TIDMPRIM

RNS Number : 0493D

Primorus Investments PLC

16 June 2023

Primorus Investments plc

("Primorus" or the "Company")

Final Results

Primorus Investments plc (AIM: PRIM) is pleased to report its

final results for the year ended 31 December 2022. The Annual

Report & Accounts for the year ended 31 December 2022 ("Annual

Report") are available on the Company's website,

www.primorusinvestments.com .

Caution regarding forward looking statements

Certain statements in this announcement, are or may be deemed to

be, forward-looking statements. Forward-looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward-looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward-looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors. While management believes that these forward-looking

statements are reasonable as and when made, there can be no

assurance that future developments affecting the Company will be

those that it anticipates.

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation and the Directors of the Company

are responsible for the release of this announcement.

For further information please contact:

Primorus Investments plc

Matthew Beardmore, Chief Executive

Officer +44 (0) 20 8154 7907

Nominated Adviser

Cairn Financial Advisers LLP

Sandy Jamieson/James Caithie +44 (0) 20 7213 0880

Chairman's Statement

Overview

I am pleased to present the Chairman's Statement and Strategic

Report for the financial results of Primorus Investments plc for

the year ended 31 December 2022.

Introduction

The period under review was one again of significant change. The

COVID-19 pandemic was overtaken by the events of the Russian

invasion of Ukraine. Global interest rates have risen as central

banks attempt to stem the rise of inflation. This has made for an

uncertain macro-economic environment as companies, especially small

caps, have struggled where cheap liquidity is no longer available.

Primorus has remained in a favourable position where it has not

needed to raise new funds.

It has again been pleasing to see the progress made by several

of our investee companies which have taken the opportunity to grow

significantly. Some of the investee companies have continued to

struggle in this economic environment and will need to raise

capital - we took the view that some of these legacy investments

will not be core to Primorus in the future. We have and will

continue to look for opportunities to divest our holdings in them.

Any non- material divestments will be updated on the website.

Concurrent with reviewing the Company's existing investments,

the management team was also presented with many new proposals and

opportunities during the period. The management team carefully

reviewed each opportunity in accordance with the strategy

highlighted last year and decided to invest in one new company this

year, Interpac Limited, with further details set out below.

The Directors continue to align themselves with shareholders as

demonstrated by numerous share purchases by Directors on the market

culminating in a current combined Director holding of over 25% of

shares in issue.

Investment highlights

-- The Company made a new investment of GBP250,000 into Interpac

Ltd ("Interpac"). Interpac was founded in 2013 to create a new

corrugation process for the manufacture of cardboard which is more

cost-efficient and environmentally friendly than current

manufacturing processes.

-- In February 2022, the Company divested its convertible loan

notes ("CLNs") issued by Mustang Energy PLC ("Mustang"), a special

purpose acquisition company listed on the Standard list of the

London Stock Exchange's main market "Standard List"). Due to

Mustang not being in a position to complete its reverse takeover

and readmission by the applicable maturity date, Primorus exercised

its right to enact the backstop arrangement. Under this provision

Primorus converted its CLN into a new CLN with Bushveld Minerals

PLC ("BMN").

In 2022, two tranches of the CLN were exercised and the

resulting holding of BMN shares were sold into the market. The

remainder of the CLN will either be converted or the balance plus

interest of 10% repaid in July 2023.

-- The Company's investment into Alteration Earth PLC ("ALTE")

commenced trading on the Standard List on 1st July 2022. ALTE is

still seeking a reverse acquisition target. We look forward to ALTE

fulfilling its strategy and delivering a value enhancing outcome

for its shareholders.

-- Fresho Pty Ltd ("Fresho") had another successful year and

continued to progress throughout 2022. Engagement continues to

increase year on year and this resulted in an annualized gross

merchandise volume of +60% to $1.9bn. Orders increased 50% to

370,000 per month with 45% more venues. This resulted in revenue

increasing by 60%. With continued planned investment further

significant growth is forecasted.

-- The Payapps group ("Payapps") has continued to perform well

during 2022 with both sales and revenue growth increasing over the

comparative period for 2021. This growth reflects the investments

made in the business in 2021 and has been supported by largely

positive macroeconomic conditions in Australia and the UK post

COVID lockdowns in 2021. Sales results have been very strong within

all regions achieving a record sales year.

-- Engage Technology Partners Limited ("Engage"), the end-to end

workforce management platform provider looked to move their focus

towards Managed Service Providers. This will allow Engage to scale

up and to expand internationally. As Engage moved away from

Outsourced Payroll they have managed to exceed their pre Covid

revenues and allow future revenues to now come purely from SaaS

products.

-- SOA Energy ("SOA") SOA is working on acquiring new offshore

assets and creating a new partnership with a European oil major

company after which SOA intends to seek a listing on the London

Stock Exchange in Q4 2023.

-- Clean Power Hydrogen ("CPH2") encountered a number of issues.

Supply chain problems meant commissioning and delivery of its first

MF220 units experienced delays and therefore impacted planned

commissioning schedules. A further issue was identified in the

design and operation of the cryostat unit. The appointment of a CTO

and the manufacturing agreement with Fabrum Solutions Ltd will

hopefully lead to a swift resolution and accelerate the delivery of

the technology to an ever-growing market.

Primorus holds several legacy investments which do not form part

of its long-term strategy and which the Board considers a

distraction to the Company's current and strategic future goals.

Consequently, the Company intends to dispose of these investments

when there is a suitable liquidity event, or a fair value offer is

available.

The legacy investments include Sport80, WeShop, Stream TV and

MEVIE. These investments are now classified on the website under

non-core investments. In 2022 we have sold the majority of our

holding in Supernatural Foods and Nomad Energy is in the process of

liquidation. Since the year-end, we have disposed of our entire

holdings in Truspine and Rogue Baron.

Primorus will continue to actively manage its investments and

liquidity which may involve holding certain market tradeable

investments. Where active management involves non-material

transactions, it will not be reported via an RNS, but instead, the

Company's website shall be updated periodically to reflect any

changes to the investments held by the Company. These changes may

include the purchase of additional shares or the disposal in part

or in whole of any individual investment.

Financial highlights

The operating loss for the year was GBP1.513 million (2021: loss

of GBP0.041 million). The net loss after tax was GBP1.484 million

(2021: profit of GBP0.109 million). Total assets including cash at

31 December 2022 amounted to GBP7.656 million (2021:

GBP8.990 million).

The cash balance was GBP0.114 million as at 31 December 2022

(2021: GBP0.941 million)

Investee companies

The majority of the Company's investments in underlying investee

companies are minority investments. Whilst we may offer advice to

management of the investee companies, specifically pertaining to

their business objectives and goals, they can and sometimes do

ignore such advice. Similarly, those investee companies which are

privately held do not have similar disclosure obligations to

publicly quoted companies and therefore any updates they provide in

relation to their businesses can be piecemeal and, in certain

cases, non-existent save where the Board specifically requests an

update.

Primorus has no operational capacity insofar as it pertains to

any of its investee companies, and whilst the Board will look to

structure investments in a format where Primorus can have a high

degree of oversight, this was not done with the Company's historic

investments and, as such, there are inherent risks in that investee

companies are not as accountable to the Company as the Board would

prefer them to be. The Board intends, wherever possible, to seek

more oversight in any significant new investments which the Company

makes into private companies or unquoted public companies. It is

unlikely the Company will make investments into either such

companies unless there is a clear route to a relatively near- term

liquidity event such as a trade sale or an IPO.

In relation to its investment in Alteration Earth PLC, the

Company has a nominated director on the board to ensure there is

oversight on behalf of Primorus. This is a significant step for the

Company because it is the first investment where the Company will

get an insight into the operation of the investee company and be

able to actively voice its opinions, concerns and constructive

advice instead of being informed of decisions after the event.

Hedley Clark has also been appointed as a Non-Executive director on

the board of Interpac.

Summary and Outlook

The year under review saw the Company start to gain some

meaningful traction. Although there have been several headwinds for

Primorus and the markets in general, the Board feels the Company is

in a strong position to take advantage of opportunities as they

present themselves. The drive to net zero carbon is clearly

necessary for the benefit of the wider community and the Board

feels that it can position Primorus in this investment space for

the benefit of the Company and its shareholders.

The Company did not need to raise any capital in 2022 and the

Board sees no immediate need to do so due to the Company's holdings

of liquid instruments and cash. The Board is not ruling out the

possibility of raising capital if the right opportunity presents

itself, but at the time of writing the Company is not considering

any potential investments which would necessitate a capital raising

to be undertaken.

The management team of the Company was awarded share options to

incentivise the future growth of the Company. These options have

since been cancelled, at the unanimous decision of the management

team members, to better align the interests of the management team

with the interests of the Company's shareholders. I anticipate that

all shareholders would prefer that the management team be awarded a

non-dilutive means of remuneration if their performance merits such

award. This also aligns with our decision last year to complete a

capital reduction, which provided a further means of potentially

rewarding shareholders, either by means of a share buyback or the

payment of dividends.

The Board will continue to look at innovative ways to enhance

the Company's value which may involve looking at various

alternative company structures.

It is also important to enhance clarity of those investments

which the Company holds. In the past, it has been hard to get an

accurate valuation of some of our investments but as we move

towards investments with greater liquidity this should enable the

Company to be valued at a more realistic value to its net asset

value ("NAV"). Whilst it is usual for investment companies to trade

at a discount to their NAV, the Board believes the Company to be

significantly undervalued given its current share price and

resultant market capitalisation. The Company's positioning into

holding more liquid investments should hopefully ensure it trades

closer to its NAV.

We remain highly focused on costs, especially in these

inflationary times and will always focus on efficiency whilst

working to achieve shareholder value.

The Board would like to thank all shareholders for their

continued support and understanding in this period of unsettling

and exceptional circumstances and wish them well during this

time.

2023

The Board remains committed to its strategic criteria for each

new investment and has reiterated the core requirements below:

-- It must enable Primorus the opportunity to acquire a

meaningful stake in the investee company.

-- A clear and realistic exit route must be in place.

-- There should be an opportunity for the Board to play an

active role in the investee company's development.

-- The Board and the investee company's management team must

share a common vision and strategic alignment.

-- The investment committed by the Company will be proportionate

to the risk/reward opportunity.

-- There should be a greater opportunity for the Company's

shareholders to benefit directly from the increase in capital

values from each investment.

Our operational targets for the remainder of 2023, in line with

our investing policy, are:

-- To continue to focus on applying financial resources

diligently, with controlled corporate costs and focused

investment.

-- To continue to build working capital, preferably through

organic means, by exiting investments which have generated

significant returns on investment.

-- To continue to build our external network and to develop our

managerial team to provide confidence in the market of our

abilities to achieve our strategic business objective of

identifying significant value-enhancing investment

opportunities.

-- To proactively continue the work the Board has already

started to achieve with the crystallisation of value from certain

investment opportunities which it has identified.

-- To continue to review new opportunities and where financially

and operationally practical to make investments in such

opportunities which present the most upside to the Company.

-- To retain sufficient capital resources through cash or liquid

investments to enable the Company to have access to immediate

capital for the purposes of deploying into larger positions that

are the most strategically aligned opportunities.

-- To divest the non-core investments when suitable liquidity

events arise, or fair value can be achieved by alternative

means.

Statement in accordance with section 172 of the Companies Act

2006

As required by section 172 of the Companies Act 2006, a director

of a company must act in a way they consider, in good faith, would

most likely promote the success of the company for the benefit of

its shareholders. In doing this, the director must have regard,

amongst other matters, to the:

-- likely consequences of any decision in the long term;

-- interests of the Company's employees;

-- need to foster the Company's business relationships with

suppliers, customers and others;

-- impact of the Company's operations on the community as well

as the environment;

-- company's reputation for high standards of business conduct;

and

-- need to act fairly as between members of the Company.

As a Board our aim is always to uphold the highest standards of

governance and business conduct, taking decisions in the interests

of the long-term sustainable success of the Company, generating

value for our shareholders and contributing to wider society. We

recognise that our business can only grow and prosper over the long

term by understanding the views and needs of our stakeholders.

Engaging with stakeholders is key to ensuring the Board has

informed discussions and factors stakeholder interests into

decision-making.

The Board of Directors is collectively responsible for

formulating the Company's strategy, which is to invest in

businesses where prospects appear to be exceptional at an

attractive price and deliver good risk-adjusted investment returns

to the shareholders. The Board places equal importance on all

shareholders and strives for transparent and effective external

communications, within the regulatory confines of a listed company.

The primary communication method for regulatory matters and matters

for material substance is through the Regulatory News Services

(RNS).

As always, I am available for any shareholder to contact me

directly about any concerns or suggestions they may have.

Details of the Board's decisions for the year ending 31 December

2022 to promote long-term success, and how it engaged with

stakeholders and considered their interests when making those

decisions, can be found throughout the Chairman's Statement,

Directors' Report and Corporate Governance Statements.

Rupert Labrum Chairman

Date 15 June 2023

Statement of Profit or Loss and Other Comprehensive

Income

For the year ended 31 December 2022

2022 2021

Note GBP000 GBP000

Income

Investment income 93 141

Realised (loss)/gain on financial investments (288) 323

Unrealised (loss)/gain on financial investments (542) 19

Gross (loss)/profit (737) 483

Administrative expenses (401) (418)

Impairment of financial investments 2 (375) (106)

Loss before tax (1,513) (41)

Tax credit 29 150

(Loss)/profit for the year (1,484) 109

Total comprehensive income (1,484) 109

2022 2021

Pence Pence

Earnings per share attributable to the ordinary

equity holders of the parent

Basic 3 (1.061) 0.078

Diluted 3 (1.061) 0.072

Statement of Financial Position

As at 31 December 2022

2022 2021

Note GBP000 GBP000

Assets

Non-current assets

Financial investments 2 5,444 7,533

------ ------

5,444 7,533

Current assets

Financial investments 2 2,064 511

Trade and other receivables 34 5

Bank and cash balances 114 941

------ ------

2,212 1,457

------ ------

Total assets 7,656 8,990

------ ------

Liabilities

Non-current liabilities

Current liabilities

Trade and other liabilities 110 44

Contract liabilities - 37

------ ------

110 81

------ ------

Total liabilities 110 81

------ ------

Net assets 7,546 8,909

====== ======

Issued capital and reserves

Share capital 280 280

Other reserves - 13

Retained earnings 7,266 8,616

------ ------

TOTAL EQUITY 7,546 8,909

====== ======

Statement of Changes in Equity

For the year ended 31 December 2022

Total

Share attributable

based to owners

Share Share payment Retained of the

capital premium reserve earnings company

GBP000 GBP000 GBP000 GBP000 GBP000

At 1 January 2021 15,391 35,296 - (41,901) 8,786

Profit for the year - - - 109 109

--------- --------- --------- ---------- --------------

Total comprehensive income

for the year - - - 109 109

--------- --------- --------- ---------- --------------

Shares cancelled during

the year (15,111) (35,296) - 50,408

Share based payment expense - - 13 - 13

--------- --------- --------- ---------- --------------

Total contributions by

and distributions to owners (15,111) (35,296) 13 50,408 14

At 31 December 2021 280 13 8,616 8,909

At 1 January 2022 280 - 13 8,616 8,909

Loss for the year - - (1,484) (1,484)

--------- --------- --------- ---------- --------------

Total comprehensive income

for the year - - - (1,484) (1,484)

--------- --------- --------- ---------- --------------

Share based payment expense - - 121 - 121

Reclassification upon

cancellation of

share options - - (134) 134 -

--------- --------- --------- ---------- --------------

Total contributions by

and distributions

to owners - - (13) 134 121

--------- --------- --------- ---------- --------------

At 31 December 2022 280 - - 7,266 7,546

Statement of Cash Flows

For the year ended 31 December 2022

2022 2021

GBP000 GBP000

Cash flows from operating activities

(Loss)/profit for the year (1,484) 109

Adjustments for

Loss/(Gain) on disposal of financial investments 288 (323)

Fair value movements on financial investments 542 (19)

Impairment provision on unlisted investments 375 106

Share-based payment expense 121 13

Interest income on investments (93) (142)

Net foreign exchange (gain)/loss (112) 55

Income tax (credit) (29) (150)

(392) (351)

Movements in working capital:

Increase in trade and other receivables - (3)

Increase/(decrease) in trade and other payables 66 (11)

Cash generated from operations (326) (365)

Income taxes paid (36) (260)

Net cash used in operating activities (362) (625)

Cash flows from investing activities

Proceeds on sale of financial investments 1,937 3,474

Purchase of financial investments (2,402) (6,468)

Net cash decrease in cash and cash equivalents (827) (3,619)

Cash and cash equivalents at the beginning of year 941 4,560

Cash and cash equivalents at the end of the year 114 941

1. Accounting policies

1.1 Basis of preparation

Primorus Investments plc is a public company incorporated and

domiciled in the United Kingdom. The Company's registered office is

48 Chancery Lane, London, WC2A 1JF. The Company's shares are listed

on the AIM market of the London Stock Exchange.

The Financial Statements are for the year ended 31 December 2022

and have been prepared under the historical cost convention, except

for debt and equity that have been measured at fair value.

The financial statements have been prepared in accordance with

the Companies Act 2006 and UK-adopted international accounting

standards (UK-adopted IAS) and related interpretations.

These financial statements have been prepared and approved by

the Directors on 15 June 2023 and signed on their behalf by Rupert

Labrum and Hedley Clark.

The accounting policies have been applied consistently

throughout the preparation of these financial statements and the

financial report is presented in Pound Sterling (GBP) and all

values are rounded to the nearest thousand pounds (GBP000) unless

otherwise stated.

1.2 Going concern

The Directors noted the operating losses that the Company has

made for the year ended 31 December 2022. The Directors have

prepared cash flow forecasts for a period of at least twelve months

from the date of the approval of these financial statements, i.e.

up to 30 June 2024 which take account of the current cost and

operational structure of the Company.

The cost structure of the Company comprises a high proportion of

discretionary spend and therefore in the event that cash flows

become constrained, costs can be quickly reduced to enable the

Company to operate within its available funding.

These forecasts demonstrate that the Company has sufficient cash

and liquid funds (i.e investments in listed companies) available to

allow it to continue in business for a period of at least twelve

months from the date of the approval of these financial statements.

Accordingly, the financial statements have been prepared on a going

concern basis.

It is the prime responsibility of the Board to ensure the

Company remains a going concern. At 31 December 2022, the Company

had cash and cash equivalents of GBP114,000. The Company also has

listed financial investments of

GBP1,203,000 as at 31st December 2022 and a convertible loan

note of GBP861,000, including accrued interest, that is due to be

repaid in July 2023. The Company has minimal contractual

expenditure commitments and the Board considers the present funds

together with the convertible loan note and future disposals of its

listed financial investments sufficient to maintain the working

capital of the Company for a period of at least 12 months from the

date of signing the Annual Report and Financial Statements. For

these reasons the Directors adopt the going concern basis in

preparation of the Financial Statements.

2. Financial Investments

GBP000 GBP000 GBP000 GBP000

Level Level Level Total

1 2 3

Fair value at 31 December 2021 633 - 7,409 8,042

Additions 2,153 - 1,552 3,705

Transfer 350 - (350) -

Fair value changes (542) - - (542)

Loss on disposals (288) - - (288)

Disposal (696) - (2,450) (3,146)

Impairment provision (407) - 32 (375)

Foreign exchange - - 112 112

-------- ------------- -------- --------

Fair value at 31 December 2022 1,203 - 6,305 7,508

======== ============= ======== ========

The financial assets are split as GBP000 GBP000 GBP000 GBP000

follows:

Level Level Level Total

1 2 3

Current assets - listed 1,203 - - 1,203

Current assets - unlisted convertible

loans - - 861 861

Non-current assets - unlisted - - 5,444 5,444

-------- ------------- -------- --------

Total 1,203 - 6,305 7,508

======== ============= ======== ========

GBP000 GBP000 GBP000 GBP000

Level Level Level Total

(Loss)/profits on investments held at 1 2 3

fair value through profit or loss

Fair value (loss)/gain on investments (542) - - (542)

Realised (loss)/gain on disposal of investments (288) - - (288)

--------- -------- -------- ----------

Net profit on investments held at fair

value through profit or loss (830) - - (830)

Level 1 represent those assets, which are measured using unadjusted

quoted prices for identical assets

Level 2 applies inputs other than quoted prices included in Level

1 that are observable for the assets either directly

(as prices) or indirectly (derived from prices).

Level 3 applies inputs, which are not based on observable market

data

Investments are held at fair value through profit and loss using

a three-level hierarchy for estimating fair value.

The Directors have reviewed the carrying value of the

investments, and have determined an impairment is required of

GBP374,805 (2021: GBP105,693). This represents an impairment of

GBP406,740 in respect of Rambler Metals and Mining PLC and a

reinstatement of value of GBP31,935 in respect of the Supernatural

Foods Limited shares that were disposed of during the year.

Investments comprise both listed and unlisted investments. The

listed investments are traded on stock markets throughout the world

and are held by the Company as a mix of strategic and short-term

investments.

Significant additions and disposals during the year

Mustang Energy PLC ("Mustang") and Bushveld Minerals Limited

("Bushveld")

In January 2022 the Company sold $1.0 million of its US$2.5

million CLN in Mustang , plus accrued interest, to certain existing

Mustang CLN investors. In March 2022 the Company converted the

remainder of the CLN plus accrued interest in Mustang to a CLN in

Bushveld. In April and May 2022 the Company exercised its rights

under the CLN with Bushveld and converted a total of GBP411,000 of

the CLN to shares, of which it subsequently disposed. The CLN is

due to be repaid on 14th July 2023, along with accrued

interest.

Clean Power Hydrogen PLC

In February 2022 the Company invested GBP1.0 million in Clean

Power Hydrogen PLC, a manufacturer of the membrane-free

electrolyser which is used to create hydrogen and medical grade

oxygen. The company is listed on the UK Alternative Investment

Market.

Rambler Metals & Mining PLC ("Rambler")

During the year the Company acquired GBP514,000 of shares and

sold GBP114,000 of shares in Rambler. Subsequent to the year-end,

Rambler went into liquidation. As a result, the directors have made

an impairment provision for the full value of the remaining

shares.

3. Earnings per share

(i) Basic earnings per share

2022 2021

pence Pence

From continuing operations attributable to

the ordinary equity holders of the Company (1.061) 0.078

-------- ------

Total basic earnings per share attributable

to the ordinary equity holders of the Company (1.061) 0.078

======== ======

(ii) Diluted earnings per share

2022 2021

pence pence

From continuing operations attributable to the

ordinary equity holders of the Company (1.061) 0.072

-------- ------

Total diluted earnings per share attributable

to the ordinary equity holders of the Company (1.061) 0.072

======== ======

(iii) Weighted average number of shares used

as the denominator

2022 2021

No. No.

Weighted average number of ordinary shares used

as the denominator in calculating basic earnings

per share 139,830,968 139,830,968

Options - 12,000,000

Weighted average number of ordinary shares

and potential ordinary shares used as the denominator

in calculating diluted earnings per share 139,830,968 151,830,968

4. Events after the reporting date

Subsequent to the year-end, Rambler Metals and Mining PLC went

into liquidation. As a result, the directors have made an

impairment provision of GBP406,740 for the full value of the shares

held at the year-end.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR SFAFLMEDSESM

(END) Dow Jones Newswires

June 16, 2023 10:18 ET (14:18 GMT)

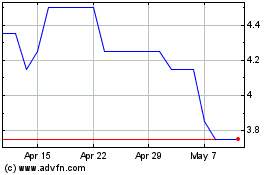

Primorus Investments (LSE:PRIM)

Historical Stock Chart

From Apr 2024 to May 2024

Primorus Investments (LSE:PRIM)

Historical Stock Chart

From May 2023 to May 2024