TIDMSVM

SVM UK EMERGING FUND PLC

(the "Fund")

HALF YEARLY REPORT

(FOR THE SIX MONTHS TO 30 SEPTEMBER 2023)

A copy of the Half Yearly Report will be available to download from the

Manager's website at www.svmonline.co.uk and a copy will shortly be available

for inspection at the National Storage Mechanism at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism in due course. Copies are

also available at 7 Castle Street, Edinburgh EH2 3AH, the registered office of

the Fund.

HIGHLIGHTS

· Over the 6 months to 30 September 2023, net asset value per share fell 4.1% to

89.21p, while the share price gained 3.1% compared to a return of 0.1% in the

chosen comparator, the IA UK Companies Sector Average Index.

· Over the five years to 30 September 2023, net asset value per share has fallen

30.6% and the share price 46.0%, against the comparator index return of +10.0%.

· Medium sized companies lagged the FTSE 100 and smaller companies over the

period.

· Three portfolio companies attracted takeovers, indicating share prices have

fallen below underlying business value.

"Long term capital growth from investments in smaller UK companies. Its aim is

to outperform the IA UK All Companies Sector Average Index on a total return

basis"

Financial Highlights

Total Return 6 months 3 years 5 Years 10 Years

Performance to 30

September 2023

Net Asset Value -4.1% -15.0% -30.6% 39.7%

Share Price 3.1% -4.9% -46.0% 22.2%

Comparator Index* 0.1% 26.5% 10.0% 59.5%

* The comparator index for the Fund was changed to the IA UK All Companies

Sector Average Index from 1 October 2013 prior to which the FTSE AIM Index was

used.

SVM UK EMERGING FUND plc

Half Yearly Report 2023

CHAIRMAN'S STATEMENT

During the six months to 30 September 2023, net asset value per share fell 4.1%

to 89.21p, while the share price gained 3.1% compared to a return of 0.1% in the

chosen comparator, the IA UK Companies Sector Average Index. In the five years

to 30 September 2023, net asset value per share has fallen 30.6% and the share

price 46.0%, against the comparator index return of +10.0%.

During the period under review the UK economy continued to grow despite the rise

in interest rates. There was, however, market concern that the delay in bringing

UK inflation under control would involve a longer period of tight monetary

policy, constraining demand. This led to falls in property shares and those in

consumer sectors. The sectors that performed best reflected mainly those with

global exposure; information technology, energy, financials and industrials.

The strongest contributions to performance over the period were Dechra

Pharmaceuticals, 4Imprint Group, Instem, Kooth and Computacenter. Three

portfolio holdings were taken over; Dechra, Instem and Kape Technologies. Merger

and acquisition activity may point to recognition that share prices of a number

of successful British businesses have become attractive to corporate or private

equity buyers. Negative performers included Watches of Switzerland, Impax Asset

Management. FDM Group, Jet2 and JD Sports fashion . Sales were made of

Activeops, Revolution Beauty, Frontier Developments, Avon Protection, Molten

Ventures, Maxcyte, Genus, Libertine and Impax. The holding in Watches of

Switzerland was reduced after its prospects were adversely impacted by a change

in strategy of its main supplier. These sales funded new investments in Melrose

Industries, JTC, CRH, Intercontinental Hotels, Greggs, Informa and Compass

Group. Portfolio changes emphasised improved liquidity, growth prospects and

earnings visibility.

The UK economy has held up better in 2023 than feared. Consumer spending has

proved resilient, driven by significant excess savings. Amongst international

investors, the UK continues to be out of favour, with historically low

valuations of smaller and medium-sized companies. Many UK mid-cap and smaller

companies now look inexpensive. There is a risk both in the UK and US of

excessive tightening by central banks, possibly misunderstanding the supply-side

nature of current inflation.

The portfolio focuses on resilient growing businesses, with low exposure to

commodities, oils and banks. Portfolio investments are typically scalable

businesses with a competitive edge. The Fund remains fully invested with minimal

gearing.

During the period under review, the Manager agreed to waive its management fee,

with effect from 1st September 2023, reflecting its assessment of the

implications of Consumer Duty regulation. This will be reviewed if circumstances

change. The lead portfolio manager of the Fund, Margaret Lawson, retired on 1st

October 2023 and is succeeded by Colin McLean, previously deputy investment

manager. The Board thanks Margaret for her enthusiasm and valuable advice.

Peter Dicks

Chairman

3 November 2023

SVM UK EMERGING FUND plc

Half Yearly Report 2023

INVESTMENT OBJECTIVE and POLICY

The investment objective of SVM UK Emerging Fund plc (the "Fund" or the

"Company") is long term capital growth from investments in medium-sized and

smaller UK companies. Its aim is to outperform the IA UK All Companies Sector

Average Index on a total return basis.

The Fund aims to achieve its objective and to diversify risk by investing in

shares and related instruments, controlled by a number of limits on exposures.

Appropriate guidelines for the management of the investments, gearing and

financial instruments have been established by the Board. This is an abridged

version of the Fund's investment policy. The full investment policy can be

found in the Strategic Report within the Fund's latest Annual Report & Accounts.

DIRECTORS' RESPONSIBILITY STATEMENT

The Directors are responsible for preparing the Half Yearly Report in accordance

with applicable law and regulations.

The Directors confirm that to the best of their knowledge:

(i) the condensed set of financial statements have been

prepared in accordance with the Financial Reporting Council Statement 104

"Interim Financial Reporting" on a going concern basis, taking in to account

guidance on Covid-19, and give a true and fair view of the assets, liabilities,

financial position and gain or loss of the Fund;

(ii)the Half Yearly Report includes a fair review of the information required by

the Disclosure and Transparency Rules DTR 4.2.7R (an indication of important

events that have occurred during the first six months of the financial year, and

their impact on the condensed set of financial statements; and a description of

the principal risks and uncertainties for the remaining six months of the

financial year); and DTR 4.2.8R (disclosure of related party transactions and

changes therein that could have a material effect on the financial position or

performance of the Fund during the first six months of the current financial

year).

(iii)No related party transactions have taken place during the first six months

of the year that have materially affected the financial position of the Fund

during the period and there have been no changes in the related party

transactions as described in the Annual Report & Accounts for the year end 31

March 2023 that could do so.

The Directors consider that the Half Yearly Report, taken as a whole, is fair,

balanced and understandable and provides the information necessary for

shareholders to assess the Fund's performance and strategy,

The Half Yearly Report has not been audited or reviewed by the Fund's auditors.

By Order of the Board

Peter Dicks

Chairman

3 November 2023

SVM UK EMERGING FUND plc

Half Yearly Report 2023

UNAUDITED ACCOUNTS

Income Statement

Six Six

months to months to

30 30

September September

2022

2023

Revenue Capital Total Revenue Capital Total

£'000 £'000 £'000 £'000 £'000 £'000

Net loss on - (214) (214) - (1,787) (1,787)

investments at

fair value

Income 95 - 95 61 - 61

Investment - (17) (17) - (22) (22)

management fees

Other expenses (76) - (76) (72) - (72)

Gain/(loss) before 19 (231) (212) (11) (1,809) (1,820)

finance costs and

taxation

Finance costs (17) - (17) (9) - (9)

Gain/(loss) on 2 (231) (229) (20) (1,809) (1,829)

ordinary

activities before

taxation

Taxation - - - - - -

Gain/(loss) 2 (231) (229) (20) (1,809) (1,829)

attributable to

ordinary

shareholders

Gain/(loss) per 0.03p (3.85)p (3.82)p (0.33)p (30.18)p (30.51)p

Ordinary Share

The Total column of

this statement is the

profit and loss

account of the Fund.

All revenue and

capital items are

derived from

continuing

operations. No

operations were

acquired or

discontinued in the

year. A Statement of

Comprehensive Income

is not required as all

gains and losses of

the Fund have been

reflected in the above

statement.

Year

ended 31

March

2023

(audited)

Revenue Capital Total

£'000 £'000 £'000

Net loss on - (1,065) (1,065)

investments at fair

value

Income 104 - 104

Investment management - (42) (42)

fees

Other expenses (143) - (143)

Loss before finance (39) (1,107) (1,146)

costs and taxation

Finance costs (22) - (22)

Loss on ordinary (61) (1,107) (1,168)

activities before

taxation

Taxation - - -

Loss attributable to (61) (1,107) (1,168)

ordinary shareholders

Loss per Ordinary (1.02)p (18.46)p (19.48)p

Share

SVM UK EMERGING FUND plc

Half Yearly Report 2023

UNAUDITED ACCOUNTS

Balance Sheet

As at As at As at

30 September 31 March 30 September

2023 2023 2022

(unaudited) (audited) (unaudited)

£'000 £'000 £'000

Fixed Assets

Investments at fair 4,836 4,882 4,318

value through profit or

loss

Total current assets 979 1,272 1,264

Creditors: amounts (467) (577) (666)

falling due within one

year

Net current assets 512 695 598

Total assets less 5,348 5,577 4,916

current liabilities

Capital and Reserves 5,348 5,577 4,916

Equity shareholders' 5,348 5,577 4,916

funds

Net asset value per 89.21p 93.03p 82.00p

Ordinary Share

SVM UK EMERGING FUND plc

Half Yearly Report 2023

UNAUDITED ACCOUNTS

Statement of

Changes

in Equity

For the

period to 30

September

2023

Share Share Special Capital Capital Revenue Total

reserve reserve reserve

capital premium redemption

reserve

£'000 £'000 £'000 £'000 £'000 £'000 £'000

As at 1 300 314 5,136 27 394 5,577

April 2023 (594)

Loss - - - - (231) 2 (229)

attributable

to

shareholders

As at 30 300 314 5,136 27 163 (592) 5,348

September

2023

For the year

to 31

March 2023

Share Share Special Capital Capital Revenue Total

reserve reserve reserve

capital premium redemption

reserve

£'000 £'000 £'000 £'000 £'000 £'000 £'000

As at 1 300 314 5,136 27 1,501 (533) 6,745

April 2022

Loss - - - - (1,107) (61) (1,168)

attributable

to

shareholders

As at 31 300 314 5,136 27 394 (594) 5,577

March 2023

For the

period to 30

September

2022

Share Share Special Capital Capital Revenue Total

reserve reserve reserve

capital premium redemption

reserve

£'000 £'000 £'000 £'000 £'000 £'000 £'000

As at 1 300 314 5,136 27 1,501 6,745

April 2022 (533)

Gain/(loss) - - - - (1,809) (20) (1,829)

attributable

to

shareholders

As at 30 300 314 5,136 27 (308) (553) 4,916

September

2022

SVM UK EMERGING FUND plc

Half Yearly Report 2023

UNAUDITED ACCOUNTS

Investment

Portfolio

as at 30

September

2023

Stock Market % of Sector analysis as % of

Exposure Net at 30 September Gross

2022 Assets 2023 Exposure

£000 Sector

1 4Imprint Group 364 6.8 Industrials 27.1

2 Alpha FX Group 214 4.0 Consumer 24.7

Discretionary

3 Unite Group 181 3.4 Financials 12.3

4 Beazley Group 173 3.2 Information 11.9

Technology

5 Rentokil Initial 170 3.2 Communication 10.5

Services

6 Howden Joinery 162 3.0 Real Estate 5.4

Group

7 Whitbread* 157 2.9 Consumer Staples 3.3

8 Ashtead Group 156 2.9 Materials 3.0

9 Games Workshop 153 2.9 Healthcare 1.8

Group

10 JD Sports 141 2.6 Total 100.0

Fashion*

Ten largest 1,871 34.9

investments

11 Experian 135 2.6

12 Flutter 133 2.5

Entertainment*

13 Jet2 123 2.3

14 Keystone Law 123 2.3

Group

15 JTC 119 2.2

16 CRH 112 2.1

17 Intercontinental 112 2.1

Hotels Group

18 Oxford 109 2.0

Instruments

19 Compass Group 108 2.0

20 Serco Group 107 2.0

Twenty 3,052 57.0

largest

investments

21 Computacenter 105 2.0

22 Hilton Food 105 2.0

Group

23 Watches of 99 1.9

Switzerland

Group*

24 Kainos Group 99 1.9

25 Kooth 98 1.8

26 XP Power 94 1.8

27 Renew 91 1.7

28 FDM Group 86 1.6 *Includes Contract

Holdings for Difference

("CFDs")

Market exposure for

equity investments

held is the same as

fair value and for

CFDs held is the

market value of the

underlying shares

to which the

portfolio is

exposed via the

contract. The

investment

portfolio is

grossed up to

include CFDs and

the net CFD

position is then

deducted in

arriving at the net

asset total.

29 Informa 82 1.5

30 Auto Trader 81 1.5

Group

Thirty 3,992 74.7

largest

investments

Other 1,542 28.8

investments

(30

holdings)

Total 5,534 103.5

investments

CFD (721) (13.5)

positions

CFD 23 0.4

unrealised

gains

Net current 512 9.6

assets

Net assets 5,348 100.0

SVM UK EMERGING FUND plc

Half Yearly Report 2023

UNAUDITED ACCOUNTS

Risks and Uncertainties

The major risks inherent within the Fund are market risk, liquidity risk, credit

risk and interest rate risk. It has an established environment for the

management of these risks which are continually monitored by the Manager.

Appropriate guidelines for the management of its financial instruments and

gearing have been established by the Board of Directors. It has no foreign

currency assets and therefore does not use currency hedging. It does not use

derivatives within the portfolio with the exception of CFDs. An explanation of

these risks and how they are mitigated is explained in the 2023 Annual Report,

which is available on the Manager's website: www.svmonline.co.uk. These

principal risks and uncertainties have not changed from those disclosed in the

2023 Annual Report.

Going Concern

The Board, having made appropriate enquiries has a reasonable expectation that

the Fund has adequate resources and sufficient liquidity to continue in

operational existence for the foreseeable future, a period of not less than 12

months from the date of this report. This conclusion takes in to account the

Directors' assessment of the continuing risks and impacts from the COVID-19

pandemic, the geopolitical risks relating to the conflict between Russia and

Ukraine, the conflict in the Middle East, and economic factors that are

influencing the current market volatility, such as inflation, interest rates and

supply chains. Accordingly, it continues to adopt the going concern basis in

preparing the financial statements.

Notes

1.The Financial Statements have been prepared on a going concern basis in

accordance with FRS 102 "Financial Reporting Standard applicable in the UK and

Republic of Ireland", FRS 104 "Interim Financial Reporting" and under the

Association of Investment Companies Statement of Recommended Practice "Financial

Statements of Investment Trust Companies and Venture Capital Trusts" ("SORP")

issued in April 2021. The Company is exempt from presenting a Cash Flow

Statement as a Statement of Changes in Equity is presented and substantially all

of the Company's investments are liquid and are carried at market value. These

financial statements have been prepared in accordance with the accounting

policies used for the financial year ended 31 March 2023.

2.During the period no shares were bought back (2022: no shares were bought back

during the period).

The number of shares in issue at 30 September 2023 was 6,005,000 (2022:

6,005,000).

Returns per share are based on a weighted average of 5,995,000 (2022:

5,995,000) ordinary shares, being the number of shares in issue during the

periodexcluding the 10,000 shares held in Treasury.

Total return per share is based on the total loss for the period of £229,000

(2022: loss of £1,829,000). Capital return per share is based on the capital

loss for the period of £231,000 (2022: loss of £1,809,000). Revenue return per

share is based on the revenue gain after taxation for the period of £2,000

(2022: loss of £20,000).

SVM UK EMERGING FUND plc

Half Yearly Report 2023

UNAUDITED ACCOUNTS

3.All investments are held at fair value. At 30 September 2023 no unlisted

investments were held with value attributed (31 March 2023: same; 30 September

2022: same).

Investments have been classified using the fair value hierarchy:

+------------------+---------------+-------------+------+--------------------+

| | September 2023 |March 2023 |

| | | |

| | £000 £000| £000 £000|

+------------------+---------------+-------------+------+--------------------+

|Classification of |Assets |Liabilities |Assets|Liabilities |

|financial | | | | |

|instruments | | | | |

+------------------+---------------+-------------+------+--------------------+

|Level 1 |4,813 |- |4,860 |- |

+------------------+---------------+-------------+------+--------------------+

|Level 2 | 23|418 |22 |507 |

+------------------+---------------+-------------+------+--------------------+

|Level 3 - 2 |- |- |- |- |

|investments (March| | | | |

|2022: 3) | | | | |

+------------------+---------------+-------------+------+--------------------+

Level 1 reflects financial instruments quoted in an active market.

Level 2 reflects financial instruments whose fair value is evidenced by

comparison with other observable current market transactions in the same

instrument or based on a valuation technique whose variables include only data

from observable markets. The CFD positions are the sole Level 2 investments at

30 September 2023 and 31 March 2023.

Level 3 reflects financial instruments whose fair value is determined in whole

or in part using a valuation technique based on assumptions that are not

supported by prices from observable market transactions in the same instrument

and not based on available observable market data.

4.The Board has granted the Manager a limited authority to invest in CFDs to

achieve some degree of gearing and/or hedging without incurring the gross cost

of the investment. The Board requires the Manager to operate within certain risk

limits, as detailed in the Annual Report. The following table details the CFD

positions:

Number of CFD holdings at 30 September 2023: 8 (31 March 2023: 9)

+-----------------+--------------+----------+

|CFD positions |September 2023|March 2023|

+-----------------+--------------+----------+

| |£000 |£000 |

+-----------------+--------------+----------+

|Gross exposure |721 |892 |

+-----------------+--------------+----------+

|Net exposure |721 |892 |

+-----------------+--------------+----------+

|Unrealised gains |23 |22 |

+-----------------+--------------+----------+

|Unrealised losses|418 |507 |

+-----------------+--------------+----------+

The gearing ratio is 9.0% at 30 September 2023 (31 March 2023: 9.3%). The

gearing ratio indicates the extra amount by which the shareholders' funds would

change if total assets (including CFDs' position exposure and netting off cash

and cash equivalents) were to rise or fall. A figure of zero per cent means

that the Company has a nil geared position.

5.SVM Asset Management Limited provides investment management and secretarial

services to the Fund. The Manager is entitled to a fee for these services,

payable quarterly in arrears, equivalent to 0.75% per annum of the total assets

of the Fund, less current liabilities. The Manager has elected to waive the

investment management fee from 1 September 2023 until further notice.

SVM UK EMERGING FUND plc

Half Yearly Report 2023

UNAUDITED ACCOUNTS

6.The above figures do not constitute full or statutory accounts in terms of

Sections 434 and 435 of the Companies Act 2006. All information shown for the

six months to 30 September 2023 is unaudited. The accounts for the year to 31

March 2023, on which the auditors issued an unqualified report, have been lodged

with the Registrar of Companies and did not contain a statement required under

Section 498 of the Companies Act 2006.

For further information, please contact:

Colin McLeanSVM Asset Management

Sally Moore Four Communications

SVM UK EMERGING FUND plc

Half Yearly Report 2023

CORPORATE INFORMATION

Directors

Peter Dicks (Chairman)

Ian Gray

Jeremy Harris

Investment Manager, Secretary and

Registered Office

SVM Asset Management Limited

6th Floor

7 Castle Street

Edinburgh EH2 3AH

Telephone: +44 (0) 0131 226 6699

Facsimile: +44 (0) 131 226 7799

Email: info@svmonline.co.uk

Web: www.svmonline.co.uk

Registrars

Computershare Investor Services plc

Edinburgh House

4 North St Andrew Street

Edinburgh EH2 1HU

Telephone: +44 (0) 370 702 0003

Authorised and regulated by the Financial Conduct Authority

Auditor

Johnston Carmichael LLP

7-11 Melville Street

Edinburgh

EH3 7PE

Custodians

State Street Bank & Trust Company

Registered Office:

20 Churchill Place

Canary Wharf

London EH14 5HJ

Correspondence Address:

Quartermile 3

10 Nightingale Way

Edinburgh EH3 9EG

Authorised and regulated by the Financial Conduct Authority and a member of the

Investment Association

Registered Number

SC211841

Company Website

www.svmonline.co.uk

© SVM Asset Management Limited 2023

This information was brought to you by Cision http://news.cision.com

https://news.cision.com/svm-uk-emerging-fund-plc/r/half-year-report,c3870864

The following files are available for download:

https://mb.cision.com/Main/22438/3870864/2412805.pdf UK Emerging Interim 2023

END

(END) Dow Jones Newswires

November 07, 2023 05:28 ET (10:28 GMT)

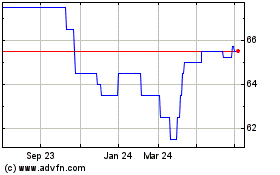

Svm Uk Emerging (LSE:SVM)

Historical Stock Chart

From Mar 2024 to Apr 2024

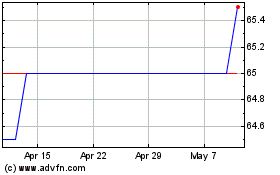

Svm Uk Emerging (LSE:SVM)

Historical Stock Chart

From Apr 2023 to Apr 2024