- Approximately A$20-A$22 million1 total funding to progress

BNC210 development for the treatment of PTSD and other anxiety and

stress-related disorders (subject to shareholder and FIRB

approvals; exact amount depends upon the take up under entitlement

offer)

- Potential entitlement offer for eligible shareholders

(including eligible retail shareholders) with opportunity to

purchase shares at the same price as Apeiron

Bionomics Limited (ASX: BNO, OTCQB:BNOEF) (Bionomics or

Company), a clinical stage biopharmaceutical company, today

announced that it has entered into a Subscription Agreement, with

Apeiron Investment Group Ltd (Apeiron), the family office of

entrepreneur and founder Christian Angermayer with a strong focus,

amongst others, on life sciences, to recapitalise the Company and

to assist in securing further equity capital (Subscription

Agreement).

Apeiron has made significant investments in several European and

U.S. based biotech companies over the last few years, with a

special focus on the development of novel treatments for various

mental health disorders like treatment-resistant depression,

anxiety and Post Traumatic Stress Disorder (PTSD), all

diseases with a high unmet medical need.

Under the Subscription Agreement, Apeiron agrees to subscribe or

procure subscriptions2 of 135,833,000 Shares at an issue price of

A$0.04 per Share to raise A$5,433,320 (to proceed in two tranches

of 81,500,000 and 54,333,000 shares, the second being subject to

shareholder approval). Apeiron also agrees to underwrite further

capital raisings by Bionomics within a fifteen-month-period from

the Extraordinary General Meeting of Shareholders (EGM) to

be convened, with the effect that Bionomics will raise up to

A$15,000,000 at a minimum issue price of A$0.06 per Share [subject

to Foreign Investment Review Board (FIRB) and shareholder

approvals].

As part of the subscription process with Apeiron, and after

completion of the second tranche, an entitlement offer will be

launched in favour of eligible shareholders (including eligible

retail shareholders) providing the opportunity to purchase in pro

rata up to 54,333,000 shares at A$0.04 per Share and hence at the

same price as the Apeiron subscriptions across the two tranches

(subject to shareholder approvals and completion of the second

tranche).

If shareholder and FIRB approvals are received, the Company

expects to raise approximately A$20.4-A$22 million in aggregate

across several tranches (exact amount depending on take up under

the entitlement offer), which would ensure that the Company has

significant funds to progress Phase 2 clinical trials for the

treatment of PTSD and other anxiety and stress-related disorders

for its lead compound, BNC210, which recently received Fast Track

Designation from the U.S. Food and Drug Administration (FDA)

for the treatment of PTSD.

Upon satisfaction of Aperion’s underwriting obligations, and

subject to the Company raising the additional A$15,000,000, Apeiron

will be granted 150,000,000 Warrants. Every one Warrant grants

Apeiron the right to be issued one further Share in Bionomics at an

exercise price of A$0.06. If all Warrants are issued and exercised,

Bionomics will receive a further A$9,000,000 in the period 15 to 36

months after the EGM.

Bionomics’ Executive Chairman Dr Errol De Souza said “We are

pleased to have secured the support of a world-class and

like-minded life science investor of the quality of Apeiron. I have

no doubt that their expertise in investing in mental health

companies will make a significant contribution to Bionomics as we

continue to progress BNC210 for the treatment of PTSD and other

anxiety and stress-related disorders. The funding will ensure that

we can initiate our second Phase 2b clinical trial in PTSD, which

the Board believes will provide shareholders the best prospects to

realise value in the Company. In the meantime, we will continue to

actively pursue monetisation and potential licensing of all our

assets in order to secure non-dilutive funding and maximise

shareholder value.”

Apeiron founder Mr Christian Angermayer said “PTSD and other

mental health disorders are enormous burdens for those that live

with them. Around 8% of people will develop PTSD at some point in

their lives, and up to 30% will meet the diagnostic criteria for an

anxiety disorder. In short, the unmet need is massive with hundreds

of millions of people suffering from those diseases. Through

Apeiron, I support numerous promising drug candidates, for example

the psychedelics being developed by my biotech platform ATAI Life

Sciences. However, it is important to remember that there is no

such thing as a “one-size-fits-all” drug – we need to think broadly

and creatively. That is why I am enthusiastically supporting

Bionomics as a value-add shareholder. Bionomics’ lead drug BNC210

has already received Fast Track Designation from the FDA and I am

confident of the strong potential of the upcoming Phase 2 PTSD

trial to drive value for both patients and shareholders.”

Further details of the agreement can be found in this ASX

announcement:

https://www.asx.com.au/asxpdf/20200602/pdf/44j9rhvc7v3zr3.pdf

AUTHORISED BY THE BOARD

About Bionomics Limited

Bionomics (ASX: BNO) is a global, clinical stage

biopharmaceutical company leveraging its proprietary platform

technologies to discover and develop a deep pipeline of best in

class, novel drug candidates. Bionomics’ lead drug candidate BNC210

is a novel, proprietary negative allosteric modulator of the

alpha-7 (α7) nicotinic acetylcholine receptor. Beyond BNC210,

Bionomics has a strategic partnership with MSD (known as Merck

& Co in the US and Canada) and a pipeline of pre-clinical ion

channel programs targeting pain, depression, cognition and

epilepsy.

www.bionomics.com.au

Factors Affecting Future Performance

This announcement contains "forward-looking" statements within

the meaning of the United States’ Private Securities Litigation

Reform Act of 1995. Any statements contained in this announcement

that relate to prospective events or developments, including,

without limitation, statements made regarding Bionomics’ drug

candidates (including BNC210), its licensing agreements with MSD

and any milestone or royalty payments thereunder, drug discovery

programs, ongoing and future clinical trials, and timing of the

receipt of clinical data for our drug candidates are deemed to be

forward-looking statements. Words such as "believes,"

"anticipates," "plans," "expects," "projects," "forecasts," "will"

and similar expressions are intended to identify forward-looking

statements.

There are a number of important factors that could cause actual

results or events to differ materially from those indicated by

these forward-looking statements, including unexpected safety or

efficacy data, unexpected side effects observed in clinical trials,

risks related to our available funds or existing funding

arrangements, our failure to introduce new drug candidates or

platform technologies or obtain regulatory approvals in a timely

manner or at all, regulatory changes, inability to protect our

intellectual property, risks related to our international

operations, our inability to integrate acquired businesses and

technologies into our existing business and to our competitive

advantage, as well as other factors. Results of studies performed

on our drug candidates and competitors’ drugs and drug candidates

may vary from those reported when tested in different settings.

1 All references in this release to “A$” are to Australian

dollars 2 Apeiron may procure other persons to subscribe for part

of its subscription obligation with Bionomics’ prior consent.

References in this announcement to Apeiron subscriptions or

shareholdings include subscriptions by and shareholdings of such

persons.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200602005372/en/

Mr Jack Moschakis Legal Counsel & Company Secretary

Bionomics Limited 31 Dalgleish St, Thebarton, South Australia +61 8

8354 6100, jmoschakis@bionomics.com.au

Bionomics (ASX:BNO)

Historical Stock Chart

From Feb 2025 to Mar 2025

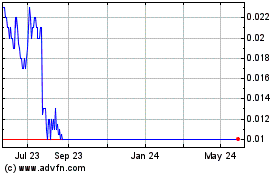

Bionomics (ASX:BNO)

Historical Stock Chart

From Mar 2024 to Mar 2025