Nyrstar: First Half 2019 Results

Regulated Information

First Half 2019 Results

29 November 2019 at 07:00 CET

Nyrstar NV (“Nyrstar” or the “Company”) advises

that due to recent technical issues, the publication of its

consolidated accounts for H1 2019 are not available for publication

today. The Company is working to complete the consolidated accounts

as soon as possible and expects to have them published on the

website of Nyrstar (www.nyrstar.be) by no later than Friday 13

December 2019. It is important to note that at 30 June 2019, the

assets and liabilities of the Company will be primarily classified

as assets and liabilities held for sale and, in accordance with

IFRS 5 (“non-current assets held for sale and discontinued

operations”), the income statement will provide a detailed

presentation of the results from the continued operations and

separately the results from the discontinued operations. The

information presented on page 2 of this press release provides the

aggregated result for the Company (i.e. both continued and

discontinued operations).

SUMMARY:

- Group underlying EBITDA1 of EUR 3 million for H1 2019, a

decrease of EUR 117 million on H1 2018, primarily due to reduced

availability of raw materials caused by liquidity constraints as

the Company completed its balance sheet restructuring and

consequently reduced metal and by-product production, lower

commodity prices, a sustained unplanned stoppage of the blast

furnace and TSL furnace at Port Pirie in Q2 2019 and the negative

impact of metal at risk which was not hedged between March 2019 and

June 2019.

- Metals Processing underlying EBITDA of EUR 10 million, down EUR

108 million year-on-year

- Mining underlying EBITDA of EUR 17 million, down EUR 11 million

year-on-year

- Loss for H1 2019 was EUR 207 million, comprising of EUR 38

million from continuing operations and EUR 169 million from

discontinued operations

- Net debt inclusive of zinc metal prepay and perpetual

securities of EUR 1,936 million at the end of June 2019, an

increase of EUR 449 million on 30 June 2018, driven predominantly

by working capital outflow since the Q3 2018 results announcement

and reduced earnings in H1 2019. All of this debt has been assumed

by the restructured operating group of Nyrstar and will be part of

the liabilities classified as held for sale at 30 June 2019

- Port Pirie Redevelopment ramp-up impacted by a sustained

production outage between May and July 2019 due to unplanned

maintenance outages at the TSL furnace, blast furnace and

continuous drossing furnace

- Myra Falls mine re-commenced operations in April 2019

KEY FIGURES2

| EUR

million (unless otherwise

indicated) |

H1 |

H1 |

% |

|

|

2018 |

2019 |

Change |

| Income

Statement Summary |

|

|

|

| Revenue |

1,930 |

1,587 |

(18%) |

| Gross Profit |

600 |

511 |

(15%) |

| Direct operating costs |

(485) |

(504) |

4% |

| Non-operating and other |

6 |

(4) |

(176%) |

| |

|

|

|

| Underlying EBITDA |

|

|

|

| Metals Processing Underlying EBITDA |

118 |

10 |

(91%) |

| Mining Underlying EBITDA |

28 |

17 |

(41%) |

| Other

and Eliminations Underlying EBITDA |

(26) |

(24) |

(8%) |

|

Group Underlying EBITDA |

120 |

3 |

(98%) |

| Underlying EBITDA margin |

6% |

0% |

(97%) |

| |

|

|

|

| Embedded derivatives |

(3) |

(1) |

(71%) |

| Restructuring expense |

(13) |

(37) |

188% |

| M&A related transaction expense |

(2) |

- |

- |

| Other income |

2 |

- |

- |

| Profit /

(Loss) on disposal of investments |

- |

- |

- |

|

Underlying adjustments |

(16) |

(38) |

140% |

| |

|

|

|

| Depreciation, depletion,

amortisation |

(75) |

(66) |

(12%) |

|

Impairment gain / (loss) |

- |

- |

- |

|

Result from operating activities |

30 |

(101) |

(437%) |

| |

|

|

|

| Net finance expense (excluding fx) |

(71) |

(106) |

49% |

| Net foreign exchange (loss)/gain |

(5) |

6 |

(227%) |

| Income tax (expense) / benefit |

1 |

(7) |

(717%) |

| |

|

|

|

| Profit / (Loss) from continuing

operations |

(2) |

(38) |

- |

| Profit / (Loss) from discontinued

operations |

(48) |

(169) |

252% |

| Profit / (Loss)

for the period |

(49) |

(207) |

322% |

| Basic Loss per share (EUR) |

(0.45) |

(1.89) |

320% |

| |

|

|

|

| Capex |

|

|

|

| Metals Processing |

70 |

43 |

(39%) |

| Mining |

63 |

28 |

(56%) |

| Other |

1 |

1 |

(15%) |

|

Group Capex |

134 |

71 |

(47%) |

| |

|

|

|

|

|

30 Jun 2018 |

30 Jun 2019 |

|

| Loans and borrowings, end of the

period |

1,276 |

1,954 |

53% |

| Less cash and cash equivalents, end of

period |

(78) |

(148) |

89% |

| Net Debt3 |

1,198 |

1,806 |

51% |

| |

|

|

|

| Zinc Prepay |

104 |

130 |

25% |

| Perpetual

Securities3 |

186 |

0 |

- |

|

Net Debt Inclusive of Zinc Prepay and Perpetual

Securities |

1,487 |

1,936 |

30% |

|

|

|

|

|

| EUR

million (unless otherwise

indicated) |

H1 |

H1 |

% |

|

|

2018 |

2019 |

Change |

| |

|

|

|

| Metals Processing

Production |

|

|

|

| Zinc metal (‘000 tonnes) |

528 |

480 |

(9%) |

| Lead metal (‘000 tonnes) |

69 |

51 |

(51%) |

| |

|

|

|

| Mining Production |

|

|

|

| Zinc in concentrate (‘000 tonnes) |

70 |

61 |

(13%) |

| |

|

|

|

| Market4 |

|

|

|

| Zinc price (USD/t) |

3,268 |

2,732 |

(16%) |

| Lead price (USD/t) |

2,456 |

1,962 |

(20%) |

| Silver price (USD/t.oz) |

16.65 |

15.23 |

(12%) |

| Gold price (USD/t.oz) |

1,319 |

1,307 |

(1%) |

| EUR/USD average exchange rate |

1.21 |

1.13 |

(7%) |

| EUR/AUD

average exchange rate |

1.57 |

1.60 |

2% |

GROUP FINANCIAL OVERVIEW

Revenue for H1 2019 of EUR 1,587 million was

down 18% on H1 2018, driven by lower zinc, lead, silver and gold

prices which were down 16%, 20%, 12% and 1% respectively and

decreased production volumes in zinc and lead smelting and zinc

mining.

Group gross profit for H1 2019 of EUR 511

million was down 15% on H1 2018, driven by lower production volumes

in both Metals Processing and Mining and lower zinc, lead, silver

and gold prices, partially offset by improving zinc treatment

charge terms.

Direct operating costs for H1 2019 of EUR 504

million increased 4% on H1 2018, due to a number of unplanned

maintenance outages at the smelters and higher mining costs as a

result of the continued ramp-up of operations at Myra Falls.

Group underlying EBITDA of EUR 3 million in H1

2019, a decrease of EUR 117 million on H1 2018, due to reduced

availability of raw materials caused by liquidity constraints as

the Company completed its balance sheet restructuring and

consequently reduced metal and by-product production, lower

commodity prices, a sustained unplanned stoppage of the blast

furnace and TSL furnace at Port Pirie in Q2 2019 and the negative

impact of metal at risk which was not hedged between March 2019 and

June 2019.

Depreciation, depletion and amortisation expense

for H1 2019 of EUR 66 million was down 12% year-on year.

Net finance expense excluding foreign exchange

for H1 2019 of EUR 105 million was up EUR 34 million on H1 2018

primarily due to net debt inclusive of zinc prepay and perpetual

securities increasing by 30% compared to end June 2018.

Income tax expense for H1 2019 of EUR 7

million (H1 2018: income tax benefit of EUR 1 million).

Loss in H1 2019 of EUR 207 million, compared to

a net loss of EUR 49 million in H1 2018, mainly as a result of

higher operating losses, restructuring expenses and consulting

expenses compared to the prior period.

Capital expenditure was EUR 71 million in H1

2019, representing a decrease of 47% year-on-year driven by a

substantial reduction in capital expenditure across the group as

the Company tightly managed its liquidity during the restructuring

process that was completed at the end of July 2019.

Net debt of EUR 1,936 million at the end of

H1 2019, inclusive of the zinc metal prepay and perpetual

securities, was 30% higher year-on-year (EUR 1,487 million at the

end of June 2018). Cash balance at the end of H1 2019 was EUR 148

million compared to EUR 78 million at the end of June 2018 with

immediately available liquidity at the end of H1 2019 of EUR 210

million. All of this debt has been assumed by the restructured

operating group of Nyrstar and will be part of the liabilities

classified as held for sale at 30 June 2019.

SAFETY, HEALTH AND

ENVIRONMENT

The frequency rate of cases with time lost or

under restricted duties (DART) was 6.0, this is 45% higher than in

the same period of last year. The frequency rate of cases requiring

at least a medical treatment (RIR) increased by 33% compared to H1

2018. The severity of the injuries in H1 2019, measured as the

number of days lost or under restrictions due to Lost Time or

Restricted Work Injuries was reduced by 105% compared to the same

period of last year.

At the end of H1 2019, the Auby smelter in

France and the Myra Falls Mine in Canada had achieved more than

500,000 and 800,000 working hours without restricted work or lost

time injuries, respectively.

No environmental events with material business

consequences or long-term environmental impacts occurred during H1

2019.

OPERATIONS REVIEW: METALS PROCESSING

| EUR million |

H1 |

H1 |

% |

|

(unless otherwise indicated) |

2018 |

2019 |

Change |

|

|

|

|

|

| Treatment charges |

123 |

146 |

19% |

| Free metal contribution |

193 |

151 |

(22%) |

| Premiums |

76 |

68 |

(11%) |

| By-Products |

106 |

78 |

(27%) |

| Other |

(47) |

(80) |

70% |

| Gross Profit |

451 |

362 |

(20%) |

| |

|

|

|

| Employee expenses |

(109) |

(107) |

(3%) |

| Energy expenses |

(117) |

(114) |

(3%) |

| Other expenses /income |

(120) |

(135) |

(13%) |

| Direct Operating

Costs |

(346) |

(356) |

3% |

|

Non-operating and other |

14 |

4 |

(71%) |

|

Underlying EBITDA |

118 |

10 |

(91%) |

| |

|

|

|

|

Metal Processing Capex |

70 |

43 |

(39%) |

Metals Processing delivered an underlying EBITDA

result of EUR 10 million in H1 2019, a decrease of EUR 108 million

over H1 2018 due to reduced zinc, lead and by-product production

caused by reduced availability of raw materials with the liquidity

constraints imposed as the Company completed its balance sheet

restructuring.

Gross profit at EUR 362 million in H1 2019 was

down 20% compared to H1 2018 with lower zinc, lead, silver and gold

commodity prices and lower production partially offset by an

increase in the annual zinc benchmark treatment charges (base TC of

USD 147 per dmt of concentrate in 2018 versus USD 245 in 2019).

Direct operating costs year-over-year at EUR 356

million increased marginally, predominantly due to increased

contractor maintenance spend with various unplanned outages

experienced at the smelting sites.

Sustaining and growth capital spend in H1 2019

decreased substantially by 39% on H1 2018 due to the liquidity

constraints imposed on the Company during the completion of the

capital structure review process and balance sheet restructuring

which was completed at the end of July 2019.

|

EUR |

H1 |

H1 |

% |

|

DOC/tonne |

2018 |

2019 |

Change |

| |

|

|

|

| Auby |

477 |

548 |

15% |

| Balen/Overpelt |

483 |

475 |

(2%) |

| Budel |

411 |

443 |

8% |

| Clarksville |

536 |

647 |

21% |

| Hobart |

453 |

450 |

(1%) |

| Port

Pirie5 |

1,117 |

1,488 |

33% |

|

DOC/tonne6 |

580 |

671 |

16% |

Direct operating costs per tonne increased by

16% in H1 2019 compared to H1 2018 due to lower production volumes

and a number of unplanned production outages across the smelting

sites.

| |

H1 |

H1 |

% |

|

|

2018 |

2019 |

Change |

| |

|

|

|

| Zinc metal ('000

tonnes) |

|

|

|

| Auby |

78 |

67 |

(14%) |

| Balen/Overpelt |

137 |

132 |

(4%) |

| Budel |

133 |

113 |

(15%) |

| Clarksville |

52 |

48 |

(8%) |

| Hobart |

129 |

121 |

(6%) |

| Total |

528 |

480 |

(9%) |

| |

|

|

|

| Lead metal ('000

tonnes) |

|

|

|

| Port Pirie |

69 |

51 |

(27%) |

| |

|

|

|

| Other products |

|

|

|

| Copper cathode ('000 tonnes) |

1.6 |

2.0 |

23% |

| Silver (million troy ounces) |

4.9 |

4.5 |

(8%) |

| Gold (‘000 troy ounces) |

25.7 |

16.4 |

(36%) |

| Indium metal (tonnes) |

21.4 |

19.3 |

(9%) |

| Sulphuric acid ('000 tonnes) |

653 |

680 |

4% |

Metals Processing produced approximately 480,000

tonnes of zinc metal in H1 2019, representing a 9% decrease on H1

2018. The decrease in zinc metal production year-over-year was

caused by reduced availability of raw materials with the liquidity

constraints imposed as the Company completed its balance sheet

restructuring.

Lead market metal production at Port Pirie of

51kt was 27% lower compared to H1 2018 due to the failure of the

main gas duct on the TSL furnace. This failure of the TSL furnace

led to the subsequent shutdown of the blast furnace from 26 April

2019 until the end of July 2019 due to a lack of feed as a result

of the extended outage in the TSL furnace.

Sulphuric acid production of 680,000 tonnes in

H1 2019 was marginally higher compared to H1 2018.

OPERATIONS REVIEW: MINING

| EUR million |

H1 |

H1 |

% |

|

(unless otherwise indicated) |

2018 |

2019 |

Change |

| |

|

|

|

| Treatment charges |

(14) |

(23) |

65% |

| Payable metal contribution |

160 |

163 |

2% |

| By-Products |

9 |

7 |

(18%) |

| Other |

(7) |

(3) |

(53%) |

| Gross Profit |

148 |

145 |

(2%) |

| |

|

|

|

| Employee expenses |

(42) |

(55) |

30% |

| Energy expenses |

(11) |

(12) |

5% |

| Other expenses |

(57) |

(54) |

(5%) |

| Direct Operating

Costs |

(111) |

(121) |

31% |

| |

|

|

|

| Non-operating and other |

(9) |

(7) |

(22%) |

|

Underlying EBITDA |

28 |

17 |

(41%) |

| |

|

|

|

|

Mining Capex |

63 |

28 |

(56%) |

Mining Underlying EBITDA of EUR 17 million in H1

2019 was EUR 11 million lower than in H1 2018 due to the lower zinc

price, continued ramp-up of the Myra Falls mine and a higher

benchmark zinc treatment charge set for 2019.

Mining capital expenditure in H1 2019 was EUR 28

million, down EUR 35 million year-on-year, due primarily to the

liquidity constraints imposed on the Company during the

restructuring process.

| |

H1 |

H1 |

% |

|

DOC USD/tonne ore milled |

2018 |

2019 |

Change |

| |

|

|

|

| Langlois |

139 |

118 |

(15%) |

| East Tennessee |

38 |

38 |

(2%) |

| Middle Tennessee |

64 |

81 |

26% |

| Myra

Falls |

- |

638 |

- |

|

Average DOC/tonne ore milled |

63 |

71 |

12% |

| '000 tonnes |

H1 |

H1 |

% |

|

unless otherwise indicated |

2018 |

2019 |

Change |

| |

|

|

|

| Total ore milled |

2,075 |

1,886 |

(9%) |

| |

|

|

|

| Zinc in Concentrate |

|

|

|

| Langlois |

12 |

13 |

9% |

| East Tennessee |

36 |

32 |

(10%) |

| Middle Tennessee |

22 |

15 |

(31%) |

| Myra

Falls |

- |

1 |

|

|

Total |

70 |

61 |

(13%) |

| |

|

|

|

| Other metals |

|

|

|

| Copper in concentrate |

0.8 |

0.8 |

(3%) |

| Silver (‘000 troy oz) |

214 |

216 |

1% |

| Gold (‘000 troy oz) |

0.7 |

1 |

40% |

Nyrstar’s Mining operations produced

approximately 61kt of zinc in concentrate in H1 2019, a decrease of

13% compared to H1 2018.

FORWARD-LOOKING STATEMENTS

This release includes forward-looking statements

that reflect Nyrstar's intentions, beliefs or current expectations

concerning, among other things: Nyrstar’s results of operations,

financial condition, liquidity, performance, prospects, growth,

strategies and the industry in which Nyrstar operates. These

forward-looking statements are subject to risks, uncertainties and

assumptions and other factors that could cause Nyrstar's actual

results of operations, financial condition, liquidity, performance,

prospects or opportunities, as well as those of the markets it

serves or intends to serve, to differ materially from those

expressed in, or suggested by, these forward-looking statements.

Nyrstar cautions you that forward-looking statements are not

guarantees of future performance and that its actual results of

operations, financial condition and liquidity and the development

of the industry in which Nyrstar operates may differ materially

from those made in or suggested by the forward-looking statements

contained in this news release. In addition, even if Nyrstar's

results of operations, financial condition, liquidity and growth

and the development of the industry in which Nyrstar operates are

consistent with the forward-looking statements contained in this

news release, those results or developments may not be indicative

of results or developments in future periods. Nyrstar and each of

its directors, officers and employees expressly disclaim any

obligation or undertaking to review, update or release any update

of or revisions to any forward-looking statements in this report or

any change in Nyrstar's expectations or any change in events,

conditions or circumstances on which these forward-looking

statements are based, except as required by applicable law or

regulation.

About NyrstarThe Company is

incorporated in Belgium and, following completion of the

recapitalisation/restructuring has a 2% shareholding in the Nyrstar

group. The Company is listed on Euronext Brussels under the symbol

NYR. For further information please visit the Nyrstar website:

www.nyrstar.be

For further information contact:

Anthony Simms - Head of External

Affairs T: +41 44 745 8157 M: +41 79

722 2152 anthony.simms@nyrstar.com

MINING PRODUCTION ANNEX

|

PERIOD |

Production KPI by Site |

Ore milled ('000 tonnes) |

Mill head grade |

Recovery |

Concentrate |

Metal in concentrate |

|

Zinc (%) |

Lead (%) |

Copper (%) |

Gold (g/t) |

Silver (g/t) |

Zinc (%) |

Lead (%) |

Copper (%) |

Gold (%) |

Silver (%) |

Zinc(kt) |

Lead(kt) |

Copper(kt) |

Zinc(kt) |

Lead(kt) |

Copper(kt) |

Gold(k’toz) |

Silver(m‘toz) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CONTINUING

OPERATIONS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H1 2018 |

Langlois |

209 |

5.86% |

- |

0.49% |

0.15 |

37.32 |

94.2% |

- |

77.8% |

75.0% |

85.1% |

23 |

- |

3.6 |

11.6 |

- |

0.8 |

0.7 |

214 |

| East Tennessee |

1,132 |

3.38% |

- |

- |

- |

- |

93.9% |

- |

- |

- |

- |

58 |

- |

- |

35.9 |

- |

- |

- |

- |

| Middle Tennessee |

734 |

3.19% |

- |

- |

- |

- |

95.1% |

- |

- |

- |

- |

34 |

- |

- |

22.3 |

- |

- |

- |

- |

| Myra Falls |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

MiningTotal |

2,075 |

3.57% |

- |

0.49% |

0.15 |

37.32 |

94.4% |

- |

77.8% |

75.0% |

85.1% |

115 |

- |

3.6 |

69.8 |

- |

0.8 |

0.7 |

214 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H1 2019 |

Langlois |

205 |

6.50% |

- |

0.48% |

0.14 |

37.24 |

94.7% |

- |

78.4% |

74.1% |

88.0% |

24 |

- |

3.2 |

12.6 |

- |

0.8 |

0.7 |

216 |

| East Tennessee |

1,064 |

3.20% |

- |

- |

- |

- |

94.6% |

- |

- |

- |

- |

52 |

- |

- |

32.2 |

- |

- |

- |

- |

| Middle Tennessee |

582 |

2.83% |

- |

- |

- |

- |

93.7% |

- |

- |

- |

- |

24 |

- |

- |

15.5 |

- |

- |

- |

- |

| Myra Falls |

36 |

2.91% |

0.38% |

0.31% |

0.67 |

21.53 |

64.9% |

2.9% |

53.6% |

43.9% |

69.1% |

1.3 |

0.12 |

0.6 |

0.7 |

0.00 |

0.1 |

0.3 |

17 |

|

MiningTotal |

1,886 |

3.44% |

0.38% |

0.45% |

0.22 |

34.90 |

93.8% |

2.9% |

74.7% |

69.6% |

85.2% |

115 |

- |

3.7 |

61.0 |

- |

0.8 |

1.0 |

233 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% Change |

Langlois |

(2%) |

11% |

- |

(2%) |

(2%) |

(0%) |

0% |

- |

1% |

(1%) |

3% |

6% |

- |

(11%) |

9% |

- |

(3%) |

(6%) |

1% |

| East Tennessee |

(6%) |

(5%) |

- |

- |

- |

- |

1% |

- |

- |

- |

- |

(11%) |

- |

- |

(10%) |

- |

- |

- |

- |

| Middle Tennessee |

(21%) |

(11%) |

- |

- |

- |

- |

(1%) |

- |

- |

- |

- |

(30%) |

- |

- |

(31%) |

- |

- |

- |

- |

| Myra Falls |

- |

|

|

|

|

|

|

|

|

|

|

- |

- |

- |

- |

- |

- |

- |

- |

|

MiningTotal |

(9%) |

(3%) |

- |

(7%) |

51% |

(6%) |

(0.61%) |

- |

(4%) |

(7%) |

0% |

(12%) |

- |

5% |

(13%) |

- |

4% |

40% |

9% |

1 Underlying EBITDA is a non-IFRS measure of earnings, which is

used by management to assess the underlying performance of

Nyrstar’s operations and is reported by Nyrstar to provide

additional understanding of the underlying business performance of

its operations. Nyrstar defines “Underlying EBITDA” as profit or

loss for the period adjusted to exclude loss from discontinued

operations (net of income tax), income tax (expense)/benefit, share

of loss of equity-accounted investees, gain on the disposal of

equity-accounted investees, net finance expense, impairment losses

and reversals, restructuring expense, M&A related transaction

expenses, depreciation, depletion and amortization, income or

expenses arising from embedded derivatives recognised under IAS 39

“Financial Instruments: Recognition and Measurement” and other

items arising from events or transactions clearly distinct from the

ordinary activities of Nyrstar.

2 Small differences in tables are due to rounding to zero

decimal places

3 The zinc prepay (Politus) have been accounted for entirely as

financial liabilities at 30 June 2019 whilst at 30 June 2018 the

zinc prepay was accounted for as deferred income. The Perpetual

Securities have been accounted for entirely as loans and borrowings

at 30 June 2019 whilst at 30 June 2018 the Perpetual Securities

were accounted for as equity and not included in loans and

borrowings.

4 Zinc, lead and copper prices are averages of LME daily cash

settlement prices. Silver/Gold price is average of LBMA daily

fixing / daily PM fixing, respectively

5 Per tonne of lead metal and zinc contained in fume

6 DOC/tonne calculated based on segmental direct operating costs

and total production of Zinc and Lead Market Metal

- H1-2019 Results EN - FINAL

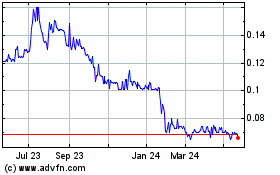

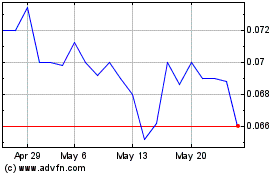

Nyrstar NV (EU:NYR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Nyrstar NV (EU:NYR)

Historical Stock Chart

From Jul 2023 to Jul 2024