Pathward Financial, Inc. (the “Company”) (Nasdaq: CASH) today

announced that its wholly owned subsidiary Pathward®, N.A.

(“Pathward”), an industry leading financial empowerment company

driven by its purpose to power financial inclusion, has entered

into a definitive agreement to sell its commercial insurance

premium finance business to AFS IBEX Financial Services, LLC

(“AFS”), a Delaware limited liability company and subsidiary of

Honor Capital Holdings, LLC, a Delaware limited liability company

(“Honor”). Through its subsidiaries, Honor originates and services

premium finance loans and is one of the nation’s largest

independently owned insurance premium finance companies with

offices in Massachusetts, New York, Florida, Texas and California.

Honor will be guaranteeing the obligations of AFS under the

agreement.

The agreement includes, among other things, AFS’s commitment to

offer employment to those within the commercial insurance premium

finance business subject to certain conditions, to purchase the

commercial insurance premium finance loan portfolio, which had a

balance of $617.1 million at June 30, 2024, and to assume its real

property leases.

The cash purchase price to be paid by AFS at closing consists of

the final net asset value of the assets purchased pursuant to the

Purchase Agreement, which was $617.1 million as of June 30, 2024,

plus a $31.2 million premium, subject to fluctuations in the loan

portfolio, plus the assumption of certain liabilities, subject to

adjustment.

“As I have mentioned before, we need to have the right sized

balance sheet with an optimized asset mix to deliver on our fiscal

2025 strategy. This transaction supports our strategy of

simplification and gives us the opportunity to accelerate our

rotation into higher yielding assets in verticals where we believe

we have a competitive advantage,” said Brett Pharr, chief executive

officer of the Company.

The Company believes, excluding any related gains, that the

transaction will be relatively neutral to fiscal 2024 net income

and earnings per diluted share. However, the Company expects the

transaction to be increasingly accretive as it redeploys the

released capital and deposits into other commercial finance loans

and leases. The Company expects the transaction to close by the end

of fiscal year 2024 and will update fiscal 2025 guidance at that

time.

The transaction has been approved by the Boards of Directors of

the Company and Pathward and remains subject to the satisfaction or

waiver of certain customary closing conditions. Colonnade

Securities LLC served as financial advisor to Pathward.

Conference Call

The Company will host a conference call and webcast with a

corresponding presentation at 4:00 p.m. Central Time (5:00 p.m.

Eastern Time) on Thursday, August 29, 2024. The live webcast of the

call can be accessed from Pathward’s Investor Relations website at

www.pathwardfinancial.com. Telephone participants may access the

conference call by dialing 1-833-470-1428 approximately 10 minutes

prior to start time and reference access code 675477.

The Investor Presentation prepared for use in connection with

the Company's conference call and webcast is available under the

Presentations link in the Investor Relations - Events &

Presentations section of the Company's website at

www.pathwardfinancial.com. A webcast replay will also be archived

at www.pathwardfinancial.com for one year.

About Pathward Financial, Inc.

Pathward Financial, Inc. (Nasdaq: CASH) is a U.S.-based

financial holding company driven by its purpose to power financial

inclusion. Through our subsidiary, Pathward®, N.A., we strive to

increase financial availability, choice and opportunity across our

Banking as a Service and Commercial Finance business lines. These

strategic business lines provide end-to-end support to individuals

and businesses. Learn more at www.pathwardfinancial.com.

Forward-Looking Statements

The Company and Pathward may from time to time make written or

oral “forward-looking statements,” including statements contained

in this press release, the Company’s filings with the Securities

and Exchange Commission ("SEC"), the Company’s reports to

stockholders, and in other communications by the Company and

Pathward, which are made in good faith by the Company pursuant to

the “safe harbor” provisions of the Private Securities Litigation

Reform Act of 1995.

You can identify forward-looking statements by words such as

“may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,”

“intend,” “believe,” “estimate,” “predict,” “potential,”

“continue,” “could,” “future,” "target," or the negative of those

terms, or other words of similar meaning or similar expressions.

You should carefully read statements that contain these words

because they discuss our future expectations or state other

“forward-looking” information. These forward-looking statements are

based on information currently available to us and assumptions

about future events, and include statements with respect to the

Company’s beliefs, expectations, estimates, and intentions, which

are subject to significant risks and uncertainties, and are subject

to change based on various factors, some of which are beyond the

Company’s control. Such risks, uncertainties and other factors may

cause our actual growth, results of operations, financial

condition, cash flows, performance and business prospects and

opportunities to differ materially from those expressed in, or

implied by, these forward-looking statements. Among other things,

these forward-looking statements include expectations concerning

the estimated closing cash purchase price of the transaction,

expected timetable for completing the transaction, employment of

employees by AFS, assumption of real property leases by AFS, the

impact of the transaction on net income and earnings per diluted

share, the timing of provision of additional financial details if

any, and other benefits of the transaction to the Company. The

Company’s actual actions or results may differ materially from

those expected or anticipated in the forward-looking statements due

to both known and unknown risks and uncertainties. Specific factors

that might cause such a difference include but are not limited to:

uncertainty as to whether the transaction will be completed in a

timely manner or at all; the conditions precedent to completion of

the transaction, including the ability to secure third-party

consents in a timely manner or at all or on expected terms; and

risks of unexpected costs, liabilities or delay.

The foregoing list of factors is not exclusive. We caution you

not to place undue reliance on these forward-looking statements.

The forward-looking statements included in this press release speak

only as of the date hereof. Additional discussions of factors

affecting the Company’s business and prospects are reflected under

the caption “Risk Factors” and in other sections of the Company’s

Annual Report on Form 10-K for the Company’s fiscal year ended

September 30, 2023, and in other filings made with the SEC. Except

as required by law, the Company expressly disclaims any intent or

obligation to update, revise or clarify any forward-looking

statements, whether written or oral, that may be made from time to

time by or on behalf of the Company or its subsidiaries, whether as

a result of new information, changed circumstances, or future

events or for any other reason.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240828701257/en/

Investor Relations Contact: Darby Schoenfeld, CPA Senior

Vice President, Chief of Staff & Investor Relations

877-497-7497 investorrelations@pathward.com

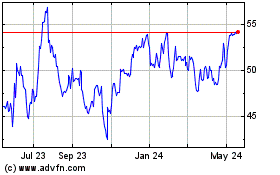

Pathward Financial (NASDAQ:CASH)

Historical Stock Chart

From Oct 2024 to Nov 2024

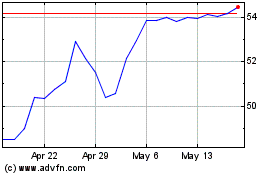

Pathward Financial (NASDAQ:CASH)

Historical Stock Chart

From Nov 2023 to Nov 2024