TIDMPBX

RNS Number : 0684E

Probiotix Health PLC

28 June 2023

ProBiotix Health plc

(' ProBiotix' or the 'Company' or the 'Group')

Final results

ProBiotix Health p lc (AQSE: PBX), a life sciences busi ness d

eveloping probiotics to tackle cardiovascular disease and other

lifestyle conditions, a nnounces its audited results for the period

ended 31 December 2022, the Company's inaugural results as a

separately listed public company following its flotation on the

AQSE Growth Market on 31 March 2022.

Highlights

á The Company continues to achieve rapid growth with revenue of

GBP1.3m, a 19% increase on FY 2021 (GBP1.1m*)

á Cash balance of GBP1.74m as on 31 December 2022

á Financially robust with no debt and a strong balance sheet

á Successful flotation on the AQSE Growth Market on 31 March

2022, raising GBP2.5m for future development of the Group

á Third human volunteer study confirming safety and efficacy of LP(LDL) (R)

á Research and clinical study agreements with two UK and one

Italian university to examine the role of LP(LDL) (R) to improve

sleep, and reduce stress and anxiety

á The appointment of Steen Andersen as Chief Executive Officer of ProBiotix

á Appointment of Nutraconnect Pte Ltd, based in Singapore, as a

new commercialisation partner to develop strategies to expand sales

opportunities for both LP(LDL) (R) and CholBiome(R)

á New customers gained in China, Israel, Hong Kong and Belgium

Post period

á Strong order pipeline in 2023 with confirmed orders to first week of June 2023 of GBP1.1m

á Launch of Cholbiome(CH) a dual action bilayer tablet

containing phytosterols and L P(LDL) (R) to increase opportunities

in the US market

á An enhanced strategy focusing on turnkey solutions and new line extensions

*2021 revenues of GBP1.1m for ProBiotix Limited, the Company's

principal operating subsidiary

Steen Andersen, CEO of ProBiotix, commented: " Since I became

CEO in January 2023, I have developed a strategy which focuses the

business on becoming a solutions provider of finished probiotic

products in consumer formats, both under our own brands and partner

private labels, with the objective of building ProBiotix into a

GBP10m turnover company in the years ahead. Although the markets

are challenging, we have a strong balance sheet with no debt, good

sales growth and a healthy cash reserve.

"Given the scale of the market opportunity, the proven efficacy

of our existing products, the substantial scope for expansion of

our product range and geography and the financial strength of the

Company, we look to the future with enthusiasm and high confidence

in building a valuable company for shareholders".

For further information, please contact:

ProBiotix Health plc https://probiotixhealth-ir.com/

Steen Andersen, Chief Executive Contact via Walbrook

below

Peterhouse Capital Ltd (AQSE Corporate Tel: 020 7220 9797

Adviser and Broker)

Mark Anwyl Tel: 020 7469 0930

Duncan Vasey

Brefo Gyasi

Walbrook PR Ltd probiotix@walbrookpr.com

Anna Dunphy Mob: 07876 741 001

Chairman and Chief Executive's Report

This annual report presents the Company's inaugural results as a

separately listed public company, following its flotation on the

AQSE Growth Market on 31 March 2022. The Company can demonstrate

good scientific and commercial progress with strong sales growth in

a difficult economic global environment. This is a testimony to the

quality and uniqueness of our products as highlighted by our

clinical studies, excellent customer reviews, and high customer

retention rates and creates the potential for strong future growth,

particularly as economic conditions improve. The Company remains

financially robust with no debt with a strong balance sheet. Whilst

investors may have concerns over the current market capitalisation

the board are confident that this is a reflection of current public

markets and comparisons with similar probiotic companies suggest

the stock is undervalued with potential for a substantive uplift if

stock market conditions improve.

In January 2023 Steen Andersen joined the business as CEO. He

has developed a strategic plan to focus the business on becoming a

solutions provider of finished probiotic products in consumer

formats, both under our own brands and partner private labels, with

the objective of building ProBiotix into a GBP10m turnover company

by 2028.

Strategic overview

ProBiotix is a life sciences business developing probiotics to

tackle cardiovascular disease and other lifestyle conditions.

The market opportunity

The global probiotics market is forecast to reach $94.48 billion

by 2027, at a CAGR of 7.9%, of which approximately 85% is in food

and beverages with a strong consumer trend towards use of dietary

supplements, driven by an increasing consumer awareness towards

healthy living and disease prevention e.g. within the

cardiovascular, and a growing trend for using clinically proven

probiotics as a natural replacement for pharmaceutical solutions

(Fortune Business insights, 2022).

ProBiotix's strategy is to develop next-generation microbiome

solutions for a wide range of health conditions and to deliver

commercially successful products supported by a strong scientific

and clinical evidence base. We aim to partner with scientifically

driven dietary supplement companies, pharmaceutical consumer health

companies globally who have a strong strategic focus on human

microbiome and the use of probiotics in disease prevention and

wellbeing.

Since its creation, ProBiotix has made considerable progress and

has successfully transitioned from a research and development

specialist into a commercial structure with products already

commercialised around the world.

The Company has now completed three independent clinical studies

with human volunteers which consistently show that ProBiotix's

principal product, Lactobacillus plantarum ECGC13110402 ( LP(LDL)

(R) ) can reduce key cardiovascular risk markers, such as total

cholesterol, LDL (bad) cholesterol, and Apolipo protein B

(biomarker of atherosclerosis), by up to 34.2 per cent, 28.4 per

cent and 28.6 per cent respectively. We now have eight conference

poster presentations on LP(LDL) (R)'s safety, efficacy, and

mechanisms of action and three peer reviewed publications have

shown L P(LDL) (R) to be safe and well-tolerated, as well as

showcasing statistically significant reductions in multiple

cardiovascular disease risk biomarkers within six weeks.

Independent peer review publications are critical to support

regulatory approval for health claims in international markets and

increasingly a prerequisite to attract the interest of large

partners.

The fact that 50 percent of all deaths globally can be related

to cardiovascular disease, and 80percent are believed to be

preventable, underlines the scale of the opportunity for L P(LDL)

(R).

The CholBiome(R) portfolio

ProBiotix commercialises L P(LDL) (R) in a unique range of

patented and proprietary food supplements under the CholBiome(R)

brand and as private label. The CholBiome(R) portfolio in 2022

comprised four products, which can either be sold under the

CholBiome(R) brand or customers' private labels:

á CholBiome(R)

Contains L P(LDL) (R) as the only active ingredient, to focus on

healthy cholesterol maintenance and deliver tangible health

benefits.

á CholBiome(R)(X3)

A cholesterol-reducing formula that combines three targeted

ingredients into a triple-layer tablet. It consists of L PLDL(R) ,

Monacolin K from red yeast rice, and Vitamin B3 (niacin) to deliver

a tri-factor approach that utilises synergistic mechanisms of

action to reduce cholesterol and aid overall cardiovascular

health.

á CholBiome(R)(BP)

A blood pressure reducing formula that combines four

science-backed natural ingredients - L P(LDL) (R), Thiamine

(Vitamin B1), L-arginine and CoEnzyme Q10 - to provide a

multi-targeted mechanism approach for aiding hypertension and

improving cardiovascular health.

á CholBiome(R)(VH)

A vascular health formula that combines three specialised

ingredients in a triple layer tablet. Consisting of L P(LDL) (R),

Thiamine and Vitamin K2 Vital (from Kappa Bioscience) to provide a

multi-targeted mechanism to work against the build-up of lipid and

calcium deposits in the blood vessels.

The CholBiome(R) product portfolio provides a platform allowing

us to create different formulations targeting individual customer

needs and open the widest possible range of international markets.

This is important because regulatory conditions vary widely around

the world. For example, Monacolin K is used extensively across Asia

but is prohibited in food supplements in North America and subject

to restrictions on dosage in Europe. Our CholBiome(R) product range

has been developed to meet existing and anticipated regulatory

requirements in all key potential markets, and has been further

extended in 2023 with the launch of CholBiome(R)(CH) , a new

dual-action cholesterol-reducing bi-layer tablet containing both L

P(LDL) (R) and Plant Sterols / Stanols (PSS), also known as

phytosterols, with health claims which will support our continued

growth in both Europe and the US.

Public listing and its benefits

ProBiotix floated on the AQSE Growth Market on 31 March 2022,

raising GBP2.5m through a placing and subscription of shares to

accelerate the future development of the Group. Prior to this date

it was a wholly-owned subsidiary of AIM-listed OptiBiotix Health

plc ("OptiBiotix"). OptiBiotix has retained a 44% shareholding in

the Company following its flotation.

We believe that the separate listing of the Company will enhance

recognition of the value of the probiotics opportunity by allowing

investors to perceive and evaluate ProBiotix as a standalone

business in way that was not previously realised within its former

parent company. The listing also improves our access to funding,

enabling the Company to meet its working capital needs more

effectively than it could either as an unquoted company or as a

division competing for resources within a broader quoted group.

The enhanced status of the Company through the public trading of

its shares offers significant benefits in raising its corporate

profile and improving its ability to attract and retain key staff.

The appointment of an industry-leading figure such as Steen

Dannemann Andersen as CEO, announced in June 2022, is unlikely to

have been possible in the absence of a public listing. The ability

to attract personnel through the future grant of share options will

be of great value in securing, retaining and motivating high

calibre personnel.

The Company believes that the scale of the opportunities

available to ProBiotix are greater than those previously being

exploited within OptiBiotix, where there was competition for

available resource across many parts of the business. A separate

listing, and the ability to fundraise independently, will enhance

the Company's ability to further explore the potential of LP(LDL)

(R) as discussed in the outlook. These developments have the

potential for substantial future value enhancement.

Commercial and scientific overview

During 2022 we announced:

á Publication of a third human volunteer study on the medical

efficacy of LP(LDL) (R), demonstrating through a placebo-controlled

trial that LP(LDL) (R) delivered large and statistically

significant reductions in total cholesterol, LDL-C (bad)

cholesterol and Apolipoprotein B (widely accepted as the most

important causal agent of atherosclerotic cardiovascular disease),

with no compliance, tolerance or safety issues. The results of this

and other studies suggest efficacy similar to many statins and

other treatments more typically associated with pharmaceuticals,

suggesting considerable potential in high value pharmacy and

consumer health markets for the use of LP(LDL) (R) in individuals

who are unwilling or unable to tolerate other treatments.

á Publication of a consumer study undertaken among customers from our e-commerce website of CholBiome(x3) , our proprietary food supplement containing LP(LDL) (R) , which confirmed its effectiveness in reducing cholesterol with no reports of side-effects or any tolerance issues.

á The appointment of Steen Andersen as Chief Executive Officer

of ProBiotix Health, discussed in more detail below.

á The launch by our partner Granja Pocha in Uruguay of a new

probiotic functional yoghurt brand, Yo-Life(R), containing

ProBiotix's patented cholesterol-reducing Lactobacillus plantarum

strain (LP(LDL) (R)). Granja Pocha is one of Uruguay's largest and

most respected dairy producers. Since the launch of Yo-Life(R) we

have seen increased use of LP(LDL) (R) in other dairy products,

with the launch of a spreadable cream, a drinking yogurt and Greek

yogurt starter culture in the USA, and a creamy herb cheese in

Canada.

á Entry into an agreement with the University of Southampton,

University of Leeds and Fondazione Edmund Mach - Centro Ricerca e

Innovazione ("FEM"), based in Trento, Italy to examine the role of

LP(LDL) (R) to improve sleep, stress, and anxiety. Sleep aids and

stress management products are the fastest growing category within

healthcare (Goldstein Market Intelligence, 2020) and this is

another step in extending the range of applications for our

products into large growing markets where there is an unmet

clinical need.

á The appointment in September of Nutraconnect Pte Ltd, based in

Singapore, as a new commercialisation partner to develop strategies

to expand sales opportunities for both LP(LDL) (R) as an ingredient

and Cholbiome(R) finished products across the Asia Pacific

region.

The pace of our entry into new geographical areas reflects the

fact that ProBiotix is dependent on its partners' thorough and

successful registration in each territory of our LP(LDL) (R)

ingredient or CholBiome(R) finished products as dietary

supplements. Whilst such regulatory approvals are time-consuming

and costly, they represent a significant barrier to entry to many

companies, reducing the competitive landscape and creating the

potential for long term recurrent revenues for the Company.

Results

The subsidiary consolidated in these Group accounts was acquired

via a group re-organisation and as such merger accounting

principles have been applied. The subsidiaries financial figures

are included for the period from the date the Company took control

of it (31(st) March 2022).

It is not possible under accounting principles to compare with

previous years as this group does not have a comparative

period.

Sales for the period were GBP1.3m with a gross profit of

GBP739k. After total administrative costs including listing fees

are taken into account there was a loss before tax of GBP215K.

Following the raising of GBP2.5m through a placing and

subscription of new shares as part of the listing, the Group ended

the year in a very strong financial position with cash balances

totalling GBP1.74m.

Board and management

The appointment of Steen Dannemann Andersen as Chief Executive

Officer ("CEO") was announced in June 2022. Steen joined the

Company in January 2023, after completion of his notice period with

his previous employer. This appointment was part of a long-planned

strategy to appoint an experienced industry business leader to the

Company to drive sales and profitability, allowing Stephen O'Hara,

who led ProBiotix in 2022, to focus on finding and developing new

technologies that will provide the pipeline of new products and

applications to ensure future growth for both ProBiotix and

OptiBiotix.

Steen has brought to ProBiotix more than 30 years' experience in

building businesses in the Probiotics industry, having been

President of Deerland Probiotics and Enzymes, President and CEO of

Bifodan, President and CEO of Fluxome, and Vice President of Human

Health at Chr. Hansen. Deerland is a market leading turnkey

probiotic solution provider acquired by ADM in November 2021 to

help ADM meet the $775 billion global demand in health and

wellness. Prior to joining Deerland, Steen was President and CEO of

Bifodan, a leading provider of ready to market probiotic dietary

supplements and over the counter (OTC) pharma products. Bifodan was

acquired by Deerland in November 2019. Steen was integral in

building these businesses, increasing global reach, revenues, and

profitability. Prior to this he worked as CEO and President at

Fluxome, a young biotechnology company, and Vice President of Chr.

Hansen's Health and Nutrition unit where he built an organisation

and position in the market allowing the company to become a leading

provider of probiotic solutions within the dietary supplement

space.

Steen brings experience of selling high value turnkey probiotic

solutions as supplements and OTC solutions in international

markets, building strategy and organisations, a wealth of industry

contacts, and is well respected within the probiotic industry. He

has a strong track record of rapidly growing sales and

profitability and has been involved in a number of acquisitions and

takeovers in support of accelerating business growth. His

experience in the Probiotics industry will help build ProBiotix's

business in its next phase of growth, as it moves from selling

ingredients to delivering high value turnkey solutions.

The Company has also benefited from a number of board level

senior appointments which bring both industry and public market

expertise to the business. These include Adam Reynolds as Chairman,

and Marco Caspani as Non executive Director, and Mikkel Hvid-Hansen

as Commercial Director. Stephen O'Hara will continue in the near

term as a director to support the transition.

The Company anticipates further changes to the board,

management, and Commercial team as ProBiotix progresses its

independence from OptiBiotix and focuses more on its strategy of

becoming a solutions provider of finished probiotic products to

capitalise on the opportunities created by our growing pipeline of

final products.

Outlook

ProBiotix has traded strongly since the beginning of the new

financial year and has a strong order book from existing and new

customers.

Our CEO Steen Dannemann Andersen is already leveraging his

industry-leading contacts to introduce ProBiotix to new customers,

some of which - including SymbioPharm one of the top three

probiotic brands in Germany - have already placed a significant

order. We are also enjoying continued strong growth in e-commerce

sales direct to consumers albeit ongoing issues with our supply

chain has impacted on the availability of our best-selling product

CholBiome(X3) . The Company identified a new manufacturer in 2022

and first orders were supplied in H1 2023.

We have recently made an addition to our CholBiome(R) product

portfolio, with the launch at Vitafoods Europe in May of

CholBiome(R)(CH) , a dual-action cholesterol reducing bi-layer

tablet containing both our patented and proven cholesterol-reducing

ingredient L P(LDL) (R) and Plant Sterols / Stanols (PSS). These

have different mechanisms of action which combine synergistically

to support the reduction of the cholesterol the body makes with

LP(LDL) (R), and dietary cholesterol through stanols and sterols.

The introduction of CholBiome(R)(CH) provides us with an

opportunity for growth in the US market, where the use of Monacolin

K found in CholBiome(X3) in food supplements has been banned by the

FDA since 1998.

In the first three months after joining the Company in January

2023, our new CEO undertook a comprehensive initiation programme to

develop a full understanding of our business and its people. He has

now set out a strategy to focus the business on becoming a

solutions provider of finished probiotic products in consumer

formats, both under our own brands and partner private labels.

Moving towards final product formats allows us to strengthen our

value proposition by de-bottlenecking the challenges for our

customers to handle sensitive probiotics in their own manufacturing

thereby increasing customer loyalty which eventually will lead to

higher revenue and profitability potential for ProBiotix as well as

support building strong entry barriers around the business.

We will focus initially on developing turnkey consumer solutions

and growing our business with existing customers by moving from

sales of bulk ingredients to finished formats, and the introduction

of line extensions. In the first phase of implementation of this

strategy, we will concentrate on expanding our sales structure in

Europe and the Middle East, and building a platform for growth in

North America, before moving in the medium term to explore the

potential of additional markets in the Asia Pacific region, South

America and South Africa. We will also seek to prove the potential

for direct-to-consumer sales, focusing initially on the UK. This is

likely to be through the OptiBiotix online platform with OptiBiotix

acting as an agent of ProBiotix online products.

As part of our focus on finished products, we will expand our

range by developing new dosage formats such as sticks and chewable

tablets, in addition to our existing capsules and tablets, and

develop new and improved packaging formats to extend shelf-life. In

research and development, we will develop or in-license new

probiotic strains to expand our product offering and sustain the

robustness of our heart health claims based on LP(LDL) (R), while

diversifying into new indications within the area of metabolic

health.

This strategy presents a clear five-year pathway for ProBiotix

Health to build annual sales of GBP10 million while shifting the

balance of the business from deriving 85% of turnover from bulk

sales of LP(LDL) (R) in 2022 to making 85% of sales from finished

products.

To support this new strategic focus and ensure the delivery of

the expected results we will need to make changes to the internal

structure of the business and recruit additional personnel,

including a sales director for Europe and the Middle East and new

sales manager for North America, together with an operations

manager and a development scientist to add impetus to our product

development. Recruitment and additional staffing costs mean that

whilst we expect sales to grow in 2023 the additional investment

will impact on profitability in 2023, but will form a much stronger

platform to deliver growth and shareholder value in the medium and

longer term.

We will continue to work with AQUIS and explore opportunities on

other markets, including AIM, to increase liquidity in ProBiotix

shares.

The Company sees 2023 as a year of opportunity and continued

growth with a focus on commercialising final products and building

the Company sales team and supporting structure to drive future

growth. This will be supported by a developing product pipeline

with new probiotic strains extending the applications and use of

LP(LDL) (R) into new areas, all supported by strong science and

human studies.

The scale of the market opportunity in probiotics, the proven

efficacy of our existing products, the substantial scope for

expansion of our range and geography, the significant benefits of

public listing, the quality of our leadership, the clarity and

distinctiveness of our future strategy and the financial strength

of the Company, all allow us to look to the future with confidence

and enthusiasm.

A Reynolds

Chairman

23 June 2023

S Andersen

Director

23 June 2023

Consolidated statement of comprehensive income

Notes Period from

4 November 2021

to

31 December

2022

GBP'000

Revenue from contracts with

customers 3 1,309

Cost of sales (570)

--------------

Gross Profit 739

Depreciation and amortisation (37)

Listing costs (166)

Other administrative costs (798)

Total administrative expenses 6 (1,001)

--------------

Operating loss (262)

Finance cost 5 -

Finance income 5 59

--------------

59

--------------

Loss before tax (203)

Taxation 7 (12)

--------------

Loss for the period (215)

Other comprehensive income -

--------------

Total comprehensive loss

for the period (215)

Total comprehensive loss attributable

to:

Owners of the company (215)

Earnings per share from continued

operations

Basic profit/(loss) per share

- pence 8 0.0024

Diluted profit/(loss) per

share - pence 0.0024

All activities relate to continuing operations

Consolidated Statement of Financial Position

Notes As at

31 December

2022

ASSETS GBP'000

Non-current assets

Intangibles 9 358

--------------

358

--------------

CURRENT ASSETS

Inventories 11 49

Trade and other receivables 12 496

Cash and cash equivalents 13 1,740

--------------

2,285

--------------

TOTAL ASSETS 2,643

EQUITY

Shareholders, Equity

Called up share capital 14 61

Share premium 15 3,338

Share based payment reserve 15 8

Group reorganisation reserve 15 (945)

Retained earnings 15 (215)

--------------

Total Equity 2,247

--------------

LIABILITIES

Current liabilities

Trade and other payables 16 307

--------------

307

--------------

Non - current liabilities

Deferred tax liability 17 89

--------------

89

--------------

TOTAL LIABILITIES 396

--------------

TOTAL EQUITY AND LIABILITIES 2,643

These financial statements were approved and authorised for

issue by the Board of Directors on 23 June 2023 and were signed on

its behalf by:

S Andersen

Director

Consolidated Statement of Changes in Equity

Called

up Share Share-based Group Retained Total

Share Premium Payment Reorganisation Earnings equity

capital Reserve Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 4 November - - - - - -

2021

Group

reorganisation - - - (945) - (945)

Loss for

the period - - - - (215) (215)

Share issue 61 3,514 - - - 3,575

Share issue

costs - (176) - - - (176)

Share based

payments - - 8 - - 8

------------ -------------- ------------ ------------ ---------- --------------

Balance at

31 December

2022 61 3,338 8 (945) (215) 2,247

Consolidated Statement of Cash Flows

Notes Period ended

31 December

2022

GBP

Cash flows from operating activities

Cash utilised by operations 1 (720)

------------

Net cash outflow from operating

activities (720)

Cash flows from investing activities

Purchase of intangible assets (52)

Cash acquired on acquisition

of subsidiary 188

------------

Net cash outflow from investing

activities 136

------------

Cash flows from financing activities

Share issues net of issue costs 2,324

------------

Net cash inflow from financing

activities 2,324

------------

Increase/(decrease) in cash

and equivalents 1,740

Cash and cash equivalents at -

beginning of period

------------

Cash and cash equivalents at

end of period 2 1,740

Notes to the Consolidated Statement of Cash Flows

1. Reconciliation of loss before income tax to cash outflow from operations

Period ended

31 December

2022

GBP'000

Operating loss (262)

Decrease/(Increase) in inventories (49)

(Increase) in trade and other

receivables (497)

Increase/ (Decrease) in trade

and other payables 307

Amortisation of patents and development

costs 37

Adjustment for net working capital

required on common control transaction (256)

------------

Net cash outflow from operations (720)

2. Cash and Cash Equivalents

Period ended

31 December

2022

GBP

Cash and cash equivalents 1,740

Company Statement of Financial Position

Notes As at

31 December

2022

ASSETS GBP'000

Non-current assets

Investments 10 50

Other receivables 12 -

--------------

50

--------------

CURRENT ASSETS

Trade and other receivables 12 79

Cash and cash equivalents 13 1,449

--------------

1,528

--------------

TOTAL ASSETS 1,578

EQUITY

Shareholders, Equity

Called up share capital 14 61

Share premium 15 3,338

Share based payment reserve 15 8

Retained earnings 15 (1,871)

--------------

Total Equity 1,536

--------------

LIABILITIES

CURRENT LIABILITIES

Trade and other payables 16 42

--------------

TOTAL LIABILITIES 42

--------------

TOTAL EQUITY AND LIABILITIES 1,578

The Company has elected to take the exemption under section 408

of the Companies Act 2006 not to present the parent Company income

statement account.

The loss for the parent Company for the period was GBP1.87m.

These financial statements were approved and authorised for

issue by the Board of Directors on 23 June 2023 and were signed on

its behalf by:

S Andersen

Director

Company Statement of Changes in Equity

Share-based

Called Payment

up Retained Share reserve Total

Share Earnings Premium equity

capital

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at incorporation - - - - -

4 November 2021

Loss for the year - (1,871) - - (1,871)

Issues of shares

during the year 61 - 3,514 - 3,575

Share issue costs - - (176) - (176)

Share based payments - - - 8 8

------------ -------------- -------------- ------------ --------------

Balance at 31 December

2022 61 (1,871) 3,338 8 1,536

Company Statement of Cash Flows

Notes

Period ended

31 December

2022

GBP'000

Cash flows from operating activities

Cash utilised by operations 1 (492)

--------------

Net cash outflow from operating

activities (492)

Cash flows from financing activities

Share issues net of issue costs 2,324

--------------

Net cash inflow from financing

activities 2,324

--------------

Cash flows from investing activities

Net amounts advanced to subsidiary (383)

--------------

Net cash inflow from investing

activities (383)

--------------

Increase/(decrease) in cash

and equivalents 1,449

Cash and cash equivalents at -

beginning of period

--------------

Cash and cash equivalents at

end of period 2 1,449

Notes to the Company Statement of Cash Flows

1. Reconciliation of loss before income tax to cash generated from operations

Period ended

31 December

2022

GBP'000

Operating (loss)/Profit (1,871)

(Decrease) in trade and other receivables (79)

Loan to subsidiary written off 1,416

(Decrease)/Increase in trade and

other payables 42

------------

Net cash outflow from operations (492)

2. Cash and Cash Equivalents

As at

31 December

2022

GBP'000

Cash and cash equivalents 1,449

Notes to the Financial Statements

1. General Information

ProBiotix Health plc is a Public Limited Com pany limited by

shares incorp orated and d omiciled in England and Wales. Details

of the re gistered office, the officers and ad visers to the Com

pany are prese nted on the com pany information page at the start

of this re p ort. The Com pan y 's offices are at First Floor

Zucchi Suite, Nostell Business Estate, Wakefield, England, WF4 1AB.

The Com pany is listed on the AQSE Growth Market .

The principal activity is that of developing probiotics to

tackle cardiovascular disease and other lifestyle conditions which

are affecting growing numbers of people across the world.

The Company was incorporated on 4 November 2021 and these

financial statements cover the period from 4 November 2021 to 31

December 2022. Being the first period since incorporation, no

comparatives are presented.

2. Accounting Policies

Statement of compliance

The consolidated financial statements of Probiotix Health Plc

have been prepared in accordance with UK adopted international

accounting standards (IFRSs), IFRIC interpretations and the

Companies Act 2006 applicable to companies reporting under IFRS.

These are the first financial statements prepared under UK adopted

international accounting standards.

Basis of preparation

The financial statements have been prepared under the historical

cost convention. The functional currency is GBP.

The principal accounting policies are summarised below. They

have all been applied consistently throughout the period under

review.

On 7 February 2022 the Company acquired 100% of the share

capital of Probiotix Limited. At that time, the Company was a

subsidiary of Optibiotix Health plc and so the acquisition

represented a common control transaction outside the scope of IFRS

3.

Therefore the Board have determined that the most appropriate

accounting policy is to apply merger accounting prospectively from

31 March 2022 being the date of the Group's IPO on AQSE Growth. The

Group has consolidated Probiotix Limited's assets and liabilities

at book value at 31 March 2022, with the difference between the

nominal value of shares issued and net liabilities acquired

recorded in a reserve within equity.

Going concern

The financial statements have been prepared on the assumption

that the Group is a going concern. When assessing the foreseeable

future, the Directors have looked at the budget for the next 12

months from the date of this report, the cash at bank available as

at the date of approval of these financial statements and are

satisfied that the group should be able to cover its forecast

maintenance costs, other administrative expenses and its ongoing

research and development expenditure.

Management have considered its forecast of the group,s cash

requirements reflecting contracted and anticipated future revenue

and the resulting net cash outflows. Management have not seen a

material disruption to the business as a result of the current

political crises in Europe. Management will keep events under

constant review, and remedial action will be taken if the situation

demands it.

After making enquiries, the Directors have a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future. Accordingly, they

continue to adopt a going concern basis in preparing the annual

report and financial statements

Standards, amendments and interpretations effective and adopted

in 2022

These are the group's first financial statements since

incorporation and therefore the first set of accounts prepared in

compliance with UK-adopted IFRS. The group therefore adopted all

existing IFRS standards as of 4 November 2021.

Basis of consolidation

The consolidated financial statements incorporate the financial

statements of the Company and entities controlled by the Company

(its subsidiaries) made up to 31 December each year. The group

controls an investee when it is exposed, or has rights, to variable

returns from its involvement with the investee and has the ability

to affect those returns through its power over the investee.

The results of subsidiaries acquired or disposed of during the

year are included in the consolidated statement of comprehensive

income from the effective date of acquisition or up to the

effective date of disposal, as appropriate.

Where necessary, adjustments are made to the financial

statements of subsidiaries to bring their accounting policies into

line with those used by other members of the Group.

All intra-group transactions, balances, income and expenses are

eliminated on consolidation.

Changes in the Group,s ownership interests in subsidiaries that

do not result in the Group losing control over the subsidiaries are

accounted for as equity transactions. The carrying amounts of the

Group,s interests and the non-controlling interests are adjusted to

reflect the changes in their relative interests in the

subsidiaries. Any difference between the amount by which the

non-controlling interests are adjusted and the fair value of the

consideration paid or received is recognised directly in equity and

attributed to owners of the Company.

When the Group loses control of a subsidiary, the profit or loss

on disposal is calculated as the difference between (i) the

aggregate of the fair value of the consideration received and the

fair value of any retained interest and (ii) the previous carrying

amount of the assets (including goodwill), and liabilities of the

subsidiary and any non-controlling interests. Where certain assets

of the subsidiary are measured at revalued amounts or fair values

and the related cumulative gain or loss has been recognised in

other comprehensive income and accumulated in equity, the amounts

previously recognised in other comprehensive income and accumulated

in equity are accounted for as if the Company had directly disposed

of the related assets (i.e. reclassified to profit or loss or

transferred directly to retained earnings).

The fair value of any investment retained in the former

subsidiary at the date when control is lost is regarded as the fair

value on initial recognition for subsequent accounting under IFRS 9

ÒFinancial Instruments: Recognition and MeasurementÓ or, when

applicable, the cost on initial recognition of an investment in an

associate or a jointly controlled entity.

2.1 Business combinations

Subsidiaries are all entities which the Group has control. The

subsidiary consolidated in these Group accounts was acquired via

group re-organisation and as such merger accounting principles have

been applied. The subsidiary,s results are consoidated for the

period from the date the company took control of it.

This is a business combination involving entities under common

control Therefore, the assets and liabilities of Probiotix Limited

have been recognised and measured in these consolidated financial

statements at their pre combination carrying values.

The retained earnings and other equity balances recognised in

these consolidated financial statements are the retained earnings

and other equity balances of the Company and subsidiary. The equity

structure appearing in these consolidated financial statements (the

number and the type of equity instruments issued) reflect the

equity structure of the Company including equity instruments issued

by the Company to affect the consolidation.

The difference between consideration given and net assets of PL

at the date of acquisition is included in a Group reorganisation

reserve. Inter-company transactions, balances and unrealised gains

on transactions between Group companies are eliminated during the

consolidation process.

2.2 Revenue recognition

Revenue is measured at the fair value of sales of goods and

services less returns and sales taxes. The Group has analysed its

business activities and applied the five-step model prescribed by

IFRS 15 to each material line of business, as outlined below:

2.2.1 Sale of products

The contract to provide a product is established when the

customer places a purchase order. The performance obligation is to

provide the product requested by an agreed date, and the

transaction price is the value of the product as stated in our

order acknowledgement. The performance obligation is typically met

when the product is dispatched and so revenue is primarily

recognised for each product when dispatching takes place. In some

limited situations when the product is complete but the customer is

unable to take delivery the performance obligation is met when the

customer formally accepts transfer of risk and control even though

the product has not been dispatched.

2.2.2 License arrangements

Revenue is recognised when the customer obtains control of the

rights to use the IP. The performance obligations are considered to

be distinct from any ongoing distribution arrangements which are

treated in line with sales of products.

2.3 Taxation

Income tax expense represents the sum of the tax currently

payable and deferred tax.

(i) Current tax

Current taxes are based on the results shown in the financial

statements and are calculated according to local tax rules using

tax rates enacted or substantially enacted by the statement of

financial position date.

Income tax is recognised in the income statement or in equity if

it relates to items that are recognised in the same or a different

period, directly in equity.

Current tax assets and liabilities for the current and prior

periods are measured at the amount expected to be recovered from or

paid to the taxation authorities.

(ii) Deferred tax

Deferred tax is provided, using the liability method, on

temporary differences at the statement of financial position date

between the tax base of assets and liabilities and their carrying

amounts for financial reporting purposes.

Deferred tax liabilities are recognised for all taxable

temporary differences.

Deferred tax assets are recognised for all deductible temporary

differences, carry forward of unused tax assets and unused tax

losses, to the extent that it is probable that taxable profit

will

be available against which the deductible temporary differenced

and the carrying forward or unused tax assets and unused tax losses

can be utilised.

The carrying amount of deferred tax assets is reviewed at each

balance sheet date and reduced to the extent that it is no longer

probable that sufficient taxable profit will be available to allow

all or part of the deferred tax assets to be utilised. Conversely,

previously unrecognised deferred tax assets are recognised to the

extent that it is probable that sufficient taxable profit that

sufficient taxable profit will be available to allow all or part of

the deferred tax asset to be utilised.

Deferred tax assets and liabilities are measured at the tax

rates that are expected to apply to the year when the asset is

realised or the liability is settled, based on the tax rates and

tax laws that have been enacted or substantively enacted at the

balance sheet date.

2.4 Financial instruments

Financial assets and financial liabilities are recognised when

the group becomes a party to the contractual provisions of the

instrument.

Loans and receivables are initially measured at fair value and

are subsequently measured at amortised cost using the effective

interest rate method.

Trade receivables are initially measured at fair value and are

subsequently measured at amortised cost less appropriate provisions

for estimated irrecoverable amounts. Such provisions are recognised

in the statement of income.

Cash and cash equivalents comprise cash in hand and demand

deposits and other short-term highly liquid investments with

maturities of three months or less at inception that are readily

convertible to a known amount of cash and are subject to an

insignificant risk of changes in value.

Trade payables are not interest-bearing and are initially valued

at their fair value and are subsequently measured at amortised

cost.

2.5 Equity instruments are recorded at fair value, being the

proceeds received, net of direct issue costs.

2.6 Share Capital - Ordinary shares are classified as equity.

Incremental costs directly attributable to the issue of new shares

or options are shown in equity as a deduction, net of taxation,

from the proceeds.

2.7 Inventory

Inventories are stated at the lower of cost and net realisable

value. Cost is determined using the first-in, first-out (FIFO)

method. Net realisable value is the estimated selling price in the

ordinary course of business, less applicable variable selling

expenses.

2.8 Impairment of non-financial assets

At each statement of financial position date, the Group reviews

the carrying amounts of its investments to determine whether there

is any indication that those assets have suffered an impairment

loss. If any such indication exists, the recoverable amount of the

asset is estimated in order to determine the extent of the

impairment loss (if any). Where the asset does not generate cash

flows that are independent from other assets, the group estimates

the recoverable amount of the cash-generating unit to which the

asset belongs. An intangible asset with an indefinite useful life

is tested for impairment annually and whenever there is an

indication that the asset may be impaired.

Recoverable amount is the higher of fair value less costs to

sell and value in use. In assessing value in use, the estimated

future cash flows are discounted to their present value using a

pre-tax discount rate that reflects current market assessments of

the time value of money and the risks specific to the asset for

which the estimates of future cash flows have not been

adjusted.

If the recoverable amount of an asset (or cash-generating unit)

is estimated to be less than its carrying amount, the carrying

amount of the asset (cash-generating unit) is reduced to its

recoverable amount. An impairment loss is recognised as an expense

immediately, unless the relevant asset is carried at a re-valued

amount, in which case the impairment loss is treated as a

revaluation decrease.

Where an impairment loss subsequently reverses, the carrying

amount of the asset (cash-generating unit) is increased to the

revised estimate of its recoverable amount, but so that the

increased carrying amount does not exceed the carrying amount that

would have been determined had no impairment loss been recognised

for the asset (cash-generating unit) in prior years. A reversal of

an impairment loss is recognised as income immediately, unless the

relevant asset is carried at a revalued amount, in which case the

reversal of the impairment loss is treated as a revaluation

increase.

2.9 Capital management

Capital is made up of stated capital, premium, other reserves

and retained earnings. The objective of the Group,s capital

management is to ensure that it maintains strong credit ratings and

capital ratios. This will ensure that the business is correctly

supported and shareholder value is maximised.

The Group manages its capital structure through adjustments that

are dependent on economic conditions. In order to maintain or

adjust the capital structure, the Company may choose to issue new

share capital to shareholders. There were no changes to the

objectives, policies or processes during the period ended 31

December 2022.

2.10 Share-based compensation

The fair value of the employee and suppliers services received

in exchange for the grant of the options is recognised as an

expense. The total amount to be expensed over the vesting year is

determined by reference to the fair value of the options granted,

excluding the impact of any non-market vesting conditions (for

example, profitability and sales growth targets). Non-market

vesting conditions are included in assumptions about the number of

options that are expected to vest. At each statement of financial

position date, the entity revises its estimates of the number of

options that are expected to vest. It recognises the impact of the

revision to original estimates, if any, in the income statement,

with a corresponding adjustment to equity.

The proceeds received net of any directly attributable

transaction costs are credited to share capital (nominal value) and

share premium when the options are exercised.

The fair value of share-based payments recognised in the income

statement is measured by use of the Black Scholes model, which

takes into account conditions attached to the vesting and exercise

of the equity instruments. The expected life used in the model is

adjusted; based on management,s best estimate, for the effects of

non-transferability, exercise restrictions and behavioural

considerations. The share price volatility percentage factor used

in the calculation is based on management,s best estimate of future

share price behaviour and is selected based on past experience,

future expectations and benchmarked against peer companies in the

industry.

2.11 Intangibles - Patents

Separately acquired patents are shown at historical cost.

Patents have a finite useful life and are carried at cost less

accumulated amortisation. Amortisation is calculated using the

straight line method to allocate the cost of the patents over their

estimated useful life of ten years once the patents have been

granted.

2.12 Research and Development

Research expenditure is written off to the statement of

comprehensive income in the year in which it is incurred.

Development expenditure is written off in the same way unless the

Directors are satisfied as to the technical, commercial and

financial viability of individual projects. In this situation, the

expenditure is deferred and amortised over the 10 years during

which the Company is expected to benefit.

2.13 Critical accounting judgments and key sources of estimation

uncertainty

The preparation of the financial statements requires management

to make estimates and assumptions concerning the future that affect

the reported amounts of assets and liabilities and the disclosure

of contingent assets and liabilities at the dates of the financial

statements and the reported amounts of revenues and expenses during

the reporting period.

The resulting accounting estimates will, by definition, differ

from the related actual results.

á Share based payments

The fair value of share based payments recognised in the income

statement is measured by use of the Black Scholes model, which

takes into account conditions attached to the vesting and exercise

of the equity instruments. The expected life used in the model is

adjusted; based on management,s best estimate, for the effects of

non-transferability, exercise restrictions and behavioural

considerations. The share price volatility percentage factor used

in the calculation is based on management,s best estimate of future

share price behaviour and is selected based on past experience,

future expectations and benchmarked against peer companies in the

industry.

á Amortisation

Management have estimated that the useful life of the fair value

of the patents acquired on the acquisition to be 20 years. Research

and developments that have been capitalised in line with the

recognition criteria of IAS38 have been estimated to have a useful

economic life of 10 years. These estimates will be reviewed

annually and revised if the useful life is deemed to be lower based

on the trading business or any changes to patent law.

á Impairment reviews

IFRS requires management to undertake an annual test for

impairment of indefinite lived assets and, for finite lived assets

to test for impairment if events or changes in circumstances

indicate that the carrying amount of an asset may not be

recoverable. Impairment testing is an area involving management

judgement, requiring assessment as to whether the carrying value of

assets can be supported by the net present value of future cash

flows derived from such assets using cash flow projections which

have been discounted at an appropriate rate. In calculating the net

present value of the future cash flows, certain assumptions are

required to be made in respect of highly uncertain matters.

3. Segmental Reporting

In the opinion of the directors, the Group has one class of

business, in three geographical areas being that of identifying and

developing microbial strains, compounds and formulations for use in

the nutraceutical industry. The Group sells into three highly

interconnected markets, all costs assets and liabilities are

derived from the UK location.

Revenue analysed by geographical market

Period ended

31 December

2022

GBP'000

UK 43

US 934

Rest of world 332

------------

1,309

During the reporting period one customer represented GBP0.921m

(70%) of Group revenues.

4. Employees and Directors

Period ended

31 December

2022

GBP'000

Wages and salaries 106

Directors, remuneration 125

Directors, fees 187

Social security costs 25

Pension costs 14

------------

457

Wages and salaries represent a recharge

of salaries from Optibiotix Health for

employees who are under employment contracts

with Optibiotix and recharged under a share

services agreement.

Period ended

31 December

2022

No.

The average monthly number of employees

during the period was as follows:

Group

Directors 3

Research and development 2

------------

5

Company

Directors 3

------------

3

Period ended

31 December

2022

GBP

Directors, remuneration 233

Directors, share based payments -

Bonus 70

Pension 9

------------

Total emoluments 312

Emoluments paid to the highest paid

director 132

There are no key management personnel other than the directors

of the company.

The number of directors to whom defined contribution pension

benefits accrue is 2. No directors exercised share options in the

period. Of the GBP70k bonus GBP60k bonus relates to shares issues

in respect of the IPO with further details given in Note 18.

Directors, remuneration

Details of emoluments received by Directors of the Group for the

period ended 31 December 2022 are as follows:

Share Pension Total

Remuneration based Costs

and fees Bonuses payments

----------------- -------------- --------- ---------- --------- ---------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- -------------- --------- ---------- --------- ---------

A Reynolds* 22 30 - - 52

S P O,Hara* 90 30 - 3 123

M Caspani* 15 - - - 15

M Hvid-Hansen* 106 10 - 6 122

Total 233 70 - 9 312

----------------- -------------- --------- ---------- --------- ---------

*For disclosure in relation to directors, fees please refer to

Note 18.

5. Net Finance Income / (Costs)

Period ended

31 December

2022

GBP'000

Finance Income:

Interest on convertible loan notes waived

on conversion 59

Finance Cost:

-

------------

Net Finance Income / (Costs) 59

6. Expenses - analysis by nature

Period ended

31 December

2022

GBP'000

Research and development 4

Directors' fees & remuneration (Note

4)* 312

Salaries 106

Auditor remuneration - audit fees (Group

and Company accounts 7

Auditor remuneration - audit fees (Subsidiary

accounts) 14

Auditor remuneration - non audit fees

(reporting accountant on AQSE listing) 12

Auditor remuneration - non audit fees

(tax compliance) 2

Brokers & Advisors 106

Listing costs 166

Advertising & marketing 68

Share based payments charge 8

Amortisation 37

Legal and professional fees 32

Travel costs 6

Other expenses 96

------------

Total administrative expenses 976

7. Corporation Tax

Period ended

31 December

2022

GBP'000

Deferred tax movement (12)

------------

Total taxation (12)

Analysis of tax expense

No liability to UK corporation tax arose on ordinary activities

for the period ended 31 December 2022.

Period ended

31 December

2022

GBP'000

Profit (Loss) on ordinary activities

before income tax (203)

Loss on ordinary activities multiplied

by the standard rate of corporation tax

in UK of 19% (39)

Effects of:

Disallowables 303

Income not taxable (265)

Amortisation 9

Losses utilised (66)

Unused tax losses carried forward 58

------------

Tax credit -

The Group has estimated losses of GBP0.28m which can be carried

forward to be utilised against future profits.

The tax losses have resulted in a deferred tax asset at 25% of

approximately GBP0.07m which has not been recognized as it is

uncertain whether future taxable profits will be sufficient to

utilise the losses.

8. Earnings per share

Basic earnings per share is calculated by dividing the earnings

attributable shareholders by the weighted average number of

ordinary shares outstanding during the period.

Reconciliations are set out below:

2022

Weighted average

Basic and diluted EPS Earnings Number of shares Profit per-share

GBP'000 No. Pence

Basic EPS (215) 90,398,559 (0.0024)

Diluted EPS (215) 90,398,559 (0.0024)

As at 31 December 2022 there were 6,500,000 outstanding share

options. These are non-dilutive due to the losses incurred in the

year.

9. Intangible assets

Group Development Costs

and Patents

GBP'000

Cost

At 4 November 2021

Acquired in Probiotix Ltd acquisition 475

Additions 53

Disposals -

--------------

At 31 December 2022 528

Amortisation

At 4 November 2021 -

Acquired in Probiotix Ltd acquisition 133

Amortisation charge for the year 37

--------------

At 31 December 2022 170

Carrying amount

At 31 December 2022 358

All intangible assets relate to the group's principal

activities.

The company had no intangible assets

10. Investments

2022

GBP'000

Investments

At the beginning of the period -

Additions 50

At 31 December 50

--------------------------------- ---------

As at 31 December 2022 the Company directly held the following

subsidiaries:

Name of company Principal Country of incorporation Proportion of

activities and place of equity interest

business

Probiotix Limited Health Foods United Kingdom 100% of ordinary

shares

The registered office of Probiotix Limited is the same as the

company.

The Company acquired its 100% interest in Probiotix Limited in

the period by way of a share for share exchange

11. Inventories

Group Company

2022 2022

GBP'000 GBP

Finished goods 11

Work in progress 38

-------------- --------------

Finished goods 49 -

During the period GBP0.570m has been expensed to the income

statement.

12. Trade and other Receivables

Group Company

2022 2022

GBP'000 GBP'000

Accounts receivable 397 -

Other receivables 90 70

Prepayments 9 9

---------- ----------

496 79

See note 21 in respect of the group's credit risk

assessment.

13. Cash and Cash Equivalents

Group Company

2022 2022

GBP'000 GBP'000

Cash and bank balances 1,740 1,449

14. Called Up Share Capital

2022

Issued share capital comprises: GBP

Ordinary shares of 0.0005p each - 121,666,666 60,833

------------

60,833

O n 4 November 2021 the Company was incorporated with 1 share of

GBP1

On 7 February 2022 the GBP1 share capital was converted into

2,000 Ordinary shares of GBP0.0005 each.

On 4 March 2022 99,998,000 Ordinary shares of GBP0.0005 were

issued to acquire the whole share capital of Probiotix Limited.

On 31 March 2022 9,761,904 Ordinary shares of GBP0.0005 were

issued in settlement of convertible loan notes which automatically

converted to shares on IPO at a conversion rate based on 50% of the

IPO price.

On 31 March 2022 11,904,762 Ordinary shares of GBP0.0005 were

used at 21p a share in respect of a placing and subscription.

15. Reserves

Share capital is the amount subscribed for shares at nominal

value. Share premium represents amounts subscribed for share

capital in excess of nominal value, net of expenses.

Group reorganisation reserve arises from the 100% acquisition of

ProBiotix Limited on 31 March 2022 whereby the excess of the

nominal value of the issued ordinary share capital issued over the

net liabilities acquired is transferred to this reserve.

At 31 March 2022 Probiotix Health Plc investment in Probiotix

Limited was GBP50k and the net liabilities acquired were GBP995K,

resulting in the recognition of a group reorganisation reserve of

GBP945k.

Retained earnings represents the cumulative profits and losses

of the group attributable to the owners of the company.

Share based payment reserve represents the cumulative amounts

charged in respect of unsettled options issued.

No dividends are proposed in respect of the period

16. Trade and other payables

Current:

Group Company

2022 2022

GBP'000 GBP'000

Accounts Payable 179 4

* Accrued expenses 75 15

* Other payables 53 23

- -------------- --------------

Total trade and other

payables 307 42

-------------- --------------

All payables are due within 12 months

17. Deferred Tax

Deferred tax is provided, using the liability method, on

temporary differences at the statement of financial position date

between the tax base of assets and liabilities and their carrying

amounts for financial reporting purposes.

Deferred tax is calculated in full on temporary differences

under the liability method using a tax rate of 25%.

The movement on the deferred tax account is as shown below:

2022

GBP'000

At 4 November 2021 -

Acquired in common control

transaction 78

Movement in the period 11

------------

At 31 December 2022 89

The deferred tax liability relates to timing differences in

respect of tax treatment of intangible assets.

Deferred tax assets have not been recognised in respect of tax

losses and other temporary differences giving rise to deferred tax

assets as the directors believe there is uncertainty whether the

assets are recoverable.

18. Related Party Disclosures

Group

On 31 March 2022, Stephen O Hara and Adam Reynolds each received

142,857 shares in settlement of a bonus of GBP30,000 each relating

to the group's IPO.

During the period to 31 December 2022 GBP52,500 was paid to

Reyco Limited for the services of Adam Reynolds as Director of

ProBiotix Health Plc. The year end balance was NIL

During the period to 31 December 2022 GBP15,000 was paid to

Marco Caspani for his the services of Marco Caspani as Director of

ProBiotix Health plc. The year end balance was NIL

During the period to 31 December 2022 GBP90,000 was paid to

Optibiotix Health Plc for the services of Stephen O,Hara as

Director of ProBiotix Health Plc. The year end balance was NIL

During the period 1 January 2022 to 31 March 2022 Optibiotix

Health Plc loaned Probiotix Limited GBP150,000 to finance working

capital costs in the period up to the listing of Probiotix Health

Group Plc. During the year GBP203,835 was repaid. The balance due

to Probiotix Limited at 31 December 2022 of GBP10,137 (2021 owing:

GBP53,835) was repaid post year end. There was no interest charged

during the year.

During the year Optibiotix Limited transactions with Probiotix

Limited were as follows:-

Yen GBP440,663 for salaries and administration costs;

Yen GBP60,676 income received on behalf of Probiotix limited; and

Yen GBP544,177 repayments received.

There was no interest charged during the year. The remaining

balance of GBP30,146 was received after the year end.

During the period 31 March to 31 December 2022 the Group

purchased LPLDL stock to the value of GBP490,001 from Centro

Sperimentale del Latte srl, a company in which Marco Capsani is a

director. At 31 December 2022 there was balance owing to Centro

Sperimentale del Latte srl of GBP146,135.12, which was paid after

the year end.

During the year Optibiotix Limited recharged Probiotix Health

Plc GBP23,139 for directors, fees. Optibiotix Limited received a

recharge from Probiotix Health Plc for admin costs of GBP148. The

balance at the year end of GBP22,991 owing to Optibiotix Limited

was paid after the year end. There was no interest charged during

the year.

Company

During the year to 31 December 2022 GBP126,065 was paid to Balin

S.a.g.l for the services of Mikkel Hvid-Hansen as Director of

ProBiotix Health Plc.

During the year Probiotix Health PLC loaned Probiotix limited

GBP1,543,948 of which GBP147,837 was repaid. The balance at the 31

December 2022 of GBP1,396,111 was cancelled. This does not impact

on the consolidated Group accounts.

19. Ultimate Controlling Party

The Board consider that there is no overall controlling

party.

20. Share Based payment Transactions

(i) Share options

The Company had introduced a share option programme to grant

share options as an incentive for employees.

Each share option converts into one ordinary share of the

Company on exercise. No amounts are paid or payable by the

recipient on receipt of the option and the Company has no legal

obligation to repurchase or settle the options in cash. The options

carry neither rights to dividends nor voting rights prior to the

date on which the options are exercised. Options may be exercised

at any time from the date of vesting to the date of expiry.

The remaining life of all options is 9.25 years.

Movements in the number of share options outstanding and their

related weighted average exercise prices are as follows:

Number of options Average exercise

price

2022

No. GBP

Outstanding at the beginning - -

of the period

* Granted during the period 6,500,000 0.21

- -

* Forfeited/cancelled during the year

- -

* Exercised during the period

- -------------- --------------

Outstanding at the end

of the period 6,500,000 0.21

-------------- --------------

In respect of options which include market based vesting

conditions in respect of revenue and share price targets, the Board

have determined that the value of this proportion of shares have

immaterial value in light of the Group's results for the 2022

accounting period in which they were granted.

No share options were exercisable at 31 December 2022.

(i) Warrants

On 31 March 2022, the Company executed a warrant instrument to

create and issue warrants to Peterhouse to subscribe for, an

aggregate, of 112,857 Ordinary Shares. The warrants will be

exercisable at any time from Admission for a period of ten years

from Admission at the Fundraising Price.

Movements in the number of share warrants outstanding and their

related weighted average exercise prices are as follows:

Number of warrants Average exercise price

2022 2022

No. GBP

Outstanding at the beginning -

of the period

-

* Granted during the period 112,857 0.21

- -------------- --------------

-

Outstanding at the end

of the period 112,857 0.21

-------------- --------------

A charge of GBP7,900 has been recognised during the year for the

share based payments over the vesting period.

The warrants were issued to the company's broker in respect of

shares issues on IPO and so the fair value has been deducted from

share premium.

21. Financial Risk Management Objectives and Policies

The Group,s financial instruments comprise cash balances and

receivables and payables that arise directly from its

operations.

The main risks the Group faces are liquidity risk and capital

risk.

The Board regularly reviews and agrees policies for managing

each of these risks. The Group,s policies for managing these risks

are summarised below and have been applied throughout the period.

The numerical disclosures exclude short-term debtors and their

carrying amount is considered to be a reasonable approximation of

their fair value.

Interest risk

The Group is not exposed to significant interest rate risk as it

has limited interest bearing liabilities at the year end.

Credit risk

Management have regard to credit exposures when entering into

new contracts and seek to agree settlement terms on all contracts.

Credit exposure is regularly monitored by management and any

overdue debts are followed up as part of the group's credit control

procedures.

Where a debt becomes significantly overdue, management have

regard to credit loss provisions to reflect the existence of

expected credit losses, taking account of forward looking

information as well as the pattern of cash collections for that

category of customer.

On 31 March 2022 as part of the common control transaction the

group acquired GBP345k of credit-impaired receivables against which

full provision had been made prior to that date.

Whilst the group has continued efforts to collect these

receivables, none of these amounts were collected at 31 December

2022. No additional credit loss provision has raised after having

regard to cash collections on other receivables.

Liquidity risk

Liquidity risk is the risk that Group will encounter difficulty

in meeting these obligations associated with financial

liabilities.

The responsibility for liquidity risks management rest with the

Board of Directors, which has established appropriate liquidity

risk management framework for the management of the Group,s short

term and long-term funding risks management requirements.

During the period under review, the Group has not utilised any

borrowing facilities.

The Group manages liquidity risks by maintaining adequate

reserves and reserve borrowing facilities by continuously

monitoring forecast and actual cash flows, and by matching the

maturity profiles of financial assets and liabilities.

Capital risk

The Group,s objectives when managing capital are to safeguard

the ability to continue as a going concern in order to provide

returns for shareholders and benefits to other stakeholders and to

maintain an optimal capital structure to reduce the cost of

capital.

22. Post Balance Sheet Events

Steen Andersen joined the Group as CEO on 1 January 2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXFLFIIRVIDFIV

(END) Dow Jones Newswires

June 28, 2023 02:00 ET (06:00 GMT)

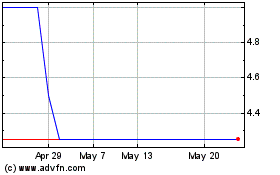

Probiotix Health (AQSE:PBX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Probiotix Health (AQSE:PBX)

Historical Stock Chart

From Dec 2023 to Dec 2024