Splitit Triples Global Growth, Achieves Record Third Quarter

October 08 2020 - 7:00AM

Business Wire

Splitit also announces availability of

self-onboarding, making it easier for businesses to integrate the

Splitit platform as they head to the holiday shopping

season

Splitit Payments Limited (ASX:SPT), a global payment

solutions provider, today announces record Q3 earnings and

exceptional year-over-year growth. As the go-to platform that

uniquely empowers shoppers to maximize the value of their own

earned credit, Splitit is continuing to see rapid adoption by both

forward-thinking ecommerce brands and shoppers.

“As we head towards Q4, we are excited to report another

record quarter with rapid growth. The continued uptick in merchant

sales volume (MSV) and addition of new customers is further proof

that today’s shoppers are turning to Splitit to better use their

own earned credit,” said Brad Paterson, CEO of Splitit. “Especially

now, we are pleased to offer shoppers a responsible installment

payment solution, while at the same time, helping brands drive

value by cost-effectively converting more site visitors into

buyers.”

Splitit’s Merchant Sales Volume grew 214% from Q3 2019, with

North America growing 200%. This growth is attributed to expansion

in merchant acceptance, particularly larger merchants. Average

order value grew to more than $1K, resulting in a 318% increase in

revenue.

With the holiday season fast-approaching and ecommerce retailers

seeking to differentiate and build brand loyalty with consumers,

Splitit also announces self-onboarding, powered in part by the

Stripe Connect partnership. Self-onboarding, which is now available

to any US merchant, accelerates merchant acquisition by empowering

companies to more quickly add Splitit and adopt installment

payments.

“The availability of self-onboarding is a critical step toward

achieving our goal of enabling any merchant that accepts credit

cards to offer Splitit as a payment option, within minutes. This

will enable rapid scaling to meet growing demand for Splitit’s

card-based installment solution globally,” said Paterson.

As further evidence of Splitit’s unique value proposition in the

fast-growing Buy Now Pay Later space, Splitit added more merchants

in Q3 than ever before.

Leading brands that joined Splitit during the quarter included

fitness brands Bianchi, Specialized, Bicycle Warehouse and Echelon

Fitness; luxury brands The Hut Group, Fabergé; jewelry brands

Frederique Constant and 77 Diamonds; audio brands Steven Slate

Audio and Waves; mattress brands Eight Sleep, Silentnight and Puffy

as well as HockeyShot, Snow Joe, Finance 4 Group, Tyresales and

CrazySales. Splitit also marked its entry into the professional

services market with its Quickfee partnership.

Splitit is currently used by more than 1400 e-commerce

merchants. A list of some major merchants that offer Splitit can be

found here.

About Splitit

Splitit is a payment method solution enabling customers to pay

for purchases with an existing debit or credit card by splitting

the cost into interest and fee free monthly payments, without

additional registrations or applications. Splitit enables merchants

to offer their customers an easy way to pay for purchases in

monthly installments with instant approval, decreasing cart

abandonment rates and increasing revenue. Serving many of Internet

Retailer’s top 500 merchants, Splitit’s global footprint extends to

hundreds of merchants in countries around the world. Headquartered

in New York, Splitit has an R&D centre in Israel and offices in

London and Australia.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201008005464/en/

Media: Cari Sommer RAISE Communications

cari@raisecg.com

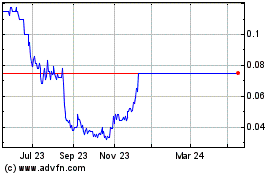

Splitit Payments (ASX:SPT)

Historical Stock Chart

From Mar 2025 to Apr 2025

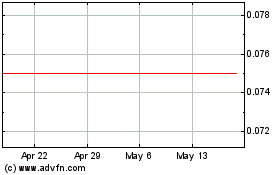

Splitit Payments (ASX:SPT)

Historical Stock Chart

From Apr 2024 to Apr 2025