TIDMSEIT

RNS Number : 9250C

SDCL Energy Efficiency Income Tst

24 June 2021

24 June 2021

SDCL Energy Efficiency Income Trust plc

("SEEIT" or the "Company")

Announcement of Financial Results for The Year Ended 31 March

2021

SDCL Energy Efficiency Income Trust plc (LSE: SEIT) ("SEEIT" or

the "Company") announces financial results for the year ended 31

March 2021.

Highlights

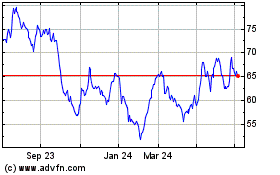

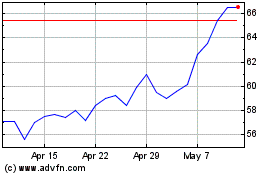

-- Net Asset Value ("NAV") [1] per share of 102.5p as at 31

March 2021, up from 101.0p as at 31 March 2020 and a total NAV

return for the period of 8.0%

-- Earnings per share of 7.0p for year to 31 March 2021 (March 2020: 5.2p)

-- Profit Before Tax of GBP32.4 million for year to 31 March

2021, up from GBP11.6 million for the prior year to 31 March

2020

-- Aggregate dividends of 5.5p per share declared relating to

the year ended 31 March 2021, in line with target

-- Target dividend [2] of 5.62p per share for year to March

2022, a 2.2% increase from 31 March 2021

-- Portfolio Valuation of GBP553 million at 31 March 2021, up

73% from GBP320 million at 31 March 2020

-- Investment at fair value on balance sheet of GBP573 million

at 31 March 2021, up from GBP254 million 31 March 2020

-- Market Capitalisation of GBP758 million at 31 March 2021, up

from GBP296 million at 31 March 2020 and a total shareholder return

of 30.0% since IPO to 22 June 2021

-- Investment of approximately GBP255 million made in 7 investments during the year

-- Cash of GBP126 million at 31 March 2021 available for

investments and the fourth interim dividend payable in June

2021

-- Capital raised of GBP375 million during the financial year

from three well-supported equity issues, with proceeds deployed

into investments from the Company's pipeline

-- Carbon Savings of 654,205 tCO2 (2020: 156,000 [3] tCO2) from

Company's portfolio, which also produced 895,212 MWh of electricity

(2020: 113,000(3) MWh)

Post Year End Highlights

-- $177 million acquisition of RED-Rochester, LLC, a commercial

district energy system in the United States

Tony Roper, Chairman of SEEIT, said:

"Twelve months ago, no-one could have foreseen the effect that

the COVID-19 pandemic would have on the world, its human impact and

the repercussions for the global economy. Despite this and other

challenges that it brought about, the performance of the Company's

underlying investment portfolio of energy efficiency infrastructure

assets remained resilient, achieving growth in NAV and enabling us

to achieve our dividend targets. Capital raised in the year has

been successfully committed through a number of substantial

investments, further diversifying its portfolio. We are very

grateful for the continued support from new and existing

investors."

Jonathan Maxwell, CEO of SDCL, the Investment Manager said:

"We will continue to seek to build a diversified portfolio for

the Company and, particularly, to further diversify in terms of

technologies that are compatible with a pathway towards

decarbonisation. The sectors in which SEEIT is investing are

receiving increasing levels of interest. Governments and companies

are continually increasing their carbon reduction commitments and

therefore the demand for cost effective and low carbon energy

solutions will continue to increase."

There will be a call for analysts at 9.00am on 24 June 2021. For

details, please email SEEIT@tbcardew.com.

Notes

1 In this preliminary announcement, there are a number of

references to financial Alternative Performance Measures. For

further details on these, please see the Glossary of financial

Alternative Performance Measures ("APM")

2 The target dividend stated above is based on a projection by

the Investment Manager and should not be treated as a profit

forecast for the Company

3 Per SEEIT's ESG Report, October 2020

For Further Information

Sustainable Development Capital T: +44 (0) 20 7287 7700

LLP

Jonathan Maxwell

Eugene Kinghorn

Purvi Sapre

Keith Driver

Jefferies International Limited T: +44 (0) 20 7029 8000

Tom Yeadon

Gaudi Le Roux

Neil Winward

TB Cardew T: +44 (0) 20 7930 0777

Ed Orlebar M: +44 (0) 7738 724 630

Joe McGregor E: SEEIT@tbcardew.com

Chair's Statement

On behalf of the Board, I am pleased to present the annual

report and financial statements (the "Annual Report") for the SDCL

Energy Efficiency Income Trust ("SEEIT" or "the Company") for the

year ended 31 March 2021.

Twelve months ago, no-one could have foreseen the effect that

the COVID-19 pandemic would have on the world, its human impact and

the repercussions for the global economy. Despite this and other

challenges that it brought about, the performance of the Company's

underlying investment portfolio of energy efficiency infrastructure

assets remained resilient, achieving growth in NAV, and was

supported by Sustainable Development Capital LLP's ("SDCL" or the

"Investment Manager") strong focus on asset management and asset

enhancements.

During the past year, the Company has successfully invested

approximately GBP255 million in new investments and a further

GBP136 million after the year-end, via SEEIT Holdco Limited

("Holdco"), the Company's single subsidiary and main investment

vehicle for the group. This enabled us to deploy the GBP375 million

of equity raised from three equity issuances in the year, all of

which were very well supported by existing and new shareholders.

This has allowed the Investment Manager to diversify the portfolio

into key new markets such as district energy, electric vehicle

("EV") charging, green gas, solar and storage. We made our first

investments in Sweden and Singapore, as well as further new

investments in the UK and US.

The Board is pleased with the financial and operational

performance of the Company during the year and the role that it is

playing in climate change mitigation and delivering net zero

targets. The Company now has a large portfolio of energy efficiency

infrastructure assets that offers investors a diverse exposure to

this growing sector.

Further information on the Investment Manager's activities is

included in the Investment Manager's Report.

Financial performance

Profit before tax for the year ended 31 March 2021 was GBP32.4

million (March 2020: GBP11.6 million) and earnings per share were

7.0p (March 2020: 5.2p). The Company's net asset value ("NAV") at

31 March 2021 was GBP693.8 million (March 2020: GBP323.5 million)

and NAV per share was 102.5p (March 2020: 101.0p).

The Company's investment portfolio ("Portfolio Valuation") was

valued at GBP552.7 million at 31 March 2021, up from the Portfolio

Valuation of GBP319.0 million at 30 September 2020 and GBP319.8

million at 31 March 2020, predominantly as a result of investments

made in the second half of the year.

The Company's Ongoing Charges ratio(4) reduced to 1.13% (2020:

1.17%), reflecting the increased size of the Company's investment

portfolio. Further detail on the Company's financial performance

and the alternative performance measures of Portfolio Valuation and

Ongoing Charges can be found in Financial Review.

Investment cash inflow from the portfolio during the year ended

31 March 2021 was GBP42.1 million (2020: GBP17.1 million) on a

Portfolio Basis(4) (see Financial Review for details), delivering

1.2x cash cover for dividends paid during the year.

Total return on a NAV per share basis for the year was 8.0%,

comprising an increase in NAV from 101.0p at 31 March 2020 to

102.5p and total dividends paid during the year totalling

6.625p.

The Company's currency hedging strategy has been successful in

limiting the impact on the NAV arising from material movements in

foreign exchange rates. Further details on the Company's hedging

strategy can be found in Financial Review.

Dividends

In line with previous guidance, on 28 May 2021 the Company

announced its fourth interim dividend for the year ended 31 March

2021 of 1.375p per share, providing an aggregate dividend of 5.5p

per share declared for the year ended 31 March 2021. The Company

paid a total of GBP30.4 million in dividends during the financial

year which included the second semi-annual interim dividend for the

year ended 31 March 2020 and three quarterly interim dividends for

the year ended 31 March 2021, the Company having transitioned from

semi-annual to quarterly dividends from 1 April 2020.

After the Board and the Investment Manager reviewed the

projected investment cash flows from the current portfolio, the

Company announced in March 2021 new dividend guidance of 5.62p per

share for the year to March 2022 (an increase of 2.2% p.a.) and

progressive dividend growth thereafter. The Company intends to

continue to pay interim dividends on a quarterly basis through four

broadly equal instalments (in pence per share).

Investment activity

The Company's target geographies remain the UK, USA and Europe

plus other countries where the Company can invest on a

risk-adjusted basis to receive returns that support the Company's

objective. During the year, new investments were made in the UK,

US, Sweden and Singapore and, after period end, further investments

were sourced in the US, Vietnam (via an existing Singapore

investment vehicle) and the Republic of Ireland. Details of these

new investments are provided in the Investment Manager's

Report.

The Company has carefully targeted key markets as it continues

to build its portfolio, that include district energy, EV charging,

green gas, solar and storage. The weighted average number of

contract years remaining across the portfolio increased from 11.3

at 31 March 2020 to 13.4 as at 31 March 2021 as a result of the

longer-term horizon of investments made during the year. The

Company invested a total of GBP255 million during the financial

year and a further GBP136 million after the financial year.

The Company has entered into new, exclusive framework agreements

during the year that demonstrate its ability to unlock pipelines of

further investment opportunities from existing investments and

relationships. These include an agreement with BasePower for a

right to invest an expected GBP10 million per annum for the next

five years in onsite energy projects in the UK and a second

agreement of up to US$20 million, expected to be deployed over the

next 12 months, in energy efficiency measures developed by

SparkFund in the USA.

In August 2020 the Company conditionally committed up to GBP50

million to fund the construction of ultra-fast EV charging

stations, with an initial agreement with a charge point operator

signed in September 2020. In March 2021 an agreement was signed

with bp pulse, the UK's largest operator of public EV charging

points, and an agreement with another major charge point operator

is also well advanced. The first sites are planned to commence

construction shortly and are expected to be operational later in

2021, when they will earn revenues under long-term fixed price

contracts.

The Board is pleased with the timely deployment of capital into

these new investments during the year that are consistent with the

Company's targeted technologies and geographic markets and

demonstrate the Investment Manager's ability to source and secure

attractive investments that meet the Company's investment strategy

and objectives.

Funding

In June 2020, the Company published a new prospectus and a

12-month placing programme was put in place. The Company has

utilised the share issuance programme three times since publishing

the prospectus, raising a total of GBP375 million.

The equity raises in June 2020 (GBP105 million), October 2020

(GBP110 million) and February 2021 (GBP160 million) were strongly

supported by existing shareholders and the Board was pleased to

welcome a significant number of new shareholders. The Board would

like to thank all these shareholders for their support.

To maintain capital efficiency and support the current pipeline,

the Investment Manager has increased the revolving credit facility

("RCF") at the level of Holdco, to GBP115 million in June 2021 and

anticipates a further increase in the near term.

Portfolio and COVID-19 update

The Company's portfolio performance was resilient during the

year, with limited financial impact from the effects of the

COVID-19 pandemic. All the operational assets in the portfolio

continued to operate, despite the COVID-19 pandemic, on account of

providing key services to essential industries. Overall, to date,

the pandemic has not had a material impact on the financial

performance of the investment portfolio. The Investment Manager

continues to monitor for any new impacts resulting from the

consequences of the COVID-19 pandemic and associated governments'

policies and restrictions.

Asset specific impacts of the COVID-19 pandemic included

temporary interruption in the ability to supply and install solar

PV equipment in the Onyx portfolio (since resolved), delay in the

commissioning phase in the Huntsman Energy Centre construction

project (on-going, but expected to be resolved during the year

ending 31 March 2022), and loss of revenue due to idling of a blast

furnace at Primary Energy (since resolved).

Sustainable future

The Company invests exclusively in projects which contribute to

a greener future. The Company is dedicated to accelerating the

transition to a net zero carbon economy and delivering long-term

value for shareholders and society as a whole.

During the year, SEEIT published its first ESG report, with a

second report due later this year. The marketplace in which the

Company is investing is receiving increasing levels of interest

from policymakers and financial markets. Governments and companies

in all the Company's existing and target markets increased carbon

reduction commitments and therefore the demand for further

cost-effective and low carbon energy solutions.

During the year, the Company's portfolio achieved carbon savings

of 654,205 tCO2 (2020: 156,000 tCO2) and produced 895,212 MWh of

electricity (2020: 113,000 MWh). See Sustainability Update for

further details, including the Company and its group's contribution

to the UN Sustainable Development Goals.

Board and Governance

In October 2020, the Board appointed Emma Griffin as a fourth

independent non-executive Director of the Company. Emma brings a

wealth of experience from existing positions on the boards of both

UK FTSE100 and North American companies.

The Company seeks to maintain an open and constructive dialogue

with its shareholders, primarily via meetings with the Investment

Manager at regular intervals throughout the year. As part of good

governance, the Chair held a series of shareholder meetings (via

video due to lockdown restrictions) in 2020 to gain feedback

directly from shareholders.

The Company is a member of the Association of Investment

Companies ("AIC") and has chosen to comply with the latest AIC code

on corporate governance during the year. The Company held an Annual

General Meeting ("AGM") on 31 July 2020. 11 Resolutions were put

forward to be voted on, with all resolutions tabled being approved.

In line with corporate governance best practice, the existing

Directors offered themselves for re-election at the AGM and were

duly re-elected.

The 2021 AGM is expected to be held in Q3 2021 and, based on

current government guidance, this will likely take the form of the

minimum attendance necessary to conduct the business of the

meeting. The notice for the AGM is expected to be published in

July.

With the development of the energy efficiency sector, the Board

and Investment Manager have been considering some possible

amendments to the current Investment Policy. The Investment Manager

will consult on these in upcoming shareholder meetings, and if

feedback is positive, we will bring forward some small amendments

for shareholder approval at the forthcoming AGM following approval

by the Financial Conduct Authority ("FCA").

Key risks

The Board, its Audit & Risk Committee and the Investment

Manager monitor the risks that the Company and its investment

portfolio may face on an ongoing basis. Where relevant, mitigants

against these risks are put in place in line with the Company's

risk appetite and then adjusted over time as necessary.

The key risks to the Company have not changed from the prior

year and thus continue to be:

-- Credit and Counterparty - risks relating to default by

counterparties of energy service contracts;

-- Operational - risk of interruption to operations and/or

construction resulting in loss of expected revenue and ultimately a

reduction in value of investments; and

-- Global macroeconomic factors - rises in corporation tax,

interest rates and inflation which, if not mitigated, may result in

a reduction in value of investments.

The Board monitors the key credit risks arising within the

portfolio which relate to applicable counterparties, for which they

receive regular updates from the Investment Manager. There were no

significant matters to address in this regard during the financial

year and there were no major defaults by the Company's project

counterparties.

Global macroeconomic factors have not had a material impact on

the Company during the financial year, despite the uncertainty

brought about by COVID-19. Interest rates, inflation rates and

corporation taxes have either remained broadly within the Company's

projections or mitigation mechanisms were applied, although the

likelihood of such factors impacting the Company is now much higher

than previously.

The Company also has relatively limited exposure to

re-contracting risk. The substantial majority of projects in its

portfolio are contracted for the medium to long-term, however, the

Company's investment in the five projects involved in Primary

Energy does assume that some re-contracting is achieved. The risk

is mitigated by the fact that Primary Energy has a good track

record of re-contracting, given inter alia that it is providing a

combination of emissions control and renewable energy, providing

essential services to the operations of the project clients and at

a competitive price compared to the grid. This was again proven

when the contract for the Ironside project was extended by a

further ten years during 2020.

The Investment Manager continues to track the evolution and

value of the EU Emissions Trading Scheme ("EU ETS") and carbon

markets, which can generate at least short-term costs to some

projects, for example Oliva Spanish Cogeneration, which pays EU ETS

in respect of cogeneration and receives compensation given its

environmental attributes later via the regulatory mechanisms.

Certain projects in SEEIT's portfolio should also benefit directly

from higher carbon pricing where projects result in greater avoided

costs and reduced greenhouse gas emissions for the end user, for

example the generation of renewable energy certificates ("RECs") by

Primary Energy in the US.

Further information is provided in the Investment Manager's

Report.

Pipeline and Outlook

Despite the diversification across SEEIT's portfolio, it is

bound together by the fact that its investments seek to deliver

cost-effective, low carbon and reliable energy solutions to end

users in the built environment, in industry and in transport. The

projects involve the supply and distribution of energy or helping

to manage or reduce the demand for energy at the point of use.

The Investment Manager believes that a range of technologies

will be required to achieve carbon emission reductions over time

and that it is therefore important to maintain flexibility in terms

of which technologies to employ to address client needs and to

secure required returns on investment. The Investment Manager will

continue to seek to build a diversified portfolio for the Company

and, particularly, to further diversify in terms of technologies

that are compatible with a pathway towards decarbonisation. Beyond

combined heat and power, solar, storage and district energy, the

Investment Manager is evaluating investments in heat pumps, micro

grids, cooling, low carbon fuel for transport (including green

gases as well as well as electricity) and hydrogen.

An important feature of SEEIT's portfolio is the rights to

invest in additional pipeline opportunities from a number of its

existing project investments, often at pre-agreed rates of return.

This has created an organic source of investment opportunities

which the Investment Manager has a high degree of familiarity with

to complement the pipeline of potential new portfolio investments

identified through long-standing relationships with developers,

financial intermediaries and counterparties. The Investment Manager

remains highly selective and focused on where it can add value and

to acquire opportunities via privately negotiated transactions

where possible.

I would like to thank shareholders for their continued support

of the Company as we look to continue delivering upon our

objectives and making further investments as suitable opportunities

arise.

Tony Roper

Chair

24 June 2020

Strategic Report: The Company

The Role of Efficiency in the Energy Market

Energy efficiency solutions seek to solve a fundamental problem

in the energy markets. While energy markets are worth trillions of

dollars and energy is an essential service for society, energy

markets remain highly inefficient. Most energy is wasted somewhere

between the generation, transmission, distribution process and the

point of use. This is enormously costly and involves substantial

carbon emissions that could be avoided. It also involves

substantial risks as the energy system has historically been

designed around centralised grid systems that can fail. Indeed,

were energy efficiencies to be fully realised - and there is an

increasing number of cost-effective solutions involving efficiency

and decentralisation - in some cases we may only need a third of

the energy currently used in the energy system. This potential

offers some of the largest and most cost-effective solutions to

greenhouse gas emissions reductions, as well as higher levels of

productivity and resilience.

SEEIT's investments provide solutions to problems in the energy

markets. They include investments in decentralised energy

solutions, generating energy at, or close to, the point of use and

investment in the distribution of green and efficient energy. They

also reduce the amount of energy that users need through

conservation measures.

Users of energy

The energy system can be highly inefficient, with energy losses

on the supply side occurring all the way from the point of

generation, through the transmission and distribution system before

it reaches the end user. While up to most energy can be lost on the

supply side, further substantial losses occur on the demand side,

at the point of use.

Around 40% of energy today is used in buildings and 20% in

transport. Commercial, industrial and public sector buildings

comprise a large proportion of the demand from buildings, including

datacentres and hospitals, universities and schools, as well as the

largest industrial energy users and greenhouse gas emitters such as

steel, cement, chemicals and plastics.

The opportunity

The energy industry is increasingly focussing on the demand side

of the equation, not just on how to get more and cleaner power into

the grid, but how to get it to where it is needed most efficiently

and how to ensure that as little of it as possible is wasted when

it gets there. A previously under-served market is now attracting

more attention from the energy industry, which is extending its

focus from the supply to the demand side.

A combination of high energy prices, carbon emission reduction

targets and energy security concerns has made energy efficiency a

crucial component in the development of the modern energy economy.

Corporate energy users have been attracted to cheaper, cleaner and

more reliable energy solutions offered by decentralised energy and

energy efficiency for some time, but it is now reaching the top of

the board agenda following new compulsory disclosure requirements

and increased stakeholder focus on Corporate Social Responsibility

("CSR") and Environmental, Social or Governance ("ESG"),

underpinned by ambitious carbon emission reduction targets and a

commitment to achieve net zero over increasingly aggressive

timeframes.

Energy efficient solutions present an attractive proposition for

end user clients, offering;

-- Reduction in energy costs - avoiding or reducing the

significant generation, transmission and distribution costs

associated with a centralised grid;

-- Improved energy performance - greater efficiency due to

minimal grid losses and reduced energy intensity through employment

of efficient technology;

-- Improved reliability - reduced reliance on increasingly

constrained centralised power grids;

-- Cleaner energy - increased efficiency reduces the reliance on

existing traditional centralised generation, reducing carbon

intensity; and

-- Environmental impact - energy efficiency is widely recognised

as the most cost-effective solution in seeking to reduce greenhouse

gas emissions.

Regulatory response

In addition to encouraging renewable sources of energy onto the

grid, it is crucial to reduce inefficiency of supply and to reduce

energy demand. Governments are now focussing on energy efficiency

and decentralised energy. The European Commission's 'Green Deal'

recognises that, to achieve 2030 carbon emission reduction targets

and economic productivity, it is insufficient to focus on the

supply side alone. At the forefront of the Green Deal, the European

Commission's 'Renovation Wave' claims the largest share of budget

of all proposed solutions, targeting the retrofit of 34 million

buildings across Europe. Meanwhile, in the United States, the

Biden-Harris administration's focus on green infrastructure and the

'Climate Plan' stands out, as does the target to retrofit 4 million

public buildings with energy efficiency solutions. The UK, which is

host to the COP26 climate summit in 2021, has increased its

de-carbonisation target to a world leading 78% by 2035 and in order

to get there, energy efficiency and decentralised energy will need

to play a crucial role.

Similarly, corporate reporting and associated regulation has

developed considerably on a global scale. The Task Force on

Climate-related Financial Disclosures ("TCFD") was established by

the Financial Stability Board, an international body, to improve

climate-related corporate disclosure and allow for more informed

investment, credit and insurance underwriting decisions in the

context of carbon-related assets in the financial sector and the

financial system's exposures to climate-related risks as a whole.

The EU taxonomy regulation published in June 2020 defined six

environmental objectives to which a substantial contribution must

be provided in order for economic activities to qualify as

'sustainable' and acts as an essential reference in a number of

other forthcoming sustainable finance regulations in the EU. The

Sustainable Finance Disclosure Regulation ("SFDR"), introduced by

the European Commission from March 2021, imposes mandatory ESG

disclosure obligations for asset managers and other financial

markets participants to bring transparency in relation to

sustainability risks, the consideration of adverse sustainability

impacts in their investment processes and the provision of

sustainability related information with respect to financial

products.

The solution

Providing cheaper, cleaner and more reliable solutions to these

users' needs are one of the keys to reductions in greenhouse gas

emissions and, at the same time, economic productivity.

The technologies to deliver cheaper, cleaner and more reliable

energy solutions to the end user have become available at scale and

are increasingly cost-effective. Energy efficient lighting has

increased from a 2% market share a decade ago to over 60% market

share today. Solar and storage can now deliver cheaper and cleaner

energy from rooftops than the grid, even in less sunny countries

like the UK. Engines and turbines can be located at or close to the

point of use, running at high efficiency on low carbon fuels.

Similarly, low carbon energy for transport, including

electricity for car charging and green fuels and hydrogen for heavy

and long-distance vehicles are crucial solutions and present a

major market opportunity for SEEIT.

By investing in green energy distribution and demand reduction

solutions at the point of use, SEEIT is able to help reduce energy

wastage, while also incorporating a higher proportion of

sustainable fuel in the production of energy. This serves to reduce

or eliminate reliance on centrally generated power and avoids the

significant generation, transmission and distribution losses

associated with a centralised grid, saving money and reducing the

carbon intensity associated with large energy-users.

SEEIT invests in projects which are sustainable from

environmental, commercial and operational perspectives. Across the

portfolio the Company's projects demonstrate the benefits of energy

efficiency and decentralised energy - achieving the same level of

output with less energy - and the Investment Manager continues to

evaluate attractive investment opportunities in key target

markets.

Investment Proposition

Listed in December 2018 on the Premium segment of the Main

Market of the London Stock Exchange, SEEIT is the first investment

company of its kind in the UK focused primarily on investments in

operational energy efficiency projects located primarily in the UK,

Europe and North America.

Investment objective

The Company's investment objective is to generate an attractive

total return for investors comprising stable dividend income and

capital preservation, with the opportunity for capital growth.

Investment Policy

The Company seeks to achieve its investment objective by

investing principally in a diversified portfolio of Energy

Efficiency Projects with high quality, private and public sector

counterparties.

The contracts governing these Energy Efficiency Projects

typically entitle the Company to receive stable, predictable cash

flows over the medium to long-term in respect of predominantly

operational Energy Efficiency Equipment. The Company's returns take

the form of contractual payments by counterparties in respect of

the Energy Efficiency Equipment used by them.

Whilst the Company invests predominantly in operational

projects, the Company may under certain circumstances invest in

projects that are in a construction or development phase, subject

to applicable investment restrictions.

In respect of each type of Energy Efficiency Equipment, the

Company seeks to diversify its exposure to service providers by

contracting, where commercially practicable, with a range of

different engineers, manufacturers or other service providers.

Energy Efficiency Projects may be acquired individually or as a

portfolio from a single or a range of vendors. The Company may also

invest in Energy Efficiency Projects jointly with a co-investor.

The Company aims to achieve diversification by investing in

different energy efficiency technologies and contracting with a

wide range of counterparties.

The Company invests and manages its Energy Efficiency Projects

with the objective of assembling a high quality, diversified

portfolio.

Investment restrictions

In order to ensure a spread of investment risk, the Company has

adopted the following investment restrictions:

-- no Energy Efficiency Project investment by the Company will

represent more than 20% of Gross Asset Value, calculated at the

time of investment;

-- the aggregate maximum exposure to any Counterparty will not

exceed 20% of Gross Asset Value, calculated at the time of

investment;

-- the aggregate maximum exposure to Energy Efficiency Projects

in either a development phase or construction phase will not exceed

35% of Gross Asset Value, calculated at the time of investment,

provided that, of such aggregate amount, the aggregate maximum

exposure to Energy Efficiency Projects in a development phase will

not exceed 10% of Gross Asset Value, calculated at the time of

investment; and

-- the Company will not invest in other UK listed closed-ended investment companies.

Gearing

The Company maintains a conservative level of aggregate gearing

in the interests of capital efficiency, in order to seek to enhance

income returns, long-term capital growth and capital flexibility.

The Company's medium-term gearing target is up to 35% of NAV,

calculated at the time of borrowing (the "Structural Gearing").

The Company may also enter into borrowing facilities on a

short-term basis to finance investments ("Acquisition Finance"),

provided that the aggregate consolidated borrowing of the Company

and the Project SPVs, including any Structural Gearing, shall not

exceed 50% of NAV, calculated at the time of borrowing. The Company

intends to repay any Acquisition Finance with the proceeds of a

share issue in the short to medium-term.

Structural Gearing and Acquisition Finance are employed either

at the level of the Company, at the level of the relevant Project

SPV or at the level of any intermediate wholly owned subsidiary of

the Company, and any limits set out in this investment objective

and policy shall apply on a consolidated basis across the Company,

the Project SPVs and such intermediate holding company. Structural

Gearing and Acquisition Finance primarily comprise bank borrowings,

though small overdraft facilities may be utilised for flexibility

in corporate actions.

Use of derivatives

The Company may use derivatives for efficient portfolio

management but not for investment purposes. In particular, the

Company may engage in full or partial interest rate hedging or

otherwise seek to mitigate the risk of interest rate increases and

full or partial foreign exchange hedging to mitigate the risk of

currency fluctuation.

The Company only enters into hedging contracts and other

derivative contracts when they are available in a timely manner and

on terms acceptable to it. The Company reserves the right to

terminate any hedging arrangement in its absolute discretion.

Cash management

Whilst it is the intention of the Company to be fully or near

fully invested in normal market conditions, the Company may hold

cash on deposit with banking institutions and may invest in cash

equivalent investments, which may include short-term investments in

money market type funds and tradeable debt securities ("Cash and

Cash Equivalents").

There is no restriction on the amount of Cash and Cash

Equivalents that the Company may hold and there may be times when

it is appropriate for the Company to have a significant Cash and

Cash Equivalent position instead of being fully or near fully

invested.

Changes to the Investment Policy

The Board and the Investment Manager have been considering some

possible small amendments to and clarifications of the Investment

Policy. The Investment Manager will use upcoming shareholder

meetings to consult on proposals regarding a potential increase to

short-term gearing limits (thus enabling a larger RCF to be used

between capital raises), as well as clarifying the scope of energy

efficiency investments. If feedback is positive, a small number of

proposed changes to the Investment Policy will be tabled for

shareholder approval at the forthcoming AGM, as material changes to

the Company's Investment Policy require the prior approval by

ordinary resolution of Shareholders, following approval by the

FCA.

Business Model

The Company's group structure

The Company has been established in the UK as an investment

trust to provide an efficient manner in which shareholders can

access investment into energy efficiency infrastructure

investments.

The Company has an independent Board of Directors, has no

employees and has appointed Sustainable Development Capital LLP

("SDCL" or "Investment Manager") to manage the investments on its

behalf (See the Investment Manager's Report).

In order for the Company to achieve its investment objective, it

makes its investments via its sole direct subsidiary and main

investment vehicle, SEEIT Holdco Limited ("Holdco").

The Investment Manager controls the actions of Holdco and its

direct and indirect subsidiaries with the aim of assisting the

Company to achieve its stated objective through making new

investments via Holdco that are funded by the Company and managing

the existing investments that Holdco has directly or indirectly

invested in.

Holdco typically invests in project SPV's - special purpose

vehicles that hold assets the Holdco invests in. The SPV's normally

provide energy efficiency solutions to counterparties, often

through long-term contracts with a fixed lifespan. The SPV - and by

implication the portfolio of investments as a whole - therefore

normally has a limited lifetime over which it provides target

returns to Holdco and ultimately the Company. These SPV's are

normally structured that they can be sold in an active secondary

market for energy efficiency assets although each of the

investments will also have been assessed individually to ensure

appropriate alternative exit strategies are in place.

Sanne Group (UK) Limited ("Sanne") has been appointed by the

Company as a third-party service provider via an administration

agreement.

Investment sourcing

The Investment Manager sources investments through its

long-standing relationships with third-party developers, utility

companies, project owners, energy service companies, financial

intermediaries and directly from counterparties. Each prospective

investment is assessed against the Company's investment objectives

and Investment Policy as well as ESG screening and, if considered

potentially suitable, an initial analysis and review of the

opportunity will be undertaken. Each opportunity is scrutinised on

the basis of the investment criteria outlined below.

In selecting potential energy efficiency and distributed

generation projects, the Investment Manager employs established

criteria and portfolio construction guidelines in order to source

projects with some or all of the following characteristics:

-- operational assets installed at energy intensive and

inefficient commercial and public buildings and facilities;

-- projects utilising commercially proven technologies, with an

appropriate level of warranties and performance guarantees;

-- contracting with energy efficiency equipment vendors and

manufacturers, subcontractors and counterparties who are strong

credit counterparties;

-- passing performance risks down to engineering, procurement

and construction ("EPC") contractors, operations and maintenance

("O&M") contractors, subcontractors, energy efficiency

equipment vendors and manufacturers via warranties and

guarantees;

-- based upon measured and verifiable savings criteria as set

forth in an energy services agreement ("ESA") governing the terms

on which energy savings are apportioned between the counterparty

and the Project SPV;

-- projects based in the key target markets of the UK, Europe,

North America and selectively in Asia Pacific and other OECD

countries;

-- achieving economies of scale, either individually or through aggregation;

-- appropriate ESG characteristics and where the Investment

Manager considers that further ESG improvements can be achieved;

and

-- ability to achieve significant reductions in energy use and

consequently emissions of greenhouse gases and other

pollutants.

The above characteristics enabled the Investment Manager to

select investments for Holdco that will help deliver the Company's

investment objective. In doing so, the Investment Manager also

assesses exit strategies of individual investments, determining the

role each will play in delivering stable and predictable revenues

over defined periods. These investments are described in greater

detail in the Investment Manager's report.

Investment process

Once a potential opportunity that falls within the Company's

Investment Policy has been identified, and the Investment Manager

wishes to proceed with the investment in such project, the

Investment Manager undertakes further analysis which sets out the

investment structure, investment rationale, key environmental

benefits, risks and returns, capital expenditure budget, proposed

revenue model, necessary next steps and recommendations. The same

process takes place whether the Company is in a competitive

process, such as with the investment in Onyx, or in a bilateral

negotiation, such as with the investment in Gasnätet.

Based on the analysis, the Investment Manager determines whether

further detailed financial, legal and technical due diligence

should be carried out by the team and/or third-party firms and

advisers, or whether to proceed with further negotiation of deal

terms with the relevant counterparties. Once the decision to

proceed has been made, the Investment Manager is responsible for

further business due diligence, while the appropriate financial,

environmental, social, governance, tax, legal, technical and other

due diligence processes is conducted by third-party firms and/or

advisers.

The Investment Manager also seeks to ensure that the transaction

terms with relevant counterparties such as developers, EPC

contractors, O&M contractors, advisers, and revenue

counterparties meet with the Investment Manager's ESG criteria

(unless not applicable).

Once the detailed due diligence process has been completed, the

Investment Manager prepares an updated analysis that comprises

details of the investment opportunity, environmental

characteristics, impact on portfolio construction and development,

risks and returns, identification of any investment upside or

portfolio enhancement, investment structure based on due diligence

process and final contract terms, as a result of negotiations, as

well as a financial model used to assess risk and return, including

scenario and sensitivity analyses as appropriate.

The Investment Manager uses all material information collated on

the investment through the diligence process, along with an

analysis of the potential impact the investment would bring to the

composition of a balanced portfolio, to decide on whether to

proceed with the investment or not. The Investment Manager will, if

the proposed investment meets the agreed criteria, notify the Board

of its decision prior to committing to an investment, including the

provision of further papers as required.

Whilst this has not been a key area of focus for the Company,

where the Investment Manager intends to acquire projects from funds

related to SDCL, such as in the case of the Singapore Energy

Efficiency investment in November 2020, the Investment Manager will

approach the Board at an early stage of the investment process to

discuss any additional diligence or comfort, such as independent

valuation or audits required. The Investment Manager will not

execute an investment in any project where it constitutes a related

party transaction without prior Board approval and will only

proceed in accordance with the requirements of the FCA Listing

Rules.

Investment Manager's Report

The Investment Manager

Sustainable Development Capital LLP, the appointed Investment

Manager of the Company, is an investment firm with a proven track

record of investment in energy efficiency and decentralised energy

generation projects. Its proactive project development and

industrial expertise gives it a significant competitive advantage

in creating, originating, evaluating, financing and managing

investments, as well as securing enhanced risk-adjusted

returns.

SDCL was founded in 2007 by Jonathan Maxwell, and since 2012,

has raised four funds exclusively focused on energy efficiency with

projects in the UK, Europe, North America and Asia. The Investment

Manager is headquartered in London with offices in New York,

Dublin, Hong Kong and Singapore and has a team of over 45

people.

The Investment Manager is responsible for the active investment

management and risk management of the portfolio in accordance with

SEEIT's Investment Objective, Investment Policy and ESG policy and

principles. The Investment Manager achieves this by:

o finding and then making investment decisions on new energy

efficiency investment opportunities;

o providing strategic management of the portfolio and oversight

of project operations;

o ensuring that SEEIT's Responsible Investment Policy and set of

ESG principles are effectively applied in underlying

investments;

o managing investment and operational risks of SEEIT;

o focusing on the identification of cost and efficiency

improvements and optimisation of project value;

o maintaining a high standard of business conduct and integrity;

and

o building strong relationships with suppliers, customers,

communities and authorities among others.

Market review and outlook

The sectors in which SEEIT is investing are receiving increasing

levels of interest from both policymakers and financial markets.

Governments and companies in all of SEEIT's existing and target

markets are continually increasing their carbon reduction

commitments and therefore the demand for cost-effective and low

carbon energy solutions is increasing. Meanwhile, the costs,

inefficiencies and risks of energy systems reliant on centralised

generation and the grid continue to be exposed, with the 2021

outages in Texas, USA caused by severe winter storms recalling

memories of Superstorm Sandy on the US East Coast in 2012 and

highlight the need for greater resilience in the energy system.

COVID-19, in parallel to its far-reaching societal consequences,

reduced global economic output, energy demand and energy prices.

SEEIT's portfolio was relatively defensive, given limited exposure

to demand or energy prices and the fact that most of its clients

were deemed essential and remained operational during national

lockdowns. The pandemic led several governments to turn to energy

efficiency as a source of post-COVID recovery, economic

productivity and growth, as well as a pathway to substantially

lower both costs and greenhouse gas emissions. Energy efficiency

project investments performed notably strongly and reliably

compared to assets linked to economic growth, energy demand or

prices.

The EU taxonomy regulation and SFDR, both introduced during the

financial year, represented significant developments in the EU's

framework for sustainable energy investment, ESG disclosure and

corporate reporting. SEEIT, through its Investment Manager, is

adapting quickly to the new disclosure rules, taking steps to

categorise and monitor all the Company's underlying investments in

line with the new disclosure standards. This is part of the

Company's broader strategy for reporting on climate-related and

other ESG issues which includes working towards implementing the

full scope of the disclosure recommendations of TCFD.

Investment update

During the financial year, the Investment Manager continued to

secure new investments for the Company and actively manage the

existing portfolio of project investments.

New investments were secured for SEEIT in key markets, including

on-site solar generation, energy storage, district energy, green

gas distribution and EV charging infrastructure. The portfolio has

seen growth in existing markets, such as the United States and the

UK, as well as in new markets in Asia (Singapore) and Europe

(Sweden).

SEEIT's portfolio, supported by the Investment Manager's asset

management activities, now covers a wide range of buildings and

transport customers, including public sector (hospitals), data

centres (banking), industrial facilities (steel and agriculture),

commercial (banks and retail, including restaurants) and low carbon

fuels for transport such as EV and green gas.

While SEEIT's portfolio is diversified by various factors, it is

bound together by the fact that its investments seek to deliver

cost-effective, low carbon and reliable energy solutions to end

users in the built environment, in industry and in transport. The

projects involve the supply and distribution of energy or helping

to manage or reduce the demand for energy at the point of use.

The Investment Manager believes that a range of technologies

will be required to achieve carbon emission reductions over time

and that it is therefore important to maintain flexibility in terms

of which technologies to employ to address client needs and to

secure the required returns on investment.

The investments made by the Investment Manager during and

following the financial year ended 31 March 2021 fit well within

the Company's investment criteria, by reducing energy consumption

or related greenhouse gas emissions arising from supply,

transmission, distribution and consumption. In doing so, the

Company has been able to secure predictable long-term revenue and

the opportunity for capital growth from these investments.

Investment activity since 31 March 2020

Project Investment Close Location Amount

EV Network August 2020 UK Up to GBP50 million

=========================== ========================= ========== ========================

GET Solutions September 2020 UK GBP5 million

=========================== ========================= ========== ========================

Singapore Energy September 2020 Singapore GBP2 million

Efficiency

=========================== ========================= ========== ========================

Gasnätet October 2020 Sweden GBP107 million

=========================== ========================= ========== ========================

Onyx December 2020 (completed USA Up to US$150 million

in February 2021) initially with further

commitments over time

=========================== ========================= ========== ========================

Primary Energy portfolio December 2020 USA US$36 million

(follow on)

=========================== ========================= ========== ========================

Spark US Energy Efficiency February 2021 USA Up to US$20 million

II

=========================== ========================= ========== ========================

Investment activity since 31 March 2021

Project Investment Close Location Amount

SOGA April 2021 Vietnam US$3.6 million

=================== =========================== ========== ===============

RED April 2021 (completion in USA US$177 million

May 2021)

=================== =========================== ========== ===============

Tallaght Hospital May 2021 Ireland EUR6.5 million

=================== =========================== ========== ===============

EV Network involves a conditional commitment to fund the rollout

of EV charging stations across the UK. The Company made an initial

GBP50 million investment commitment in August 2020 to the EV

Network as its development partner in EV charging infrastructure.

The EV charging sites will be developed and funded by EV Network to

the point at which they are contracted and construction ready, at

which stage they will be acquired by the Company. The commitment,

subject to certain criteria being met, will be drawn down in

tranches to fund the implementation of projects, with the most

recent agreement signed with bp pulse, the UK's largest operator of

public EV charging points. Once operational, EV charging sites will

be contracted through 20-year, fixed price, CPI inflated Energy

Service Agreements.

GET Solutions is an investment in an initial portfolio of 15

highly efficient combined heat and power ("CHP") assets at premises

of the Intercontinental Hotel Group. The assets are designed to

provide the base-load energy generation to meet the operational

needs of the hotels, irrespective of their levels of occupancy. The

initial portfolio comprised four operating projects, two installed

projects and nine ready to build projects, all of which are now

operational. The projects have all been developed by GET Solutions,

a specialist provider of energy services that has worked with over

40,000 business clients over the last 20 years. The contractual

structure of the projects provides predictable revenues with

potential for upside for the Company in the event that certain

levels of consumption are achieved. The Company owns the project

assets that provide essential services to the buildings throughout

the 15-year life of the project contracts. There is a follow-on

pipeline of up to 51 highly efficient CHP projects in the UK hotel

sector and additional rights to invest in a substantial pipeline of

more than 100 energy efficiency installations with GET Solutions in

the UK.

Singapore Energy Efficiency is an investment in a portfolio of

six operating cooling and energy efficiency assets, including

chillers and bespoke energy-efficient air compressors that are

installed at the premises of five leading industrial counterparties

in Singapore, including subsidiaries of large multinational

institutions. The assets are leased under fixed contracts, with a

total remaining portfolio life of approximately 6 years. The

acquisition represents the Company's first energy efficiency

investment in Singapore and provides a platform from which it can

explore future opportunities in this and other attractive

jurisdictions in the region.

Gasnätet is an investment in Gasnätet and Värtan Gas Stockholm

AB ("VGSAB"). The VGSAB group owns and operates Stockholm's

established operational regulated gas distribution network, the

majority of which is sourced from locally produced biogas (c.70%),

supplying and distributing to over 50,000 residential, commercial,

industrial, transportation and real estate customers in Stockholm.

It is an essential infrastructure service that helps to reduce

pollution and greenhouse gas emissions by reducing and reusing

waste gases both at the point of production, for example at

municipal waste water treatment plants and, at the point of use,

through the displacement of natural gas in buildings and diesel in

transport. The grid is an essential component of an integrated gas

distribution system and is aligned with national and regional

strategies to attain carbon neutrality by 2040, with the Company

working towards increasing the proportion of green gas in the

network to 100% over time. Revenues, which are primarily regulated,

are predominantly based on fixed tariffs with relatively low

sensitivity to customer demand or consumption. In addition to

existing revenues, the Investment Manager has identified

opportunities for growth, for example from serving new transport

customers, as commercial and municipal vehicle fleets continue to

switch to cleaner fuels, including biogas. Furthermore, there are

opportunities for the Investment Manager to work with the in-house

management team to deliver new energy and infrastructure services

to customers by developing the network and through vertical

integration.

Onyx involved the investment in a 100% interest in four

sub-portfolios totalling over 175 MW across over 200 operational,

construction and late-stage development rooftop, carport and

'private wire' ground mounted solar PV assets. The four portfolios

provide renewable energy generated on-site directly to the end-user

and are expected to become fully operational over the next 12

months. The operational projects are contracted under long-term

power purchase agreements with predominantly investment grade

commercial and industrial counterparties, including municipalities,

universities, schools, hospitals, military housing providers,

utilities and corporates. In addition, the Company acquired a 50%

interest in Onyx's follow-on pipeline, which is projected to exceed

500MW over the next 5 years through Onyx's highly experienced and

dedicated project development and asset management team based in

New York. In addition, the Company will have a right of first

refusal to purchase pipeline portfolios at a pre-agreed rate of

return. The investment provides the Company with a substantial

initial portfolio and a scalable pipeline of opportunities in a

major growth market.

A further 15% interest in Primary Energy, a portfolio of

recycled energy and cogeneration projects located in Indiana, USA,

was acquired in December 2020, after the initial 50% interest

acquired in February 2020. The Company also agreed terms under

which it could increase its stake and further enhance returns for

shareholders. The 298MW portfolio consists of five operating

projects which generate low-cost, efficient energy with substantial

environmental benefits via three recycled energy projects, one

natural gas combined heat and power project and a 50% interest in

an industrial process efficiency project. Four of the five projects

relate to steel mills that are now owned by Cleveland-Cliffs Inc.

("Cleveland-Cliffs") following its acquisition of ArcelorMittal

USA, making Cleveland-Cliffs the largest flat-rolled steel producer

as well as the largest iron ore pellet producer in North America.

One of the five projects services Midwest Steel, a subsidiary of

United States Steel Corporation. The projects are fully integrated

into the steel mill facilities, including fuel handling and

emissions control equipment and systems that are critical for the

operations of the facilities.

A new agreement with Sparkfund was signed in February 2021

representing a follow-on investment commitment on a conditional

basis of approximately $20 million in a new portfolio of projects

achieving construction completion over the next 12 months. These

projects include energy efficiency and resiliency measures such as

lighting, heating, ventilation and air conditioning, backup

generation and building management systems and controls. The

investment follows a US$22 million investment in a portfolio of

loans, leases and subscription agreements relating to energy

systems outsourcing and energy efficiency projects with Sparkfund

in September 2019.

In April 2021, the Company invested in a 4.5 MWp portfolio of

operational commercial and industrial rooftop solar systems and

secured a 20 MWp pipeline of late-stage development and

ready-to-build assets at multiple sites in Vietnam. The investment

was made via a Singapore-based platform. The Company entered into a

partnership with Shire Oak Green Asia ("SOGA'"), an experienced

developer of renewable energy projects with a strong presence in

Vietnam, including locally based engineering capacity and asset

management services. The counterparties are multinational

corporates using Vietnam as a manufacturing hub, as well as

established large Vietnamese companies, diversified across

industries including automotive, food & beverage, garment &

textile, furniture and agricultural products. The projects will

generate on-site electricity for consumption by the counterparties,

reducing the carbon footprint of their manufacturing processes.

The Company completed the investment in RED-Rochester, LLC

("RED"), a commercial district energy system that provides

exclusive utility services to commercial and industrial customers

within the 1,200 acre Eastman Business Park, in May 2021. RED is

one of North America's largest district energy systems with 117 MW

of steam turbine generators plus boilers, chillers and other

equipment. As the exclusive provider of utility services to the

park, RED offers 16 on-site services including electricity, steam,

chilled water, wastewater, compressed air, nitrogen, lake water

treatment, industrial water distribution and high purity water

distribution. RED has over 100 commercial and industrial customers,

typically contracted on a 20-year fixed-term basis with automatic

five or ten year renewals, linked to their tenancy on the Eastman

Business Park. The contracts provide stable and predictable cash

flows with a relatively fixed cost base and substantial mitigation

against volatility in demand. Some two thirds of the value of RED's

offtake contracts are derived from investment grade or equivalent

counterparties. Since 2016, RED has delivered 40+ additional energy

efficiency projects across its operations that have resulted in

annual savings of over US$4 million and carbon savings of over 50%.

Additionally, the Investment Manager has identified a further

pipeline of potentially accretive energy efficiency initiatives

that it believes can deliver additional cost and carbon

savings.

Tallaght Hospital involves an investment in the installation of

a range of energy efficiency equipment, including LED lighting and

high efficiency CHP, providing cleaner and more efficient on-site

energy generation for the large County Dublin hospital. The

contract consists of fixed, indexed linked revenues, payable by the

hospital counterparty, monthly for 15 years once the equipment is

installed.

Portfolio construction

The Company focuses on investments that provide effective and

reliable energy solutions that typically fit into one or more of

three key categories:

-- Cleaner and more efficient supply, such as in Onyx (on-site

solar), Primary Energy (on-site cogeneration for the steel

industry) and Oliva Spanish Cogeneration (on-site cogeneration for

olive industry)

-- Green energy distribution, such as Gasnätet (Stockholm's gas

grid) and EV Network (fast EV charging)

-- Point of use / demand reduction such as Santander UK Lighting

(LED lighting) and EV Network (fast EV charging)

The Company invests with the objective of assembling a portfolio

of energy efficiency projects, diversified by:

Investment stage: whilst the Company invests predominantly in

operational energy efficiency and distributed generation projects,

the Company may under certain circumstances invest in projects that

are in construction or their development phase;

Equipment/Service providers: the Company diversifies its

exposure to equipment manufacturers, engineers and other service

providers through investing in different energy efficiency

technologies and contracting with a wide range of

counterparties;

Geography: the existing portfolio comprises projects located in

the UK, EU, Asia Pacific and the USA. In addition, the company is

actively pursuing further investments in other jurisdictions that

provide attractive risk-adjusted returns across, including the UK,

EU, North America, the Asia Pacific region and, selectively, other

OECD countries; and

Counterparty: the Company provides services to range of high

quality counterparties in both the private and public sectors,

across many industries. The majority of the portfolio by value

derives revenues from investment grade or equivalent

counterparties, and in some instances adopts significant

diversification in the number of counterparties, such as in the

case of Gasnätet's 50,000+ customers.

SEEIT's portfolio is mostly operational, consistent with its

investment objectives and with a view to generation of cash and

earnings to cover dividends. New investments during the financial

year have extended the weighted average term of projects from

approximately 11 years to approximately 13.4 years, providing

long-term visibility of cash flows.

SEEIT may invest up to 35% of its gross asset value, calculated

at the time of the investment, in development and construction

phase projects (including a 10% limit on development), subject to

relatively short construction periods and low construction risks,

i.e. projects that the Investment Manager considers can be

commissioned within a short period of time following commitment and

at low risk that the commissioning of the project will overrun

(both in terms of time and budget).

During the financial year, SEEIT's commitments to development

and construction phase projects increased from approximately 5% to

approximately 15% of gross asset value, following the acquisition

of Onyx which represented an attractive investment opportunity with

a higher proportion of non-operational stage assets. The Board

considers that this increase is consistent with the objective of

securing long-term value and organic growth for SEEIT's portfolio,

while remaining in line with the Company's risk appetite.

The Board believes that the allocation to both operational and

construction phase projects offers significant opportunity for

growth. For instance, in the case of operational projects, there is

an opportunity to expand the range of services to customers

connected to district energy networks in SEEIT's portfolio, such as

Stockholm's gas grid, Gasnätet, and SEEIT's investment at the

second largest business park in the United States, RED.

There is also an opportunity to add value to existing

investments through increased market share in some cases, for

instance by leveraging a top 10 market position in commercial and

industrial on-site solar and storage in the United States, through

SEEIT's joint venture with Blackstone, Onyx, by increasing margins

and capacity in our projects serving Spain's olive industry, Oliva

Spanish Cogeneration and by securing contract extensions, as was

achieved by Primary Energy in 2020. In other markets, SEEIT has the

opportunity to increase scale, for example through its investment

in EV charging infrastructure services via EV Network for major

clients such as bp pulse.

SEEIT has continued to diversify by geography, with further

expansion into the United States and Europe (Sweden, Ireland and

Spain) and the UK. In addition, albeit to a more limited extent,

SEEIT has established some exposure to new and high-quality markets

in Asia, primarily providing energy services to multinational

clients in locations such as Singapore and, since the year-end, in

Vietnam. This expansion provides access to a large pool of

attractive new investment opportunities for the Investment Manager

to evaluate. The Investment Manager is focused on securing value

over exposure to an individual country, although it would expect

most of the portfolio to be broadly evenly allocated as between

North America and Europe in the medium to long-term.

As SEEIT's portfolio has continued to grow, it has also

significantly diversified. For instance, it now has exposure to

some 500 individual project sites in the United States, over 500

sites in the UK and over 50,000 customers in Sweden. Its projects

provide essential, cost-effective and green energy services such as

power, heat, cooling and lighting to clients from very different

industries, from agriculture in Spain, to steel in the United

States to datacentres, banking, hospitals, transport, cooking and

food retail in the UK, Ireland and Sweden. While this

diversification by industry and geography limits exposure to market

cycles in normal market conditions, the essential services provided

by the client base led to a general continuation of operations,

even during the challenging and extraordinary market conditions

caused by the global COVID-19 pandemic. As such, while the COVID-19

crisis impacted on some of the Company's assets and hindered some

development and construction activity, the portfolio demonstrated

resilience and the crisis had limited impact on SEEIT's overall

financial performance.

Diversification by technology was also an important feature and

achievement since March 2020. SEEIT's portfolio considerably

expanded in solar and storage, in green gas distribution, in energy

recycling and energy and cooling efficiency as well as in EV

charging infrastructure.

SEEIT's portfolio has also been constructed with a prudent view

on counterparty credit risk. Approximately 65 percent of the

portfolio by value (as at June 2021) derives revenues from

investment grade or equivalent counterparties. In the cases where a

counterparty is not investment grade or equivalent, risk mitigants

are often in place, such as security packages associated with debt

investments, ownership of assets or equipment, or other forms of

guarantee. In addition, credit risk exposure can be heavily

mitigated by significant diversification of counterparties, such as

in the case of Gasnätet's 50,000+ customers. There were no material

credit defaults or events during financial year, notwithstanding

the global economic crisis, although the Board and the Investment

Manager remain focused on the economic risks associated with the

COVID-19 pandemic and its aftermath through careful asset

management by the Investment Manager and ongoing engagement with

stakeholders.

The Board and the Investment Manager continue to focus on risks

that can be identified and mitigated. As such, SEEIT's investments

have limited exposure to unmitigated power or commodity price risk.

Prices of energy services are usually fixed or pre-determined and

any fuel costs are typically passed through to the client. SEEIT's

project investments have limited, or in many cases no demand or

volume risk. A number of projects have fixed contracts consisting

of revenues with availability-based characteristics, principally

derived from making a project's assets or services available for

use and that do not depend substantially on the demand for or use

of the project. Other cases have capacity-based characteristics,

where revenues are principally derived from a contractual right of

first dispatch, whereby an off-taker agrees to pay for a volume of

output to the extent that it has demand for it. The Investment

Manager has also sought to limit exposure to regulatory risks. For

instance, in Sweden, energy services are delivered below the

regulatory cap and in Spain, the main commodity price risks are

mitigated through a regulatory regime that applies and adjusts over

the medium-term.

Acquisitions and pipeline

SEEIT's portfolio of investments increased substantially in

value during the year, from approximately GBP320 million to

approximately GBP695 million (including investments made after the

year-end).

The Investment Manager secured most of SEEIT's major investments

during the year through bilateral or private negotiations,

including large investments such as Gasnätet from iCON, the

increase in its stake in Primary Energy from Fortistar and a recent

investment, after the financial year-end, of RED from Stonepeak.

Smaller investments such as SEEIT's investment in projects with GET

Solutions, in a portfolio in Singapore and in framework agreements

such as with Sparkfund were also secured outside of competitive

auction processes. While the original framework with EV charging

infrastructure development, EV Network, was won through a

competitive process, the Investment Manager actively assisted in

bilateral negotiations of the underlying projects with charge point

operators such as bp pulse.

Investment sizes were quite diverse from approximately GBP2

million to nearly GBP140 million. While larger investments offer

the benefits of scale and underlying diversification - for example

via over 100 customers at RED, over 200 projects in Onyx and over

50,000 customers in Gasnätet - smaller investments offer value and

diversification through replication or are otherwise strategic

platforms for targeting a client, an industrial sector, a

technology, a new geography or a delivery partner.

An important feature of SEEIT's portfolio is that a number of

its existing project investments include rights to invest in

additional pipeline opportunities, often at pre-agreed rates of

return. This has created an organic pipeline that offers the

flexibility to secure value and growth where pre-agreed pricing

allows for efficient investment in projects generating robust

returns. The Investment Manager will continue to seek to secure

attractive investment opportunities for SEEIT through new

investments but will remain highly selective and focused on where

it can add value and preferably via privately negotiated

transactions. By contrast, during the financial year, the

Investment Manager withdrew or declined a large number of

investments where competitive auction prices made forecast returns

unattractive, particularly in the more established sub sectors such

as Nordic district energy and cogeneration in the United

States.

The diversification of the portfolio by energy efficient

technology, remains a priority for the Board and the Investment

Manager in assessing new investment opportunities, with careful

evaluation of technologies that fit well into the Company's

investment remit. Examples of new technologies the Investment

Manager has been exploring on a selective basis as part of its

investment strategy include heat pumps, micro grids, cooling, low

carbon fuel for transport (including green gases as well as well as

electricity) and hydrogen.