UNITED STATES

SECURITIES AND EXCHANGE COMMISSION,

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

| Akari Therapeutics, PLC |

| (Name of Issuer) |

|

Ordinary Shares, par value $0.0001 per

share

(represented by American Depositary Shares) |

| (Title of Class of Securities) |

|

Rob Condon

Dentons US LLP

1221 Avenue of the Americas

New York, NY 10020

(212) 768-6700 |

| (Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications) |

| May 31, 2024 |

| (Date of Event Which Requires Filing of This Statement) |

If the filing person has previously filed

a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of

§§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

| * | The

remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class

of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| CUSIP

No. 00972G207 |

| |

| (1) |

Names

of reporting persons |

| |

Samir

R. Patel |

| |

|

| (2) |

Check

the appropriate box if a member of a group (see instructions) |

| |

(a)

☐ |

| |

(b)

☐ |

| |

|

| |

|

| (3) |

SEC

use only |

| |

|

| |

|

| (4) |

Source

of funds (see instructions) |

| |

PF |

| |

|

| (5) |

Check

if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) |

| |

|

| |

|

| (6) |

Citizenship

or place of organization |

| |

United

States |

| |

|

| |

Number

of shares beneficially owned by each reporting person with: |

| |

|

|

| |

(7) |

Sole voting

power |

| |

|

3,413,162,167(1)(2) |

| |

|

|

| |

(8) |

Shared voting

power |

| |

|

0 |

| |

|

|

| |

(9) |

Sole dispositive

power |

| |

|

3,413,162,167(1)(2) |

| |

|

|

| |

(10) |

Shared dispositive

power |

| |

|

0 |

| |

|

| (11) |

Aggregate

amount beneficially owned by each reporting person |

| |

3,413,162,167(1)(2) |

| |

|

| (12) |

Check

if the aggregate amount in Row (11) excludes certain shares (see instructions) |

| |

☒ |

| |

|

| (13) |

Percent

of class represented by amount in Row (11) |

| |

14.5%(2)(3) |

| |

|

| (14) |

Type

of reporting person (see instructions) |

| |

IN |

| (1) | Comprised of Ordinary Shares (as defined below) represented

by American Depositary Shares (as defined below). Each American Depositary Share represents 2,000 Ordinary Shares. |

| (2) | Includes (i) 3,411,495,500 Ordinary Shares and (ii) 1,666,667

options to purchase Ordinary Shares which are exercisable within 60 days from the date of this report. Excludes (i) 425,000,000 warrants

to purchase Ordinary Shares (“Ordinary Share Warrants”) and (ii) 96,774,000 pre-funded warrants to purchase Ordinary Shares

(“Prefunded Warrants” and together with the Ordinary Share Warrants, the “Warrants”). All Warrants held by the

Reporting Person (as defined below) are subject to a 9.99% beneficial ownership limitation. The Reporting Person disclaims beneficial

ownership of the Warrants and securities issuable upon exercise of the Warrants. |

| (3) | The percentage of the Reporting Person’s beneficial

ownership is based on 23,482,497,523 Ordinary Shares issued and outstanding as of June 7, 2024, as per information provided to the Reporting

Person by the Issuer (as defined below). |

ITEM 1. SECURITY AND ISSUER.

This statement on Schedule 13D relates to the ordinary shares, par

value $0.0001 per share (the “Ordinary Shares”) of Akari Therapeutics, Plc, a public limited company formed under the laws

of England and Wales (the “Issuer”). The address of the Issuer’s principal executive offices is 22 Boston Wharf Road,

FL 7, Boston, Massachusetts, 02210.

ITEM 2. IDENTITY AND BACKGROUND.

(a) Name;

Samir R. Patel (the “Reporting Person”).

(b) Residence or business address;

c/o Akari Therapeutics, Plc., 22 Boston Wharf Road, FL 7, Boston, Massachusetts,

02210.

(c) Present principal occupation or employment;

Interim Chief Executive Officer, and director of the Issuer.

(d) Criminal Convictions:

During the past five years, the Reporting Person has not been convicted

in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) Civil Proceedings:

During the past five years, the Reporting Person has not been a party

to a civil proceeding of a judicial or administrative body of competent jurisdiction and, as a result of such proceeding, was or is subject

to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state

securities laws or finding any violation with respect to such laws.

(f) Citizenship/State of Incorporation/Organization:

United States.

ITEM 3. SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION.

Prior to the closing of the May 2024 Private Placement (as defined below), the Reporting Person purchased an aggregate of 2,085,237,500

Ordinary Shares (represented as American Depositary Shares), 96,774,000 Prefunded Warrants and 425,000,000 Ordinary Share Warrants, in

various transactions, and was issued an option to purchase up to 5,000,000 Ordinary Shares. Such transactions were reported pursuant to

Schedule 13G under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Section 16 promulgated under

the Exchange Act.

On May 31, 2024, the Issuer closed a private placement of the Issuer’s securities (the “May 2024 Private Placement”).

The Reporting Person acquired 1,326,258,000 Ordinary Shares (represented by American Depositary Shares) and 1,326,258,000 Ordinary Share

Warrants in the May 2024 Private Placement. The funds used by the Reporting Person to acquire the securities in the May 2024 Private Placement

were from his personal funds.

ITEM 4. PURPOSE OF TRANSACTION.

On May 31, 2024, the Reporting Person purchased the securities described

in the May 2024 Private Placement as described in Item 3 above.

Prior to the closing of the May 2024 Private Placement, the Reporting

Person was the owner of the securities as set forth in Item 3 above.

ITEM 5. INTEREST IN SECURITIES OF THE ISSUER.

The Reporting Person, either in his individual capacity or as sole manager and member of PranaBio Investments LLC, beneficially owns an

aggregate of 3,413,162,167 Ordinary Shares (represented by Ordinary Shares or American Depositary Shares), including an aggregate of 1,666,667

options to purchase Ordinary Shares, which represents approximately 14.5% of the Issuer’s Ordinary Shares. The Reporting Person

holds sole voting and dispositive power over all securities held by PranaBio Investments LLC.

As set forth above, the Reporting Person’s aggregate beneficial ownership percentage of the Issuer’s Ordinary Shares excludes

(i) 1,654,484,000 Ordinary Share Warrants and (ii) 96,774,000 Prefunded Warrants. All Warrants held by the Reporting Person are subject

to a 9.99% beneficial ownership limitation. The Reporting Person disclaims beneficial ownership of the Warrants and securities issuable

upon exercise of the Warrants.

The percentage of the Reporting Person’s aggregate beneficial

ownership is based on 23,482,497,523 Ordinary Shares issued and outstanding as of June 7, 2024, as per information provided to the Reporting

Person by the Issuer.

ITEM 6. CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS

WITH RESPECT TO SECURITIES OF THE ISSUER.

(a), (b)

The responses of the Reporting Person with respect to Rows 7 through

13 of the cover page of the Reporting Person to this Schedule 13D are incorporated herein by reference.

The percentage of the Reporting Person’s beneficial ownership

is based on 23,482,497,523 Ordinary Shares issued and outstanding as of June 7, 2024, as per information provided to the Reporting Person

by the Issuer.

(c)

As described elsewhere in this Form 13D, in May 2024, the Reporting Person acquired 1,326,258,000 Ordinary Shares (represented by American

Depositary Shares) and 1,326,258,000 Ordinary Share Warrants in the May 2024 Private Placement.

(d)

Not applicable.

(e)

Not applicable.

ITEM 7. MATERIAL TO BE FILED AS EXHIBITS.

Not applicable.

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief,

I certify that the information set forth in this statement is true, complete and correct.

| |

Date |

June 7, 2024 |

| |

|

|

| |

Signature |

/s/ Samir R. Patel |

| |

|

|

| |

Name |

Samir R. Patel |

5

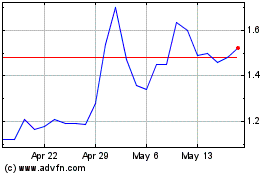

Akari Therapeutics (NASDAQ:AKTX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Akari Therapeutics (NASDAQ:AKTX)

Historical Stock Chart

From Dec 2023 to Dec 2024