Document Security Systems, Inc. Prices $34.5 Million Upsized Public Offering of Common Stock

February 04 2021 - 9:33PM

Document Security Systems, Inc. (NYSE American: DSS) (the

“Company”), a multinational company operating businesses focusing

on brand protection technology, blockchain security, direct

marketing, healthcare, real estate, and securitized digital assets,

today announced the pricing of an upsized underwritten public

offering with gross proceeds to the Company expected to be

approximately $34.5 million, before deducting underwriting

discounts and commissions and other estimated offering expenses

payable by the Company.

The public offering equates to 12,319,346 shares

of the Company’s common stock at a price of $2.80 per share. The

Company intends to use the net proceeds from this offering,

together with their existing cash, to fund the development and

growth of new business lines, acquisition opportunities, and

general corporate and working capital needs.

The Company has also granted the underwriters a

45-day option to purchase up to an additional 15% of shares of

common stock offered in the public offering to cover

over-allotments, if any, which would increase the total gross

proceeds of the offering to approximately $39.7 million, if

exercised in full.

Aegis Capital Corp. is acting as sole

bookrunner for the offering.

The shares of common stock are being offered

pursuant to a shelf registration statement on Form S-3 (File No.

333-230740), which was declared effective by the Securities and

Exchange Commission (the "SEC") on May 8, 2019. A prospectus

supplement relating to the shares of common stock will be filed by

the Company with the SEC. Copies of the prospectus supplement

relating to the offering, together with the accompanying

prospectus, may be obtained when available on the SEC's website,

www.sec.gov, or by contacting Aegis Capital Corp., Attention:

Syndicate Department, 810 7th Avenue, 18th Floor, New York, NY

10019, by email at syndicate@aegiscap.com, or by telephone at (212)

813-1010.

This press release shall not constitute an offer

to sell, or a solicitation of an offer to buy these securities, nor

shall there be any sale of, these securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

About Document Security Systems,

Inc.

DSS is a multinational company operating

businesses focused on brand protection technology, blockchain

security, direct marketing, healthcare, real estate, and

securitized digital assets. Its business model is based on a

distribution sharing system in which shareholders will receive

shares in its subsidiaries as DSS strategically spins them out into

IPOs. Its historic business revolves around counterfeit deterrent

and authentication technologies, smart packaging, and consumer

product engagement. DSS is led by its Chairman and largest

shareholder, Mr. Fai Chan, a highly successful global business

veteran of more than 40 years specializing in corporate

transformation while managing risk. He has successfully

restructured more than 35 corporations with a combined value of $25

billion.

Investor Contact:

Dave Gentry, CEORedChip Companies

Inc.407-491-4498Dave@redchip.com

Safe Harbor Disclosure

This press release contains forward-looking

statements that are made pursuant to the safe harbor provisions

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Such forward-looking statements include, but are not

limited to, statements related to the Company's ability to complete

the financing, its intended use of proceeds and other statements

that are not historical facts. Forward-looking statements are based

on management’s current expectations and are subject to risks and

uncertainties that may cause actual results or events to differ

materially from those projected. These risks and uncertainties,

many of which are beyond our control, include: the risk that the

public offering of common stock may not close; risks relating to

our growth strategy; our ability to obtain, perform under and

maintain financing and strategic agreements and relationships;

risks relating to the results of development activities; our

ability to attract, integrate and retain key personnel; our need

for substantial additional funds; patent and intellectual property

matters; competition; as well as other risks described in the

section entitled “Risk Factors” in the prospectus and in our other

filings with the SEC, including, without limitation, our reports on

Forms 8-K and 10-Q, all of which can be obtained on the SEC website

at www.sec.gov. Readers are cautioned not to place undue reliance

on the forward-looking statements, which speak only as of the date

on which they are made and reflect management’s current estimates,

projections, expectations and beliefs. We expressly disclaim any

obligation or undertaking to release publicly any updates or

revisions to any forward-looking statements contained herein to

reflect any change in our expectations or any changes in events,

conditions or circumstances on which any such statement is based,

except as required by law.

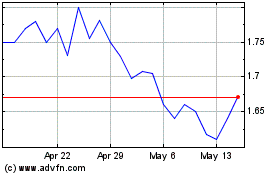

DSS (AMEX:DSS)

Historical Stock Chart

From Oct 2024 to Nov 2024

DSS (AMEX:DSS)

Historical Stock Chart

From Nov 2023 to Nov 2024