TIDMTLW

RNS Number : 2195V

Tullow Oil PLC

30 November 2023

NOT FOR DISTRIBUTION IN ANY OTHER JURISDICTION WHERE IT IS

UNLAWFUL TO DISTRIBUTE THIS DOCUMENT.

THIS ANNOUNCEMENT IS FOR INFORMATION ONLY AND IS NOT AN OFFER TO

PURCHASE OR A SOLICITATION OF AN OFFER TO SELL ANY NOTES.

Tullow Oil plc

Early Results of its Tender Offer for 2025 Notes

November 30, 2023 - Tullow Oil plc (the "Company") announces the

early results of its previously announced invitation to holders of

its outstanding 7.00% Senior Notes due 2025 (the "Notes") to tender

such Notes for purchase by the Company for cash (the "Tender

Offer") up to an aggregate tender consideration, excluding any

accrued and unpaid interest, of U.S.$300,000,000 (the "Aggregate

Tender Consideration") in respect of tenders from registered

holders of Notes ("Holders") who validly tendered their Notes on or

prior to 5:00 p.m., New York City time, on November 29, 2023 (the

"Early Tender Deadline").

As of the Early Tender Deadline, U.S.$130,086,000 principal

amount of Notes were validly tendered. The table below identifies

the principal amount of Notes validly tendered and accepted as of

the Early Tender Deadline:

Outstanding

Principal

Amount as Principal

at the date Amount

Title of of the Offer Tendered Early Tender

Security CUSIP/ISIN to Purchase and Accepted Offer Consideration(1)

7.00% Senior Rule 144A: U.S.$633,463,000 U.S.$130,086,000 U.S.$920.00

Notes due 899415AE3

2025 (the / US899415AE32

"Notes")

Regulation

S: G91237AA8

/ USG91237AA87

---------------- ----------------- ----------------- ------------------------

Notes:

(1) The clearing price per U.S.$1,000 principal amount of Notes

validly tendered prior to the Early Tender Deadline and accepted

for purchase (the "Clearing Price" or "Early Tender Offer

Consideration", as applicable) (exclusive of any accrued and unpaid

interest on such Notes from, and including, the last interest

payment date applicable to such Notes, which will be paid in

addition to the applicable Consideration to, but not including, the

Final Payment Date (as defined herein)).

Capitalized terms used in this announcement but not defined

herein have the meanings given to them in the offer to purchase

dated November 15, 2023 (the "Offer to Purchase").

The Early Tender Offer Consideration for each U.S.$1,000

principal amount of Notes validly tendered on or prior to the Early

Tender Deadline and accepted for purchase pursuant to the Tender

Offer shall be U.S.$920.00, which includes the Early Tender Offer

Premium (as defined in the Offer to Purchase) of U.S.$50.00 per

U.S.$1,000 principal amount of Notes accepted for purchase.

Pursuant to the terms of the Tender Offer, the Company has

elected that the settlement date for the Notes tendered on or prior

to the Early Tender Deadline and accepted for purchase is expected

to be December 20, 2023, unless extended by the Company (the "Final

Payment Date"). Holders will also receive with respect to any Notes

validly tendered and accepted for purchase accrued and unpaid

interest on such Notes from, and including, the last interest

payment date applicable to such Notes to, but not including, the

Final Payment Date.

The Tender Offer will remain open until 5:00 p.m., New York City

time, on December 14, 2023, unless extended by the Company (the

"Expiration Deadline"). The settlement date for the Notes tendered

after the Early Tender Deadline and on or prior to the Expiration

Deadline and accepted for purchase is expected to be the Final

Payment Date.

Amendments to the Tender Offer

The Company hereby announces that it has amended the terms of

the Tender Offer, such that the Late Tender Consideration is now

equal to the Early Tender Offer Consideration (including, for the

avoidance of doubt, the Early Tender Offer Premium). As such,

Holders whose Notes are validly tendered after the Early Tender

Deadline but on or prior to the Expiration Deadline and accepted

for purchase will receive U.S.$920.00, which includes the Early

Tender Offer Premium (as defined in the Offer to Purchase) of

U.S.$50.00 per U.S.$1,000 principal amount of Notes accepted for

purchase. The terms and conditions of the Tender Offer, as set

forth in the Offer to Purchase, otherwise remain unchanged.

Questions and requests for assistance in connection with the

Tender Offer should be directed to the Lead Dealer Managers :

ING Bank N.V., London Branch Standard Chartered Bank

1 Basinghall Avenue

8-10 Moorgate London EC2V 5DD

London EC2R 6DA United Kingdom

United Kingdom Attention: Liability Management

Attention: Liability Management Group Telephone: +1 212 667 0351 / +44 20 7885 5739 /

Telephone: +44 20 7767 6784 + 852 3983 8658 / +65 6557 8286

Email: liability.management@ing.com Email: liability_management@sc.com

The Co-Dealer Managers in connection with the Tender Offer

are:

Absa Bank Limited DNB Markets, J.P. Morgan Nedbank Limited The Standard

(acting through Inc. Securities (acting through Bank of South

its Corporate LLC its Nedbank Africa Limited

and Investment Corporate

Banking Division) and Investment

Banking Division)

Questions and requests for assistance in connection with

tendering Notes and participating in the Tender Offer and the

submission of a Tender Instruction should be directed to the

Information and Tender Agent:

Information and Tender Agent

Morrow Sodali Limited

29/F. No. 28 Stanley 103 Wigmore Street 333 Ludlow Street

Street London W1U 1QS South Tower, 5(th)

Central Hong Kong United Kingdom Floor

Stamford, CT 06902

United States

Telephone: +44 20

Telephone: +852 2319 4513 6933 Telephone: +1 203

4130 658 9457

Email: tullowoil@investor.morrowsodali.com

Electronic copies of all documents related to the Tender Offer will be available from the

website of the Luxembourg Stock Exchange, the London Stock Exchange and/or online via the

Tender Offer Website at https://projects.morrowsodali.com/tullowoilSUN until the consummation

or termination of the Tender Offer.

This announcement contains inside information for the purposes

of Article 7 of Regulation 2014/596/EU which is part of domestic UK

law pursuant to the Market Abuse (Amendment) (EU Exit) Regulations

(SI 2019/310) ("UK MAR"). Upon the publication of this

announcement, this inside information (as defined in UK MAR) is now

considered to be in the public domain. This announcement is being

made on behalf of Tullow by Adam Holland, Company Secretary.

Disclaimer

This announcement is for informational purposes only and should

be read in conjunction with the Offer to Purchase. Holders should

carefully consider all of the information in the Offer to Purchase

and seek their own financial and legal advice from their

stockbroker, bank manager, solicitor, accountant or other

independent financial adviser. The Offer to Purchase sets out the

full terms of the Tender Offer. Copies of the Offer to Purchase are

available from the Information and Tender Agent, at the address set

out above.

None of the Company, the Trustee, the Dealer Managers or the

Information and Tender Agent or any of their respective directors,

officers, employees, agents or affiliates makes any recommendation

about whether Holders should tender their Notes.

Neither the Offer to Purchase nor this announcement constitutes

an offer to buy or the solicitation of an offer to sell Notes (and

tenders of Notes will not be accepted from Holders) in any

circumstances in which the Tender Offer or solicitation is

unlawful. If a jurisdiction requires that the Tender Offer be made

by a licensed broker or dealer, and the Dealer Managers or any of

their affiliates is a licensed broker or dealer in that

jurisdiction, the Tender Offer shall be deemed to be made by such

person on behalf of the Company in such jurisdiction.

The Offer to Purchase does not constitute an invitation to

participate in the Tender Offer in any jurisdiction in which, or to

any person to or from whom, it is unlawful to make such invitation

or for there to be such participation under applicable securities

laws. The distribution of the Offer to Purchase in certain

jurisdictions may be restricted by law. Persons into whose

possession the Offer to Purchase comes are required to inform

themselves about and to observe any such restrictions. Holders are

referred to the "Offer and Distribution Restrictions" in the Offer

to Purchase.

Nothing in this communication constitutes an offer to purchase

or an offer of securities for sale in the United States or any

other jurisdiction. No securities may be offered or sold in the

United States absent registration or an applicable exemption from

registration requirements. Any public offering of securities to be

made in the United States will be made by means of a prospectus.

Such prospectus will contain detailed information about the company

making the offer and its management and financial statements. No

public offer of securities is to be made by the Company in the

United States. The Notes have not been registered under the U.S.

Securities Act of 1933, as amended, or the securities laws of the

United States or any state thereof or the applicable laws of any

other jurisdiction.

The Tender Offer is not being made in any Member State of the

European Economic Area or in the United Kingdom, other than to

persons who are "qualified investors" as defined in Regulation (EU)

No 2017/1129 (as amended, the "Prospectus Regulation"), or in other

circumstances falling within Article 1(4) of the Prospectus

Regulation.

The Tender Offer is not being made, and has not been approved,

by an authorized person for the purposes of section 21 of the

Financial Services and Markets Act 2000 (the "FSMA"). Accordingly,

the Tender Offer is not being made to the general public in the

United Kingdom. This communication is exempt from the restriction

on financial promotions under section 21 of the FSMA on the basis

that it is only directed at and may be communicated to (1) those

persons who are existing members or creditors of the Company or

other persons within Article 43 of the Financial Services and

Markets Act 2000 (Financial Promotion).

Each Holder participating in the Tender Offer will be deemed to

give certain representations in respect of the jurisdictions

referred to above and generally as set out in "Procedures for

Participating in the Tender Offer" in the Offer to Purchase. Any

tender of Notes for purchase pursuant to the Tender Offer from a

Holder that is unable to make these representations will not be

accepted. Each of the Company and the Information and Tender Agent

reserves the right, in its absolute discretion, to investigate, in

relation to any tender of Notes for purchase pursuant to the Tender

Offer, whether any such representation given by a Holder is correct

and, if such investigation is undertaken and as a result the

Company determines (for any reason) that such representation is not

correct, such tender of Notes shall not be accepted.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RTENKKBPCBDKNDN

(END) Dow Jones Newswires

November 30, 2023 05:00 ET (10:00 GMT)

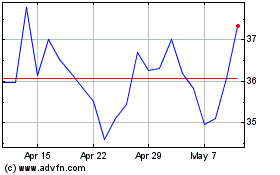

Tullow Oil (LSE:TLW)

Historical Stock Chart

From Apr 2024 to May 2024

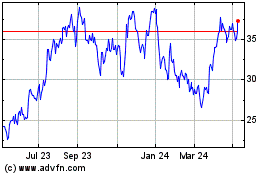

Tullow Oil (LSE:TLW)

Historical Stock Chart

From May 2023 to May 2024