TIDMHYDP; HYDP

9 July 2019

Hydro Hotel, Eastbourne, Plc

("Hydro Hotel" or the "Company")

Interim Results for the Half Year ended 30 April 2019

YOUR CHAIRMAN'S LETTER

Dear Shareholder,

SIX MONTHS TO 30 APRIL 2019

I am pleased to report on the Company's results for the six months to 30 April

2019. The total turnover for the six-month period to 30 April 2019 was GBP

1,553,553 compared to GBP1,514,627 for the same period the previous year, an

increase of 2.57% (compared to a decrease in the six months to 30 April 2018 of

0.29%).

The gross profit percentage for the period was 0.65% higher than in the six

months to 30 April 2018 and staff costs increased by 6.7% compared to the

figure for the period to 30 April 2018 (2.7% decrease in the half year to 30

April 2018).

Overheads decreased by 15.02% (14.32% increase in the half year ended 30 April

2018). Essential repair work to the fabric of the building was undertaken

during the six months to 30 April 2018. With no comparable repair work carried

out during the period to 30 April 2019, there was a reduction in repairs costs

of GBP103,533 for this period compared to the same period in the previous year.

There is a reduction in the loss for the half year to 30 April 2019 to GBP101,271

compared to GBP199,834 for the half year to 30 April 2018.

The bedroom refurbishment programme continued (12 rooms refurbished in the

period ended 30 April 2019 compared to 29 rooms in the period ended 30 April

2018) and the fire alarm system was upgraded.

The management team continue to explore new methods of promoting and marketing

the enhanced facilities at our 4* status hotel.

Yours sincerely,

Graeme C King, MA, CA

9 July 2019

STATEMENT OF COMPREHENSIVE INCOME

FOR THE HALF YEARED 30 APRIL 2019

Half year to Half year to Year ended

30 April 2019 30 April 2018 31 October

(Unaudited) (Unaudited) 2018

(Audited)

GBP GBP GBP

TURNOVER 1,553,553 1,514,627 3,658,461

OPERATING (LOSS)/PROFIT (106,271) (203,817) 185,135

INTEREST RECEIVABLE 5,000 3,983 8,190

(LOSS)/PROFIT BEFORE TAXATION (101,271) (199,834) 193,325

TAXATION - - (40,065)

(LOSS)/PROFIT FOR PERIOD GBP(101,271) GBP(199,834) GBP153,260

(Loss)/Earnings per share (16.88)p (33.31)p 25.54p

STATEMENT OF FINANCIAL POSITION

AT 30 APRIL 2019

30 April 2019 30 April 2018 31 October

(Unaudited) (Unaudited) 2018

GBP GBP (Audited)

GBP

FIXED ASSETS

Tangible Assets 2,823,218 2,707,485 2,620,992

CURRENT ASSETS

Stocks 27,502 32,883 30,438

Debtors 103,049 112,685 150,087

Investment - 6-month notice deposit 200,000 200,000 200,000

account

Cash at bank and in hand 601,622 634,892 1,089,507

932,173 980,460 1,470,032

CREDITORS

Amounts falling due within one year (503,138) (563,668) (611,500)

NET CURRENT ASSETS 429,035 416,792 858,532

TOTAL ASSETS LESS

CURRENT LIABILITIES 3,252,253 3,124,277 3,479,524

PROVISION FOR LIABILITIES (87,175) (85,022) (87,175)

NET ASSETS GBP3,165,078 GBP3,039,255 GBP3,392,349

CAPITAL AND RESERVES

Called up share capital 600,000 600,000 600,000

Revaluation reserve 415,488 419,767 415,488

Profit and loss reserves 2,149,590 2,019,488 2,376,861

GBP3,165,078 GBP3,039,255 GBP3,392,349

STATEMENT OF CASH FLOWS

FOR THE HALF YEARED 30 APRIL 2019

Half year to Half year to Year ended

30 April 2019 30 April 2018 31 October

(Unaudited) (Unaudited) 2018

(Audited)

GBP GBP GBP

NET CASH (USED IN)/INFLOW FROM OPERATING ACTIVITIES (67,538) (187,991) 362,383

(Note 1)

NET CASH GENERATED (USED IN) INVESTING ACTIVITIES (294,347) (153,443) (165,202)

(Note 2)

FINANCING ACTIVITIES

Dividends paid (126,000) (42,000) (126,000)

NET (DECREASE) IN CASH AND CASH EQUIVALENTS (487,885) (383,434) 71,181

CASH AND CASH EQUIVALENTS AT THE BEGINNING OF THE PERIOD 1,089,507 1,018,326 1,018,326

CASH AND CASH EQUIVALENTS AT THE OF THE PERIOD GBP601,622 GBP634,892 GBP1,089,507

RELATING TO:

Cash at bank and in hand GBP601,622 GBP634,892 GBP1,089,507

NOTES TO THE STATEMENT OF CASH FLOWS

FOR THE HALF YEARED 30 APRIL 2019

Half year to Half year to Year ended

30 April 2019 30 April 2018 31 October 2018

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Note 1

CASH FLOWS FROM OPERATING

ACTIVITIES

(Loss)/profit after tax (101,271) (199,834) 153,260

Adjustments for:

Taxation - - 40,065

Depreciation 98,308 91,392 183,937

(Gain)/Loss on disposal of fixed (1,187) 3,574 3,574

assets

Interest receivable (5,000) (3,983) (8,190)

OPERATING CASH FLOW BEFORE WORKING (9,150) (108,851) 372,646

CAPITAL CHANGES

MOVEMENTS IN WORKING CAPITAL

Decrease/(increase) in stocks 2,936 (5,164) (2,719)

Decrease/(increase) in debtors 47,038 (69) (37,471)

(Decrease)/increase in creditors (108,362) (73,907) 46,432

Income taxes paid - - (16,505)

NET CASH (USED IN)/GENERATED FROM GBP(67,538) GBP(187,991) GBP362,383

OPERATING ACTIVITIES

Note 2

INVESTING ACTIVITIES

Purchases of tangible fixed assets (300,744) (157,994) (173,960)

Proceeds on disposal of tangible 1,397 - -

fixed assets

Interest received 5,000 3,983 8,190

Proceeds from/(payment for) other - 568 568

investments

NET CASH FLOW (USED IN) INVESTING GBP(294,347) GBP(153,443) GBP(165,202)

ACTIVITIES

NOTES TO THE ACCOUNTS

1 The results are prepared on the basis of the accounting policies set out in

the Company's Annual Report and Accounts for the year ended 31 October 2018.

2 The earnings per share are based on a loss of GBP101,271 (2018 loss GBP199,834)

being the loss on ordinary activities after taxation.

3 The movement in retained Profit and loss Reserves and Revaluation Reserves

from GBP2,792,349 at 31 October 2018 to GBP2,565,078 at 30 April 2019 includes the

loss for the period and dividends of GBP126,000 (GBP126,000 paid in the period and

GBPNil accrued).

4 All dividends in 2019 were paid in the period and no accrual is included in

creditors, amounts falling due within one year as at 30 April 2019. The

comparative creditors, amounts falling due within one year for 2018, include a

dividend for the year ended 31 October 2017 declared by the directors and paid

on 3 May 2018 at the rate of 14p per share of GBP84,000.

5 A copy of the interim report and accounts and the Chairman's statement

thereto, which were approved by the Board of Directors on 9 July 2019, will be

posted to all registered shareholders shortly thereafter.

6 The financial information set out above does not constitute statutory

accounts as defined in section 434 of the Companies Act 2006. Statutory

accounts for the year ended 31 October 2018, on which the report of the auditor

was unqualified and did not contain a statement under section 498 of the

Companies Act 2006, have been filed with the Registrar of Companies.

7 The Company's auditor, Mazars LLP, has not reviewed these unaudited interim

accounts.

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by the Company to

constitute inside information as stipulated under the Market Abuse Regulation

(EU) No. 596/2014. Upon the publication of this announcement via a Regulatory

Information Service, this inside information is now considered to be in the

public domain.

END

(END) Dow Jones Newswires

July 09, 2019 10:59 ET (14:59 GMT)

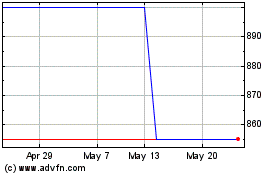

Hydro Hotel Eastbourne (AQSE:HYDP)

Historical Stock Chart

From Oct 2024 to Nov 2024

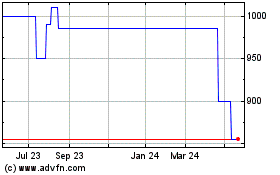

Hydro Hotel Eastbourne (AQSE:HYDP)

Historical Stock Chart

From Nov 2023 to Nov 2024