false

0001429764

0001429764

2023-10-30

2023-10-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 30, 2023

| BLINK

CHARGING CO. |

| (Exact

name of registrant as specified in its charter) |

| Nevada |

|

001-38392 |

|

03-0608147 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

605

Lincoln Road, 5th

Floor

Miami Beach,

Florida |

|

33139 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (305) 521-0200

| N/A |

| (Former name or former address,

if changed since last report.) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| Common Stock |

|

BLNK |

|

The Nasdaq Stock Market

LLC |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

CURRENT

REPORT ON FORM 8-K

Blink

Charging Co. (the “Company”)

October

30, 2023

| Item 5.02. |

Departure of Directors

or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On

October 30, 2023, the Company entered into a new employment offer letter with Harjinder Bhade, who has been the Company’s Chief

Technology Officer since April 2021. The new offer letter, which extends Mr. Bhade’s employment through October 2025 (and is automatically

renewable for an additional one-year term unless either party provides timely notice of non-renewal), provides that Mr. Bhade will receive

an annual base salary of $500,000. Mr. Bhade will be eligible for an annual performance cash bonus equal to 60% of his annual base salary

based on meeting or exceeding key performance indicators established by the Compensation Committee of the Company’s Board and Mr.

Bhade for the relevant 12-month period. Mr. Bhade will also be eligible to receive aggregate annual equity awards under the Company’s

2018 Incentive Compensation Plan equal to 60% of his annual base salary. Such awards will be issued in the form of restricted stock units.

Of such restricted stock units, 50% of the restricted stock units will vest on the first anniversary of the grant date, and 50% of the

restricted stock units will vest in equal one-third increments on each anniversary of the grant date, in each instance subject to his

continued employment with the Company on the applicable vesting date and satisfying the key performance indicators and other performance

criteria. The Company also granted to Mr. Bhade, upon the execution of the new offer letter, a signing bonus of 150,000 restricted stock

units, vesting immediately. The above bonus and equity grants are subject to the Company’s “clawback” policies.

The

other terms of Mr. Bhade’s new offer employment letter closely followed the terms of his original employment letter, dated April

20, 2021.

The

foregoing summary of the employment offer letter does not purport to be complete and is subject to, and qualified in its entirety by,

the full text of the employment offer letter, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated

herein by reference.

| Item 9.01. |

Financial Statements

and Exhibits. |

(d)

Exhibits.

*

Exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K. A copy of any omitted exhibit will be furnished supplementally

to the SEC upon request; provided, however, that the parties may request confidential treatment pursuant to Rule 24b-2 of the Exchange

Act for any document so furnished.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

BLINK CHARGING CO. |

| |

|

| Dated: November 3, 2023 |

By: |

/s/

Brendan S. Jones |

| |

Name: |

Brendan S. Jones |

| |

Title: |

President and Chief Executive Officer |

Exhibit

10.1

October

30, 2023

Harjinder

Bhade

VIA

EMAIL

Dear

Harjinder:

Blink

Charging Co., through its wholly owned subsidiary Blink Charging Inc., (the “Company”), is pleased to offer you the

position of Chief Technology Officer (“CTO”) starting today (the “Starting Date”). As CTO you will

be reporting to the Company’s Chief Executive Officer while working in San Jose, California (remote). Your appointment is subject

to approval by the Board and your compensation package, as outlined herein, is subject to the recommendation of the Compensation Committee

(“Compensation Committee”) and the approval of the Board. Upon signing this offer letter (the “Offer Letter”),

your offer letter dated April 20, 2021, will be replaced by this Offer Letter. Your new Base Salary and Annual Performance Cash Bonus

will be retroactive as of May 1st 2023.

Obligations.

During your employment, you shall devote your full business efforts and time to the Company. However, this obligation shall not preclude

you from engaging in appropriate civic, charitable or religious activities, or, with the consent of the Board, from serving on the boards

of directors of companies that are not competitors to the Company, as long as these activities do not materially interfere or conflict

with your responsibilities to, or your ability to perform your duties of employment at, the Company. Any outside activities must be in

compliance with and if required, approved by the Company’s Corporate Governance Guidelines.

Base

Salary. Your starting annual base salary will be $41,666 per month ($500,000 annually), less applicable taxes, deductions, and withholdings,

paid monthly and subject to annual review (“Base Salary”). This is an exempt position. You will be paid on the Company’s

regularly scheduled payday. The Company’s current regularly scheduled payday is on the 15th and 30th of every month.

Annual

Performance Cash Bonus. You, your supervisor and the Compensation Committee will collaborate annually to establish Key

Performance Indicators (“KPIs”). The KPIs list shall be attached to this Offer Letter as Appendix A.

Provided you achieve your established KPIs within the relevant timeframe, you will be eligible to receive an annual cash bonus in an

amount equal to 60% of your Base Salary, which currently amounts to $500,000 (“Annual Performance Cash Bonus”)

less applicable taxes, deductions, and withholdings, The Failure to establish KPI’s which is not the fault of the Compensation

Committee will exclude you from eligibility for the Annual Performance Cash Bonus. To qualify for the Annual Performance Cash Bonus,

you must meet or exceed the KPIs for the relevant 12-month period.

Previous

Supplemental Bonus. You remain eligible for the remaining balance ($500,000) of your Supplemental Bonus outlined in the appendix

of your previous contract.

Equity

Awards. As a “C” level executive of the Company, you will be entitled to receive equity awards (“Equity Awards”)

under the Company’s 2018 Incentive Compensation Plan, (the “Plan”). The aggregate annual award value under the

Plan will be equal to 60% of your Base Salary, as adjusted from time to time (the “Grant”). The Equity Awards will

be paid to you as follows: (i) fifty percent (50%) of such Grant will be in the form of Restricted Stock Units (the “RSUs”).

These RSUs shall vest on the first anniversary of the day they were granted. The remaining fifty percent (50%) of such Equity Awards

will be in the form of additional RSUs which will vest in equal one-third (1/3) increments on each anniversary of the date the Equity

Award is granted to you). All Equity Awards shall be granted to you, provided that: (1) at the end of each applicable vesting date, you

are still employed by the Company; and (2) provided that you satisfy the KPIs and other performance criteria established by the Plan.

All Equity Awards, including RSUs, Stock Options, future bonuses and future Equity Awards will be awarded on or about March 31st of each

year.

605

Lincoln Road, 5TH Floor

Miami Beach, FL 33139

Nasdaq:BLNK

|

|

(305)

521-0200

BlinkCharging.com

|

|

Signing

Bonus. Following your execution of this Offer Letter, the Company will grant you one hundred and fifty thousand (150,000) Restricted

Stock Units that shall vest immediately.

Clawbacks.

All bonuses and equity grants are subject to the Company’s “clawback” policies that may currently be in place or

may be adopted in the future, including any established under the Dodd-Frank Wall Street Reform and Consumer Protection Act.

Benefits.

At no cost to you, you and your family will participate in the Company’s current medical, dental, life and accident benefit

programs. Understandably, the Company may change those plans from time to time. In addition, if you drive an electric car or a “plug-in

hybrid” vehicle, the Company will pay you an additional $750 a month. The estimated value of medical benefits per employee annually

is $4,118.00, and per employee with family, $13,000.00.

Business

Expense Reimbursement. Upon presentation of appropriate documentation in accordance with the Company’s expense reimbursement

policies, the Company will reimburse you for the reasonable business expenses you incur in connection with your employment.

Paid

Time Off. You will accrue Paid Time Off, which you will be allowed to use for absences due to illness, vacation, or personal need,

at a rate of 240 hours, or twenty (30) days (based upon an eight-hour work day), per year.

Term

and Termination. The initial term shall be two (2) years commencing on your Employment Start Date (the “Term”).

On the second anniversary, your employment will be renewed automatically for an additional one-year term, unless the Company provides

you with a notice of non-renewal at least 30 days prior to the end of the Term.

Termination

by the Company for Cause. You may be terminated by the Company immediately and without notice for “Cause.” “Cause”

shall mean: (i) your willful material misconduct; or (ii) your willful failure to materially perform your responsibilities to the Company.

“Cause” shall be determined by the Company after conducting a meeting where you can be heard on the topic.

Termination

Without Cause. The Company may terminate your employment without Cause. Upon Termination Without Cause, the Company will (i) continue

payment of your Base Salary for an additional number of months equal to the number of months of your actual employment prior to the termination,

capped at 12 months maximum payment. If during the Term of your agreement you are Terminated Without Cause, all awarded RSUs will vest

within 30 days of your termination date. All other types of termination or resignation on your part, then all further vesting of your

outstanding equity awards or bonus will terminate immediately, and all payments of compensation by the Company to you hereunder will

terminate immediately (except as to amounts already earned). The foregoing is your sole entitlement to severance payments and benefits

in connection with the termination of your employment. In case of a buy-out or a “change of control” as this term is defined

in the Plan, you will be entitled to obtain your Base Salary for a period of 12 months as your severance payment.

Death

and Disability. In the event of your death during the Term, your employment shall terminate immediately. If, during the Term

you shall suffer a “Disability” within the meaning of Section 22(e)(3) of the Internal

Revenue Code of 1986, the Company may terminate your employment. In the event your employment is terminated due to death or Disability,

you (or your estate in case of death) shall be eligible to receive the separation benefits (in lieu of any severance payments): all unpaid

Base Salary amounts, and all outstanding and fully vested stock options and other equity awards.

605

Lincoln Road, 5TH Floor

Miami Beach, FL 33139

Nasdaq:BLNK

|

|

(305)

521-0200

BlinkCharging.com

|

|

Proprietary

Agreement and No Conflict with Prior Agreements. As an employee of the Company, it is likely that you will become knowledgeable about

confidential and/or proprietary information related to the operations, products, and services of the Company and its clients. Similarly,

you may have confidential or proprietary information from prior employers that must not be used or disclosed to anyone at the Company.

Therefore, you will be required to read, complete, and sign the Company’s standard Employee Confidentiality and Assignment of Inventions

Agreement (“Proprietary Agreement”) and the Proprietary Information Obligations Checklist and return it to the Company

on or prior to your Employment Start Date. In addition, the Company requests that you comply with any existing and/or continuing contractual

obligations that you may have with your former employers. By signing this offer letter, you represent that your employment with the Company

shall not breach any agreement you have with any third party.

Non-Compete.

During your employment and for twelve (12) months after termination for any reason, you agree not to engage in or support any business,

profession, or activity that competes with the Company’s business within a 60-mile radius from any Company location or your primary

work location. Exceptions apply if your employment ends without cause or if offered a non-competing position elsewhere. You agree to

protect the Company’s confidential information and refrain from soliciting its customers during this period. In consideration for

this covenant, your Base Salary was determined based on, among other things, your agreement not to compete with the Company during the

restricted period. You further agree that if this clause is found unenforceable, a court may modify it to the fullest extent allowed

by law.

Non-Solicitation.

During your employment with Company and for a period of twelve (12) months after the termination of your employment, for any reason,

you agree not to (i) directly or indirectly solicit, entice, or attempt to solicit or entice any customer or client of the Company for

whom you had substantial contact or responsibility during your employment with the Company, with the intent of providing products or

services that compete with those offered by the Company; (ii) directly or indirectly solicit, recruit, or attempt to solicit or recruit

any current employee of the Company to leave their employment with the Company. This non- solicitation obligation does not prohibit you

from responding to unsolicited inquiries or from general solicitations that are not directed specifically at customers or employees of

the Company. Violation of this non- solicitation clause may result in disciplinary action or legal remedies as permitted by law.

Non-Disparagement.

During and after your employment with the Company, you agree not to make any disparaging or negative statements, whether orally or in

writing, about the Company, its employees, products, services, or business practices. This includes, but is not limited to, comments

made on social media platforms, in public forums, or in private communications. This non-disparagement obligation does not prohibit you

from providing truthful information in response to legal inquiries, investigations, or as required by law. Violation of this non-disparagement

clause may result in disciplinary action or legal remedies as permitted by law.

Company

Policy Documents. As part of your onboarding process, you will be provided copies of the Company’s handbook which shall be

considered the terms and conditions of your employment, including the Confidentiality, Non-Disclosure, and IP Ownership Agreement (“Company

Documents”) all of which must be returned to the Company with signed consents and acknowledgments on or before your Employment

Start Date.

[signature

page follows]

605

Lincoln Road, 5TH Floor

Miami Beach, FL 33139

Nasdaq:BLNK

|

|

(305)

521-0200

BlinkCharging.com

|

|

This

offer of employment is conditioned upon the following: (i) you, executing this offer letter; (ii) you signing the Company Documents’

acknowledgment forms;

We

look forward to you joining the Company. Please indicate your acceptance of this offer by signing below and returning an executed copy

of this offer to me at your earliest convenience.

| |

Sincerely, |

| |

|

| |

/s/

Brendan Jones |

| |

Brendan

Jones |

| |

CEO

and President |

I

accept this offer of employment with Blink Charging, Co. and agree to the terms and conditions outlined in this letter.

| /s/

Harjinder Bhade |

|

10/30/2023 |

| Harjinder

Bhade |

|

Date |

605

Lincoln Road, 5TH Floor

Miami Beach, FL 33139

Nasdaq:BLNK

|

|

(305)

521-0200

BlinkCharging.com

|

|

Appendix

A

KPI

List

605

Lincoln Road, 5TH Floor

Miami Beach, FL 33139

Nasdaq:BLNK

|

|

(305)

521-0200

BlinkCharging.com

|

|

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

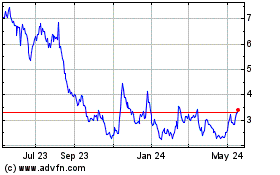

Blink Charging (NASDAQ:BLNK)

Historical Stock Chart

From Dec 2024 to Jan 2025

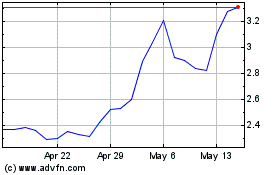

Blink Charging (NASDAQ:BLNK)

Historical Stock Chart

From Jan 2024 to Jan 2025