U.S. Dollar Higher After Strong PPI Data

March 14 2024 - 8:22AM

RTTF2

The U.S. dollar firmed against its major counterparts in the New

York session on Thursday, as hotter-than-expected producer

inflation data for February prompted investors to slightly scale

back expectations for a rate cut in June.

Data from the Labor Department showed that the producer price

index climbed by 0.6 percent in February after rising by 0.3

percent in January. Economists had expected producer prices to rise

by another 0.3 percent.

The report also said the annual rate of producer price growth

accelerated to 1.6 percent in February from a revised 1.0 percent

in January.

Economists had expected the year-over-year price growth to rise

to 1.1 percent from the 0.9 percent originally reported for the

previous month.

A separate data showed that first-time claims for U.S.

unemployment benefits edged slightly lower in the week ended

February 9.

The report said initial jobless claims slipped to 209,000, a

decrease of 1,000 from the previous week's revised level of

210,000.

Economists had expected jobless claims to inch up to 218,000

from the 217,000 originally reported for the previous week.

The greenback firmed to 1-week highs of 1.0882 against the euro

and 1.2730 against the pound, from an early low of 1.0954 and a

2-day low of 1.2823, respectively. The greenback is likely to find

resistance around 1.06 against the euro and 1.24 against the

pound.

The greenback advanced to 1-week highs of 148.32 against the yen

and 0.6569 against the aussie, off its early lows of 147.42 and

0.6631, respectively. The currency is likely to locate resistance

around 153.00 against the yen and 0.64 against the aussie.

The greenback climbed to 8-day highs of 1.3534 against loonie

and 0.6122 against the kiwi, from an early low of 1.3459 and a

2-day low of 0.6631, respectively. Immediate resistance for the

currency is seen around 1.37 against loonie and 0.60 against the

kiwi.

The greenback touched 0.8838 against the franc, setting an 8-day

high. Should the greenback continues its uptrend, 0.90 is possibly

seen as its next resistance level.

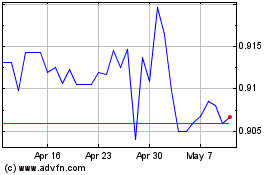

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs CHF (FX:USDCHF)

Forex Chart

From Apr 2023 to Apr 2024