SEC Strikes Again: Cumberland DRW Charged For ‘Unregistered Crypto Operations’

October 10 2024 - 2:48PM

NEWSBTC

The US Securities and Exchange Commission (SEC) has stepped up its

regulatory scrutiny of the crypto industry by charging Cumberland

DRW LLC with operating as an “unregistered dealer”, underscoring

the agency’s relentless enforcement approach that has come under

increasing criticism from stakeholders and advocates in the digital

asset space. Accused Of Trading $2B In Crypto As ‘Unregistered

Dealer’ In a statement released on Thursday, the SEC revealed that

Chicago-based Cumberland DRW is accused of trading over $2 billion

in crypto assets offered and sold as alleged “securities” in

violation of federal registration requirements designed to protect

investors. The SEC’s complaint alleges that Cumberland has

been engaging in these activities since at least March 2018, acting

as an “unregistered dealer” by buying and selling crypto assets for

its own accounts as part of its regular business operations.

Related Reading: US Charges 14 Individuals And Four Crypto

Companies In Major ‘Sham Trading’ Scandal According to the firm’s

website, it provided “deep, reliable liquidity” in crypto assets,

as well as investing in technology, claiming to have decades of

experience in the field. Cumberland DRW has publicly

positioned itself as “one of the world’s leading liquidity

providers” in the digital asset market, operating around the clock

and executing trades with counterparties via telephone and its

online platform, Marea. Cumberland also offered spot

cryptocurrency liquidity, and operations for “dozens” of

cryptocurrencies, including stablecoins, for institutional

investors in the market. Other services offered by the company

included options and futures trading, bilateral crypto options, and

non-deliverable forwards. SEC Seeks Penalties Against

Cumberland DRW The SEC further alleges that Cumberland has been

trading crypto assets treated as investment contracts on

third-party exchanges. Jorge G. Tenreiro, Acting Chief of the SEC’s

Crypto Assets and Cyber Unit, stated: The federal securities

laws require all dealers in all securities to register with the

Commission, and those who operate in the crypto asset markets are

no exception. Related Reading: Solana Bullish Pattern Signals

Massive Gains Ahead – 2021 Rally Could Repeat The SEC’s Head Of the

digital assets divison noted that despite industry claims equating

crypto asset sales to commodity sales, the SEC’s complaint asserts

that Cumberland, the issuers, and investors viewed the transactions

as investments in securities. Tenreiro further alleged:

Cumberland profited from its dealer activity in these assets

without providing investors and the market with the important

protections afforded by registration. The SEC’s complaint was filed

in the US District Court for the Northern District of Illinois and

charges Cumberland with violating Section 15(a) of the Securities

Exchange Act of 1934. The agency is seeking permanent injunctive

relief, recovery of ill-gotten gains, prejudgment interest, and

civil penalties against the firm. Featured image from DALL-E, chart

from TradingView.com

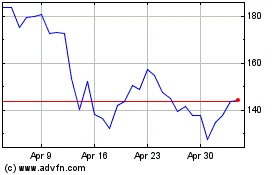

Solana (COIN:SOLUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Solana (COIN:SOLUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024