2024

Lancashire (LSE:LRE)

Historical Stock Chart

From May 2023 to May 2024