0001869141

false

0001869141

2023-09-22

2023-09-22

0001869141

ACAQ:UnitsEachConsistingOfOneClassCommonStockParValue0.0001PerShareAndOnehalfOfOneRedeemableWarrantMember

2023-09-22

2023-09-22

0001869141

ACAQ:SharesOfClassCommonStockParValue0.0001PerShareIncludedAsPartOfUnitsMember

2023-09-22

2023-09-22

0001869141

ACAQ:RedeemableWarrantsEachExercisableForOneShareOfClassCommonStockFor11.50PerShareMember

2023-09-22

2023-09-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): September 22, 2023

ATHENA CONSUMER ACQUISITION CORP.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40921 |

|

87-1178222 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

442 5th Avenue

New York, NY 10018

(Address

of principal executive offices, including zip code)

Registrant’s

telephone number, including area code: (970) 925-1572

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Units, each consisting of one Class A common stock, par value $0.0001 per share, and one-half of one Redeemable Warrant |

|

ACAQ.U |

|

NYSE American LLC |

| |

|

|

|

|

| Shares of Class A common stock, par value $0.0001 per share, included as part of the units |

|

ACAQ |

|

NYSE American LLC |

| |

|

|

|

|

| Redeemable warrants, each exercisable for one share of Class A common stock for $11.50 per share |

|

ACAQ WS |

|

NYSE American LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

7.01 Regulation FD Disclosure.

On

September 25, 2023, Athena Consumer Acquisition Corp. (“Athena”) and Next.e.GO Mobile SE (“e.GO”)

issued a joint press release announcing that, on September 22, 2023, the U.S. Securities and Exchange Commission (the “SEC”)

declared effective the registration statement on Form F-4 (the “Registration Statement”), relating to the previously

announced business combination (the “Business Combination”) among e.GO, Athena, Next.e.GO B.V., a wholly-owned

subsidiary of e.GO (“TopCo”), and Time is Now Merger Sub, Inc., a wholly-owned subsidiary of TopCo (“Merger

Sub”). A copy of the joint press release issued by Athena and e.GO is attached hereto as Exhibit 99.1 and is incorporated

by reference herein.

The

information in this Item 7.01, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject

to liabilities under that section, and shall not be deemed to be incorporated by reference into any filings of Athena under the Securities

Act of 1933, as amended (the “Securities Act”), or the Exchange Act, regardless of any general incorporation

language in such filings. This Current Report on Form 8-K shall not be deemed an admission as to the materiality of any information in

this Item 7.01, including Exhibit 99.1.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

| Exhibit

No. |

|

Description |

| 99.1 |

|

Press

Release. |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

ATHENA

CONSUMER ACQUISITION CORP. |

| |

|

|

| |

By: |

/s/

Jane Park |

| |

|

Name:

|

Jane

Park |

| |

|

Title: |

Chief

Executive Officer |

Dated:

September 25, 2023

2

Exhibit

99.1

E.GO’S

REGISTRATION STATEMENT ON FORM F-4 IN CONNECTION WITH ITS PROPOSED BUSINESS COMBINATION WITH ATHENA DECLARED EFFECTIVE BY THE U.S. SECURITIES

AND EXCHANGE COMMISSION

AACHEN,

Germany & NEW YORK (SEPTEMBER 25, 2023) – Next.e.GO Mobile SE (“e.GO”), an innovative producer of urban electric

vehicles and Athena Consumer Acquisition Corp. (NYSE American: ACAQ) (“Athena”), a publicly-traded special purpose acquisition

company, announced today that the U.S. Securities and Exchange Commission (“the SEC”) has declared effective the registration

statement on Form F-4 of e.GO (the “Registration Statement”) in connection with its proposed business combination (the “Business

Combination”) among e.GO, Athena, Next.e.GO B.V., a wholly-owned subsidiary of e.GO (“TopCo”), and Time is Now Merger

Sub, Inc., a wholly-owned subsidiary of TopCo (“Merger Sub”).

Athena

has scheduled the special meeting of its stockholders (the “Special Meeting”) and the special meeting of its warrant holders

(the “Warrant Holders Meeting” and together with the Special Meeting, the “Special Meetings”) for September 28,

2023 to, among other things, approve the proposed Business Combination and the proposed warrant exchange which will become effective

immediately prior to the closing of the Business Combination.

Ali

Vezvaei, Chairman of e.GO, said: “Today represents a remarkable milestone as we move towards our proposed U.S. listing, providing

us with the opportunity to advance our growth strategy and expand our global footprint. We are focused on bringing convenience, practicality,

and affordability to everyday urban e-mobility, leveraging innovation across the entire product and production value chain, in particular

our unique and disruptive production facilities that are, in our view, the future of flexible and capital efficient production. To-date,

we have put over 1,200 vehicles on the road, and we are truly excited to further advance with our plans through our proposed U.S. listing.”

Isabelle

Freidheim, Chairman of Athena, said: “The declaration of the SEC effectiveness is a significant step towards the successful

completion of the business combination between Athena and e.GO. We have diligently sought out a partner that aligns with our vision,

and we are confident that this transaction will position us for long-term success. We at Athena are incredibly excited to be partnering

with e.GO on this transaction because we believe e.GO is a truly disruptive company, one that can contribute meaningfully to solving

the challenges of electric mobility in the urban environment.”

About

e.GO

Headquartered

in Aachen, Germany, e.GO designs and manufactures battery electric vehicles for the urban environment, with a focus on convenience, reliability

and affordability. e.GO has developed a disruptive solution for producing its electric vehicles using proprietary technologies and low

cost MicroFactories, and has vehicles already on the road today. e.GO is helping cities and their inhabitants improve the way they get

around and is making clean and convenient urban mobility a reality. Visit https://www.e-go-mobile.com/ to learn more.

About

Athena Consumer Acquisition Corp.

Athena

is a special purpose acquisition company (“SPAC”). Athena is the second SPAC founded by Isabelle Freidheim, with Jane Park

serving as Chief Executive Officer, Jennifer Carr-Smith as President and Angy Smith as Chief Financial Officer. All three Athena SPACs

have been comprised entirely of women founders, CEOs, board members and other executives.

Important

Information about the Business Combination and Where to Find It

This

communication is not a substitute for the Registration Statement, the definitive proxy statement/prospectus or any other document that

Athena has sent or will send to its stockholders in connection with the Business Combination. Investors and security holders of Athena

are advised to read the proxy statement/prospectus in connection with Athena’s solicitation of proxies for the Special Meetings

because the proxy statement/prospectus contains important information about the Business Combination and the parties to the Business

Combination. Athena has mailed the definitive proxy statement/final prospectus and other relevant documents to its stockholders as of

the close of business on August 28, 2023 (the “Record Date”). Stockholders are also able to obtain copies of the proxy statement/prospectus,

without charge at the SEC’s website at www.sec.gov or by directing a request to: 442 5th Avenue, New York, NY, 10018.

Participants

in the Solicitation

Athena,

e.GO, TopCo and their respective directors, executive officers, other members of management, and employees, under SEC rules, may be deemed

to be participants in the solicitation of proxies of Athena’s stockholders in connection with the Business Combination. Investors

and security holders may obtain more detailed information regarding the names and interests in the Business Combination of Athena’s

directors and officers in Athena’s filings with the SEC, and such information and names of e.GO’s directors and executive

officers are also in the Registration Statement.

Forward

Looking Statements

This

communication includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the

United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such

as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,”

“expect,” “anticipate,” “believe,” “seek,” “target”, “may”, “intend”,

“predict”, “should”, “would”, “potential”, “seem”, “future”,

“outlook” or other similar expressions (or negative versions of such words or expressions) that predict or indicate future

events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to,

statements regarding Athena, e.GO, and TopCo’s expectations with respect to future performance and anticipated financial impacts

of the Business Combination, the satisfaction of the closing conditions to the Business Combination, the level of redemptions by Athena’s

public stockholders, the timing of the completion of the Business Combination and the use of the cash proceeds therefrom. These statements

are based on various assumptions, whether or not identified herein, and on the current expectations of Athena, e.GO, and TopCo’s

management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only

and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive

statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and may differ from assumptions,

and such differences may be material. Many actual events and circumstances are beyond the control of Athena, e.GO, and TopCo.

These

forward-looking statements are subject to a number of risks and uncertainties, including: (i) changes in domestic and foreign business,

market, financial, political and legal conditions; (ii) the inability of the parties to successfully or timely consummate the proposed

Business Combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated

conditions that could adversely affect the combined company or the expected benefits of the proposed Business Combination or that the

approval of the stockholders of Athena or e.GO is not obtained; (iii) failure to realize the anticipated benefits of the proposed Business

Combination; (iv) risks relating to the uncertainty of the projected financial information with respect to e.GO; (v) the outcome of any

legal proceedings that may be instituted against Athena and/or e.GO following the announcement of the Business Combination; (vi) future

global, regional or local economic and market conditions; (vii) the development, effects and enforcement of laws and regulations; (viii)

e.GO’s ability to grow and achieve its business objectives; (ix) the effects of competition on e.GO’s future business; (x)

the amount of redemption requests made by Athena’s public stockholders; (xi) the ability of Athena or the combined company to issue

equity or equity-linked securities in the future; (xii) the ability of e.GO and Athena to raise interim financing in connection with

the Business Combination; (xiii) the outcome of any potential litigation, government and regulatory proceedings, investigations and inquiries;

(xiv) the risk that the proposed Business Combination disrupts current plans and operations as a result of the announcement and consummation,

(xv) costs related to the Business Combination, (xvi) the impact of the global COVID-19 pandemic and (xvi) those factors discussed below

under the heading “Risk Factors” and in the documents filed, or to be filed, by Athena and TopCo with the SEC. Additional

risks related to e.GO’s business include, but are not limited to: the market’s willingness to adopt electric vehicles; volatility

in demand for vehicles; e.GO’s dependence on the proceeds from the contemplated Business Combination and other external financing

to continue its operations; significant challenges as a relatively new entrant in the automotive industry; e.GO’s ability to control

capital expenditures and costs; cost increases or disruptions in supply of raw materials, semiconductor chips or other components; breaches

in data security; e.GO’s ability to establish, maintain and strengthen its brand; e.GO’s minimal experience in servicing

and repairing vehicles; product recalls; failure of joint-venture partners to meet their contractual commitments; unfavorable changes

to the regulatory environment; risks and uncertainties arising from the acquisition of e.GO’s predecessor business and assets following

the opening of insolvency proceedings over the predecessor’s assets in July 2020; and e.GO’s ability to protect its intellectual

property. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results

implied by these forward-looking statements.

There

may be additional risks that neither e.GO nor Athena presently know or that e.GO and Athena currently believe are immaterial that could

also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect

e.GO’s and Athena’s expectations, plans or forecasts of future events and views as of the date of this communication. e.GO

and Athena anticipate that subsequent events and developments will cause e.GO’s and Athena’s assessments to change. However,

while e.GO and Athena may elect to update these forward-looking statements at some point in the future, e.GO and Athena specifically

disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing e.GO’s and Athena’s

assessments as of any date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking

statements.

No

Offer or Solicitation

This

communication is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any

securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No

offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or

an applicable exemption from the registration requirements thereof.

Contacts

e.GO

For Investors:

Timo

Wamig

ir@e-go-mobile.com

For

Media:

Dan

Brennan

ICR, Inc.

eGOPR@icrinc.com

Athena

Consumer Acquisition Corp.

For

Media & Investors:

Libbie Wilcox

Bevel PR

athena@bevelpr.com

3

v3.23.3

Cover

|

Sep. 22, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 22, 2023

|

| Entity File Number |

001-40921

|

| Entity Registrant Name |

ATHENA CONSUMER ACQUISITION CORP.

|

| Entity Central Index Key |

0001869141

|

| Entity Tax Identification Number |

87-1178222

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

442 5th Avenue

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10018

|

| City Area Code |

(970)

|

| Local Phone Number |

925-1572

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one Class A common stock, par value $0.0001 per share, and one-half of one Redeemable Warrant |

|

| Title of 12(b) Security |

Units, each consisting of one Class A common stock, par value $0.0001 per share, and one-half of one Redeemable Warrant

|

| Trading Symbol |

ACAQ.U

|

| Security Exchange Name |

NYSEAMER

|

| Shares of Class A common stock, par value $0.0001 per share, included as part of the units |

|

| Title of 12(b) Security |

Shares of Class A common stock, par value $0.0001 per share, included as part of the units

|

| Trading Symbol |

ACAQ

|

| Security Exchange Name |

NYSEAMER

|

| Redeemable warrants, each exercisable for one share of Class A common stock for $11.50 per share |

|

| Title of 12(b) Security |

Redeemable warrants, each exercisable for one share of Class A common stock for $11.50 per share

|

| Trading Symbol |

ACAQ WS

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ACAQ_UnitsEachConsistingOfOneClassCommonStockParValue0.0001PerShareAndOnehalfOfOneRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ACAQ_SharesOfClassCommonStockParValue0.0001PerShareIncludedAsPartOfUnitsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ACAQ_RedeemableWarrantsEachExercisableForOneShareOfClassCommonStockFor11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

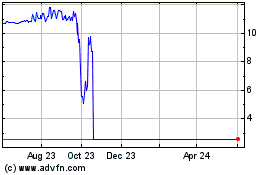

Athena Consumer Acquisit... (AMEX:ACAQ)

Historical Stock Chart

From Nov 2024 to Dec 2024

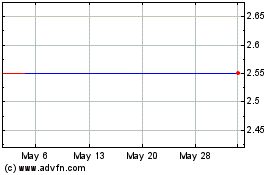

Athena Consumer Acquisit... (AMEX:ACAQ)

Historical Stock Chart

From Dec 2023 to Dec 2024