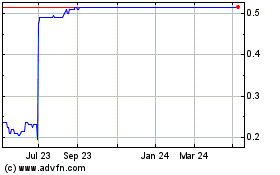

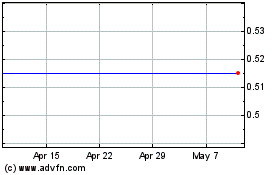

TIDMYGEN

RNS Number : 8391T

Yourgene Health PLC

27 July 2022

Yourgene Health plc

("Yourgene", the "Company" or the "Group")

Audited Final Results

Manchester, UK - 27 July 2022: Yourgene (AIM: YGEN), the

international molecular diagnostics group, announces its final

results for the financial year ended 31 March 2022 ("FY22"), and

provides an unaudited update on trading for the first quarter of

the current financial year ("Q1 FY23").

The Group's performance in FY22 reflects the significant revenue

growth delivered from COVID-related products and services, as well

as a return to growth in the Company's core business. The strong

financial performance has allowed Yourgene to invest further in

creating a broader platform or products and services to serve a

wider, global customer base, focussed on accelerating growth across

Genomic Services, NIPT, Ranger(R) Technology and PCR testing.

Financial highlights

-- Record revenues of GBP37.6m (FY21: GBP18.3m), up 105% and ahead

of previously upgraded expectations

- Genomic Services up 238% to GBP21.6m, dominated by COVID-19

testing

- Genomic Technologies up 34% to GBP16.0m including +9% year-on-year

growth in non-COVID sales

-- Gross profit up 88% to GBP21.4m (FY21: GBP11.4m)

-- Adjusted EBITDA* of GBP3.4m (FY21: loss of GBP2.0m)

-- Reported pre-tax loss of GBP3.2m (FY21: loss of GBP12m)

-- Reported loss after tax of GBP1.9m, following GBP1.3m tax credit

(FY21: GBP12.2m)

-- EPS loss of 0.3p (FY21: 1.8p loss)

-- GBP1.3m cash generated from operating activities (FY21: GBP3.8m

used), despite a net working capital outflow of GBP1.7m (FY21:

GBP0.9m outflow)

-- GBP3.5m of cash used in investing activities (FY21: GBP7.4m) -

reflecting investment in growth strategy

-- GBP5.0m term loan secured in January 2022 from Silicon Valley

Bank to support growth strategy

-- Cash improved to GBP8.4m (31 March 2021: GBP7.0m)

* Adjusted EBITDA is the operating profit/(loss) before

interest, tax, depreciation, amortisation, share-based payments and

acquisition-related expenses shown separately disclosed on the face

of the Income Statement

Operational highlights

-- National Microbiology Framework awards for COVID-19 PCR testing

and variant sequencing services

-- DPYD screening contract for NHS Wales and DPYD screening recommended

in Spain

-- Opening of new Yourgene Health Canada facilities to support future

growth of Ranger(R) Technology

-- US strategic partnership for NIPT with Ambry Genetics and expanded

market access to oncology portfolio for Yourgene Genomic Services

-- Secured two supply contracts with US diagnostic majors for Ranger(R)

Technology (announced in March and June 2021 respectively) are

-- now validated and using the technology in routine clinical testing)

Launch of IONA(R) Care - our NIPT service with expanded clinical

-- menu including sex chromosome aneuploidies

Expansion of geographical reach with indirect distribution channels

-- strengthened in Middle East, Africa and Eastern Europe and commercial

teams strengthened in APAC, Americas and EMEA

New customers for IONA(R) Nx NIPT Workflow with strong installed

base in the USA, Mexico and Singapore

Post period end developments

-- Strategic partnership with Ambry Genetics extended to oncology

services portfolio offering in Europe

-- Launch of Yourgene's Accelerator Phase for its Microdeletions

Plugin, which expands on the clinical menu and capabilities of

IONA(R) Nx NIPT Workflow offering

-- Yourgene Genomic Services receive ISO 15189:2012 accreditation

for UK laboratory

-- Ranger(R) technology offering expanded with launch of LightBench(R)

Detect - clinical platform for liquid biopsy applications including

NIPT with the use of EDTA blood collection tubes

-- Business restructuring is now complete, the Group's platform has

been reshaped to deliver growth within the core portfolio across

Yourgene's operating footprint

-- Q1 FY23 trading returns to pre-pandemic growth rates (20% year-on-year)

for non-COVID revenue streams

Lyn Rees, Chief Executive Officer of Yourgene, commented: "We

are greatly encouraged by the performance of the business over the

last 12 months. We have delivered record revenues as a result of

high demand for our COVID-related products and services, and we

have been able to invest the resultant proceeds towards enhancing

the growth drivers for our core markets opportunities. Yourgene has

progressed significantly over the last few years, and we remain

focused on our long-term growth strategy despite some of the

challenges faced over the last two years.

"Looking forward we are now established as a growing force in

genomic testing with a team of nearly 200 staff with a strong and

increasing presence in key overseas geographies including North

America, Europe and Asia. We have diverse revenue streams built on

proprietary technologies and growth opportunities across cell-free

DNA applications such as NIPT, oncology, reproductive health and

infectious disease. Our core business is now back to being a stable

platform from which to deliver growth, building on the progress in

the first quarter. Yourgene has a unique opportunity to benefit

from the more significant growth rates available from the expanded

range of market segments in which we operate."

Q&A with CEO, Lyn Rees:

Your browser does not support HTML5 video.

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation

and the Directors of the Company are responsible for the release

of this announcement.

Yourgene Health plc Tel: +44 (0)161 669 8122

Lyn Rees, Chief Executive Officer investors@yourgene-health.com

Barry Hextall, Chief Financial Officer

Joanne Cross, Director of Marketing

Cairn Financial Advisers LLP (NOMAD) Tel: +44 (0)20 7213 0880

Liam Murray / James Caithie / Ludovico

Lazzaretti

Singer Capital Markets (Joint Corporate Tel: +44 (0)20 7496 3000

Broker)

Aubrey Powell / Tom Salvesen / George

Tzimas

Stifel Nicolaus Europe Limited (Joint Tel: +44 (0)20 7710 7600

Corporate Broker)

Nicholas Moore / Matthew Blawat / Ben

Maddison

Walbrook PR Ltd (Media and Investor Tel: +44 (0)20 7933 8780 or yourgene@walbrookpr.com

Relations)

Paul McManus / Lianne Applegarth Mob: 07980 541 893 / Mob: 07584 391

Alice Woodings 303

Mob: 07407 804 654

About Yourgene Health

Yourgene Health is an international molecular diagnostics group

which develops integrated genomic technologies and services

enabling precision medicine. The group works in partnership with

global leaders in DNA technology to advance diagnostic science.

Yourgene primarily develops, manufactures, and commercialises

simple and accurate molecular diagnostic solutions, for

reproductive health, precision medicine and now infectious

diseases. The Group's flagship products include non-invasive

prenatal tests (NIPT) for Down's Syndrome and other genetic

disorders, Cystic Fibrosis screening tests, invasive rapid

aneuploidy tests, and a recent extension into the oncology space

with DPYD genotyping.

The Yourgene Genomic Services team works with healthcare

professionals, researchers and pharmaceutical organisations to

support and accelerate scientific advances in genomic medicine. The

division's specialist services guide decisions about abnormalities,

hereditary risk and treatment in addition to providing novel

insights in research and discovery. Accredited clinical services

are provided in Oncology and Reproductive Health within the UK and

worldwide. The team of scientific experts offer consultative

services to help guide partners in selecting the right technology

and approach for their applications.

In August 2020, Yourgene acquired Coastal Genomics , Inc., a

sample preparation technology company based in Vancouver, Canada,

enabling the Company to extend its offering and IP portfolio in the

DNA sample preparation sector. The acquisition increased Yourgene's

geographical penetration into the US and Canada, supplementing

existing coverage in the UK, Europe, MEA and Asia.

Yourgene Health is headquartered in Manchester, UK with offices

in Taipei, Singapore, the US and Canada, and is listed on the

London Stock Exchange's AIM market under the ticker "YGEN". For

more information visit www.yourgene-health.com and follow us on

twitter @Yourgene_Health.

Forward-Looking Statements

Certain statements made in this announcement are forward-looking

statements. These forward-looking statements are not historical

facts but rather are based on the Company's current expectations,

estimates, and projections about its industry; its beliefs; and

assumptions. Words such as 'anticipates,' 'expects,' 'intends,'

'plans,' 'believes,' 'seeks,' 'estimates,' and similar expressions

are intended to identify forward-looking statements. These

statements are not guarantees of future performance and are subject

to known and unknown risks, uncertainties, and other factors, some

of which are beyond the Company's control, are difficult to

predict, and could cause actual results to differ materially from

those expressed or forecasted in the forward-looking statements.

The Company cautions security holders and prospective security

holders not to place undue reliance on these forward-looking

statements, which reflect the view of the Company only as of the

date of this announcement. The forward-looking statements made in

this announcement relate only to events as of the date on which the

statements

are made. The Company will not undertake any obligation to

release publicly any revisions or updates to these forward-looking

statements to reflect events, circumstances, or unanticipated

events occurring after the date of this announcement except as

required by law or by any appropriate regulatory authority.

Chairman's statement

The foundations for growth are stronger than ever.

Yourgene has come on a considerable journey over the last six

years since I became Chairman. Despite current market conditions

the business has weathered the pandemic and delivered its best ever

results. More importantly it has used the income generated from

COVID testing to strengthen the growth drivers for the business in

the future. At the same time, we have continued to build a strong

Board and appropriate governance as we build a business of

scale.

At the IPO in 2014 we were a UK focused pre-revenue business

with a headcount of 10, and a single product due to launch into the

NIPT space. Today we have established ourselves as a growing force

in genomic testing and technologies: we are a team of approximately

200 staff with more direct presence in key overseas geographies

than ever before. On behalf of the Board, I would like to thank the

management team and all Yourgene colleagues for their considerable

efforts and outstanding contribution to the national pandemic

response.

During the year Nick Mustoe left the Board after eight years and

Mary Tavener joined the Board as a Non-executive Director. I would

like to take this opportunity to thank Nick for all of his time and

support during his tenure with Yourgene and to welcome Mary to the

Board for the next phase of the Group's journey.

As announced in April 2022 I will be stepping back from my role

as Non-executive Chairman of Yourgene to return to being a

Non-executive Director and Dr John Brown CBE will assume the role

as Non-executive Chairman, which I totally support. John has over

20 years capital markets experience in the healthcare and life

sciences sector and has significant relevant Board experience. I

look forward to working with John and the rest of the Board as we

strive to leverage these strong foundations and deliver the

shareholder returns we all desire.

Adam Reynolds

Non-executive Chairman

27 July 2022

Chief Executive's report

We have achieved record results through agility and

resilience

Over the last 12 months Yourgene has been both agile and

resilient in equal measure. We have achieved record revenues as a

result of high demand for our COVID-related products and services,

and we have also seen a return to growth in many of our core

markets as the year progressed. This success has provided us with

additional funds to invest across our Genomic Services and Genomic

Technologies businesses, both of which offer strong growth

potential. We are very excited about the broader service offering

that we now have, as well as the growth opportunities available

from our Genomic Services business, the NIPT markets in the

Americas, and in particular the disruptive potential of our

Ranger(R) Technology.

First and foremost, I must offer a huge thanks to all our staff

for their hard work over the last 12 months. The application of our

skill-base to meet the demands and challenges of the COVID-19

pandemic, and to now redeploy those skills into other growth areas,

has been remarkable. Last year's success is a testimony to the

commitment of the whole team and there is no doubt that they have

helped ensure that Yourgene is in a much better position now than

we were going into the pandemic.

We enter the new financial year with a strong platform to meet

the needs of a wider customer-base via an adaptable mixture of

technologies and services, with the aim of delivering improved

profitable growth from our core business in FY23 and beyond.

Full year trading overview

Revenues for FY22 were GBP37.6m, up 105% on the previous year,

with the vast majority of this revenue derived from UK focused

COVID PCR testing and variant sequencing services, as well as sales

of our own Clarigene(R) COVID-19 PCR assay. Going forward we expect

to see these geographical splits normalise and in particular a

greater contribution from sales in North America, a key growth area

for Yourgene.

Revenue by Geographical 2022 % of Group 2021 % of Group Growth/

Market GBPm GBPm decrease

------------------------ ----- ---------- ----- ---------- ---------

UK 26.5 71% 5.5 30% 387%

Europe 5.5 14% 5.5 30% 0%

International 5.6 15% 7.4 40% -24%

------------------------ ----- ---------- ----- ---------- ---------

Group 37.6 100% 18.3 100% 105%

------------------------ ----- ---------- ----- ---------- ---------

Genomic Services

Our Genomic Services business delivers clinical and research

testing services to consistently high standards, incorporating our

longstanding NIPT testing services, our oncology and CRO (contract

research organisations) testing services, as well as

high-throughput COVID testing services. We have an established

international laboratory network with upgraded facilities in the UK

(Manchester) and Taiwan (Taipei).

2022 % of Group 2021 % of Group Growth/

Genomic Services revenue mix GBPm GBPm decrease

----------------------------- ----- ---------- ----- ---------- ---------

COVID-19 services 18.7 50% 1.7 10% +981%

NIPT services 1.6 4% 1.9 10% -12%

Other services 1.3 3% 2.8 15% -55%

----------------------------- ----- ---------- ----- ---------- ---------

Genomic Services 21.6 57% 6.4 35% +238%

----------------------------- ----- ---------- ----- ---------- ---------

COVID-19 Testing Services

The significant growth in Genomic Services revenues to GBP21.6m

can be attributed to a very strong performance from the team in

delivering the highest-quality COVID PCR testing and variant

sequencing for the Department of Health and Social Care and

non-Government customers. Whilst private COVID-19 testing continues

these are at more modest levels and we continue to repurpose our

testing capacity in this area.

One of the many examples of how we are now stronger as a

business coming out of the pandemic is the recognition of the high

quality of performance and competence that our Genomic Services

provide. Following assessments by the UK accreditation service, our

Manchester labs received ISO 15189:2012 accreditation for its

COVID-19 testing and sequencing services, one of the few

independent UK labs to have attained this globally recognised ISO

standard. It is also a testament to our team that our labs also

passed the rigorous assessments required to support the

Government's COVID-19 testing programme and provide genetic

sequencing services to the UK Health Security Agency.

Our expertise in preparing for successful contract tenders was

also developed further during the pandemic as was evidenced by

Yourgene's inclusion in the Public Health England National

Microbiology Framework Agreement and then subsequent awards granted

under it. We have a number of submissions for tenders in place

currently where we believe we are well-placed to compete, and we

will update shareholders on those that are successful.

Non-Invasive Prenatal Testing (NIPT) services

NIPT and research testing services stabilised in H2 after a

challenging first half of the financial year. Whilst the pandemic

had a negative effect on birth rates globally, trading at the end

of the financial year indicates an encouraging recovery in NIPT

services towards previous pre-pandemic growth rates.

Expansion into oncology testing services

We also continue to expand our range of genomic testing

services, and in April 2022 we announced an extension of our

strategic partnership with Ambry Genetics, part of REALM IDx, Inc

(previously Konica Minolta Precision Medicine), which adds a range

of leading oncology products to our services offering.

Genomic Technologies

Our Genomic Technologies business encompasses a wide range of

instruments, reagents, consumables and software including screening

and diagnostic products in the areas of NIPT, Cystic Fibrosis,

chemotoxicity (DPYD) and COVID-19 as well as our Ranger(R)

Technology, used in DNA applications such as liquid biopsy

including; NIPT, infectious diseases and oncology. Our Ranger(R)

Technology offers clinical and research laboratories with an

automated DNA target enrichment solution to enrich and purify DNA

samples with a low overall level of target present which improves

the performance of DNA test. This provides a clear economic benefit

to labs when incorporated into sample preparation.

Genomic Technologies revenues were up 34% to GBP16.0m (FY21:

GBP11.8m).

Genomic Technologies revenue 2022 % of Group 2021 % of Group Growth/

mix GBPm GBP 000 decrease

------------------------------- ----- ---------- -------- ---------- ---------

NIPT 5.4 15% 5.9 32% -9%

COVID-19 related assays 4.5 12% 1.4 8% +216%

Reproductive health 3.9 10% 3.6 20% +7%

Precision Medicine (Ranger(R),

DPYD and other) 2.2 6% 1.0 5% +135%

------------------------------- ----- ---------- -------- ---------- ---------

Genomic Technologies 16.0 43% 11.9 65% +34%

------------------------------- ----- ---------- -------- ---------- ---------

NIPT

Whilst we have grown our portfolio considerably into areas

beyond NIPT we remain very excited about the growth opportunity

this market offers. We saw a recovery in the second half of the

year to double digit growth, recording 11% growth year-on-year

compared to H2 2021, and a 19% improvement against H1 2022

sales.

Our UK and European NIPT customer base is now firmly established

on our IONA(R) Nx NIPT workflow using Illumina's next generation

sequencing technology, and we have added new partners across the

region. Internationally, the launch of IONA(R) NX and its component

technologies opened up many new markets to us and we are building a

strong installed base for IONA(R) NX in the USA, Mexico and

Singapore. This installed base is starting to build clinical

volumes and offers significant growth potential in the coming

years.

We remain active in R&D to ensure we continue to offer class

leading products to the NIPT market. Post-period end we announced

the launch of the accelerator phase for clinical menu expansion for

our IONA(R) Nx NIPT Workflow offering, the Microdeletions Plugin.

The expansion offers customers the ability to detect chromosomal

microdeletions, an abnormality that occurs when a piece of a

chromosome is missing, with a number of microdeletion patterns

being associated with a number of clinically categorised syndromes.

Yourgene is one of a small group of NIPT providers to include

microdeletions in the NIPT workflow and we are pleased to be

working alongside leading genomics partners in Asia and Europe.

Looking forward, we are confident that we can exploit

commercially the significant opportunity that Yourgene has to

influence and disrupt the NIPT market in the Americas by leveraging

our Ranger(R) technology for size selection into established

competitor NIPT workflows. The Ranger(R) Technology is already

integrated as a key element in the IONA(R) Nx NIPT workflow, but

the technology can be integrated into other NIPT workflows, and

immediately offers laboratories a clear value proposition with

unrivalled fetal fraction enrichment, thus improving the success

rates of testing and reducing the number of false positives. It

also offers potential customers clear economic benefits by

simplifying the sample preparation process, allowing considerably

lower cost sample tubes to be used and potentially halving the

number of sample tubes required. Given that the Ranger(R)

Technology can be used with existing NIPT workflows it allows the

Yourgene sales team to begin dialogue with potential customers at

any time during the sales cycle, not only when longer term service

contracts are approaching renewal. Over time we expect to gain

entry to subsequent tender processes via the adoption of the

Ranger(R) Technology into NIPT workflows currently using competing

sample testing or reporting workflows.

Across the NIPT landscape in the Americas we have already

demonstrated that our technology offering is attractive to all of

the various market segments: from the high volume 'Mega Labs', to

large private screening labs, as well as to smaller regional

reference labs. The fact that we have attracted a key strategic

partner such as Ambry Genetics, a leading US laboratory services

provider, reinforces the credibility our Ranger(R) Technology has

in the NIPT market.

COVID-19 related assays

Clarigene(R) COVID-19 PCR assay reported revenues of GBP4.5m

(FY21: GBP1.4m). Sales are continuing into the new financial year

through private testing channels, although ongoing sales are

expected to reduce in line with a global reduction in mandatory

COVID testing requirements.

Reproductive Health

The reproductive health PCR portfolio of tests such as Cystic

Fibrosis, male factor infertility, QST*R rapid aneuploidy analysis

and pregnancy loss test has seen a 7% year on year growth. This

growth has been with our CE-IVD kits through our existing direct

sales and distributor network for predominantly UK, European,

Canada and Australian markets. We are now making research use only

(RUO) versions that we can take to non IVD regulated markets.

Ranger(R) technology, DPYD and other technologies

Revenues in this category more than doubled year-on-year and now

represent 15% of core Group revenues (i.e.

non-COVID-related revenues) and we continue to invest in

developing additional complementary precision medicine

products.

We are very pleased with the growth being delivered by our DPYD

chemotoxicity genotyping test, which is being used increasingly

across Europe to determine which cancer patients (those with a

specific genetic deficiency) will be subject to severe, or

sometimes lethal, side effects after being treated with a widely

used chemotherapy drug, 5-Fluorouracil ("5-FU"). DPYD test revenues

increased to GBP1.2m for the financial year (FY21: GBP0.7m)

reflecting the wider adoption of this screening test, which is now

recommended in Wales, England, Germany, Spain and Belgium.

Ranger(R) Technology is applicable beyond NIPT and this

disruptive technology can be applied to all types of DNA testing

where automated size selection can bring considerable benefits to

labs by enriching the DNA interest in a sample with considerable

precision and speed. We have the unique opportunity to take

advantage of multiple market segments, addressing needs in areas

that use liquid biopsy (such as NIPT, oncology and infectious

disease) as well as the gene synthesis and RNA size selection

markets. We have a significant pipeline of opportunities for

Ranger(R) Technology which are at various stages of feasibility and

validation.

Operational improvements and right sizing

With a return to focusing on growth acceleration in our core

activities, we have ensured the business has an appropriate

resource allocation moving forward. As COVID-testing activities

have receded we have reduced our variable cost base in that domain

and have started to consolidate our UK activities through a

programme of co-location and shared support services between both

segments of the business. We believe that, once complete, these

actions will reduce the Group's annual operating cost base to a

more appropriate post-COVID level. At the same time, we are also

undertaking a strategic review of our Taiwan business unit which

was badly hit by the pandemic with key CRO customer business

continuing to fluctuate while the region remains subject to ongoing

travel restrictions. The restructuring process is largely complete

at the date of this Annual Report and the UK facilities

consolidation is very well advanced.

Strengthening global routes to market

During the year we have invested in developing our commercial

team to ensure we are best placed to deliver on the growth

opportunities we have ahead of us. This has meant that we have

strengthened our team in key regions, in particular across the

Americas, Asia and Europe. Yourgene now has more teams in local

settings and in closer dialogue with our customers and potential

customers on the ground. I am delighted to be taking the

opportunity to meet these teams over the next few months and to

support them to deliver our next stage of commercial growth.

During the pandemic, we also benefitted from a fast-tracked

experience curve whereby our Genomic Services team were tested

under exceptional circumstances, in terms of delivering to

accelerated timelines and unprecedented testing volumes. I am very

proud of the team as they have adapted and developed during

challenging times whilst ensuring that we continue to operate to

the highest quality standards. Our best-of-breed approach to

solving customer challenges remains a key differentiator.

As part of our continued investment in growth and the wider

drive for operational improvement we opened our new Yourgene Health

Canada facilities in Vancouver in January 2022. The new facility,

approximately four times larger than our previous facility, will

support the scale up of manufacturing for our Ranger(R) Technology

platforms, reagents and consumables.

Outlook

As we realign our business to focus on post-pandemic growth

drivers the strategic pillars for this growth are unchanged:

product penetration, geographic expansion, new products and

targeted synergistic M&A.

Within Genomic Services we expect to see recovery in NIPT and

research services as we also broaden our portfolio to provide whole

exome and whole genome sequencing services. We continue to

repurpose our testing capacity towards non-COVID testing and our

extension of our partnership with Ambry Genetics provides us with

an oncology testing range that broadens the Genomic Service

offering considerably.

For Genomic Technologies we expect to maintain the momentum that

is building in the adoption of the IONA(R) Nx NIPT solution and we

will continue to enhance this technology with new innovations to

complement the recently launched Microdeletions Plugin. We also

believe that the commercial adoption of our Ranger(R) Technology

provides an exciting opportunity for the business, whether as part

of our IONA(R) Nx NIPT Workflow offering or as an enabler for

third-party NIPT workflows. It also has the potential to be a

hugely disruptive technology bringing the advantage of Ranger(R)

size selection to adjacent markets of liquid biopsy, RNA and gene

synthesis. We believe the offering we have has a number of

unique-selling points that will support continued market adoption

across all market segments, from the largest "Mega-labs" to smaller

regional testing facilities. We also anticipate further growth in

our DPYD chemotoxicity test as screening becomes adopted more

widely and we continue to invest in developing further

complementary content.

Overall, I believe we have a stable business platform and a

number of exciting routes to deliver future growth across the core

business, along with a unique opportunity to benefit from the

significant growth that is expected from the segments of the

molecular diagnostic market in which we operate.

Lyn Rees

Chief Executive Officer

27 July 2022

FINANCIAL REVIEW

Strengthened financial position despite pandemic turbulence

Income Statement

In the reporting period revenues more than doubled to GBP37.6

million (2021: GBP18.3 million) as Covid-related products and

services delivered significant revenues and core markets started to

return to pre-pandemic growth levels. Our Genomic Services

operating segment delivered revenue growth of 240% whilst our

product-focused segment, Genomic Technologies, delivered 33%

growth. Gross profits grew by 88% to GBP21.4m (2021: GBP11.4m) with

gross margins decreasing slightly to 57% (2021: 62%) due to the mix

bias towards lower margin COVID testing services in a highly

competitive market.

Administrative expenses increased to GBP18.0m (2021: GBP13.5m).

A more detailed breakdown of key administrative expenses is shown

in note 6 and includes expenditure on projects which are expected

to generate significant financial improvements which the pandemic

deferred into future reporting periods, such as expanding Genomic

Services capabilities for post-Covid opportunities, continued

investment in the Group's North American commercial presence and

the acquired Coastal Genomics business (now renamed Yourgene Health

Canada). Long-term projects standardising cloud-based business

systems and transitioning to the IONA(R) Nx NIPT workflow continued

and made significant progress during the reporting period.

2022 2021

----------------------------------------- -----------------------------------------

Genomic Genomic Genomic Genomic

Technologies Services Central Total Technologies Services Central Total

GBP m GBP m GBP m GBP m GBP m GBP m GBP m GBP m

------------------------ ------------- --------- ------- ------ ------------- --------- ------- ------

Revenues 16.0 21.6 - 37.6 11.9 6.4 - 18.3

Cost of sales (6.6) (9.6) - (16.2) (4.7) (2.2) - (6.9)

------------------------ ------------- --------- ------- ------ ------------- --------- ------- ------

Gross profit 9.4 12.0 - 21.4 7.2 4.2 - 11.4

Other operating - - - -

income - - - -

Segmental expenses (5.6) (6.6) - (12.2) (5.3) (3.4) - (8.7)

Central overheads - - (5.8) (5.8) - - (4.7) (4.7)

------------------------ ------------- --------- ------- ------ ------------- --------- ------- ------

Adjusted EBITDA

* 3.8 5.4 (5.8) 3.4 1.9 0.8 (4.7) (2.0)

Depreciation and

amortisation - - (4.6) (4.6) - - (3.2) (3.2)

Goodwill impairment - - (1.0) (1.0) - - (4.8) (4.8)

Share-based payments

expense - - (0.3) (0.3) - - (1.0) (1.0)

Costs associated

with subsidiary

acquisition - - - - - - (0.3) (0.3)

Acquisition integration

expense - - - - - - (0.4) (0.4)

------------------------ ------------- --------- ------- ------ ------------- --------- ------- ------

Operating profit/(loss) 3.8 5.4 (11.7) (2.5) 1.9 0.8 (14.4) (11.7)

------------------------ ------------- --------- ------- ------ ------------- --------- ------- ------

* Adjusted EBITDA is measured as the operating loss before

depreciation, amortisation, and separately disclosed items.

The Group's two operating segments both delivered positive

adjusted EBITDA contributions after segment-specific expenses.

Genomic Services contributed GBP5.6m (2021: GBP0.8m) with COVID

testing services in the UK offsetting pandemic-related weakness in

our Taiwan laboratory services. Genomic Technologies contributed

GBP3.6m (2021: GBP1.9m) with sales of Clarigene(R) COVID-19 PCR

test augmenting a return to growth in core product lines. Overall

adjusted EBITDA after deducting central expenses was a profit of

GBP3.4m (2021: GBP2.0m loss). The increase in central expenses

reflects the expansion of the Group through previous acquisitions

and the Group's decisions to continue investing in its future

growth drivers despite the pandemic headwinds in its core

markets.

Separately Disclosed Items

Significant items within administrative expenses are shown

separately in the Consolidated Statement of Comprehensive Income,

with further details in note 6. These include non-cash accounting

charges for share-based payments of GBP312k (2021: GBP952k) which

reflect lower awards in recent years as the Company has moved

towards a Share Incentive Plan for general staff participation.

Acquisition related expenses were GBPnil (2021: GBP674k) reflecting

the Group's focus on organic growth and driving the benefits from

acquisitions made in earlier reporting periods.

Within separately disclosed items is a GBP1,045k (2021:

GBP4,789k) impairment of goodwill and other intangibles relating to

the Genomic Services Taiwan cash-generating unit. These intangibles

arose from the 2017 acquisition of Yourgene Health Taiwan (Yourgene

Bioscience at the time of acquisition). The markets in which

Genomic Services Taiwan operates were particularly badly hit by the

COVID-19 pandemic and these restrictions have continued throughout

the reporting period. The Group has announced a strategic review of

this operation and this impairment writes down to nil the value of

the acquired intangibles.

Operating Loss

The business growth in the reporting period has resulted in a

significantly reduced operating loss of GBP2.5m (2021: GBP11.7m

loss).

Finance Income/(Expenses)

During the period the Group incurred net finance expenses of

GBP0.7m (2021: GBP0.3m) which reflects the additional term loan

secured with Silicon Valley Bank as well as increased lease

liability interest charges arising from new leases on the Group's

upgraded facilities in Taiwan, Vancouver and Manchester.

Taxation and Foreign Exchange

The resulting loss on ordinary activities after taxation of

GBP1.9m (2021: GBP12.2m) reflects a GBP1.3m tax credit (2021:

GBP0.2m charge) which is described in note 12 and is primarily the

recognition of a deferred tax asset. This tax asset arises from

previously unrecognised historic losses based on the Group's

expectation of profitability in its UK operations over the next 5

years. There are still significant historic tax losses in the UK

which have not yet been recognised and which will help offset taxes

arising on any additional future profits.

Total Comprehensive Loss

After accounting for exchange differences arising on

consolidation the Group recorded a much-reduced total comprehensive

loss of GBP1.8m (2021: GBP12.2m).

Earnings per Share

Earnings per share were a loss of 0.3 pence (2021: 1.8 pence

loss).

Statement of Financial Position

At the reporting date the Group had total assets of GBP64.1m

(2021: GBP49.1m). Intangible assets reduced to GBP12.9m (2021:

GBP14.8m) as a result of the impairment of the Taiwanese assets and

ongoing amortisation of previously acquired or capitalised

intangible assets. Goodwill reduced to GBP8.9m (2021: GBP9.2m) due

to the Genomic Services Taiwan impairment. Property, plant and

equipment increased to GBP4.8m (2021: GBP4.1m) with capital

expenditure on new laboratory facilities in the UK and expansion of

the Group's facility in Vancouver. Right of use assets increased to

GBP13.5m (2021: GBP4.2m) due to the relocation to a new long-term

leased facility in Vancouver. In the UK the Group is in the process

of relocating from multiple sites to a single facility leading to

some temporary duplication of property leases until the relocation

completes by March 2023. The recognised deferred tax asset

increased slightly to GBP2.3m (2021: GBP1.1m) in light of improved

business forecasts for the Group's UK operations which have

significant unrecognised historic tax losses available.

Total current assets increased to GBP21.7m (2021: GBP15.7m) with

inventories increased significantly (to GBP6.0m from GBP2.9m) for

extra resilience in response to global supply chain challenges

experienced during the pandemic, and also to support planned

business growth. Trade and other receivables also increased (to

GBP7.0m from GBP5.3m) reflecting a strong second half of the

reporting period. There was also an increase in cash and cash

equivalents to GBP8.4m (2021: GBP7.0m).

Total equity and liabilities increased to GBP64.1m (2021:

GBP49.1m) with the principal increases being due to the new

property lease liabilities in Vancouver and Manchester (IFRS16

lease liabilities up to GBP13.9m from GBP4.6m) and also a GBP5m

term loan facility entered into in January 2022 with Silicon Valley

Bank. This funding was secured to support growth for the Group.

After an initial 3-month interest free period the loan is repayable

over the remainder of a 3-year term (see note 21 for more

details).

Statement of Cash Flows

The Group had an opening cash position of GBP7.0m (2021:

GBP2.8m) and a net cash increase of GBP1.4m during the year (2021:

GBP4.2m increase). Cash and cash equivalents at the end of the

period were GBP8.4m (2021: GBP7.0m). During the period the Group's

improved performance generated GBP1.3m (2021: used GBP3.8m) of cash

in operating activities despite a net working capital outflow of

GBP1.7m (2021: GBP0.9m outflow). Cash used in investing activities

was GBP3.5m (2021: GBP7.4m) reflecting capital expenditure in the

year on service capacity, new facilities in Vancouver plus

capitalisation of internally generated intangible assets.

Financing activities generated a surplus of GBP3.6m (2020:

GBP15.5m surplus) primarily due to the Silicon Valley Bank term

loan entered into in January 2022 (see note 21).

As with all businesses at this stage of development and with

high growth ambitions, the Board assesses carefully the Group's

ability to operate as a going concern and has detailed plans for

revenue growth, margin improvement and cash flow control, which are

intended to achieve positive cash flows in the near future. More

detail on these plans can be found in the notes to the

accounts.

Dividends

No dividend is recommended (2021: GBPnil) in order to invest in

the Group's growth strategy, which is designed to enhance value

over the longer term.

Capital Management

The Board's objective is to maintain a balance sheet that is

both efficient for delivering long-term shareholder value and also

safeguards the Group's financial position in light of variable

economic cycles and the principal risks and uncertainties outlined

elsewhere in the Annual Report. The COVID pandemic presented

significant challenges during the reporting period but the

provision of COVID-related services also provided some risk

mitigation against consequential instability in our core markets.

As the COVID pandemic recedes the Group is restructuring itself to

better reflect its underlying business model and to capitalise on

the significant growth opportunities available in its core markets.

As at 31 March 2022 the Group had net cash of GBP3.2m (2021:

GBP6.8m) which is stated after borrowings of GBP5.2m (2021:

GBP0.2m) but before lease liabilities arising under IFRS16 (with

their offsetting Right of Use assets). Business growth in the

Group's Genomic Services and Genomic Technologies segments are

expected to enable the Group to operate as a going concern for the

foreseeable future.

Post-balance Sheet Events

After the end of the reporting period the Group has undertaken a

restructuring of its operations, primarily in the UK and Taiwan, to

better reflect its post-COVID model and to direct resources at its

primary growth drivers of NIPT, Ranger(R) technology, Genomic

Services and DPYD assets.

Barry Hextall

Chief Financial Officer

27 July 2022

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year ended 31 March 2022

2022 2021

----------------- -----------------

Notes GBP 000 GBP 000 GBP 000 GBP 000

----------------------------------- ----- ------- -------- ------- --------

Revenue 37,562 18,288

Cost of sales (16,197) (6,912)

----------------------------------- ----- ------- -------- ------- --------

Gross profit 21,365 11,376

Other operating income 7 60

Administrative expenses 6 (17,967) (13,483)

----------------------------------- ----- ------- -------- ------- --------

Adjusted EBITDA 3,405 (2,047)

Depreciation and amortisation 6 (4,588) (3,247)

Impairment of goodwill 5 (1,045) (4,789)

Share-based payments expense 5 (312) (952)

Costs associated with acquisitions

and integration 5 - (674)

Total depreciation, amortisation

and separately disclosed items 5 (5,945) (9,662)

Operating loss 6 (2,540) (11,709)

Financing income 10 5 2

Financing expenses 11 (656) (302)

----------------------------------- ----- ------- -------- ------- --------

Loss on ordinary activities before

taxation (3,191) (12,009)

Tax credit/(charge) on loss on

ordinary activities 12 1,275 (175)

----------------------------------- ----- ------- -------- ------- --------

Loss for the year (1,916) (12,184)

Other comprehensive expense: to

be subsequently reclassified to

profit or loss

Exchange translation differences 68 (57)

----------------------------------- ----- ------- -------- ------- --------

Loss and total comprehensive loss

for the year (1,848) (12,241)

----------------------------------- ----- ------- -------- ------- --------

Earnings per share (pence) 13

Basic: Loss (0.3p) (1.8p)

Diluted: Loss (0.3p) (1.7p)

----------------------------------- ----- ------- -------- ------- --------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 31 March 2022

2022 2021

-------- --------

Notes GBP 000 GBP 000

Assets

Non-current assets

Goodwill 14 8,881 9,181

Intangible assets 14 12,932 14,750

Property, plant and equipment 15 4,752 4,109

Right-of-use assets 16 13,475 4,209

Deferred tax assets 23 2,282 1,145

Total non-current assets 42,322 33,394

Current assets

Inventories 17 5,987 2,897

Trade and other receivables 19 6,982 5,333

Tax asset 23 343 507

Cash and cash equivalents 8,429 6,995

Total current assets 21,741 15,732

Total assets 64,063 49,127

Equity and liabilities attributable to equity

holders of the Company

Equity

Called up share capital 28 32,672 32,668

Share premium account 28 67,786 67,260

Merger relief reserve 28 12,994 12,970

Reverse acquisition reserve 28 (39,947) (39,947)

Foreign exchange translation reserve 28 2 (66)

Other reserves 28 5,833 4,914

Retained losses 28 (46,595) (44,876)

Total equity 32,745 32,923

Current liabilities

Trade and other payables 20 8,403 5,239

Lease liabilities 16 1,250 587

Current tax liabilities 405 543

Borrowings 21 2,193 119

Other liabilities and provisions 22 - 2,283

Total current liabilities 12,251 8,771

Non-current liabilities

Borrowings 21 3,027 77

Deferred tax liability 23 2,060 2,173

Lease liabilities 16 12,641 4,057

Other long-term liabilities and provisions 22 1,339 1,128

Total non-current liabilities 19,067 7,435

Total equity and liabilities 64,063 49,127

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 31 March 2022

Share Merger Reverse Foreign

Share premium relief Other acquisition exchange Retained

capital account reserve reserves reserve reserve losses Total

Notes GBP 000 GBP 000 GBP 000 GBP 000 GBP 000 GBP 000 GBP 000 GBP 000

------------------------ ----- -------- -------- -------- --------- ------------ --------- -------- --------

Balance at 1

April 2020 32,561 51,180 12,938 3,069 (39,947) (8) (33,495) 26,298

Year ended 31

March 2021:

Loss for the

year - - - - - - (12,184) (12,184)

Other comprehensive

loss - - - - - (58) - (58)

------------------------ ----- -------- -------- -------- --------- ------------ --------- -------- --------

Total comprehensive

loss for the (12,24

year - - - - - ( 58 ) (12,184) 2 )

------------------------ ----- -------- -------- -------- --------- ------------ --------- -------- --------

Issue of share

capital 28 106 17,149 - - - - - 17,255

Share issue (1,06

expenses - (1,069) - - - - - 9 )

Issue of share

capital on acquisition - - 33 - - - - 33

Issue of exchange

share on acquisition - - - 1,845 - - - 1,845

Share-based

payments: share

option schemes 29 - - - - - - 802 802

------------------------ ----- -------- -------- -------- --------- ------------ --------- -------- --------

Balance at 31 32,66 12,97 (44,87

March 2021 7 67,260 1 4,914 (39,947) (66) 7 ) 32,923

------------------------ ----- -------- -------- -------- --------- ------------ --------- -------- --------

Balance at 1 32,66 12,97 (44,87

April 2021 7 67,260 1 4,914 (39,947) (66) 7 ) 32,923

------------------------ ----- -------- -------- -------- --------- ------------ --------- -------- --------

Year ended 31

March 2022:

Loss for the

year - - - - - - (1,916) (1,916)

Other comprehensive

gain - - - - - 68 - 68

------------------------ ----- -------- -------- -------- --------- ------------ --------- -------- --------

Total comprehensive

loss for the

year - - - - - 68 (1,916) (1,848)

Issue of share

capital 28 4 526 24 919 - - - 1,472

Share-based

payments: share

option schemes 29 - - - - - - 198 198

------------------------ ----- -------- -------- -------- --------- ------------ --------- -------- --------

Balance at 31

March 2022 32,672 67,786 12,994 5,833 (39,947) 2 (46,595) 32,745

------------------------ ----- -------- -------- -------- --------- ------------ --------- -------- --------

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEARED 31 MARCH 2022

2022 2021

---------------- -----------------

GBP 000 GBP 000 GBP 000 GBP 000

--------------------------------------------- ------- ------- ------- --------

Cash flows from operating activities

Loss for the year before tax (3,190) (12,009)

Adjustments for:

Finance costs 656 302

Finance income (5) (2)

Depreciation and impairment of property,

plant and equipment 1,755 1,023

Depreciation and impairment of right-of-use

asset 959 699

Loss on disposal of property, plant and

equipment 1 -

Loss on revaluation of right-of-use asset 25 -

Amortisation of intangible non-current

assets 1,874 1,526

Impairment of goodwill and intangible

non-current assets 1,044 4,789

Impairment on financial assets (IFRS

9) 13 (39)

Non-cash foreign exchange movements (421) (204)

Share-based payment and warrant expense 198 802

Release of provisions - (85)

Tax received 144 296

Movements in working capital:

(Increase) in inventories (3,089) (1,528)

(Increase)/Decrease in trade and other

receivables (1,661) 646

Increase in trade and other payables 3,165 44

(Increase) in tax asset (158) (78)

Cash used by operations 1,309 (3,820)

Investing activities

Purchase of subsidiaries (832) (3,637)

Cash acquired on purchase of subsidiaries - 32

Purchase of property, plant and equipment (2,334) (3,004)

Capitalisation of intangible assets (324) (838)

Finance income 5 2

--------------------------------------------- ------- ------- ------- --------

Net cash used in investing activities (3,484) (7,445)

Financing activities

Net proceeds from issue of shares 55 16,186

Proceeds from borrowings 5,286 160

Loan arrangement fee (159) -

Repayment of borrowings (289) (321)

Decrease or repayment of lease liability

obligations (935) (319)

Finance expense (349) (211)

--------------------------------------------- ------- ------- ------- --------

Net cash generated from financing activities 3,609 15,496

--------------------------------------------- ------- ------- ------- --------

Net increase in cash and cash equivalents 1,434 4,231

Cash and cash equivalents at beginning

of period 6,995 2,764

--------------------------------------------- ------- ------- ------- --------

Cash and cash equivalents at end of period 8,429 6,995

--------------------------------------------- ------- ------- ------- --------

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 March 2022

Notes to the financial statements are taken directly from the

Annual Report and Accounts, and Note numbering refers to that

document, which is now available to view in full here:

https://www.yourgene-health.com/investors/key-documents/financial-reports

1. Accounting Policies

Basis of Preparation

The financial information set out in this preliminary

announcement does not constitute statutory accounts as defined by

section 434 and 435 of the Companies Acct 2006. The financial

information for the year ended 31 March 2022 has been extracted

from the Group's financial statements upon which the auditor's

opinion is unmodified and does not include any statement under

section 498(2) or (498(3) of the Companies Act 2006.

The financial information has been prepared in accordance with

International Financial Reporting Standards (IFRS), adopted for use

in the United Kingdom and including IFRIC interpretations issued by

the International Accounting Standards Board (IASB) and the

Companies Act (2006).

The consolidated financial information has been prepared on the

basis of accounting policies set out in the Group's Annual Report

and Accounts for 2022 and selectively included in this

announcement.

Company information

Yourgene Health PLC is a public limited company incorporated and

domiciled in the United Kingdom. The address of its registered

office is Citylabs 1.0, Nelson Street, Manchester M13 9NQ.

The principal activity of Yourgene Health PLC and its

subsidiaries is that of a molecular diagnostics business for

research into, and the development and commercialisation of gene

analysis techniques for prenatal screening and other clinical

applications in the early detection, monitoring and treatment of

disease.

The financial statements are presented in British Pounds

Sterling, the currency of the primary economic environment in which

the Company's headquarters is operated.

1. Going concern

In their assessment of the Group's ability to continue as a

going concern, the Directors have looked at the business prospects

for the business as it adjusts to a post-pandemic operating model.

These forecasts are largely based on recurring organic growth

drivers including the cash profiles of various prior year asset

acquisitions and business combinations.

The COVID pandemic suppressed organic growth somewhat and the

forecasts reflect a transition period during which these

longer-term growth drivers regain momentum as the pandemic recedes.

The Group anticipates a return to organic growth of the non-Covid

business streams including the 2020 acquisition of Coastal Genomics

(now renamed Yourgene Health Canada) which has secured some

strategic customers but remains an early-stage cash-consuming

business. The acquired company's Ranger(R) technology has multiple

competitive advantages in NIPT testing, oncology, liquid biopsy

more generally and adjacent markets such as gene synthesis. The

more speculative applications for this technology are not factored

into business forecasts at this stage and the technology is still

highly regarded and is expected to act as a catalyst for the

Group's accelerating penetration of the US diagnostics market, the

largest in the world. For the enlarged Group the Directors have

assessed the market dynamics in which it operates, the historic and

anticipated rate of growth of gross profits, decisions available to

them for management of the cost base of the Group and the potential

for future fundraising.

The Group operates a strategic planning process which has

historically delivered strong progress on its ambitious multi-year

business plan and which has proven resilient and agile, including

in the face of the COVID pandemic which continued to significantly

impact the reporting period but which is noticeably receding, at

least in the Company's home and Western hemisphere markets. There

are early signs that Eastern hemisphere markets are also starting

to reopen to non-Covid diagnostics activity.

As described in the Strategic Report, the Group has been

leveraging Covid-generated funds inflows to invest in more

recurring cashflow drivers. The August 2020 fundraise enabled the

acquisition of Coastal Genomics Inc and has also continued to

facilitate the significant expansion of the Group's UK laboratory

testing services activities, the underlying business systems and

the Group's laboratory in Taiwan, all of which are designed to

drive cash-generative growth in the years to come. These

investments, coupled with the pandemic headwinds which affected the

Group's traditional customers and inhibited the penetration into

new target markets such as the USA and Japan, have meant that the

Group continues to use cash in its trading and that break-even

trading performance has not yet been reached. The Group's forecasts

include assumptions of further growth in revenue, which are key in

achieving positive cash flows. The Directors have also assessed the

Group's cost structure as part of the strategic planning process

and believe that an ongoing scalability programme, coupled with a

significant cost base restructure to adjust to the expected absence

of Covid-related revenues, will enable costs growth to be contained

below gross profit increases.

There remains an ongoing commitment to keep costs and working

capital under control so that increasing gross profits can drive

positive cash flows. Detailed sensitivity analysis has been

performed to assess the potential impact on the Group's liquidity

caused by any continuing delays in revenue growth up to -10%

against expected levels along with potential mitigating actions

which can be taken to safeguard the Group's cash position if

revenues are in a range of -10% to -20% against expected levels.

These include working capital controls and reductions in

discretionary spending.

If events transpire differently to this assessment, for example

if revenues fail to grow at the anticipated pace, there could be

lower cash headroom. To mitigate this scenario the existence of

significant share options and warrants could potentially generate

additional funds within the forecast horizon. The Group also has a

successful track record in raising funds from capital markets and

has new debt facilities which could potentially be restructured or

expanded. Taking all the above into account the Directors believe

there is sufficient cash available or accessible to avoid a cash

shortfall.

The Directors have concluded that considering the circumstances

described above and mitigation strategies in place, the Directors

have a reasonable expectation that the Group and Company will have

adequate resources to continue in operational existence for the

foreseeable future. For these reasons, they continue to adopt the

going concern basis in preparing the Annual Report and

Accounts.

Revenue

Revenue from the sale of goods, equipment and related services

is recognised in accordance with IFRS 15 'Revenue from Contracts

with Customers' in the Statement of Comprehensive Income when the

deemed Contractual Performance Obligations have been completed,

which is determined to be at the point of despatch of the product

or service unless there are specific provisions in the relevant

contract. Revenue from the provision of testing and reporting

services is recognised upon delivery of the report to the customer.

Invoices are typically raised upon delivery of the products or

reporting services, unless there is a different contractual

requirement, for payment according to credit terms which are

usually 30-75 days from date of invoice. For some contracts advance

invoices are raised and payments received. These are held on the

Statement of Financial Position as 'payments received on account'

(see note 20) and are only recognised as revenue once the

performance obligations have been deemed satisfied as described

above.

Grant income and income for research projects is recognised when

all conditions for receiving the grant or research income have been

satisfied.

Adjusted EBITDA

Earnings before interest, tax, depreciation and amortisation

(EBITDA) is a recognised measure for shareholders and investor

analysts when comparing the performance of different companies in

their investment portfolios. The Company reports on this measure

after excluding certain separately disclosed items which are shown

on the face of the Statement of Comprehensive Income and in Note 5,

and recognises these exclusions by using the term Adjusted

EBITDA.

Separately disclosed items

Separately disclosed items are those significant items, within

Administrative expense which in management's judgement should be

highlighted on the face of the Statement of Comprehensive Income by

virtue of their size or incidence to enable a full understanding of

the Group's financial performance.

Property, plant and equipment

Items of property, plant and equipment are initially recognised

at cost. Cost includes the original purchase price, costs directly

attributable to bringing the asset to its working condition for its

intended use, dismantling and restoration costs. Depreciation is

provided on all items of property, plant and equipment to write off

the carrying value of items over their expected useful lives.

Depreciation is applied at the following rates:

Leasehold land and buildings 20% straight

line

Plant and equipment 20-25% straight

line

Computer software and hardware 25%-33% straight

line

The gain or loss arising on the disposal of an asset is

determined as the difference between the sale proceeds and the

carrying value of the asset and is recognised in the Statement of

Comprehensive Income.

Leases and right-of-use assets (IFRS 16)

Right-of-use assets and lease liabilities are valued on a

present value basis of the lease payments over the lease term. The

right-of-use asset is depreciated over the term or remaining term

of the lease.

Where there is potential for future increases in lease payments,

amounts are not included in the lease liability until they are

implemented. The leases are reviewed annually and where the lease

liability is increased the lease liability is reassessed and

adjusted against the right-of-use asset. When a lease is

terminated, or a term amended, the lease liability and right-of-use

asset are recalculated and adjusted accordingly.

Lease payments are divided between principal and interest

expense. The interest expense is charged to finance expense in the

statement of comprehensive income.

The Group has also elected not to reassess whether a contract is

or contains a lease at the date of initial application. Instead,

for contracts entered into before the transition date, the Group

relied on its assessment made in applying IAS 17 and IFRIC 4,

'Determining whether an Arrangement contains a Lease'.

Accounting for acquisitions

The Group assesses the acquisition of shares in a company under

IFRS 3 'Business Combinations', to make an initial determination as

to whether the acquisition meets the test for the definition "a

business". This is defined as: "An integrated set of activities and

assets that is capable of being conducted and managed for the

purpose of providing goods or services to customers, generating

investment income (such as dividends or interest) or generating

other income from ordinary activities." For acquisitions that meet

the test, the accounting treatment will follow IFRS 3 protocols to

arrive at fair values. Where the test for a business is not met,

then the assets of the acquired company will be accounted for as

acquired tangible or intangible assets as described in these

policies.

Where the acquisition includes future contingent consideration,

this is accrued based on management's judgement of the contingent

consideration it considers likely to be paid. Where the actual

consideration paid varies to this amount then the difference is

written off through General administrative expense in the Statement

of Comprehensive Income.

Goodwill

Goodwill represents the excess of the cost of acquisition over

the fair value of net assets acquired. It is initially recognised

as an asset at cost and is subsequently measured at cost less any

accumulated impairment losses. Goodwill is not amortised but is

tested annually for impairment, or earlier if there is an

indication of impairment. Goodwill impairments are not reversed

even if a subsequent fair value assessment would ordinarily give

rise to an upward revaluation.

Acquired intangible assets

Intangible assets acquired directly or as part of business

combinations are capitalised at fair value at the date of

acquisition. Following the initial recognition, the carrying amount

of an intangible is its cost less accumulated amortisation and any

accumulated impairment losses. Amortisation is charged on the basis

of the estimated useful life on a straight-line basis and the

expense is taken to the Statement of Comprehensive Income where it

is recognised within Depreciation & Amortisation.

The Group has recognised customer relationships as separately

acquired intangible assets. The useful economic life attributed to

each intangible asset is determined at the time of the acquisition

and ranges from 4 to 10 years as described in note 14.

Impairment reviews are undertaken annually and whenever the

Directors consider that there has been a potential indication of

impairment.

Impairment of tangible and intangible assets

At each reporting end date, the Group reviews the carrying

amounts of its tangible and intangible assets to determine whether

there is any indication that those assets have suffered an

impairment loss. If any such indication exists, the recoverable

amount of the asset is estimated in order to determine the extent

of the impairment loss (if any). Where it is not possible to

estimate the recoverable amount of an individual asset, the Group

estimates the recoverable amount of the cash-generating unit to

which the asset belongs.

Recoverable amount is the higher of fair value less costs to

sell and value in use. In assessing value in use, the estimated

future cash flows are discounted to their present value using a

pre-tax discount rate that reflects current market assessments of

the time value of money and the risks specific to the asset for

which the estimates of future cash flows have not been

adjusted.

If the recoverable amount of an asset (or cash-generating unit)

is estimated to be less than its carrying amount, the carrying

amount of the asset (or cash-generating unit) is reduced to its

recoverable amount. Where the recoverable amount is determined by

reference to fair value less costs to sell, the recoverable value

is assessed by analysing publicly listed peer group revenue

multiples, deemed a relevant basis for the sector in which Yourgene

operates. An impairment loss is recognised immediately in profit or

loss, unless the relevant asset is carried at a revalued amount, in

which case the impairment loss is treated as a revaluation

decrease.

Where an impairment loss subsequently reverses, the carrying

amount of the asset (or cash-generating unit) is increased to the

revised estimate of its recoverable amount, but so that the

increased carrying amount does not exceed the carrying amount that

would have been determined had no impairment loss been recognised

for the asset (or cash-generating unit) in prior years. A reversal

of an impairment loss is recognised immediately in profit or loss,

unless the relevant asset is carried at a revalued amount, in which

case the reversal of the impairment loss is treated as a

revaluation increase.

Deferred tax

Deferred tax is the tax expected to be payable or recoverable on

differences between the carrying amounts of assets and liabilities

in the financial statements and the corresponding tax bases used in

the computation of taxable profit and is accounted for using the

balance sheet liability method. Deferred tax liabilities are

generally recognised for all taxable temporary differences and

deferred tax assets are recognised to the extent that it is

probable that taxable profits will be available against which

deductible temporary differences can be utilised. Such assets and

liabilities are not recognised if the temporary difference arises

from goodwill or from the initial recognition of other assets and

liabilities in a transaction that affects neither the tax profit

nor the accounting profit.

The carrying amount of deferred tax assets is reviewed at each

reporting end date and reduced to the extent that it is not

probable that sufficient taxable profits will be available to allow

all or part of the asset to be recovered, or to the extent that

there are deferred tax liabilities recognised that would not fall

due as a result of previously unrecognised deferred tax assets.

Where deferred tax assets not recognised in prior periods begin to

meet the criteria for recognition, their value is assessed based on

a discounted view of five-year profit forecasts for the relevant

taxable entity or Group deferred tax is calculated at the tax rates

that are expected to apply in the period when the liability is

settled, or the asset is realised. Deferred tax is charged or

credited in the income statement, except when it relates to items

charged or credited directly to equity, in which case the deferred

tax is also dealt with in equity. Deferred tax assets and

liabilities are offset when the Group has a legally enforceable

right to offset current tax assets and liabilities and the deferred

tax assets and liabilities relate to taxes levied by the same tax

authority.

Leases

Leases are classified under IFRS 16 'Leases' as lease

liabilities with corresponding right-of-use assets in most

circumstances except for leases of low value or a lease term of

less than 12 months, in which circumstances the lease payments are

expensed as incurred.

Research and development tax credits

The Group undertakes research and development activities in the

UK which potentially attract a tax credit. Where such activities

give rise to a tax credit, amounts receivable are recorded in the

Statement of Financial Position as a tax asset and the associated

credit is recorded within administrative expenses. The research and

development tax credit is recognised in the financial statements in

the same year in which the research and development expenditure

occurred. This treatment is in line with the recognition of

government grants to which the UK research and development tax

credits scheme approximates.

Critical judgements

Accounting for acquisitions of a business and intangible

assets

In the prior reporting period the Group acquired Ex5 Genomics

Ltd (July 2020; now renamed Yourgene Genomic Services Ltd), and

Coastal Genomics Inc (August 2020; now renamed Yourgene Health

Canada Inc). In the prior period the acquisition of Coastal

Genomics Inc was deemed to meet the IFRS 3 criteria for a business

combination as it was a full standalone trading business. Also in

the prior period, the acquisition of Ex5 Genomics Ltd was deemed to

be the acquisition of assets in the form of plant and equipment and

customer relationships, as there were no significant trading

activities.

The acquisition of Coastal Genomics also contained provisions

for earn-out payments to the vendors, based on achieving certain

sales performance and concluding contracts with strategic partners

post acquisition. Those targets were based on business forecasts

and deemed sufficiently probable to be met such that they are

recorded as provisions rather than contingent liabilities.

Note 14 Intangibles and note 18 Subsidiaries provide further

information on these acquisitions.

Accounting for the capitalisation of development costs

The Group has now been in operation for several years and has

resolved some significant technical challenges in bringing its

products to market. In certain circumstances this leads to reduced

technical risk during the product development cycle. The Group has

also started to decouple some previously integrated components of

its products, for example its software applications. Development

costs are capitalised where it is judged that a development project

has met the IAS 38 criteria as described in the accounting policy

for internally generated intangible assets above. The triggers for

capitalisation are assessed by reference to the completion of

specific design review stages as defined by the Group's product

development methodology.

Accounting for share-based payments

The Group's rapid growth in revenues and gross profits resulted

in a significant swing to an adjusted EBITDA profit in the

reporting period. This was largely due to commercial revenues

generated through COVID-19 related products and services. The

pandemic in the UK is now receding and the UK Government has

significantly reduced testing levels. Whilst the Group expects to

see a reduction in revenues and margins as a result of this, there

has been significant investment in the Group's non-Covid revenue

generation capabilities. The Directors assessment is that these

enhanced revenue generation capabilities will return the Group

quickly to historic sustained growth in earnings per share, the key

basis on which share based payments are measured. This performance

trajectory is forecast to continue which increases the likelihood

that share options will become exercisable in the future. As a

result the assumptions for share-based payments remain likely to

meet the relevant performance conditions.

Accounting for deferred tax

The Group has generated significant historic losses during its

development stage, which have largely not been recognised as a

deferred tax asset due to lack of visibility of future

profitability within a 5 year time horizon. As the Group now moves

towards profitability, such visibility is becoming more likely in

the near term. The Group has therefore started to recognise some of

these losses where it deems it has a prudent basis on which to do

so, including where there are deferred tax liabilities arising on

acquisition that can be offset against historic tax losses.

Key sources of estimation uncertainty

Impairment of goodwill and customer relationship intangible

assets

The Group's management undertakes impairment reviews of its cash

generating units (CGUs) annually, or more frequently if events or

changes in circumstances indicate that the carrying value may not

be recoverable. In respect of impairment reviews, the key

assumptions are as follows:

Growth rates

The value in use of the intangible assets is calculated from

cash flow projections for the relevant business activities based on

the latest financial projections covering the anticipated useful

economic life of the intangible assets.

Discount rates

The pre-tax discount rate used to calculate value is determined

in relation to the relevant business activities and their

geographic location, using external benchmarks where possible to

arrive at a relevant weighted average cost of capital.

Cash flow assumptions

The key assumptions for the value-in-use calculations are those

regarding discount rates, growth rates and expected cash flows.

Changes in revenues and expenditures are based on past experience

and expectations of future growth.

As a result of this exercise, GBP472k of Goodwill and GBP572k of

Customer relationships were impaired as described in note 14 where

the relevant growth and discount rates are detailed.

4. Segment Reporting

In the opinion of the Directors, the Group has two business

segments; Genomic Technologies and Genomic Services which are

monitored by the Group's chief operating decision maker (CODM).

Strategic decisions are made on the basis of unadjusted operating

results. The Genomic Technologies segment represents the in vitro

diagnostic products, software and instrumentation manufactured by

the Group and distributed globally through the Group's direct and