UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-21323

Eaton Vance Limited Duration Income Fund

(Exact Name of Registrant as Specified in Charter)

Two

International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

Deidre E. Walsh

Two

International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

March 31

Date of Fiscal Year End

September 30, 2023

Date of Reporting Period

Item 1. Reports to Stockholders

Eaton Vance

Limited Duration Income

Fund (EVV)

Semiannual Report

September 30, 2023

Commodity Futures Trading Commission Registration. The Commodity Futures Trading Commission (“CFTC”) has adopted regulations that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a

prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. The investment adviser has claimed an exclusion

from the definition of “commodity pool operator” under the Commodity Exchange Act with respect to its management of the Fund. Accordingly, neither the Fund nor the adviser with respect to the operation of the Fund is subject to CFTC

regulation. Because of its management of other strategies, the Fund's adviser is registered with the CFTC as a commodity pool operator. The adviser is also registered as a commodity trading advisor.

Fund shares are not insured by the FDIC and are not deposits or

other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

Semiannual Report September 30,

2023

Eaton Vance

Limited Duration Income Fund

Eaton Vance

Limited Duration Income Fund

September 30, 2023

Performance

Portfolio Manager(s)

Catherine C. McDermott, Andrew Szczurowski, CFA, Eric A. Stein, CFA and Kelley Gerrity

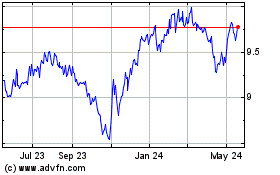

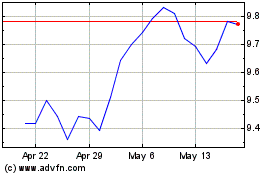

| %

Average Annual Total Returns1,2 |

Inception

Date |

Six

Months |

One

Year |

Five

Years |

Ten

Years |

| Fund

at NAV |

05/30/2003

|

2.25%

|

11.17%

|

2.32%

|

4.14%

|

| Fund

at Market Price |

—

|

(3.49)

|

9.65

|

2.81

|

3.33

|

|

| Bloomberg

U.S. Aggregate Bond Index |

—

|

(4.05)%

|

0.64%

|

0.10%

|

1.13%

|

| Blended

Index |

—

|

1.57

|

7.97

|

2.15

|

2.97

|

| %

Premium/Discount to NAV3 |

|

| As

of period end |

(11.46)%

|

| Distributions

4 |

|

| Total

Distributions per share for the period |

$0.470

|

| Distribution

Rate at NAV |

9.20%

|

| Distribution

Rate at Market Price |

10.39

|

| %

Total Leverage5 |

|

| Auction

Preferred Shares (APS) |

12.44%

|

| Borrowings

|

19.18

|

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results.

Returns are historical and are calculated net of management fees and other expenses by determining the percentage change in net asset value (NAV) or market price (as applicable) with all distributions reinvested in accordance with the Fund’s

Dividend Reinvestment Plan. Furthermore, returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Performance at market price will differ from performance at NAV due to

variations in the Fund’s market price versus NAV, which may reflect factors such as fluctuations in supply and demand for Fund shares, changes in Fund distributions, shifting market expectations for the Fund’s future returns and

distribution rates, and other considerations affecting the trading prices of closed-end funds. Investment return and principal value will fluctuate so that shares, when sold, may be worth more or less than their original cost. Performance for

periods less than or equal to one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month-end,

please refer to eatonvance.com.

Eaton Vance

Limited Duration Income Fund

September 30, 2023

| Asset

Allocation (% of total investments)1 |

Footnotes:

|

1 |

Including

the Fund’s use of leverage, Asset Allocation as a percentage of the Fund's net assets amounted to 164.3%. |

Eaton Vance

Limited Duration Income Fund

September 30, 2023

Endnotes and

Additional Disclosures

| 1 |

Bloomberg U.S. Aggregate

Bond Index is an unmanaged index of domestic investment-grade bonds, including corporate, government and mortgage-backed securities. The Blended Index consists of 33.33% Morningstar® LSTA® US Leveraged Loan IndexSM, 33.33% ICE BofA Single-B U.S. High Yield Index and 33.34% ICE BofA U.S. Mortgage-Backed Securities Index, rebalanced monthly. Morningstar® LSTA® US Leveraged Loan

IndexSM is an unmanaged index of the institutional leveraged loan market. Morningstar® LSTA® Leveraged Loan indices are a product of Morningstar, Inc.

(“Morningstar”) and have been licensed for use. Morningstar® is a registered trademark of Morningstar licensed for certain use. Loan Syndications and Trading Association® and LSTA® are trademarks of the LSTA licensed

for certain use by Morningstar, and further sublicensed by Morningstar for certain use. Neither Morningstar nor LSTA guarantees the accuracy and/or completeness of the Morningstar® LSTA® US Leveraged Loan IndexSM or any data included therein, and shall have no liability for any errors, omissions, or interruptions therein. Prior to August 29, 2022, the index name was S&P/LSTA Leveraged

Loan Index. ICE BofA Single-B U.S. High Yield Index is an unmanaged index of below-investment grade U.S. corporate bonds with a credit quality rating of B. ICE BofA U.S. Mortgage-Backed Securities Index is an unmanaged index of fixed rate

residential mortgage pass-through securities issued by U.S. agencies. ICE® BofA® indices are not for redistribution or other uses; provided “as is”, without warranties, and with no liability. Eaton Vance has prepared this

report and ICE Data Indices, LLC does not endorse it, or guarantee, review, or endorse Eaton Vance’s products. BofA® is a licensed registered trademark of Bank of America Corporation in the United States and other countries. Unless

otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. |

|

2 |

Performance

results reflect the effects of leverage. Included in the average annual total return at NAV for the five- and ten-year periods is the impact of the 2018 tender and repurchase of a portion of the Fund’s Auction Preferred Shares (APS) at 92% of

the Fund’s APS per share liquidation preference. Had this transaction not occurred, the total return at NAV would be lower for the Fund. Performance reflects expenses waived and/or reimbursed, if applicable. Without such waivers and/or

reimbursements, performance would have been lower. Pursuant to the Fund’s Dividend Reinvestment Plan, if the NAV per share on the distribution payment date is equal to or less than the market price per share plus estimated brokerage

commissions, then new shares are issued. The number of shares shall be determined by the greater of the NAV per share or 95% of the market price. Otherwise, shares generally are purchased on the open market by the Plan’s agent. |

|

3 |

The

shares of the Fund often trade at a discount or premium to their net asset value. The discount or premium may vary over time and may be higher or lower than what is quoted in this report. For up-to-date premium/discount information, please refer to

https://funds.eatonvance.com/closed-end-fund-prices.php. |

| 4 |

The Distribution Rate is

based on the Fund’s last regular distribution per share in the period (annualized) divided by the Fund’s NAV or market price at the end of the period. The Fund’s distributions in any period may be more or less than the net return

earned by the Fund on its investments, and therefore should not be used as a measure of performance or confused with “yield” or “income.” Distributions in excess of Fund returns may include a return of capital which, over

time, will cause the Fund’s net assets and net asset value per share to erode. When the Fund’s distributions include amounts from sources other than net investment income, shareholders are notified. The final determination of the tax

characteristics of Fund distributions will occur after the end of the year, at which time that determination will be reported to shareholders. |

|

5 |

Leverage

represents the liquidation value of the Fund’s APS and borrowings outstanding as a percentage of Fund net assets applicable to common shares plus APS and borrowings outstanding. Use of leverage creates an opportunity for income, but creates

risks including greater price volatility. The cost of leverage rises and falls with changes in short-term interest rates. The Fund may be required to maintain prescribed asset coverage for its leverage and may be required to reduce its leverage at

an inopportune time. |

| |

Fund profile subject to

change due to active management. |

| |

Important Notice to

Shareholders |

| |

Effective October 18, 2023,

the Fund’s portfolio management team includes Catherine C. McDermott, Kelley Gerrity, Tara O’Brien and Andrew Szczurowski. |

| |

On January

26, 2023, the Fund’s Board of Trustees voted to exempt, on a going forward basis, all prior and, until further notice, new acquisitions of Fund shares that otherwise might be deemed “Control Share Acquisitions” under the

Fund’s By-Laws from the Control Share Provisions of the Fund’s By-Laws. |

Eaton Vance

Limited Duration Income Fund

September 30, 2023

Portfolio of

Investments (Unaudited)

| Asset-Backed

Securities — 9.4% |

| Security

|

Principal

Amount

(000's omitted) |

Value

|

| Alinea

CLO, Ltd., Series 2018-1A, Class E, 11.588%, (3 mo. SOFR + 6.26%), 7/20/31(1)(2) |

$

|

1,000

|

$ 920,195

|

| AMMC

CLO 15, Ltd., Series 2014-15A, Class ERR, 12.48%, (3 mo. SOFR + 7.17%), 1/15/32(1)(2) |

|

500

|

439,478

|

| AMMC

CLO XII, Ltd., Series 2013-12A, Class ER, 11.807%, (3 mo. SOFR + 6.44%), 11/10/30(1)(2) |

|

2,000

|

1,675,814

|

| Ares

XXXIV CLO, Ltd., Series 2015-2A, Class ER, 12.42%, (3 mo. SOFR + 7.11%), 4/17/33(1)(2) |

|

2,000

|

1,823,496

|

| Ares

XXXVR CLO, Ltd., Series 2015-35RA, Class E, 11.27%, (3 mo. SOFR + 5.96%), 7/15/30(1)(2) |

|

2,000

|

1,745,634

|

| Benefit

Street Partners CLO XVI, Ltd., Series 2018-16A, Class E, 12.27%, (3 mo. SOFR + 6.96%), 1/17/32(1)(2) |

|

3,000

|

2,932,233

|

| Benefit

Street Partners CLO XVII, Ltd., Series 2019-17A, Class ER, 11.92%, (3 mo. SOFR + 6.61%), 7/15/32(1)(2) |

|

3,000

|

2,812,476

|

| Benefit

Street Partners CLO XVIII, Ltd., Series 2019-18A, Class ER, 12.32%, (3 mo. SOFR + 7.01%), 10/15/34(1)(2) |

|

4,500

|

4,443,318

|

| Benefit

Street Partners CLO XXII, Ltd., Series 2020-22A, Class ER, 12.256%, (3 mo. SOFR + 6.93%), 4/20/35(1)(2) |

|

2,000

|

1,856,466

|

| BlueMountain

CLO XXIV, Ltd., Series 2019-24A, Class ER, 12.428%, (3 mo. SOFR + 7.10%), 4/20/34(1)(2) |

|

1,000

|

918,616

|

| BlueMountain

CLO XXV, Ltd., Series 2019-25A, Class ER, 12.82%, (3 mo. SOFR + 7.51%), 7/15/36(1)(2) |

|

2,000

|

1,812,930

|

| BlueMountain

CLO XXVI, Ltd., Series 2019-26A, Class ER, 12.718%, (3 mo. SOFR + 7.39%), 10/20/34(1)(2) |

|

2,500

|

2,387,172

|

| BlueMountain

CLO XXX, Ltd., Series 2020-30A, Class ER, 12.008%, (3 mo. SOFR + 6.70%), 4/15/35(1)(2) |

|

2,000

|

1,826,774

|

| BlueMountain

CLO XXXIV, Ltd., Series 2022-34A, Class E, 12.876%, (3 mo. SOFR + 7.55%), 4/20/35(1)(2) |

|

1,000

|

966,839

|

| BlueMountain

CLO, Ltd.: |

|

|

|

| Series

2016-3A, Class ER, 11.576%, (3 mo. SOFR + 6.21%), 11/15/30(1)(2) |

|

2,000

|

1,678,650

|

| Series

2018-1A, Class E, 11.581%, (3 mo. SOFR + 6.21%), 7/30/30(1)(2) |

|

1,000

|

814,648

|

| Bryant

Park Funding, Ltd., Series 2023- 21A, Class D, 10/18/36(1)(2)(3) |

|

3,000

|

3,011,760

|

| Canyon

Capital CLO, Ltd.: |

|

|

|

| Series

2016-2A, Class ER, 11.57%, (3 mo. SOFR + 6.26%), 10/15/31(1)(2) |

|

3,350

|

2,996,093

|

| Series

2019-2A, Class ER, 12.32%, (3 mo. SOFR + 7.01%), 10/15/34(1)(2) |

|

1,000

|

931,639 |

| Security

|

Principal

Amount

(000's omitted) |

Value

|

| Carlyle

CLO C17, Ltd., Series C17A, Class DR, 11.631%, (3 mo. SOFR + 6.26%), 4/30/31(1)(2) |

$

|

1,750

|

$ 1,523,646

|

| Carlyle

Global Market Strategies CLO, Ltd.: |

|

|

|

| Series

2012-3A, Class DR2, 12.073%, (3 mo. SOFR + 6.76%), 1/14/32(1)(2) |

|

2,000

|

1,666,938

|

| Series

2014-4RA, Class D, 11.22%, (3 mo. SOFR + 5.91%), 7/15/30(1)(2) |

|

1,250

|

1,074,589

|

| Series

2015-5A, Class DR, 12.288%, (3 mo. SOFR + 6.96%), 1/20/32(1)(2) |

|

1,000

|

873,597

|

| Cedar

Funding X CLO, Ltd., Series 2019-10A, Class ER, 12.088%, (3 mo. SOFR + 6.76%), 10/20/32(1)(2) |

|

1,500

|

1,347,312

|

| Clover

CLO, Ltd., Series 2019-1A, Class ER, 12.01%, (3 mo. SOFR + 6.70%), 4/18/35(1)(2) |

|

2,877

|

2,801,246

|

| Dryden

Senior Loan Fund: |

|

|

|

| Series

2015-41A, Class ER, 10.87%, (3 mo. SOFR + 5.56%), 4/15/31(1)(2) |

|

2,000

|

1,687,374

|

| Series

2016-42A, Class ER, 11.12%, (3 mo. SOFR + 5.81%), 7/15/30(1)(2) |

|

1,000

|

863,217

|

| Elmwood

CLO 14, Ltd., Series 2022-1A, Class E, 11.676%, (3 mo. SOFR + 6.35%), 4/20/35(1)(2) |

|

1,000

|

988,095

|

| Elmwood

CLO 17, Ltd., Series 2022-4A, Class E, 12.458%, (3 mo. SOFR + 7.15%), 7/17/35(1)(2) |

|

2,000

|

1,988,686

|

| Galaxy

XIX CLO, Ltd., Series 2015-19A, Class D2R, 12.607%, (3 mo. SOFR + 7.26%), 7/24/30(1)(2) |

|

1,600

|

1,393,083

|

| Galaxy

XV CLO, Ltd., Series 2013-15A, Class ER, 12.215%, (3 mo. SOFR + 6.91%), 10/15/30(1)(2) |

|

3,275

|

3,061,218

|

| Galaxy

XXI CLO, Ltd., Series 2015-21A, Class ER, 10.838%, (3 mo. SOFR + 5.51%), 4/20/31(1)(2) |

|

1,100

|

993,704

|

| Galaxy

XXV CLO, Ltd., Series 2018-25A, Class E, 11.563%, (3 mo. SOFR + 6.21%), 10/25/31(1)(2) |

|

1,000

|

925,913

|

| Golub

Capital Partners CLO 37B, Ltd., Series 2018-37A, Class E, 11.338%, (3 mo. SOFR + 6.01%), 7/20/30(1)(2) |

|

3,000

|

2,966,961

|

| Golub

Capital Partners CLO 50B-R, Ltd., Series 2020-50A, Class ER, 12.426%, (3 mo. SOFR + 7.10%), 4/20/35(1)(2) |

|

2,000

|

1,868,880

|

| Madison

Park Funding XVII, Ltd., Series 2015-17A, Class ER, 12.095%, (3 mo. SOFR + 6.76%), 7/21/30(1)(2) |

|

2,000

|

1,907,526

|

| Madison

Park Funding XXXVI, Ltd., Series 2019-36A, Class ER, 12.358%, (3 mo. SOFR + 7.05%), 4/15/35(1)(2) |

|

3,000

|

2,973,426

|

| Madison

Park Funding XXXVII, Ltd., Series 2019-37A, Class ER, 11.72%, (3 mo. SOFR + 6.41%), 7/15/33(1)(2) |

|

3,500

|

3,387,447

|

| Neuberger

Berman CLO XXII, Ltd., Series 2016-22A, Class ER, 11.63%, (3 mo. SOFR + 6.32%), 10/17/30(1)(2) |

|

1,500

|

1,364,708

|

| Neuberger

Berman Loan Advisers CLO 30, Ltd., Series 2018-30A, Class ER, 11.788%, (3 mo. SOFR + 6.46%), 1/20/31(1)(2) |

|

2,000

|

1,887,790 |

5

See Notes to Financial Statements.

Eaton Vance

Limited Duration Income Fund

September 30, 2023

Portfolio of

Investments (Unaudited) — continued

| Security

|

Principal

Amount

(000's omitted) |

Value

|

| Neuberger

Berman Loan Advisers CLO 31, Ltd., Series 2019-31A, Class ER, 12.088%, (3 mo. SOFR + 6.76%), 4/20/31(1)(2) |

$

|

1,000

|

$

955,667 |

| Neuberger

Berman Loan Advisers CLO 48, Ltd., Series 2022-48A, Class E, 11.851%, (3 mo. SOFR + 6.50%), 4/25/36(1)(2) |

|

2,000

|

1,941,898

|

| NRZ

Excess Spread-Collateralized Notes, Series 2021-GNT1, Class A, 3.474%, 11/25/26(1) |

|

3,241

|

2,923,676

|

| Octagon

68, Ltd.: |

|

|

|

| Series

2023-1A, Class D, 10/20/36(1)(2)(3) |

|

5,000

|

5,000,000

|

| Series

2023-1A, Class E, 10/20/36(1)(2)(3) |

|

2,000

|

1,970,000

|

| Palmer

Square CLO, Ltd.: |

|

|

|

| Series

2013-2A, Class DRR, 11.42%, (3 mo. SOFR + 6.11%), 10/17/31(1)(2) |

|

2,000

|

1,871,944

|

| Series

2018-2A, Class D, 11.17%, (3 mo. SOFR + 5.86%), 7/16/31(1)(2) |

|

1,000

|

968,651

|

| Series

2019-1A, Class DR, 12.131%, (3 mo. SOFR + 6.76%), 11/14/34(1)(2) |

|

2,000

|

1,954,884

|

| Series

2021-3A, Class E, 11.72%, (3 mo. SOFR + 6.41%), 1/15/35(1)(2) |

|

2,500

|

2,448,702

|

| RAD

CLO 5, Ltd., Series 2019-5A, Class E, 12.307%, (3 mo. SOFR + 6.96%), 7/24/32(1)(2) |

|

4,550

|

4,429,875

|

| Regatta

IX Funding, Ltd., Series 2017-1A, Class E, 11.57%, (3 mo. SOFR + 6.26%), 4/17/30(1)(2) |

|

450

|

422,736

|

| Regatta

XII Funding, Ltd., Series 2019-1A, Class ER, 11.92%, (3 mo. SOFR + 6.61%), 10/15/32(1)(2) |

|

2,000

|

1,978,980

|

| Regatta

XIII Funding, Ltd., Series 2018-2A, Class D, 11.52%, (3 mo. SOFR + 6.21%), 7/15/31(1)(2) |

|

2,000

|

1,740,790

|

| Regatta

XIV Funding, Ltd., Series 2018-3A, Class E, 11.563%, (3 mo. SOFR + 6.21%), 10/25/31(1)(2) |

|

1,000

|

923,209

|

| Regatta

XVI Funding, Ltd., Series 2019-2A, Class E, 12.57%, (3 mo. SOFR + 7.26%), 1/15/33(1)(2) |

|

1,800

|

1,808,926

|

| Vibrant

CLO IX, Ltd., Series 2018-9A, Class D, 11.838%, (3 mo. SOFR + 6.51%), 7/20/31(1)(2) |

|

1,000

|

771,718

|

| Vibrant

CLO XI, Ltd., Series 2019-11A, Class D, 12.358%, (3 mo. SOFR + 7.03%), 7/20/32(1)(2) |

|

575

|

498,664

|

| Voya

CLO, Ltd.: |

|

|

|

| Series

2015-3A, Class DR, 11.788%, (3 mo. SOFR + 6.46%), 10/20/31(1)(2) |

|

3,000

|

2,404,833

|

| Series

2016-3A, Class DR, 11.652%, (3 mo. SOFR + 6.34%), 10/18/31(1)(2) |

|

1,400

|

1,110,876

|

| Wellfleet

CLO, Ltd., Series 2020-1A, Class D, 12.81%, (3 mo. SOFR + 7.50%), 4/15/33(1)(2) |

|

2,000

|

1,806,828

|

Total

Asset-Backed Securities

(identified cost $118,647,387) |

|

|

$ 111,472,444

|

| Security

|

Shares

|

Value

|

| BlackRock

Corporate High Yield Fund, Inc. |

|

2,188,579

|

$

18,887,437 |

Total

Closed-End Funds

(identified cost $26,062,179) |

|

|

$ 18,887,437

|

| Collateralized

Mortgage Obligations — 12.0% |

| Security

|

Principal

Amount

(000's omitted) |

Value

|

| Cascade

MH Asset Trust, Series 2022-MH1, Class A, 4.25% to 7/25/27, 8/25/54(1)(4) |

$

|

2,835

|

$ 2,492,939

|

| Federal

Home Loan Mortgage Corp.: |

|

|

|

| Series

24, Class J, 6.25%, 11/25/23 |

|

0

(5) |

333

|

| Series

1620, Class Z, 6.00%, 11/15/23 |

|

1

|

517

|

| Series

1702, Class PZ, 6.50%, 3/15/24 |

|

51

|

50,746

|

| Series

2113, Class QG, 6.00%, 1/15/29 |

|

136

|

134,616

|

| Series

2122, Class K, 6.00%, 2/15/29 |

|

27

|

26,400

|

| Series

2130, Class K, 6.00%, 3/15/29 |

|

18

|

18,102

|

| Series

2167, Class BZ, 7.00%, 6/15/29 |

|

21

|

21,394

|

| Series

2182, Class ZB, 8.00%, 9/15/29 |

|

202

|

205,356

|

| Series

2198, Class ZA, 8.50%, 11/15/29 |

|

190

|

192,406

|

| Series

2458, Class ZB, 7.00%, 6/15/32 |

|

327

|

332,794

|

| Series

3762, Class SH, 0.00%, (9.77% - 30-day average SOFR x 2.00, Floor 0.00%), 11/15/40(6) |

|

379

|

274,012

|

| Series

4273, Class PU, 4.00%, 11/15/43 |

|

2,263

|

1,956,784

|

| Series

4273, Class SP, 0.00%, (11.69% - 30-day average SOFR x 2.67, Floor 0.00%), 11/15/43(6) |

|

503

|

370,818

|

| Series

4678, Class PC, 3.00%, 1/15/46 |

|

2,336

|

2,116,136

|

| Series

5028, Class TZ, 2.00%, 10/25/50 |

|

2,644

|

1,267,524

|

| Series

5035, Class AZ, 2.00%, 11/25/50 |

|

8,105

|

3,484,348

|

| Series

5083, Class SK, 0.00%, (3.87% - 30-day average SOFR x 1.33, Floor 0.00%), 3/25/51(6) |

|

2,047

|

1,091,377

|

| Series

5327, Class B, 6.00%, 8/25/53 |

|

5,000

|

4,903,176

|

| Interest

Only:(7) |

|

|

|

| Series

284, Class S6, 0.672%, (5.99% - 30-day average SOFR), 10/15/42(6) |

|

1,044

|

86,916

|

| Series

362, Class C7, 3.50%, 9/15/47 |

|

4,322

|

788,544

|

| Series

362, Class C11, 4.00%, 12/15/47 |

|

4,018

|

833,353

|

| Series

4067, Class JI, 3.50%, 6/15/27 |

|

541

|

21,561

|

| Series

4070, Class S, 0.672%, (5.99% - 30-day average SOFR), 6/15/32(6) |

|

2,318

|

117,435

|

| Series

4088, Class EI, 3.50%, 9/15/41 |

|

20

|

29

|

| Series

4094, Class CS, 0.572%, (5.89% - 30-day average SOFR), 8/15/42(6) |

|

612

|

49,035

|

| Series

4095, Class HS, 0.672%, (5.99% - 30-day average SOFR), 7/15/32(6) |

|

474

|

14,653

|

| Series

4109, Class ES, 0.722%, (6.04% - 30-day average SOFR), 12/15/41(6) |

|

81

|

6,749 |

6

See Notes to Financial Statements.

Eaton Vance

Limited Duration Income Fund

September 30, 2023

Portfolio of

Investments (Unaudited) — continued

| Security

|

Principal

Amount

(000's omitted) |

Value

|

| Interest

Only: (continued) |

|

|

|

| Series

4110, Class SA, 0.222%, (5.54% - 30-day average SOFR), 9/15/42(6) |

$

|

1,965

|

$ 105,772

|

| Series

4149, Class S, 0.822%, (6.14% - 30-day average SOFR), 1/15/33(6) |

|

1,239

|

67,441

|

| Series

4188, Class AI, 3.50%, 4/15/28 |

|

431

|

15,211

|

| Series

4203, Class QS, 0.822%, (6.14% - 30-day average SOFR), 5/15/43(6) |

|

2,265

|

116,046

|

| Series

4408, Class IP, 3.50%, 4/15/44 |

|

1,421

|

190,027

|

| Series

4435, Class BI, 3.50%, 7/15/44 |

|

2,965

|

460,107

|

| Series

4629, Class QI, 3.50%, 11/15/46 |

|

1,187

|

240,485

|

| Series

4644, Class TI, 3.50%, 1/15/45 |

|

1,290

|

191,919

|

| Series

4744, Class IO, 4.00%, 11/15/47 |

|

2,073

|

408,655

|

| Series

4749, Class IL, 4.00%, 12/15/47 |

|

923

|

182,568

|

| Series

4793, Class SD, 0.772%, (6.09% - 30-day average SOFR), 6/15/48(6) |

|

4,402

|

396,570

|

| Series

4966, Class SY, 0.621%, (5.94% - 30-day average SOFR), 4/25/50(6) |

|

11,455

|

1,123,274

|

| Principal

Only:(8) |

|

|

|

| Series

242, Class PO, 0.00%, 11/15/36 |

|

1,784

|

1,381,230

|

| Series

259, Class PO, 0.00%, 4/15/39 |

|

1,126

|

857,748

|

| Series

3606, Class PO, 0.00%, 12/15/39 |

|

1,197

|

890,785

|

| Series

4417, Class KO, 0.00%, 12/15/43 |

|

184

|

113,287

|

| Series

4478, Class PO, 0.00%, 5/15/45 |

|

564

|

394,273

|

| Federal

National Mortgage Association: |

|

|

|

| Series

G93-35, Class ZQ, 6.50%, 11/25/23 |

|

5

|

5,073

|

| Series

G93-40, Class H, 6.40%, 12/25/23 |

|

3

|

2,554

|

| Series

1994-45, Class Z, 6.50%, 2/25/24 |

|

1

|

785

|

| Series

1994-89, Class ZQ, 8.00%, 7/25/24 |

|

34

|

33,974

|

| Series

1996-57, Class Z, 7.00%, 12/25/26 |

|

82

|

81,401

|

| Series

1997-77, Class Z, 7.00%, 11/18/27 |

|

52

|

52,523

|

| Series

1998-44, Class ZA, 6.50%, 7/20/28 |

|

66

|

66,062

|

| Series

1999-45, Class ZG, 6.50%, 9/25/29 |

|

19

|

18,718

|

| Series

2000-22, Class PN, 6.00%, 7/25/30 |

|

259

|

256,540

|

| Series

2002-21, Class PE, 6.50%, 4/25/32 |

|

183

|

186,839

|

| Series

2005-75, Class CS, 2.482%, (23.74% - 30-day average SOFR x 4.00), 9/25/35(6) |

|

541

|

558,153

|

| Series

2007-74, Class AC, 5.00%, 8/25/37 |

|

2,102

|

2,061,128

|

| Series

2011-49, Class NT, 6.00%, (64.86% - 30-day average SOFR x 10.00, Cap 6.00%), 6/25/41(6) |

|

212

|

196,154

|

| Series

2012-134, Class ZT, 2.00%, 12/25/42 |

|

1,307

|

1,007,291

|

| Series

2013-6, Class TA, 1.50%, 1/25/43 |

|

1,195

|

1,007,327

|

| Series

2013-67, Class NF, 5.00%, (30-day average SOFR + 1.11%), 7/25/43(2) |

|

947

|

854,135

|

| Series

2017-15, Class LE, 3.00%, 6/25/46 |

|

456

|

438,620

|

| Series

2017-48, Class LG, 2.75%, 5/25/47 |

|

1,346

|

1,128,548

|

| Interest

Only:(7) |

|

|

|

| Series

2011-101, Class IC, 3.50%, 10/25/26 |

|

1,242

|

36,174 |

| Security

|

Principal

Amount

(000's omitted) |

Value

|

| Interest

Only: (continued) |

|

|

|

| Series

2011-101, Class IE, 3.50%, 10/25/26 |

$

|

400

|

$ 11,414

|

| Series

2012-33, Class CI, 3.50%, 3/25/27 |

|

634

|

13,117

|

| Series

2012-118, Class IN, 3.50%, 11/25/42 |

|

2,883

|

571,606

|

| Series

2012-124, Class IO, 1.484%, 11/25/42(9) |

|

1,239

|

56,353

|

| Series

2012-125, Class IG, 3.50%, 11/25/42 |

|

9,042

|

1,921,091

|

| Series

2012-150, Class SK, 0.721%, (6.04% - 30-day average SOFR), 1/25/43(6) |

|

1,695

|

139,915

|

| Series

2013-12, Class SP, 0.221%, (5.54% - 30-day average SOFR), 11/25/41(6) |

|

301

|

3,191

|

| Series

2013-15, Class DS, 0.771%, (6.09% - 30-day average SOFR), 3/25/33(6) |

|

3,752

|

166,590

|

| Series

2013-16, Class SY, 0.721%, (6.04% - 30-day average SOFR), 3/25/43(6) |

|

902

|

102,227

|

| Series

2013-54, Class HS, 0.871%, (6.19% - 30-day average SOFR), 10/25/41(6) |

|

12

|

18

|

| Series

2013-64, Class PS, 0.821%, (6.14% - 30-day average SOFR), 4/25/43(6) |

|

1,246

|

67,021

|

| Series

2013-75, Class SC, 0.821%, (6.14% - 30-day average SOFR), 7/25/42(6) |

|

1,586

|

27,562

|

| Series

2014-32, Class EI, 4.00%, 6/25/44 |

|

339

|

59,381

|

| Series

2014-55, Class IN, 3.50%, 7/25/44 |

|

726

|

148,369

|

| Series

2014-89, Class IO, 3.50%, 1/25/45 |

|

963

|

207,261

|

| Series

2015-52, Class MI, 3.50%, 7/25/45 |

|

838

|

168,785

|

| Series

2018-21, Class IO, 3.00%, 4/25/48 |

|

3,872

|

684,973

|

| Series

2019-1, Class AS, 0.571%, (5.89% - 30-day average SOFR), 2/25/49(6) |

|

6,286

|

342,832

|

| Series

2019-33, Class SK, 0.621%, (5.94% - 30-day average SOFR), 7/25/49(6) |

|

4,083

|

303,714

|

| Series

2020-23, Class SP, 0.621%, (5.94% - 30-day average SOFR), 2/25/50(6) |

|

3,549

|

351,728

|

| Principal

Only:(8) |

|

|

|

| Series

379, Class 1, 0.00%, 5/25/37 |

|

1,116

|

847,313

|

| Series

2006-8, Class WQ, 0.00%, 3/25/36 |

|

1,869

|

1,480,084

|

| Government

National Mortgage Association: |

|

|

|

| Series

2017-121, Class DF, 5.00%, (1 mo. SOFR + 0.61%), 8/20/47(2) |

|

3,119

|

2,945,530

|

| Series

2017-137, Class AF, 5.00%, (1 mo. SOFR + 0.61%), 9/20/47(2) |

|

1,635

|

1,542,999

|

| Series

2018-6, Class JZ, 4.00%, 1/20/48 |

|

5,204

|

4,557,477

|

| Series

2021-160, Class NZ, 3.00%, 9/20/51 |

|

1,514

|

787,629

|

| Series

2021-165, Class MZ, 2.50%, 9/20/51 |

|

9,209

|

4,941,949

|

| Series

2022-189, Class US, 3.248%, (22.73% - 30-day average SOFR x 3.667), 11/20/52(6) |

|

4,486

|

4,163,383

|

| Series

2023-56, Class ZE, 6.00%, 4/20/53 |

|

10,253

|

9,491,032

|

| Series

2023-63, Class S, 3.064%, (22.55% - 30-day average SOFR x 3.667), 5/20/53(6) |

|

4,936

|

4,500,195

|

| Series

2023-65, Class SD, 3.064%, (22.55% - 30-day average SOFR x 3.667), 5/20/53(6) |

|

5,968

|

5,704,395

|

| Series

2023-96, Class BL, 6.00%, 7/20/53 |

|

4,326

|

4,236,292

|

| Series

2023-96, Class DB, 6.00%, 7/20/53 |

|

2,500

|

2,444,831 |

7

See Notes to Financial Statements.

Eaton Vance

Limited Duration Income Fund

September 30, 2023

Portfolio of

Investments (Unaudited) — continued

| Security

|

Principal

Amount

(000's omitted) |

Value

|

Government

National Mortgage Association:

(continued) |

|

|

|

| Series

2023-97, Class CB, 6.00%, 7/20/53 |

$

|

10,000

|

$

9,907,751 |

| Series

2023-99, Class AL, 6.00%, 7/20/53 |

|

2,500

|

2,445,172

|

| Series

2023-102, Class SG, 2.742%, (22.55% - 30-day average SOFR x 3.727), 7/20/53(6) |

|

8,398

|

7,630,503

|

| Series

2023-115, Class AL, 6.00%, 8/20/53 |

|

8,500

|

8,333,922

|

| Series

2023-116, Class CY, 6.00%, 8/20/53 |

|

5,000

|

4,890,295

|

| Series

2023-133, Class S, 5.66%, (21.60% - 30-day average SOFR x 3.00), 9/20/53(6) |

|

4,300

|

4,153,351

|

| Series

2023-149, Class S, (21.45% - 30-day average SOFR x 3.00), 10/20/53(3)(6) |

|

5,000

|

4,986,570

|

| Interest

Only:(7) |

|

|

|

| Series

2017-104, Class SD, 0.761%, (6.08% - 1 mo. SOFR), 7/20/47(6) |

|

2,424

|

204,935

|

| Series

2020-151, Class AI, 2.00%, 10/20/50 |

|

11,645

|

1,427,132

|

| Series

2020-154, Class PI, 2.50%, 10/20/50 |

|

10,573

|

1,415,781

|

| Series

2020-176, Class HI, 2.50%, 11/20/50 |

|

12,354

|

1,661,957

|

| Series

2021-131, Class QI, 3.00%, 7/20/51 |

|

10,035

|

1,260,257

|

| Series

2021-193, Class IU, 3.00%, 11/20/49 |

|

21,186

|

2,843,528

|

| Series

2021-209, Class IW, 3.00%, 11/20/51 |

|

13,848

|

1,789,428

|

Total

Collateralized Mortgage Obligations

(identified cost $193,000,760) |

|

|

$ 141,926,289

|

| Commercial

Mortgage-Backed Securities — 5.8% |

| Security

|

Principal

Amount

(000's omitted) |

Value

|

| BAMLL

Commercial Mortgage Securities Trust: |

|

|

|

| Series

2019-BPR, Class ENM, 3.843%, 11/5/32(1)(9) |

$

|

910

|

$ 301,055

|

| Series

2019-BPR, Class FNM, 3.843%, 11/5/32(1)(9) |

|

3,505

|

775,904

|

| BBCMS

Mortgage Trust, Series 2017-C1, Class D, 3.709%, 2/15/50(1)(9) |

|

2,200

|

1,458,403

|

| BX

Commercial Mortgage Trust, Series 2021-VOLT, Class C, 6.547%, (1 mo. SOFR + 1.214%), 9/15/36(1)(2) |

|

2,000

|

1,925,011

|

| CFCRE

Commercial Mortgage Trust: |

|

|

|

| Series

2016-C3, Class C, 4.911%, 1/10/48(9) |

|

1,300

|

1,118,091

|

| Series

2016-C3, Class D, 3.052%, 1/10/48(1)(9) |

|

3,500

|

2,679,251

|

| Series

2016-C7, Class D, 4.514%, 12/10/54(1)(9) |

|

1,675

|

1,157,300

|

| CGMS

Commercial Mortgage Trust, Series 2015-P1, Class D, 3.225%, 9/15/48(1) |

|

1,100

|

883,357

|

| COMM

Mortgage Trust: |

|

|

|

| Series

2013-CR11, Class D, 4.828%, 8/10/50(1)(9) |

|

7,400

|

6,635,487

|

| Series

2014-CR21, Class C, 4.564%, 12/10/47(9) |

|

2,000

|

1,848,232

|

| Series

2015-CR22, Class D, 4.203%, 3/10/48(1)(9) |

|

4,100

|

3,232,593 |

| Security

|

Principal

Amount

(000's omitted) |

Value

|

| CSMC

Trust: |

|

|

|

| Series

2016-NXSR, Class C, 4.574%, 12/15/49(9) |

$

|

2,770

|

$

1,944,848 |

| Series

2016-NXSR, Class D, 4.574%, 12/15/49(1)(9) |

|

3,000

|

1,904,133

|

| Series

2020-TMIC, Class A, 8.948%, (1 mo. SOFR + 3.614%), 12/15/35(1)(2) |

|

2,100

|

2,098,510

|

| Series

2021-WEHO, Class A, 9.417%, (1 mo. SOFR + 4.083%), 4/15/26(1)(2) |

|

72

|

70,502

|

| Federal

National Mortgage Association Multifamily Connecticut Avenue Securities Trust, Series 2019-01, Class M10, 8.679%, (30-day average SOFR + 3.364%), 10/25/49(1)(2) |

|

1,497

|

1,463,722

|

| JPMBB

Commercial Mortgage Securities Trust: |

|

|

|

| Series

2014-C22, Class D, 4.70%, 9/15/47(1)(9) |

|

5,276

|

3,567,039

|

| Series

2014-C23, Class D, 4.129%, 9/15/47(1)(9) |

|

3,488

|

2,899,475

|

| Series

2014-C25, Class D, 4.081%, 11/15/47(1)(9) |

|

4,400

|

1,863,864

|

| Series

2015-C29, Class D, 3.827%, 5/15/48(9) |

|

2,000

|

1,311,879

|

| JPMorgan

Chase Commercial Mortgage Securities Trust: |

|

|

|

| Series

2013-C13, Class D, 4.116%, 1/15/46(1)(9) |

|

608

|

559,721

|

| Series

2013-C16, Class D, 5.10%, 12/15/46(1)(9) |

|

3,500

|

3,017,870

|

| Series

2014-DSTY, Class B, 3.771%, 6/10/27(1) |

|

2,600

|

380,835

|

| Series

2021-MHC, Class C, 6.747%, (1 mo. SOFR + 1.414%), 4/15/38(1)(2) |

|

1,900

|

1,869,625

|

| Morgan

Stanley Bank of America Merrill Lynch Trust: |

|

|

|

| Series

2014-C16, Class B, 4.438%, 6/15/47(9)(10) |

|

363

|

328,827

|

| Series

2015-C23, Class D, 4.276%, 7/15/50(1)(9)(10) |

|

2,670

|

2,253,613

|

| Series

2016-C29, Class D, 3.00%, 5/15/49(1)(10) |

|

3,577

|

2,569,828

|

| Series

2016-C32, Class D, 3.396%, 12/15/49(1)(9)(10) |

|

1,600

|

1,057,262

|

| Morgan

Stanley Capital I Trust: |

|

|

|

| Series

2016-UBS12, Class D, 3.312%, 12/15/49(1)(10) |

|

4,489

|

2,372,598

|

| Series

2019-BPR, Class C, 8.972%, (1 mo. SOFR + 3.642%), 5/15/36(1)(2)(10) |

|

1,845

|

1,746,482

|

| UBS-Barclays

Commercial Mortgage Trust, Series 2013-C6, Class D, 4.103%, 4/10/46(1)(9) |

|

4,398

|

3,645,737

|

| VMC

Finance, LLC, Series 2021-HT1, Class B, 9.945%, (1 mo. SOFR + 4.614%), 1/18/37(1)(2) |

|

6,000

|

5,691,163

|

| Wells

Fargo Commercial Mortgage Trust: |

|

|

|

| Series

2013-LC12, Class D, 4.087%, 7/15/46(1)(9) |

|

3,000

|

598,417

|

| Series

2015-C31, Class D, 3.852%, 11/15/48 |

|

2,475

|

1,873,748

|

| Series

2016-C35, Class D, 3.142%, 7/15/48(1) |

|

1,850

|

1,316,033

|

| Series

2016-C36, Class D, 2.942%, 11/15/59(1) |

|

1,500

|

869,149

|

Total

Commercial Mortgage-Backed Securities

(identified cost $86,349,267) |

|

|

$ 69,289,564

|

8

See Notes to Financial Statements.

Eaton Vance

Limited Duration Income Fund

September 30, 2023

Portfolio of

Investments (Unaudited) — continued

| Security

|

Shares

|

Value

|

| Aerospace

and Defense — 0.0% |

| IAP

Worldwide Services, LLC(11)(12)(13) |

|

30

|

$

0 |

| |

|

|

$ 0

|

| Chemicals

— 0.0% |

| Flint

Campfire Topco, Ltd.(12)(13) |

|

43,048

|

$

0 |

| |

|

|

$ 0

|

| Commercial

Services & Supplies — 0.1% |

| Monitronics

International, Inc.(12)(13) |

|

26,092

|

$

547,932 |

| Phoenix

Services International, LLC(12)(13) |

|

17,026

|

170,260

|

| Phoenix

Services International, LLC(12)(13) |

|

1,554

|

15,540

|

| |

|

|

$ 733,732

|

| Containers

and Glass Products — 0.1% |

| LG

Parent Holding Co.(12)(13) |

|

166,175

|

$

1,262,930 |

| |

|

|

$ 1,262,930

|

| Electronics/Electrical

— 0.0%(14) |

| Skillsoft

Corp.(12)(13) |

|

143,062

|

$

126,810 |

| |

|

|

$ 126,810

|

| Entertainment

— 0.0%(14) |

| New

Cineworld, Ltd.(12)(13) |

|

12,854

|

$

304,212 |

| |

|

|

$ 304,212

|

| Health

Care — 0.0% |

| Akorn

Holding Company, LLC, Class A(11)(12)(13) |

|

42,374

|

$

0 |

| |

|

|

$ 0

|

| Household

Durables — 0.3% |

| Serta

Simmons Bedding, Inc.(12)(13) |

|

246,099

|

$

3,645,341 |

| Serta

SSB Equipment Co.(12)(13) |

|

246,099

|

0

|

| |

|

|

$ 3,645,341

|

| Investment

Companies — 0.0%(14) |

| Aegletes

B.V.(13) |

|

11,215

|

$

27,056 |

| Jubilee

Topco, Ltd., Class A(11)(12)(13) |

|

807,124

|

0

|

| |

|

|

$ 27,056

|

| Security

|

Shares

|

Value

|

| Media

— 0.1% |

| National

CineMedia, Inc.(12)(13) |

|

147,914

|

$

664,134 |

| |

|

|

$ 664,134

|

| Nonferrous

Metals/Minerals — 0.0%(14) |

| ACNR

Holdings, Inc., Class A(12)(13) |

|

3,818

|

$

342,348 |

| |

|

|

$ 342,348

|

| Oil

and Gas — 0.0%(14) |

| AFG

Holdings, Inc.(11)(12)(13) |

|

29,751

|

$

61,287 |

| McDermott

International, Ltd.(12)(13) |

|

93,940

|

23,955

|

| |

|

|

$ 85,242

|

| Pharmaceuticals

— 0.0%(14) |

| Covis

Midco 1 S.a.r.l., Class A(12)(13) |

|

560

|

$

285 |

| Covis

Midco 1 S.a.r.l., Class B(12)(13) |

|

560

|

285

|

| Covis

Midco 1 S.a.r.l., Class C(12)(13) |

|

560

|

286

|

| Covis

Midco 1 S.a.r.l., Class D(12)(13) |

|

560

|

286

|

| Covis

Midco 1 S.a.r.l., Class E(12)(13) |

|

560

|

286

|

| |

|

|

$ 1,428

|

| Retailers

(Except Food and Drug) — 0.0%(14) |

| David’s

Bridal, LLC(11)(12)(13) |

|

40,851

|

$

0 |

| Phillips

Feed Service, Inc.(11)(12)(13) |

|

582

|

27,774

|

| |

|

|

$ 27,774

|

| Telecommunications

— 0.0% |

| Global

Eagle Entertainment(11)(12)(13) |

|

37,259

|

$

0 |

| |

|

|

$ 0

|

| Utilities

— 0.0%(14) |

| Longview

Intermediate Holdings, LLC, Class A(12)(13) |

|

10,730

|

$

86,591 |

| |

|

|

$ 86,591

|

Total

Common Stocks

(identified cost $9,739,632) |

|

|

$ 7,307,598

|

9

See Notes to Financial Statements.

Eaton Vance

Limited Duration Income Fund

September 30, 2023

Portfolio of

Investments (Unaudited) — continued

| Security

|

Principal

Amount

(000's omitted) |

Value

|

| Energy

— 0.1% |

| NextEra

Energy Partners, L.P., 2.50%, 6/15/26(1) |

$

|

1,440

|

$

1,228,320 |

| |

|

|

$ 1,228,320

|

| Transportation

— 0.1% |

| CryoPort,

Inc., 0.75%, 12/1/26(1) |

$

|

2,335

|

$

1,856,325 |

| |

|

|

$ 1,856,325

|

Total

Convertible Bonds

(identified cost $3,191,481) |

|

|

$ 3,084,645

|

| Security

|

Principal

Amount*

(000's omitted) |

Value

|

| Aerospace

and Defense — 1.4% |

| Boeing

Co., 5.04%, 5/1/27 |

|

475

|

$

463,969 |

| Bombardier,

Inc.: |

|

|

|

| 7.125%,

6/15/26(1) |

|

736

|

713,784

|

| 7.875%,

4/15/27(1) |

|

1,795

|

1,753,009

|

| Moog,

Inc., 4.25%, 12/15/27(1) |

|

955

|

863,344

|

| Rolls-Royce

PLC: |

|

|

|

| 5.75%,

10/15/27(1) |

|

2,954

|

2,853,293

|

| 5.75%,

10/15/27(15) |

GBP

|

200

|

232,372

|

| Spirit

AeroSystems, Inc.: |

|

|

|

| 4.60%,

6/15/28 |

|

567

|

442,573

|

| 9.375%,

11/30/29(1) |

|

220

|

224,155

|

| TransDigm,

Inc.: |

|

|

|

| 5.50%,

11/15/27 |

|

2,552

|

2,392,104

|

| 6.25%,

3/15/26(1) |

|

2,408

|

2,368,161

|

| 6.75%,

8/15/28(1) |

|

1,812

|

1,786,158

|

| 7.50%,

3/15/27 |

|

2,862

|

2,870,351

|

| |

|

|

$ 16,963,273

|

| Agriculture

— 0.2% |

| Darling

Ingredients, Inc., 6.00%, 6/15/30(1) |

|

1,277

|

$

1,210,414 |

| Imperial

Brands Finance PLC: |

|

|

|

| 3.125%,

7/26/24(1) |

|

300

|

292,419

|

| 6.125%,

7/27/27(1) |

|

475

|

473,936

|

| Philip

Morris International, Inc., 5.125%, 11/17/27 |

|

750

|

734,816

|

| |

|

|

$ 2,711,585

|

| Security

|

Principal

Amount*

(000's omitted) |

Value

|

| Air

Transport — 0.9% |

| Air

France-KLM: |

|

|

|

| 7.25%,

5/31/26(15) |

EUR

|

100

|

$

108,499 |

| 8.125%,

5/31/28(15) |

EUR

|

100

|

110,453

|

| American

Airlines, Inc., 7.25%, 2/15/28(1) |

|

478

|

457,492

|

| American

Airlines, Inc./AAdvantage Loyalty IP, Ltd.: |

|

|

|

| 5.50%,

4/20/26(1) |

|

1,789

|

1,749,168

|

| 5.75%,

4/20/29(1) |

|

1,952

|

1,817,068

|

| Delta

Air Lines, Inc./SkyMiles IP, Ltd., 4.75%, 10/20/28(1) |

|

1,016

|

965,924

|

| Deutsche

Lufthansa AG: |

|

|

|

| 2.875%,

5/16/27(15) |

EUR

|

100

|

96,420

|

| 3.50%,

7/14/29(15) |

EUR

|

300

|

281,921

|

| 4.382%

to 2/12/26, 8/12/75(15)(16) |

EUR

|

200

|

198,022

|

| Gatwick

Airport Finance PLC, 4.375%, 4/7/26(15) |

GBP

|

300

|

340,542

|

| Heathrow

Finance PLC, 4.75% to 12/1/23, 3/1/24(4)(15) |

GBP

|

225

|

271,777

|

| Mileage

Plus Holdings, LLC/Mileage Plus Intellectual Property Assets, Ltd., 6.50%, 6/20/27(1) |

|

1,811

|

1,796,245

|

| United

Airlines, Inc.: |

|

|

|

| 4.375%,

4/15/26(1) |

|

835

|

773,031

|

| 4.625%,

4/15/29(1) |

|

1,276

|

1,098,094

|

| |

|

|

$ 10,064,656

|

| Airlines

— 0.2% |

| Air

Canada: |

|

|

|

| 3.875%,

8/15/26(1) |

|

2,039

|

$

1,852,489 |

| 4.625%,

8/15/29(1) |

CAD

|

717

|

466,186

|

| |

|

|

$ 2,318,675

|

| Auto

Components — 0.4% |

| Daimler

Truck Finance North America, LLC, 2.00%, 12/14/26(1) |

|

550

|

$

491,653 |

| General

Motors Financial Co., Inc.: |

|

|

|

| 1.50%,

6/10/26 |

|

1,125

|

994,558

|

| 5.80%,

6/23/28 |

|

475

|

464,305

|

| Hyundai

Capital America, 1.30%, 1/8/26(1) |

|

350

|

315,294

|

| Mercedes-Benz

Finance North America, LLC, 3.30%, 5/19/25(1) |

|

500

|

482,309

|

| Nissan

Motor Acceptance Co., LLC, 6.95%, 9/15/26(1) |

|

450

|

453,479

|

| Volkswagen

Group of America Finance, LLC: |

|

|

|

| 0.875%,

11/22/23(1) |

|

975

|

968,481

|

| 1.25%,

11/24/25(1) |

|

525

|

476,799

|

| |

|

|

$ 4,646,878

|

10

See Notes to Financial Statements.

Eaton Vance

Limited Duration Income Fund

September 30, 2023

Portfolio of

Investments (Unaudited) — continued

| Security

|

Principal

Amount*

(000's omitted) |

Value

|

| Automotive

— 1.7% |

| Asbury

Automotive Group, Inc.: |

|

|

|

| 4.625%,

11/15/29(1) |

|

512

|

$ 440,425

|

| 4.75%,

3/1/30 |

|

1,134

|

971,285

|

| 5.00%,

2/15/32(1) |

|

217

|

180,048

|

| Clarios

Global, L.P./Clarios U.S. Finance Co.: |

|

|

|

| 4.375%,

5/15/26(15) |

EUR

|

400

|

407,457

|

| 6.25%,

5/15/26(1) |

|

1,504

|

1,473,317

|

| 6.75%,

5/15/25(1) |

|

432

|

429,188

|

| 8.50%,

5/15/27(1) |

|

3,484

|

3,480,538

|

| Dana

Financing Luxembourg S.a.r.l., 8.50%, 7/15/31(15) |

EUR

|

200

|

214,692

|

| Dornoch

Debt Merger Sub, Inc., 6.625%, 10/15/29(1) |

|

1,263

|

1,045,653

|

| Ford

Motor Co.: |

|

|

|

| 3.25%,

2/12/32 |

|

2,825

|

2,179,893

|

| 4.75%,

1/15/43 |

|

1,274

|

931,264

|

| 7.45%,

7/16/31 |

|

457

|

474,602

|

| 9.625%,

4/22/30 |

|

201

|

229,841

|

| Forvia

SE: |

|

|

|

| 2.375%,

6/15/29(15) |

EUR

|

100

|

86,438

|

| 2.75%,

2/15/27(15) |

EUR

|

260

|

248,283

|

| 3.75%,

6/15/28(15) |

EUR

|

100

|

95,256

|

| Goodyear

Europe B.V., 2.75%, 8/15/28(15) |

EUR

|

100

|

87,755

|

| IHO

Verwaltungs GmbH: |

|

|

|

| 6.375%,

(6.375% cash or 7.125% PIK), 5/15/29(1)(17) |

|

200

|

180,610

|

| 8.75%,

(8.75% cash or 9.50% PIK), 5/15/28(15)(17) |

EUR

|

100

|

109,309

|

| Jaguar

Land Rover Automotive PLC, 2.20%, 1/15/24(15) |

EUR

|

100

|

104,842

|

| Lithia

Motors, Inc.: |

|

|

|

| 3.875%,

6/1/29(1) |

|

651

|

549,379

|

| 4.375%,

1/15/31(1) |

|

1,171

|

969,936

|

| 4.625%,

12/15/27(1) |

|

514

|

469,896

|

| Real

Hero Merger Sub 2, Inc., 6.25%, 2/1/29(1) |

|

1,453

|

1,123,903

|

| Renault

S.A.: |

|

|

|

| 2.375%,

5/25/26(15) |

EUR

|

100

|

98,176

|

| 2.50%,

6/2/27(15) |

EUR

|

500

|

479,731

|

| Sonic

Automotive, Inc.: |

|

|

|

| 4.625%,

11/15/29(1) |

|

1,297

|

1,076,904

|

| 4.875%,

11/15/31(1) |

|

1,081

|

861,779

|

| TI

Automotive Finance PLC, 3.75%, 4/15/29(15) |

EUR

|

112

|

96,935

|

| Volkswagen

International Finance N.V., 3.875% to 6/17/29(15)(16)(18) |

EUR

|

200

|

174,975

|

| Wheel

Pros, Inc., 6.50%, 5/15/29(1) |

|

1,069

|

359,451

|

| ZF

Europe Finance B.V., 6.125%, 3/13/29(15) |

EUR

|

200

|

211,741

|

| ZF

Finance GmbH: |

|

|

|

| 2.00%,

5/6/27(15) |

EUR

|

100

|

92,847 |

| Security

|

Principal

Amount*

(000's omitted) |

Value

|

| Automotive

(continued) |

| ZF

Finance GmbH: (continued) |

|

|

|

| 5.75%,

8/3/26(15) |

EUR

|

100

|

$

105,732 |

| |

|

|

$ 20,042,081

|

| Banks

— 1.3% |

| ABN

AMRO Bank NV, 6.339% to 9/18/26, 9/18/27(1)(16) |

|

400

|

$

399,171 |

| AIB

Group PLC, 6.608% to 9/13/28, 9/13/29(1)(16) |

|

200

|

199,298

|

| Australia

& New Zealand Banking Group, Ltd., 4.829%, 2/3/25(1) |

|

900

|

892,307

|

| Bank

of New York Mellon Corp. (The), 4.947% to 4/26/26, 4/26/27(16) |

|

600

|

585,791

|

| Banque

Federative du Credit Mutuel S.A., 2.375%, 11/21/24(1) |

|

1,025

|

983,441

|

| Canadian

Imperial Bank of Commerce: |

|

|

|

| 3.30%,

4/7/25 |

|

500

|

480,727

|

| 5.144%,

4/28/25 |

|

650

|

641,684

|

| Citizens

Bank N.A., 6.064% to 10/24/24, 10/24/25(16) |

|

700

|

675,678

|

| Danske

Bank A/S, 6.259% to 9/22/25, 9/22/26(1)(16) |

|

500

|

499,996

|

| Deutsche

Bank AG: |

|

|

|

| 0.962%,

11/8/23 |

|

975

|

969,209

|

| 7.146%

to 7/13/26, 7/13/27(16) |

|

150

|

151,072

|

| Discover

Bank, 2.45%, 9/12/24 |

|

1,000

|

961,417

|

| Fifth

Third Bancorp, 6.339% to 7/27/28, 7/27/29(16) |

|

100

|

98,840

|

| Intesa

Sanpaolo SpA, 7.00%, 11/21/25(1) |

|

925

|

936,641

|

| KeyBank

N.A., 4.15%, 8/8/25 |

|

500

|

471,063

|

| National

Bank of Canada, 0.55% to 11/15/23, 11/15/24(16) |

|

1,000

|

992,619

|

| National

Securities Clearing Corp., 5.00%, 5/30/28(1) |

|

675

|

660,784

|

| Santander

UK Group Holdings PLC, 6.833% to 11/21/25, 11/21/26(16) |

|

1,900

|

1,911,400

|

| Sumitomo

Mitsui Trust Bank, Ltd., 5.55%, 9/14/28(1) |

|

350

|

348,208

|

| Toronto-Dominion

Bank (The): |

|

|

|

| 5.523%,

7/17/28 |

|

750

|

740,694

|

| 8.125%

to 10/31/27, 10/31/82(16) |

|

450

|

448,809

|

| U.S.

Bancorp, 5.775% to 6/12/28, 6/12/29(16) |

|

1,475

|

1,436,554

|

| UBS

Group AG, 6.442% to 8/11/27, 8/11/28(1)(16) |

|

475

|

474,798

|

| |

|

|

$ 15,960,201

|

| Banks

and Thrifts — 0.6% |

| American

Express Co., 2.55%, 3/4/27 |

|

525

|

$

473,589 |

| BPCE

S.A., 5.15%, 7/21/24(1) |

|

950

|

935,126

|

| Capital

One Financial Corp.: |

|

|

|

| 3.273%

to 3/1/29, 3/1/30(16) |

|

395

|

330,648

|

| 6.312%

to 6/8/28, 6/8/29(16) |

|

350

|

342,235 |

11

See Notes to Financial Statements.

Eaton Vance

Limited Duration Income Fund

September 30, 2023

Portfolio of

Investments (Unaudited) — continued

| Security

|

Principal

Amount*

(000's omitted) |

Value

|

| Banks

and Thrifts (continued) |

| HSBC

Holdings PLC, 6.161% to 3/9/28, 3/9/29(16) |

|

1,350

|

$

1,337,148 |

| Swedbank

AB, 3.356%, 4/4/25(1) |

|

975

|

938,456

|

| Synchrony

Bank, 5.625%, 8/23/27 |

|

1,300

|

1,214,177

|

| Texas

Capital Bancshares, Inc., 4.00% to 5/6/26, 5/6/31(16) |

|

1,500

|

1,245,702

|

| United

Overseas Bank, Ltd., 3.863% to 10/7/27, 10/7/32(1)(16) |

|

686

|

630,729

|

| |

|

|

$ 7,447,810

|

| Beverage

and Tobacco — 0.1% |

| BAT

Capital Corp., 3.557%, 8/15/27 |

|

277

|

$

253,564 |

| JDE

Peet's NV, 0.80%, 9/24/24(1) |

|

800

|

759,533

|

| |

|

|

$ 1,013,097

|

| Biotechnology

— 0.0%(14) |

| Royalty

Pharma PLC, 1.20%, 9/2/25 |

|

525

|

$

477,383 |

| |

|

|

$ 477,383

|

| Building

and Development — 1.6% |

| Ashton

Woods USA, LLC/Ashton Woods Finance Co.: |

|

|

|

| 4.625%,

8/1/29(1) |

|

392

|

$

331,230 |

| 4.625%,

4/1/30(1) |

|

390

|

319,679

|

| Builders

FirstSource, Inc.: |

|

|

|

| 4.25%,

2/1/32(1) |

|

2,118

|

1,739,377

|

| 5.00%,

3/1/30(1) |

|

1,085

|

968,658

|

| Castle

UK Finco PLC, 9.031%, (3 mo. EURIBOR + 5.25%), 5/15/28(2)(15) |

EUR

|

200

|

183,475

|

| Emerald

Debt Merger Sub, LLC: |

|

|

|

| 6.375%,

12/15/30(15) |

EUR

|

200

|

211,135

|

| 6.625%,

12/15/30(1) |

|

379

|

365,327

|

| James

Hardie International Finance DAC, 3.625%, 10/1/26(15) |

EUR

|

400

|

407,553

|

| KB

Home: |

|

|

|

| 4.00%,

6/15/31 |

|

86

|

69,419

|

| 4.80%,

11/15/29 |

|

556

|

489,880

|

| Masonite

International Corp., 5.375%, 2/1/28(1) |

|

570

|

530,847

|

| MIWD

Holdco II, LLC/MIWD Finance Corp., 5.50%, 2/1/30(1) |

|

760

|

628,706

|

| Mohawk

Industries, Inc., 5.85%, 9/18/28 |

|

275

|

273,105

|

| Patrick

Industries, Inc.: |

|

|

|

| 4.75%,

5/1/29(1) |

|

1,187

|

992,457

|

| 7.50%,

10/15/27(1) |

|

225

|

215,677

|

| PGT

Innovations, Inc., 4.375%, 10/1/29(1) |

|

1,456

|

1,344,140

|

| Smyrna

Ready Mix Concrete, LLC, 6.00%, 11/1/28(1) |

|

3,078

|

2,845,152 |

| Security

|

Principal

Amount*

(000's omitted) |

Value

|

| Building

and Development (continued) |

| SRS

Distribution, Inc.: |

|

|

|

| 6.00%,

12/1/29(1) |

|

692

|

$

582,052 |

| 6.125%,

7/1/29(1) |

|

1,195

|

1,018,892

|

| Standard

Industries, Inc.: |

|

|

|

| 2.25%,

11/21/26(15) |

EUR

|

450

|

421,377

|

| 3.375%,

1/15/31(1) |

|

1,634

|

1,265,102

|

| 4.375%,

7/15/30(1) |

|

1,779

|

1,475,225

|

| 5.00%,

2/15/27(1) |

|

457

|

424,064

|

| Taylor

Morrison Communities, Inc., 5.875%, 6/15/27(1) |

|

808

|

769,031

|

| Victoria

PLC, 3.625%, 8/24/26(15) |

EUR

|

275

|

230,056

|

| White

Cap Buyer, LLC, 6.875%, 10/15/28(1) |

|

719

|

636,341

|

| White

Cap Parent, LLC, 8.25%, (8.25% cash or 9.00% PIK), 3/15/26(1)(17) |

|

691

|

667,563

|

| |

|

|

$ 19,405,520

|

| Business

Equipment and Services — 0.8% |

| Adtalem

Global Education, Inc., 5.50%, 3/1/28(1) |

|

1,900

|

$

1,742,404 |

| Allied

Universal Holdco, LLC/Allied Universal Finance Corp.: |

|

|

|

| 6.625%,

7/15/26(1) |

|

2,443

|

2,318,187

|

| 9.75%,

7/15/27(1) |

|

1,148

|

1,028,469

|

| Allied

Universal Holdco, LLC/Allied Universal Finance Corp./Atlas Luxco 4 S.a.r.l.: |

|

|

|

| 3.625%,

6/1/28(15) |

EUR

|

300

|

262,459

|

| 4.625%,

6/1/28(1) |

|

776

|

645,315

|

| 4.625%,

6/1/28(1) |

|

549

|

458,308

|

| 4.875%,

6/1/28(15) |

GBP

|

100

|

97,654

|

| GEMS

MENASA Cayman, Ltd./GEMS Education Delaware, LLC: |

|

|

|

| 7.125%,

7/31/26(1) |

|

2,576

|

2,508,676

|

| 7.125%,

7/31/26(15) |

|

350

|

340,853

|

| Techem

Verwaltungsgesellschaft 675 mbH, 2.00%, 7/15/25(15) |

EUR

|

100

|

102,336

|

| |

|

|

$ 9,504,661

|

| Cable

and Satellite Television — 1.6% |

| Altice

Financing S.A.: |

|

|

|

| 3.00%,

1/15/28(15) |

EUR

|

100

|

$

89,472 |

| 5.00%,

1/15/28(1) |

|

814

|

696,200

|

| Altice

France S.A.: |

|

|

|

| 2.125%,

2/15/25(15) |

EUR

|

100

|

99,923

|

| 2.50%,

1/15/25(15) |

EUR

|

100

|

100,427

|

| 5.125%,

7/15/29(1) |

|

767

|

546,415

|

| 5.50%,

1/15/28(1) |

|

841

|

649,056

|

| 5.875%,

2/1/27(15) |

EUR

|

100

|

91,374 |

12

See Notes to Financial Statements.

Eaton Vance

Limited Duration Income Fund

September 30, 2023

Portfolio of

Investments (Unaudited) — continued

| Security

|

Principal

Amount*

(000's omitted) |

Value

|

| Cable

and Satellite Television (continued) |

| CCO

Holdings, LLC/CCO Holdings Capital Corp.: |

|

|

|

| 4.25%,

2/1/31(1) |

|

2,263

|

$

1,803,642 |

| 4.50%,

8/15/30(1) |

|

2,140

|

1,759,333

|

| 4.50%,

5/1/32 |

|

771

|

605,908

|

| 4.75%,

3/1/30(1) |

|

1,789

|

1,504,006

|

| 4.75%,

2/1/32(1) |

|

1,044

|

836,364

|

| 5.00%,

2/1/28(1) |

|

1,755

|

1,595,704

|

| 5.375%,

6/1/29(1) |

|

595

|

534,452

|

| 6.375%,

9/1/29(1) |

|

1,974

|

1,842,671

|

| Charter

Communications Operating, LLC/Charter Communications Operating Capital, 4.908%, 7/23/25 |

|

950

|

928,605

|

| DISH

Network Corp., 11.75%, 11/15/27(1) |

|

1,293

|

1,304,561

|

| UPC

Holding B.V., 5.50%, 1/15/28(1) |

|

593

|

526,940

|

| Virgin

Media Finance PLC: |

|

|

|

| 3.75%,

7/15/30(15) |

EUR

|

125

|

105,731

|

| 5.00%,

7/15/30(1) |

|

946

|

744,837

|

| Virgin

Media Secured Finance PLC, 5.25%, 5/15/29(15) |

GBP

|

200

|

211,077

|

| Virgin

Media Vendor Financing Notes III DAC, 4.875%, 7/15/28(15) |

GBP

|

525

|

534,805

|

| Virgin

Media Vendor Financing Notes IV DAC, 5.00%, 7/15/28(1) |

|

1,091

|

942,711

|

| VZ

Vendor Financing II B.V., 2.875%, 1/15/29(15) |

EUR

|

100

|

81,870

|

| Ziggo

B.V., 4.875%, 1/15/30(1) |

|

628

|

512,381

|

| Ziggo

Bond Co., B.V.: |

|

|

|

| 3.375%,

2/28/30(15) |

EUR

|

230

|

179,712

|

| 6.00%,

1/15/27(1) |

|

745

|

682,972

|

| |

|

|

$ 19,511,149

|

| Capital

Goods — 0.1% |

| BWX

Technologies, Inc.: |

|

|

|

| 4.125%,

6/30/28(1) |

|

948

|

$

839,118 |

| 4.125%,

4/15/29(1) |

|

733

|

643,735

|

| |

|

|

$ 1,482,853

|

| Chemicals

— 0.1% |

| Calderys

Financing, LLC, 11.25%, 6/1/28(1) |

|

1,444

|

$

1,480,904 |

| |

|

|

$ 1,480,904

|

| Chemicals

and Plastics — 1.1% |

| ASP

Unifrax Holdings, Inc., 5.25%, 9/30/28(1) |

|

1,242

|

$

886,428 |

| Avient

Corp., 7.125%, 8/1/30(1) |

|

1,551

|

1,525,584

|

| Celanese

US Holdings, LLC, 6.35%, 11/15/28 |

|

725

|

716,261

|

| Herens

Holdco S.a.r.l., 4.75%, 5/15/28(1) |

|

545

|

423,867

|

| Herens

Midco S.a.r.l., 5.25%, 5/15/29(15) |

EUR

|

400

|

243,811 |

| Security

|

Principal

Amount*

(000's omitted) |

Value

|

| Chemicals

and Plastics (continued) |

| INEOS

Finance PLC: |

|

|

|

| 2.875%,

5/1/26(15) |

EUR

|

100

|

$

98,391 |

| 3.375%,

3/31/26(15) |

EUR

|

100

|

99,942

|

| INEOS

Quattro Finance 2 PLC, 2.50%, 1/15/26(15) |

EUR

|

154

|

148,657

|

| Italmatch

Chemicals SpA, 10.00%, 2/6/28(15) |

EUR

|

200

|

206,652

|

| NOVA

Chemicals Corp.: |

|

|

|

| 4.25%,

5/15/29(1) |

|

1,242

|

967,864

|

| 4.875%,

6/1/24(1) |

|

1,276

|

1,254,837

|

| Nufarm

Australia, Ltd./Nufarm Americas, Inc., 5.00%, 1/27/30(1) |

|

1,759

|

1,554,261

|

| Olympus

Water US Holding Corp.: |

|

|

|

| 3.875%,

10/1/28(15) |

EUR

|

110

|

97,666

|

| 9.75%,

11/15/28(1) |

|

2,204

|

2,201,991

|

| Valvoline,

Inc., 3.625%, 6/15/31(1) |

|

802

|

622,170

|

| W.R.

Grace Holdings, LLC: |

|

|

|

| 4.875%,

6/15/27(1) |

|

1,472

|

1,352,308

|

| 7.375%,

3/1/31(1) |

|

611

|

592,953

|

| |

|

|

$ 12,993,643

|

| Clothing/Textiles

— 0.1% |

| William

Carter Co. (The), 5.625%, 3/15/27(1) |

|

811

|

$

780,847 |

| |

|

|

$ 780,847

|

| Commercial

Services — 1.5% |

| Abertis

Infraestructuras Finance B.V., 3.248% to 11/24/25(15)(16)(18) |

EUR

|

600

|

$

581,433 |

| APi

Group DE, Inc., 4.75%, 10/15/29(1) |

|

1,510

|

1,327,772

|

| Arena

Luxembourg Finance S.a.r.l., 1.875%, 2/1/28(15) |

EUR

|

200

|

175,664

|

| BCP

V Modular Services Finance II PLC, 4.75%, 11/30/28(15) |

EUR

|

100

|

88,874

|

| Global

Payments, Inc., 4.95%, 8/15/27 |

|

475

|

456,802

|

| GTCR

W-2 Merger Sub, LLC, 7.50%, 1/15/31(1)(3) |

|

1,328

|

1,331,552

|

| GTCR

W-2 Merger Sub, LLC/GTCR W Dutch Finance Sub B.V., 8.50%, 1/15/31(3)(15) |

GBP

|

100

|

124,900

|

| HealthEquity,

Inc., 4.50%, 10/1/29(1) |

|

1,974

|

1,702,822

|

| IPD

3 B.V., 8.00%, 6/15/28(15) |

EUR

|

200

|

213,903

|

| Korn

Ferry, 4.625%, 12/15/27(1) |

|

1,355

|

1,248,063

|

| LABL,

Inc.: |

|

|

|

| 5.875%,

11/1/28(1) |

|

507

|

456,094

|

| 8.25%,

11/1/29(1) |

|

1,016

|

831,215

|

| Loxam

S.A.S., 2.875%, 4/15/26(15) |

EUR

|

100

|

97,896

|

| Metis

Merger Sub, LLC, 6.50%, 5/15/29(1) |

|

2,923

|

2,472,671

|

| Mooney

Group SpA, 7.742%, (3 mo. EURIBOR + 3.875%), 12/17/26(2)(15) |

EUR

|

110

|

116,094

|

| NESCO

Holdings II, Inc., 5.50%, 4/15/29(1) |

|

1,282

|

1,126,501 |

13

See Notes to Financial Statements.

Eaton Vance

Limited Duration Income Fund

September 30, 2023

Portfolio of

Investments (Unaudited) — continued

| Security

|

Principal

Amount*

(000's omitted) |

Value

|

| Commercial

Services (continued) |

| PROG

Holdings, Inc., 6.00%, 11/15/29(1) |

|

1,085

|

$

947,965 |

| Spectrum

Brands, Inc., 4.00%, 10/1/26(15) |

EUR

|

200

|

203,982

|

| Verisure

Holding AB, 3.25%, 2/15/27(15) |

EUR

|

400

|

381,139

|

| Verisure

Midholding AB, 5.25%, 2/15/29(15) |

EUR

|

175

|

162,995

|

| VT

Topco, Inc., 8.50%, 8/15/30(1) |

|

1,824

|

1,808,596

|

| WASH

Multifamily Acquisition, Inc., 5.75%, 4/15/26(1) |

|

2,060

|

1,925,894

|

| |

|

|

$ 17,782,827

|

| Computers

— 1.0% |

| Booz

Allen Hamilton, Inc.: |

|

|

|

| 3.875%,

9/1/28(1) |

|

1,341

|

$

1,202,770 |

| 4.00%,

7/1/29(1) |

|

717

|

633,261

|

| Dell