TIDMTAN

RNS Number : 9849C

Tanfield Group PLC

14 October 2022

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

Tanfield Group Plc

("Tanfield" or the "Company")

Snorkel Investment & Legal Proceeding Update

The Board of Tanfield (the "Board") is pleased to update the

market on its investment in Snorkel International Holdings LLC

("Snorkel"), the aerial work platform business, as well as with

respect to additional loan subscriptions.

Investment Background

-- Tanfield is a 49% shareholder in the equity of Snorkel

following the joint venture between the Company and Xtreme

Manufacturing LLC ("Xtreme") (the "Contemplated Transaction"), a

company owned by Don Ahern of Ahern Rentals Inc, relating to

Snorkel, in October 2013.

-- The Snorkel investment is valued at GBP19.1m. The outcome of

the US and UK Proceedings referenced below could have an impact on

this valuation.

-- On 22 October 2019, the Company announced that it had

received a Summons and Complaint, filed in Nevada (the "US

Proceedings") by subsidiaries of Xtreme, relating to the

Contemplated Transaction.

-- On 24 October 2019, the Company announced it had become

necessary to issue and serve a claim in the English High Court

against Ward Hadaway (the "UK Proceedings"), the solicitor acting

for the Company at the time of the Contemplated Transaction, in

order to fully protect the Company's rights.

-- On 26 February 2021, Ward Hadaway was granted permission to

join Foulston Siefkin, Tanfield's US based law firm who were

retained in 2013 to draft the documents governed by US law relating

to the Contemplated Transaction, into the UK Proceedings. As a

result, the Company amended its claim to include Foulston Siefkin

as a second defendant.

Highlights

-- The Company has agreed to settle its claim against Foulston

Siefkin, the second defendant, in relation to the UK Proceedings on

a no-fault basis for the sum of $4,500,000 including interest and

costs (GBP3,978,903).

-- Whilst the Company is no longer pursuing its claim against

Foulston Siefkin in relation to the UK Proceedings, its claim

against Ward Hadaway, the first defendant, continues with the

3-week trial scheduled to begin on 7 November 2022.

-- The US Proceedings are also continuing, with the jury trial

currently expected to take place around the summer of 2023.

Business Update

Tanfield is a 49% shareholder in the equity of Snorkel following

the joint venture between the Company and Xtreme, a company owned

by Don Ahern of Ahern Rentals Inc, relating to Snorkel, in October

2013 .

Non-Fault Settlement

The Board is pleased to announce that the Company has reached an

agreement to settle its claim against Foulston Siefkin, Tanfield's

US based law firm at the time of the Contemplated Transaction, in

relation to the UK Proceedings, on a no-fault basis for the sum of

$4,500,000 including interest and costs (GBP3,978,903). For the

avoidance of doubt, the agreed settlement should not be construed

as an admission of liability or wrongdoing by Foulston Siefkin.

Save as required under the AIM Rules for Companies, to which the

Company remains subject, the terms of the settlement remain

confidential between the parties.

UK & US Legal Proceedings

Whilst the Company is no longer pursuing its claim against

Foulston Siefkin in relation to the UK Proceedings, its claim

against Ward Hadaway, the solicitor acting for the Company at the

time of the Contemplated Transaction, continues. The 3-week trial

for the UK Proceedings is scheduled to begin on 7 November 2022

.

Further to the update on 24 August 2022, the US Proceedings are

continuing. Whilst there are ongoing deficiencies in the production

of documents by Snorkel / Xtreme, the jury trial is currently still

expected to take place around the summer of 2023.

The Board continues to believe that a positive outcome to either

or both proceedings is possible. So far as it is necessary, the

Company will continue to vigorously defend and advance its position

in both proceedings, whilst continuing to seek advice.

Loan Instruments

As updated on 24 August 2022, the first loan note instrument has

subscriptions totalling GBP625,000, the second loan note instrument

has subscriptions totalling GBP950,000, and the third loan note

instrument has subscriptions totalling GBP1,250,000. All of the

loans are unsecured and carry annual interest of 10% which is to

accrue and is repayable on the earlier of (i) 28 February 2025 or

(ii) receipt of funds relating to either the US or UK Proceedings.

Furthermore, should repayment take place prior to 28 February 2025,

a 20% early redemption premium shall apply.

As a consequence of the above settlement with Foulston Siefkin,

the Board, with guidance from its legal advisors, will be assessing

the level of funds required to complete the UK and US Proceedings.

As required by the loan agreements, any excess funds will be used

to repay a proportion of the loan note instruments.

The Board currently does not believe that further loans will be

necessary to ensure that the Company can continue to protect its

investment in Snorkel.

Further updates will be provided to Shareholders as and when

appropriate.

For further information:

Tanfield Group Plc 020 7220 1666

Daryn Robinson

WH Ireland Limited - Nominated Advisor / Broker

James Joyce / Megan Liddell 020 7220 1666

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBKQBDBBDDPKD

(END) Dow Jones Newswires

October 14, 2022 08:17 ET (12:17 GMT)

Tanfield (AQSE:TAN.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

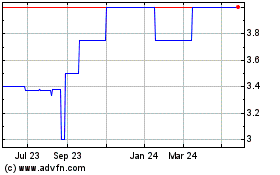

Tanfield (AQSE:TAN.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024