Cardlytics, Inc. (NASDAQ: CDLX) (“Cardlytics”), an advertising

platform in banks’ digital channels, today announced its intention

to offer, subject to market and other conditions, $150.0 million

aggregate principal amount of convertible senior notes due 2029

(the “notes”) in a private offering to qualified institutional

buyers pursuant to Rule 144A under the Securities Act of 1933, as

amended (the “Securities Act”). Cardlytics also expects to grant

the initial purchasers of the notes an option to purchase, for

settlement within a period of 13 days from, and including, the date

the notes are first issued, up to an additional $22.5 million

aggregate principal amount of notes.

The notes will be senior, unsecured obligations

of Cardlytics, will accrue interest payable semi-annually in

arrears and will mature on April 1, 2029, unless earlier converted

or repurchased by Cardlytics. Noteholders will have the right to

convert their notes in certain circumstances and during specified

periods. Cardlytics will settle conversions by paying or

delivering, as applicable, cash, shares of its common stock or a

combination of cash and shares of its common stock, at Cardlytics’

election.

If certain corporate events that constitute a

“fundamental change” occur, then, subject to a limited exception,

noteholders may require Cardlytics to repurchase their notes for

cash. The repurchase price will be equal to the principal amount of

the notes to be repurchased, plus accrued and unpaid interest, if

any, to, but excluding, the applicable repurchase date.

The interest rate, initial conversion rate and

other terms of the notes will be determined at the time of pricing

of the offering in negotiations with the initial purchasers of the

notes.

Cardlytics expects to use a portion of the net

proceeds from the offering to repurchase for cash a portion of its

1.00% convertible senior notes due 2025 (the “2025 Notes”) in

privately negotiated transactions entered into concurrently with

the pricing of the offering through one of the initial purchasers

or its affiliate, as Cardlytics’ agent (each, a “note repurchase

transaction”). Cardlytics expects to use any remainder of the net

proceeds for general corporate purposes, including working capital,

operating expenses and capital expenditures.

The terms of each note repurchase transaction

will depend on a variety of factors. No assurance can be given as

to how much, if any, of the 2025 Notes will be repurchased or the

terms on which they will be repurchased. This press release is not

an offer to repurchase the 2025 Notes, and the offering of the

notes is not contingent upon the repurchase of the 2025 Notes.

In connection with any note repurchase

transaction, Cardlytics expects that holders of the 2025 Notes who

agree to have their 2025 Notes repurchased and who have hedged

their equity price risk with respect to such notes (the “hedged

holders”) will unwind all or part of their hedge positions by

buying Cardlytics’ common stock and/or entering into or unwinding

various derivative transactions with respect to Cardlytics’ common

stock. The amount of Cardlytics’ common stock to be purchased by

the hedged holders or in connection with such derivative

transactions may be substantial in relation to the historic average

daily trading volume of Cardlytics’ common stock. This activity by

the hedged holders could increase (or reduce the size of any

decrease in) the market price of Cardlytics’ common stock,

including concurrently with the pricing of the notes, which could

result in a higher effective conversion price of the notes.

Cardlytics cannot predict the magnitude of such market activity or

the overall effect it will have on the price of the notes offered

or Cardlytics’ common stock.

Additionally, Cardlytics entered into capped

call transactions (the “existing capped call transactions”) with

certain financial institutions (the “existing option

counterparties”) in connection with issuing the 2025 Notes. If

Cardlytics repurchases any of its 2025 Notes, it may enter into

agreements with the option counterparties to terminate a portion of

the existing capped call transactions in a notional amount

corresponding to the amount of 2025 Notes repurchased (such

terminations, the “unwind transactions”). In connection with any

such terminations of the existing capped call transactions,

Cardlytics expects such existing option counterparties and/or their

respective affiliates will unwind various derivatives with respect

to Cardlytics’ common stock and/or sell shares of Cardlytics’

common stock concurrently with or shortly after pricing of the

notes. This activity could decrease (or reduce the size of any

increase in) the market price of Cardlytics’ common stock at that

time and could decrease (or reduce the size of any increase in) the

market value of the notes.

The offer and sale of the notes and the shares

of common stock issuable upon conversion of the notes, if any, have

not been, and will not be, registered under the Securities Act or

any other securities laws of any other jurisdiction, and the notes

and any such shares cannot be offered or sold in the United States

absent registration or an applicable exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act and any other applicable securities laws. This press

release does not constitute an offer to sell, nor a solicitation of

an offer to buy, the notes or any shares of common stock issuable

upon conversion of the notes, nor will there be any sale of the

notes or any such shares, in any state or other jurisdiction in

which such offer, sale or solicitation would be unlawful.

About Cardlytics, Inc.

Cardlytics, Inc. (NASDAQ: CDLX) is a digital

advertising platform. We partner with financial institutions to run

their banking rewards programs that promote customer loyalty and

deepen relationships. In turn, we have a secure view into where and

when consumers are spending their money. We use these insights to

help marketers identify, reach, and influence likely buyers at

scale, as well as measure the true sales impact of marketing

campaigns. Headquartered in Atlanta, Cardlytics has offices in

Menlo Park, Los Angeles, New York, and London.

Forward-Looking Statements

This press release includes forward-looking

statements, including statements regarding the anticipated terms of

the notes being offered and the note repurchase transactions, the

completion, timing and size of the proposed offering, the note

repurchase transactions and any unwind transactions, the intended

use of the proceeds and the potential impact of the foregoing or

related transactions on dilution to holders of Cardlytics’ common

stock and the market price of Cardlytics’ common stock or the notes

or the conversion price of the notes. Forward-looking statements

represent Cardlytics’ current expectations regarding future events

and are subject to known and unknown risks and uncertainties that

could cause actual results to differ materially from those implied

by the forward-looking statements. Among those risks and

uncertainties are market conditions, including market interest

rates, the trading price and volatility of Cardlytics’ common

stock, Cardlytics’ ability to complete the proposed offering on the

expected terms, or at all, whether and on what terms Cardlytics may

repurchase any of the 2025 Notes or enter into any unwind

transactions and risks relating to Cardlytics’ business, including

those described in Cardlytics’ Annual Report on Form 10-K filed

with the Securities and Exchange Commission on March 14, 2024

and in subsequent periodic reports that Cardlytics files with the

Securities and Exchange Commission. Cardlytics may not consummate

the proposed offering described in this press release and, if the

proposed offering is consummated, cannot provide any assurances

regarding the final terms of the offering or the notes or its

ability to effectively apply the net proceeds as described above.

The forward-looking statements included in this press release speak

only as of the date of this press release, and Cardlytics does not

undertake to update the statements included in this press release

for subsequent developments, except as may be required by law.

Contacts:

Public Relations:pr@cardlytics.com

Investor Relations:ir@cardlytics.com

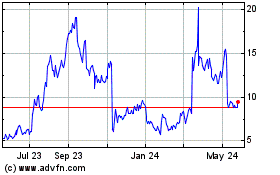

Cardlytics (NASDAQ:CDLX)

Historical Stock Chart

From Dec 2024 to Jan 2025

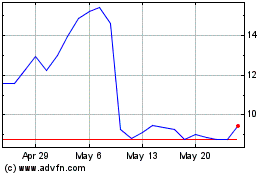

Cardlytics (NASDAQ:CDLX)

Historical Stock Chart

From Jan 2024 to Jan 2025