falsetrue00015411570001541157sic:Z88802024-11-072024-11-070001541157aktx:OrdinarySharesParValue00001PerShareMember2024-11-072024-11-0700015411572024-11-072024-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 7, 2024

Akari Therapeutics, Plc

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

England and Wales |

|

001-36288 |

|

98-1034922 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

22 Boston Wharf Road FL 7

Boston, MA 02210

(Address, including zip code, of Principal Executive Offices)

Registrant’s telephone number, including area code: (929) 274-7510

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class: |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

American Depositary Shares, each representing 2,000 Ordinary Shares |

|

AKTX |

|

The Nasdaq Capital Market |

Ordinary Shares, par value $0.0001 per share* |

|

|

|

|

*Trading, but only in connection with the American Depositary Shares.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.07 Submission of Matters to a Vote of Security Holders.

On November 7, 2024, Akari Therapeutics, Plc (“Akari”) held a general meeting of its shareholders (the “Akari General Meeting”) in connection with the transactions contemplated by the Agreement and Plan of Merger (the “Merger Agreement”), dated as of March 4, 2024, as amended, by and among Akari, Peak Bio, Inc. (“Peak Bio”) and Pegasus Merger Sub, Inc. There were 24,289,231,523 ordinary shares of Akari entitled to vote at the Akari General Meeting based on the number of issued ordinary shares of Akari par value $0.0001 (“Akari Ordinary Shares”) outstanding as of November 5, 2024 (the record date for ordinary shareholders), of which approximately 24,284,912,423 were held in the name of Deutsche Bank Trust Company Americas, which issues the American Depositary Shares of Akari each of which, in turn, represents 2,000 Akari Ordinary Shares (“Akari ADSs”). Of the Akari Ordinary Shares entitled to vote, holders representing 14,591,339,889 shares, or approximately 60.1%, were present in person or by proxy at the Akari General Meeting. In accordance with Akari’s Articles of Association, two persons being present and between them holding (or being the proxy or corporative representative of the holders of) at least one-third (33 1/3%) of the outstanding issued Akari Ordinary Shares entitled to vote at the Akari General Meeting constitutes a quorum for the transaction of business at the Akari General Meeting.

Akari’s shareholders voted on (i) the Merger Allotment Proposal, (ii) the Share Issuance Proposal, (iii) the Chairman Appointment Proposal, (iv) the General Allotment Proposal, (v) the Equity Plan Proposal and (vi) the Pre-emption Rights Proposal (each proposal as defined below) at the Akari General Meeting. Each proposal is described in more detail in the definitive joint proxy statement/prospectus filed by Akari with the U.S. Securities and Exchange Commission (the “SEC”) on Form S-4 on October 9, 2024. All six proposals were approved on a poll in accordance with Akari’s Articles of Association. Set forth below are the total number of proxy votes received for and against each matter, as well as the total number of proxy abstentions (or votes withheld) received with respect to each matter. Abstentions and broker non-votes had no effect on the vote outcome.

|

|

|

|

Ordinary Resolution |

For |

Against |

Abstain |

Without prejudice to all existing authorities (which will remain in full force and effect), to authorize Akari’s directors generally and unconditionally, for the purposes of section 551 of the U.K. Companies Act 2006 (the “Companies Act 2006”), to allot Akari Ordinary Shares, and grant rights to subscribe for or to convert any security into Akari Ordinary Shares, up to a maximum aggregate nominal amount of $14,444,680 in connection with the merger contemplated by the Merger Agreement for a period expiring (unless previously renewed, varied or revoked by resolution of Akari) at the conclusion of Akari’s annual general meeting in 2025 (the “Merger Allotment Proposal”). |

14,557,567,889 |

25,340,000 |

8,432,000 |

Subject to and conditional upon the passing of the Allotment Proposal, to approve the issuance of Akari Ordinary Shares to be represented by Akari ADSs in connection with the merger contemplated by the Merger Agreement for purposes of applicable Nasdaq Capital Market rules (the “Share Issuance Proposal”). |

14,428,157,889 |

144,614,000 |

18,568,000 |

Subject to and conditional upon the passing of the Allotment Proposal and Share Issuance Proposal, to approve the appointment of Hoyoung Huh, M.D., Ph.D. as the non-executive chairman of the Akari board of directors, contingent upon and effective as of the effective time of the merger contemplated by the Merger Agreement (the “Chairman Appointment Proposal”). |

14,390,327,889 |

172,438,000 |

28,574,000 |

That, in accordance with section 551 of the Companies Act 2006, Akari’s directors or any duly authorized committee of the directors be generally and unconditionally authorized to allot shares in Akari and to grant rights to subscribe for or to convert |

14,419,815,889 |

162,996,000 |

8,528,000 |

|

|

|

|

any security into shares in Akari up to an aggregate nominal amount of $5,546,667 for a period expiring (unless otherwise renewed, varied or revoked by Akari in general meeting) on November 6, 2029 (the “General Allotment Proposal”). |

|

|

|

To generally and unconditionally authorize an increase in the number of shares available for the grant of awards under Akari’s 2023 Equity Incentive Plan by 7,800,000,000 Akari Ordinary Shares to an aggregate of 8,780,000,000 Akari Ordinary Shares (the “Equity Plan Proposal”). |

14,376,517,889 |

206,286,000 |

8,536,000 |

|

|

|

|

Special Resolution |

For |

Against |

Abstain |

That, conditional upon the General Allotment Proposal being duly passed, in accordance with section 570 of the Companies Act 2006 the directors of Akari (or any duly authorized committee of the directors of Akari) be generally empowered to allot equity securities (as defined in section 560 of the Companies Act 2006) for cash pursuant to the authorization conferred on them by the General Allotment Proposal as if section 561 of the Companies Act 2006 and any pre-emption provisions in Akari’s articles of association (or howsoever otherwise arising) did not apply to the allotment for a period expiring (unless previously renewed, varied or revoked by Akari prior to or on that date) November 6, 2029 (the “Pre-emption Rights Proposal”). |

14,442,105,889 |

139,124,000 |

10,110,000 |

Item 7.01 Regulation FD Disclosure.

On November 8, 2024, Akari issued a press release announcing the results of the Akari General Meeting, a copy of which is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information contained in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), about Akari. Actual events or results may differ materially from these forward-looking statements. Words such as “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “future,” “opportunity” “will likely result,” “target,” variations of such words, and similar expressions or negatives of these words are intended to identify such forward-looking statements, although not all forward-looking statements contain these identifying words. These statements are based on Akari’s and Peak Bio’s current plans, estimates and projections. By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific. A number of important factors, including those described in this communication, could cause actual results to differ materially from those contemplated in any forward-looking statements. Factors that may affect future results and may cause these forward-looking statements to be inaccurate include, without limitation: uncertainties as to the timing for completion of the merger contemplated by the Merger Agreement; the possibility that competing offers will be made by third parties; the occurrence of events that may give rise to a right of one or both of Akari and Peak Bio to terminate the Merger Agreement; the possibility that various closing conditions for the proposed Merger may not be satisfied or waived on a timely basis or at all, including the possibility that a governmental entity may prohibit, delay, or refuse to grant approval, if required, for the consummation of the proposed Merger (or only grant approval subject to adverse conditions or limitations); the difficulty of predicting the timing or outcome of consents or regulatory approvals or actions, if any; the possibility that the proposed Merger may not be completed in the time frame expected by Akari and Peak Bio, or at all; the risk that Akari and Peak Bio may not realize the anticipated benefits of the proposed Merger in the time frame expected, or at all; the effects of the proposed Merger on relationships with Akari’s or Peak Bio’s employees, business or collaboration partners or governmental entities; the ability to retain and hire key personnel; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed Merger; significant or unexpected costs, charges or expenses resulting from the proposed Merger; the potential impact of unforeseen liabilities, future capital expenditures, revenues, costs, expenses, earnings, synergies, economic performance, indebtedness, financial condition and losses on the future prospects, business and management strategies for the management, expansion and growth of the combined business after the consummation of the proposed Merger; potential negative effects related to this announcement or the consummation of the proposed Merger on the market price of Akari’s American Depositary Shares or Peak Bio’s common stock and/or Akari’s or Peak Bio’s operating or financial results; uncertainties as to the long-term value of Akari’s American Depositary Shares (and the ordinary shares represented thereby), including the dilution caused by Akari’s issuance of additional American Depositary Shares (and the ordinary shares represented thereby) in connection with the proposed Merger; unknown liabilities related to Akari or Peak Bio; the nature, cost and outcome of any litigation and other legal proceedings involving Akari, Peak Bio or their respective directors, including any legal proceedings related to the proposed Merger; risks related to global as well as local political and economic conditions, including interest rate and currency exchange rate fluctuations; potential delays or failures related to research and/or development of Akari’s or Peak Bio’s programs or product candidates; risks related to any loss of Akari’s or Peak Bio’s patents or other intellectual property rights; any interruptions of the supply chain for raw materials or manufacturing for Akari or Peak Bio’s product candidates, the nature, timing, cost and possible success and therapeutic applications of product candidates being developed by Akari, Peak Bio and/or their respective collaborators or licensees; the extent to which the results from the research and development programs conducted by Akari, Peak Bio, and/or their respective collaborators or licensees may be replicated in other studies and/or lead to advancement of product candidates to clinical trials, therapeutic applications, or regulatory approval; uncertainty of the utilization, market acceptance, and commercial success of Akari’s or Peak Bio’s product candidates, and the impact of studies (whether conducted by Akari, Peak Bio or others and whether mandated or voluntary) on any of the foregoing; unexpected breaches or terminations with respect to Akari’s or Peak Bio’s material contracts or arrangements; risks related to competition for Akari’s or Peak Bio’s product candidates; Akari’s or Peak Bio’s ability to successfully develop or commercialize Akari’s or Peak Bio’s product candidates; Akari’s, Peak Bio’s, and their collaborators’ abilities to continue to conduct current and future developmental, preclinical and clinical programs; potential exposure to legal proceedings and investigations; risks related to changes in governmental laws and related interpretation thereof, including on reimbursement, intellectual property protection and regulatory controls on testing, approval, manufacturing, development or commercialization of any of Akari’s or Peak Bio’s product candidates; unexpected increase in costs and expenses with respect to the potential transaction or

Akari’s or Peak Bio’s business or operations; and risks and uncertainties related to epidemics, pandemics or other public health crises and their impact on Akari’s and Peak Bio’s respective businesses, operations, supply chain, patient enrollment and retention, preclinical and clinical trials, strategy, goals and anticipated milestones and other risks described in our reports filed from time to time with the SEC.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

Akari Therapeutics, Plc |

|

|

Date: November 8, 2024 |

By: |

/s/ Samir R. Patel, M.D. |

|

|

Samir R. Patel, M.D. |

|

|

Interim President and Chief Executive Officer |

Akari Therapeutics Announces Shareholder Approval in Connection With

Peak Bio Inc. Merger

BOSTON and LONDON, November 8, 2024 (GLOBE NEWSWIRE) – Akari Therapeutics, Plc (Nasdaq: AKTX), an innovative biotechnology company developing advanced therapies for autoimmune and inflammatory diseases, announces shareholder approval in connection with the merger of Akari Therapeutics, Plc (the Company) and Peak Bio, Inc. At a General Meeting held in relation to the merger at 9:00 a.m. Eastern Time on Thursday, November 7, 2024 at the Company’s offices in London, shareholders approved the Company’s issuance of shares in connection with the proposed merger, with approximately 99% of shares present at the General Meeting, in person or by proxy, voted in support.

“I am thrilled to announce this important step toward finalization of the merger of our two companies,” said Samir Patel, MD, Akari’s Interim President & CEO. “With the support of our shareholders at the General Meeting, we are targeting an official close of the transaction on November 13, 2024 and will begin executing against the strategy for the combined entity, with specific focus on the Antibody Drug Conjugate (ADC) and Geography Atrophy (GA) platforms. Very importantly, upon close of the merger and based on our current calculations, we expect to be able to remedy our Nasdaq shareholder deficiency matter removing the current risk to our Nasdaq listing.”

About the Merger

On March 5, 2024, Akari and Peak Bio announced a definitive agreement to merge as equals in an all-stock transaction. The combined entity will operate as Akari Therapeutics, Plc, which is expected to continue to be listed and trade on the Nasdaq Capital Market as AKTX. Under the terms of the agreement, Peak Bio stockholders will receive a number of Akari ordinary shares (represented by American Depositary Shares) for each share of Peak Bio stock they own, as determined on the basis of the exchange ratio described in the merger agreement. The exchange is expected to result in implied equity ownership in the combined company of approximately 50% for Akari shareholders and approximately 50% for Peak Bio stockholders on a fully diluted basis, subject to adjustment under certain circumstances, including based on each party’s relative level of net cash at the closing of the proposed transaction.

About Akari Therapeutics

Akari Therapeutics, Plc (Nasdaq: AKTX) is a biotechnology company developing advanced therapies for autoimmune and inflammatory diseases. Akari’s lead asset, investigational nomacopan, is a bispecific recombinant inhibitor of complement C5 activation and leukotriene B4 (LTB4) activity. The Company is conducting pre-clinical research of long-acting PAS-nomacopan in geographic atrophy (GA). For more information about Akari, please visit akaritx.com.

About Peak Bio, Inc.

Peak Bio (OTC: PKBO) is a clinical-stage biopharmaceutical company focused on developing therapeutics addressing significant unmet needs in the areas of oncology and inflammation. The Peak Bio pipeline includes an antibody-drug-conjugate (ADC) platform that includes novel toxins and linkers coupled with important cancer antibody targets and a Phase 2-ready neutrophil elastase inhibitor for alpha1 anti-trypsin deficiency disorder (AATD). For more information about Peak Bio, please visit peak-bio.com.

Cautionary Note Regarding Forward-Looking Statements

This communication relates to the proposed transaction pursuant to the terms of the Merger Agreement, by and among Akari, Pegasus Merger Sub, Inc., and Peak Bio. This communication includes express or implied forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), about the proposed transaction between Peak Bio and Akari and the operations of the combined company that involve risks and uncertainties relating to future events and the future performance of Akari and Peak Bio. Actual events or results may differ materially from these forward-looking statements. Words such as “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “future,” “opportunity” “will likely result,” “target,” variations of such words, and similar expressions or negatives of these words are intended to identify such forward-looking statements, although not all forward-looking statements contain these identifying words. Examples of such forward-looking statements include, but are not limited to, express or implied statements regarding: the business combination and related matters, including, but not limited to, satisfaction of closing conditions to the proposed transaction, prospective performance and opportunities with respect to Akari or Peak Bio, post-closing operations and the outlook for the companies’ businesses; Akari’s, Peak Bio’s or the combined company’s targets, plans, objectives or goals for future operations, including those related to Akari’s and Peak Bio’s product candidates, research and development, product candidate introductions and product candidate approvals as well as cooperation in relation thereto; projections of or targets for revenues, costs, income (or loss), earnings per share, capital expenditures, dividends, capital structure, net financials and other financial measures; future economic performance, future actions and outcome of contingencies such as legal proceedings; and the assumptions underlying or relating to such statements. These statements are based on Akari’s and Peak Bio’s current plans, estimates and projections. By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific. A number of important factors, including those described in this communication, could cause actual results to differ materially from those contemplated in any forward-looking statements. Factors that may affect future results and may cause these forward-looking statements to be inaccurate include, without limitation: uncertainties as to the timing for completion of the proposed transaction; the possibility that competing offers will be made by third parties; the occurrence of events that may give rise to a right of one or both of Akari and Peak Bio to terminate the merger agreement; the possibility that various closing conditions for the proposed transaction may not be satisfied or waived on a timely basis or at all, including the possibility that a governmental entity may prohibit, delay, or refuse

to grant approval, if required, for the consummation of the proposed transaction (or only grant approval subject to adverse conditions or limitations); the difficulty of predicting the timing or outcome of consents or regulatory approvals or actions, if any; the possibility that the proposed transaction may not be completed in the time frame expected by Akari and Peak Bio, or at all; the risk that Akari and Peak Bio may not realize the anticipated benefits of the proposed transaction in the time frame expected, or at all; the effects of the proposed transaction on relationships with Akari’s or Peak Bio’s employees, business or collaboration partners or governmental entities; the ability to retain and hire key personnel; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed transaction; significant or unexpected costs, charges or expenses resulting from the proposed transaction; the potential impact of unforeseen liabilities, future capital expenditures, revenues, costs, expenses, earnings, synergies, economic performance, indebtedness, financial condition and losses on the future prospects, business and management strategies for the management, expansion and growth of the combined business after the consummation of the proposed transaction; potential negative effects related to this announcement or the consummation of the proposed transaction on the market price of Akari’s American Depositary Shares or Peak Bio’s common stock and/or Akari’s or Peak Bio’s operating or financial results; uncertainties as to the long-term value of Akari’s American Depositary Shares (and the ordinary shares represented thereby), including the dilution caused by Akari’s issuance of additional American Depositary Shares (and the ordinary shares represented thereby) in connection with the proposed transaction; unknown liabilities related to Akari or Peak Bio; the nature, cost and outcome of any litigation and other legal proceedings involving Akari, Peak Bio or their respective directors, including any legal proceedings related to the proposed transaction; risks related to global as well as local political and economic conditions, including interest rate and currency exchange rate fluctuations; potential delays or failures related to research and/or development of Akari’s or Peak Bio’s programs or product candidates; risks related to any loss of Akari’s or Peak Bio’s patents or other intellectual property rights; any interruptions of the supply chain for raw materials or manufacturing for Akari or Peak Bio’s product candidates, the nature, timing, cost and possible success and therapeutic applications of product candidates being developed by Akari, Peak Bio and/or their respective collaborators or licensees; the extent to which the results from the research and development programs conducted by Akari, Peak Bio, and/or their respective collaborators or licensees may be replicated in other studies and/or lead to advancement of product candidates to clinical trials, therapeutic applications, or regulatory approval; uncertainty of the utilization, market acceptance, and commercial success of Akari’s or Peak Bio’s product candidates, and the impact of studies (whether conducted by Akari, Peak Bio or others and whether mandated or voluntary) on any of the foregoing; unexpected breaches or terminations with respect to Akari’s or Peak Bio’s material contracts or arrangements; risks related to competition for Akari’s or Peak Bio’s product candidates; Akari’s or Peak Bio’s ability to successfully develop or commercialize Akari’s or Peak Bio’s product candidates; Akari’s, Peak Bio’s, and their collaborators’ abilities to continue to conduct current and future developmental, preclinical and clinical programs; potential exposure to legal proceedings and investigations; risks related to changes in governmental laws and related interpretation thereof, including on reimbursement, intellectual property protection and regulatory controls on testing, approval, manufacturing, development or

commercialization of any of Akari’s or Peak Bio’s product candidates; unexpected increase in costs and expenses with respect to the potential transaction or Akari’s or Peak Bio’s business or operations; and risks and uncertainties related to epidemics, pandemics or other public health crises and their impact on Akari’s and Peak Bio’s respective businesses, operations, supply chain, patient enrollment and retention, preclinical and clinical trials, strategy, goals and anticipated milestones. While the foregoing list of factors presented here is considered representative, no list should be considered to be a complete statement of all potential risks and uncertainties. There can be no assurance that the proposed transaction or any other transaction described above will in fact be consummated in the manner described or at all. A more complete description of these and other material risks can be found in Akari’s and Peak Bio’s respective filings with the U.S. Securities and Exchange Commission (the “SEC”), including each of their Annual Reports on 10-K, for the year ended December 31, 2023, subsequent periodic reports, and other documents that may be filed from time to time with the SEC. These risks, as well as other risks associated with the proposed transaction, are more fully discussed in the joint proxy statement/prospectus that are included in the registration statement on Form S-4 that was filed with the SEC on September 13, 2024, as amended, and declared effective on October 11, 2024, in connection with the proposed transaction. Any forward-looking statements speak only as of the date of this communication and are made based on the current beliefs and judgments of Akari’s and Peak Bio’s management, and the reader is cautioned not to rely on any forward-looking statements made by Akari or Peak Bio. Unless required by law, neither Akari nor Peak Bio is under no duty and undertakes no obligation to update or revise any forward-looking statement after the distribution of this document, including without limitation any financial projection or guidance, whether as a result of new information, future events or otherwise.

Additional Information and Where to Find It

The Registration Statement on Form S-4 includes a prospectus of Akari and a joint proxy statement of Akari and Peak Bio. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ CAREFULLY THE REGISTRATION STATEMENT ON FORM S-4, JOINT PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE THEREIN, IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION, RELATED MATTERS AND THE PARTIES TO THE PROPOSED TRANSACTION.

You may obtain a free copy of the Registration Statement on Form S-4, joint proxy statement/prospectus and other relevant documents that are on file with the SEC for free at the SEC’s website at www.sec.gov. Copies of the documents filed with the SEC by Akari are available free of charge on Akari’s website at http://investor.akaritx.com/ or by contacting Akari’s Investor Relations Department at http://investor.akaritx.com/investor-resources/contact-us. Copies of the documents filed with the SEC by Peak Bio are available free of charge on Peak Bio’s website at https://peak-bio.com/investors or by contacting Peak Bio’s Investor Relations Department at https://peak-bio.com/contact.

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer to subscribe for, buy or sell or the solicitation of an offer to subscribe for, buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of, or offer to sell or buy, securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. This communication is for informational purposes only. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

For more information

Investor Contact:

Mike Moyer

LifeSci Advisors

(617) 308-4306

mmoyer@lifesciadvisors.com

v3.24.3

Cover Page

|

Nov. 07, 2024 |

| Document Information Line Items |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 07, 2024

|

| Entity File Number |

001-36288

|

| Entity Registrant Name |

Akari Therapeutics, Plc

|

| Entity Central Index Key |

0001541157

|

| Entity Tax Identification Number |

98-1034922

|

| Entity Incorporation, State or Country Code |

X0

|

| Entity Address, Address Line One |

22 Boston Wharf Road FL 7

|

| Entity Address, City or Town |

Boston

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02210

|

| City Area Code |

929

|

| Local Phone Number |

274-7510

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| ADR [Member] |

|

| Document Information Line Items |

|

| Title of 12(b) Security |

American Depositary Shares, each representing 2,000 Ordinary Shares

|

| Trading Symbol |

AKTX

|

| Security Exchange Name |

NASDAQ

|

| Ordinary Shares, par value $0.0001 per share [Member] |

|

| Document Information Line Items |

|

| Title of 12(b) Security |

Ordinary Shares, par value $0.0001 per share*

|

| No Trading Symbol Flag |

true

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=sic_Z8880 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=aktx_OrdinarySharesParValue00001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

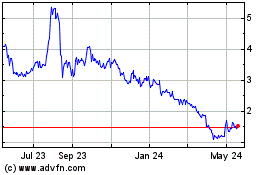

Akari Therapeutics (NASDAQ:AKTX)

Historical Stock Chart

From Nov 2024 to Dec 2024

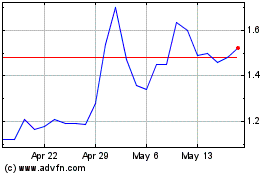

Akari Therapeutics (NASDAQ:AKTX)

Historical Stock Chart

From Dec 2023 to Dec 2024