TIDMNESF

RNS Number : 4105T

NextEnergy Solar Fund Limited

25 March 2021

LEI: 213800ZPHCBDDSQH5447

25 March 2021

NextEnergy Solar Fund Limited

("NESF" or the "Company")

NextEnergy Solar Fund reaches c.150MWp UK subsidy-free

development target

NextEnergy Solar Fund, the solar power renewable energy

investment company, is delighted to announce that it has

successfully reached its subsidy-free development target of

c.150MWp, through two newly approved subsidy-free development

assets. Both assets are currently being prepared for construction

and are expected to be energised in early 2022.

The assets have an approximate investment value of GBP45m and

comprise:

-- Whitecross, a 124-acre solar project, based in Lincolnshire

with an installed capacity of c.35.3MWp

-- Hatherden, a 198-acre solar project, based in Hampshire with an installed capacity of c.50MWp

The two assets will cover the yearly electricity demand for

approximately 25,000 UK households. NESF has selected Whitecross

and Hatherden from its development portfolio based on the assets'

attractive forecast financial returns and their relative near-term

energisation.

NESF's early entry into the UK subsidy-free market has shown its

ability to develop attractive value-accretive opportunities and has

allowed NESF to establish its expertise and leadership position in

this space. Through NextEnergy Capital's ("NEC's") specialist

energy sales desk, NESF's subsidy-free portfolio will benefit from

active hedging and greater trading flexibility, thereby maximising

risk-adjusted returns for shareholders.

Smaller Related Party Transaction

Having achieved its target subsidy-free capacity of c.150MWp,

NESF is looking to divest any residual development risk and has

agreed to divest 16 development projects (not in construction or in

operation) from its subsidy-free pipeline. The identified projects

will be sold to a subsidiary of NextPower Development Ltd

("NextPower"). The divestment amounts to a combined consideration

of c.GBP5.6m and will result in NESF receiving an attractive return

on the capital invested into this development activity. This

follows NESF's announcement in May 2020 regarding the sale of two

subsidy-free projects under development (not in construction or in

operation) with a capacity of 115MW to NextPower for a combined

total consideration of GBP11.5m.

NextPower and its subsidiaries are under the common control of

the wider NEC Group along with NextEnergy Capital Limited

(Investment Adviser to NESF) and NextEnergy Capital IM Limited

(Investment Manager to NESF) and as such are related parties of the

Company. Based on the amounts involved, this transaction

constitutes a smaller related party transaction as set out in

Listing Rule 11.1.10R.

NESF may sell further subsidy-free projects from its pipeline to

subsidiaries of NextPower. All related-party disposals are at the

Board's discretion and comply with the FCA's Listing Rules. There

are no exclusivity arrangements in place between NESF and any

member of the NEC Group in relation to this transaction or future

disposals.

Kevin Lyon, Chairman of NextEnergy Solar Fund commented:

"With the investment approval of Hatherden and Whitecross, both

exciting subsidy-free assets of scale, NESF has reached its target

of c.150MWp of subsidy-free assets in the portfolio. The divestment

is a result of NESF having achieved this target and reducing

exposure to any further development risk at this time. This allows

NESF to increase its focus on investment opportunities both in and

outside the UK in line with the expansion of NESF's investment

policy approved by shareholders last year".

Michael Bonte-Friedheim, CEO of NextEnergy Capital Group,

commented:

"Reaching the c.150MWp target of subsidy-free assets in

development is truly a milestone achievement for NESF, as we have

shown the market that we have achieved what we set out to do. NESF

has firmly demonstrated its leadership in the UK solar market and

continues to achieve superior technical and operational

performance. In parallel, NESF continues to focus on further growth

opportunities in the UK and internationally."

-End-

For further information:

NextEnergy Capital Group 020 3746 0700

Michael Bonte-Friedheim ir@nextenergysolarfund.com

Aldo Beolchini

Ross Grier

Peter Hamid (Investor Relations)

Cenkos Securities 020 7397 8900

James King

William Talkington

Shore Capital 020 7408 4090

Anita Ghanekar

Sarah Mather

Fiona Conroy

Camarco 020 3781 8334

Owen Roberts

Eddie Livingstone-Learmonth

Apex Fund and Corporate Services (Guernsey)

Limited 01481 735 827

Nick Robilliard

Notes to Editors(1) :

About NextEnergy Solar Fund

NextEnergy Solar Fund is a renewable energy infrastructure

investment company that currently invests in operating solar power

plants in the UK and Italy. The Company may invest up to 30% of its

gross asset value in non-UK OECD countries, 15% in private equity

structures, and 10% in standalone energy storage.

NESF has a diversified portfolio comprising 92 operating solar

assets, primarily on agricultural, industrial, and commercial

sites, with a combined installed power capacity of c.813MW.

As at 31 December 2020, the Company had gross assets of GBP1,001

million, of which 88% was invested in the UK, and net assets of

GBP591 million. The majority of long-term cash flows from its

investments are inflation-linked.

NESF's investment objective is to provide ordinary shareholders

with attractive risk-adjusted returns, principally in the form of

regular dividends, by investing in a diversified portfolio of

primarily UK-based solar energy infrastructure assets. The dividend

is payable quarterly, and the Company has announced a dividend

target for the year ending 31 March 2021 of 7.05p per ordinary

share.

For further information on NESF please visit

nextenergysolarfund.com

Commitment to ESG

NESF is committed to ESG principles and responsible investment

which make a meaningful contribution to reducing CO2 emissions

through the generation of clean solar power. NESF will only select

investments that meet the requirements of NEC Group's Sustainable

Investment Policy. Based on this policy, NESF benefits from NEC's

rigorous ESG due diligence on each investment. NESF is committed to

reporting on its ESG performance in accordance with the UN

Sustainable Development Goals framework and the EU Sustainable

Finance Disclosure Regulation.

NESF has been awarded the London Stock Exchange's Green Economy

Mark and has been designated a Guernsey Green Fund by the Guernsey

Financial Services Commission.

NESF's sustainability-related disclosures in the financial

services sector in accordance with Regulation (EU) 2019/2088 can be

accessed on the ESG section of both the NESF website (

nextenergysolarfund.com/esg/ ) & NEC Group website (

nextenergycapital.com/sustainability/transparency-and-reporting/

).

About NextEnergy Capital Group ("NEC Group")

NESF is managed by the NextEnergy Capital Group, a specialist

solar investment manager, which has a strong track record in

sourcing, acquiring, and managing operating solar assets. NEC Group

is a leading player in the global solar investment sector and has

over 190 team members with offices in UK, Italy, India, and the USA

and assets under management of over $2.3bn across three

institutional funds.

NextEnergy Capital Group donates 5% of its net annual profits to

NextEnergy Foundation. NextEnergy Foundation is an international

charity that was founded in 2016. Its mission is to participate

proactively in the global effort to reduce carbon emissions,

provide clean power sources in regions where they are not yet

available, and contribute to poverty alleviation.

For further information on NEC Group please visit

nextenergycapital.com

For further information on NextEnergy Foundation visit

nextenergyfoundation.org

About WiseEnergy

WiseEnergy is NEC Group's specialist operating asset management

division. NESF is differentiated by its access to WiseEnergy, which

has provided operating asset management, monitoring, technical due

diligence, and other services to over 1,500 utility-scale solar

power plants with an installed capacity in excess of 2.3GW.

For further information on Wise Energy please visit

wise-energy.com

([1]) Note: All financial data is as at 31 December 2020, being

the latest date in respect of which NESF has published financial

information

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCJIMLTMTTTBJB

(END) Dow Jones Newswires

March 25, 2021 03:00 ET (07:00 GMT)

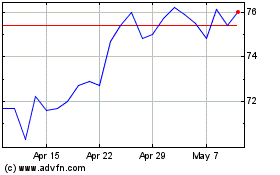

Nextenergy Solar (LSE:NESF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nextenergy Solar (LSE:NESF)

Historical Stock Chart

From Apr 2023 to Apr 2024