UPDATE: Energy Resources Of Australia Fiscal Year Net Profit Up 23%

January 28 2010 - 6:17PM

Dow Jones News

Energy Resources of Australia Ltd. (ERA.AU) on Friday met

analysts' forecasts with a 23% rise in annual profit boosted by

higher uranium contract prices, but it foreshadowed higher costs in

2010 as it works to expand its Ranger mine.

ERA forecast 2010 production, sales and average realized sale

prices to be "broadly similar" to those of 2009 but said the Ranger

expansion plus higher maintenance costs are expected to "adversely

impact earnings over the year".

The forecast of flat output and revenue but higher costs

suggests that ERA is expecting its annual profit to fall this year,

which is in line with analysts' expectations.

The Darwin-based uranium miner, 68%-owned by Rio Tinto Ltd.

(RIO.AU), booked a net profit for the year to Dec. 31 of A$272.6

million, rising from A$221.8 million in 2008. The average forecast

of five analysts polled by Dow Jones Newswires was for a 2009

profit of A$270.9 million.

ERA owns the Ranger mine in Australia's Northern Territory,

which in 2008 was the second largest producing uranium mine in the

world, according to the World Nuclear Association.

In a move to extend its life, ERA is studying what it calls the

Ranger 3 Deeps mineral resource. It expects the studies to be

complete around the middle of 2010 before making a decision on how

it plans to develop the resource.

ERA reiterated Friday that it expects to submit a draft

Environmental Impact Statement for its proposed heap leach facility

some time in 2010. Heap leaching uses acid filtration to extract

minerals from ore.

The company declared a final dividend of 25 cents per share, up

from 20 cents in 2008.

Earlier this month, ERA said annual 2009 production fell 2% on

year to 5,240 tons but sales rose 4% to 5,497 tons as the company

drew on stockpiled ore.

Revenue totaled A$780.6 million in 2009, up 13% from A$691.8

million in 2008.

Over the longer term, ERA said its prospects remain strong. "The

outlook for uranium mining remains bright, with a strong market and

sustained government and public interest around the world in

nuclear energy as a critical part of the mix in a

carbon-constrained economy," it said.

The average spot price of uranium oxide in 2009 was US$44.50 per

pound, down from US$52.50 per pound in 2008.

ERA, however, got an average 2009 uranium oxide price of

US$50.84 per pound, up from US$32.53 per pound as old contracts

struck at lower prices rolled out of its sales portfolio.

-By Ross Kelly, Dow Jones Newswires; 61-2-8272-4692;

ross.kelly@dowjones.com

Order free Annual Report for Rio Tinto PLC

Visit http://djnweurope.ar.wilink.com/?ticker=GB0007188757 or

call +44 (0)208 391 6028

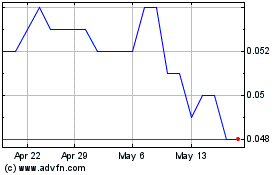

Energy Resources Of Aust... (ASX:ERA)

Historical Stock Chart

From Jun 2024 to Jul 2024

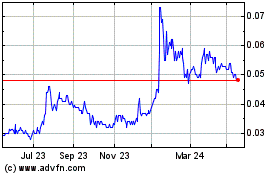

Energy Resources Of Aust... (ASX:ERA)

Historical Stock Chart

From Jul 2023 to Jul 2024