This Binance Wallet Triggered A Temporary 30X Surge In Ethereum Gas Fees

September 21 2023 - 7:00PM

NEWSBTC

A cryptocurrency wallet associated with the prominent trading

platform, Binance, has seen massive activity in the last 24 hours,

leading to abnormally high transaction fees on the Ethereum

network. Binance Wallet Incurs Nearly $850,000 Gas Fees In One Day

A crypto wallet labeled “Binance 14” witnessed a significant

transaction surge on September 21, rising above 140,000. As a

result of this activity surge, transactions of the Binance-owned

wallet consistently incurred gas fees of over 300 gwei, even though

the network’s average fee was around 10 gwei. This gas fee jump and

significant wallet activity have resulted in around 530 ETH

(equivalent to nearly $850,000) in gas used on the Binance 14

address today. Related Reading: Binance & Deribit Traders

Aggressively Short Bitcoin, Squeeze Incoming? The increase in

transactions on the Binance wallet had a broader, albeit temporary,

impact on the Ethereum network. Gas fees on the blockchain

momentarily jumped from less than 10 gwei to above 330 gwei per

transaction, according to blockchain data tracker Etherscan. Gas

fees refer to the cost blockchain users incur or pay validators to

conduct transactions or execute contracts on the Ethereum network.

Fees depend on the blockchain’s demand and supply of processing

power. This means when a network has many transactions, there is

often a high demand for processing power, which increases gas fees.

Possible Reasons For The Gas Fee Spike In the wake of this

incident, Wu Blockchain reported that Binance said it was carrying

out its wallet aggregation process when the gas fees were low to

facilitate withdrawals and ensure the safety of user funds.

Nonetheless, some prominent crypto community members have weighed

in on the situation, offering possible explanations for the gas fee

spike. Martin Koppelmann, cofounder of the Gnosis chain, said

on the X (formerly Twitter) platform that Binance might be using a

“really inefficient script” to consolidate, leading to high

transaction costs. Blockchain analysts at Scopescan gave a similar

prognosis on the gas incident. The on-chain analytics platform

said: Due to Binance consolidating funds from long-inactive deposit

addresses, the Ethereum network is experiencing congestion, causing

Gas fees to surge to 300 gwei. Related Reading: Ethereum Bearish

Signal Reappears After Five Years To Threaten ETH’s Price Adam

Cochran, a popular crypto investor, suggested that the abnormally

high transaction fees might have been due to Binance’s subpar APIs.

In his X post, Cochran criticized the exchange’s technological

infrastructure while casting doubts on its capacity to safe-keep

“hundreds of billions in coins across multiple protocols.”

According to CoinGecko data, the price of Ethereum currently sits

below $1,600, reflecting a 2.8% decline in the past 24 hours.

Nevertheless, Ether maintains its position as the second-largest

cryptocurrency, with a market capitalization of over $190 billion.

Ethereum price trading beneath $1,600 on the daily timeframe |

Source: TOTAL chart on TradingView Featured image from Unsplash,

chart from TradingView

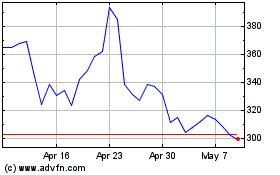

Gnosis (COIN:GNOUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gnosis (COIN:GNOUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024