Stellar Breaks Long-Term Resistance, Recovery Underway?

April 11 2023 - 3:05PM

NEWSBTC

Over the past few trading sessions, Stellar has attempted to

advance on its chart. Within the last 24 hours, XLM experienced a

close to 4% appreciation in value. However, on the weekly chart,

Stellar did not observe any price increase. Nonetheless, the

altcoin has finally surpassed its multi-week resistance level, and

its technical outlook appears bullish at the time of writing.

Related Reading: Why Is Ethereum (ETH) Still Trading Below $2,000?

The buying strength and demand for XLM have surged as accumulation

rose on the chart. Furthermore, the altcoin has increased above its

bearish order block, previously below the $0.094 price mark. The

demand must remain consistent on its chart since the overhead

resistance mark remains crucial for the altcoin. Assuming that XLM

surpasses the $0.100 price mark, it is likely that the recovery is

underway. With Bitcoin increasing by 7% on its daily chart, other

altcoins have also indicated positive price movements on their

respective charts. Additionally, the market capitalization of XLM

has registered an upward movement showing an increase in demand.

Stellar Price Analysis: One-Day Chart At the time of writing, XLM

was trading at $0.106. Buyers were activated as Stellar entered the

$0.100 zone, and a move above the overhead resistance could take

XLM to the overbought territory. The immediate resistance was

$0.108, and breaking above this mark would pave the way for XLM to

target $0.113. The amount of XLM traded during the last session was

green, indicating increased buying strength. Conversely, support

for Stellar stood at $0.102 and then at $0.098. If XLM falls below

$0.098, it could bring the bears back. Technical Analysis Following

its crossing of the $0.100 mark, the altcoin has recently

experienced an upward movement on its chart. The Relative Strength

Index was above the 60-mark, indicating strong demand on the chart.

Similarly, XLM has risen above the 20-Simple Moving Average line as

demand surges. These trends suggest that buyers are in control and

are driving the price momentum in the market. Price reversal,

however, could occur as the 200-SMA line may cross over the 50-SMA

line, resulting in a death cross. This could cause the altcoin to

dip on its chart. On the one-day chart, XLM has formed sell signals

in line with a possible death cross. The Moving Average Convergence

Divergence has depicted price momentum and reversal, with red

signal bars indicating sell signals. Related Reading: Polkadot

Rises In Popularity Among Futures Traders – A Bullish Turn For DOT

Price? The Parabolic SAR, which portrays the price direction, has

dotted lines appearing above the price candlestick, indicating the

beginning of a downward trend. However, this impending reversal may

be brief if buyers maintain their confidence. Featured Image From

UnSplash, Charts From TradingView.com

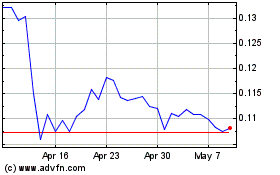

Stellar Lumens (COIN:XLMUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Stellar Lumens (COIN:XLMUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024