Schroder Real Estate NAV and Dividend for Quarter to 30 June 2021

July 19 2021 - 1:00AM

UK Regulatory

TIDMSREI

For release 19 July 2021

Schroder Real Estate Investment Trust Limited

LEI Number: 549300ZIJJTMTIIQJP67

ANNOUNCEMENT OF NAV AND DIVIDEND FOR QUARTER TO 30 JUNE 2021

Schroder Real Estate Investment Trust (the 'Company' or 'SREIT'), the actively

managed UK-focused REIT, announces its net asset value ('NAV') and dividend for

the quarter to 30 June 2021.

Highlights

· Net asset value ('NAV') per share increase of 4.1% and a NAV total

return of 5.3% per share based on dividends paid during the quarter.

· Further 3% quarterly dividend increase to 0.675 pence per share ('pps')

for the period 1 April 2021 to 30 June 2021.

· The portfolio valuation increased by 2.6% net of capital expenditure

over the quarter, driven by the performance of industrial, which represents the

largest component of the portfolio by value at 40.2%.

· Rent collection levels continue to improve, with 90% of rent due for the

quarter ending 30 September 2021 collected as at 16 July 2021, ahead of the

equivalent date in the previous quarter.

· High levels of earnings enhancing asset management activity across the

portfolio, with 14 leasing transactions generating £1.1 million per annum of

rental income. These reflected a £400,000 per annum like for like increase

compared with the rental income as at 31 March 2021.

· The Company's strategy is focused on the acceleration in structural

changes and emerging occupier trends through a fully integrated ESG approach,

specialist capabilities, hospitality mindset and operational excellence with

respect to tenant management to create sustainable income and long term value.

Net Asset Value

The unaudited NAV as at 30 June 2021 was £309.1 million or 62.9 pps, a 4.1% per

share increase compared with the NAV as at 31 March 2021. During the quarter

the Company paid a dividend of 0.656 pps, which resulted in a NAV total return

of 5.3%.

A breakdown of the quarterly NAV movement is set out below:

£m pps Comments

NAV as at 31 March 2021 296.8 60.4

Unrealised net increase 12.3 2.5 Reflecting a gross portfolio capital

in the valuations of value uplift of £12.3 million or 2.8%.

the direct real estate

portfolio and Joint

Ventures

Capital expenditure (0.9) (0.2) Capital expenditure included the ongoing

(direct portfolio and industrial planning application at

share of Joint Stanley Green Trading Estate, Cheadle;

Ventures) industrial refurbishments across

multi-let estate; and works in

connection with the BBC letting at The

Tun, Edinburgh. This resulted in a net

portfolio capital value uplift of 2.6%.

Realised gains on Nil Nil No disposals made during the quarter.

disposals

Net revenue 3.9 0.8 EPRA earnings.

Dividend paid (3.2) (0.7) Dividend for the period 1 January 2021

to 31 March 2021 paid in June 2021 (at

0.656 pence per share).

Others 0.3 0.1 All other items.

NAV as at 30 June 2021 309.1 62.9 A 4.1% increase in the NAV per share

over the quarter. The NAV per share

movement includes 338,340 shares

repurchased over the quarter at an

average price of 40.3p.

Dividend payment

The Company today announces an interim dividend of 0.675 pps for the period 1

April 2021 to 30 June 2021. This equates to a 3% increase compared with the

prior quarter's dividend level and reflects progress with rent collection and

active asset management. The Board continues to target a sustainable and

progressive dividend policy.

The dividend payment will be made on 13 August 2021 to shareholders on the

register as at 30 July 2021. The ex-dividend date will be 29 July 2021. The

dividend of 0.675 pps will be wholly designated as an interim property income

distribution ('PID').

Rent collection

Rent collected that was payable in March 2021 for the quarter ended 30 June

2021 currently totals 88% of contracted rents.

Rent collection levels continue to improve and rent collected that was payable

for the quarter ending 30 September 2021 currently totals 90% of contracted

rents. The breakdown between sectors for rent collection is 97% for office, 99%

for of industrial, 66% for retail and leisure, and 84% for other.

The Company remains in active dialogue with its tenants for outstanding rent as

a result of which it continues to see improved rent collection rates.

Investment management fee

As outlined in the year end results, with effect from 1 July 2021 the

Investment Management fee has reduced from 1.1% of NAV to a blended (not cliff

edge), tiered fee structure set out in the table below:

£ NAV % p.a. on NAV

<£500 million 0.9%

£500 million - £1 billion 0.8%

> £1 billion 0.7%

Based on the NAV as at 30 June 2021 the fee is 0.9% which results in an

annualised saving to the Company of 0.2% or £618,200.

Performance versus latest available MSCI Benchmark Index

Over the quarter to 31 March 2021, the underlying portfolio produced a total

return of 2.9%. This compares favourably with the total return for the MSCI

Benchmark of 1.9%. The portfolio's quarterly income return of 1.6% compared

with the Benchmark at 1.1%. The MSCI Benchmark Index figures to 30 June 2021

will be available in August 2021.

Property portfolio

As at 30 June 2021, the underlying portfolio comprised 39 properties valued at

£451.1 million. At the same date the portfolio produced a rent of £28.8 million

per annum reflecting a net initial yield of 6.0%. The portfolio's estimated

rental value is £31.4 million per annum, resulting in a reversionary yield of

7.0%.

The void rate was 4.9% calculated as a percentage of rental value. The average

unexpired lease term, assuming all tenants vacate at the earliest opportunity,

is 5.1 years. The tables below summarise the portfolio information as at 30

June 2021:

Sector weightings Weighting %

SREIT MSCI Index*

Industrial 40.2 28.5

Offices 33.4 27.2

Retail Warehousing 11.3 9.0

Retail 8.4 15.1

- Mixed-use retail 4.8 n/a

- Retail single use 3.6 n/a

Other 6.7 20.2

Regional weightings Weighting %

SREIT MSCI Index*

Central London 8.7 21.1

South East excluding Central London 20.2 33.3

Rest of South 11.7 14.5

Midlands and Wales 24.1 12.4

North 32.8 13.8

Scotland 2.5 4.5

Northern Ireland 0.0 0.2

*Latest available Index data as at 31 March 2021

Balance sheet and debt

The Company has two loan facilities, a £129.6 million term loan with Canada

Life and a £52.5 million revolving credit facility ('RCF') with Royal Bank of

Scotland. As at 30 June 2021, £24.5 million of the RCF was drawn. Fully drawn,

the facilities have an average duration of approximately 13 years and an

average interest cost of 2.5%.

As at 30 June 2021, the Company has cash of £11.8 million and unsecured

property with a value of £39.4 million. This results in a loan to value ratio,

net of cash, of 31.5%.

-ENDS-

For further information:

Schroder Real Estate Investment Management Limited: 020 7658 6000

Nick Montgomery

FTI Consulting: 020 3727 1000

Dido Laurimore / Richard Gotla / Ollie Parsons

END

(END) Dow Jones Newswires

July 19, 2021 02:00 ET (06:00 GMT)

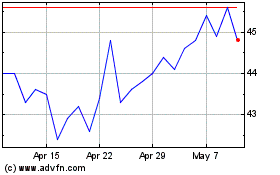

Schroder Real Estate Inv... (LSE:SREI)

Historical Stock Chart

From Mar 2024 to Apr 2024

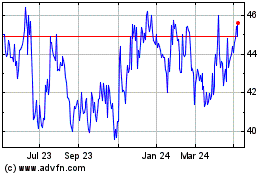

Schroder Real Estate Inv... (LSE:SREI)

Historical Stock Chart

From Apr 2023 to Apr 2024