Italy to Offer Financing for Investment in Iran

January 18 2016 - 7:00PM

Dow Jones News

The Italian government is planning to offer up to €8 billion

($8.71 billion) in financing for companies to invest in Iran, as

they expect Italian exports to Iran to quadruple in two years.

Under the terms of the agreement announced Saturday, the United

Nations lifted its sanctions on Iran, and the European Union and

the U.S. lifted their nuclear-related measures. U.S. President

Barack Obama immediately issued an executive order revoking earlier

orders that imposed nuclear sanctions on Iran, and the names of

hundreds of people and companies removed from U.S. blacklists were

released in a single list.

Italy—which had strong ties with Iran before the sanctions—is

eager to benefit from potential business opportunities arising. The

government has been trying to pave the way to revamp trade

relations in the last months and is working to help Italians get

closer to investors and prospective clients in Iran. Vice Minister

for the Economic Development Carlo Calenda already visited Iran

this past November to help nearly 400 Italian firms meet Iranian

prospective counterparts. He said he would go back every few months

to check on the progress made by Italy's corporate world.

"We see all the elements lined up to reach a target of €4

billion in exports with Iran by 2017," Mr. Calenda said in an

interview Monday. He added that at the moment, exports are at €1

billion.

Mr. Calenda said export credit company SACE—controlled by

State-controlled lender Cassa Depositi e Prestiti -- is getting

ready to make available up to €8 billion in financing for Italian

firms that want to have business in Iran. He also said the Bank of

Italy is in talks with the Bank of Iran to open the branch of an

Iranian bank in Italy in a move to make financial transactions

easier. He expects an agreement to come by March.

According to SACE, Italy's loss from the sanctions has been

"significant", noting that the trade exchange between the two

countries had dropped to €1.6 billion in 2014 from €7.2 billion in

2011, the year in which sanctions were made harsher.

Exports of machinery alone, which in 2014 accounted for 58% of

the total, fell 29% over the 2011 to 2014 period, SACE said.

Italy's corporate world hasn't been caught by surprise with the

sanction relief process. Several companies with strong ties to Iran

before the sanctions haven't left the country, although business

slowed down significantly.

Some have kept a small presence in the country, which they are

looking to expand now. Some are refreshing their old contacts. For

instance, Fadis, a textile machinery company, tried to keep its old

clients over the sanction years by selling them spare parts when

needed. But now that local carpet makers will have the chance to

increase production and possibly turnover, they hope they will need

up-to-date machinery.

"Iran has old petrochemical plants," said Fabrizio Di Amato,

president of Maire Tecnimont—a company that designs and builds oil

and gas processing and petrochemical plants—as he added that the

firm will be a candidate to upgrade or complete existing

plants.

Mr. Di Amato said his company could make plants to produce

fertilizers in the country, for example, using cheap Iranian gas

and exporting the output to India, an important buyer of

fertilizers. Transportation costs would lower significantly if they

are made in Iran rather than in farther away countries, he

said.

Oil giant Eni SpA, has been visiting Iran in recent months to

rekindle ties, too. "No doubts Iran is interesting [as an

investment opportunity]," Eni's chief executive, Claudio Descalzi,

said in a television interview Sunday. "I am happy that Iran is

returning [to energy markets]…it means Europe has a more

diversified supply for its energy."

The Italian government's next mission to Iran is slated for

February, where Maire Tecnimont and other firms will meet local

businesses, government representatives and potential investors.

"What we found in Iran when we went on a mission in November was

a strong entrepreneurial class," Mr. Calenda said. "They know how

to make business."

Pietro Piccinetti, the chief executive of Pordenone Fiere, which

organizes trade events for Italian small and medium-size

businesses, said last week that he also brought about 60 companies

in the furniture business to Tehran so that they could meet

potential customers.

Yet doubts remain about how quick such opportunities will become

real. In an interview Friday, Italian Foreign Minister Paolo

Gentiloni warned that, while the Iranian economy offers

opportunity, business may not yet rush to invest there quite

yet.

"The Iranian economy is in decent shape. It has had to

differentiate more than other countries in the region over the

years due to the sanctions," he said. "The interest (from business)

is enormous in several sectors. Although in the energy sector,

because of (low) oil prices, the break-even point on oil projects

is so low that multinationals won't probably be rushing there quite

yet."

Write to Manuela Mesco at manuela.mesco@wsj.com and Liam Moloney

at liam.moloney@wsj.com

(END) Dow Jones Newswires

January 18, 2016 19:45 ET (00:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

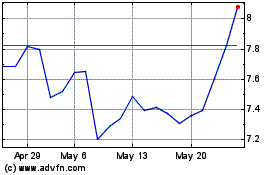

Maire (BIT:MAIRE)

Historical Stock Chart

From Oct 2024 to Nov 2024

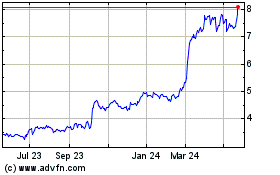

Maire (BIT:MAIRE)

Historical Stock Chart

From Nov 2023 to Nov 2024