Pan African Resources Plc Operational Update for the Half Year ended 31 December 2023 (H1 FY2024)

January 22 2024 - 1:00AM

UK Regulatory

TIDMPAF

Pan African Resources PLCPan African Resources Funding Company

(Incorporated and registered in England and WalesLimited

under Companies Act 1985 with registeredIncorporated in the Republic of South

Africa

number 3937466 on 25 February 2000)with limited liability

Share code on AIM: PAFRegistration number: 2012/021237/06

Share code on JSE: PANAlpha code: PARI

ISIN: GB0004300496

ADR code: PAFRY

("Pan African" or "the Company" or "the Group")

OPERATIONAL UPDATE FOR THE HALF YEARED DECEMBER 2023 (H1 FY2024)

Pan African is pleased to provide its shareholders and noteholders with a

production update for the half year ended 31 December 2023 (Reporting Period)

and information on progress being made with the construction of the processing

plant at the Mogale Tailings Retreatment project (MTR Project).

KEY FEATURES

· Improvement in overall Group safety performance

· Gold price received of US$1,961/oz (2022: US$1,725/oz), an increase of 13,7%

relative to the six months ended 31 December 2022 (Previous Reporting Period)

· Excellent operational results, with gold production of 98,458oz (2022:

92,307oz), an increase of 6.7% relative to the Previous Reporting Period

· Production costs were well managed despite inflationary pressures, with

Group all-in sustaining costs (AISC) expected to be approximately US$1,300/oz at

an average exchange rate of US$/ZAR18.69, below the FY2024 guidance of

US$1,350/oz (at an assumed exchange rate of US$/ZAR18.50)

· MTR Project construction on time and within budget, with commissioning

expected in the latter half of the 2024 calendar year

· Commissioning of further renewable energy generating capacity is on

schedule.

SAFETY AND GROUP GOLD PRODUCTION FOR SIX MONTHSING DECEMBER 2023

· The Group continues to implement initiatives in pursuit of its `Zero Harm'

goal

· Group safety rates remain industry leading:

· Total recordable injury frequency rate (TIFR) declined to 6.13 per

million man hours (FY2022: 8.54), a notable improvement

· Operations performed in line, or better than expected, with production

forecast for the Reporting Period, as follows:

· Barberton Mines underground: 36,779oz* (2022: 32,022oz). The

implementation of continuous operations at Barberton Mines contributed to

increases in mined tonnages and grades, when compared to the Previous Reporting

Period

· Evander Mines underground: 21,307oz (2022: 19,173oz). The ramping up of

mining operations at Evander Mines' 24 Level underground operations contributed

to the increased gold production, successfully replacing the depletion of the 8

Shaft pillar ore resources, consistent with the mine plan

· Elikhulu tailings retreatment: 28,106oz (2022: 25,830oz), with operations

benefitting from improved metallurgical recoveries

· Barberton tailings retreatment plant (BTRP): 9,864oz (2022: 10,012oz)*

· Evander Mines' surface sources: 2,401oz (2022: 5,270oz).

* Surface sources from Fairview Mine included in BTRP production

PRODUCTION GUIDANCE

· Production guidance for the full 2024 year is maintained at between

180,000oz to 190,000oz (FY2023: 175,209oz). However, given the excellent

production performance in the Reporting Period, revised guidance may be

considered in due course. Production for FY2025 is expected to be significantly

higher, following commissioning of the MTR project, which will add approximately

50,000oz/yr to Group production, increasing annual output by some 25%.

FINANCIAL RESULTS

· The Group's AISC for the Reporting Period is expected to be approximately

US$1,300/oz, at an average exchange rate of US$/ZAR18.69

· The AISC reduction resulted from excellent cost control, improved gold

production, as well as the weaker US$/ZAR exchange rate that prevailed during

the Reporting Period

· Group net senior debt increased to US$60.0 million (June 2023: US$18.9

million), primarily as a result of the capital expenditure of US$23.2 million

incurred on the MTR Project and the dividend of US$22.1 million paid to

shareholders in December 2023.

MTR PROJECT

· As previously communicated, significant progress has been made with the

construction of the MTR Project's processing plant, with commissioning being on

track for the latter half of the 2024 calendar year and steady state production

expected by December 2024:

· Construction is progressing on time and capital expenditure is in line

with the project's budget

· Construction highlights include completion of the laying of foundations

for the nine CIL tanks and the tower crane's construction.

UPDATE ON THE ORGANIC GROWTH PROJECTS

· Progress at Evander Gold Mine's 24 to 26 Level underground expansion project

remains on track, with the following notable achievements:

· Construction of Phase 2 of the refrigeration plant on 24 Level at Evander

Mines' 8 Shaft is currently at an advanced stage, with completion anticipated

during the 2024 financial year, as 25 Level mining operations commence

· Development to access 25 and 26 Level mining areas has commenced

· Equipping of the existing 17 Level underground ventilation shaft, with a

hoisting capacity of up to 40,000 tpm, is expected to be completed during

FY2024, improving efficiencies and eliminating the existing cumbersome conveyor

system

· Dewatering of Evander's 7 Shaft Egoli project is ongoing. Once dewatered to

below 20 Level, reserve delineation drilling will commence to further define the

ore payshoot and its grade variability.

ESG UPDATES

· Construction of Fairview Mine's 8.75MW solar energy plant is progressing

according to plan, with commissioning expected during June 2024

· Community social and labour plan projects:

· Barberton Mines completed the construction and refurbishment of two local

schools, benefitting over 1,600 learners

· Evander Mines constructed and fully equipped science and computer

laboratories at two local schools, benefitting over 1,200 learners

· MTR Project:

· Community engagement structures and social initiatives have commenced with

host communities and small local businesses

· Environmental rehabilitation is ongoing, including cleanup of historical

spillages and removal of derelict pipelines, eradication of alien vegetation and

wetlands remediation, which positively impacts local living conditions.

Cobus Loots, Pan African's CEO commented:

"We are pleased with the Group's excellent safety, production and cost

performance for the Reporting Period which positions us well to deliver on our

guidance for the full financial year. Commissioning of the world-class

processing plant at the MTR Project towards the end of this calendar year will

further increase the Group's production with approximately 50,000 oz per year of

high margin ounces.

The commissioning of Barberton's solar PV plant will contribute to further cost

savings in the next financial year, adding to the benefits already being

realised from Evander's PV solar plant. We are also excited by the positive and

tangible impact the Group's ESG projects have made on improving relationships

with our host communities and contributing to the sustainability of these

areas."

INTERIM RESULTS PRESENTATION, OPERATIONAL AND GROWTH PROJECTS UPDATE

A detailed update on the Group's operations and capital projects will be

included in the Company's interim results presentation, scheduled for release on

14 February 2024.

The information contained within this announcement is deemed by the Company to

constitute inside information as stipulated under the Market Abuse Regulations

(EU) No. 596/2014 as it forms part of UK Domestic Law by virtue of the European

Union (Withdrawal) Act 2018. Upon the publication of this announcement via

Regulatory Information Service (RIS), this inside information is now considered

to be in the public domain.

Rosebank

22 January 2024

For further information on Pan African Resources, please visit the Company's

website at

www.panafricanresources.com

+---------------------------------------------+---------------------------+

|Corporate information |

+---------------------------------------------+---------------------------+

|Corporate Office |Registered Office |

| | |

|The Firs Office Building |107 Cheapside |

| | |

|2nd Floor, Office 204 |Second Floor |

| | |

|Cnr. Cradock and Biermann Avenues |London |

| | |

|Rosebank, Johannesburg |EC2V 6DN |

| | |

|South Africa |United Kingdom |

| | |

|Office: + 27 (0)11 243 2900 |Office: + 44 (0)20 7796 |

| |8644 |

|info@paf.co.za | |

+---------------------------------------------+---------------------------+

|Chief Executive Officer |Financial Director |

| | |

|Cobus Loots |Deon Louw |

| | |

|Office: + 27 (0)11 243 |Office: + 27 (0)11 243 2900|

|2900 | |

+---------------------------------------------+---------------------------+

|Head: Investor Relations |Website: |

| |www.panafricanresources.com|

|Hethen Hira | |

|Tel: + 27 (0)11 243 2900 | |

|E-mail: hhira@paf.co.za | |

+---------------------------------------------+---------------------------+

|Company Secretary |Nominated Adviser and Joint|

| |Broker |

|Jane Kirton | |

| |Ross Allister/Bhavesh Patel|

|St James's Corporate Services Limited | |

| |Peel Hunt LLP |

|Office: + 44 (0)20 7796 8644 | |

| |Office: +44 (0)20 7418 8900|

+---------------------------------------------+---------------------------+

|JSE Sponsor |Joint Broker |

| | |

|Ciska Kloppers |Thomas Rider/Nick Macann |

| | |

|Questco Corporate Advisory Proprietary |BMO Capital Markets Limited|

|Limited | |

| |Office: +44 (0)20 7236 1010|

|Office: + 27 (0)11 011 9200 | |

+---------------------------------------------+---------------------------+

| |Joint Broker |

| | |

| |Matthew Armitt/Jennifer Lee|

| | |

| |Joh. Berenberg, Gossler & |

| |Co KG (Berenberg) |

| | |

| |Office: +44 (0)20 3207 7800|

+---------------------------------------------+---------------------------+

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

January 22, 2024 02:00 ET (07:00 GMT)

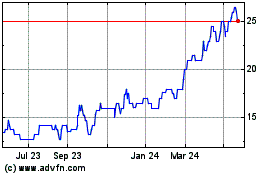

Pan African Resources (AQSE:PAF.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

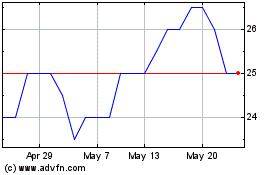

Pan African Resources (AQSE:PAF.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025