Worldwide, the semiconductor industry serves as the backbone for

technological advancement. The industry has also experienced

tremendous growth attributable to the torrid rise in demand for

semiconductor devices around the world.

Not only has the space been quickly growing, but it has

witnessed a transformation of sorts lately, as the companies

reshuffled operations with the intent to shift routine productions

to low-cost areas. This change led to the development of the Asian

market which is now into memory production and backend

operations.

However, the global financial meltdown in 2008 had a devastating

impact on the industry largely thanks to slowing growth prospects

and worries over consumer confidence. Globally, semiconductor

devices reported sales of $299.5 billion in 2011, growth of just

0.4% from 2010 levels and a far cry from the 2010 growth rate of

over 31%.

Meanwhile, the Semiconductor Industry Association (SIA) had

earlier projected growth of 6% for 2011, but in December, the

expectation was slashed to 1.3% while the actual was even less than

that.

Semiconductor Sector In Focus

Within the semiconductor industry, computing and consumer

electronics play a major role in the overall sector performance.

The two markets cumulatively contribute around 60% to the total

industry sales.

The Consumer Electronics Association anticipates global consumer

electronics sales to deliver a 5% rise this year, driven by

strength in the emerging Asia/Pacific countries (to grow 18%), the

Middle East and Africa (11%), Latin America (11%) and

Central/Eastern Europe (9%).

North America is expected to be flat, while both developed

Asia/Pacific countries and Western Europe are expected to decline.

The products that would drive growth are tablets (up 59%),

smartphones (22%), home audio (5%) and mobile PCs (3%).

Commoditization and pricing pressure in the computing market

have been big problems and continue to be issues but we are seeing

moves away from that thanks to intense segmentation. This has

allowed for more specialization in the semiconductor space and thus

wider ‘competitive moats’ for many firms in the industry as well

(Three Great Tech ETFs That Avoid Apple).

Also, growth in the data center segment has contributed

enormously to this sector. Add to this the overall sales of

semiconductor devices with its increased focus on servers, storage

and networking equipment which use semiconductors of the high-end

variety.

Semiconductor sales as we’ve seen have shown a modest growth in

2011. The trend is expected to continue this year, while 2013 would

likely be a year of stronger sales. However, the macroeconomic

condition still remains a matter of concern.

Some investors have shown avid interest in the semiconductor

sector. For investors seeking to play this trend in exchange traded

funds (ETFs), there are a variety of semiconductor ETFs offering

excellent exposure. Below, we discuss briefly some of the many

funds which fall in this sector, any of which could help investors

gain targeted exposure to the space.

Market Vectors Semiconductor ETF

(SMH)

Market Vectors Semiconductor ETF, which was converted from the

HOLDRs platform late in 2011, is one of the more popular ETFs in

the segment. The product is a non-diversified fund providing

exposure to just 26 semiconductor companies thereby offering

extremely concentrated exposure.

The fund has an asset base of $340.5 million of which it

allocates nearly 21% of its assets to Intel Corporation (INTC)

while also giving Taiwan Semiconductor Manufacturing Co. Ltd. (TSM)

and Texas Instruments (TXN) weights of 12.9% and 6.8%,

respectively (Intel Report Crushes Semiconductor ETFs).

This ensures that SMH offers investors a highly-concentrated bet

on large caps. Though broad exposure will not be achieved, this

means that the underlying securities will be extremely liquid. SMH

is rich in volume at 1,715,394 and charges an expense ratio of 35

basis points. The fund has added about 5% since the conversion.

PHLX SOX Semiconductor Sector Index Fund

(SOXX)

Just after SMH, iShares made an attempt to provide an exposure

to U.S. semiconductor stocks through PHLX SOX Semiconductor Sector

Index Fund. The fund is a non-diversified ETF that tracks the

PHLX Semiconductor Sector Index offering exposure to a small basket

of 31 semiconductor companies.

Like SMH, the fund is heavily invested in the top 10 holdings

investing 62.2% of the asset base of $213.4 million in those

companies. The fund gives its top weighting to Intel, allocating 9%

to the company. In addition to Intel, other top weightings go to

Taiwan Semiconductor and Broadcom Corp (BRCM).

The fund seems to be not as popular as SMH as the trading volume

stands at 191,100, much lower than SMH. The lower volume of the

fund can be attributed to a somewhat higher expense ratio of 48

basis points and SMH’s solid market position. In addition to the

higher expense ratio and lower volume, the fund delivered a return

of -7.9% over a period of one year.

SPDR S&P Semiconductor ETF

(XSD)

Investors looking for a broader space for investment in the

semiconductor sector should look to XSD. The fund tracks the

S&P Semiconductor Select Industry Index which represents the

Semiconductor sub-industry portion of the S&P Total Markets

Index. The index also uses a modified equal weighting system,

thereby giving equal weighting to small caps. (Small Cap Value ETF

Investing) The fund has an asset base of $34.18 million.

The fund invests in a larger basket of stocks compared to SMH

and SOXX, giving exposure to 50 semiconductor companies. Also,

unlike the first two funds, XSD does not offer concentrated

exposure, investing just 27% in the top 10 holdings, thereby

spreading the asset base in other companies as well.

Additionally, XSD doesn’t give the top portion to Intel, instead

allocating higher weightings to Cirrus Logic Inc. (CRUS) and

Skyworks Solutions Inc. (SWKS). For this diversified and less

concentrated exposure to semiconductor companies, the fund charges

an expense ratio of 35 basis points. However, over a period of one

year, the fund delivered a negative return of 23.1%.

PowerShares Dynamic Semiconductors Portfolio

(PSI)

For a slightly more active approach in the industry, PSI could

be an intriguing choice. The fund tracks the Dynamic Semiconductors

Intellidex Index which is designed to provide exposure to the

semiconductor space by thoroughly evaluating companies based on a

variety of investment merit criteria, including fundamental growth,

stock valuation, investment timeliness and risk factors.

Like other funds, this fund also provides a very narrow exposure

to semiconductor stocks. PSI holds a small basket of 30 stocks. The

fund invests 41% of the asset base of $18.4 million in top 10

holdings. Broadcom Corp and Qualcomm (QCOM) occupy the top two

positions in the fund while Intel takes the sixth position.

The fund appears to be expensive when compared to many others as

it charges an expense ratio of 63 basis points. PSI delivered a

negative return of 13.6% over a period of one year.

Direxion Daily Semiconductor Bull 3x Shares

(SOXL)

The Direxion Daily Semiconductor Bull 3x ETF seeks daily

investment results, before fees and expenses, of 300% of the

performance of the PHLX Semiconductor Sector Index. The

Semiconductor Index measures the performance of the semiconductor

subsector of the U.S. equity market (read Understanding Leveraged

ETFs).

As of March 31, 2012, the Semiconductor Index included companies

with a median market capitalization of $7.1 billion. The average

capitalization of the companies comprising the Semiconductor Index

was approximately $14.3 billion.

The fund holds a total of 30 semiconductor stocks. The fund

delivered a return of negative 41.9% over a period of one year. The

fund charges an expense ratio of 95 basis points.

Ultra Semiconductors

(USD)

The Ultra Semiconductors ETF seeks daily investment results,

before fees and expenses, of 200% of the performance of the Dow

Jones U.S. Semiconductor Index. The Dow Jones U.S.

Semiconductor Index measures the performance of the semiconductor

subsector of the U.S. equity market.

The Index holds a total of 45 semiconductor stocks, with Intel

coming in with the most assets. The fund delivered a return of

negative 18.3% over a period of one year and it charges an expense

ratio of 95 basis points a year.

Direxion Daily Semiconductor Bear 3x Shares

(SOXS)

The Direxion Daily Semiconductor Bear 3x ETF seeks daily

investment results, before fees and expenses, of 300% of the

inverse performance of the PHLX Semiconductor Sector Index.

The Semiconductor Index measures the performance of the

semiconductor subsector of the U.S. equity market.

Recently, the Semiconductor Index included companies with a

median market capitalization of $7.1 billion. The average

capitalization of the companies comprising the Semiconductor Index

was approximately $14.3 billion.

The fund holds a total of 30 semiconductor stocks. The fund

delivered a return of negative 30.2% over a period of one year but

charges investors 95 basis points a year in fees.

UltraShort Semiconductors

(SSG)

The UltraShort Semiconductors ETF seeks daily investment

results, before fees and expenses, of 200% of the inverse

performance of the Dow Jones U.S. Semiconductor Index. The

Dow Jones U.S. Semiconductor Index measures the performance of the

semiconductor subsector of the U.S. equity market.

The Index holds a total of 45 semiconductor stocks, with Intel

being the top choice for investment. The fund delivered a return of

negative 14.7% over a period of one year and charges an expense

ratio of 95 basis points. (Three All-Star Leveraged ETFs)

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

INTEL CORP (INTC): Free Stock Analysis Report

PWRSH-DYN SEMI (PSI): ETF Research Reports

MKT VEC-SEMICON (SMH): ETF Research Reports

DIR-D SM BL 3X (SOXL): ETF Research Reports

DIR-D SM BR 3X (SOXS): ETF Research Reports

ISHARS-PH SOX S (SOXX): ETF Research Reports

PRO-ULS SEMICON (SSG): ETF Research Reports

PRO-ULT SEMICON (USD): ETF Research Reports

SPDR-SP SEMICON (XSD): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

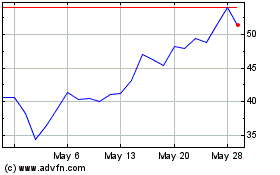

Direxion Daily Semicondu... (AMEX:SOXL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Direxion Daily Semicondu... (AMEX:SOXL)

Historical Stock Chart

From Feb 2024 to Feb 2025