TIDMWWH

22 November 2022

LONDON STOCK EXCHANGE ANNOUNCEMENT

Worldwide Healthcare Trust PLC

Unaudited Half Year Results for the six months ended

30 September 2022

This Announcement is not the Company's Half Year Report & Accounts. It is an

abridged version of the Company's full Half Year Report & Accounts for the six

months ended 30 September 2022. The full Half Year Report & Accounts, together

with a copy of this announcement, will also shortly be available on the

Company's website: www.worldwidewh.com where up to date information on the

Company, including daily Net Asset Value, share prices and fact sheets, can

also be found.

The Company's Half Year Report & Accounts for the six months ended 30 September

2022 has been submitted to the UK Listing Authority, and will shortly be

available for inspection on the National Storage Mechanism (NSM): https://

data.fca.org.uk/#/nsm/nationalstoragemechanism

For further information please contact: Mark Pope, Frostrow Capital LLP 020 3

008 4913.

Performance

Six months to One year to

30 September 31 March

2022 2022

Net asset value per share (total return)* # 3.1% (5.8%)

Share price (total return)* # 1.9% (10.8%)

Benchmark (total return)^ # 2.1% 20.4%

30 September 31 March Six months

2022 2022 change

Net asset value per share 3,550.7p 3,465.2p 2.5%

Share price 3,315.0p 3,275.0p 1.2%

Discount of share price to the net asset value 6.6% 5.5%

per share*

Leverage* 11.5% 10.9%

Ongoing charges* 0.8% 0.9%

Ongoing charges (including performance fees 0.8% 1.4%

crystallised during the period)*

# Source - Morningstar.

^ Benchmark - MSCI World Health Care Index on a net total return, sterling

adjusted basis (see Glossary)

* Alternative Performance Measure. Leverage calculated under the

Commitment Method (see Glossary)

Board Chair's Statement

Doug McCutcheon

Performance

This is my first report to shareholders, having succeeded Sir Martin Smith as

Chair of the Board of the Company in July 2022. I would like to thank Sir

Martin for his leadership, wise counsel and friendship during his time on the

Board, a period during which the Company achieved excellent performance over

many years.

As a sector, healthcare again demonstrated its defensive qualities during the

first half of the Company's financial year. It was a challenging period for

stock markets globally, with the MSCI World and the FTSE All-Share Indices

producing sterling based total returns of -7.3% and -8.3%, respectively. In

contrast, the Company's Benchmark, the MSCI World Healthcare Index, measured on

a net total return, sterling adjusted basis rose by 2.1%.

In this context, I am pleased to report that the Company's net asset value per

share total return of +3.1% outperformed its Benchmark during the period. In

absolute terms, net asset value performance was helped by the continued

weakness of sterling, which depreciated by 15.2% against the U.S. dollar, the

currency in which the majority of the Company's investments are denominated.

The Company's share price total return of +1.9%, while still positive, fared

slightly less well and, as a result, the discount of the Company's share price

to its net asset value per share widened to 6.6% as at 30 September 2022 (from

5.5% at the beginning of the half year), having been wider at times during the

period.

The principal reason for the Company's positive performance was its continuing

significant overweight position in Emerging Biotechnology*. The strategy had

not worked well during the Company's previous financial year, but is now

benefitting from investors beginning to again focus more on sector related news

flow and fundamentals rather than on macro-related issues.

Looking at specific names in the portfolio, the largest contributions during

the reporting period came from Global Blood Therapeutics, the U.S.

biopharmaceutical company that was acquired by Pfizer, and the U.S. health

insurance company Humana. The principal detractors from performance were the

U.S. pharmaceutical company Horizon Therapeutics and Intuitive Surgical, which

focusses on the development and manufacture of robotic technology used in

medical procedures. Further information regarding the Company's investments and

performance can be found in the Review of Investments.

The Company had, on average, leverage of 11.3% during the period, which

contributed 0.4% to performance. As at the half year-end leverage stood at

11.5% compared to 10.9% at the beginning of the period. Our Portfolio Manager

continues to adopt both a pragmatic and a tactical approach to the use of

leverage, which adds to performance in periods of rising portfolio share

prices.

As has been mentioned previously, the Company is able to invest up to 10% of

the portfolio, at the time of acquisition, in unquoted securities. Our

Portfolio Manager, through its extensive private equity research capabilities,

continues to identify unquoted opportunities for the portfolio. Exposure to

unquoted equities accounted for 7.1% of the total portfolio at the half

year-end, and these holdings made a positive contribution of 0.7% to the

Company's performance during the period under review.

* See Glossary.

Performance Fee

No performance fee was accrued as at 30 September 2022 and no performance fee

can become payable within the next year. The performance fee arrangements are

described in detail in the Company's Annual Report.

Capital

Challenging stock market conditions since the beginning of 2022 have had a

negative impact on share price discounts across the investment company sector,

with the average level of discount currently standing at c.11%*.

The Company began buying back shares, in line with the Board's discount

management policy, starting in the last quarter of the previous financial year

and there were 80,509 shares held in treasury at the beginning of the half

year. The Company has continued to buy back shares where necessary throughout

the period under review. A total of 1,093,997 shares were repurchased for

treasury during the period at a cost of £36.1m and at an average discount of

8.4%. At the half year-end there were 64,363,249 shares in issue (excluding the

695,529 shares held in treasury).

It is the Board's policy to try to limit the share price discount to the net

asset value per share to no more than a 6% on an ongoing basis. Shareholders

should note, however, that it remains possible for the discount to be greater

than 6% on any given day. Short-term share price volatility is influenced by

the overall supply and demand for the Company's shares in the secondary market.

In addition, short-term volatility in the Company's net asset value per share

is driven by share prices in the broader healthcare sector worldwide. Since the

end of the half year, a further 220,615 shares have been bought back for

treasury and, at the time of writing, the share price discount stands at 6.0%.

In line with the Company's stated policy, I confirm that 478,977 shares held in

treasury following the date of the Company's Annual General Meeting in July

2022, were cancelled. The Company currently holds 916,144 shares in treasury.

*Source: Winterflood Investment Trusts

Dividends

The Board has declared an unchanged interim dividend of 7.0p per share, for the

year to 31 March 2023, which will be payable on 11 January 2023 to shareholders

on the register of members on 25 November 2022. The associated ex-dividend date

is 24 November 2022.

I remind shareholders that it remains the Company's policy to pay out dividends

at least to the extent required to maintain investment trust status. These

dividend payments are paid out of the Company's net revenue for the year and,

in accordance with investment trust rules, a maximum of 15% of income can be

retained by the Company in any financial year.

It is the Board's continuing belief that the Company's capital should be

deployed rather than paid out as dividends to achieve a particular target

yield.

Composition of the Board

I am pleased to confirm the two new additions to the Board that were announced

in September. Tim Livett is a qualified accountant and the Chief Financial

Officer at Caledonia Investments PLC. Jo Parfrey is a Chartered Accountant, a

non?executive Director and Chair of the Audit Committee of Henderson

International Income Trust plc and a non?executive Director of Octopus AIM VCT.

Their financial, investment management and life sciences experience will

be invaluable to the Board's deliberations going forward.

Outlook

With the recent enactment of the Inflation Reduction Act* in the U.S., our

Portfolio Manager believes that a key overhang to the healthcare sector

relating to drug pricing has been reduced. They further believe that this,

together with continued high levels of innovation and merger and acquisition

activity, will support sustained attractive performance by the Company.

Your Board believes that long-term investors in the Company will continue to be

rewarded.

Doug McCutcheon

Chair

22 November 2022

* See the Review of Investments and also the Glossary.

Review of Investments

Markets

Major macro events have dictated the performance of global equity markets in

the first half of the financial year ending 31 March 2023. The Russian invasion

of Ukraine was perhaps the biggest shock of all, with numerous ripple effects

including falling equity prices, rising bond yields, increased commodity

prices, increased inflation, and further supply chain disruption. As the year

progressed, inflation worsened, interest rates continued to rise, and

recessionary fears increased. This was accompanied by extreme currency moves

across markets, including the pound reaching a new low against the U.S. dollar

(reaching almost parity in late September, a level not seen since 1985).

Continued geopolitical uncertainty over China's intentions with respect to

Taiwan compounded the situation, complicating the macro backdrop even further.

The result was precipitous declines across all major equity indices. The MSCI

World Index (measured on a sterling total return basis) fell more than 7% and

over 21% in U.S. dollar terms for the six-month reported period. Similarly, in

the UK the FTSE All-Share index fell more than 8% whilst in the U.S. the S&P

500 index fell over 20%, again differences reflecting volatility in currencies.

Healthcare stocks proved typically defensive during the broader market

turbulence in the first half of the financial year. On the plus side,

therapeutic stocks (biotechnology and pharmaceuticals) moved higher in sterling

terms, as did healthcare services. On the negative side, medical technology and

life science tools stocks moved lower in sterling terms, as supply chain and

other macro concerns impacted valuations.

Performance

For the six-month period ended 30 September 2022, we are pleased to confirm

both positive absolute and relative performance. Specifically, the net asset

value per share total return was 3.1%, outperforming the Benchmark return of

2.1% (MSCI World Healthcare Index measured on a net total return sterling

adjusted basis). The share price total return was 1.9%.

The primary driver of this positive performance - both absolute and relative -

was Emerging Biotechnology stocks, via both allocation and stock picking.

Another driver of import was stock picking in Japanese Pharmaceutical stocks.

Additional performance was generated in Life Science Tools (allocation and

stock picking) and Medical Technology (stock picking). We would also note the

very noticeable impact of currencies on absolute returns in the period. With

sterling reaching all-time lows versus the U.S. dollar in late September 2022,

and the portfolio denominated predominantly in U.S dollars, currency impacted

returns by 15.2%.

The primary source of negative performance - both absolute and relative - was

Pharmaceuticals (allocation and stock picking) whilst Medical Technology

detracted materially on an absolute basis only (allocation). Overall Emerging

Markets investments were down slightly, with both Indian and Chinese based

investments detracting from performance.

During the first half of the financial year, the Company made no new

investments in unquoted companies as a continued challenging public offering

market for small and mid-capitalisation therapeutics companies made pre-Initial

Public Offering (IPO) crossover investments unattractive. Notwithstanding the

market environment, one of the existing unquoted investments, DingDang Health

Technology Group, completed its IPO in mid-September at a step-up value of

c.26% on its cost in U.S. dollars.

As at 30 September 2022, investments in unquoted companies accounted for 7.1%

of the Company's net assets versus 7.0% as of 31 March 2022. For the period

ended 30 September 2022, the Company's unquoted strategy contributed gains of £

14.6m, a return of 8.7%. DingDang Health Technology Group represented a large

portion of those gains, £5.6m, a return of c.45%, in sterling, for the period.

The other unquoted positions were up an average of 5.8%, in sterling, over the

period, largely due to currency effects.

Overall, the Company's reported returns were not linear in the period. The

first two months of the financial year were similar to the end of calendar year

2021 and early 2022. That is, macro factors continued to be the dominant

influence on equity markets, including parts of healthcare. This resulted in

continued selling pressure on Emerging Biotechnology stocks - our key strategic

overweight - in April and May 2022, impacting our performance. In fact, the

SPDR S&P Biotech ETF (or "XBI") sold off an additional 23.5% in this two-month

period alone, extending the calendar year losses to 38.5% by the end of May

(U.S. dollar terms). Consequently, additional underperformance was accrued to

start the current financial year, continuing a trend observed in the previous

financial year. However, the environment changed significantly in June and

beyond, when Mergers & Acquisitions (M&A) activity accelerated significantly.

As specialist investors, we are perpetually optimistic about M&A. That said,

2021 was clearly a down year for M&A and the pace slowed even more at the

beginning of 2022. However, during the first half of the calendar year we noted

that large capitalisation pharmaceutical executives were particularly vocal

about the need for additional M&A, noting looming patent expirations across the

industry in 2025 and beyond. This talk finally turned into action and a

material inflection in M&A finally emerged in the biopharmaceutical sector in

June 2022 that carried well into September. The number of deals reported

through mid-October 2022 was tracking above a 10-year high (2020) with the

highest annual average deal value in recent memory.

In turn, the Company's performance also inflected, not only through a direct

contribution from specific M&A targets, but also through the rising tide of the

U.S. Biotechnology XBI ETF. Biotechnology stocks further shook-off the macro

overhang that had persisted for well over a year. A number of positive clinical

catalysts (Alzheimer's disease, oncology, orphan disorders, among others)

occurred in this four-month period which saw share prices respond accordingly,

a phenomenon that was lacking in the previous 15 months. As a result, absolute

and relative performance moved higher with net asset value returns of 11.0% for

the four-month period of June through September 2022, outperforming the

Benchmark by almost 9%.

Overall, we are pleased to update the Company's performance since inception, as

of 28 April 1995, where the Company's net asset value has posted a 4,362%

return, or an average of 14.9% per annum through 30 September 2022. This

compares to a Benchmark return of 2,181% and 12.1% over the same investment

horizon. This compares to the FTSE All-Share Index return of +505% and +6.8%

over the same investment horizon.

Major Contributors to Performance

The top five contributors to absolute performance were a combination of

therapeutic and non-therapeutic stocks, but the impact of M&A in the

biopharmaceutical sector on performance was an undeniable feature.

The largest contributor in the six-month period was Global Blood Therapeutics.

The California based small-mid-cap biotechnology company focuses on clinical

medicines used to treat blood-based disorders, such as sickle cell disease

(SCD). The company was acquired by Pfizer in an announced transaction in August

2022. The agreed upon price was for a total enterprise value of U.S.$5.4

billion, a 100% premium to the unaffected share price. In addition to an

already marketed product for the treatment of SCD, Oxbryta (voxelotor), Pfizer

also gained important pipeline assets, including GBT601, an oral, once-daily,

next-generation sickle haemoglobin (HbS) polymerisation inhibitor in the Phase

2 portion of a Phase 2/3 clinical study. GBT601 has the potential to be a

best-in-class agent targeting improvement in both haemolysis and frequency of

vaso-occlusive crisis (VOC). Another promising pipeline asset is inclacumab, a

fully human monoclonal antibody targeting P-selectin which is being evaluated

in two Phase 3 clinical trials as a potential quarterly treatment to reduce the

frequency of VOCs and to reduce hospital readmission rates due to VOCs. The

transaction officially closed in early October 2022.

The second largest contributor to performance was Humana, one of the largest

and pre-eminent managed care companies in the U.S. Following a negative update

in January 2022, that Medicare Advantage enrolment would be below expectations,

Humana's primary goal for the rest of 2022 had been to return to market-leading

growth while maintaining or improving margins. Subsequently, the company

unveiled an ambitious U.S.$1 billion value creation plan and has steadily

executed on that plan, with better-than-expected quarterly earnings reports

throughout the remainder of 2022. Additionally, in September 2022, the company

hosted an investor event in which they announced a long-term guidance target of

U.S.$37.00 in earnings per share for 2025, with subsequent earnings growth of

14% or better. This news was well received by investors.

Another key contributor of import was Shanghai Bio-Heart Biological Technology,

a cardiovascular medical device startup in China that held its IPO in late

2021. The company sells two product lines: Renal Denervation (RDN) and

Bioresorbable Vascular Scaffold System (BVS). Together, these technologies

address the unmet medical needs of Chinese patients for the treatment of

coronary and peripheral artery diseases and uncontrolled hypertension.

Bio-Heart's line of RDN products is a "best-in-class" product in China, with a

unique catheter design which is the only one that can be inserted by both

radial artery and femoral artery (unlike the competition). The investment into

the company was an unquoted investment. The company listed on the Hong Kong

Exchange in December 2021 at HKD 21.25, peaked at HKD 75.55, before closing on

30 September 2022 at HKD 59.00, a return of +178%.

Turning Point Therapeutics is another California based small-mid-capitalisation

biotechnology company that was acquired during the period. In June 2022,

Bristol-Myers Squibb announced a definitive agreement to acquire the company

for a total equity value of U.S.$4.1 billion, representing a +125% premium to

the previous closing share price. Turning Point Therapeutics is a

clinical-stage precision oncology company with a pipeline of investigational

medicines designed to target the most common mutations associated with

oncogenesis. Their lead asset, repotrectinib, is a next generation, potential

best-in-class tyrosine kinase inhibitor, targeting the ROS1 and NTRK oncogenic

drivers of non-small cell lung cancer (NSCLC) and other advanced solid tumours.

Repotrectinib is expected to be approved in the U.S. in the second half of 2023

and become a new standard of care for patients with ROS1-positive NSCLC in the

first line setting. The merger transaction closed in the third quarter of 2022.

BioMarin Pharmaceutical, yet another California based small-mid-capitalisation

biotechnology company, rounds out the top five contributors. The company is

well known for developing and commercialising therapeutic enzyme products but

has more recently added efforts in gene therapy. Their lead asset, Roctavian

(valoctocogene roxaparvovec), is the first gene therapy for the treatment of

severe haemophilia A. A recent approval for Roctavian in Europe (August 2022)

and an imminent submission to the U.S. Food & Drug Administration (FDA)

(confirmed by the company in October 2022), helped push the share price higher

in the reported period. Additionally, the company's new product launch for

achondroplasia, Voxzogo (vosoritide), has been very successful. Multiple upward

sales revisions for Voxzogo through 2022 was also an important tailwind for the

share price.

Major Detractors from Performance

Investments that experienced negative returns were very diverse in nature,

including both sub-sector and geographic diversity, but all stocks seemingly

faced idiosyncratic events that pressured their respective share prices.

Horizon Therapeutics is a U.S. based specialty pharmaceutical company that

presided over one of the most successful drug launches ever in 2020. Tepezza

(teprotumumab) was developed by the company to treat "TED" or thyroid eye

disease, a painful, disfiguring, and debilitating disorder of the musculature

of the eye. Launched in January 2020, the drug was well on its way to

blockbuster status despite the commercial headwinds of the COVID-19 pandemic.

Despite a temporary government-mandated shutdown in the manufacturing of

Tepezza due to the prioritisation of COVID-19 vaccine production in early 2021,

the re-launch of the product in April 2021 exceeded expectations. Whilst this

success continued into early 2022, the sales growth for Tepezza then began to

unexpectedly flatten, and the company reported second quarter sales that were

disappointing and full year sales guidance was lowered. Additionally, investors

learned that a key study (Tepezza usage in chronic patients) was delayed into

2023. As a result, the stock fell. We exited the position as the company

pondered new marketing initiatives and increased spend to re-invigorate Tepezza

sales in 2023, whilst awaiting trial results for the chronic indication.

One of the true pioneers of robotic-assisted surgery is Intuitive Surgical, a

medical equipment company based in California that developed the da Vinci

Surgical System - a combination of software, hardware, and optics that allows

doctors to perform robotically aided surgery from a remote console. In recent

months, tightening economic conditions and the rising interest rate environment

have fuelled investor concerns around a slowdown in the hospital capital

equipment spending cycle. In addition, growth stocks with high P/E based

valuations have come under pressure as investors have weighed the impact of

rising interest rates on discounted cash flow-based valuation models. Both

factors have adversely impacted the company's share price. On the positive

side, Intuitive Surgical's procedure volumes have continued to grow at a very

strong rate, which over time should increase current system utilisation levels

and result in hospitals acquiring additional systems. Also, heightened research

and development (R&D) levels over the past several years and historical system

launch timelines suggest the company is on the verge of another new system

launch, an event that would be a strong catalyst for Intuitive shares.

The French global pharmaceutical company, Sanofi, is a worldwide leader in the

treatment of inflammatory diseases, orphan medicines, and vaccine development.

However, increasing investor concerns over product liability claims from a drug

that was first approved in the 1980s took the stock lower in the reported

period. Zantac (ranitidine) was first launched by GSK in 1983 as a novel

medication for the treatment of stomach ulcers and soon became one of the

bestselling prescription medications of its era. The combination of

well-established efficacy and safety provided the confidence to the FDA to

approve over the counter (OTC) versions of Zantac in 2004. Sanofi subsequently

acquired the OTC marketing rights to Zantac from Boehringer Ingelheim in 2017.

However, On September 13, 2019, the FDA issued a statement alerting the public

that some ranitidine medicines, including OTC Zantac, contained a nitrosamine

impurity called N-nitrosodimethylamine (NDMA) at low levels. NDMA, at certain

levels of exposure, is considered a "probable" human carcinogen. With

insufficient evidence as to the immediate risk posed to individuals taking

Zantac, the agency did not institute a recall. Nevertheless, Sanofi, "out of an

abundance of caution" issued a voluntary recall of all Zantac products they

marketed in the U.S. and Canada in 2019. As is customary in the U.S., an

onslaught of lawsuits quickly began to pile up against Sanofi (and all other

manufacturers). Yet inexplicably, three years later on 11 August 2022, despite

no new news or headlines, a sudden and rapid rise of investor concerns over

imminent legal decisions around Sanofi's potential financial liability led to a

precipitous fall in the company's share price. Whilst the company responded

swiftly and strongly with a very rational defence through a comprehensive press

release, the share price remained depressed. We viewed the share price drop as

excessive and not representative of any future liabilities, if any.

The medical technology company, Edwards Lifesciences, is a developer of tissue

replacement heart valves, and more specifically transcatheter heart valves

(THV). The company's current valve portfolio is largely comprised of

transcatheter aortic heart valves (TAVR), a market which has been growing

solidly in the double-digit range but experienced some disruption in the second

quarter of the year due to medical imaging agent shortages and elevated summer

vacation schedules for physicians. This has fuelled investor concerns that the

market is maturing and is one of the primary reasons for prolonged weakness in

the share price during the reported period. Other headwinds on the stock were

mostly macro in nature, including the negative sentiment for growth stocks and

rising interest rates. That said, whilst some investors remain concerned that

the slowdown in the TAVR market will continue, we believe the recent slowdown

is more one time in nature. Moreover, as the company enters 2023, a significant

new product cycle in the transcatheter mitral heart valve (TMVR) market will

launch, which has the potential to accelerate top line growth.

Located in the Pacific-Northwest of the United States, NanoString Technologies

is a life science tools company that develops technology for gene expression

and spatial biology analysis (the study of human tissues within their own 2D or

3D context, a new frontier of molecular biology). However, the company reported

negative preliminary first quarter results in April, due to uneven quarterly

sales execution, as well as negative impacts from a re-alignment of the

commercial team. The stock fell in response, and we exited the position. The

share price continued to sell off into the end of the reported period.

Derivative Strategy

The Company has the ability to use equity swaps and options. During the half

year the Company employed single stock equity swaps to gain exposure to

emerging market Chinese and Indian stocks. In a difficult market environment

for emerging market securities, these detracted £21.8m from performance.

In addition, the Company invested in a customised tactical basket swap looking

to take advantage of depressed valuations in small and mid-capitalisation

therapeutics companies that, in our view, would be attractive acquisition

targets for larger companies. Merger activity has started to increase during

the period and this tactical basket contributed gains of £5.1m despite

unprecedented market turmoil.

Further explanation regarding swaps can be found in the Glossary.

Leverage Strategy

Historically, the typical leverage level employed by the Company has been in

the mid-to-high teens range. Considering the market volatility during the past

three financial years, we have, more recently, used leverage in a more tactical

fashion. For example, around the beginning of the COVID-19 pandemic in March

2020 after the dramatic "V"-shape market recovery of April 2020, leverage was

significantly reduced by over 10% month-over-month, to 3% and ultimately to 1%

in May 2020. Another example includes lowered leverage ahead of and into the

U.S. Presidential election, under the threat of a Democratic "sweep" of the

U.S. Congress.

More recently, we have increased leverage back into the low-to-mid-teens, a

reflection of our overall bullishness on the portfolio, a turn in biotechnology

stocks, and the relative outlook for healthcare ahead of a potential recession.

One caveat that keeps us from extending leverage even further, is the volatile

and uncertain macro backdrop, either economic in nature or even further

geopolitical unsettlement in the east.

Sector Developments

Whilst 2021 was a difficult year for many parts of healthcare equities given

excessive macro headwinds, 2022 saw many of these overhangs begin to lift.

Certainly, one of those overhangs was the perception that the FDA was

"rudderless"; without a commissioner since January 2021 and still pressured by

the demands brought by the COVID-19 pandemic. However, in February 2022, a new

(albeit recycled) commissioner was finally confirmed. Dr. Robert Califf, a

world?renowned cardiologist and previous FDA commissioner in the Obama

Administration, was approved by the U.S. Senate just ahead of the Company's

current financial year. He is viewed as "industry friendly" and we expect his

efforts to continue to align with the impressive productivity that the FDA has

achieved over the past five plus years.

Also of import at the FDA is the continued record-breaking pace of new drug

approvals. With another 50 novel prescription medicines approved by the agency

in 2021, the past five years have been the most productive period in the past

two decades. Overall, we think investor perception of the FDA is going to

improve immensely and any misperception of a slow down at the agency should

continue to diminish.

Perhaps the largest sector development that has occurred during the period

under review is new legislation that was approved by the U.S. Senate and signed

into law in July 2022 - the Inflation Reduction Act of 2022 ("IRA") - which

settled concerns about prescription drug price reform. The threat of drug price

reform in the U.S. has been a persistent source of uncertainty and negative

sentiment, an overhang for the biopharmaceutical sector for decades, but

particularly over the past two years since President Biden took office. Given

the narrow Democratic congressional majorities, the IRA was modest in scope and

included a mix of positive and negative factors for the biopharmaceutical

industry.

On the negative side, a selected group of up to 10 drugs per year will be

subject to price negotiation beginning in 2026. The legislation narrowly

focuses on older drugs (9 to 13 years after FDA approval) with no generic

competitors. As a result of these restrictions, we estimate a modest

mid-single-digit reduction in pharmaceutical industry revenues in the coming

decade.

On the positive side, the IRA provided additional funding to limit

"out-of-pocket" spending on drugs for Medicare beneficiaries, which should

increase the affordability (and usage) of many medicines. Additionally, the IRA

includes a drug price inflation cap, which will require pharmaceutical

companies to pay rebates to Medicare if they increase drug prices faster than

inflation or face penalties for doing so. We view this as neutral as price

increases have not been a major revenue driver for the industry for some time.

In fact, this may be construed as a positive as it will curb some small company

bad actors who sometimes grab headlines for egregious price increases. Overall,

we view the IRA as very manageable for the biopharmaceutical sector, with

limited impact on profits into the end of the decade, and perhaps the issue of

drug price reform can now begin to dissipate as an overhang on the sector.

U.S. Drug Price Reform Impact: Mixed but Manageable

We are perennial optimists about the pace of M&A activity in the

biopharmaceutical sector. With the insatiable need for the large capitalisation

companies to continue to fill their pipelines and replace revenues lost to

patent expirations, this is a logical view. However, there is, ultimately, a

natural ebb and flow to M&A activity due to a variety of external factors. With

that, 2021 was a down year for M&A and there was a dearth of activity at the

beginning of 2022. However, come mid?year, M&A activity has virtually exploded.

With the historic small-mid-capitalisation biotechnology stock sell-off and

large capitalisation executives talking up the need to execute deals, a

plethora of transactions began in earnest, inflecting in June 2022 and beyond.

We expect total deal volumes to eclipse recent highs, with significant average

deal value and premiums paid. We expect this recent acceleration to continue

into 2023, as evidenced by this recent comment by Johnson & Johnson CFO Joseph

Wolk and their most recent quarterly call (18 October 2022) when asked about M&

A: "We still hold U.S.$34 billion of cash, which positions us extremely well to

continue exercising that lever of capital allocation around acquisitions or

significant collaborations, going forward. So, our priorities have not changed.

In fact, maybe we are even a little bit more bullish and eager to do something

(M&A wise)".

Across healthcare, innovation remains a critical theme, and the

biopharmaceutical sector continues to deliver essential new therapies for unmet

medical needs at a blistering pace. In particular, two highly anticipated

clinical catalysts occurred this period for which investor expectations were

decidedly negative, yet both were notably positive. The first was Alnylam

Pharmaceuticals' Phase 3 study of Onpattro (patisiran) in the treatment of

patients with amyloidosis-induced cardiomyopathy, a rare disease that weakens

heart muscle. Data showed unequivocal improvement in walk test scores and

quality of life for these very sick patients.

More dramatically, Eisai and Biogen released positive results in a Phase 3

Alzheimer's disease trial for the beta?amyloid?targeted antibody, lecanemab,

that showed a remarkable 27% reduction in cognitive decline after 18 months.

This data was precedent setting; the first registrational trial ever to show

true disease modification in the treatment of Alzheimer's disease. The benefits

of lecanemab therapy began to appear as early as six months - and the benefit

continued to increase at 12 and 18 months - suggesting a duration of efficacy

beyond the parameters of the trial. Moreover, the results were highly

statistically significant, indicating that this effect should be very

reproducible across the spectrum of patients with mild-to-moderate disease and

provide confidence to prescribing physicians and caregivers that a clinically

meaningful impact will be observed. Finally, we note that the safety of

lecanemab also exceeded expectations, with the incidence of symptomatic brain

swelling being exceptionally low. The full data set will be released in late

November 2022 and is likely sufficient to warrant FDA approval. Overall, we

view this result as an unequivocal win for the companies and patients, but a

big win for the healthcare sector as the consensus expectation was that this

trial would fail.

Importantly, this clinical trial further validates the amyloid beta hypothesis

for treating Alzheimer's, increasing the odds of success for similar therapies

from Eli Lilly, and others. Based on our team's proprietary assessment of the

molecule and Phase 3 clinical trial design, the portfolio was well positioned

for this event, with important equity positions in Eisai and Roche. Whilst

Roche disclosed in November 2022 that their antibody failed to show a

statistical difference in treated patients, we do note there was a positive

trend for clinical benefit versus placebo in patients receiving Roche's

experimental medicine, a modest but supportive observation. Dementia from

Alzheimer's is a genuinely staggering unmet medical need, with over six million

afflicted in the U.S. alone and we remain optimistic about the commercial

opportunity new therapies will present.

Outlook

Finally, we note that the equity markets remain challenging due to many

volatile factors, including rising interest rates, accelerating inflation,

currency fluctuations, and significant geopolitical risks. With recession risk

looming, we take this opportunity to remind investors of the defensive

qualities among various healthcare sub-sectors. Overall, we view the

biopharmaceutical sector as the most resilient to recessionary pressures given

consistent demand across economic volatility and prior track record of

maintaining revenue growth during economic slowdowns.

Moreover, the history of share price outperformance during prior downturns is

evident for therapeutic stocks as the outlook for these companies is primarily

driven by their ability to bring new drugs to market to meet unmet medical

needs - either through internal R&D or external M&A. Government and private

payers have shown consistent willingness to reimburse new prescription

medicines regardless of the economic climate. Whilst there may be moderate

utilisation and pricing downside, we expect the extent of the headwinds to be

manageable, particularly when comparing with those during the 2008 period and

when considering the group's ability to maintain margins during the 2008

downturn. To note, a positive outlook for healthcare is evidenced by the

group's outperformance vs. the S&P 500 in each of the last four recessions.

Sven H. Borho and Trevor M. Polischuk

OrbiMed Capital LLC

Portfolio Manager

22 November 2022

Principal Stock Contributors to and Detractors from Absolute Net Asset Value

Performance

For the Six Months Ended 30 September 2022

Contribution

Contribution per share*

Top Five Contributors Country Sector £'000 £

Global Blood Therapeutics** USA Biotechnology 30,805 0.5

Humana USA Healthcare Services 27,962 0.4

Shanghai Bio-Heart Biological China Healthcare Equipment/ 22,129 0.3

Technology Supplies

Turning Point Therapeutics** USA Biotechnology 19,464 0.3

BioMarin Pharmaceutical USA Biotechnology 18,353 0.3

Top Five Detractors

Nanostring Technologies** USA Life Sciences Tools/ (8,766) (0.1)

Services

Edwards Lifesciences USA Healthcare Equipment/ (12,316) (0.2)

Supplies

Sanofi USA Pharmaceuticals (16,586) (0.3)

Intuitive Surgical USA Healthcare Equipment/ (26,149) (0.4)

Supplies

Horizon Therapeutics** USA Pharmaceuticals (29,324) (0.5)

*Based on 65,045,376 shares being the weighted average number in issue during

the period.**Not held at 30 September 2022

Source: Frostrow Capital LLP

Portfolio

As At 30 September 2022

Market value % of

Investments Country £'000 investments

Bristol-Myers Squibb USA 139,570 6.0

AstraZeneca United Kingdom 138,762 6.0

Humana USA 115,701 5.0

UnitedHealth Group USA 101,578 4.4

Boston Scientific USA 98,263 4.2

BioMarin Pharmaceutical USA 80,246 3.5

Pfizer USA 77,273 3.3

Intuitive Surgical USA 76,266 3.3

Vertex Pharmaceuticals USA 76,092 3.3

Roche Holding Switzerland 73,586 3.2

Top 10 investments 977,337 42.2

AbbVie USA 72,206 3.1

Thermo Fisher Scientific USA 71,597 3.1

Sanofi France 71,124 3.1

Stryker USA 69,458 3.0

Shanghai Bio-Heart Biological Technology China 68,686 3.0

Seagen USA 62,055 2.7

Edwards Lifesciences USA 59,497 2.6

Mirati Therapeutics USA 57,977 2.5

Neurocrine Biosciences USA 52,171 2.2

Sarepta Therapeutics USA 50,600 2.2

Top 20 investments 1,612,708 69.7

Argenx Netherlands 48,636 2.1

Evolent Health USA 47,190 2.0

Caris Life Science (unquoted) USA 46,029 2.0

Eisai Japan 42,758 1.8

Natera USA 42,263 1.8

Daiichi Sankyo Japan 40,874 1.8

Guardant Health USA 35,881 1.5

SI-BONE USA 29,669 1.3

Progyny USA 28,912 1.2

Alnylam Pharmaceuticals USA 24,179 1.0

Top 30 investments 1,999,099 86.2

Tenet Healthcare USA 24,087 1.0

Shanghai Kindly Medical Instruments China 20,556 0.9

Crossover Health (unquoted) USA 19,399 0.8

uniQure Netherlands 18,963 0.8

Chugai Pharmaceutical Japan 18,684 0.8

Dingdang Health Technology Group China 18,073 0.8

EDDA (unquoted) China 17,803 0.8

WuXi AppTec China 17,378 0.7

API Holdings (unquoted) India 15,943 0.7

Ruipeng Pet Group (unquoted) USA 15,907 0.7

Top 40 investments 2,185,892 94.2

Market value % of

Investments Country £'000 investments

Beijing Yuanxin Technology (unquoted) USA 15,539 0.7

Joinn Laboratories China China 15,016 0.6

Visen Pharmaceutical (unquoted) China 14,020 0.6

RiMAG (unquoted) USA 12,247 0.5

Arrail Group China 11,975 0.5

Xenon Pharmaceuticals Canada 11,577 0.5

RxSight USA 9,930 0.4

Apollo Hospitals Enterprise India 9,094 0.4

Shanghai Fosun Pharmaceutical Group China 8,673 0.4

Alphamab Oncology China 8,158 0.3

Top 50 investments 2,302,121 99.1

Ionis Pharmaceuticals USA 7,774 0.3

MeiraGTx USA 7,162 0.3

Shenzhen Hepalink Pharmaceutical Group China 6,725 0.3

MabPlex International (unquoted) China 6,583 0.3

New Horizon Health China 5,824 0.2

Ikena Oncology USA 5,084 0.2

Iovance Biotherapeutics USA 5,055 0.2

Abbisko Cayman China 3,270 0.1

Achilles Therapeutics USA 2,617 0.1

Passage USA 2,341 0.1

Top 60 investments 2,354,556 101.2

Burning Rock Biotech China 1,481 0.1

Harpoon Therapeutics USA 1,266 0.1

Clover Biopharmaceuticals China 1,232 0.1

MicroTech Medical Hangzhou China 633 -

Peloton Interactive (DCC*-unquoted) USA 538 -

Vor BioPharma USA 399 -

Total equity investments 2,360,105 101.5

OTC Equity Swaps^

Healthcare M&A Target Swap USA 112,322 4.8

Apollo Hospitals India 36,951 1.6

Pharmaron Beijing China 17,587 0.8

Ningbo Menudo Pharmaceutical China 11,178 0.5

Air Eye Hospital China 9,435 0.4

Less: Gross exposure on financed swaps (223,740) (9.6)

Total OTC Swaps (36,267) (1.5)

Total investments including OTC Swaps 2,323,838 100.0

* DCC = deferred contingent consideration.

^ See Glossary for further information on swaps.

Summary

Market value % of

Investments £'000 investments

Quoted equities 2,196,097 94.4

Unquoted equities 164,008 7.1

Equity swaps (36,267) (1.5)

Total of all investments 2,323,838 100.0

Interim Management Report

Principal Risks and Uncertainties

The Directors continue to review the Company's key risk register, which

identifies the risks and uncertainties that the Company is exposed to, and the

controls in place and the actions being taken to mitigate them.

A review of the half year and the outlook for the Company can be found in the

Chair of the Board's Statement and the Review of Investments. The principal

risks and uncertainties faced by the Company include the following:

· Exposure to market risks and those additional risks specific to the

sectors in which the Company invests, such as political interference in drug

pricing.

· The Company uses leverage (both through derivatives and gearing) the

effect of which is to amplify the gains or losses the Company experiences.

· Macro events may have an adverse impact on the Company's performance by

causing exchange rate volatility, changes in tax or regulatory environments,

and/or a fall in market prices. Emerging markets, which a portion of the

portfolio is exposed to, can be subject to greater political uncertainty and

price volatility than developed markets.

· Unquoted investments are more difficult to buy, sell or value and so

changes in their valuations may be greater than for listed assets.

· The risk that the individuals responsible for managing the Company's

portfolio may leave their employment or may be prevented from undertaking their

duties.

· The risk that, following the failure of a counterparty, the Company

could be adversely affected through either delay in settlement or loss of

assets.

· The Board is reliant on the systems of the Company's service providers

and as such disruption to, or a failure of, those systems could lead to a

failure to comply with law and regulations leading to reputational damage and/

or financial loss to the Company.

· The risk that investing in companies that disregard Environmental,

Social and Governance (ESG) factors will have a negative impact on investment

returns and also that the Company itself may become unattractive to investors

if ESG is not appropriately considered in the Portfolio Manager's decision

making process.

· The risk, particularly if the investment strategy and approach are

unsuccessful, that the Company may underperform, resulting in the Company

becoming unattractive to investors and a widening of the share price discount

to the net asset value per share. Also, falls in stock markets, such as those

experienced as a consequence of the COVID-19 pandemic, and the risk of a global

recession, are likely to adversely affect the performance of the Company's

investments.

Further information on these risks is given in the Annual Report for the year

ended 31 March 2022. The Board has noted that global markets are continuing to

experience unusually high levels of uncertainty and heightened geopolitical

risks. Russia's invasion of Ukraine has created near-term risks for markets

such as high energy prices, rising food prices and also disrupted supply

chains, contributing to a substantial increase in global inflation. Against a

background of rising interest rates and slowing economic growth, risks

associated with leverage and illiquid assets, especially in combination, have

become more elevated. The Board has investment guidelines in place to mitigate

these risks.

Related Party Transactions

During the first six months of the current financial year no material

transactions with related parties have taken place which have affected the

financial position or the performance of the Company during the period.

Going Concern

The Directors believe, having considered the Company's investment objectives,

risk management policies, capital management policies and procedures, the

nature of the portfolio and expenditure projections, that the Company has

adequate resources, an appropriate financial structure and suitable management

arrangements in place to continue in operational existence for the foreseeable

future and, more specifically, that there are no material uncertainties

relating to the Company that would prevent its ability to continue in such

operational existence for at least 12 months from the date of the approval of

this half yearly financial report. For these reasons, they consider there is

reasonable evidence to continue to adopt the going concern basis in preparing

the accounts. In reviewing the position as at the date of this report, the

Board has considered the guidance issued by the Financial Reporting Council.

As part of their assessment, the Directors have given careful consideration to

the next continuation vote to be held in 2024. As previously reported, stress

testing was carried out in May 2022, which modelled the effects of substantial

falls in markets and significant reductions in market liquidity, on the

Company's net asset value, its cash flows and its expenses.

Directors' Responsibilities

The Board of Directors confirms that, to the best of its knowledge:

i. the condensed set of financial statements contained within the Half Year

Report have been prepared in accordance with Financial Reporting Standard

104 (Interim Financial Reporting); and

ii. the interim management report includes a true and fair review of the

information required by:

a. DTR 4.2.7R of the Disclosure Guidance and Transparency Rules, being an

indication of important events that have occurred during the first six

months of the financial year and their impact on the condensed set of

financial statements; and a description of the principal risks and

uncertainties for the remaining six months of the year; and

b. DTR 4.2.8R of the Disclosure Guidance and Transparency Rules, being related

party transactions that have taken place in the first six months of the

current financial year and that have materially affected the financial

position or performance of the entity during that period; and any changes

in the related party transactions described in the last annual report that

could do so.

The Half Year Report has not been reviewed or audited by the Company's

auditors.

This Half Year Report contains certain forward-looking statements. These

statements are made by the Directors in good faith based on the information

available to them up to the date of this report and such statements should be

treated with caution due to the inherent uncertainties, including both economic

and business risk factors, underlying any such forward?looking information.

For and on behalf of the Board

Doug McCutcheon

Chair

22 November 2022

Income Statement

For the Six Months Ended 30 September 2022

(Unaudited) (Unaudited)

Six months ended Six months ended

30 September 2022 30 September 2021

Revenue Capital Revenue Capital

Return Return Total Return Return Total

£'000 £'000 £'000 £'000 £'000 £'000

Gains/(losses) on investments - 82,697 82,697 - (5,449) (5,449)

Foreign exchange losses - (15,052) (15,052) - (4,482) (4,482)

Income from investments (note 2) 9,295 - 9,295 11,246 - 11,246

AIFM, portfolio management, and (444) (8,430) (8,874) (483) 9,706 9,223

performance fees (note 3)

Other expenses (579) (22) (601) (467) - (467)

Net return/(loss) before finance charges 8,272 59,193 67,465 10,296 (225) 10,071

and taxation

Finance charges (61) (1,157) (1,218) (16) (308) (324)

Net return/(loss) before finance 8,211 58,036 66,247 10,280 (533) 9,747

Taxation (323) - (323) (1,287) - (1,287)

Net return/(loss) after taxation 7,888 58,036 65,924 8,993 (533) 8,460

Return/(loss) per share (note 4) 12.1p 89.2p 101.3p 13.8p (0.8)p 13.0p

The "Total" column of this statement is the Income Statement of the Company.

The "Revenue" and "Capital" columns are supplementary to this and are prepared

under guidance published by the Association of Investment Companies.

All revenue and capital items in the above statement derive from continuing

operations.

The Company has no recognised gains and losses other than those shown above and

therefore no separate Statement of Total Comprehensive Income has been

presented.

The accompanying notes are an integral part of these statements.

Statement of Changes in Equity

For the Six Months Ended 30 September 2022

(Unaudited) (Unaudited)

Six months Six months

ended ended

30 September 30 September

2022 2021

£'000 £'000

Opening shareholders' funds 2,268,233 2,381,425

Issue of new shares - 41,676

Shares purchased for treasury (36,086) -

Return for the period 65,924 8,460

Dividends paid - revenue (12,721) (10,085)

Closing shareholders' funds 2,285,350 2,421,476

Statement of Financial Position

As at 30 September 2022

(Unaudited) (Audited)

30 September 31 March

2022 2022

£'000 £'000

Fixed assets

Investments 2,360,105 2,379,848

Derivatives - OTC swaps 2,189 283

2,362,294 2,380,131

Current assets

Debtors 3,367 14,724

Cash and cash equivalents 55,105 26,594

58,472 41,318

Current liabilities

Creditors: amounts falling due within one year (96,960) (147,804)

Derivative - OTC Swaps (38,456) (5,412)

(135,416) (153,216)

Net current liabilities (76,944) (111,898)

Total net assets 2,285,350 2,268,233

Capital and reserves

Ordinary share capital - (note 5) 16,265 16,385

Capital redemption reserve 8,341 8,221

Share premium account 841,599 841,599

Capital reserve 1,402,988 1,381,038

Revenue reserve 16,157 20,990

Total shareholders' funds 2,285,350 2,268,233

Net asset value per share - (note 6) 3,550.7p 3,465.2p

Cash Flow Statement

For the Six Months Ended 30 September 2022

(Unaudited) (Unaudited)

Six months Six months

ended ended

30 September 30 September

2022 2021

Note £'000 £'000

Net cash inflow/(outflow) from operating activities 8 3,678 (13,453)

Purchases of investments and derivatives (460,385) (540,411)

Sales of investments and derivatives 580,399 384,014

Realised losses on foreign exchange (14,343) (1,770)

Net cash inflow/(outflow) from investing activities 105,671 (158,167)

Issue of shares - 44,253

Shares repurchased (36,086) -

Equity dividends paid (12,721) (10,085)

Interest paid (1,218) (324)

Net cash (outflow)/inflow from financing activities (50,025) 33,844

Decrease/(increase) in net debt 59,324 (137,776)

Cash flows from operating activities includes interest received of £592,000

(2021: £780,000) and dividends received of £9,235,000 (2021: £10,650,000).

Reconciliation of Net Cash Flow Movement to Movement in Net Debt

(Unaudited) (Unaudited)

Six months Six months

ended ended

30 September 30 September

2022 2021

£'000 £'000

Decrease/(increase) in net debt resulting from cashflows 59,324 (137,776)

Losses on foreign currency cash and cash equivalents (709) (2,712)

Movement in net debt in the period 58,615 (140,488)

Net debt at 1 April (87,003) (20,301)

Net debt at period end (28,388) (160,789)

Notes to the Financial Statements

1. Accounting Policies

The condensed Financial Statements for the six months to 30 September 2022

comprise the financial statements together with the related notes below. They

have been prepared in accordance with FRS 104 'Interim Financial Reporting',

the AIC's Statement of Recommended Practice published in February 2021 ('SORP')

and using the same accounting policies as set out in the Company's Annual

Report and Financial Statements at 31 March 2022.

Going Concern

After making enquiries, and having reviewed the Investments, Statement of

Financial Position and projected income and expenditure for the next 12 months,

the Directors have a reasonable expectation that the Company has adequate

resources to continue in operation for the foreseeable future. The Directors

have therefore adopted the going concern basis in preparing these condensed

financial statements.

Fair Value

Under FRS 102 and FRS 104 investments have been classified using the following

fair value hierarchy:

Level 1 - Quoted market prices in active markets

Level 2 - Prices of a recent transaction for identical instruments

Level 3 - Valuation techniques that use:

(i) observable market data; or

(ii) non-observable data

Level 1 Level 2 Level 3 Total

AS AT 30 SEPTEMBER 2022 £'000 £'000 £'000 £'000

Investments held at fair value through profit 2,196,097 - 164,008 2,360,105

or loss

Derivatives: OTC swaps (assets) - 2,189 - 2,189

Derivatives: OTC swaps (liabilities) - (38,456) - (38,456)

Financial instruments measured at fair value 2,196,097 (36,267) 164,008 2,323,838

Level 1 Level 2 Level 3 Total

AS AT 31 MARCH 2022 £'000 £'000 £'000 £'000

Investments held at fair value through profit 2,207,375 - 172,473 2,379,848

or loss

Derivatives: OTC swaps (assets) - 283 - 283

Derivatives: OTC swaps (liabilities) - (5,412) - (5,412)

Financial instruments measured at fair value 2,207,375 (5,129) 172,473 2,374,719

2. Income

(Unaudited) (Unaudited)

Six months ended Six months

ended

30 September 30 September

2022 2021

£'000 £'000

Investment income 9,295 11,246

Total 9,295 11,246

3. Aifm, Portfolio Management and Performance Fees

(Unaudited) (Unaudited)

Six months ended Six months ended

30 September 2022 30 September 2021

Revenue Capital Total Revenue Capital Total

£'000 £'000 £'000 £'000 £'000 £'000

AIFM fee 76 1,444 1,520 82 1,565 1,647

Portfolio management fee 368 6,986 7,354 401 7,617 8,018

Performance fee charge for the - - - - (18,888) (18,888)

period*

444 8,430 8,874 483 (9,706) (9,223)

* During the six months ended 30 September 2021, due to underperformance

against the Benchmark in the period, a reversal of prior period provisions

totalling £18,888,000 occurred.

As at 30 September 2022 no performance fees were accrued or payable (31 March

2022: nil accrued).

No performance fee could become payable by 30 September 2023.

See the Glossary for further information on the performance fee.

4. Return/(Loss) Per Share

(Unaudited) (Unaudited)

Six months Six months

ended ended

30 September 30 September

2022 2021

£'000 £'000

The return per share is based on the following figures:

Revenue return 7,888 8,993

Capital return/(loss) 58,036 (533)

Total return 65,924 8,460

Weighted average number of shares in issue for the period 65,053,457 65,108,269

Revenue return per share 12.1p 13.8p

Capital return/(loss) per share 89.2p (0.8)p

Total return per share 101.3p 13.0p

The calculation of the total, revenue and capital returns per ordinary share is

carried out in accordance with IAS 33, "Earnings per Share (as adopted in the

EU)".

5. Share Capital

Total

Treasury shares

Shares shares in issue

number number number

Issued and fully paid at 1 April 2022 65,457,246 80,509 65,537,755

Shares purchased for treasury (1,093,997) 1,093,997 -

Shares cancelled from treasury - (478,977) (478,977)

At 30 September 2022 64,363,249 695,529 65,058,778

(Unaudited) (Audited)

30 September 31 March

2022 2022

£'000 £'000

Issued and fully paid:

Nominal value of ordinary shares of 25p 16,265 16,385

During the period ended 30 September 2022 1,093,997 Ordinary Shares were bought

back by the Company into treasury at a cost of £36,086,000 (Year ended 31 March

2022: 80,509 bought back at a cost of £2,544,000) and 478,977 (31 March 2022:

nil) shares were cancelled.

6. Net Asset Value Per Share

The net asset value per share is based on the assets attributable to equity

shareholders of £2,285,350,000 (31 March 2022: £2,268,233,000) and on the

number of shares in issue at the period end of 64,363,249 (31 March 2022:

65,457,246).

7. Transaction Costs

Purchase transaction costs for the six months ended 30 September 2022 were £

705,000 (six months ended 30 September 2021: £461,000).

Sales transaction costs for the six months ended 30 September 2022 were £

592,000 (six months ended 30 September 2021: £403,000).

1. Reconciliation of Operating Return to Net Cash Inflow/(Outflow) from

Operating Activities

(Unaudited) (Unaudited)

Six months Six months

ended ended

30 September 30 September

2022 2021

£'000 £'000

Gains before finance costs and taxation 67,465 10,071

(Less: capital gain)/add: capital loss before finance charges (59,193) 225

and taxation

Revenue return before finance charges and taxation 8,272 10,296

Expenses charged to capital (8,452) 9,706

Decrease/(increase) in other debtors 525 (133)

Increase/(decrease) in provisions, and other creditors and 3,422 (31,781)

accruals

Net taxation suffered on investment income 19 (1,293)

Amortisation (108) (248)

Net cash inflow/(outflow) from operating activities 3,678 (13,453)

9. Principal Risks and Uncertainties

The principal risks facing the Company are listed in the Interim Management

Report. An explanation of these risks and how they are managed is contained in

the Strategic Report and note 16 of the Company's Annual Report & Accounts for

the year ended 31 March 2022.

10. Comparative Information

The condensed financial statements contained in this half year report do not

constitute statutory accounts as defined in section 434 of the Companies Act

2006. The financial information for the half years ended 30 September 2022 and

30 September 2021 has not been audited or reviewed by the Company's auditor.

The information for the year ended 31 March 2022 has been extracted from the

latest published audited financial statements of the Company. Those financial

statements have been filed with the Registrar of Companies. The report of the

auditor on those financial statements was unqualified, did not include a

reference to any matters to which the auditors drew attention by way of

emphasis without qualifying the report, and did not contain statements under

either section 498 (2) or 498 (3) of the Companies Act 2006.

Earnings for the first six months should not be taken as a guide to the results

for the full year.

Glossary of Terms and Alternative Performance Measures ("APMs")

Alternative Investment Fund Managers Directive ("AIFMD")

Agreed by the European Parliament and the Council of the European Union and

transposed into UK legislation, the AIFMD classifies certain investment

vehicles, including investment companies, as Alternative Investment Funds

("AIFs") and requires them to appoint an Alternative Investment Fund Manager

("AIFM") and depositary to manage and oversee the operations of the investment

vehicle. The Board of the Company retains responsibility for strategy,

operations and compliance and the Directors retain a fiduciary duty to

shareholders.

Benchmark

The performance of the Company is measured against the MSCI World Health Care

Index on a net total return, sterling adjusted basis. (Please see the

Glossary).

The net total return is calculated by reinvesting dividends after the deduction

of withholding taxes.

Discount Or Premium ("APM")

A description of the difference between the share price and the net asset value

per share. The size of the discount or premium is calculated by subtracting the

share price from the net asset value per share and is usually expressed as a

percentage (%) of the net asset value per share. If the share price is higher

than the net asset value per share the result is a premium. If the share price

is lower than the net asset value per share, the shares are trading at a

discount.

Emerging Biotechnology

Biotechnology companies with a market capitalisation less than $10 billion.

Equity Swaps

An equity swap is an agreement in which one party (counterparty) transfers the

total return of an underlying equity position to the other party (swap holder)

in exchange for a one-off payment at a set date. Total return includes dividend

income and gains or losses from market movements. The exposure of the holder is

the market value of the underlying equity position.

Your Company uses two types of equity swap:

· funded, where payment is made on acquisition. They are equivalent to

holding the underlying equity position with the exception of additional

counterparty risk and not possessing voting rights in the underlying; and,

· financed, where payment is made on maturity. As there is no initial

outlay, financed swaps increase economic exposure by the value of the

underlying equity position with no initial increase in the investments value -

there is therefore embedded leverage within a financed swap due to the deferral

of payment to maturity.

The Company employs swaps for two purposes:

· To gain access to individual stocks in the Indian, Chinese and other

emerging markets, where the Company is not locally registered to trade or is

able to gain in a more cost efficient manner than holding the stocks directly;

and,

· To gain exposure to thematic baskets of stocks (a Basket Swap). Basket

Swaps are used to build exposure to themes, or ideas, that the Portfolio

Manager believes the Company will benefit from and where holding a Basket Swap

is more cost effective and operationally efficient than holding the underlying

stocks or individual swaps.

Inflation Reduction Act 2022

U.S. legislation which became effective in August 2022. It contains a package

of measures to tackle inflation including lower prescription drug and

healthcare costs.

Leverage ("APM")

Leverage is defined in the AIFMD as any method by which the AIFM increases the

exposure of an AIF. In addition to the gearing limit the Company also has to

comply with the AIFMD leverage requirements. For these purposes the Board has

set a maximum leverage limit of 140% for both methods. This limit is expressed

as a percentage with 100% representing no leverage or gearing in the Company.

There are two methods of calculating leverage as follows:

The Gross Method is calculated as total exposure divided by Shareholders'

Funds. Total exposure is calculated as net assets, less cash and cash

equivalents, adding back cash borrowing plus derivatives converted into the

equivalent position in their underlying assets.

The Commitment Method is calculated as total exposure divided by Shareholders'

Funds. In this instance total exposure is calculated as net assets, less cash

and cash equivalents, adding back cash borrowing plus derivatives converted

into the equivalent position in their underlying assets, adjusted for netting

and hedging arrangements.

See the definition of Equity Swaps (in the Glossary) for more details on how

exposure through derivatives is calculated.

As at As at

30 September 2022 31 March 2022

Fair Value Exposure* Fair Value Exposure*

£'000 £'000 £'000 £'000

Investments 2,360,105 2,360,105 2,379,848 2,379,848

OTC equity swaps (36,267) 187,473 (5,129) 135,018

2,323,838 2,547,578 2,374,719 2,514,866

Shareholders' funds 2,285,350 2,268,233

Leverage % 11.5% 10.9%

* Calculated in accordance with AIFMD requirements using the Commitment

Method

MSCI World Health Care Index (The Company's Benchmark)

The MSCI information (relating to the Benchmark) may only be used for your

internal use, may not be reproduced or redisseminated in any form and may not

be used as a basis for or a component of any financial instruments or products

or indices. None of the MSCI information is intended to constitute investment

advice or a recommendation to make (or refrain from making) any kind of

investment decision and may not be relied on as such. Historical data and

analysis should not be taken as an indication or guarantee of any future

performance analysis, forecast or prediction. The MSCI information is provided

on an "as is" basis and the user of this information assumes the entire risk of

any use made of this information. MSCI, each of its affiliates and each other

person involved in or related to compiling, computing or creating any MSCI

information (collectively, the "MSCI Parties") expressly disclaims all

warranties (including, without limitation, any warranties of originality,

accuracy, completeness, timeliness, non-infringement, merchantability and

fitness for a particular purpose) with respect to this information. Without

limiting any of the foregoing, in no event shall any MSCI Party have any

liability for any direct, indirect, special, incidental, punitive,

consequential (including, without limitation lost profits) or any other

damages. (www.msci.com)

Net Asset Value ("NAV") Total Return ("APM")

The theoretical total return on shareholders' funds per share, reflecting the

change in NAV assuming that dividends paid to shareholders were reinvested at

NAV at the time the shares were quoted ex-dividend. A way of measuring

investment management performance of investment trusts which is not affected by

movements in discounts/premiums.

Six months to Year to

30 September 31

March

2022 2022

(p) (p)

Opening NAV per share 3,462.2 3,703.0

Increase/(decrease) in NAV per share 88.5 (237.8)

Closing NAV per share 3,550.7 3,465.2

% Change in NAV per share 2.6% (6.4%)

Impact of reinvested dividends 0.5% 0.6%

NAV per share Total Return 3.1% (5.8%)

Ongoing Charges ("APM")

Ongoing charges are calculated by taking the Company's annualised ongoing

charges, excluding finance costs, taxation, performance fees and exceptional

items, and expressing them as a percentage of the average daily net asset value

of the Company over the year.

Six months One year to

to

30 September 31 March

2022 2022

£'000 £'000

AIFM & Portfolio Management fees 8,874 18,765

Other Expenses 601 1,305

Total Ongoing Charges 9,475 20,070

Performance fees paid/crystallised - 12,861

Total 9,475 32,931

Average net assets 2,257,375 2,356,131

Ongoing Charges (annualised) 0.8% 0.9%

Ongoing Charges (annualised, including performance fees paid or 0.8% 1.4%

crystallised during the period)

Performance Fee

Dependent on the level of long-term outperformance of the Company, a

performance fee can become payable. The performance fee is calculated by

reference to the amount by which the Company's net asset value ("NAV")

performance has outperformed the Benchmark.

The fee is calculated quarterly by comparing the cumulative performance of the

Company's NAV with the cumulative performance of the Benchmark since the launch

of the Company in 1995. Provision is also made within the daily NAV per share

calculation as required and in accordance with generally accepted accounting

standards. The performance fee amounts to 15.0% of any outperformance over the

Benchmark (see page 43 of the Company's Annual Report & Accounts for the year

ended 31 March 2022 for further information).

In order to ensure that only sustained outperformance is rewarded, at each

quarterly calculation date any performance fee payable is based on the lower

of:

i. The cumulative outperformance of the investment portfolio over the

Benchmark as at the quarter end date; and

ii. The cumulative outperformance of the investment portfolio over the

Benchmark as at the corresponding quarter end date in the previous year.

The effect of this is that outperformance has to be maintained for a 12 month

period before the related fee is paid.

In addition, a performance fee only becomes payable to the extent that the

cumulative outperformance gives rise to a total fee greater than the total of

all performance fees paid to date.

Share Price Total Return ("APM")

Return to the investor on mid-market prices assuming that all dividends paid

were reinvested.

Six months to One year to

30 September 31 March

2022 2022

Opening share price 3,275.0 3,695.0

Increase/(decrease) in share price 40 (420.0)

Closing share price 3,315.0 3,275.0

% Change in share price 1.2% (11.4%)

Impact of reinvested dividends 0.7% 0.6%

Share price Total Return 1.9% (10.8%)

For and on behalf of

Frostrow Capital LLP, Secretary

22 November 2022

- ENDS -

END

(END) Dow Jones Newswires

November 23, 2022 02:00 ET (07:00 GMT)

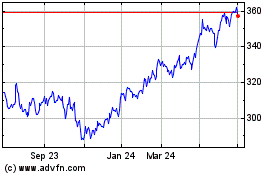

Worldwide Healthcare (LSE:WWH)

Historical Stock Chart

From Mar 2024 to Apr 2024

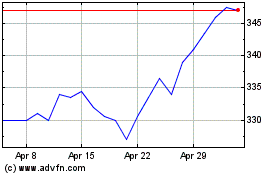

Worldwide Healthcare (LSE:WWH)

Historical Stock Chart

From Apr 2023 to Apr 2024