TIDMYCA

RNS Number : 6863A

Yellow Cake PLC

24 January 2024

24 January 2024

Yellow Cake plc ("Yellow Cake" or the "Company")

QUARTERLY OPERATING UPDATE

Yellow Cake, a specialist company operating in the uranium

sector holding physical uranium ("U(3) O(8) ") for the long term,

is pleased to report its performance for the quarter ended 31

December 2023 (the "Quarter").

Highlights

Market Highlights

-- The uranium spot price increased 23.8% from US$73.50/lb ([1])

on 30 September 2023 to US$91.00/lb ([2]) as at 31 December 2023

and is currently US$105.00/lb. [3]

-- The global uranium market remains supply constrained. Limited

supply from inventories, geo-political issues, including the

on-going Russia-Ukraine war, announced delays in production

ramp-ups coupled with rising uranium demand continues to exert

upward pressure on the uranium price which reached US$106.00/lb on

15 January 2024. These factors may contribute to further upward

pressure on the uranium spot price in the near- to medium-term.

Company Highlights

-- Following the completion of a further oversubscribed share

placing on 2 October 2023 which raised gross proceeds of

approximately GBP103 million (approximately US$125 million), Yellow

Cake informed Kazatomprom that it had elected to purchase 1,526,717

lb of U(3) O(8) at a price of US$65.50/lb, or US$100.0 million in

aggregate, exercising the entirety of the Company's 2023 uranium

purchase option under its Framework Agreement with Kazatomprom.

Yellow Cake expects delivery to take place in June 2024. On

completion of this purchase, Yellow Cake will hold 21.68 million lb

of U(3) O(8) .

-- The value of U(3) O(8) held increased 23.8% over the Quarter

from US$1,481.4 million as at 30 September 2023 to US$1,834.2

million as at 31 December 2023 as a result of a corresponding

increase in the uranium spot price.

-- Estimated net asset value per share increased 15.0% over the

Quarter from GBP6.18 per share [4] as at 30 September 2023 to

GBP7.11 per share [5] as at 31 December 2023, a result of the

increase in the uranium price, partly offset by the appreciation of

Sterling over the Quarter.

-- Yellow Cake's estimated proforma net asset value on 23

January 2024 was GBP8.40 per share or US$2,308.9 million, assuming

21.68 million lb of U(3) O(8) [6] valued at a spot price of

US$105.00/lb [7] and cash and other current assets and liabilities.

[8]

-- All U(3) O(8) to which the Company has title and has paid

for, is held at the Cameco storage facility in Canada and the Orano

storage facility in France. The Company's operations, financial

condition and ability to purchase and take delivery of U(3) O(8)

from Kazatomprom, or any other party, have to date remained

unaffected by the geopolitical events in Ukraine.

Andre Liebenberg, CEO of Yellow Cake, said:

" We were proud to pass the considerable milestone of a US$ 2

billion market value, up from US$200 million when we first listed

in 2018. Since then, we have remained committed to our stated

strategy and delivered significant value to our shareholders

through the buying and holding of physical uranium. Though the

uranium price reached a 16-year high this month, we continue to

believe the same supply-demand characteristics that have made the

investment case in Yellow Cake so compelling, remain as relevant

today as they did in 2018. The uranium market is still under

stress, driven by limited supply as a result of geopolitical

factors and project ramp-up delays, alongside rising demand as

nuclear power gains market share worldwide due to the need to

decarbonise our energy supply. We remain confident in the outlook

for uranium and for Yellow Cake. "

Uranium Market Developments and Outlook

Global Uranium Market

The uranium spot price rose very significantly during the

Quarter as emerging demand was met with limited supply. UxC data

indicated that a total of 15.1 million pounds of U(3) O(8) were

transacted over the three-month period, with the uranium spot price

increasing from US$73.50/lb at the end of September 2023 to

US$91.00/lb at the end of December 2023, an increase of almost 30%.

The global spot uranium price began 2023 at US$48.00/lb gaining

US$43.00/lb by year-end, an increase of almost 90%.

Price indicators reflecting the longer-term uranium market

strengthened over the Quarter as the 3-year forward price rose from

US$75.00/lb up to US$96.00/lb and the 5-year forward price

increased from US$79.00/lb reaching US$101.00/lb by the end of

December. The Long-Term uranium price indicator showed moderate

improvement from the end of September figure of US$61.00/lb

compared to the end of December level of US$68.00/lb, an increase

of 11.5% over the period. [9] [10]

Nuclear Generation / Uranium Demand

During the Quarter, the Council of Ministers of Bulgaria

approved the construction of Kozloduy nuclear power plant - Unit 7

and preparatory work for Unit 8, both of which will be AP1,000

reactors. The target date for commercial operation of Unit 7 has

been set at 2033, while Unit 8 is expected to follow two to three

years later. The planned capacity of the two units will total 2,300

Mwe, which exceeds the aggregate capacity of the four closed units

located at Kozloduy. [11]

Slovenian utility GEN Energy is considering the construction of

two large reactors totalling 2,400 Mwe (JEK2 Project). Three

reactor suppliers, Westinghouse, EDF and KHNP, are competing for

the business with a decision expected by 2028 and a commercial

operation date in the 2030s. At the present time, Slovenia has a

single 696 Mwe pressurised water reactor, Krsko, jointly owned with

Croatia, which provides approximately one-third of the country's

electricity. [12]

In September 2023, the Swedish government decided to table a

proposed amendment to the country's nuclear energy regulations

(Environmental Code) which would remove the current stipulation

that any new nuclear reactor can only be authorised if it replaces

a permanently closed reactor and must be built on a site where one

of the existing reactors is located. The recently elected

government is also pursuing legislation which would address the

potential development of small modular reactors ("SMRs") in Sweden.

[13]

Finnish utility, Teollisuuden Voima Oyj ("TVO") announced that

it had initiated an environmental impact assessment for the

possible operating license extension and potential power uprating

of Units 1 and 2 at its Olkiluoto nuclear power plant. The two

units which supply 15% of Finland's annual electricity needs, were

granted a 20-year operating license extension in 2018 allowing for

operations until the end of 2038. TVO is considering applying for a

further 10-year extension. [14]

Norsk Kjernkraft submitted a proposal to Norway's Ministry of

Oil and Energy for an assessment of the construction of a power

plant based on multiple SMRs in the municipalities of Aure and

Heim. Once approved by the government agency, the environmental

impact assessment phase can begin. In June, the company signed a

letter of intent with TVO Nuclear Services, a consulting company

wholly owned by the Finnish utility TVO, to jointly investigate the

suitability and effectiveness of the development of nuclear power

in Norway. [15]

In November 2023, the Cabinet of Ministers of Sri Lanka approved

a sweeping reform bill (Electricity Act) providing for the

unbundling and restructuring of the Ceylon Electricity Board

("CEB"), the country's electricity provider. The CEB has included

nuclear power from 2030 under scenarios in its long-term energy

plans. [16]

In November 2023, the United States and the Philippines executed

a 123 Agreement addressing nuclear cooperation between the two

countries. The Philippine government has committed to pursuing

nuclear power especially SMRs within the country as peak energy

demands are forecast to nearly quadruple by 2040. President Marcos

stated that the country envisions nuclear energy becoming a

component of the Philippine energy mix by 2032. [17]

Also in November 2023, the European Parliament adopted its

official position on the proposed Net-Zero Industry Act ("NZIA")

which aims to support Europe's manufacturing output in technologies

needed for decarbonisation. The MEPs included nuclear fission and

fusion amongst the list of 17 technologies addressed by the

legislation. The NZIA sets a target for Europe to produce 40% of

its annual deployment needs in net zero technologies by 2030 and to

capture 25% of the global market value for these technologies.

[18]

On 25 December 2023, Russia and India executed agreements in

support of two additional Russian-designed VVER-1000 reactors to be

built at Kudankulam in the state of Tamil Nadu in southern India.

The two units will join an existing nuclear complex consisting of

two VVER-1000 reactors which entered commercial operation in 2014

and 2017, two additional units under construction since 2017 as

well as a further two reactors which entered construction in 2021.

[19]

Korea Hydro & Nuclear Power ("KHNP") announced the grid

connection of Unit 2 of the Shin Hanul nuclear power plant in South

Korea. The national utility stated that the 1,350 Mwe pressurized

water reactor was connected on 21 December 2023, becoming the

28(th) operating nuclear unit in the country. KHNP plans to

construct two additional APR-1,400 reactors at the site. [20]

On 27 December 2023, the Nuclear Regulation Authority ("NRA") of

Japan authorized fuel loading in Units 6 & 7 at the

Kashiwazaki-Kariwa nuclear power plant located in Niigata

prefecture. Unit-6 (1,315 Mwe) entered commercial operation in

January 1996 followed by Unit 7 (1,315 Mwe) which became

operational in December 1996. The massive Kashiwazaki facility,

owned and operated by Tokyo Electric Power Company ("TEPCO") with a

capacity of 8,212 Mwe has been off-line since 2012 following the

Fukushima nuclear accident in March 2011. [21]

Uranium/Nuclear Fuel Supply

In October 2023, Boss Energy announced the commencement of

uranium mining at its South Australia-based facility, Honeymoon.

Subsequent to being shut down in November 2013 due to depressed

uranium prices, the in-situ recovery project has undergone

refurbishment with initial production of uranium beginning during

the Quarter. The initial well field began pre-conditioning in the

lead up to feeding the processing plant prior to year-end. [22]

In October 2023, Orano took the decision to expand uranium

enrichment capacity at the Georges Besse 2 Uranium Enrichment

Plant, located at Tricastin, France. The facility entered operation

in 2011 reaching its current full production capacity of 7.5

million SWU (separative work units) in 2016, based on centrifuge

technology. The Orano board approved the planned expansion of 2.5

million SWU at a cost of 1.7 billion euros. [23]

On 7 November 2023, Cameco (49%) and Brookfield Asset

Management/Renewable Partners (51%) announced the completion of the

acquisition of Westinghouse Electric Company. The final enterprise

value totalled US$8.2 billion. The announcement went on to state

that "Westinghouse has a stable and predictable core business

generating durable cash flows. Like Cameco, Westinghouse has a

long-term contract portfolio, which positions it well to compete

for growing demand for new nuclear reactors and reactors services,

as well as fuel supplies and services needed to keep the global

fleet operating safely and reliably." [24]

Kazatomprom released its Q3 2023 Operations and Trading Update

which reported a slight decline in Kazakh uranium production for

the first nine months of the year (2023 - 39.8 million lb compared

to 2022 - 40.2 million lb) but reconfirmed its 2023 guidance at

53.3 - 55.9 million lb. However, the world's largest producer of

uranium cautioned that "issues associated with limited access to

certain key materials, such as sulfuric acid, remain persistent,

and might potentially have a negative impact on 2024 production."

The company reported that as of the first half of 2023, 58% of all

shipments of uranium from Kazakhstan to Western countries were

shipped through the Trans-Caspian International Transport Route

("TITR") and that it is expected that for the full year of 2023,

TITR shipments would represent 71% of Kazakhstan's shipments to

Western countries. [25]

Following the Quarter-end, Kazatomprom announced that it

expected its 2024 production to be adjusted due to the challenges

related to the availability of sulphuric acid, a critical operating

material, as well as delays in completing construction works at the

newly developed deposits. The company stated that the exact impact

on the Company's operational performance was being assessed and

would be detailed in their Q4 2023 Trading Update, expected to be

released no later than 1 February 2024. [26]

The EURATOM Supply Agency ("ESA") distributed its Annual Report

for 2022 which documents various aspects of the nuclear fuel cycle

within the European Union. According to the ESA's survey of the 103

reactors operating in 13 Member Countries as of the end of 2022,

future uncovered uranium requirements through 2031 range from a

minimum of 51.9 million lb (assuming all current supply agreements

are honoured) and a maximum of 87.5 million lb (assuming

Russian-sourced agreements are not completed as scheduled). Total

uranium inventories held by EU utilities at the end of 2022

approximated 92.8 million lb, a decrease from the aggregate

inventories held at the end of 2021 (95.7 million lb). During 2022,

the purchases of Russian-origin uranium declined by 16% to 5.2

million lb compared to 2021 buying levels. [27]

On 11 December 2023, the US House of Representatives passed the

Prohibiting Russian Uranium Imports Act (H.R. 1042). If enacted,

the bill would ban Russian uranium imports 90 days after enactment

but would allow individual utilities to request a waiver from the

US Department of Energy if there are no other viable fuel sources

available to support the operation of a specific nuclear reactor or

nuclear company. A companion bill (S. 763) must now be passed by

the US Senate before the legislation can be signed into law by

President Biden. [28]

Nuclear Power Forecasts

The International Atomic Energy Agency ("IAEA") released its

latest nuclear power forecast to 2050. The international nuclear

regulatory agency now foresees a High Case installed nuclear

generating capacity in 2050 of 890 Gwe, an increase over the 2020

forecast of 24%. [29]

The International Energy Agency ("IEA") published its latest

forecast, "World Energy Outlook 2023." The Net Zero emissions

("NZE") scenario now projects more than a doubling of installed

nuclear capacity from the current 417 GWe, increasing to 916 GWe by

2050, up from 871 GWe in the 2022 edition. Large-scale reactors

remain the dominant form of nuclear power in all scenarios,

including advanced reactor designs, but the development of and

growing interest in SMRs increases the potential for nuclear power.

[30]

During the World Climate Action Summit of the 28(th) Conference

of the Parties to the UN Framework Convention ("COP28"), more than

20 countries lead by the United States, France, Japan, Republic of

Korea, United Arab Emirates and the United Kingdom, launched the

Declaration to Triple Nuclear Energy. The Declaration "recognises

the key role of nuclear energy in achieving global net-zero

greenhouse gas emissions by 2050 and keeping the 1.5-degree goal

within reach." [31]

Market Outlook

The global uranium market remains supply constrained. Limited

supply from inventories, geo-political issues including the

on-going Russia-Ukraine war, announced delays in production

ramp-ups coupled with rising uranium demand continues to exert

upward pressure on the uranium price which reached US$106.00/lb by

15 January 2024. These factors may contribute to further price

increases in the near- to medium-term.

Net Asset Value

Yellow Cake's estimated net asset value on 31 December 2023 was

GBP7.11 per share or US$1,966.4 million, consisting of 20.16

million lb of U(3) O(8) , valued at a spot price of US$91.00/lb

[32] and cash and other current assets and liabilities of US$132.2

million. [33]

Yellow Cake Estimated Net Asset Value as at 31 December

2023

--------------------------------------------------------------------------

Units

Investment in Uranium

Uranium oxide in concentrates

("U(3) O(8) ") (A) lb 20,155,601

U(3) O(8) fair value per pound

(37) (B) US$/lb 91.00

(A) x (B)

U(3) O(8) fair value = (C) US$ m 1,834.2

------------

Cash and other net current

assets/(liabilities) (38) (D) US$ m 132.2

(C) + (D)

Net asset value in US$ m = (E) US$ m 1,966.4

------------

Exchange Rate ( [34] ) (F) USD/GBP 1.2747

(E) / (F)

Net asset value in GBP m = (G) GBP m 1,542.6

Number of shares in issue

less shares held in treasury

( [35] ) (H) 216,856,447

Net asset value per share (G) / (H) GBP/share 7.11

---------------------------------- ----------- ----------- ------------

Yellow Cake's estimated proforma net asset value on 23 January

2024 was GBP8.40 per share or US$2,308.9 million, based on 21.68

million lb of U(3) O(8) [36] valued at a spot price of US$105.00/lb

[37] and cash and other current assets and liabilities of US$132.2

million as at 31 December 2023 less cash consideration of US$100.0

million to be paid to Kazatomprom following delivery of 1.53

million lb of U(3) O(8) in June 2024 .

Yellow Cake Estimated Proforma Net Asset Value as at 23

January 2024

--------------------------------------------------------------------------

Units

Investment in Uranium

Uranium oxide in concentrates

("U(3) O(8) ") (37) (A) lb 21,682,318

U(3) O(8) fair value per pound

(38) (B) US$/lb 105.00

(A) x (B)

U(3) O(8) fair value = (C) US$ m 2,276.6

------------

Cash and other net current

assets/(liabilities) ( [38]

) (D) US$ m 32.2

(C) + (D)

Net asset value in US$ m = (E) US$ m 2,308.9

------------

Exchange Rate (F) USD/GBP 1.2681

(E) / (F)

Net asset value in GBP m = (G) GBP m 1,820.7

Number of shares in issue

less shares held in treasury

( [39] ) (H) 216,856,447

Net asset value per share (G) / (H) GBP/share 8.40

---------------------------------- ----------- ----------- ------------

ENQUIRIES:

Yellow Cake plc

Andre Liebenberg, CEO Carole Whittall, CFO

Tel: +44 (0) 153 488 5200

Nominated Adviser and Joint Broker: Canaccord Genuity Limited

James Asensio Henry Fitzgerald-O'Connor

Ana Ercegovic

Tel: +44 (0) 207 523 8000

Joint Broker: Berenberg

Matthew Armitt Jennifer Lee

Detlir Elezi

Tel: +44 (0) 203 207 7800

Financial Adviser: Bacchus Capital Advisers

Peter Bacchus Richard Allan

Tel: +44 (0) 203 848 1640

Communications Adviser: Powerscourt

Peter Ogden Jade Sampayo

Tel: +44 (0) 7793 858 211

ABOUT YELLOW CAKE

Yellow Cake is a London-quoted company, headquartered in Jersey,

which offers exposure to the uranium spot price. This is achieved

through its strategy of buying and holding physical triuranium

octoxide (" U(3) O(8) "). It may also seek to add value through

other uranium related activities. Yellow Cake seeks to generate

returns for shareholders through the appreciation of the value of

its holding of U(3) O(8) and its other uranium related activities

in a rising uranium price environment. The business is

differentiated from its peers by its ten-year Framework Agreement

for the supply of U(3) O(8) with Kazatomprom, the world's largest

uranium producer. Yellow Cake currently holds 20.16 million pounds

of U(3) O(8) , all of which is held in storage in Canada and

France.

FORWARD LOOKING STATEMENTS

Certain statements contained herein are forward looking

statements and are based on current expectations, estimates and

projections about the potential returns of the Company and the

industry and markets in which the Company will operate, the

Directors' beliefs and assumptions made by the Directors. Words

such as "expects", "anticipates", "should", "intends", "plans",

"believes", "seeks", "estimates", "projects", "pipeline", "aims",

"may", "targets", "would", "could" and variations of such words and

similar expressions are intended to identify such forward looking

statements and expectations. These statements are not guarantees of

future performance or the ability to identify and consummate

investments and involve certain risks, uncertainties and

assumptions that are difficult to predict, qualify or quantify.

Therefore, actual outcomes and results may differ materially from

what is expressed in such forward looking statements or

expectations. Among the factors that could cause actual results to

differ materially are: uranium price volatility, difficulty in

sourcing opportunities to buy or sell U(3) O(8) , foreign exchange

rates, changes in political and economic conditions, competition

from other energy sources, nuclear accident, loss of key personnel

or termination of the services agreement with 308 Services Limited,

changes in the legal or regulatory environment, insolvency of

counterparties to the Company's material contracts or breach of

such material contracts by such counterparties. These

forward-looking statements speak only as at the date of this

announcement. The Company expressly disclaims any obligation or

undertaking to disseminate any updates or revisions to any forward

looking statements contained herein to reflect any change in the

Company's expectations with regard thereto or any change in events,

conditions or circumstances on which any such statements are based

unless required to do so by applicable law or the AIM Rules.

[1] Daily spot price published by UxC, LLC on 30 September 2023.

[2] Daily spot price published by UxC, LLC on 29 December 2023.

[3] Daily spot price published by UxC, LLC on 23 January 2024.

[4] Estimated net asset value as at 30 September 2023 of

US$1,494.2 million comprises 20.16 million lb of U(3) O(8) valued

at the daily spot price of US$73.50/lb published by UxC, LLC on 30

September 2023 and cash and other current assets and liabilities of

US$12.7 million. Estimated net asset value per share as at 30

September 2023 is calculated assuming 202 ,740,730 ordinary shares

in issue, less 4,584,283 shares held in treasury on that date and

the Bank of England's daily USD/ GBP exchange rate of 1.2207.

[5] Estimated net asset value as at 31 December 2023 of

US$1,966.4 million comprises 20.16 million lb of U(3) O(8) valued

at the daily spot price of US$91.00/lb published by UxC, LLC on 29

December 2023 and cash and other current assets and liabilities of

US$132.2 million. Estimated net asset value per share as at 31

December 2023 is calculated assuming 221 ,440,730 ordinary shares

in issue less 4,584,283 shares held in treasury on that date and

the Bank of England's daily USD/ GBP exchange rate of 1.2747 on 29

December 2023.

[6] Comprises 20.16 million lb of U(3) O(8) held as at 23

January 2024 plus 1.53 million lb of U(3) O(8) which the Company

has committed to purchase in June 2024.

[7] Daily spot price published by UxC, LLC on 23 January 2024.

[8] Estimated proforma net asset value per share as at 23

January 2024 is calculated assuming 221 , 440,730 ordinary shares

in issue, less 4,584,283 shares held in treasury, a USD/ GBP

exchange rate of 1.2681 and the daily spot price published by UxC,

LLC on 23 January 2024. For purposes of estimating proforma net

asset value, cash and other current assets and liabilities is

calculated US$132.2 million as at 31 December 2023 less a total

cash consideration of US$100.0 million to be paid to Kazatomprom

following delivery of 1.53 million lb of U(3) O(8) in June

2024.

[9] Ux Weekly; "Ux Price Indicators"; 2 October 2023.

[10] Ux Weekly; "Ux Price Indicators"; 2 January 2024.

[11] World Nuclear News; "Bulgaria to push ahead with two new

units at Kozloduy"; 25 October 2023.

[12] World Nuclear News; "JEK2: Larger capacity considered,

Westinghouse, EDF, KHNP in running"; 12 October 2023.

[13] World Nuclear News; "Swedish nuclear: Government moves to change law"; 5 October 2023.

[14] World Nuclear News; "TVO eyes extended, expanded use if

Olkiluoto units"; 10 October 2023.

[15] World Nuclear News; "SMR power plant proposed in Norway"; 3 November 2023.

[16] World Nuclear News; "Sri Lankan government has plans for

nuclear, minister says"; 21 November 2023.

[17] World Nuclear News; "Nuclear accord signed between USA and

Philippines"; 17 November 2023.

[18] World Nuclear News; "MEPs fully include nuclear in Net-Zero

Industry Act"; 22 November 2023.

[19] The Hindu; "India, Russia ink pacts on construction of

future power units of Kudankulam nuclear plant"; 27 December

2023.

[20] World Nuclear News; "Grid connection for second Shin Hanul unit"; 2 January 2024.

[21] World Nuclear News; "NRA lifts ban on Kashiwazaki-Kariwa

fuel activities"; 2 January 2024.

[22] Boss Energy Press Announcement; "Boss achieves significant

milestone with commencement of mining operations on Honeymoon"; 11

October 2023.

[23] Orano Press Announcement; "Board of Directors of Orano

approves project to extend the enrichment capacity of the Georges

Bess 2 plant"; 19 October 2023.

[24] Cameco Press Release; "Cameco and Brookfield Acquisition of

Westinghouse Electric Company Creating a Powerful Platform for

Strategic Growth"; 7 November 2023.

[25] Kazatomprom Press Release; "Kazatomprom 3Q23 Operations and

Trading Update"; 1 November 2023.

[26] Kazatomprom Press Release; "Kazatomprom expects adjustments

to its 2024 Production Plans "; 12 January 2024.

[27] Euratom Supply Agency; "Annual Report 2022"; 13 October 2023.

[28] H.R. 1042 - 118th Congress (2023-2024); 11 December 2023.

[29] IAEA Press Announcement; "IAEA Annual Projections Rise

Again as Countries Turn to Nuclear for Energy Security and Climate

action"; 9 October 2023.

[30] International Energy Agency; "World Energy Outlook 2023"; 26 October 2023.

[31] U.S. Department of State; "At COP28, Countries Launch

Declaration to Triple Nuclear Energy Capacity by 2050, recognizing

the Key role of Nuclear Energy in Reaching Net Zero"; 1 December

2023.

[32] Daily spot price published by UxC, LLC on 29 December 2023.

[33] Cash and cash equivalents and other net current assets and

liabilities as at 31 December 2023.

[34] Bank of England's daily USD/ GBP exchange rate as at 29 December 2023.

[35] Estimated net asset value per share on 31 December 2023 is

calculated assuming 221 ,440,730 ordinary shares in issue less

4,584,283 shares held in treasury on that date.

[36] Comprises 20.16 million lb of U(3) O(8) held as at 23

January 2024 plus 1.53 million lb of U(3) O(8) which the Company

has committed to purchase in June 2024.

[37] Daily spot price published by UxC, LLC on 23 January 2024.

[38] Cash and other current assets and liabilities of US$132.2

million as at 31 December 2023 less cash consideration of US$100.0

million to be paid to Kazatomprom following delivery of 1.53

million lb of U3O8 in June 2024.

[39] Estimated proforma net asset value per share on 23 January

2024 is calculated assuming 221 ,440,730 ordinary shares in issue,

less 4,584,283 shares held in treasury on that date.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDUOSARSVUAUUR

(END) Dow Jones Newswires

January 24, 2024 02:00 ET (07:00 GMT)

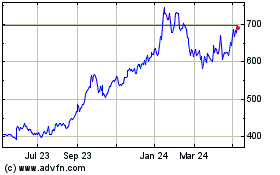

Yellow Cake (LSE:YCA)

Historical Stock Chart

From Jan 2025 to Feb 2025

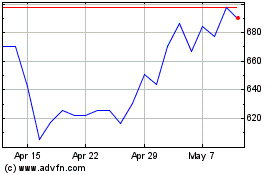

Yellow Cake (LSE:YCA)

Historical Stock Chart

From Feb 2024 to Feb 2025