0001505732FALSE00015057322025-01-222025-01-22

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 22, 2025

Bankwell Financial Group, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Connecticut | 001-36448 | 20-8251355 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

258 Elm Street

New Canaan, Connecticut 06840

(203) 652-0166

(Address of Principal Executive Officers and Telephone Number)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of Each Class

| Trading Symbol(s)

| Name of Each Exchange on Which

Registered

|

Common Stock, no par value per share

| BWFG

| NASDAQ Global Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

| | | | | |

| Emerging growth company | ☐

|

| | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐

|

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition |

| | |

| | On January 22, 2025, Bankwell Financial Group, Inc., the holding company for Bankwell Bank, issued a press release describing its results of operations for the period ended December 31, 2024. A copy of the press release is included as Exhibit 99.1 to this current report on Form 8-K and is incorporated herein by reference.

|

| |

| The information furnished under this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or subject to the liabilities of that section. The information shall not be deemed incorporated by reference into any other filing with the Securities and Exchange Commission made by the Company, regardless of any general incorporation language in such filing.

|

| | |

| Item 5.02 | Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers |

| |

| Matthew McNeill, age 49, was elected to President of Bankwell Bank (the "Bank") and Bankwell Financial Group, Inc. (the "Company") as of January 22, 2025.

Mr. McNeill joined the Company in 2020 as Executive Vice President and Chief Banking Officer. He has more than 20 years of experience in Commercial Banking. Prior to joining Bankwell, he served as Head of Commercial Lending at Metropolitan Commercial Bank, Mr. McNeill has additionally held lending roles at HSBC Bank US and Banco Santander.

There are no family relationships between Mr. McNeill and any director or executive officer, or any arrangements or understandings between Mr. McNeill and the Company or any other person, pursuant to which he was appointed President of the Bank and the Company.

Mr. McNeill is party to an employment contract with the Company and the Bank that expires December 31, 2026, the terms of which are described in the proxy statement for the Company’s 2024 annual shareholders meeting, and is eligible to participate in the Company’s annual and long-term incentive programs for senior executives as well as all general employee benefit plans maintained by the Company. Neither the Company nor the Bank entered into any new contract or arrangement with Mr. McNeill in connection with his appointment as President of the Bank and the Company.

|

| |

| Item 7.01 | Regulation FD Disclosure |

| | |

| | On January 22, 2025, Bankwell Financial Group, Inc., the holding company for Bankwell Bank, issued slide presentation material, which includes among other things, a review of financial results and trends through the period ended December 31, 2024. A copy of the material will also be available on the Company’s website, https://investor.mybankwell.com/events-and-presentations/ A copy of the Presentation Material is included as Exhibit 99.2 to this current report on Form 8-K and is incorporated herein by reference. |

| |

| The information furnished under this Item 7.01, including Exhibit 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or subject to the liabilities of that section. The information shall not be deemed incorporated by reference into any other filing with the Securities and Exchange Commission made by the Company, regardless of any general incorporation language in such filing.

|

| |

| |

| |

| |

| |

| |

| |

| | | | | |

| Item 8.01 | Other Events |

| |

| | Quarterly Dividend Announcement

On January 22, 2025, Bankwell Financial Group, Inc. (the Company), parent company of Bankwell Bank, announced that on January 22, 2025, its Board of Directors voted to pay a quarterly dividend in the amount of $0.20 per share on February 21, 2025 to all shareholders of record as of February 11, 2025.

|

| |

| Item 9.01 | Financial Statements and Exhibits |

| (a) | Not applicable. |

| (b) | Not applicable. |

| (c) | Not applicable. |

| (d) | Exhibits. |

| | | | | |

| Exhibit Number | Description |

| | |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| | | | | |

| SIGNATURES |

| | |

| Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. |

| | |

| | BANKWELL FINANCIAL GROUP, INC. |

| | Registrant |

| | |

| | |

| | |

January 22, 2025 | By: /s/ Courtney E. Sacchetti |

| | Courtney E. Sacchetti |

| | Executive Vice President |

| | and Chief Financial Officer |

BANKWELL FINANCIAL GROUP REPORTS OPERATING RESULTS FOR THE FOURTH QUARTER, DECLARES FIRST QUARTER DIVIDEND

New Canaan, CT – January 22, 2025 – Bankwell Financial Group, Inc. (NASDAQ: BWFG) reported GAAP net income of $2.5 million, or $0.32 per share for the fourth quarter of 2024, versus $1.9 million, or $0.24 per share, for the third quarter of 2024. The Company's Board of Directors declared a $0.20 per share cash dividend, payable February 21, 2025 to shareholders of record on February 11, 2025.

Pre-tax, pre-provision net revenue (PPNR) of $7.9 million, or $1.02 per share, fell 12% relative to the third quarter of 2024 of $9.0 million, or $1.17 per share.

Discussion of Outlook; Bankwell Financial Group Chief Executive Officer, Christopher R. Gruseke:

"Results for the fourth quarter of 2024 include $3.0 million in charge-offs. The main components of these charge offs are discussed in this earnings release as well as in our Investor Presentation. As of January 22, 2025, however, the Company has executed purchase and sale agreements on two nonperforming assets, totaling $35.4 million. These sales will reduce the reported nonperforming assets as a percentage of total assets of 1.88% reported as of December 31, 2024 by 108 basis points upon final disposition early in the first quarter with no further impact to the Company’s financial results. We look forward to further reductions in nonperforming assets in the quarters ahead. We have also made significant progress in reducing CRE exposure. The Company’s CRE concentration as a percentage of total risked based capital stood at 375% at year-end 2024 versus 397% at year-end 2023, and 425% at year-end 2022.

Regarding our liability sensitive balance sheet, $1.3 billion of time deposits are due to re-price at lower rates in the next 12 months. These deposits alone will contribute approximately $4.4 million on an annualized basis to net interest income. This repricing assumes no further actions by the Fed. With approximately $500 million in loans maturing in the year ahead, net interest margin could further benefit by an additional 15-20 basis points on an annualized basis.

After investing in robust infrastructure and risk management in 2024, the Company’s new SBA lending division has begun to originate loans in the first quarter of 2025. Given stable market conditions, we expect material growth in noninterest income attributable to future gains on sale of the guaranteed portions of the new SBA loans.

Given the above, we are guiding to $93-$95 million in net interest income and $7-$8 million in noninterest income, as well as a $56-$57 million spend in noninterest expense for the full year 2025.

On behalf of the Company’s Board of Directors, I’d also like to congratulate Matt McNeill on his promotion to President of Bankwell Financial Group and its wholly owned subsidiary, Bankwell Bank. We salute Matt for a job well done."

Key Points for Fourth Quarter and Bankwell’s Outlook

Brokered Deposits Decrease, Liability Sensitive Balance Sheet.

•Brokered deposits declined $78.4 million in the fourth quarter of 2024 and have decreased by $246.8 million since December 31, 2023.

•Reported net interest margin was 2.60%, down 12 basis points from the third quarter of 2024, primarily due to lower loan fees and elevated cash balances. Total deposit costs of 3.72% declined 9 basis points from the third quarter of 2024.

•With $1.3 billion of time deposits maturing in the next 12 months at a weighted average rate of 4.79%, the Company anticipates an annualized reduction in funding costs of $4.4 million, given current market pricing. This translates into approximately $0.44 of incremental EPS, or approximately 14 basis points of increase to the net interest margin, assuming no further changes to Fed Funds and stable asset yields.

•The Company anticipates $0.5 billion of loans to reprice or mature over the same period, which could further benefit net interest margin by an additional 15 to 20 basis points on an annualized basis.

Credit Trends Stable, Material Improvement Expected in Early 2025.

•The Company disposed of a previously disclosed non-performing C&I loan (pediatric dental practice), recognizing a $0.7 million charge off and reducing non-performing loan balances by $1.7 million during the quarter.

•The Company took possession of the collateral securing a non-performing construction loan, creating a $8.3 million Other Real Estate Owned (“OREO”) asset. The Company recorded a $1.2 million charge off and incurred $0.7 million in OREO expenses during the quarter. Subsequent to December 31, 2024, the Company executed an agreement to sell the property at book value.

•During the third quarter of 2024, a $27.1 million multifamily commercial real estate loan was put on nonperforming status. Subsequent to December 31, 2024, the Company executed a signed purchase agreement for the sale of this loan at par value. As of December 31, 2024, this loan comprised 83 basis points of the 1.88% nonperforming assets as a percentage of total assets.

Ongoing Investments with Continued Focus on Efficiency.

•The Company launched an SBA Lending division, which began originating loans in December of 2024.

•The Company continues to grow Bankwell Direct, our digital deposit channel. Bankwell Direct balances have increased to $136 million as of December 31, 2024.

•The Company continues to operate efficiently with a non-interest expense to average asset ratio of 1.63% for the quarter ended December 31, 2024.

Fourth Quarter 2024 Financial Highlights and Key Performance Indicators (KPIs):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| December 31,

2024 | | September 30,

2024 | | June 30,

2024 | | March 31,

2024 | | December 31,

2023 | | |

Return on average assets(1)(6) | 0.31 | % | | 0.24 | % | | 0.14 | % | | 0.47 | % | | 1.03 | % | | |

Pre-tax, pre-provision net revenue return on average assets(1)(6) | 0.98 | % | | 1.13 | % | | 1.22 | % | | 1.10 | % | | 1.27 | % | | |

Return on average shareholders' equity(1)(6) | 3.68 | % | | 2.83 | % | | 1.65 | % | | 5.59 | % | | 12.82 | % | | |

Net interest margin(1)(6) | 2.60 | % | | 2.72 | % | | 2.75 | % | | 2.71 | % | | 2.81 | % | | |

Efficiency Ratio(1)(3) | 59.2 | % | | 58.8 | % | | 55.9 | % | | 60.3 | % | | 55.0 | % | | |

Noninterest expense to average assets(1)(6) | 1.63 | % | | 1.62 | % | | 1.55 | % | | 1.66 | % | | 1.56 | % | | |

Net loan charge-offs as a percentage of average loans(1)(6) | 0.11 | % | | 0.56 | % | | 0.01 | % | | 0.11 | % | | 0.01 | % | | |

Dividend payout(1)(4) | 62.50 | % | | 82.30 | % | | 142.86 | % | | 41.67 | % | | 18.35 | % | | |

Fully diluted tangible book value per common share(1)(2) | $ | 34.03 | | | $ | 33.76 | | | $ | 33.61 | | | $ | 33.57 | | | $ | 33.39 | | | |

Total capital to risk-weighted assets(1)(5) | 12.67 | % | | 12.83 | % | | 12.98 | % | | 12.63 | % | | 12.32 | % | | |

Total common equity tier 1 capital to risk-weighted assets(1)(5) | 11.61 | % | | 11.80 | % | | 11.73 | % | | 11.60 | % | | 11.30 | % | | |

Tier I Capital to Average Assets(1)(5) | 10.07 | % | | 10.24 | % | | 10.17 | % | | 10.09 | % | | 9.81 | % | | |

Tangible common equity to tangible assets(1)(2) | 8.19 | % | | 8.40 | % | | 8.42 | % | | 8.42 | % | | 8.19 | % | | |

| Earnings per common share - diluted | $ | 0.32 | | | $ | 0.24 | | | $ | 0.14 | | | $ | 0.48 | | | $ | 1.09 | | | |

| Common shares issued and outstanding | 7,859,873 | | | 7,858,573 | | | 7,866,499 | | | 7,908,180 | | | 7,882,616 | | | |

(1) Non-GAAP Financial Measure, refer to the "Non-GAAP Financial Measures" section of this document for additional detail.

(2) Refer to the "Reconciliation of GAAP to Non-GAAP Measures" section of this document for additional detail.

(3) Efficiency ratio is defined as noninterest expense, less other real estate owned expenses and amortization of intangible assets, divided by our operating revenue, which is equal to net interest income plus noninterest income excluding gains and losses on sales of securities and gains and losses on other real estate owned. In our judgment, the adjustments made to operating revenue allow investors and analysts to better assess our operating expenses in relation to our core operating revenue by removing the volatility that is associated with certain one-time items and other discrete items that are unrelated to our core business.

(4) The dividend payout ratio is calculated by dividing dividends per share by earnings per share.

(5) Represents Bank ratios. Current period capital ratios are preliminary subject to finalization of the FDIC Call Report.

(6) Return on average assets is calculated by dividing annualized net income by average assets. Pre-tax, pre-provision net revenue return on average is calculated by dividing PPNR (using the "Pre-Tax, Pre-Provision Net Revenue (PPNR)) section of this document by average assets. Return on average shareholders' equity is calculated by dividing annualized net income by average shareholders' equity. Net interest margin is calculated by dividing average annualized net interest income by average total earning assets. Noninterest expense to average assets is calculated by dividing annualized noninterest expense by average total assets. Net loan charge-offs as a percentage of average loans is calculated by dividing net loan (charge offs) recoveries by average total loans.

Pre-Tax, Pre-Provision Net Revenue(1) ("PPNR")

PPNR for the quarter and year ended December 31, 2024, were $7.9 million and $35.4 million, respectively, a decrease of 24.6% and 27.7%, respectively, from the $10.5 million and $48.9 million recognized for the quarter and year ended December 31, 2023, respectively.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Quarter Ended | For the Year Ended |

| (Dollars in thousands) | December 31,

2024 | | September 30,

2024 | | June 30,

2024 | | March 31,

2024 | | December 31,

2023 | | | | December 31,

2024 | | December 31,

2023 |

| Net interest income | $ | 20,199 | | | $ | 20,717 | | | $ | 21,219 | | | $ | 21,147 | | | $ | 22,245 | | | | | $ | 83,282 | | | $ | 94,468 | |

| Total noninterest income | 964 | | | 1,156 | | | 683 | | | 915 | | | 1,129 | | | | | 3,718 | | | 4,842 | |

| Total revenues | 21,163 | | | 21,873 | | | 21,902 | | | 22,062 | | | 23,374 | | | | | 87,000 | | | 99,310 | |

| Total noninterest expense | 13,243 | | | 12,865 | | | 12,245 | | | 13,297 | | | 12,864 | | | | | 51,650 | | | 50,401 | |

| PPNR | $ | 7,920 | | | $ | 9,008 | | | $ | 9,657 | | | $ | 8,765 | | | $ | 10,510 | | | | | $ | 35,350 | | | $ | 48,909 | |

(1) Non-GAAP Financial Measure, refer to the "Non-GAAP Financial Measures" section of this document for additional detail.

•Revenues (net interest income plus noninterest income) for the quarter ended December 31, 2024 were $21.2 million, versus $23.4 million for the quarter ended December 31, 2023. The decrease in revenues for the quarter ended December 31, 2024 was mainly attributable to lower fees on loans. Revenues for the year ended December 31, 2024 were $87.0 million, versus $99.3 million for the year ended December 31, 2023. The decrease in revenues for the year ended December 31, 2024 was attributable to an increase in interest expense on deposits and lower gains from loan sales, partially offset by an increase in interest and fees on loans due to higher loan yields and prepayment fees.

•The net interest margin (fully taxable equivalent basis) for the quarters ended December 31, 2024 and December 31, 2023 was 2.60% and 2.81%, respectively. The decrease in the net interest margin was due to an increase in funding costs.

•Total non-interest expense of $13.2 million increased 2.9% compared to the third quarter which was mainly driven by an increase in OREO expenses.

Allowance for Credit Losses - Loans ("ACL-Loans")

The ACL-Loans was $29.0 million as of December 31, 2024 compared to $27.9 million as of December 31, 2023. The ACL-Loans as a percentage of total loans was 1.07% as of December 31, 2024 compared to 1.03% as of December 31, 2023.

Provision for credit losses was $4.5 million for the quarter ended December 31, 2024. The increase in the provision for credit losses for the quarter was primarily due to charge-offs of $3.0 million, including a $1.2 million charge off taken on a Construction loan transferred to OREO during the quarter.

Total nonperforming loans decreased $12.3 million to $53.3 million as of December 31, 2024 when compared to the previous quarter. The decrease was primarily due to an $8.8 million construction loan transferred to OREO, the disposition of a C&I loan (pediatric dental practice) of $1.7 million, and a charge off to a commercial real estate loan of $1.1 million in the fourth quarter of 2024. Nonperforming assets as a percentage of total assets increased to 1.88% at December 31, 2024 from 1.53% at December 31, 2023.

BANKWELL FINANCIAL GROUP, INC.

ASSET QUALITY (unaudited)

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Quarter Ended |

| December 31,

2024 | | September 30,

2024 | | June 30,

2024 | | March 31,

2024 | | December 31,

2023 | | |

| ACL-Loans: | | | | | | | | | | | |

| Balance at beginning of period | $ | 27,752 | | | $ | 36,083 | | | $ | 27,991 | | | $ | 27,946 | | | $ | 29,284 | | | |

| Charge-offs: | | | | | | | | | | | |

| Residential real estate | — | | | — | | | (9) | | | (132) | | | — | | | |

| Commercial real estate | (1,100) | | | (8,184) | | | (522) | | | (3,306) | | | (824) | | | |

| Commercial business | (703) | | | (7,010) | | | — | | | (197) | | | — | | | |

| Consumer | (5) | | | (17) | | | (12) | | | (49) | | | (15) | | | |

| Construction | (1,155) | | | (616) | | | — | | | — | | | — | | | |

| Total charge-offs | (2,963) | | | (15,827) | | | (543) | | | (3,684) | | | (839) | | | |

| Recoveries: | | | | | | | | | | | |

| Residential real estate | — | | | — | | | 141 | | | — | | | — | | | |

| Commercial real estate | — | | | 1,013 | | | 113 | | | — | | | — | | | |

| Commercial business | 4 | | | (34) | | | — | | | 27 | | | 464 | | | |

| Consumer | 5 | | | 1 | | | 13 | | | 4 | | | 3 | | | |

| Construction | — | | | — | | | — | | | — | | | — | | | |

| Total recoveries | 9 | | | 980 | | | 267 | | | 31 | | | 467 | | | |

| Net loan (charge-offs) recoveries | (2,954) | | | (14,847) | | | (276) | | | (3,653) | | | (372) | | | |

| Provision (credit) for credit losses - loans | 4,209 | | | 6,516 | | | 8,368 | | | 3,698 | | | (966) | | | |

| Balance at end of period | $ | 29,007 | | | $ | 27,752 | | | $ | 36,083 | | | $ | 27,991 | | | $ | 27,946 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of |

| December 31,

2024 | | September 30,

2024 | | June 30,

2024 | | March 31,

2024 | | December 31,

2023 | | |

| Asset quality: | | | | | | | | | | | |

| Nonaccrual loans | | | | | | | | | | | |

| Residential real estate | $ | 791 | | | $ | 1,316 | | | $ | 1,339 | | | $ | 1,237 | | | $ | 1,386 | | | |

| Commercial real estate | 44,814 | | | 46,360 | | | 28,088 | | | 19,083 | | | 23,009 | | | |

| Commercial business | 7,672 | | | 9,101 | | | 17,396 | | | 16,841 | | | 15,430 | | | |

| Construction | — | | | 8,766 | | | 9,382 | | | 9,382 | | | 9,382 | | | |

| Consumer | — | | | — | | | — | | | — | | | — | | | |

| Total nonaccrual loans | 53,277 | | | 65,543 | | | 56,205 | | | 46,543 | | | 49,207 | | | |

| Other real estate owned | 8,299 | | | — | | | — | | | — | | | — | | | |

| Total nonperforming assets | $ | 61,576 | | | $ | 65,543 | | | $ | 56,205 | | | $ | 46,543 | | | $ | 49,207 | | | |

| | | | | | | | | | | |

| Nonperforming loans as a % of total loans | 1.97 | % | | 2.42 | % | | 2.12 | % | | 1.74 | % | | 1.81 | % | | |

| Nonperforming assets as a % of total assets | 1.88 | % | | 2.01 | % | | 1.79 | % | | 1.48 | % | | 1.53 | % | | |

| ACL-loans as a % of total loans | 1.07 | % | | 1.07 | % | | 1.36 | % | | 1.04 | % | | 1.03 | % | | |

| ACL-loans as a % of nonperforming loans | 54.44 | % | | 44.26 | % | | 64.20 | % | | 60.14 | % | | 56.79 | % | | |

| Total past due loans to total loans | 1.63 | % | | 2.40 | % | | 0.84 | % | | 1.44 | % | | 0.78 | % | | |

Financial Condition & Capital

Assets totaled $3.3 billion at December 31, 2024, an increase of $53.1 million, or 1.7% compared to December 31, 2023. Gross loans totaled $2.7 billion at December 31, 2024, a decrease of $12.7 million, or 0.5% compared to December 31, 2023. Deposits totaled $2.8 billion at December 31, 2024, an increase of $50.8 million, or 1.9% compared to December 31, 2023. Brokered deposits have decreased $246.8 million or 25.9%, when compared to December 31, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Period End Loan Composition | December 31, 2024 | | September 30, 2024 | | December 31, 2023 | |

Current QTD

% Change | | YTD

% Change |

| Residential Real Estate | $ | 42,766 | | | $ | 45,553 | | | $ | 50,931 | | | (6.1) | % | | (16.0) | % |

Commercial Real Estate(1) | 1,899,134 | | | 1,887,942 | | | 1,947,648 | | | 0.6 | | | (2.5) | |

| Construction | 173,555 | | | 160,292 | | | 183,414 | | | 8.3 | | | (5.4) | |

| Total Real Estate Loans | 2,115,455 | | | 2,093,787 | | | 2,181,993 | | | 1.0 | | | (3.0) | |

| | | | | | | | | |

| Commercial Business | 515,125 | | | 490,292 | | | 500,569 | | | 5.1 | | | 2.9 | |

| | | | | | | | | |

| Consumer | 75,308 | | | 39,126 | | | 36,045 | | | 92.5 | | | 108.9 | |

| Total Loans | $ | 2,705,888 | | | $ | 2,623,205 | | | $ | 2,718,607 | | | 3.2 | % | | (0.5) | % |

| | | | | | | | | |

| (1) Includes owner occupied commercial real estate of $0.7 billion at December 31, 2024, September 30, 2024, and December 31, 2023, respectively. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Period End Deposit Composition | December 31, 2024 | | September 30, 2024 | | December 31, 2023 | |

Current QTD

% Change | | YTD

% Change |

| Noninterest bearing demand | $ | 321,875 | | | $ | 295,552 | | | $ | 346,172 | | | 8.9 | % | | (7.0) | % |

| NOW | 105,090 | | | 76,413 | | | 90,829 | | | 37.5 | | | 15.7 | |

| Money Market | 899,413 | | | 840,234 | | | 887,352 | | | 7.0 | | | 1.4 | |

| Savings | 90,220 | | | 87,212 | | | 97,331 | | | 3.4 | | | (7.3) | |

| Time | 1,370,972 | | | 1,388,760 | | | 1,315,073 | | | (1.3) | | | 4.3 | |

| Total Deposits | $ | 2,787,570 | | | $ | 2,688,171 | | | $ | 2,736,757 | | | 3.7 | % | | 1.9 | % |

Shareholders’ equity totaled $270.1 million as of December 31, 2024, an increase of $4.3 million compared to December 31, 2023, primarily a result of net income of $9.3 million for the year ended December 31, 2024. The increase was partially offset by dividends paid of $6.3 million.

The Company's capital position was generally stable during the fourth quarter, with total risk-based capital, common-equity tier 1 capital and leverage ratios at 12.67%, 11.61%, and 10.07%, respectively, at December 31, 2024. The Company repurchased 85,990 shares at a weighted average price of $24.82 per share for the year ended December 31, 2024.

We recommend reading this earnings release in conjunction with the Fourth Quarter 2024 Investor Presentation, located at https://investor.mybankwell.com/events-and-presentations/ and included as an exhibit to our January 22, 2025 Current Report on Form 8-K.

Conference Call

Bankwell will host a conference call to discuss the Company’s financial results and business outlook on January 23, 2025, at 10:00 a.m. E.T. The call will be accessible by telephone and webcast using https://investor.mybankwell.com/events-and-presentations/. A supplementary slide presentation will be posted to the website prior to the event, and a replay will be available for 12 months following the event.

About Bankwell Financial Group

Bankwell Financial Group, Inc. is the holding company for Bankwell Bank ("Bankwell"), a full-service commercial bank headquartered in New Canaan, CT. Bankwell offers its customers unmatched accessibility, expertise, and responsiveness through a range of commercial financing products including working capital lines of credit, SBA loans, acquisition loans, and commercial mortgages as well as treasury management and deposit services.

For more information about this press release, interested parties may contact Christopher R. Gruseke, Chief Executive Officer or Courtney E. Sacchetti, Executive Vice President and Chief Financial Officer of Bankwell Financial Group at (203) 652-0166 or at ir@mybankwell.com.

For more information, visit www.mybankwell.com.

This press release may contain certain forward-looking statements about the Company. Forward-looking statements include statements regarding anticipated future events and can be identified by the fact that they do not relate strictly to historical or current facts. They often include words such as “believe,” “expect,” “anticipate,” “estimate,” and “intend” or future or conditional verbs such as “will,” “would,” “should,” “could,” or “may.” Forward-looking statements, by their nature, are subject to risks and uncertainties. Certain factors that could cause actual results to differ materially from expected results include increased competitive pressures, changes in the interest rate environment, general economic conditions or conditions within the banking industry or securities markets, and legislative and regulatory changes that could adversely affect the business in which the Company and its subsidiaries are engaged.

Non-GAAP Financial Measures

In addition to evaluating the Company's financial performance in accordance with U.S. generally accepted accounting principles ("GAAP"), management may evaluate certain non-GAAP financial measures, such as the efficiency ratio. A computation and reconciliation of certain non-GAAP financial measures used for these purposes is contained in the accompanying Reconciliation of GAAP to Non-GAAP Measures tables. We believe that providing certain non-GAAP financial measures provides investors with information useful in understanding our financial performance, our performance trends and financial position. For example, the Company believes that the efficiency ratio is useful in the assessment of financial performance, including noninterest expense control. The Company believes that tangible common equity, tangible assets, tangible common equity to tangible assets, tangible common shareholders' equity, fully diluted tangible book value per common share, operating revenue, efficiency ratio, noninterest expense to average assets, average tangible common equity, annualized return on average tangible common equity, return on average assets, return on average shareholders' equity, pre-tax, pre-provision net revenue, net interest margin, net loan charge-offs as a percentage of average loans, pre-tax, pre-provision net revenue on average assets, and the dividend payout ratio are useful to evaluate the relative strength of the Company's performance and capital position. We utilize these measures for internal planning and forecasting purposes. These non-GAAP financial measures should not be considered a substitute for GAAP basis measures and results, and we strongly encourage investors to review our consolidated financial statements in their entirety and not to rely on any single financial measure.

BANKWELL FINANCIAL GROUP, INC.

CONSOLIDATED BALANCE SHEETS (unaudited)

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| December 31,

2024 | | September 30,

2024 | | June 30,

2024 | | March 31,

2024 | | December 31,

2023 | | |

| ASSETS | | | | | | | | | | | |

| Cash and due from banks | $ | 293,552 | | | $ | 275,829 | | | $ | 234,277 | | | $ | 245,043 | | | $ | 267,521 | | | |

| Federal funds sold | 13,972 | | | 15,508 | | | 17,103 | | | 2,584 | | | 1,636 | | | |

| Cash and cash equivalents | 307,524 | | | 291,337 | | | 251,380 | | | 247,627 | | | 269,157 | | | |

| | | | | | | | | | | |

| Investment securities | | | | | | | | | | | |

| Marketable equity securities, at fair value | 2,118 | | | 2,148 | | | 2,079 | | | 2,069 | | | 2,070 | | | |

| Available for sale investment securities, at fair value | 107,428 | | | 108,866 | | | 107,635 | | | 108,417 | | | 109,736 | | | |

| Held to maturity investment securities, at amortized cost | 36,553 | | | 34,886 | | | 28,286 | | | 15,739 | | | 15,817 | | | |

| Total investment securities | 146,099 | | | 145,900 | | | 138,000 | | | 126,225 | | | 127,623 | | | |

| Loans receivable (net of ACL-Loans of $29,007, $27,752, $36,083, $27,991, and $27,946 at December 31, 2024, September 30, 2024, June 30, 2024, March 31, 2024, and December 31, 2023, respectively) | 2,672,959 | | | 2,591,551 | | | 2,616,691 | | | 2,646,686 | | | 2,685,301 | | | |

| Accrued interest receivable | 14,535 | | | 14,714 | | | 14,675 | | | 15,104 | | | 14,863 | | | |

| Federal Home Loan Bank stock, at cost | 5,655 | | | 5,655 | | | 5,655 | | | 5,655 | | | 5,696 | | | |

| Premises and equipment, net | 23,856 | | | 24,780 | | | 25,599 | | | 26,161 | | | 27,018 | | | |

| Bank-owned life insurance | 52,791 | | | 52,443 | | | 52,097 | | | 51,764 | | | 51,435 | | | |

| Goodwill | 2,589 | | | 2,589 | | | 2,589 | | | 2,589 | | | 2,589 | | | |

| Deferred income taxes, net | 9,742 | | | 9,300 | | | 11,345 | | | 9,137 | | | 9,383 | | | |

| Other real estate owned | 8,299 | | | — | | | — | | | — | | | — | | | |

| Other assets | 24,571 | | | 22,811 | | | 23,623 | | | 24,326 | | | 22,417 | | | |

| Total assets | $ | 3,268,620 | | | $ | 3,161,080 | | | $ | 3,141,654 | | | $ | 3,155,274 | | | $ | 3,215,482 | | | |

| | | | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | |

| Deposits | | | | | | | | | | | |

| Noninterest bearing deposits | $ | 321,875 | | | $ | 295,552 | | | $ | 328,475 | | | $ | 376,248 | | | $ | 346,172 | | | |

| Interest bearing deposits | 2,465,695 | | | 2,392,619 | | | 2,333,900 | | | 2,297,274 | | | 2,390,585 | | | |

| Total deposits | 2,787,570 | | | 2,688,171 | | | 2,662,375 | | | 2,673,522 | | | 2,736,757 | | | |

| | | | | | | | | | | |

| Advances from the Federal Home Loan Bank | 90,000 | | | 90,000 | | | 90,000 | | | 90,000 | | | 90,000 | | | |

| Subordinated debentures | 69,451 | | | 69,389 | | | 69,328 | | | 69,266 | | | 69,205 | | | |

| Accrued expenses and other liabilities | 51,536 | | | 45,594 | | | 52,975 | | | 54,454 | | | 53,768 | | | |

| Total liabilities | 2,998,557 | | | 2,893,154 | | | 2,874,678 | | | 2,887,242 | | | 2,949,730 | | | |

| | | | | | | | | | | |

| Shareholders’ equity | | | | | | | | | | | |

| Common stock, no par value | 119,108 | | | 118,429 | | | 118,037 | | | 118,401 | | | 118,247 | | | |

| Retained earnings | 152,199 | | | 151,257 | | | 150,895 | | | 151,350 | | | 149,169 | | | |

| Accumulated other comprehensive (loss) | (1,244) | | | (1,760) | | | (1,956) | | | (1,719) | | | (1,664) | | | |

| Total shareholders’ equity | 270,063 | | | 267,926 | | | 266,976 | | | 268,032 | | | 265,752 | | | |

| | | | | | | | | | | |

| Total liabilities and shareholders’ equity | $ | 3,268,620 | | | $ | 3,161,080 | | | $ | 3,141,654 | | | $ | 3,155,274 | | | $ | 3,215,482 | | | |

BANKWELL FINANCIAL GROUP, INC.

CONSOLIDATED STATEMENTS OF INCOME (unaudited)

(Dollars in thousands, except share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Quarter Ended | For the Year Ended |

| December 31,

2024 | | September 30,

2024 | | June 30,

2024 | | March 31,

2024 | | December 31,

2023 | | | | December 31,

2024 | | December 31,

2023 |

| Interest and dividend income | | | | | | | | | | | | | | | |

| Interest and fees on loans | $ | 42,851 | | | $ | 43,596 | | | $ | 43,060 | | | $ | 43,325 | | | $ | 44,122 | | | | | $ | 172,832 | | | $ | 170,181 | |

| Interest and dividends on securities | 1,482 | | | 1,390 | | | 1,190 | | | 1,130 | | | 1,108 | | | | | 5,192 | | | 4,126 | |

| Interest on cash and cash equivalents | 3,510 | | | 3,205 | | | 3,429 | | | 3,826 | | | 4,164 | | | | | 13,970 | | | 14,147 | |

| Total interest and dividend income | 47,843 | | | 48,191 | | | 47,679 | | | 48,281 | | | 49,394 | | | | | 191,994 | | | 188,454 | |

| | | | | | | | | | | | | | | |

| Interest expense | | | | | | | | | | | | | | | |

| Interest expense on deposits | 25,640 | | | 25,579 | | | 24,677 | | | 25,362 | | | 25,307 | | | | | 101,258 | | | 86,906 | |

| Interest expense on borrowings | 2,004 | | | 1,895 | | | 1,783 | | | 1,772 | | | 1,842 | | | | | 7,454 | | | 7,080 | |

| Total interest expense | 27,644 | | | 27,474 | | | 26,460 | | | 27,134 | | | 27,149 | | | | | 108,712 | | | 93,986 | |

| | | | | | | | | | | | | | | |

| Net interest income | 20,199 | | | 20,717 | | | 21,219 | | | 21,147 | | | 22,245 | | | | | 83,282 | | | 94,468 | |

| Provision (credit) for credit losses | 4,458 | | | 6,296 | | | 8,183 | | | 3,683 | | | (960) | | | | | 22,620 | | | 866 | |

| Net interest income after provision (credit) for credit losses | 15,741 | | | 14,421 | | | 13,036 | | | 17,464 | | | 23,205 | | | | | 60,662 | | | 93,602 | |

| | | | | | | | | | | | | | | |

| Noninterest income | | | | | | | | | | | | | | | |

| Bank owned life insurance | 348 | | | 346 | | | 333 | | | 329 | | | 316 | | | | | 1,356 | | | 1,192 | |

| Service charges and fees | 589 | | | 575 | | | 495 | | | 304 | | | 688 | | | | | 1,963 | | | 1,629 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Gains and fees from sales of loans | 24 | | | 133 | | | 45 | | | 321 | | | 79 | | | | | 523 | | | 1,972 | |

| Other | 3 | | | 102 | | | (190) | | | (39) | | | 46 | | | | | (124) | | | 49 | |

| Total noninterest income | 964 | | | 1,156 | | | 683 | | | 915 | | | 1,129 | | | | | 3,718 | | | 4,842 | |

| | | | | | | | | | | | | | | |

| Noninterest expense | | | | | | | | | | | | | | | |

| Salaries and employee benefits | 5,656 | | | 6,223 | | | 6,176 | | | 6,291 | | | 6,088 | | | | | 24,346 | | | 24,595 | |

| Occupancy and equipment | 2,600 | | | 2,334 | | | 2,238 | | | 2,322 | | | 2,231 | | | | | 9,494 | | | 8,665 | |

| Professional services | 1,286 | | | 1,142 | | | 989 | | | 1,065 | | | 1,033 | | | | | 4,482 | | | 3,538 | |

| Data processing | 905 | | | 851 | | | 755 | | | 740 | | | 747 | | | | | 3,251 | | | 2,888 | |

| Director fees | 342 | | | 292 | | | 306 | | | 900 | | | 605 | | | | | 1,840 | | | 1,812 | |

| FDIC insurance | 862 | | | 853 | | | 705 | | | 930 | | | 1,026 | | | | | 3,350 | | | 4,164 | |

| Marketing | 175 | | | 73 | | | 90 | | | 114 | | | 139 | | | | | 452 | | | 651 | |

| | | | | | | | | | | | | | | |

| Other | 1,417 | | | 1,097 | | | 986 | | | 935 | | | 995 | | | | | 4,435 | | | 4,088 | |

| Total noninterest expense | 13,243 | | | 12,865 | | | 12,245 | | | 13,297 | | | 12,864 | | | | | 51,650 | | | 50,401 | |

| | | | | | | | | | | | | | | |

| Income before income tax expense | 3,462 | | | 2,712 | | | 1,474 | | | 5,082 | | | 11,470 | | | | | 12,730 | | | 48,043 | |

| Income tax expense | 955 | | | 786 | | | 356 | | | 1,319 | | | 2,946 | | | | | 3,416 | | | 11,380 | |

| Net income | $ | 2,507 | | | $ | 1,926 | | | $ | 1,118 | | | $ | 3,763 | | | $ | 8,524 | | | | | $ | 9,314 | | | $ | 36,663 | |

| | | | | | | | | | | | | | | |

| Earnings Per Common Share: | | | | | | | | | | | | | | | |

| Basic | $ | 0.32 | | | $ | 0.24 | | | $ | 0.14 | | | $ | 0.48 | | | $ | 1.09 | | | | | $ | 1.18 | | | $ | 4.71 | |

| Diluted | $ | 0.32 | | | $ | 0.24 | | | $ | 0.14 | | | $ | 0.48 | | | $ | 1.09 | | | | | $ | 1.17 | | | $ | 4.67 | |

| | | | | | | | | | | | | | | |

| Weighted Average Common Shares Outstanding: | | | | | | | | | | | | | | | |

| Basic | 7,713,970 | | | 7,715,040 | | | 7,747,675 | | | 7,663,521 | | | 7,603,938 | | | | | 7,710,076 | | | 7,587,768 | |

| Diluted | 7,727,412 | | | 7,720,895 | | | 7,723,888 | | | 7,687,679 | | | 7,650,451 | | | | | 7,737,952 | | | 7,647,411 | |

| Dividends per common share | $ | 0.20 | | | $ | 0.20 | | | $ | 0.20 | | | $ | 0.20 | | | $ | 0.20 | | | | | $ | 0.80 | | | $ | 0.80 | |

BANKWELL FINANCIAL GROUP, INC.

RECONCILIATION OF GAAP TO NON-GAAP MEASURES (unaudited)

(Dollars in thousands, except share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of |

| Computation of Tangible Common Equity to Tangible Assets | December 31,

2024 | | September 30,

2024 | | June 30,

2024 | | March 31,

2024 | | December 31,

2023 | | |

| Total Equity | $ | 270,063 | | | $ | 267,926 | | | $ | 266,976 | | | $ | 268,032 | | | $ | 265,752 | | | |

| Less: | | | | | | | | | | | |

| Goodwill | 2,589 | | | 2,589 | | | 2,589 | | | 2,589 | | | 2,589 | | | |

| Other intangibles | — | | | — | | | — | | | — | | | — | | | |

| Tangible Common Equity | $ | 267,474 | | | $ | 265,337 | | | $ | 264,387 | | | $ | 265,443 | | | $ | 263,163 | | | |

| | | | | | | | | | | |

| Total Assets | $ | 3,268,620 | | | $ | 3,161,080 | | | $ | 3,141,654 | | | $ | 3,155,274 | | | $ | 3,215,482 | | | |

| Less: | | | | | | | | | | | |

| Goodwill | 2,589 | | | 2,589 | | | 2,589 | | | 2,589 | | | 2,589 | | | |

| Other intangibles | — | | | — | | | — | | | — | | | — | | | |

| Tangible Assets | $ | 3,266,031 | | | $ | 3,158,491 | | | $ | 3,139,065 | | | $ | 3,152,685 | | | $ | 3,212,893 | | | |

| | | | | | | | | | | |

| Tangible Common Equity to Tangible Assets | 8.19 | % | | 8.40 | % | | 8.42 | % | | 8.42 | % | | 8.19 | % | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of |

| Computation of Fully Diluted Tangible Book Value per Common Share | December 31,

2024 | | September 30,

2024 | | June 30,

2024 | | March 31,

2024 | | December 31, 2023 | | |

| Total shareholders' equity | $ | 270,063 | | | $ | 267,926 | | | $ | 266,976 | | | $ | 268,032 | | | $ | 265,752 | | | |

| Less: | | | | | | | | | | | |

| Preferred stock | — | | | — | | | — | | | — | | | — | | | |

| Common shareholders' equity | $ | 270,063 | | | $ | 267,926 | | | $ | 266,976 | | | $ | 268,032 | | | $ | 265,752 | | | |

| Less: | | | | | | | | | | | |

| Goodwill | 2,589 | | | 2,589 | | | 2,589 | | | 2,589 | | | 2,589 | | | |

| Other intangibles | — | | | — | | | — | | | — | | | — | | | |

| Tangible common shareholders' equity | $ | 267,474 | | | $ | 265,337 | | | $ | 264,387 | | | $ | 265,443 | | | $ | 263,163 | | | |

| | | | | | | | | | | |

| Common shares issued and outstanding | 7,859,873 | | | 7,858,573 | | | 7,866,499 | | | 7,908,180 | | | 7,882,616 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Fully Diluted Tangible Book Value per Common Share | $ | 34.03 | | | $ | 33.76 | | | $ | 33.61 | | | $ | 33.57 | | | $ | 33.39 | | | |

BANKWELL FINANCIAL GROUP, INC.

EARNINGS PER SHARE ("EPS") (unaudited)

(Dollars in thousands, except share data) | | | | | | | | | | | | | | | | | | | | | | | |

| For the Quarter Ended December 31, | | For the Year Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (In thousands, except per share data) |

Net income | $ | 2,507 | | | $ | 8,524 | | | $ | 9,314 | | | $ | 36,663 | |

Dividends to participating securities(1) | (39) | | | (40) | | | (156) | | | (164) | |

Undistributed earnings allocated to participating securities(1) | (23) | | | (181) | | | (76) | | | (794) | |

Net income for earnings per share calculation | 2,445 | | | 8,303 | | | 9,082 | | | 35,705 | |

| | | | | | | |

Weighted average shares outstanding, basic | 7,714 | | | 7,604 | | | 7,710 | | | 7,588 | |

Effect of dilutive equity-based awards(2) | 13 | | | 46 | | | 28 | | | 60 | |

Weighted average shares outstanding, diluted | 7,727 | | | 7,650 | | | 7,738 | | | 7,648 | |

Net earnings per common share: | | | | | | | |

Basic earnings per common share | $ | 0.32 | | | $ | 1.09 | | | $ | 1.18 | | | $ | 4.71 | |

Diluted earnings per common share | $ | 0.32 | | | $ | 1.09 | | | $ | 1.17 | | | $ | 4.67 | |

(1) Represents dividends paid and undistributed earnings allocated to unvested stock-based awards that contain non-forfeitable rights to dividends.

(2) Represents the effect of the assumed exercise of stock options and the vesting of restricted shares, as applicable, utilizing the treasury stock method.

BANKWELL FINANCIAL GROUP, INC.

NET INTEREST MARGIN ANALYSIS ON A FULLY TAX EQUIVALENT BASIS - QTD (unaudited)

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Quarter Ended |

| December 31, 2024 | | December 31, 2023 |

| Average

Balance | | Interest | | Yield/ Rate (4) | | Average

Balance | | Interest | | Yield/ Rate (4) |

| Assets: | | | | | | | | | | | |

| Cash and Fed funds sold | $ | 313,777 | | | $ | 3,510 | | | 4.45 | % | | $ | 314,950 | | | $ | 4,164 | | | 5.25 | % |

Securities(1) | 151,300 | | | 1,506 | | | 3.98 | | | 133,440 | | | 1,041 | | | 3.12 | |

| Loans: | | | | | | | | | | | |

| Commercial real estate | 1,896,551 | | | 28,222 | | | 5.82 | | | 1,933,736 | | | 28,546 | | | 5.78 | |

| Residential real estate | 44,329 | | | 753 | | | 6.79 | | | 52,026 | | | 718 | | | 5.52 | |

| Construction | 171,244 | | | 3,281 | | | 7.50 | | | 199,541 | | | 3,793 | | | 7.44 | |

| Commercial business | 505,655 | | | 9,911 | | | 7.67 | | | 496,476 | | | 9,944 | | | 7.84 | |

| Consumer | 43,315 | | | 684 | | | 6.29 | | | 43,639 | | | 1,120 | | | 10.18 | |

| Total loans | 2,661,094 | | | 42,851 | | | 6.30 | | | 2,725,418 | | | 44,121 | | | 6.33 | |

| Federal Home Loan Bank stock | 5,655 | | | 119 | | | 8.36 | | | 5,696 | | | 119 | | | 8.31 | |

| Total earning assets | 3,131,826 | | | $ | 47,986 | | | 6.00 | % | | 3,179,504 | | | $ | 49,445 | | | 6.08 | % |

| Other assets | 94,781 | | | | | | | 94,459 | | | | | |

| Total assets | $ | 3,226,607 | | | | | | | $ | 3,273,963 | | | | | |

| | | | | | | | | | | |

| Liabilities and shareholders' equity: | | | | | | | | | | | |

| Interest bearing liabilities: | | | | | | | | | | | |

| NOW | $ | 90,497 | | | $ | 42 | | | 0.18 | % | | $ | 95,603 | | | $ | 42 | | | 0.17 | % |

| Money market | 855,522 | | | 8,472 | | | 3.94 | | | 893,043 | | | 9,369 | | | 4.16 | |

| Savings | 88,956 | | | 692 | | | 3.10 | | | 99,242 | | | 759 | | | 3.04 | |

| Time | 1,385,264 | | | 16,434 | | | 4.72 | | | 1,341,871 | | | 15,136 | | | 4.48 | |

| Total interest bearing deposits | 2,420,239 | | | 25,640 | | | 4.21 | | | 2,429,759 | | | 25,306 | | | 4.13 | |

| Borrowed Money | 159,416 | | | 2,004 | | | 5.00 | | | 159,165 | | | 1,842 | | | 4.59 | |

| Total interest bearing liabilities | 2,579,655 | | | $ | 27,644 | | | 4.27 | % | | 2,588,924 | | | $ | 27,148 | | | 4.16 | % |

| Noninterest bearing deposits | 322,135 | | | | | | | 351,071 | | | | | |

| Other liabilities | 54,013 | | | | | | | 70,181 | | | | | |

| Total liabilities | 2,955,803 | | | | | | | 3,010,176 | | | | | |

| Shareholders' equity | 270,804 | | | | | | | 263,787 | | | | | |

| Total liabilities and shareholders' equity | $ | 3,226,607 | | | | | | | $ | 3,273,963 | | | | | |

Net interest income(2) | | | $ | 20,342 | | | | | | | $ | 22,297 | | | |

| Interest rate spread | | | | | 1.73 | % | | | | | | 1.92 | % |

Net interest margin(3) | | | | | 2.60 | % | | | | | | 2.81 | % |

(1)Average balances and yields for securities are based on amortized cost.

(2)The adjustment for securities and loans taxable equivalency amounted to $143 thousand and $52 thousand for the quarters ended December 31, 2024 and 2023, respectively.

(3)Annualized net interest income as a percentage of earning assets.

(4)Yields are calculated using the contractual day count convention for each respective product type.

BANKWELL FINANCIAL GROUP, INC.

NET INTEREST MARGIN ANALYSIS ON A FULLY TAX EQUIVALENT BASIS - YTD (unaudited)

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Year Ended |

| December 31, 2024 | | December 31, 2023 |

| Average

Balance | | Interest | | Yield/ Rate (4) | | Average

Balance | | Interest | | Yield/ Rate (4) |

| Assets: | | | | | | | | | | | |

| Cash and Fed funds sold | $ | 283,353 | | | $ | 13,970 | | | 4.93 | % | | $ | 289,582 | | | $ | 14,147 | | | 4.89 | % |

Securities(1) | 142,744 | | | 5,098 | | | 3.57 | | | 129,785 | | | 3,906 | | | 3.01 | |

| Loans: | | | | | | | | | | | |

| Commercial real estate | 1,905,973 | | | 112,804 | | | 5.82 | | | 1,932,627 | | | 109,110 | | | 5.57 | |

| Residential real estate | 47,767 | | | 2,978 | | | 6.23 | | | 55,607 | | | 2,751 | | | 4.95 | |

| Construction | 162,180 | | | 12,197 | | | 7.40 | | | 195,773 | | | 14,268 | | | 7.19 | |

| Commercial business | 514,800 | | | 42,006 | | | 8.03 | | | 533,736 | | | 41,406 | | | 7.65 | |

| Consumer | 41,869 | | | 2,847 | | | 6.80 | | | 34,022 | | | 2,646 | | | 7.77 | |

| Total loans | 2,672,589 | | | 172,832 | | | 6.36 | | | 2,751,765 | | | 170,181 | | | 6.10 | |

| Federal Home Loan Bank stock | 5,666 | | | 477 | | | 8.41 | | | 5,570 | | | 427 | | | 7.68 | |

| Total earning assets | 3,104,352 | | | $ | 192,377 | | | 6.09 | % | | 3,176,702 | | | $ | 188,661 | | | 5.86 | % |

| Other assets | 92,886 | | | | | | | 79,571 | | | | | |

| Total assets | $ | 3,197,238 | | | | | | | $ | 3,256,273 | | | | | |

| | | | | | | | | | | |

| Liabilities and shareholders' equity: | | | | | | | | | | | |

| Interest bearing liabilities: | | | | | | | | | | | |

| NOW | $ | 96,091 | | | $ | 175 | | | 0.18 | % | | $ | 97,203 | | | $ | 170 | | | 0.17 | % |

| Money market | 851,283 | | | 34,767 | | | 4.08 | | | 906,354 | | | 32,901 | | | 3.63 | |

| Savings | 90,587 | | | 2,785 | | | 3.07 | | | 113,260 | | | 3,163 | | | 2.79 | |

| Time | 1,335,680 | | | 63,531 | | | 4.76 | | | 1,303,915 | | | 50,672 | | | 3.89 | |

| Total interest bearing deposits | 2,373,641 | | | 101,258 | | | 4.27 | | | 2,420,732 | | | 86,906 | | | 3.59 | |

| Borrowed Money | 159,320 | | | 7,454 | | | 4.68 | | | 160,661 | | | 7,080 | | | 4.35 | |

| Total interest bearing liabilities | 2,532,961 | | | $ | 108,712 | | | 4.29 | % | | 2,581,393 | | | $ | 93,986 | | | 3.64 | % |

| Noninterest bearing deposits | 332,611 | | | | | | | 368,926 | | | | | |

| Other liabilities | 60,466 | | | | | | | 53,893 | | | | | |

| Total liabilities | 2,926,038 | | | | | | | 3,004,212 | | | | | |

| Shareholders' equity | 271,200 | | | | | | | 252,061 | | | | | |

| Total liabilities and shareholders' equity | $ | 3,197,238 | | | | | | | $ | 3,256,273 | | | | | |

Net interest income(2) | | | $ | 83,665 | | | | | | | $ | 94,675 | | | |

| Interest rate spread | | | | | 1.80 | % | | | | | | 2.22 | % |

Net interest margin(3) | | | | | 2.70 | % | | | | | | 2.98 | % |

(1)Average balances and yields for securities are based on amortized cost.

(2)The adjustment for securities and loans taxable equivalency amounted to $383 thousand and $207 thousand for the year ended December 31, 2024 and 2023, respectively.

(3)Annualized net interest income as a percentage of earning assets.

(4)Yields are calculated using the contractual day count convention for each respective product type.

January 22, 2025 Fourth Quarter 2024 Investor Presentation

Important note regarding forward-looking statements: Statements made in this presentation which are not purely historical are forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995. This includes any statements regarding management’s plans, objectives, or goals for future operations, products or services, and forecasts of its revenues, earnings, or other measures of performance. Such forward-looking statements may be identified by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “estimate,” “should,” “intend,” "target,” “outlook,” “project,” “guidance,” “forecast,” or similar expressions. Forward-looking statements are based on current management expectations and, by their nature, are subject to risks and uncertainties. Actual results may differ materially from those contained in the forward-looking statements. Factors which may cause actual results to differ materially from those contained in such forward-looking statements include those identified in the Company’s most recent Form 10-K and subsequent Form 10-Qs and other SEC filings, and such factors are incorporated herein by reference. Trademarks: All trademarks, service marks, and trade names referenced in this material are official trademarks and the property of their respective owners. Presentation: Within the charts and tables presented, certain segments, columns and rows may not sum to totals shown due to rounding. Non-GAAP Measures: This presentation includes certain non-GAAP financial measures. These non-GAAP measures are provided in addition to, and not as substitutes for, measures of our financial performance determined in accordance with GAAP. Our calculation of these non-GAAP measures may not be comparable to similarly titled measures of other companies due to potential differences between companies in the method of calculation. As a result, the use of these non-GAAP measures has limitations and should not be considered superior to, in isolation from, or as a substitute for, related GAAP measures. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures can be found at the end of this presentation. Forward Looking Statement 2

Fourth Quarter 2024 Results 3 Reported net interest margin of 2.60%, down -12 bps LQ driven by lower loan fees & asset mix; 3.72% cost of deposits down -9 bps LQ Credit trends stable, with non-performing assets down $4 million to LQ; material improvement expected in early 2025 Net deposit growth of $99 million LQ, with core deposits up $169 million LQ and brokered deposit balances reduced ($78) million $34.03 Tangible Book Value; 4-year CAGR 12%

Fourth Quarter 2024 Financial Summary 4 EPS PPNR Loans Deposits Capital • Fully diluted EPS of $0.32 includes $0.29 from charge offs, $0.07 from one-time OREO expenses • PPNR of $7.9 million, or $1.02 per share, declined -12% LQ • Net interest income of $20.2 million adversely impacted by reduced loan fee income • Non-interest expense rose 3% LQ, driven by one-time OREO expenses of $0.7 million • Loan balances increased $83 million LQ, decreasing $13 million PYQ • Provision of $4.5 million included $3.0 million related to charge offs • Deposits increased $99 million, brokered deposits fell $78 million (both LQ) • Loan to deposit ratio remains stable at 96.6% • Tangible book value of $34.03, up $0.27 versus LQ and up $0.64 versus PYQ • Consolidated CET1 ratio of 9.57%; Bank Total Capital ratio of 12.67%1 1 Estimates, pending FRY9C & FDIC call report filings.

Fourth Quarter 2024 GAAP Results 5 Bankwell Financial Group, Inc. ($ in millions, except per share data) Q4 2024 Q3 2024 Q2 2024 Q1 2024 Q4 2023 Q3 2023 Q2 2023 Q1 2023 Q4 2022 Net Interest Income $ 20.2 $ 20.7 $ 21.2 $ 21.1 $ 22.2 $ 22.7 $ 24.0 $ 25.5 $ 26.8 Provision for Credit Losses 4.5 6.3 8.2 3.7 (1.0) (1.6) 2.6 0.8 4.3 Total Noninterest Income 1.0 1.2 0.7 0.9 1.1 0.8 1.4 1.5 0.5 Total Revenue 21.2 21.9 21.9 22.1 23.4 23.5 25.4 27.1 27.3 Total Noninterest Expenses 13.2 12.9 12.2 13.3 12.9 12.2 12.6 12.7 12.5 Income before Taxes 3.5 2.7 1.5 5.1 11.5 12.9 10.2 13.6 10.6 Net Income 2.5 1.9 1.1 3.8 8.5 9.8 8.0 10.4 8.0 Diluted Earnings Per Share 0.32 0.24 0.14 0.48 1.09 1.25 1.02 1.33 1.04 Total Assets 3,268.6 3,161.1 3,141.7 3,155.3 3,215.5 3,249.8 3,252.7 3,252.3 3,252.4 Gross Loans Receivable (ex. HFS) 2,702.0 2,619.3 2,652.8 2,674.7 2,713.2 2,764.5 2,767.3 2,752.5 2,668.8 Allowance for Credit Losses on Loans & Leases (29.0) (27.8) (36.1) (28.0) (27.9) (29.3) (30.7) (28.0) (22.4) All Other Assets 537.6 514.0 452.8 452.6 474.3 456.0 454.7 471.8 561.2 Total Liabilities 2,998.6 2,893.2 2,874.7 2,887.2 2,949.7 2,991.9 3,003.9 3,010.0 3,014.0 Total Deposits 2,787.6 2,688.2 2,662.4 2,673.5 2,736.8 2,768.6 2,788.9 2,798.3 2,800.8 Borrowings 159.5 159.4 159.3 159.3 159.2 159.1 159.1 159.0 159.0 Other Liabilities 51.5 45.6 53.0 54.5 53.8 64.1 55.9 52.7 54.2 Total Shareholders’ Equity 270.1 267.9 267.0 268.0 265.8 257.9 248.8 242.3 238.5 Net Interest Margin 2.60% 2.72% 2.75% 2.71% 2.81% 2.85% 3.07% 3.24% 3.70% PPNR ROAA 0.98% 1.13% 1.22% 1.10% 1.27% 1.37% 1.58% 1.80% 1.98% Effective Tax Rate 28% 29% 24% 26% 26% 24% 22% 23% 24% Noninterest Expense to Average Assets 1.63% 1.62% 1.55% 1.66% 1.56% 1.48% 1.56% 1.59% 1.66%

Maintaining our Strong Balance Sheet 6 $1,088 $662 $307 $110 Liquidity Uninsured Deposits 2.3X Liquidity Coverage $1,505 Unencumbered Securities Unencumbered Cash Borrowing Capacity1 1 Bank lines, including FHLB & FRB 2 TCE/TA consolidated ratio; all others Bank ratios. Regulatory ratios are estimates, pending FDIC call report filing. • $2,125 million total insured deposits includes: ‒ $2,008 million FDIC-insured deposits ‒ $117 million deposits secured by FHLB LOCs (municipal deposits) • 12.8% liquidity on balance sheet (Cash & Securities) • Stable insured deposit base • Additional 4Q24 ratios: ‒ 375% CRE Concentration Ratio ‒ 49% Construction Concentration Ratio • 85,990 shares repurchased in 2024 at an average price of $24.82 ‒ 250,000 share repurchase plan authorized in 3Q24 Abundant Excess Liquidity Building Excess Capital 11.61% 10.07% 12.67% 8.19% CET1 Leverage Total Risk Based TCE / TA Well Above Capital Minimums Minimum + buffer 2 Dollars in millions

Reduced Reliance on Brokered Deposits • Brokered deposit balances have fallen $247 million in 2024, with total deposits stable between approximately $2.7 and $2.8 billion • Notable growth in Bankwell Direct deposits (3Q24 launch); up $39 million LQ, to $136 million $1,774 $1,785 $2,083 $1,027 $952 $705 $2,801 $2,737 $2,788 4Q22 4Q23 4Q24 Brokered Deposits Peaked in 4Q22 Non-Brokered Brokered Dollars in millions 7

Well Positioned Balance Sheet For Lower Rates • Liability sensitive, with $1.3 billion of time deposits maturing in next twelve months: ‒ $714 million Retail time repricing an average ~22 basis points lower based on current rates; annualized savings of $1.6 million of interest expense ‒ $560 million Brokered time repricing an average ~49 basis points lower based on current rates; annualized savings of $2.8 million of interest expense • A total $4.4 million annualized savings is ~$0.44 benefit to EPS and ~14 basis points on Net interest margin, assuming no further movement in Fed Funds and stable asset yields Maturity Quarter Balance Maturity Rate Current Rate V 1Q25 $278 5.19% 4.60% -0.59% 2Q25 $234 4.77% 4.60% -0.17% 3Q25 $64 4.70% 4.60% -0.10% 4Q25 $138 4.24% 4.60% 0.36% Total Retail $714 4.82% 4.60% -0.22% Dollars in millions 8 Maturity Quarter Balance Maturity Rate Current Rate V 1Q25 $135 5.28% 4.25% -1.03% 2Q25 $155 4.67% 4.25% -0.42% 3Q25 $170 4.71% 4.25% -0.46% 4Q25 $100 4.18% 4.25% 0.07% Total Brokered $560 4.74% 4.25% -0.49% Retail Time Deposits Brokered Time Deposits

Managing CRE Concentration Lower • No single relationship greater than 4% • Expansion into Residential Care diversifying loan portfolio Dollars in millions $1,046 $1,224 $1,228 $1,175 $310 $697 $720 $724$351 $522 $501 $516 $98 $155 $183 $174 $89 $77 $87 $118 $1,895 $2,675 $2,719 $2,706 454% 425% 397% 375% 300% 320% 340% 360% 380% 400% 420% 440% 460% 480% 500% - 500 1,000 1,500 2,000 2,500 4Q21 4Q22 4Q23 4Q24 CRE Investor CRE Owner Occupied C&I Construction Residential / Other CRE Concentration 9

Credit Trends 4Q23 1Q24 2Q24 3Q24 4Q24 Risk Rating Balance % Balance % Balance % Balance % Balance % 1-5 “Pass” $2,570 94.5% $2,527 94.3% $2,497 94.0% $2,458 93.7% $2,557 94.5% 6 “Special Mention” $67 2.5% $72 2.7% $71 2.7% $97 3.7% $93 3.4% 7 “Substandard” $76 2.8% $68 2.5% $80 3.0% $67 2.5% $54 2.0% 8 “Doubtful” $6 0.2% $13 0.5% $8 0.3% $1 0.1% $1 0.1% Total Gross Loans $2,719 $2,680 $2,657 $2,623 $2,706 Non-performing Loans $49.2 $46.5 $56.2 $65.5 $53.3 % of Total Loans 1.81% 1.74% 2.12% 2.50% 1.97% Non-performing Assets $49.2 $46.5 $56.2 $65.5 $61.6 % of Total Assets 1.53% 1.48% 1.79% 2.07% 1.88% $27.9 $28.0 $36.1 $27.8 $29.0 1.03% 1.04% 1.36% 1.06% 1.07% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% $0 $5 $10 $15 $20 $25 $30 $35 4Q23 1Q24 2Q24 3Q24 4Q24 Allowance for Credit Losses (ACL) Allowance for credit losses ACL / Loans Dollars in millions 10 $0.37 $3.7 $0.3 $14.8 $3.0 4Q23 1Q24 2Q24 3Q24 4Q24 Net Charge Offs (Recoveries) 1 1, 2 1 Subsequent to December 31, 2024, the Company has a signed purchase and sale agreement on a $27 million CRE-multifamily loan at par value. This loan represents 100 basis points of the total NPL / Total Loans ratio and 83 basis points of the total NPA / Total Assets ratio 2 Subsequent to December 31, 2024, the Company has a signed purchase and sale agreement on a $8 million OREO at book value. This asset represents 25 basis points of the total NPA / Total Assets ratio

4Q24 Non-Performing Asset Update Loan Segment Balance % Total Assets Additional Update Loan 1 CRE – Multifamily $27.1 0.83% • CRE Multifamily property in Hartford County, CT • Subsequent to December 31, 2024, the Company has a signed purchase and sale agreement at par value Loan 2 CRE – Retail $9.2 0.28% • Suburban retail loan in Westchester County, NY modified during COVID • Borrower paying according to terms of restructure; 1Q25 maturity • $4.5 million charged off, life-to-date OREO 1 -- $8.3 0.25% • Bank took ownership of property in 4Q24; $1.2 million charged off in 4Q24 • Subsequent to December 31, 2024, the Company has a signed purchase and sale agreement at book value Loan 3 CRE – Office $5.5 0.17% • Class A suburban NJ office park • Bankwell 17% participant in $84 million multi-bank club deal • 80% occupied; 40% recourse; 1Q25 maturity • $8.2 million charge off, life-to-date SBA Guaranteed Balances $6.3 0.19% All Other $5.1 0.16% Total Non-performing assets $61.6 1.88% Dollars in millions All non-performing loans individually evaluated for impairment Balances charged off or specifically reserved, as appropriate Activity During the Quarter • Disposition of $1.7 million C&I loan (pediatric dental practice); $0.7 million charged off • Remaining 4Q24 Non-performing assets comprised of: 11 Activity Post December 31st, 2024 • The Company has a signed purchase and sale agreement on “Loan 1” above at par value. • The Company has a signed purchase and sale agreement on “OREO 1” at book value.

CRE Office Portfolio1 1 Includes Owner Occupied CRE 12 Geography Dollars in millions Composition $160 million Office exposure 6% of total loan portfolio • 41 loans with $3.9 million average balance • One $5.5 million non-performing loan ‒ Class A suburban NJ office park ‒ $8.2 million charged off in 2024 • 62% located in Bankwell’s primary market ‒ Out of primary market loans are generally either GSA-leased, credit tenants, or owner- occupied • $112 million have personal recourse to high-net- worth guarantors • $49 million have no recourse ‒ $22 million owner occupied ‒ $20 million GSA / credit-tenant ‒ $7 million remaining; 2 loans • ~56% of loan balances maturing in 2025 Maturities Year Balance Count 2025 $90 14 2026 $14 5 2027 $28 9 2028+ $28 13 Total $160 41 CT - Fairfield County $48.8 CT - All Other $8.1 NY - Westchester County $10.2 NY - Brooklyn $3.0 NJ $29.5 TX $28.4 MS $17.6 GA $12.4 FL $2.2

13 Strategic Initiatives Update Continue to grow recently established SBA Lending Division New Chief Technology Officer joined Bankwell in 1Q25 Bankwell Direct (online deposit platform) added $39 million in 4Q Launched enhanced business checking and dedicated Online Banking for small businesses Continued build-out of the Program Management team supporting the Bank’s risk management objectives

Dedicated to making a difference. 14 Financial Outlook Stable total assets near-term NIM expansion as short-term rates lower Reduced credit costs in 2025 Additional reductions in brokered deposit and CRE concentrations Growing regulatory capital Unchanged focus on efficiency

15 Questions?

Appendix 16

Average Deposits & NIM; Recent Trends Dollars in millions 17 $2,430 $2,386 $2,323 $2,365 $2,420 $351 $337 $368 $303 $322 $2,781 $2,723 $2,692 $2,668 $2,742 4.13% 4.28% 4.27% 4.30% 4.21% 3.61% 3.75% 3.69% 3.81% 3.72% 2.81% 2.71% 2.75% 2.72% 2.60% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% 5.50% 6.00% $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 4Q23 1Q24 2Q24 3Q24 4Q24 Average Interest Bearing Average Non-Interest Bearing IB Deposit Cost Total Deposit Cost NIM

18 Loan Composition Total Loan Portfolio = $2,706 million Favorable long-term trends in Investor CREResidential 1.6% C&I 19.1% CRE Owner Occupied 26.8% CRE Investor 43.4% Commercial Const. 6.4% Other 2.8% 60.4% 55.2% 45.8% 45.2% 43.4% 27.3% 34.9% 45.5% 44.9% 45.8% 4Q20 4Q21 4Q22 4Q23 4Q24 CRE Investor CRE O/O + C&I

$1,626 $1,895 $2,675 $2,719 $2,706 4.18% 4.30% 5.56% 5.99% 6.09% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% - 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4Q20 4Q21 4Q22 4Q23 4Q24 Loan Balance Portfolio Loan Yield 19 Favorable Loan Yield Growth Loan portfolio yields increased 191 bps since 2020 1 December 2024 Yield2 by Vintage 1 Weighted average yield based on active loans as of each date, an “exit" rate 2 Weighted average yield based on active loans as of 12-31-2024, an “exit" rate 75% of balances are 2021-2024 vintages Year Maturity Rate Reset Total % Total Loans 2025 $749 $53 $802 30% 2026 $218 $49 $266 10% 2027 $391 $38 $429 16% 2028+ $492 $85 $577 21% Total $1,849 $225 $2,075 Loan Maturities & Contractual Repricing Excluding floating rate loans Dollars in millions 5.26% Pre 2021 5.92% 2021 6.27% 2022 7.40% 2023 7.41% 2024

20 CRE Loan Portfolio Total CRE Portfolio = $1,899 million Residential Care 35% Retail 19% MultiFamily 15% Office 8% Industrial Warehouse 7% Mixed Use 5% Medical Office 5% Other 4% Special Use 2% By Property Type • 62% Non-Owner Occupied • 64% weighted average LTV2 • 69% of loan balances have recourse Property Type Investor Owner Occupied Total Residential Care $31 $384 $415 Retail $127 $7 $134 Office $88 $15 $103 Multifamily $94 $- $94 All Other $149 $17 $165 Total $489 $423 $912 Loans Maturing or Repricing in 2025 - 20263 Excluding floating rate loans Dollars in millions 1 1 Includes Owner Occupied CRE, does not include Construction 2 LTVs based on original LTV values, at origination 3 Loans subject to repricing generally have a floor of not less than the original rate

Health Care & Social Assistance 36% Insurance (Primarily Brokers) 26% Finance 13% Real Estate and Rental/Leasing 8% Admin & Support, Waste Mgmt, Remediation Svcs 4% Retail Trade 3% Arts, Entertainment & Recreation 2% Manufacturing 2% Other 6% 21 C&I Loan Portfolio By Industry Type Total Portfolio = $515 million • 98% of C&I portfolio has recourse • 97% of Healthcare loans have recourse − Primarily consists of working capital lines secured by government accounts receivable • Insurance lending primarily to independent insurance agencies 1 Does not Include Owner Occupied CRE 1

Combined Healthcare Dollars in millions 22 $830 million combined Healthcare portfolio • Consists primarily of skilled nursing facilities located across the US • Healthcare lending team has more than 15 years of industry experience • High touch service model attracts desirable ultra-high net worth Healthcare borrowers • 100% of Skilled Nursing Lending has recourse • Focused on originating Healthcare loans in the most desirable states with: – Higher average occupancy – Low denial of payment rates for Medicaid – Strong senior demographic trends – Certificate of need programs 1 Healthcare Portfolio Composition CRE Skilled Nursing Facility By State FL 50% NY 14% OH 14% IN 3% AL 2% IA 2% TN 2% IL 2% All Other 10% Skilled Nursing Facilities 78% Assisted Living 13% Recovery 5% Other 4% 1 Includes Physicians

Bankwell Financial Group (Nasdaq: BWFG) $3.3B Total Assets $2.7B Loans $0.27B Equity $2.8B Deposits 1.62% Non-interest Exp / Assets ~147 Employees 8.19% TCE Ratio 9.57% CET1 Ratio C&I & CREOO 46% CRE Inv 43% All Other 11% Loans Core 67% Time > $250k 8% Brokered 25% Deposits 23 1 1 Estimate, pending FRY9C filing.

24

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

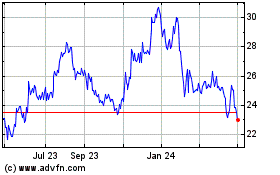

Bankwell Financial (NASDAQ:BWFG)

Historical Stock Chart

From Dec 2024 to Jan 2025

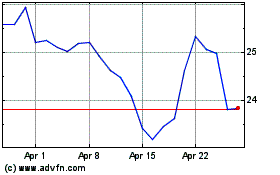

Bankwell Financial (NASDAQ:BWFG)

Historical Stock Chart

From Jan 2024 to Jan 2025