Cassidy Gold to Conduct IP Survey at Kouroussa Gold Project, Guinea

September 24 2009 - 11:13AM

Marketwired Canada

Cassidy Gold Corp. ("Cassidy") (TSX VENTURE:CDX) is pleased to announce plans

for exploration work on the Kouroussa Gold Project, located in Guinea, West

Africa. Cassidy holds a 100% interest in the project. The program will consist

of a gradient Induced Polarization (IP) survey of the Koekoe Prospect area

extending over to Sodyanfe and northeast to Kinkine. This grid, totalling 145

line-kilometres, will cover the entire project resource area and the most

prospective targets of the Kouroussa Project. Based on results of the survey,

targets will be prioritized ahead of a planned drill program. IP surveys have

been used to successfully identify priority targets at Crew Gold's Lefa Gold

Mine and Semafo's Kiniero Mine, 120 kilometres north and 35 kilometres south of

Kouroussa, respectively.

The IP survey will extend across the length and width of the Koekoe gabbro into

the surrounding Birimian sedimentary strata. Most mineralization associated with

the Sanu Filanan, Sanu Filanan North, Sanu Folo, JJ Vein, and KD-1 prospects is

hosted in the gabbro. However, significant intersections are also found

off-board of the Sanu Filanan trend and at the apparent southern limits of both

JJ and KD-1. These areas have seen limited drilling and remain poorly

understood. The survey will also cover adjoining resource areas at Sodyanfe and

Kinkine, following the Junction and Kinkine faults, respectively. Both faults

are believed to be controlling structures to mineralization. A map highlighting

the planned IP program will be posted at www.cassidygold.com shortly.

Further exploration is designed to direct future drill programs in identifying

and expanding the resource picture at Kouroussa. A Scoping Study completed by

Coffey Mining earlier this year recommended further work focused on the

discovery of additional "new" resources. Scoping work was based on an Indicated

Resource of 680,000 ounces contained in 11,380,000 tonnes grading 1.9 g/t Au and

an Inferred Resource of 363,000 ounces contained in 6,466,000 tonnes grading 1.7

g/t Au (Table 1). Coffey Mining completed the resource estimate in October 2008

in accordance with Canadian National Instrument 43-101, Standards of Disclosure

for Mineral Projects and the classifications adopted by CIM Council in December

2005.

Table 1 Total Indicated and Inferred Resources, Kouroussa Project

(0.7 g/t Au cut-off)

--------------------------------------------------------------------------

Indicated Resource Inferred Resource

--------------------------------------------------------

Resource Area Tonnage Au g/t Au oz Tonnage Au g/t Au oz

--------------------------------------------------------------------------

Koekoe Trend 5,586,000 2.3 420,000 4,963,000 1.8 293,000

--------------------------------------------------------------------------

Kinkine Trend 2,353,000 1.8 136,000 843,000 1.4 39,000

--------------------------------------------------------------------------

Sodyanfe Trend 3,441,000 1.1 125,000 660,000 1.5 31,000

--------------------------------------------------------------------------

--------------------------------------------------------------------------

TOTALS 11,380,000 1.9 680,000 6,466,000 1.7 363,000

--------------------------------------------------------------------------

Based on these estimated resources, the Scoping Study concluded that Kouroussa

could produce an average of 79,000 ounces of gold annually at a cash operating

cost of US$484 per ounce over a 6-year mine life. The Study proposed open pit

mining of a series of pits utilizing contract miners. Ore would be processed

through a conventional gravity-CIP (carbon-in-pulp) plant with a design capacity

of 1.0 million tonnes per annum (Mtpa). The average gold recovery is 94.5% and

the strip ratio is 6.7:1. Initial capital costs for the Kouroussa Project are

estimated to be $97 million, with a further $11 million estimated for sustaining

capital.

Table 1 shows the Net Present Value (NPV) at a discount rate of 10% and the

Internal Rate of Return (IRR) for the Project for a range of gold prices at a

milling throughput of 1.0 Mtpa employing a gravity-CIP process configuration and

assuming 100% equity financing. Project economics are favourable at a gold price

of greater than US$900. Cassidy believes that more work is warranted including

trying to reduce capital and operating cost and investigating alternative mining

configurations.

Table 1 NPV10% and IRR Sensitivity to Gold Price

-------------------------------------------------

Au Price (USD/oz) NPV10% (US$ million) IRR (%)

-------------------------------------------------

$ 750 -$23.6 1

-------------------------------------------------

$ 838 $0.0 10

-------------------------------------------------

$ 900 $16.8 16

-------------------------------------------------

$ 950 $30.3 21

-------------------------------------------------

$1000 $43.7 25

-------------------------------------------------

Mineral resources that are not mineral reserves do not have demonstrated

economic viability. The preliminary assessment includes inferred mineral

resources that are considered too speculative geologically to have the economic

considerations applied to them that would enable them to be categorized as

mineral reserves, and there is no certainty that the preliminary assessment will

be realized.

Christopher J. Wild, P.Eng, V.P. Exploration, is Cassidy's Qualified Person for

this release. Harry Warries, MAusIMM, Principal Consultant is the Qualified

Person overseeing the Kouroussa Scoping Study on behalf of Coffey Mining. For

more information, please visit the Company's website at www.cassidygold.com.

On behalf of the Board of Directors

Cassidy Gold Corp.

James T. Gillis, President & CEO

This press release may be accessed at Cassidy Gold Corp.'s website:

www.cassidygold.com and at www.sedar.com.

If you wish to be placed on Cassidy Gold Corp.'s e-mail press release list,

please contact us at cassidygold@telus.net.

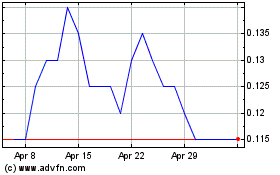

Cloud DX (TSXV:CDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

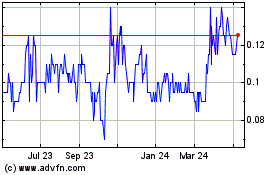

Cloud DX (TSXV:CDX)

Historical Stock Chart

From Apr 2023 to Apr 2024