Pound Climbs On China Stimulus Expectations

June 07 2023 - 3:31AM

RTTF2

The pound firmed against its major counterparts in the European

session on Wednesday, on hopes that weak export growth could prompt

Chinese authorities to roll out stimulus measures.

Official data showed Chinese exports fell 7.5 percent from a

year earlier in May, marking the first drop in three months.

Imports fell 4.5 percent, indicating slowing overseas demand for

Chinese goods.

On Tuesday, Chinese authorities told the nation's largest banks

to cut their deposit rates in an attempt to boost the economy.

Survey results from Lloyds Bank subsidiary Halifax showed that

UK house prices were unchanged in May after a slight upturn in the

first quarter as higher interest rates started to squeeze household

budgets.

House prices were stable on a monthly basis in May following a

0.4 percent fall in April, the survey revealed. That was in line

with economists' expectations.

The pound appreciated to 2-day highs of 1.1293 against the franc

and 0.8592 against the euro, from its early lows of 1.1256 and

0.8612, respectively. The pound is likely to find resistance around

1.15 against the franc and 0.84 against the euro.

The pound was up against the dollar, at a 5-day high of 1.2471.

The pound is seen finding resistance around the 1.27 level.

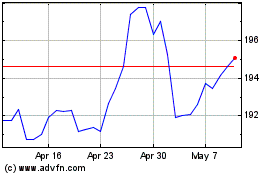

The pound edged up to 173.74 against the yen, reversing from an

early 1-week low of 172.66. The pound may find resistance around

the 177.00 level.

Looking ahead, U.S. and Canadian trade data and U.S. consumer

credit for April will be released in the New York session.

The Bank of Canada will announce its interest rate decision at

10:00 am ET. The BoC is widely expected to keep its policy rate

steady at 4.50 percent.

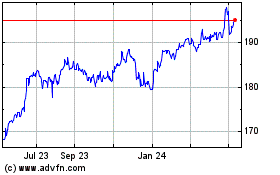

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Apr 2024 to May 2024

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From May 2023 to May 2024