Trinity Mirror PLC Trading Update (4241J)

December 17 2015 - 5:44AM

UK Regulatory

TIDMTNI

RNS Number : 4241J

Trinity Mirror PLC

17 December 2015

17 December 2015

Trinity Mirror plc

Trading Update

The Group completed the acquisition of Local World Holdings

Limited ('Local World') on 13 November 2015 and since that time the

business has traded in-line with our expectations. We have

commenced numerous integration initiatives, but given the short

period over which Local World has been under our ownership, this

update focuses on the trading performance for the Group excluding

Local World.

The Board now expects performance* for the year to be marginally

ahead of expectations.

While the trading environment remains volatile, revenue for the

fourth quarter (13 weeks to 27 December 2015) is expected to be

in-line with the third quarter, down 9% year on year. Underlying

revenue** is also expected to be in-line with the third quarter,

down 7% year on year. Publishing revenue is expected to fall by 7%

with print declining by 8% and digital growing by 12%.

We continue to deliver strong growth in our digital audience***

with average monthly unique users and page views growing year on

year by 18% and 26% respectively for October and November.

Underlying circulation and print advertising revenue in the

fourth quarter is expected to fall by 4% and 16% respectively on

the prior year with circulation revenue trends marginally better

than the third quarter and advertising revenue trends in-line with

the third quarter.

We are making good progress against our strategic initiatives

and the business continues to deliver strong cash flows and will

deliver the targeted structural cost savings of GBP20 million for

the year.

Enquiries

Trinity Mirror

Simon Fox, Chief Executive 020 7293 3553

Vijay Vaghela, Group Finance Director 020 7293 3553

Brunswick

Mike Smith, Partner 020 7404 5959

Jon Drage, Director 020 7404 5959

The statement on future performance is given as at the date of

this announcement and is subject to a number of risks and

uncertainties and actual results and events could differ materially

from those currently being anticipated as reflected in the

statement. The Company undertakes no obligation to update this

forward-looking statement.

*On an adjusted basis excluding non-recurring items,

restructuring charges in respect of cost reduction measures, the

amortisation of intangible assets, the retranslation of foreign

currency borrowings, the impact of fair value changes on derivative

financial instruments, the pension finance charge and the pension

administrative expenses.

**Underlying trends exclude revenues for titles closures in the

South and the newsprint supply to the Independent and i which

ceased at the end of 2014. In 2014 the revenue generated by the

titles closed in the South was GBP4.5 million and from newsprint

supply to the Independent and i was GBP11.1 million.

***Average monthly unique users and page views, excluding Local

World, for the Publishing division across web, mobile and apps for

October and November 2015 versus October and November 2014.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTPKODNDBDDFBD

(END) Dow Jones Newswires

December 17, 2015 06:44 ET (11:44 GMT)

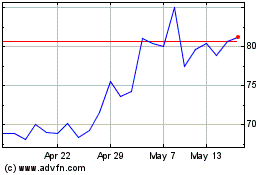

Reach (LSE:RCH)

Historical Stock Chart

From Apr 2024 to May 2024

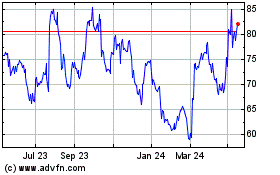

Reach (LSE:RCH)

Historical Stock Chart

From May 2023 to May 2024