TIDMWSBN

RNS Number : 3809E

Wishbone Gold PLC

29 June 2023

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR

29 June 2023

Wishbone Gold Plc

("Wishbone" or the "Company")

Wishbone Gold Plc / Index: AIM: WSBN / Sector: Natural Resources

/ AQSE: WSBN

Final Results for the Year ended 31 December 2022

Wishbone Gold Plc (AIM: WSBN, AQSE: WSBN), the dedicated gold

and precious metals exploration company with assets in Australia,

is pleased to announce its final results covering the 12 months to

31(st) December 2022. The Chairman's Statement and Financial

Statement are set out below and the full Report and Accounts is

available on the Company's website www.wishbonegold.com.

Wishbone has three major exploration properties in Australia and

three minor prospects. Two of these are located in the Pilbara

region of Western Australia ("WA") and the third is in the

Mingela-Charters Towers region in Queensland. The Company's

flagship project is Red Setter, as previously announced this has

been judged by Expert Geophysics to be analogous to Newcrest's

Telfer mine 13km away.

Cottlesloe, 35km south-east of Red Setter, has deposits visible

at surface of silver and lead: metals which are essential for

battery and electric car production. In Queensland, the Wishbone II

project has almost doubled in size recently with the addition of

Wishbone VI which could host deposits similar to the Ravenswood

mine located to the south-east.

Highlights

-- 2022 has been a year of progress for the Company with

positive developments at our assets in Western Australia and

Queensland

-- The 2022 exploration season started in March with obtaining

additional Heritage Clearance surveys on Red Setter and

Cottesloe

-- The drill program on Red Setter produced exciting results

with every hole drilled returning grades of copper or gold with

significant intercepts

-- During Q4 2022 and since the start of this year we have

deployed a number of new exploration techniques for further

analysis which has enabled much improved targeting across the

properties in WA

-- Wishbone acquired the Anketell project and completed magnetic

modelling over the large anomaly in the centre of the tenement

which could prove to be notable

-- The RC drill program at Wishbone II and IV proceeded smoothly

with copper and gold mineralisation found throughout multiple holes

drilled

Richard Poulden, Chairman of Wishbone Gold, said : "We saw some

very promising results from our extensive drill programmes and

continue to believe that we hold land that has significant

potential which underpins the inherent value in the group. Our

confidence was highlighted by the acquisition of acreage at

Cottesloe East at the start of this year which also has good

prospectivity and is strategically located."

For more information on Wishbone, please visit the Company's

website:

www.wishbonegold.com .

For further information, please contact:

Wishbone Gold PLC

Richard Poulden, Chairman

Tel: +971 4 584 6284

Beaumont Cornish Limited

(Nominated Adviser and AQUIS Exchange Corporate Adviser)

Roland Cornish/Rosalind Hill Abrahams

Tel: +44 20 7628 3396

SP Angel Corporate Finance LLP

(Broker)

Ewan Leggat / Kasia Brzozowska

Tel: +44 20 3470 0470

J&H Communications Ltd

(Financial PR)

George Hudson

Tel: +44 (0)7803 603130 / george@j-hcommunications.com

Chairman's Statement

Dear Shareholders,

2022 has been a year of progress for the Company with positive

developments at our assets in Western Australia and Queensland. The

drill program at Red Setter has produced exciting results as has

the RC drill program at Wishbone II and IV. After the period end,

we were delighted to acquire the acreage at Cottesloe East given

its prospectivity and strategic location. We continue to believe,

given the results of survey work completed to date and those

planned for the year ahead, that we hold land that has significant

potential and which underpins the inherent value in the Group.

The 2022 exploration season started in March with obtaining

additional Heritage Clearance surveys on Red Setter and Cottesloe.

We are focused on ensuring we have excellent relations with the

indigenous Martu community and we have the utmost respect for their

teams who do the surveys.

Western Australia exploration

The major event in our exploration calendar in 2022 was the

drill program on Red Setter. We have announced the results of this

program with every hole drilled returning grades of copper or gold

with significant intercepts. During the end of last year and during

2023, we have deployed a number of techniques for further analysis

including:

-- Mobile MagnetoTellurics ("Mobile MT" ) which is the most

advanced generation of airborne "AFMAG" technology. Utilising

naturally occurring electromagnetic fields in the frequency range

of 25 Hz - 21,000 Hz, MobileMT systems combine the latest advances

in electronics, airborne system design, and sophisticated signal

processing techniques.

-- Ambient Noise Tomography ("ANT"), a geophysical method that

uses faint ground vibrations produced by surface Rayleigh waves,

recorded by seismic stations to image the subsurface . The method

consists of doing cross-correlations of ambient seismic noise to

reconstruct Green's functions between pairs of stations.

-- Gravity surveys, which measure minute variations in gravity.

Gravity at every point on the surface of the earth varies slightly

depending on: distance from the equator, or density of the

underlying rocks. This enables the ability for rock density to be

detected using gravity variations.

As announced via RNS, this has enabled much improved targeting

across the properties with the knowledge gained from the drill

programs plus the additional analysis. This year, we will target

the source of the mineralisation with exploration focused on the

ground studies we have done during the off season.

In particular, I would draw your attention to the RNS of 4(th)

April 2023 where, following the Mobile MT survey, Expert

Geophysics, an airborne geophysical survey specialist, stated that

it saw Red Setter as an analogue of Newcrest's Telfer mine located

only a few kilometres away. The significance of this is that Telfer

is a major deposit with low (but viable) grades across a large area

which contrasts with Greatland's Havieron project which is a

high-grade deposit within a much smaller area than Telfer or Red

Setter. Both types of deposit are equally viable as has been shown

with the long-term success of the 20m oz plus of gold mined from

Telfer.

Figure 1: Drilling at Red Setter

During the year, Wishbone acquired the Anketell project and

completed magnetic modelling over the large anomaly in the centre

of the tenement. This anomaly could prove to be something quite

significant with further exploration.

In December 2022 we acquired Cottesloe East which is contiguous

to the existing Cottesloe project. This added 62 km(2) bringing the

total acreage to 165 km(2) . Further analysis was announced in

April and May 2023 which indicates major areas of interest across

the centre of the two tenements.

Finally, also in May, we announced we had been successful in

obtaining a grant of A$220,000 from the Western Australian

government for a co-funded drilling program on Cottesloe. We

anticipate starting this work in the third quarter this year and

look forward to the findings.

Queensland

The Queensland drill program which took place between June and

July in 2022 went off without a hitch with copper and gold

mineralisation found throughout multiple holes during the 2,500

metre RC program. (Figure 2)

The drilling was conducted across four different areas of

Wishbone II and IV with assays from the drill results returning the

makings of a large copper and gold Hyperthermal system as reported

in December.

We look forward to exploring Queensland further in the future

but with shareholder interest focused on Western Australia, this

remains our priority.

Figure 2: Drill Rig in Queensland

Figure 3: Exploration Properties Location Map in WA

Change of Advisers

In May 2023, we announced the appointment of S.P. Angel

Corporate Finance LLP as the Company's broker to replace

Peterhouse. We have also appointed Graeme Dixon's G-Force Capital

as advisers. Together, these substantially strengthen our financial

and analyst advisory team.

We are also adding J&H Communications as our corporate and

financial communications advisers to enhance our overall

communications with the market and to extend the reach of our

coverage.

Financial Review and Financing

At the end of the period under review, the accounts show that

Wishbone held cash balances totalling GBP 1,457,902 (2021:

GBP3,002,547). Administrative costs, excluding interest during the

year, were GBP 1,116,947 (2021: GBP1,194,053).

The Company continues its strategy of exploration on its

properties in Australia.

In conclusion, I would like to thank you all: staff,

shareholders and advisers for your hard work and support. We will

continue to announce news as soon as we are allowed by regulations

to do so.

___________________________

R O'D Poulden

Chairman

27 June 2023

Consolidated Income Statement

for the year ended 31 December 2022

Notes 2022 2021

GBP GBP

Discontinued Operations

Interest income - 17,605

Administration expenses 5 (37,512) (9,901)

(Loss)/income from discontinued

operations (37,512) 7,704

------------ -------------

Continuing Operations

Interest income - 16,340

Administration expenses 5 (1,079,435) (1,184,152)

------------ -------------

Operating loss (1,079,435) (1,167,812)

Foreign exchange loss (23,263) (80,049)

Loss from continuing operations

- before taxation (1,102,698) (1,247,861)

Tax on loss - -

------------ -------------

Loss from continuing operations (1,102,698) (1,247,861)

Loss for the financial year (1,140,210) (1,240,157)

Loss per share:

Basic and diluted (pence) (0.629) (0.746)

There are no recognised gains or losses other than disclosed

above and there have been no discontinued activities during the

year.

The notes on pages 31 to 50 form part of these financial

statements.

Consolidated Statement of Financial Position

as at 31 December 2022

Notes 2022 2021

GBP GBP

Current assets

Trade and other receivables 8 200,458 33,135

Cash and cash equivalents 1,457,902 3,002,547

1,658,360 3,035,682

-------------- -------------

Non-current assets

Intangible assets 10 4,900,173 1,460,055

4,900,173 1,460,055

-------------- -------------

Total assets 6,558,533 4,495,737

============== =============

Current liabilities 12 632,674 135,752

Equity

Share capital 13 3,016,333 2,991,216

Share premium 13 14,368,967 11,698,892

Share payment reserve 15 72,987 72,987

Translation adjustment (411,419) (411,419)

Foreign exchange reserve (201,366) (212,258)

Accumulated losses (10,919,643) (9,779,433)

5,925,859 4,359,985

Total equity and liabilities 6,558,533 4,495,737

============== =============

The financial statements were approved by the board and

authorised for issue on 27 June 2023 and signed on its behalf

by:

A.D. Gravett R O'D Poulden

Director Director

The notes on pages 31 to 50 form part of these financial

statements.

Company Statement of Financial Position

as at 31 December 2022

Notes 2022 2021

GBP GBP

Current assets

Trade and other receivables 8 42,772 7,584

Loans 14 5,273,575 2,398,756

Cash and cash equivalents 1,234,703 2,430,728

6,551,050 4,837,068

-------------- -------------

Non-current assets

Investments 11 104,105 104,105

104,105 104,105

-------------- -------------

Total assets 6,655,155 4,941,173

============== =============

Current liabilities 12 122,050 92,607

Equity

Share capital 13 3,016,333 2,991,216

Share premium 13 14,368,967 11,698,892

Share payment reserve 15 72,987 72,987

Translation adjustment (411,419) (411,419)

Accumulated losses (10,513,763) (9,503,110)

-------------- -------------

6,533,105 4,848,566

Total equity and liabilities 6,655,155 4,941,173

============== =============

The financial statements were approved by the board and

authorised for issue on 27 June 2023 and signed on its behalf

by:

A.D. Gravett R O'D Poulden

Director Director

The notes on pages 31 to 50 form part of these financial

statements.

Consolidated Statement of Cash Flows

for the year ended 31 December 2022

Note 2022 2021

GBP GBP

Cash flows from operating activities

( 1,140,210 ( 1,240,157

Loss before tax ) )

Reconciliation to cash generated from

operations:

Write-off of receivable 34,505 -

Foreign exchange loss 23,263 80,049

Administrative expenses under share

option scheme - 72,987

------------

Operating cash flow before changes

in working capital (1,082,442) (1,087,121)

-------------

(Increase)/decrease in receivables (201,828) 325,420

Increase/(decrease) in payables 496,922 (164,720)

------------

Net cash flows used in operations (787,348) (926,421)

-------------

Cash flows from investing activities

Acquisition of intangible assets (3,119,926) (217,125)

Net cash flows used in investing

activities (3,119,926) (217,125)

-------------

Cash flows from financing activities

Issue of shares for cash 13 2,375,000 2,556,885

Net cash flows from financing activities 2,375,000 2,556,885

-------------

Effects of exchange rates on cash

and cash equivalents, including effects

of foreign exchange reserve (12,371) (12,891)

------------- ------------

Net increase in cash and cash equivalents (1,544,645) 1,400,448

Cash and cash equivalents at 1 January 3,002,547 1,602,099

------------- ------------

Cash and cash equivalents at 31 December 1,457,902 3,002,547

============= ============

The notes on pages 31 to 50 form part of these financial

statements.

Company Statement of Cash Flows

for the year ended 31 December 2022

Notes 2022 2021

GBP GBP

Cash flows from operating activities

Loss before tax (1,010,653) (1,063,781)

Reconciliation to cash generated

from operations:

Foreign exchange loss 23,263 80,049

Write-off of receivables (10,623) -

Administrative expenses under

share option scheme - 72,987

------------

Operating cash flow before changes

in working capital (998,013) (910,745)

(Increase)/decrease in receivables (2,579,192) 897,381

Increase/(decrease) in payables 29,433 (119,997)

Net cash flows used in operations (3,547,762) (133,361)

------------ ------------

Cash flows from financing activities

Issue of shares for cash 13 2,375,000 2,556,885

Net cash flow from financing

activities 2,375,000 2,556,885

------------ ------------

Effects of exchange rates on

cash and cash equivalents (23,263) 7,204

Net (decrease)/increase in cash

and cash equivalents (1,196,025) 2,430,728

Cash and cash equivalents at 1

January 2,430,728 -

------------ ------------

Cash and cash equivalents at 31

December 1,234,703 2,430,728

------------ ------------

The notes on pages 31 to 50 form part of these financial

statements.

Notes to the Consolidated Financial Statements

for the year ended 31 December 2022

1. General Information

The consolidated financial statements of Wishbone Gold Plc (the

"Company") and its subsidiaries (the "Group") for the year ended 31

December 2022 were authorised for issue in accordance with a

resolution of the Company's

directors on 27 June 2023.

The Company was incorporated in Gibraltar under the name of

Wishbone Gold Plc as a public company under the Gibraltar Companies

Act 2014. The authorised share capital of the Company is

GBP8,000,000 divided into 8,000,000,000 shares of GBP0.001 each.

The registered office is located at Suite 16, Watergardens 5,

Waterport Wharf GX11 1AA , Gibraltar.

In November 2022, the Group completed the acquisition of the

Anketell Gold-Copper Project as per the agreement announced on 23

August 2022. The Anketell Gold- Copper Project is located 85km

north of the Company's Red Setter Gold-Copper Project in the

Patersons Range area in Western Australia.

In May 2023, the Group's application for a co-founded drill

program has been accepted by the Government of Western Australia.

Wishbone has been granted a contribution of A$220,000 for its

highly prospective Cottesloe project.

The Anketell Project consists of a single exploration licence

application E45/ 6198 covering an area of 10km2.This took the

Group's portfolio of properties to a total of 169.19 sqkm in

Western Australia and a total of 174 sqkm in the Wishbone project

group near Ravenswood in Queensland with a further 37.2 sqkm at

White Mountains further north.

Further share allotments have been made as disclosed in note

15.

2. Accounting Policies

Basis of preparation

The financial statements of the Group have been prepared in

accordance with International Financial Reporting Standards

("IFRS") as adopted by the United Kingdom applied in accordance

with the provisions of the Gibraltar Companies Act 2014 ("the

Act"). The Company and the Group changed the basis of financial

reporting from preparing the financial statements under IFRS as

adopted by the European Union to United Kingdom adopted IFRS. The

change in standards has no significant impact to the Company and

the Group's existing accounting policies and figures in the

previous year's financial reports.

In accordance with the Gibraltar Companies Act 2014, the

individual statement of financial position of the Company has been

presented as part of these financial statements. The individual

statement of comprehensive income has not been presented as part of

these financial statements as permitted by Section 288 of the Act.

The individual statement of comprehensive income of the Company

shows a loss for the year of GBP 1,010,653 (2021:

GBP1,063,781).

IFRS is subject to amendment and interpretation by the

International Accounting Standards Board ("IASB") and the

International Financial Reporting Interpretations Committee

("IFRIC"). The accounts have been prepared on the basis of the

recognition and measurement principles of IFRS that are applicable

for the year commencing 1 January 2022.

The consolidated financial statements have been prepared under

the historical cost convention. The principal accounting policies

set out in the succeeding pages have been consistently applied to

all years presented other than changes from the new and amended

standards and interpretations effective from 1 January 2022.

Notes to the Consolidated Financial Statements

for the year ended 31 December 2022

2. Accounting Policies - continued

Going concern

The Group has incurred losses during the financial years ended

31 December 2022 and 31 December 2021.

In June 2020, the Group fundamentally changed its strategy and

re-focused on exploration in Australia. Initially, this was on the

existing properties in Queensland but during the latter part of

2020, early 2021, and also late 2022, the Group took options over

and acquired additional properties in Western Australia.

The presentation of this new strategy was received extremely

well by the markets with the Company's market capitalization rising

from GBP1.25m in June 2020 to over GBP30m by June 2021. This has

enabled the Company to raise GBP2.375m in 2022 (2021:

GBP2.57m).

The Directors have reviewed the financial condition of the Group

since 31 December 2022 and have considered the Group's cash

projections and funding plan for the 12 months from the date of

approval of these financial statements. The Group's current cash

situation without any additional funding can sustain the Company

for at least the next twelve months. This can of course be adjusted

in accordance with the results. All exploration is inherently

unpredictable as to the final outcome.

The Company has also demonstrated that it has the ability to

raise capital for its new strategy that it may require to

accelerate the exploration program if it desires.

The Board of Directors is confident that the Group has access to

sufficient funds to enable the Group to meet its liabilities as and

when they fall due for at least the next twelve months and also to

continue full operations in exploration.

Basis of consolidation

The Group's consolidated financial statements incorporate the

financial statements of the Company and its subsidiaries prepared

at 31 December each year. Control is achieved where the company has

power to govern the financial and operating policies of an investee

entity so as to obtain benefits from its activities.

The results of subsidiaries acquired or disposed of during the

year are included in the consolidated income statement from the

effective date of acquisition or up to the effective date of

disposal, as appropriate.

Where necessary, adjustments are made to the financial

statements of subsidiaries to bring the accounting policies used

into line with those used by the Group.

All intra-group transactions and balances and any unrealised

gains and losses arising from intra-group transactions are

eliminated in preparing the consolidated accounts.

In the parent company financial statements, the investment in

the subsidiaries is accounted for at cost.

Functional and presentational currencies

The individual financial information of the entity is measured

and presented in the currency of the primary economic environment

in which the entity operates (its functional currency).

As at 1 January 2021, the functional currency of the Company is

the Pounds Sterling ("GBP"). The Board of Directors considered that

the Group's source of funding is predominantly GBP denominated. As

a result, the Directors have determined that GBP is the currency

which best reflects the underlying transactions, events and

conditions relevant to the Group with effect from 1 January 2021

("the effective date of the change").

Notes to the Consolidated Financial Statements

for the year ended 31 December 2022

2. Accounting Policies - continued

Functional and presentational currencies - continued

In accordance with IAS 21 'The Effect of Changes in Foreign

Exchange Rates', the effect of a change in functional currency is

accounted for prospectively. All items were translated at the

exchange rate on the effective date of the change, being US$ 0.7321

to GBP1. The resulting translated amounts for non-monetary items

are treated as their historical cost. Share capital and premium

were translated at the historic rates prevailing at the dates of

the underlying transactions.

The effects of translating the Company's financial results and

financial position into GBP were recognized in the foreign currency

translation reserve.

The financial statements are presented in GBP including the

comparative figures. All amounts are recorded in the nearest GBP,

except when otherwise indicated.

Business combinations and goodwill

On acquisition, the assets and liabilities, and contingent

liabilities of subsidiaries are measured at their fair values at

the date of acquisition. Any excess of cost of acquisition over the

fair value of identifiable net assets acquired is recognised as

goodwill. Any deficiency of the cost of acquisition below the fair

value of identifiable net assets acquired (i.e., discount on

acquisition) is credited to the income statement in the period of

acquisition. Goodwill arising on consolidation is recognised as an

asset and reviewed for impairment at least annually. Any impairment

is recognised immediately in the income statement and is not

subsequently reversed.

Exploration and evaluation assets

Exploration and evaluation expenditure in relation to separate

areas of interest for which rights of tenure are current is carried

forward as an asset in the statement of financial position where it

is expected that the expenditure will be recovered through the

successful development and exploitation of an area of interest, or

by its sale; or exploration activities are continuing in an area

and activities have not reached a stage which permits a reasonable

estimate of the existence or otherwise of economically recoverable

reserves. Where a project or an area of interest has been

abandoned, the expenditure incurred thereon is written off in the

year in which the decision is made. Exploration and expenditure

ceases after technical feasibility and commercial viability of

extracting a mineral resource are demonstrable.

Property, plant and equipment

Property, plant and equipment is stated at cost less accumulated

depreciation. Cost is depreciated on a straight-line basis over

their expected useful lives as follows:

Machinery 15% per annum

Investments

Investments in group undertakings

Investments in group undertakings are measured at cost less any

impairments arising should the fair value after disposal costs be

lower than cost.

Notes to the Consolidated Financial Statements

for the year ended 31 December 2022

2. Accounting Policies - continued

Impairment of non-financial assets

At each year end date, the Group reviews the carrying amounts of

its non-financial assets, which comprise of investments, tangible

and intangible assets, to determine whether there is any indication

that those assets have suffered an impairment loss. If any such

indication exists, the recoverable amount of the assets is

estimated in order to determine the extent of the impairment loss

(if any). Where the asset does not generate cash flows that are

independent from other assets, the Group estimates the recoverable

amount of the cash-generating unit to which the asset belongs.

Recoverable amount is the higher of fair value less cost to

sell, and value in use. In assessing value in use, the estimated

future cash flows are discounted to their present value using

pre-tax discount rate that reflects current market assessments of

the time value of money and the risks specific to the asset, for

which the estimates of future cash flows have not been

adjusted.

If the recoverable amount of an asset (or cash generating unit)

is estimated to be less than its carrying amount, the carrying

amount of the asset (cash generating unit) is reduced to its

recoverable amount. An impairment loss is recognised as an expense

immediately, unless the relevant asset is carried at revalued

amount, in which case the impairment loss is treated as a

revaluation decrease.

Where an impairment loss subsequently reverses, the carrying

amount of the asset (cash generating unit) is increased to the

revised estimate of its recoverable amount, but so that the

increased carrying amount does not exceed the carrying amount that

would have been determined had no impairment loss been recognised

for the asset (cash generating unit) in prior periods. A reversal

of impairment loss is recognised in the income statement

immediately.

In 2022, the Company did not recognise additional impairment of

its related party loans (2021: GBPNil).

Foreign currencies

The consolidated financial statements are presented in Gibraltar

Pounds Sterling ("GBP"), the presentation and functional currency

of the Company. All values are rounded to the nearest GBP.

Transactions denominated in a foreign currency are translated into

GBP at the rate of exchange at the date of the transaction or using

the average rate for the financial year. At the year-end date,

monetary assets and liabilities denominated in foreign currency are

translated at the rate ruling at that date. All exchange

differences are dealt with in the income statement.

On consolidation, the assets and liabilities of foreign

operations which have a functional currency other than GBP are

translated into GBP at foreign exchange rates ruling at the

year-end date. The revenues and expenses of these subsidiary

undertakings are translated at average rates applicable in the

period. All resulting exchange differences are recognised as a

separate component of equity. Foreign exchange gains or losses

arising from a monetary item receivable from or payable to a

foreign operation are recognised in the consolidated statement of

comprehensive income and disclosed as a separate component of

equity, such foreign exchange gains or losses are reclassified from

equity to the income statement on disposal of the net foreign

operation. The same foreign exchange gains or losses are recognised

in the stand-alone income statements of either the parent or the

foreign operation.

Notes to the Consolidated Financial Statements

for the year ended 31 December 2022

2. Accounting Policies - continued

Foreign currencies - continued

In the statement of cash flows, cash flows denominated in

foreign currencies are translated into the presentation currency of

the Group at the average exchange rate for the year or the

prevailing rate at the time of the transaction where more

appropriate.

The closing exchange rate applied at the year-end date was AUD

1.7758 per GBP1 (2021: AUD 1.8624). The average exchange rate

applied at the year-end date was AUD 1.7767 per GBP1 (2021: AUD

1.8315).

The closing exchange rate applied at the year-end date was AED

4.4439 per GBP1 (2021: AED 4.9710). The average exchange rate

applied at the year-end date was AED 4.5128 per GBP1 (2021: AED

5.0493).

Segment reporting

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker

as required by IFRS 8 "Operating Segments". The chief operating

decision-maker, who is responsible for allocating resources and

assessing performance of the operating segments, has been

identified as the Board of Directors.

The accounting policies of the reportable segments are

consistent with the accounting policies of the Group as a whole.

Segment loss represents the loss incurred by each segment without

allocation of foreign exchange gains or losses, investment income,

interest payable and tax. This is the measure of loss that is

reported to the Board of Directors for the purpose of the resource

allocation and the assessment of the segment performance.

When assessing segment performance and considering the

allocation of resources, the Board of Directors review information

about segment assets and liabilities. For this purpose, all assets

and liabilities are allocated to reportable segments (note 4).

Revenue recognition

The Group earns its revenues only from gold trading, which is

recognised at a point in time. Revenue is recognised when control

of a good or service transfers to a customer. A new five-step

approach is applied before revenue can be recognised:

identify contracts with customers;

identify the separate performance obligation;

determine the transaction price of the contract;

allocate the transaction price to each of the separate

performance obligations; and

recognise the revenue as each performance obligation is

satisfied.

The revenue recognition under IFRS 15 is similar to how the

Company has previously accounted for its revenues under the old

revenue accounting standards.

Trade and other receivables

Trade and other receivables are recognised initially at fair

value and subsequently measured at amortised cost less provision

for impairment.

Notes to the Consolidated Financial Statements

for the year ended 31 December 2022

2. Accounting Policies - continued

Impairment of financial assets

The Group has adopted the expected credit loss model ("ECL") in

IFRS 9. The ECL is to be measured through a loss allowance at an

amount equal to:

-- the 12-month expected credit losses (ECL that result from

those default events on the financial instrument that are possible

within 12 months after the reporting date); or

-- full lifetime expected credit losses (ECL that result from

all possible default events over the life of the financial

instrument).

The Group only holds cash and trade and other receivables with

no financing component and therefore has adopted an approach

similar to the simplified approach to ECLs.

Provision for impairment (or the ECL) is established based from

full lifetime ECL and when there is objective evidence that the

Group will not be able to collect all amounts due according to the

original terms of the receivable. The amount of the impairment is

the difference between the asset's carrying amount and the present

value of the estimated future cash flows, discounted at effective

interest rate.

Cash and cash equivalents

Cash and cash equivalents comprise on demand deposits held with

banks.

Trade and other payables

Trade payables are initially measured at fair value, and

subsequently measured at amortised cost, using the effective

interest rate method.

Taxation

Current tax is provided at amounts expected to be paid (or

recovered) using the tax rates and laws that have been enacted or

substantively enacted by the year end date. Deferred taxation is

provided in full, using the liability method, on temporary

differences arising between the tax bases of assets and liabilities

and their carrying amounts in the consolidated financial

statements. However, if the deferred tax arises from the initial

recognition of an asset or liability in a transaction other than a

business combination that at the time of the transaction affects

neither accounting, nor taxable profit or loss, it is not accounted

for. Deferred tax is determined using tax rates and laws that have

been enacted (or substantively enacted) by the year end date and

are expected to apply when the related deferred tax asset is

realised or the deferred tax liability is settled.

Deferred tax assets are recognised to the extent that it is

probable that future taxable profit will be available against which

the temporary differences can be utilised.

Equity instruments

An equity instrument is any contract that evidences a residual

interest in the assets of the entity after deducting all of its

liabilities. Equity instruments issued by a group entity are

recorded at the proceeds received, net of any direct issue

costs.

Notes to the Consolidated Financial Statements

for the year ended 31 December 2022

2. Accounting Policies - continued

Share based payments

The Company has historically issued warrants and share options

in consideration for services. The fair value of the warrants have

been treated as part of the cost of the service received and is

charged to share premium with a corresponding increase in the share

based payment reserve. All subscriber warrants issued in the prior

years had already lapsed, thus the share based payment reserve was

transferred to retained earnings. In 2021 and 2020, the Group

issued warrants (see note 15) as part of the total consideration

for the acquisition of exploration licenses (see note 10), for

which the value attributable to the warrants is GBPNil.

Standards, amendments and interpretations to existing standards

that are effective in 2022

The following new standards, amendments and interpretations to

existing standards have been adopted by the Group during the year

but have had no significant impact on the financial statements of

the Group:

IFRS 3 (Amendments), 'Business Combination - Reference to the

Conceptual Framework' (effective from 1 January 2022). The

amendments update an outdated reference to the Conceptual Framework

in PFRS 3 without significantly changing the requirements in the

standard.

IAS 16 (Amendments), 'Property, Plant and Equipment - Proceeds

Before Intended Use' (effective from 1 January 2022). The

amendments prohibit deducting from the cost of an item of property,

plant and equipment any proceeds from selling items produced while

bringing that asset to the location and condition necessary for it

to be capable of operating in the manner intended by management.

Instead, an entity recognizes the proceeds from selling such items,

and the cost of producing those items, in profit or loss.

IAS 37 (Amendments), 'Provisions, Contingent Liabilities and

Contingent Assets: Onerous Contracts - Cost of Fulfilling a

Contract' (effective from 1 January 2022). The amendments specify

that the 'cost of fulfilling' a contract comprises the 'costs that

relate directly to the contract'. Costs that relate directly to a

contract can either be incremental costs of fulfilling that

contract (examples would be direct labor, materials) or an

allocation of other costs that relate directly to fulfilling

contracts (an example would be the allocation of the depreciation

charge for an item of property, plant and equipment used in

fulfilling the contract).

Annual Improvements to IFRS 2018-2020 Cycle. Among the

improvements, the only amendments, which are effective from 1

January 2022, relevant to the Group are IFRS 9 (Amendments),

'Financial Instruments - Fees in the '10 per cent' Test for

Derecognition of Liability'. The improvements clarify the fees that

an entity includes when assessing whether the terms of a new or

modified financial liability are substantially different from the

terms of the original financial liability

New standards, amendments and interpretations to existing

standards that are not yet effective or have not been early adopted

by the Group

At the date of authorisation of these consolidated financial

statements, the following standards and interpretations were in

issue but not yet mandatorily effective and have not been applied

in these financial statements:

IAS 1 (Amendments), 'Presentation of Financial Statements -

Classification of Liabilities at Current or Non-current' (effective

from 1 January 2023). The amendments aim to promote consistency in

applying the requirements by helping companies determine whether,

in the statement of financial position, debt and other liabilities

with an uncertain settlement date should be classified as current

(due or potentially due to be settled within one year) or

non-current.

Amendments to IAS 1, 'Presentation of Financial Statements'

(effective from 01 January 2023). The amendment provides guidelines

on disclosures of accounting policies and material judgements in

the financial statements.

Notes to the Consolidated Financial Statements

for the year ended 31 December 2022

2. Accounting Policies - continued

New standards, amendments and interpretations to existing

standards that are not yet effective or have not been early adopted

by the Group - continued

Amendments to IAS 8, 'Accounting Policies, Changes in Accounting

Estimates and Errors (effective from 01 January 2023). The

amendment provides additional guidance on the definition of

accounting estimates, application of changes in estimates and

distinction of errors between estimates.

Amendments to IFRS 16, 'Lease Liability in a Sale and Leaseback'

(effective from 1 January 2024). The amendments. The amendments

require seller-lessee to apply the subsequent measurement

requirements for lease liabilities unrelated to a sale and

leaseback transaction to lease liabilities arising from a leaseback

in a way that it recognises no amount of the gain or loss related

to the right of use that it retains. The amendments will require

seller-lessee to reassess and potentially restate sale and

leaseback transactions entered since 2019.

The Company assessed that there is no significant impact of the

adoption of the new or amended Accounting Standards and

Interpretations on the Company's financial statements. The Company

has not early adopted any other standard, interpretation or

amendment that has been issued but is not yet effective.

3. Critical accounting estimates and judgements

The critical accounting estimates and judgements made by the

Group regarding the future or other key sources of estimation,

uncertainty and judgement that may have a significant risk of

giving rise to a material adjustment to the carrying values of

assets and liabilities within the next financial year are:

Critical judgements in applying the group's accounting

policies

Going concern

The preparation of the financial statements is based on the

going concern assumption as disclosed in note 2. The Board of

Directors, after taking into consideration the additional funding

received, believe the going concern assumption is appropriate.

Determining capitalizable exploration and evaluation

expenditures

The application of the Group's accounting policy for exploration

and evaluation expenditure requires judgement to determine whether

future economic benefits are likely from either future exploration

or sale, or whether activities has not reached a stage that permits

a reasonable assessment of the existence of reserves.

In addition to applying judgement to determine whether future

economic benefits are likely to arise from the Group's exploration

and evaluation assets, or whether activities have not reached a

stage that permits a reasonable assessment of the existence of

reserves, the Group has to apply a number of estimates and

assumptions. The determination of Joint Ore Reserves Committee

(JORC) resource is itself an estimation process that involves

varying degree of uncertainty depending on how the resources are

classified.

The estimation directly impacts when the Group defers

exploration and evaluation expenditure. The deferral policy

requirements management to make certain estimates and assumptions

about future events and circumstances, particularly, whether an

economically viable extraction operation can be established.

Any such estimates and assumptions may change as new information

becomes available. If, after expenditure is capitalised,

information becomes available suggesting that the recovery of

expenditure is unlikely, the relevant capitalised amount is written

off to the statement of profit or loss and other comprehensive

income in the period when the new information becomes

available.

Notes to the Consolidated Financial Statements

for the year ended 31 December 2022

3. Critical accounting estimates and judgements - continued

Impairment of exploration and evaluation assets

Impairment of exploration and evaluation expenditure is subject

to significant estimation, due to the complexity of the accounting

requirements and the significant judgement required in determining

the assumptions to be used to estimate the recoverable amount. As

at 31 December 2022, the Board of Directors are satisfied that no

impairment exists as outlined in note 10.

If, after expenditure is capitalised, information becomes

available suggesting that the recovery of expenditure is unlikely,

the amount capitalised is written off in profit and loss in the

period when the new information becomes available. As at 31

December 2022, no such information is available to suggest that the

expenditure is not recoverable.

Determination of functional currency

As at 1 January 2021, the functional currency of the Company is

the Pounds Sterling ("GBP"). The Board of Directors considered that

the Group's source of funding is predominantly GBP denominated. As

a result, the Directors have determined that GBP is the currency

which best reflects the underlying transactions, events and

conditions relevant to the Group with effect from 1 January 2021

("the effective date of the change").

Parent company statement of financial position - impairment of

the investment in a subsidiary and related party receivables

The Company's investments in its subsidiaries are carried at

cost less provision for impairment. The values of the investments

are inherently linked to the assets held by and or the performance

of the subsidiaries and an impairment review is undertaken by

management annually to assess whether any permanent diminution in

value has occurred.

At the reporting date, the Australian subsidiaries had net

liability of GBP507,407 (AUD 901,266) (2021: GBP406,094 (AUD

756,323)). As noted above, the Board of Directors do not consider

that the exploration and evaluation assets are impaired. No facts

or circumstances were noted that the projects are not viable.

Accordingly, no impairment of the investment in and loan to the

Australian subsidiaries of GBP104,105 (2021: 104,105) and

GBP5,273,575 (2021: GBP2,398,756), respectively, were

recognised.

At the reporting date, the UAE subsidiary had net liabilities of

GBP548,806 (AED 2,281,600) (2021: GBP458,607

(AED 2,438,400) ) . The Company provided full allowance for

impairment on the loan to the UAE subsidiary, with gross balance of

US$375,263.

Valuation of warrants

As described in note 15, the fair value of any warrants granted

was calculated using the Binomial Option Pricing model which

requires the input of highly subjective assumptions, including

volatility of the share price. Changes in subjective input

assumptions may materially affect the fair value estimate.

4. Segmental analysis

Management has determined the operating segments by considering

the business from both a geographic and product perspective. For

management purposes, the Group is currently organised into a single

operating division, resource evaluation (Australia). The division

is the business segment for which the Group reports its segment

information internally to the Board of Directors.

Notes to the Consolidated Financial Statements

for the year ended 31 December 2022

5. Administrative expenses

2022 2021

GBP GBP

Fees payable to the Company's auditor

for the audit of the Group consolidated

financial statements 38,700 36,500

Other administrative costs 778,247 902,987

Remuneration of directors of the Group 300,000 254,566

1,116,947 1,194,053

---------------------- ------------------

Remuneration to the directors of the Group may be settled via

the issue of equity in the Company and cash, as disclosed in note

20.

6. Taxation

The Company is subject to corporation tax in Gibraltar on any

profits, which are accrued in or derived from Gibraltar or any

passive income which is taxable. The corporation tax rate in

Gibraltar for the year ended 31 December 2022 is 12.5%. There was

an increase in the corporate tax in Gibraltar to 12.5% effective

from 1 August 2021; the rate prior to the effectivity of the new

rate was 10%. The Company has no operations in Gibraltar which are

taxable.

The Company has taxable losses to carry forward, consequently no

provision for corporate tax has been made in these financial

statements.

The Group's subsidiary, Wishbone Gold Pty Ltd, is subject to

corporate income tax in Australia. The corporate income tax rate in

Australia for the year ended 31 December 2022 is 25% (2021:

30%).

This subsidiary has taxable losses to carry forward,

consequently no provision for corporate tax has been made in these

financial statements.

Note that there are no group taxation provisions under the tax

laws of Gibraltar.

As at 31 December 2022 and as at 31 December 2021, the Company

has no deferred tax assets and no deferred tax liabilities.

7. Loss per share

2022 2021

GBP GBP

Loss for the purpose of basic loss

per share being net loss attributable

to equity owners of parent (1,140,210) (1,240,157)

------------- -----------------------

Loss for the purpose of diluted earnings

per share (1,140,210) (1,240,157)

Number of shares:

Weighted average number of new ordinary

shares

Issued ordinary shares at the beginning

of the year 173,795,213 149,969,321

Effect of share issues after reorganisation 7,548,438 16,369,536

------------- -----------------------

Weighted average number of new ordinary

shares at 31 December 181,343,651 166,338,857

------------- -----------------------

Basic loss per share (pence) (0.629) (0. 746)

------------- -----------------------

Due to the Company and the Group being loss making, the share

warrants (note 15) are antidilutive.

Notes to the Consolidated Financial Statements

for the year ended 31 December 2022

8. Trade and other receivables

2022 2021

Group GBP GBP

Debtors 122,278 19

Prepayments 31,452 503

Deposits 46,728 1,074

Loans to directors - 31,539

200,458 33,135

--------- -------

2022 2021

Company GBP GBP

Debtors 12 12

Prepayments 31,452 -

Other receivable (see note 20) 11,308 7,572

42,772 7,584

-------- ------

9. Property, plant and equipment

2022 2021

Group GBP GBP

Cost

As at 1 January and 31 December 184,164 184,164

Accumulated Depreciation and Impairment

As at 1 January (184,164) (184,164)

As at 31 December (184,164) (184,164)

---------- ----------

Net Book Value

As at 31 December - -

========== ==========

The plant in Honduras is currently not in production. Given the

status of the Honduran operations, Management deemed that the value

of the property, plant and equipment has been fully depreciated as

at 31 December 2022.

Notes to the Consolidated Financial Statements

for the year ended 31 December 2022

10. Intangible assets

Exploration

& evaluation

assets

Group GBP

Cost

At 1 January 2021 1,020,930

Additions 488,364

Foreign exchange revaluation (49,239)

At 31 December 2021 1,460,055

At 1 January 2022 1,460,055

Additions 3,377,051

Foreign exchange revaluation 63,067

At 31 December 2022 4,900,173

==============

The Group holds Exploration Permits for Mining ("EPMs") to four

tenements in Queensland, Australia and four exploration licenses in

Western Australia. The renewal of the EPMs is for a maximum further

period of 5 years. Permits are not automatically renewed but

require an application to the Queensland Department of Natural

Resources and Mines.

In 2021, the Group settled, through issuance of shares, certain

tenements in Western Australia for total consideration of

GBP222,000. The purchase was made in two share issuances consisting

of 600,000 new ordinary shares of 0.1 pence each at a deemed issued

price of 16 pence per share and 900,000 new ordinary shares of 0.1

pence each at a deemed issued price of 14 pence per share.

In 2022, Group acquired additional exploration license in

Western Australia for a total deemed consideration of GBP370,192

(2021: GBP161,000) which consists of cash amounting to GBP50,000

(2021: GBP35,000) , shares of stocks with deemed value of GBP

320,193 (2021: GBP126,000) and share warrants valued at nil (see

notes 13 and 15).

The total additions in 2022 is composed of the following:

GBP

Western Australia Anketell acquisition 370,192

Western Australia Cottesloe East

acquisition 25,516

Western Australia exploration

costs 2,552,849

Queensland exploration costs 428,494

Total additions 3,377,051

===========

11. Investments

Shares in subsidiary undertakings

2022 2021

Company GBP GBP

Cost

As at 1 January and 31 December 697,329 697,329

Accumulated Impairment

As at 1 January (593,224) (593,224)

As at 31 December (593,224) (593,224)

---------- ----------

Net Book Value

As at 31 December 104,105 104,105

========== ==========

Notes to the Consolidated Financial Statements

for the year ended 31 December 2022

11. Investments - continued

Country of Cost of

Class of shares registration Investment

Company held % held or incorporation GBP

110,000,000

ordinary shares

Wishbone Gold Pty of GBP 0.001

Ltd each 100% Australia 104,105

100 common

Precious Metals shares of USD British Virgin

International Ltd. 1 each 100% Islands 182,326

2,000 ordinary

Wishbone Gold Honduras shares of GBP

Ltd. 1 each 100% Gibraltar 410,898

Wishbone Gold FZ-LLC 10 ordinary

shares of AED United Arab

1,000 each 100% Emirates -

Wishbone Gold WA 100 ordinary

Pty Ltd shares of AUD

1 each 100% Australia -

Wishbone Gold Pty Ltd is an exploration company. The Company is

incorporated in Australia and the registered office address is c/o

RSM, Level 6, 340 Adelaide St, Brisbane City 4000, Australia.

Precious Metals International Ltd. is a holding company that

controls Black Sand FZE in the UAE. Precious Metals International

Ltd. is incorporated in the British Virgin Islands and the

registered office address is Nerine Chambers, P.O. Box 905, Road

Town, Tortola, British Virgin Islands.

Wishbone Gold Honduras Ltd. is a company incorporated in

Gibraltar and the registered office address is at Suite 16,

Watergardens 5, Waterport Wharf, Gibraltar. In the current and

previous years, the company has not been consolidated into the

financial statements since there were no material balances and

transactions in the company at a group level.

Wishbone Gold FZ-LLC is a company incorporated in the UAE and

the registered office address is at Al Jazirah Al Hamra, RAKEZ

Business Zone-FZ, Ras Al Khaimah, UAE. The company has not been

consolidated into the financial statements since there were no

material balances and transactions in the company at a group

level.

Wishbone Gold WA Pty Ltd is also an exploration company. The

company is incorporated in Australia and the registered office

address is c/o RSM, Level 6, 340 Adelaide St, Brisbane City 4000,

Australia.

The cost of the investments in Wishbone Gold FZ-LLC and Wishbone

Gold WA Pty Ltd is negligible and has not been recognised.

12. Current liabilities

2022 2021

GBP GBP

Group

Trade payables 571,308 63,763

Accruals and deferred income 61,366 71,989

632,674 135,752

-------- --------

Notes to the Consolidated Financial Statements

for the year ended 31 December 2022

12. Current liabilities - continued

2022 2021

Company GBP GBP

Trade payables 85,553 27,533

Accruals and deferred income 36,497 51,500

Amount due to related party undertaking - 13,574

122,050 92,607

-------- --------

Trade payables include amounts due to directors of GBP62,424

(2021: GBP 13,841) as disclosed in Note 20.

13. Share capital - Group and Company

2022 2021

Authorised: GBP GBP

8,000,000,000 Ordinary Shares of

GBP0.001 each 8,000,000 8,000,000

------------------ -----------------

Allotted and called up:

2022 2022 2021 2021

Share Share Share Share

2022 Number capital premium 2021 Number capital premium

of shares GBP GBP of shares GBP GBP

As at 1 January 173,795,213 2,991,216 11,698,892 149,969,321 2,967,390 8,943,833

Placing of

shares 25,117,655 25,117 2,670,075 10,000,000 10,000 1,390,000

Settlement of

liability

through shares

(see note 10) - - - 1,500,000 1,500 220,500

Exercise of

warrants

issued last

year

with shares

issued

this year - - - 12,325,892 12,326 1,144,559

As at 31

December 198,912,868 3,016,333 14,368,967 173,795,213 2,991,216 11,698,892

---------------- ------------ ----------- -------------- ------------- -----------

Share allotments and issuances during the year, including

comparative, are laid out below:

On 12 January 2021, the Company received exercise notices for

8,622,188 warrants, attached to the share placement announced on 10

December 2020, amounting to GBP1,034,663. This constituted 98.54%

of the warrants linked to the placing and the balance of 1.46% have

lapsed.

Pursuant to the exercise notices as detailed above, the Company

issued a total of 8,622,188 new Ordinary Shares of 0.1 pence each

from its block listing authority of up to 8,750,000 new Ordinary

shares, at a price of 12 pence per share.

On 3 March 2021, the Company issued a total of 600,000 new

ordinary shares of 0.1 pence each to Alta Zinc Limited at a deemed

issued price of 16 pence per share which totals to GBP96,000 for

the option to acquire the Cottesloe Project.

Notes to the Consolidated Financial Statements

for the year ended 31 December 2022

13. Share capital - Group and Company - continued

On 20 May 2021, the Company issued 10,000,000 new ordinary

shares of 0.1 pence each at a price of 14 pence per share through a

private placement made by the Company to a series of investors to

raise a total of GBP1,400,000 gross.

On 21 July 2021, the Company received, notice to exercise

warrants over a total of 3,703,704 new ordinary shares of 0.1 pence

each in the Company, which will be issued at 3.3 pence per share.

The Company received the exercise consideration of GBP122,222.

On 18 November 2021, the Company issued 900,000 new ordinary

shares of 0.1 pence each at a price of 14 pence per share which

equates to GBP126,000, following the completion of the Cottesloe

Project acquisition. The Company also issued 600,000 warrants at an

exercise price of 14 pence per share.

On 11 March 2022, the Company issued 238,095 warrants at an

exercise price of 10.5 pence per share.

On 6 September 2022, the Company issued 22,946,860 new ordinary

shares of 0.1 pence each at a price of 10.35 pence per share which

equates to GBP2,375,000, following the expansion of the Red Setter

and Halo projects. The Company has also issued 13,047,101 warrants

at an exercise price of 20 pence per share.

On 18 November 2022, the Company issued 2,170,795 new ordinary

shares of 0.1 pence each at a price of 14.75 pence per share which

equates to GBP320,193 following the completion of the Anketell

Project acquisition.

Ordinary shares carry a right to receive notice of, attend, or

vote at any Annual General and Extraordinary General Meetings of

the company. The holders are entitled to receive dividends declared

and paid by the Company.

14. Loans

As at 31 December 2022, there are no outstanding loans due from

third parties.

2022 2021

Company GBP GBP

Current

Amounts owed by subsidiary undertakings

(note 20) 5,273,575 2,398,756

---------- -----------

5,273,575 2,398,756

---------- -----------

15. Share based payments

Details of the warrants and share options in issue during the

year ended 31 December are as follows:

Number

of Warrants Number of Average

/ options Average exercise Warrants / exercise

2022 price 2022 options 2021 price 2021

No GBP No GBP

Outstanding at 1

January 8,951,851 0.1040 14,305,555 0.0283

Lapsed/terminated

during the year (1,851,851) 0.1400 (127,812) 0.1200

Issued during the

year 13,285,196 0.1941 7,100,000 0.1738

Exercised during

the year - - (12,325,892) 0.0939

------------- ----------------- -------------- ------------

Outstanding at 31

December 20,385,196 0.1871 8,951,851 0.1040

------------- ----------------- -------------- ------------

Fair value is measured by use of the Binomial Option Pricing

Model with the assumption of 5% future market volatility and a

future interest rate of 1.63% (2021: 1.3%) per annum based on the

current economic climate. The fair value of share warrants granted

in 2022 was GBPnil (2021: GBP72,987). The fair value of share

warrants outstanding as at 31 December 2022 is GBP72,987 (2021:

GBP72,987).

Notes to the Consolidated Financial Statements

for the year ended 31 December 2022

16. Financial instruments

The Group's financial instruments comprise of cash and cash

equivalents, borrowings and items such as trade payables which

arise directly from its operations. The main purpose of these

financial instruments is to provide finance for the Group's

operations.

Classification of financial instruments

All Group's financial assets are classified at amortised cost.

All of the Group's financial liabilities classified as other

financial liabilities are also held at amortised cost. The carrying

value of all financial instruments approximates to their fair

value.

Fair values of financial instruments

In the opinion of the directors, the book values of financial

assets and liabilities represent their fair values.

17. Financial risk management

The Group's operations expose it to a variety of financial risks

including credit risk, liquidity risk, interest rate risk and

foreign currency exchange rate risk. The Directors do not believe

the Group is exposed to any material equity price risk. The

policies are set by the Board of Directors.

Credit risk

Credit risk is the risk that a counterparty will be unable or

unwilling to meet the commitments that it has entered into with the

Group. Credit risk arises from cash and cash equivalents, and trade

and other receivables (including the Company's receivables from

related parties). As for the cash and cash equivalents, these are

deposited at reputable financial institutions, therefore management

do not consider the credit risk to be significant.

The carrying amount of financial assets represents the maximum

credit exposure. The maximum credit exposure to credit risk at the

reporting date was GBP1,662,200 (2021: GBP3,035,682).

Based on this information, the directors believe that there is a

low credit risk arising from these financial assets.

Interest rate risk

The Group's interest-bearing assets comprise only cash and cash

equivalents and earn interest at a variable rate. The Group has a

policy of maintaining debt at fixed rates which are agreed at the

time of acquiring debt to ensure certainty of future interest cash

flows. The directors will revisit the appropriateness of the policy

should the Group's operations change in size or nature.

No sensitivity analysis for interest rate risk has been

presented as any changes in the rates of interest applied to cash

balances would have no significant effect on either profit or loss

or equity.

The Group has not entered into any derivative transactions

during the year under review.

Liquidity risk

The Group actively maintains cash balances that are designed to

ensure that sufficient funds are available for operations and

planned expansions. The Group monitors its levels of working

capital to ensure that it can meet its debt repayments as they fall

due. All of the Group's financial liabilities are measured at

amortised cost. Details of the Group's funding requirements are set

out in note 19.

Non-derivative financial liabilities, comprising loans payable,

trade payables and accruals of GBP632,674 (2021: GBP135,752) are

repayable within 1-12 months from the year end, apart from

directors' fees. The amounts represent the contractual undiscounted

cash flows, balances due equal their carrying balances as the

impact of discounting is not significant.

Notes to the Consolidated Financial Statements

for the year ended 31 December 2022

17. Financial risk management - continued

Foreign currency exchange rate risk

The Group undertakes certain transactions in foreign currencies.

Hence, exposure to exchange rate fluctuations arises.

The Group incurs foreign currency risk on transactions

denominated in currencies other than its functional currency. The

principal currency that gives rise to this risk at Group level is

the Australian Dollar. At the year end, the Group's exposure to the

currency is minimal; accordingly, any increase or decrease in the

exchange rates relative to the functional currency would not have a

significant effect on the financial statements.

18. Capital management

The Group's objectives when managing capital are to safeguard

the Group's ability to continue as a going concern, to provide

returns for shareholders and to maintain an optimal capital

structure to reduce the cost of capital. The Group defines capital

as being share capital plus reserves. The Board of Directors

monitor the level of capital as compared to the Group's commitments

and adjusts the level of capital as is determined to be necessary,

by issuing new shares. The Group is not subject to any externally

imposed capital requirements. There were no changes in the Group's

approach to capital management during the year.

19. Commitments

Annual expenditure commitments

In order to maintain current rights of tenure to exploration

tenements, the Group is required to perform minimum exploration

work to meet the minimum expenditure requirements specified by

various authorities.

These obligations are subject to periodic renegotiations and

authorities allow overspend from previous years to be applied. The

Group's planned spend through its exploration contractors are as

follows:

2022 2021

GBP GBP

Within one year 460,297 400,191

After one year but not more than five

years 754,394 1,047,947

---------- ----------

1,214,691 1,448,138

---------- ----------

Notes to the Consolidated Financial Statements

for the year ended 31 December 2022

20. Related parties

The Company wholly owns Wishbone Gold Pty Ltd, an Australian

entity that is engaged in the exploration of gold in Australia. The

Company's investment in Wishbone Pty Ltd was GBP104,500 as at 31

December 2022 and 2021. The financial and operating results of this

subsidiary have been consolidated in these financial

statements.

Wishbone Gold Pty Ltd, as at 31 December 2022, has a loan

outstanding from Wishbone Gold Plc of the following amounts:

2022 2021

GBP GBP

Outstanding at 1 January 1,541,554 734,905

Additions during the year 2,479,627 806,649

Outstanding at 31 December 4,021,181 1,541,554

---------- ----------

Wishbone Gold WA Pty Ltd, as at 31 December 2022, has a loan

outstanding from Wishbone Gold Plc of the following amounts:

2022 2021

GBP GBP

Outstanding at 1 January 857,202 600,202

Additions during the year 395,192 257,000

Outstanding at 31 December 1,252,394 857,202

---------- ---------

The intercompany loans are repayable on demand and do not

attract any interest.

Asian Commerce and Commodities Trading Co. Ltd. (ACCT), a

company registered in Thailand, is 49% owned by the Company. The

fair value of the net assets of this affiliate have been assessed

as having no value, thus, not recognised in both the Group and the

Company's accounts. Management had the option to increase its

shareholdings to 95% in order to gain control but did not exercise

that option. Management believes that it has no control over this

entity and therefore, not consolidated in the group level.

The Company wholly owns Wishbone Gold FZ-LLC, a company

registered in the United Arab Emirates. The purpose of this company

is solely to hold bank accounts in the U.A.E., as it simplifies

payments that need to be made in that country. The company does not

trade and its sole asset is its bank account. The cash in bank

amounting to

GBP11,308 (2021: GBP7,572) of Wishbone Gold FZ-LLC (see note 8)

which is a wholly owned subsidiary of Wishbone Gold Plc has been

recognised as other receivable in the books of the Parent and other

payable in the books of the subsidiary. The intercompany balances

have been eliminated upon consolidation and the cash held forms

part of the cash in bank account at Group level.

Notes to the Consolidated Financial Statements

for the year ended 31 December 2022

20. Related parties - continued

The following summarises the fees incurred in respect of

directors' and officers' services for the year ended 31 December

2022 and 2021, and the amounts settled by the Company by way of

share issues and cash.

Balance Balance

as at 1 Charge as at 31

January for the Settled Settled December

31 December 2022 2022 year in shares in cash 2022

GBP GBP GBP GBP GBP

Richard Poulden 13,235 200,000 - (196,568) 16,667

Jonathan Harrison - 25,000 - (22,917) 2,083

Alan Gravett - 25,000 - (22,917) 2,083

Professor Michael

Mainelli - 25,000 - (22,917) 2,083

David Hutchins - 25,000 - (22,917) 2,083

Total 13,235 300,000 - (288,236) 24,999

--------- --------- ----------- ---------- ----------

Balance Balance

as at 1 Charge as at 31

January for the Settled Settled in December

31 December 2021 2021 year in shares cash 2021

GBP GBP GBP GBP GBP

Richard Poulden - 168,108 - (154,873) 13,235

Jonathan Harrison - 21,875 - (21,875) -

Alan Gravett - 21,875 - (21,875) -

Professor Michael

Mainelli - 21,875 - (21,875) -

David Hutchins - 20,833 - (20,833) -

Total - 254,566 - (241,331) 13,235

--------- --------- ----------- ----------- ----------

In 2022, the directors claimed expenses they paid on behalf of

the Company totaling GBP 38,716 of which GBP 37,425 (2021: GBP 607)

remained outstanding at year-end.

Consultancy fees paid to Richard Poulden include fees paid to

Black Swan Plc of which he is also the Chairman. In addition,

Jonathan Harrison's services are billed by Easy Business Consulting

Limited, in which Jonathan Harrison, a director of the Company, has

an interest, for consultancy services. Professor Michael Mainelli's

services are billed by Z/Yen Group Limited, in which Professor

Michael Mainelli, a director of the Company, has an interest, for

consulting services.

On 26 October 2021, the Group provided a short-term loan to

Valereum Blockchain Plc, a related party under common management,

amounting to GBP 500,000. The related loan, including accrued

interest, presented as part of interest income in the consolidated

statement of income, amounting to GBP 5,000, was subsequently

collected on 08 November 2021.

21. Ultimate controlling party

The directors believe that there is no single ultimate

controlling party.

Notes to the Consolidated Financial Statements

for the year ended 31 December 2022

22. Events after the reporting date

The following events took place after the year end:

On 16 March 2023, the Company provided an update on the data

analysis of the Red Setter Project

On 27 April 2023, the Company reprocessed the drill results from

the Cottesloe project (including Cottesloe East) following the

digitisation and combining of all previous data sets.

On 23 May 2023, the Company appointed SP Angel Corporate Finance

LLP as their Company Broker.

On 26 May 2023, the Company identified 8 priority targets from

MobileMT following the reprocessed historic drill and exploration

data at Cottesloe as announced on 27 April 2023.

On 31 May 2023, the Company's application for a co-founded drill

program has been accepted by the Government of Western

Australia.

23. Availability of accounts

The full report and accounts are being posted on the Company's

website, www.wishbonegold.com.

24. Contingent liability

There is some risk that native title, as established by the High

Court of Australia's decision in the Mabo case, exists over some of

the land over which Wishbone Gold Pty and Wishbone Gold WA hold

tenements or over land required for access purposes. Wishbone has

historically had good relationships with Indigenous Australians and

the board will do their utmost to continue this.

Nonetheless we have to state that the Group is unable to

determine the prospects for success or otherwise of the future

claims and, in any event, whether or not and to what extent the

future claims may significantly affect Wishbone Gold or its

projects.

There are no contingent liabilities outstanding at 31 December

2022 and 31 December 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR GCGDLUGDDGXC

(END) Dow Jones Newswires

June 29, 2023 05:12 ET (09:12 GMT)

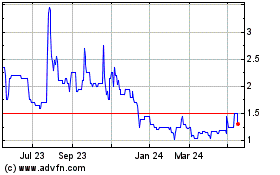

Wishbone Gold (AQSE:WSBN)

Historical Stock Chart

From Oct 2024 to Nov 2024

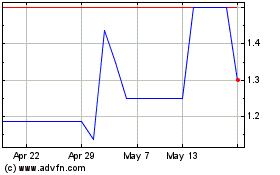

Wishbone Gold (AQSE:WSBN)

Historical Stock Chart

From Nov 2023 to Nov 2024