Bitcoin Not Out Of Danger Yet, NVT Golden Cross Warns

May 15 2024 - 9:00PM

NEWSBTC

On-chain data shows the Bitcoin Network Value to Transactions (NVT)

Golden Cross still has a high value, a sign that may be bearish for

BTC. Bitcoin NVT Golden Cross Is Still Near Historical Top Zone In

a CryptoQuant Quicktake post, an analyst discussed the recent trend

in the NVT Golden Cross for BTC and its implications for the price.

The NVT ratio is an indicator that tells us about how the Bitcoin

market cap compares against its transaction volume. The metric is

generally used to judge whether the asset’s price is fair or not

right now. Related Reading: Bitcoin Hash Ribbons Form Capitulation

Signal: What It Means When the indicator’s value is high, it

suggests the network’s value (that is, the market cap) is high

compared to its ability to transact coins (the volume). Such a

trend implies that the asset may be overpriced currently. On the

other hand, the low metric means the cryptocurrency’s price may be

undervalued due to a rebound as the market cap is low compared to

the volume. In the context of the current topic, the NVT ratio

itself isn’t of interest; rather, it is a modified form called the

NVT Golden Cross. This metric compares the short-term trend (the

10-day moving average) with the long-term trend (30-day MA) of the

NVT ratio to identify tops and bottoms. Here is a chart that shows

the trend in this Bitcoin indicator over the past couple of years:

In the graph, the quant has highlighted the two relevant zones for

the Bitcoin NVT Golden Cross. It would appear that when this metric

is above 2.2, a top can be probable for the cryptocurrency as its

price is overvalued in this zone. Similarly, the NVT Golden Cross

being under -1.6 can lead to a bottom formation for the asset. The

Bitcoin NVT Golden Cross has ventured into the red territory for

the last couple of months. Each time it has seen a decline out of

the zone, it has followed up with another rise into the zone. As

such, it hasn’t been able to visit the bullish region yet. At

present, the metric has just made another exit out of the top zone,

but its value is still quite near it. Thus, while a top may not be

especially probable now, a lasting uptrend is also unlikely to

happen. Related Reading: Bitcoin Price Linked To Binance Vs

Coinbase Battle, Quant Reveals It’s possible that Bitcoin won’t be

completely out of danger of observing more price drawdowns until

the NVT Golden Cross can see a decrease in the green zone. It now

remains to be seen how the indicator develops in the near future

and whether its changes will affect the BTC price. BTC Price At the

time of writing, Bitcoin is floating around the $64,900 mark, up

more than 4% over the past week. Featured image from Bastian

Riccardi on Unsplash.com, CryptoQuant.com, chart from

TradingView.com

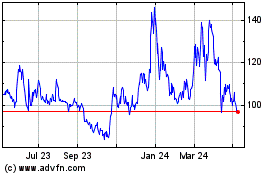

Quant (COIN:QNTUSD)

Historical Stock Chart

From Sep 2024 to Oct 2024

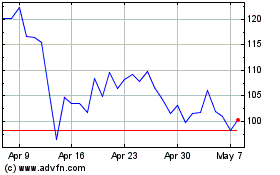

Quant (COIN:QNTUSD)

Historical Stock Chart

From Oct 2023 to Oct 2024