Q4 Triumph For Fantom (FTM): Circulating Market Cap Outpaces All Cryptos With 140% Surge

January 25 2024 - 8:00PM

NEWSBTC

In the fourth quarter of 2023, the cryptocurrency market

experienced a notable resurgence, accompanied by the anticipation

of a potential Bitcoin ETF approval. Among the standout performers

during this period was Fantom (FTM), a Layer-1 protocol launched in

2018. According to a recent report by Messari, Fantom

witnessed significant growth, with its circulating market cap

soaring by 140% quarter-over-quarter, from $0.5 billion to $1.3

billion. This performance surpassed all cryptocurrencies’ overall

market cap growth at 54% in Q4. Additionally, Fantom climbed up the

market cap rankings, ascending five spots from 63 to 58 by the end

of the quarter. FTM’s Potential For Future Growth The circulating

supply of FTM remained relatively stable quarter-over-quarter, with

changes in supply dynamics between Q4 2022 and Q1 2023.

Notably, Fantom introduced the Ecosystem Vault and Gas Monetization

program during Q4 2023, reducing the burn rate of transaction fees

and reallocating a portion of fees to the Gas Monetization program

and Ecosystem Vault. The number of daily active addresses on

the Fantom network experienced a 27% decline quarter-over-quarter,

averaging 32,700 in Q4’23. However, a steady increase in daily

active addresses throughout December indicates potential future

growth as the crypto market emerges from the bearish phase.

Related Reading: Helium (HNT) Heats Up: 21% Jump After Telefónica

Deal Ignites Growth Average daily transactions on Fantom reversed

their declining trend, surging by 126% to 531,000. This increase

was primarily attributed to the emergence of Fantom Inscription

FRC20s, with November 25 marking an all-time high of 5.11 million

transactions, including 4.99 million inscriptions. In terms

of new addresses, Q4’23 saw a 10% increase to an average of 21,100

daily new addresses. Messari suggests that the surge in daily new

addresses can be attributed to the launch of Estfor Kingdom, a

popular blockchain-based game on Fantom that gained traction in

late Q3’23. December also witnessed an uptick in daily new

addresses, likely influenced by improved market conditions. Fantom

DeFi Ecosystem Per the report, Fantom’s Total Value Locked

(TVL) denominated in USD increased by 58% quarter-over-quarter,

from $51 million in Q3 to $81 million in Q4. However, TVL

denominated in FTM decreased by 29% in the same period, primarily

due to asset price fluctuations. Q4’23 also witnessed shifts

in the top DeFi applications on Fantom, with new entrants such as

Equalizer Exchange, WigoSwap, and SpiritSwap gaining market share.

Notable protocols by TVL included Spookyswap, Beethoven X,

Equalizer Exchange, WigoSwap, Tomb Finance, and SpiritSwap.

These protocols collectively gained $29 million in TVL, accounting

for nearly 100% of Fantom’s TVL growth in Q4. Equalizer and

WigoSwap experienced the most significant market share increases.

The average daily decentralized exchange (DEX) volume on Fantom

declined by 10% to $10.2 million in Q4 2023. Still, emerging new

DEXs like Equalizer Exchange and WigoSwap contributed to the

ecosystem’s overall growth. Related Reading: Bitcoin Whales Go On

Buying Spree As Price Dips, Here’s How Much They Bought In summary,

Fantom’s performance was notable in the fourth quarter of 2023. The

protocol experienced a surge in market cap, robust revenue growth,

and an expanding DeFi ecosystem. However, its native token has

declined significantly. Despite the recent sharp correction

across the cryptocurrency market, Fantom’s native token FTM has not

been an exception. Presently, the token is trading at $0.3306,

reflecting a decline of over 3% within the last 24 hours, 37% over

the past 30 days, and a year-to-date decrease of 18%. Featured

image from Shutterstock, chart from TradingView.com

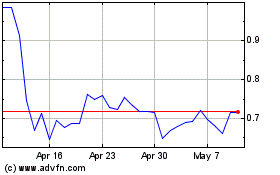

Fantom Token (COIN:FTMUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Fantom Token (COIN:FTMUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024