UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

July 18, 2023

ATHENA CONSUMER ACQUISITION CORP.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-40921 |

|

87-1178222 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

442 5th Avenue

New York, NY 10018

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (970) 925-1572

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| |

☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one Class A common stock, par value $0.0001 per share, and one-half of one Redeemable Warrant |

|

ACAQ.U |

|

NYSE American LLC |

| |

|

|

|

|

| Shares of Class A common stock, par value $0.0001 per share, included as part of the units |

|

ACAQ |

|

NYSE American LLC |

| |

|

|

|

|

| Redeemable warrants, each exercisable for one share of Class A common stock for $11.50 per share |

|

ACAQ WS |

|

NYSE American LLC |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry Into a Material Definitive Agreement

Third Amendment to the Business Combination Agreement

As previously announced, on

July 28, 2022, Athena Consumer Acquisition Corp., a Delaware corporation (“Athena”), entered into a Business

Combination Agreement (as amended by the first and second amendment to the business combination agreement, dated as of on September 29,

2022 and on June 29, 2023, respectively, and as may be further, supplemented or otherwise modified from time to time, the “Business

Combination Agreement”), by and among Athena, Next.e.GO Mobile SE, a German company (“e.GO”),

Next.e.GO B.V., a Dutch private limited liability company and a wholly-owned subsidiary of e.GO (“TopCo”), and

Time is Now Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of TopCo (“Merger Sub”). The

transactions contemplated by the Business Combination Agreement are hereinafter referred to as the “Business Combination”.

On July 18, 2023, Athena entered

into a third amendment to the Business Combination Agreement (the “Third Amendment to the Business Combination Agreement”),

by and between Athena and e.GO, pursuant to which the treatment of Athena Class B common stock was amended that,

in connection with the closing of the Business Combination, each issued and outstanding share of Athena’s Class B common stock will

be converted into TopCo ordinary shares on a one-for-one basis, instead of 1:1.05, as had been the case under the second amendment to

the Business Combination Agreement. The one-for-one conversion ratio aligns with what’s currently in Athena’s amended and

restated certificate of incorporation, dated October 19, 2021 (as amended on December 21, 2022, the “Existing Athena Charter”).

The foregoing description

of the Third Amendment to the Business Combination Agreement does not purport to be complete and is qualified in its entirety by the terms

and conditions of the Third Amendment to the Business Combination Agreement, a copy of which is attached as Exhibit 2.1 hereto and is

incorporated by reference herein.

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change

in Fiscal Year.

The information included in

Item 5.07 is incorporated by reference in this item to the extent required.

Item 5.07. Submission of Matters to a Vote

of Security Holders.

On July 19, 2023, Athena held a special meeting of stockholders (the

“Special Meeting”). At the Special Meeting, Athena’s stockholders approved (1) a proposal to amend the

Existing Athena Charter (the proposed amendment, the “Extension Amendment”) to provide Athena with the right

to extend the date by which Athena must consummate a merger, capital stock exchange, asset acquisition, stock purchase, reorganization

or similar business combination involving Athena and one or more businesses (a “business combination”) up to

three times for an additional one month each time, from July 22, 2023 (the date which is 21 months from the closing date of Athena’s

initial public offering (the “IPO”) of units) to up to October 22, 2023 (the date which is 24 months from the

closing date of the IPO) (the “Extension Amendment Proposal”) and (2) a proposal to amend the Existing Athena

Charter (the “Redemption Limitation Amendment”, together with the Extension Amendment, the “Charter

Amendment”) to eliminate (i) the limitation that Athena may not redeem public shares in an amount that would cause Athena’s

net tangible assets to be less than $5,000,001 and (ii) the limitation that Athena shall not consummate a business combination unless

Athena has net tangible assets of at least $5,000,001 (the “Redemption Limitation Amendment Proposal”).

Athena’s stockholders voted on and approved the Extension Amendment

Proposal at the Special Meeting. A detailed description of the Extension Amendment Proposal is included in Athena’s definitive proxy

statement filed with the U.S. Securities and Exchange Commission (the “SEC”) on July 7, 2023, and mailed to

Athena’s stockholders on or about the same date (the “Proxy Statement”). The final vote tabulation for

the Extension Amendment Proposal is set forth below.

| For | | |

Against | | |

Abstain | |

| | 10,427,880 | | |

| 356,642 | | |

| 1 | |

Athena’s stockholders also voted on and approved the Redemption

Limitation Amendment Proposal at the Special Meeting. A detailed description of the Redemption Limitation Amendment Proposal is included

in the Proxy Statement. The final vote tabulation for the Redemption Limitation Amendment Proposal is set forth below.

| For | | |

Against | | |

Abstain | |

| | 10,439,295 | | |

| 345,227 | | |

| 1 | |

A total of 1,082,596 shares

of Athena’s Class A common stock were presented for redemption in connection with the Special Meeting. As a result, there will be

approximately $10.40 million remaining in the trust account following redemptions.

In addition, on July 19, 2023, Athena filed the Charter Amendment with

the Secretary of State of the State of Delaware. A copy of the Charter Amendment is attached hereto as Exhibit 3.1.

Important Information about

the Business Combination and Where to Find It

In connection with the Business

Combination, TopCo has filed with the SEC a registration statement on Form F-4 on March 13, 2023 (as amended, the “Registration

Statement”), which includes a preliminary proxy statement/prospectus. This communication is not a substitute for the Registration

Statement, the definitive proxy statement/final prospectus or any other document that Athena will send to its stockholders in connection

with the Business Combination. Investors and security holders of Athena are advised to read the preliminary proxy statement/prospectus,

and when available, the definitive proxy statement/prospectus in connection with Athena’s solicitation of proxies for its special

meeting of stockholders to be held to approve the Business Combination (and related matters) because the proxy statement/prospectus will

contain important information about the Business Combination and the parties to the Business Combination. The definitive proxy statement/final

prospectus will be mailed to stockholders of Athena as of a record date to be established for voting on the Business Combination. Stockholders

will also be able to obtain copies of the proxy statement/prospectus, without charge, once available, at the SEC’s website at www.sec.gov

or by directing a request to: 442 5th Avenue, New York, NY, 10018.

This

Current Report on Form 8-K is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer

to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act,

or an applicable exemption from the registration requirements thereof.

Participants in the Solicitation

Athena, e.GO, TopCo and their

respective directors, executive officers, other members of management, and employees, under SEC rules, may be deemed to be participants

in the solicitation of proxies of Athena’s stockholders in connection with the Business Combination. Investors and security holders

may obtain more detailed information regarding the names and interests in the Business Combination of Athena’s directors and officers

in Athena’s filings with the SEC, and such information and names of e.GO’s directors and executive officers is also in the

Registration Statement, which includes the proxy statement of Athena for the Business Combination.

Forward Looking Statements

This

Current Report on Form 8-K includes “forward-looking statements” within the meaning of the “safe harbor” provisions

of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words

such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,”

“expect,” “anticipate,” “believe,” “seek,” “target”, “may”, “intend”,

“predict”, “should”, “would”, “predict”, “potential”, “seem”,

“future”, “outlook” or other similar expressions (or negative versions of such words or expressions) that predict

or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are

not limited to, statements regarding Athena, e.GO, and TopCo’s expectations with respect to future performance and anticipated financial

impacts of the Business Combination, the satisfaction of the closing conditions to the Business Combination, the level of redemptions

by Athena’s public stockholders, the timing of the completion of the Business Combination and the use of the cash proceeds therefrom.

These statements are based on various assumptions, whether or not identified herein, and on the current expectations of Athena, e.GO,

and TopCo’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative

purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction

or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and may differ

from assumptions, and such differences may be material. Many actual events and circumstances are beyond the control of Athena, e.GO, and

TopCo.

These forward-looking statements

are subject to a number of risks and uncertainties, including: (i) changes in domestic and foreign business, market, financial, political

and legal conditions; (ii) the inability of the parties to successfully or timely consummate the proposed Business Combination, including

the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely

affect the combined company or the expected benefits of the proposed Business Combination or that the approval of the stockholders of

Athena or e.GO is not obtained; (iii) failure to realize the anticipated benefits of the proposed Business Combination; (iv) risks relating

to the uncertainty of the projected financial information with respect to e.GO; (v) the outcome of any legal proceedings that may be instituted

against Athena and/or e.GO following the announcement of the Business Combination agreement and the transactions contemplated therein;

(vi) future global, regional or local economic and market conditions; (vii) the development, effects and enforcement of laws and regulations;

(viii) e.GO’s ability to grow and achieve its business objectives; (ix) the effects of competition on e.GO’s future business;

(x) the amount of redemption requests made by Athena’s public stockholders; (xi) the ability of Athena or the combined company to

issue equity or equity-linked securities in the future; (xii) the ability of e.GO and Athena to raise interim financing in connection

with the Business Combination; (xiii) the outcome of any potential litigation, government and regulatory proceedings, investigations and

inquiries; (xiv) the risk that the proposed Business Combination disrupts current plans and operations as a result of the announcement

and consummation, (xv) costs related to the Business Combination, (xvi) the impact of a sustained outbreak of COVID-19 and (xvi) those

factors discussed below under the heading “Risk Factors” and in the documents of Athena filed, or to be filed, with

the SEC. Additional risks related to e.GO’s business include, but are not limited to: the market’s willingness to adopt electric

vehicles; volatility in demand for vehicles; e.GO’s dependence on the contemplated Business Combination and other external financing

to continue its operations; significant challenges as a new entrant in the automotive industry; e.GO’s ability to control capital

expenditures and costs; cost increases or disruptions in supply of raw materials, semiconductor chips or other components; breaches in

data security; e.GO’s ability to establish, maintain and strengthen its brand; minimal experience in servicing and repairing vehicles;

product recalls; failure by joint-venture to meet their contractual commitments; unfavorable changes to the regulatory environment; risks

and uncertainties arising from the acquisition of e.GO’s predecessor business and assets following the opening of insolvency proceedings

over the predecessor’s assets in July 2020; protection of e.GO’s intellectual property. If any of these risks materialize

or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements.

There may be additional risks that neither e.GO

nor Athena presently know or that e.GO and Athena currently believe are immaterial that could also cause actual results to differ from

those contained in the forward-looking statements. In addition, forward-looking statements reflect e.GO’s and Athena’s expectations,

plans or forecasts of future events and views as of the date of this Current Report on Form 8-K. e.GO and Athena anticipate that subsequent

events and developments will cause e.GO’s and Athena’s assessments to change. However, while e.GO and Athena may elect to

update these forward-looking statements at some point in the future, e.GO and Athena specifically disclaim any obligation to do so. These

forward-looking statements should not be relied upon as representing e.GO’s and Athena’s assessments as of any date subsequent

to the date of this Current Report on Form 8-K. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

ATHENA CONSUMER ACQUISITION CORP. |

| |

|

|

| |

By: |

/s/ Jane Park |

| |

|

Name: |

Jane Park |

| |

|

Title: |

Chief Executive Officer |

| |

|

|

|

| Dated: July 19, 2023 |

|

|

5

EXHIBIT

2.1

THIRD

AMENDMENT TO BUSINESS COMBINATION AGREEMENT

This amendment (this “Amendment”),

dated as of July 17, 2023, by and between Athena Consumer Acquisition Corp., a Delaware corporation (“SPAC”),

and Next.e.GO Mobile SE, a European company incorporated in Germany (the “Company”), to that certain Business Combination

Agreement, dated as of July 28, 2022, by and among SPAC, the Company, Next.e.GO B.V., a Dutch private limited liability company, and Time

is Now Merger Sub, Inc., a Delaware corporation, as amended by that certain First Amendment to Business Combination Agreement, dated as

of September 29, 2022, and that certain Second Amendment to Business Combination Agreement, dated as of June 29, 2023 (the “Agreement”).

SPAC and the Company are collectively referred to herein as the “Amending Parties” and each individually as an “Amending

Party.” Any term used in this Amendment without definition has the meaning set forth for such term in the Agreement.

RECITALS

WHEREAS, Section 12.10 of

the Agreement provides that, prior to the Closing, the Agreement may be amended or modified upon a written agreement executed by SPAC

and the Company; and

WHEREAS, the undersigned Amending

Parties wish to amend the Agreement to reflect certain revisions as set forth herein.

AGREEMENT

NOW THEREFORE, in consideration

of the mutual agreements and covenants herein contained, and other good and valuable consideration, the receipt and sufficiency of which

are hereby acknowledged, the Amending Parties hereby agree as follows:

1. The

Agreement is hereby amended as set forth below in this Section 1. Revisions to existing provisions of the Agreement are set forth,

for ease of reference in this Amendment, with deleted text showing in strikethrough and new text shown in underlined

boldface.

(a) The

ninth and tenth Recitals of the Agreement are hereby amended and restated in their entirety to read as follows:

WHEREAS, the

certificate of incorporation of SPAC will be amended to remove the requirement that the SPAC Class B Shares automatically convert into

SPAC Class A Shares upon the consummation of an initial Business Combination (as defined therein) (the “SPAC Charter Amendment”);

WHEREAS, following

the Exchange, at the Effective Time, (i) Merger Sub will merge with and into SPAC (the “Merger”), with SPAC as the surviving

company in the Merger (the “Surviving Company”) and, after giving effect to the Merger, the Surviving Company will be a wholly

owned Subsidiary of TopCo, and (ii) each issued and outstanding SPAC Class A Share will be automatically

cancelled and extinguished and converted into one share of common stock, par value $0.0001 per share, of the Surviving Company (“Surviving

Company Common Stock”), and each issued and outstanding SPAC Class B Share will be automatically cancelled and extinguished

and converted into 1.05 shares of Surviving Company Common Stock (i.e. into 8,452,500 shares of Surviving Company Common Stock in aggregate)

and, immediately thereafter, (iii) each of the resulting shares of Surviving Company Common Stock will be exchanged for one TopCo Ordinary

Share (defined below) and (iv) each SPAC Warrant (defined below) that is outstanding immediately prior to the Effective Time will be converted

into a warrant that is exercisable for an equivalent number of TopCo Ordinary Shares on the same contractual terms and conditions as were

in effect with respect to such SPAC Warrant immediately prior to the effective time under the terms of the Warrant Agreement (defined

below), in each case, on the terms and subject to the conditions set forth in this Agreement;

WHEREAS, the

SPAC Class B Shares will automatically convert into SPAC Class A Shares prior to the cancelation and conversion described above, pursuant

to the Governing Documents (defined below) of SPAC (the “SPAC Class B Conversion”);

(b) Section

1.01 of the Agreement is hereby amended by deleting the definition “SPAC Charter Amendment”.

(c) Section

1.01 of the Agreement is hereby amended by inserting the following between the definitions of “SPAC Class A Shares” and “SPAC

Class Shares”:

“‘SPAC Class B Conversion’

has the meaning set forth in the Recitals.”

(d) Section

1.01 of the Agreement is hereby amended by amending and restating the definition of “Transactions” in its entirety to read

as follows:

“‘Transactions’ means

the transactions contemplated by this Agreement and the other Transaction Documents, including the SPAC Charter Amendment,

TopCo-SPAC Business Combination, the Exchange and the Conversion.”

(e) Section

2.01(c)(ii) of the Agreement is hereby amended and restated in its entirety to read as follows:

“(ii) At the Effective Time,

each SPAC Share (other than SPAC Shares to be cancelled pursuant to Section 2.01(c)(iii)) issued and outstanding as of immediately prior

to the Effective Time shall be automatically cancelled and extinguished and exchanged for the Merger Consideration, which Merger Consideration

will be settled as follows: (A) at the Effective Time, (x) each issued and outstanding SPAC Class A

Share (other than the SPAC Class A Shares to be cancelled pursuant to Section 2.01(c)(iii)) will be automatically cancelled

and extinguished and exchanged for one share of Surviving Company Common Stock that is held in the accounts of the Exchange Agent, solely

for the benefit of the holder of such SPAC Class A Share as of immediately prior to the Effective Time and (y)

each issued and outstanding SPAC Class B Share (other than the SPAC Class B Shares to be cancelled pursuant to Section 2.01(c)(iii)) will

be automatically cancelled and extinguished and converted into 1.05 shares of Surviving Company Common Stock (i.e. into 8,452,500 shares

of Surviving Company Common Stock in aggregate) that is held in the accounts of the Exchange Agent, solely for the benefit of the holder

of such SPAC Class B Share as of immediately prior to the Effective Time; (B) in accordance with the provisions of Section 2:94b

of the Dutch Civil Code (Burgerlijk Wetboek) the Exchange Agent, acting solely for the benefit of the Pre-Closing SPAC Holders

immediately prior to the Effective Time (other than the Pre-Closing SPAC Holders holding SPAC Shares to be cancelled pursuant to Section

2.01(c)(iii)), shall contribute and transfer on behalf of such Pre-Closing SPAC Holders (other than the Pre-Closing SPAC Holders holding

SPAC Shares to be cancelled pursuant to Section 2.01(c)(iii)) to TopCo, as a contribution in kind (inbreng op aandelen anders

dan in geld) each of the shares of common stock of the Surviving Company that were issued to the Exchange Agent solely for the account

and benefit of such Pre-Closing SPAC Holders, and, in consideration of this contribution in kind, TopCo shall issue (uitgeven)

to the Exchange Agent for the account and benefit of such Pre-Closing SPAC Holders (other than the Pre-Closing SPAC Holders holding SPAC

Shares to be cancelled pursuant to Section 2.01(c)(iii)) one TopCo Ordinary Share in respect of each share of common stock in the Surviving

Company so contributed, (such TopCo Ordinary Shares described in clause (B) of this Section 2.01(c)(ii), the “Merger Consideration”)

(such issuance, together with the Merger, the “TopCo-SPAC Business Combination”). From and after the Effective Time, the holder(s)

of Certificates, if any, evidencing ownership of SPAC Shares or SPAC Shares held in book-entry form issued and outstanding immediately

prior to the Effective Time shall cease to have any rights with respect to such shares except as otherwise provided for herein or under

applicable Law.”

2. Upon

the execution and delivery hereof, the Agreement shall be deemed to be amended and/or restated as hereinabove set forth as fully and with

the same effect as if the amendments and/or restatements made hereby were originally set forth in the Agreement, and this Amendment and

the Agreement shall henceforth respectively be read, taken and construed as one and the same instrument, but such amendments and/or restatements

shall not operate so as to render invalid or improper any action heretofore taken under the Agreement. Further, except as specifically

waived hereby, the Agreement shall continue in full force and effect as written.

3. The

terms of Article XII (Miscellaneous) of the Agreement shall apply to this Amendment mutatis mutandis, as applicable.

[Signatures on the following pages]

IN WITNESS WHEREOF, the Amending

Parties have caused this Amendment to be duly executed as of the date set forth above.

| |

ATHENA CONSUMER ACQUISITION CORP. |

| |

|

| |

By: |

/s/ Jane Park |

| |

Name: |

Jane Park |

| |

Title: |

Chief Executive Officer |

[Signature Page to Third

Amendment to Business Combination Agreement]

| |

NEXT.E.GO MOBILE SE |

| |

|

| |

By: |

/s/ Eelco Van der Leij |

| |

Name: |

Eelco Van der Leij |

| |

Title: |

Chief Financial Officer |

[Signature Page to Third

Amendment to Business Combination Agreement]

Exhibit 3.1

CERTIFICATE OF AMENDMENT TO THE

AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

ATHENA CONSUMER ACQUISITION CORP.

Athena Consumer Acquisition Corp. (the “Corporation”),

a corporation organized and existing under the laws of the State of Delaware by virtue of the General Corporation Law of the State of

Delaware (the “DGCL”), does hereby certify:

1. The name of the Corporation is Athena Consumer

Acquisition Corp.

2. The Corporation’s original Certificate

of Incorporation was filed with the Secretary of State of the State of Delaware on June 4, 2021. The Corporation’s Amended

and Restated Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on October 19, 2021, and

a Certificate of Amendment to the Amended and Restated Certificate of Incorporation of the Company was filed with the Secretary of State

of the State of Delaware on December 21, 2022 (as amended, the “Amended and Restated Certificate of Incorporation”).

3. This Amendment to the Amended and Restated

Certificate of Incorporation amends the Amended and Restated Certificate of Incorporation of the Corporation.

4. This Amendment to the Amended and Restated

Certificate of Incorporation was duly adopted by the affirmative vote of the holders of at least 65% of the outstanding shares of common

stock at a meeting of stockholders in accordance with ARTICLE IX of the Amended and Restated Certificate of Incorporation and the

provisions of Section 242 the DGCL.

5. The text of Section 9.1(b) of Article IX

of the Amended and Restated Certificate of Incorporation is hereby amended and restated to read in its entirety as follows:

“(b) Immediately

after the Offering, a certain amount of the net offering proceeds received by the Corporation in the Offering (including the proceeds

of any exercise of the underwriters’ over-allotment option) and certain other amounts specified in the Corporation’s registration

statement on Form S-1, initially filed with the U.S. Securities and Exchange Commission (the “SEC”)

on July 20, 2021, as amended (the “Registration Statement”), shall be deposited in a trust account (the

“Trust Account”), established for the benefit of the Public Stockholders (as defined below) pursuant to a trust

agreement described in the Registration Statement. Except for the withdrawal of interest to pay taxes (less up to $100,000 of interest

to pay dissolution expenses), none of the funds held in the Trust Account (including the interest earned on the funds held in the Trust

Account) will be released from the Trust Account until the earliest to occur of (i) the completion of the initial Business Combination,

(ii) the redemption of 100% of the Offering Shares (as defined below) if the Corporation is unable to complete its initial Business

Combination within 22 months from the closing of the Offering (or up to 24 months

from the closing date of the Offering, if applicable, under the provisions of this Section 9.1(b), or, if the Office of the Delaware Division

of Corporations shall not be open for business (including filing of corporate documents) on such date the next date upon which the Office

of the Delaware Division of Corporations shall be open) (the “Deadline Date”) and (iii) the redemption

of shares in connection with a vote seeking to amend such provisions of this Amended and Restated Certificate as described in Section 9.7.

Holders of shares of Common Stock included as part of the units sold in the Offering (the “Offering Shares”)

(whether such Offering Shares were purchased in the Offering or in the secondary market following the Offering and whether or not such

holders are the Sponsor or officers or directors of the Corporation, or affiliates of any of the foregoing) are referred to herein as

“Public Stockholders”.

Notwithstanding

the foregoing or any other provisions of the Articles of this Amended and Restated Certificate, the Corporation may, without a stockholder

vote, elect to extend the Deadline Date on a monthly basis for up to two times by an additional one month each time after the 22 month

anniversary of the closing of the Offering, by resolution of the Board, to up to 24 months

from the closing of the Offering.”

6. The text of sub-paragraph (a) of Section 9.2

of the Amended and Restated Certificate of Incorporation is hereby amended and restated in its entirety to read as follows:

“(a) Prior to the consummation of the initial

Business Combination, the Corporation shall provide all holders of Offering Shares with the opportunity to have their Offering Shares

redeemed upon the consummation of the initial Business Combination pursuant to, and subject to the limitations of, Sections 9.2(b) and

9.2(c) hereof (such rights of such holders to have their Offering Shares redeemed pursuant to such Sections, the “Redemption

Rights”) for cash equal to the applicable redemption price per share determined in accordance with Section 9.2(b) hereof

(the “Redemption Price”). Notwithstanding anything to the contrary contained in this Amended and Restated Certificate,

there shall be no Redemption Rights or liquidating distributions with respect to any warrant issued pursuant to the Offering.”

7. The text of sub-paragraph (e) of Section 9.2

of the Amended and Restated Certificate of Incorporation is hereby amended and restated in its entirety to read as follows:

“(e) If the Corporation offers to redeem

the Offering Shares in conjunction with a stockholder vote on an initial Business Combination, the Corporation shall consummate the proposed

initial Business Combination only if such initial Business Combination is approved by the affirmative vote of the holders of a majority

of the shares of the Common Stock that are voted at a stockholder meeting held to consider such initial Business Combination.”

8. Sub-paragraph (f) of Section 9.2 of the Amended

and Restated Certificate of Incorporation is hereby deleted in its entirety.

9. Section 9.7 of the Amended and Restated Certificate

of Incorporation is hereby amended to remove “provided, however, that any such amendment will be voided, and this Article IX will

remain unchanged, if any stockholders who wish to redeem are unable to redeem due to the Redemption Limitation.”

IN WITNESS WHEREOF, the Corporation has

caused this Amendment to the Amended and Restated Certificate of Amendment to be duly executed in its name and on its behalf by an authorized

officer as of this 19th day of July, 2023.

| |

/s/ Jane Park |

| |

Jane Park |

| |

Chief Executive Officer |

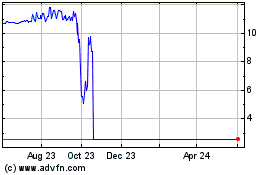

Athena Consumer Acquisit... (AMEX:ACAQ)

Historical Stock Chart

From Oct 2024 to Nov 2024

Athena Consumer Acquisit... (AMEX:ACAQ)

Historical Stock Chart

From Nov 2023 to Nov 2024